When is the best time to buy stocks in the stock market? When should you buy stocks? After you learned about the ways in making millions of money in the stock market, you ask yourself what stocks should you buy and when.

Note that this discussion is for passive and long term investing and may not be applicable for penny stock focused traders, super active traders, and those who buy and sell stocks within a short time (tsupita).

Looking back at the 3 ingredients of investing – Time, Money, and Goal, Time could answer all those questions.

Time is money. The younger you are, the more time you have in the world to do everything you want. The earlier you started investing, the wealthier you will be. It is the biggest factor to give you the other ingredients: Money and your Goal. That is why we discuss it here.

When should You Buy Stocks?

To answer that question, you must first know and decide what your strategy is as an investor. What is your plan, what is your target?

Without a plan / strategy, you are going nowhere. You’ll likely get emotional in the roller coaster ride of the stock market. Once you get emotional, you’ll panic and this will let you do bad choices.

Like I said, I won’t discuss the strategy of penny stocks traders here and those who buy and sell in a short span of time. What I’m sharing here is about passive long term investing or investing in value because it’s less risky and it is simple. We don’t want to be crazy here and we leave those other strategies to those Wall Street guys and gurus.

Our goal is to be muti-millionaire without going crazy about the complicated world and technical stuff about the stock market.

3 Amazing and Time-tested Strategies of Investing in the Stock Market:

1. Peso-Cost-Averaging Method

Peso-Cost-Averaging or what we call PCA. I know we always talk about this method here. I can’t throw it away because it is proven effective and less risky.

When do you buy stocks using PCA?

You buy stocks no matter what the price is, high or low, you buy anyway. In PCA, you are investing a fix amount of money to buy stocks every month or on every schedule over a long period of time like 10 years or so.

2. Flipping Stocks Method

Flipping Method made famous by DailyPik.com. It is similar to PCA but in this method, you must select the company listed among the Undervalued Stocks. There is a Buy-Below-Price and Target Price involved.

When do you buy stocks using Flipping method?

You continue to buy your chosen stocks as long as the price didn’t reach the Buy-Below-Price, you stop when it did and resume when it hit the BBP again. You continue buying until you reached the target price, that is when you will sell the stocks and practice flipping out other stocks again.

3. MAGIC 10 Method

Magic 10 method is my personal strategy. I choose 10 stocks from my big companies list and spend my budget to buy stocks from them according to the percentage I have set for a given time. I use experts’ analysis on this method. Read this page to learn more about Magic 10 stocks.

When do you buy stocks using Magic 10?

You continue to buy these stocks until the stock was eliminated from the magic 10 replenishing other stocks entered in the group of 10. Follow the action (buy, hold) to buy the big 5 stocks for a long term. Magic 10 is the best and most effective method I find to earn more money than any other method out there.

When is the Best Time to Buy Stocks in the Stock Market?

While you are executing your strategy, take advantage of the best time to buy stocks – that is during and after calamities. In the Philippines, these are usually in the months of September and October because typhoons are prone.

Right now there is also expected volcanic eruption and political turmoil is adding up, take note of these chances and buy more stocks coz prices are low. During these times, its PAKYAWan time. I bet Manny Pacquiao would agree. 🙂

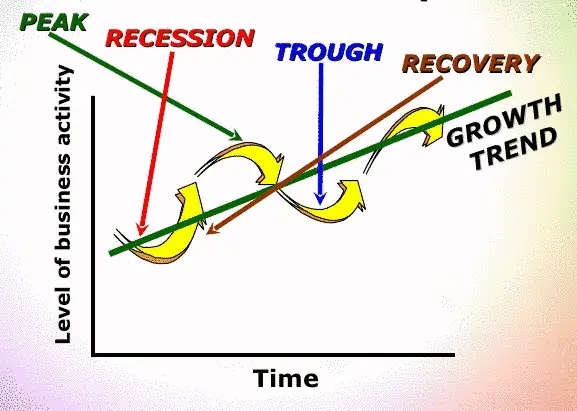

Nothing is certain in the stock market. What is certain is that there will always be peak, recession and recovery. What is important is you execute your plan and strategy until your target time and goal. Have faith and your money will roll bigger than you expected”. – Fehl Dungo

I am a bit confused of the “magic 10” thing. please enlighten me. i am a new investor of COL. (Sunlife Prosperity Balance Fund investor)

Hello Ms. Fhel!

