As requested, I’m sharing here a review of COL Financial EIP (Easy Investment Program) and their stocks list in 2023.

I also discuss the reasons why you should invest using COL EIP Easy Investment Program and who should not invest in this program? Find out in this article.

COL Financial Easy Investment Program is among the unique features of one of the leading stockbrokers in the Philippines. Before you invest, here are my insights about it.

What is COL Financial EIP?

COL EIP (Easy Investment Program) is an investment plan designed for stock market beginners wherein you can invest a fixed amount of money to buy shares of stocks (listed in the COL EIP program) regularly over some time following the concept of Peso-Cost-Averaging method.

Who should invest using COL Financial EIP?

COL Financial EIP is suitable for investors with a long-term investment plan and traders who don’t want to monitor the market and don’t want to buy regular stock manually. COL EIP will let you automatically buy stocks according to your EIP schedule.

Your EIP schedule will depend upon your chosen stocks (companies), amount of investment, and time of investment (month, quarterly, etc.)

How to pick stocks as a beginner in the stock market?

As a starter and beginner, COL Financial has already chosen the best premium stocks in the COL EIP list. All you have to do is choose which one to invest in and fit into your portfolio.

There are currently 18 stocks you can choose from, and the companies listed in the EIP are expertly chosen and analyzed according to impressive growth and performance in the market. These companies are expected to still exist for many years and decades.

COL Financial EIP Stock List in 2023:

- Ayala Corp. (AC)

- Ayala Land, Inc. (ALI)

- Aboitiz Power Corp. (AP)

- Banco de Oro (BDO)

- Bank of the Philippine Islands (BPI)

- DMCI Holdings, Inc. (DMC)

- First Metro Phil. Equity ETF (FMETF)

- GT Capital Holdings (GTCAP)

- International Container Terminal Services (ICT)

- Jollibee Foods Corp. (JFC)

- Metrobank (MBT)

- Metro Pacific Investments (MPI)

- Manila Water Company (MWC)

- Robinsons Land Corp. (RLC)

- SM Investments Corp. (SM)

- SM Prime Holdings (SMPH)

- PLDT (TEL)

- Universal Robina Corp. (URC)

Why you should invest in COL Financial Easy Investment Program?

COL Easy Investment Program is designed for long-term investment goals and passive traders. If you want to invest a fixed amount of money no matter the market and economic status, this strategy is for you.

Easy Investment Program is a time-tested strategy. Many investors, beginners or experts, are still using this to mix some funds in their portfolios because they want to minimize risk and maximize their return using the cost-averaging method.

Watch this video presented by COL Financial to learn more.

Why you should not invest in COL EIP?

Every investor is different. The COL Financial Easy Investment Program may not be for you if you are an investor who wants to trade actively at your own pace. If you have more time to study and analyze the market, you should follow your own trading methods.

As an investor, I believe you don’t just want to let your money and stocks grow, but your skills, knowledge, and technical know-how, too.

“You cannot be on EIP forever. When you’re in the stock market, you don’t want to have boundaries.”

– Fehl Dungo

I still recommend using EIP for one or two stocks while investing in your strategies. I will share my strategy here in another article soon. But I’m going to share one here that is related to EIP.

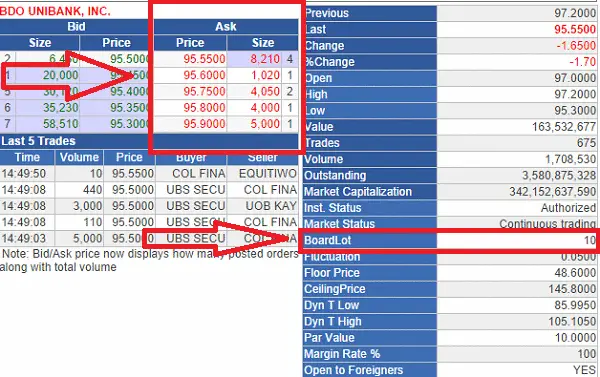

Instead of regularly using and following the EIP concept of investing a fixed amount regularly, I buy stocks monthly using my monthly budget of P10,000. My monthly budget can or can’t buy shares using P10,000 because of the Board Lot requirement.

Instead, I buy shares close to my budget of 10,000. It can be more or less than 10,000 as long as it’s close to that amount. Sometimes, I use the 10,000 budget to buy stocks from two companies instead of one.