Question lng. How much is your recommended price na ilalagay each of the companies in the Big 5 List?

5000 each/ monthly?

Hi Ms. Fehl..just need your opinion on my plan.. currently I have Bpi uitf..I think na-open almost 2 yrs ago.. for 700plus ung gain.. then meron din akong bdo eip balanced fund.. 1500 plus ung gains.. 2 yrs ago ko n rin na-open un… I’m planning to terminate my uitfs and then invest directly to stock market..

Do you think it’s a good decision? I’m planning to do PCA.

Hi Ms. Fehl.

I’ve been reading your articles about investing for quite some time to get some knowledge. It’s a big help for beginers. Ask ko lang kung saan makikita Buy-Below-Price ng stock and kung pano malalaman kung undervalued.

Thank you.

How to subscribe to daikypik? What information do the subscription have?

just go to dailypik.com and hit the SUBSCRIBE button beside the Facebook button

What are the pros and cons of upliftment and lodgement?

Hello. I’d like to invest for a long term plan. I’m still a student.Which one is better, I’d invest 2k per month or 25k annually? Also,since every transaction has its cost from the broker, how often is the advisable time to buy/sell stocks? Weekly? Monthly? Daily?

It always depends upon one’s experience and preference. I prefer periodic or monthly investing than annually. The final decision will be from you 🙂

I super agree miss Fehl

As you are saving up for the annual investment, how much did you spend, during that time? And….how many market up turns and down turns did you miss out on? You are either a saver, or an investor, so if you save your money, fine, good, that is a start, but if you are investor, invest in something to get a taste of the game, make your mistakes, and learn and gain equity

Regardless of your investment appetite: Be it conservative, aggressive, wild and crazy, or a coward, Be it long term or short term, or a mixture of both, all will make money…All of this is a matter of when and how much…None are wrong, just some are not for you or me

Always try to invest it, as soon as you meet the minimum purchase amount…Using the BDO UITF’s, the only thing I know well, some buy-ins are 1K, 10K, 100K and everything in between, so if you are depending on your salary, try to find a 1k buy-in, which will pay you more than savings, and keep buying 1K buy ins, each month, until you have the 10K needed to up the gamble, such as going from Bonds, to an Equity Fund, which most have a 10K buy-in…This is called laddering, a good investment when buying bonds…Ladder means, you go up the ladder, with small purchases, (and selling, depending on the rates and maturities) until you reach the top and I will talk about this next, because it looks as if the US FED will indeed pull the trigger, in December ( I still think March) and you do not want to have a bond funds, or port folios, with a lot of bonds on your pie chart…Film at 11

In closing, always invest, the sooner, the better, to take advantage of the ups and downs, which means, your ability to buy low and sell, high, or sit on it until retirement. Miss Fehl? Okay with you?

Hi Ms. Fehl, its me again. I’m now a newbie in stock market. I’m just curious about the prices of oil going steadily now. Is it the best time to buy stocks in companies such as petron because my gut feeling says that oil prices will soon rise up again. What are the best oil companies to buy from? Thank you so much! 🙂

I think oil prices will not jump anytime soon because of end of civil wars in Iraq and Libya could release oil reserve

Thank you Ms. Fehl, and since I’m a newbie and I want to learn more re: stock market. Is it advisable if I go to paid seminars? Thank you

Hi Ava. If you opened an account from a stockbroker, they give free seminars. They are helpful and free for members 🙂 The topics are usually the same. But our posts here are created by yours truly direct to the point 🙂 I hate information overload so I share only the important concepts. Cheers!

I agree with Miss Fehl: I not see oil prices going up, no time soon, but you asked, if you should invest in a company, not in oil futures? Did I get it right?