Board Lots make trading more straightforward through buying or selling in 5, 10, 100, 1,000, 10,000, 100,000, and 1 million shares. In Tagalog, “bawal ang butal o gansal”

That’s why I prefer buying manually and not using the EIP schedule. Then again if you don’t have enough time to buy stocks, just make your schedules and use the Easy Investment Program.

What are your thoughts about COL EIP? Share them by commenting.

Want to learn more about investing in the stock market? Go to our “Stock market Tutorials and Tips” page.

Disclaimer: This article is for information purposes only and should not be taken as professional investment advice or endorsement of a particular asset. Trading in the stock market is risky. Always apply due diligence.

gud day…

ask lng po ako kung ano po bang mangyayari kung di ka maka buy sa next schedule mo. kunyari my schedule ka sa september 15 tapos di nakalimuran mo mag buy sa araw na yun.

Hi Ms Fehl,

Ask ko lang po, nagpplan kasi ako mag open nitong COL EIP starter yung 5k a month ilang companies po pwede nyo irecommend na paglaanan ko bilhan ng stocks monthly?Thanks.

Hi Ms Fehl

Thank you for such a useful blog for beginners in stocks investment just like me. I’m just curious, kasi I have opened COL EIP account due to budget shortage. Once na umabot po yung fund and value ng investments ko sa EIP, can my account be upgraded to COL Plus? or should a separate account be opened under COL Plus? Kung yung latter po, pwede po ba i-withdraw ko lahat ng funds ko sa EIP then yun yung gamiting kong funds sa COL Plus? What do you recommend po?

Thank you so much po!

Based on my experience once your equity value is =>25k, may option po dun mismo sa home page to update your account to COL Plus. it will open a new tab asking if you want to send the request to have your account updated. Then once the request have been approved, you Account Status will reflect PLUS.

Hi po! Ask lang po kung bakit ang EIP ko ay puro mutual fund list lang pwede ko pag inbesan? Wala po sa list ang tulad ng SM, ALI, PGOLD. Meron po akong akong mutal fund code XSLEQ at doon ko lang din po na invest ang eip ko at the same time, sa video kasi na napanood ko ang sample is nag buy sya ng ALI sa akin po walang list na ganun.

Hi miss Fehl,

Asked ko lang kung bakit iba ung value ng Total Account Equity ko sa monthly ledger compare dun sa Total Account Equity value na nasa mismong Portfolio page? Im using Col Financial.

Maraming Salamat po.

Sa monthly ledger po kasi one day lang yon, while sa Portfolio naten nag-iiba every second. Hope that helps.

I just want to ask what’s the difference between the red and green boxes with ask and bid? If i will buy stock where should i base my price? on the green one or the red one?

Follow the guides here: https://philpad.com/how-to-buy-stocks-online-using-col-financial/

Ms. Fhel, how can i reach you? im thinking on where and how to invest my money for quite some time now. i may need your help. thank you

Hi. You can follow my Facebook profile page here: https://www.facebook.com/FehlDungo/

or simply follow Dailypik here: https://www.facebook.com/dailypik/

I jusy received my acct info from colfinancial yet my buying power is still zero despite the fact that i already deposited enough momey to get me started. I am able to open my acct however, when i tried to do a test transaction, a msg stating “the acct has not yet enrolled” appeared. Why is it like that?

Hi Fehl, is it possible to enroll in EIP but still you personally buy your own stock and not follow the EIP schedules?

Thanks!

Hi Ms Fehl,

Tanong ko lang po, mkakatanggap rin po ba ng dividend once i invest long term in COL EIP ?.

Marami pong Salamat.

If the company you invested with has released dividends and you’re eligible for it then yes.

Hi Ms. Fehl 🙂

How does joint account work in COL Financial? I need help. Thank you.

Hi nag submit na ko sa col financial, tanong ko lang Ms. i will invest for the start 5,000

then okay lang ba i will buy stocks Jolibee, bdo and ayala land it is possible? or dapat isa lang company then keep on buying lang sa stocks? please advise me. May isa pa its up to me pa din ba for the following month is i will deposit 2000 , or 3k or kilan ko gusto?