I feel, if you are doing your homework, Petron, is not a oil futures and they are retail also, so you will need to make a graph of their COMPANY performance, for a few months, and see how the COMPANY is doing, not crude oil futures…Those are two different animals in the oil game

Here is Petrons website: http://www.petron.com/web/

They clearly state who they are, their mission statement, and products…I am not sure if the civil wars affect the price of crude oil, too much, or it would be too high, not too low….Oil futures are concerned, the wars do affect it, but the civil wars have been raging on for over 10 years and we still have a worldwide glut of crude oil and the Middle East, insists on pumping more and putting Iran on line, also, so prices could drop more, to 20 USD a barrel

Your concern, as I said, was about the company, so in closing, do your homework, and you need to decide if you wish to invest in the stocks of a PETROLEUM COMPANY WHO DEALS IN RETAIL, WHOLESALE, MANUFACTURING, PRODUCT TRANSPORTATION, AND EXPLORATION OF PETROLEUM PRODUCTS, if so, as I said, do your own homework and be ready to sit it out and ride the tides

Petron is a well liked company in the Philippines…Auto sales still going up, and do not forget, public transportation to move your growing population, construction of new roads and highways, sky-hook trains, all burn fuel, and airport travel, since the Philippines is an emerging market…Also, more and more laws will be passed to stop charcoal burning, which will cause the sales of Propane to rise…Burning wood is a clear sign of a lack of social responsibility, propane is safe, especially if tanks are bough from Patron, and is not that costly, compared to wood, since it takes very little gasol to cook food, unlike the amount of wood, which we think is low cost, or even free…Also, it is my understanding that more people are killed in one mudslide than all of the gasol fires combined, so I not buy that idea either

Crude oil, however, I have written a post and scared to post it, because it is not good and it involves war…When oil drops this fast and supplies are this high, and still going up, and construction of oil reserves to hold more oil, war is eminent, so no, the prices will not jump up, as Miss Fehl said, but no one wants oil to jump up, either..They like to see it grow slowly, with some valleys, to be able to sell high and buy low, it is part of the game

Do your homework and decide if you wish to invest in patron, the company, and as for oil crude futures I would wait until you see more signs of a possible war, and one of when the US did a drive by, in the North China Sea…This was a clear show of force, for International Law, and the US will not allow China to go much father, without a fight, and this includes, Japan, Veit Nam, and others…Iran and the Philippines is the war hot spots for now…Film at 11

Hi Ms. Fehl, how much is the subscription fee if I will subscribe to dailypick.com. Thank you.

$4.99/ month only

Hi Ms. Fehl! I would like to ask kung ok lang po to, for example,

per month (based on board lot)

DMC – 100 shares

MER – 5 shares

MBT – 10 shares

AEV – 10 shares

I have a limited budget to invest every month and I’m planning to have these stocks, ok lang po ba na bumili ako ng stocks per month based on the number of shares on my example? I hope I can get a response, thank you

Hi 🙂 MER has a boardlot of 10. You can also buy thru oddlot but price per share is kinda higher than the one at the Main board. Yes, for people who have limited and budget, it’s a strategy to spend and allocate monthly budget buying minimum boardlot to different blue-chip stocks. If you don’t know what are the best stocks to buy right now, join dailypik.com

I am new to investing in stocks and I’m only familiar with UITF’s. I watched a couple of your videos about COL EIP and just have a few questions. If for example, I have 10,000 to invest every month. I understand that stocks are volatile and changes every so often. But with the 10,000 I invest monthly which is a better idea:

Stay invested with the same stocks month by month for 3 years

Example:

November 2014- November 2017

ALI Ayala Land- 5000 per month

TEL PLDT – 5000 per month

OR

Buy different stocks every month for 3 years

November 2014 – 5000 SM/ 5000 ALI

December 2014 – 5000 JFC/ 5000 DMC

January 2015 – 5000 BDO/ 5000 BPI

February 2015 – 5000 MBT/ 5000 AGI

so on so forth until 2017

Hope to get a response from you soon.

If I would be investing EIP having your budget of 10K, I would do your first choice but I would add 3 more stocks and divide my monthly budget buying 5 stocks every month for 10 years. EIP will only work so well for long term investing.

Hello,

Ms. Fehl, I am a newbie in the stock market. ideally how many company should i buy? rightnow I have one (SMPH)

Thank you & more power

If you are a beginner, choose 3-5 stocks first so you won’t be too overwhelmed. It will help you to focus, monitor and analyze your stock performance too.

Hi miss Fehl..if I invested in stocks and I decided to sell after three years

Just follow your plan and strategy. I hope you have it 🙂

Nice article Fehl!

Hope you teach us more about the Magic 10 startegy.

Thank you!

Thanks Yce. I will. Soon 🙂