Hi. Follow our Stock Market Guides above to learn how. If your budget is 5K per month, you can but ALI and BDO because they have lower price and boardlot. If you’re still confused, please follow our GUIDES at the menu above. They are free 🙂 Cheers!

hello fehl,

i discovered your blog couple of days ago when i was looking for information about financial education and i must say that you are doing an excellent job sharing everything that can help us newbies, even secrets other investors would never share. your blog is like a candy store, and i’m a kid with sweet tooth!

that being said (about being a newbie), i’d like to make sure i understood this right. so my questions:

1. once i initially open a COL EIP (PHP5K) account, because that is all I can afford for now, can i still buy and sell stocks as frequent as traders would or am i limited to PCA until I upgrade my account?

2. i also intend to apply PCA on the 60% of what i put into my account every month. so the 40% goes to my frequent trading. would you recommend this?

your feedback is sincerely appreciated. thank you so much!

Hi, thanks for visiting and sorry for late reply here. I try my best to reply as much as I can.

1. I’m not sure if EIP account is limited for that, my account is PLUS so can’t comment. I suggest contact COL.

2. That is a great portfolio. I can also suggest you mix Mutual Fund into it since MF are also available now in COL Financial. MF Equity Funds are stocks rolled into 1 account. 🙂

hi ms. fehl…have a good day po..tanong lng po kc bago p lng po ang account ko s COL..COL starter po pinili ko n account..bali may pondo n po xa n 5k..ako po b ang bibili ng stocks or COL n po ang bhala dun?at kung hnd po ako bumili ng stocks..maggogrow p rin po b ang pinondo kong pera or need tlgang bumili ng stocks pra kumita?..at s 5k n po b n un..kung skaling bibili k ng stocks..isang stocks lng po b mabibili mo?at maghuhulog k uli ng another 5k pra mkabili uli ng pngalwang stocks?..cnxa n po dami ko tanong..nguguluhan po kc ako..kung ano una kong gagawin..hehhe..hoping for ur kind response po..Godbless!!!:-)

Hi. Dun sa 5k mo na hinulog, ikaw mismo ang bibili ng stocks. Kung long term investment, I suggest that you invest from the EIP stock lists. Hindi mag-ggrow yung money kung nakatengga lang sya kasi wala namang pinag-iinvestan. Hehe. Kung ilang stocks naman ang mabibili sa 5k, it depends sa market price at board lot ng isang specific stock. You need to fund or kailangan mong maghulog sa account mo ng pera if you want to buy new stocks kung long-term investment.

Goodday Ms. Fehl,

Just finished reading your blog. And find it very interesting and informative.

My question is, do we really have to go to COL for enrollment or pwede na kami mag enroll online then mgdeposit na lang to our preferred bank?

Thank you.

Hi Fehl

I got interested in stock market after reading your articles here. It is straightforward and easy to understand . I am planning to open an account in COL Financial. Correct me if I’m wrong: When I use the EIP scheduler whether manual or automatic COL Financial give you a convenient way TO BUY SHARES. Say I reach my target term like 5 years, WHO WILL SELL MY SHARES? WILL COL FINANCIAL SELL MY SHARES OR I HAVE TO SELL IT THROUGH THEM. HOW TO CONVERT THE SOLD SHARE INTO CASH OR CHECK. Being an OFW’s you gave us knowledge and opportunity to seek a better future and forever I am thankful. God bless you. Keep it up!!

Hi. Thank you for visiting. Only you have the power to sell your shares of stocks. There is a SELL button on every stock on your Portfolio, just push that button and follow through. Once the sell order was executed, the money will be credited to your COL account. You can withdraw them by making a Withdrawal request. I also post stock guides at Dailypik.com. God bless!

Hi, gusto q rin mag invest help me naman.. PAANO mag earn ng money dito sa stock market. Binasa q na pero Hindi ko pa rin maintindihan. Like if I invest 25k I lang years un at paano q makukuha yung payout? At pano q malalaman na nalugi or success po. Ty

hi ms fehl,

while waiting the response of my application on col financial ive been reading ur blog and im learning a lot. just want to know if i chos COL starter as my account type is it a mandatory to enroll sa EIP. if so mandatory, am i not allowed to buy stocks not listed to eip for my flipping or strategic averaging method?

thanks and more more power

Hi, you can also purchase other stocks even if your account is a Starter. You can also use EIP only when you want to

hi po. pag 5k yung na open mo, mkaka trade ka na ba? slaamat po. my nag sabi po kasi saki dapat daw 25 k yung na open mo before ka makakatrade. i mean buy and sell po sa stocks.. offline kasi ngayon ang col financial ewan ko kung bakit. baka holiday offline site nila. slaamat po…

The 5K is just requirement for COL Starter account. Same with 25K, it’s the requirement for COL PLus. That doesn’t meant, you need that amount in order to trade all the time

cOL Fin ba broker nu mam. alam nu po ba kung pwede isubmit ung form and documents for opening of account tru lbc or any courier service. im outside manila po kc. salamat po

Hi Ms. Fehl,

I’m planning to invest sa COL EIP, since i am a newbie for investing in Stocks. They have 5k per month which is amenable and safe for me. For COL EIP is there any option na imbes na 5k a month po ako ay 5k per quarter? para di mabigay masyado. Since my Goals is to Invest for 2-5 years para makarron ako ng Capital for my business franchise like Master Siomai or Zagu. Hope for your other suggestions and opinions mo po. I found thsi blog and it is really informative.

Regards,

Tristan

Hi. Yes, it’s up to you when you will make the investment: monthly, quarterly, or anytime you want to as long as you do it regularly your portfolio will grow

Hi. Ibig sabihin ba pag EIP laging odd lot ang nabibili? Because all the while and akala ko it will just buy yung kung magkano lang ang mabili based sa board lot pa rin

Hi Miss Fehl, I found your blog very very helpful for both beginners and experienced investors. I am planning po to open in COL EIP. Is it required that I will buy stocks exactly as scheduled, or is it scheduled? or can I buy po ba depende sa akin kung kailan ko gusto, like kung mababa lang ang presyo tsaka lang ako bibili, pwede po ba yun sa COL EIP? salamat po.

Hi. Thank you. Yes, in COL EIP, you can either do automatic or manual placements. Final action will always depend on you, the investor 🙂

I have eip uitf enrolled at bdo. I am still trying to learn about investing on the stock market.

My question is, if i give 5 k in my account and choose eip , can i add on 1 k evry month to my investment with long term plan say 5 yrs?

Yes, if you have chosen to place 1K every month. BDO will follow what you have put and signed in the EIP application form

hi po gusto ko po sana mag invest pero diko po alam kung pano.student palang po ako.ano pong pwede niyong irecommend?salamat

If you have funds, I’d say start now because the earlier you invest, the better. COL EIP is good for beginners

Good morning maam. I am Clarence, 20 year old entrepreneur student and I am planning to invest. My options are BPI, Security Bank and COL. What is the best option to invest? Should i give a monthly of 10,000? Because as a student it is really heavy but i must do it because of my future plans.

Hi, Clarence. If you want to invest stocks directly, you can open you need a broker like COL. COL EIP is great and helpful for beginners and students. The objective of it is investing regularly for long term

Hi Ms. Fehl,

nice to read your post, very informative po thank you. I am planning to send na may application to open COL account, married na po do you advise na Joint na ang iopen ko or individual? also, nasa abroad po ako do you think it will be a problem for them to approve me habang nandto ako?

salamat po sa reply..

regards

If you will open joint account, you need to fill up and submit all requirements for joint accounts. You need not worry if your requirements are complete and accurate 🙂

hello maam. i i started my col eip last year,well, as far as i know that i have a 5 year investment schedule with this col. i just don’t know what to do with my stocks after 5 years. do i have to sell it?

It’s up to you and your plan. As an investor you must know your PLAN 🙂 Ask yourself why and what are you investing for? Is it for retirement, business capital, new house, etc. That way, you know what strategy to use and how long you need to invest. If your plan is really 5 years, then sell your stocks and use the money at your purpose

Hi Ms. Fehl, I am your number one follower even with your other social media blog, I’d like to ask, though I don’t know what exact method this is, perhaps lump sum, but the question is if I invested once say in URC which costs approximately 140.00 last May 20, 2014 then today’s price, May 20, 2015 (one year after) is around 215.00 meaning there is an increased of 75.00. Assuming I have 200 shares and I never buy another shares since I invested one year ago, so 200 x 75.00 = 15,000.00. Is this correct that my gross profit would be 15,000.00? Would you recommend any application to properly compute the amount I earned overtime, because I am an aggressive trader who would buy and sell in limited period of time, (though I followed magic 10 also, and I have long-term investment.)

Looking forward to your reply.

Thank you

Yes, in that case, your gross profit is 15K + dividends coz URC usually gives them although not much in your 200 shares

Hi Ms Fehl

I would like to ask where is the best to invest. In BDO EIP or in COL EIP? 5k per month and for long term.

thank you

Depends upon your preference and needs. If you prefer UITF, sa BDO ka, if you prefer more control to stocks, sa COL ka. Either way, they are great investment options 🙂 Having both will also teach you skills

thank you sa reply mo mam, sige po mag monthly nalang ako 2k, mag start po muna ako sa isang stock then pag kaya ko na ng dalawa susubukan ko po.. pwede naman po dalawa diba?.

mam question din po. while doing the EIP, can i buy stocks din ba manually? para matuto pa ako sa buy/sell ng stock market, para po masubukan ko lahat. pero do u think its very risky po ba??

o much better if i have investment in stock market and also having a mutual fund po?? sorry po dami ko tanong.. thank you

Yes, you have the power to do manual buying as well. 🙂 Mutual Fund is another type of investment. You need to open one at a MF company although there are news that COL will also serve them soon.

Ms Fehl, may tanong po ako nagopen po ako ng account sa COL tapos natanggap ko na po yubg userid and password, then pag check ko po ng balance ko zero balance po yung account ko. Tanong ko po na pag nag open ba ng account sa col eip yung 5k ay bayad sa kanila? Kaya 0 balance ako Tapos kailangan ko ulit mag fund ng 5k para makapag invest ako ? Oh pag nag open ng account sa col at nag fund ng 5k ay magagamit mo na agad yun para mkapag invest? Tnx po

The 5K is yours and COL will not get it. You can spend it in buying the stocks you want.

I asked this already to COL, and according to them, the 5k initial fund would be credited to your account and you can use it for buying stocks. Perhaps the reason why it is not yet accredited to your account is due to processing period which I think around 3days more or less. But you will receive it soon.

Happy trading.

Hi Ms Fehl,

Thank you sa mga posts mo. Ang laking tulong. Im learning a lot.

Mag start pa lang ako mag invest this month and it is clear to me yung difference beteween COL EIP vs using banks like BDO EIP or Mutual funds like FAMI,PEMI ( which I believe na they also have EIP ), I guess my question now are differences and types of fees associated. Entry fees, redeeming fees, sales loads, tax. etc which will be a better conduit if I invest considering those fees?

Thanks madam!

Hi. Fees in investing stocks directly using COL or any other stockbroker is cheaper since you only pay commission, VAT, PSE transaction fee and SEC Clearing..and Sales tax of course when you sell. With UITF and Mutual Funds, you have fund managers so there are more fees

Hi Maam Fehl

just started my investment through COL EIP. 2 stocks po ang pinili ko at regular po akong mag invest 2500 each stock every month for long term. Sa tingin nyu po maam tama ang ginawa ko? Ano po ang ma i advise nyu. Salamat po.

Yes, that’s the concept of EIP – investing monthly for a long period of time 🙂 Stick to your plan. Happy investing!

Hi ms fehl thank you for sharing this post! 🙂 Some of my questions have been answered by your posts here. Im opening my account on Col with their EIP. Hope this will be a good start. Subscribed to your blog, hope i can learn more from you. Cheers!

Congrats on your EIP stocks investing. It will absolutely reward you in the future. Thank you for subscribing! 🙂

hello, i am now waiting for the username and password from col. i follow ur advise to use col plus so i deposited 25k. inisip ko prang bumili lang ako ng bagong cellphone, kung mawala man lahat e di wow hehe, pero like u said also in other post, just buy stocks regardless of eco condition and maybe in 5 yrs who knows it may even more than double the amount,,,

regarding bdo online deposit, i checked and no deductions made by bdo

thanks madam and waiting on ur post above ur strategy

Hi, Donnel. Yes, 25K is yours naman kahit COL Plus account mo. It’s like funding your account in advance to buy stocks 🙂 Good to know there is no charge with BDO online banking.

hi Fehl, read your post. i’m planning to open an COL account. as mentioned in your above post, you recommend the COL Plus which is 25K. I just wondering if 25K should be fix amount every month or depende na sayu if when ka next mag lagay nang another amount. example. april ako mag start nang 25k col plus taz the following months will only put up amount which is 5K nlang each month. Pwede ba un?

Newbie pa kc..and i don’t want to invest an amount that is too risky.. baka nagput.up ako taz newbie pa.ubos lahat.. hehehe.

salamaters post mu..

Hi, the 25K is not a requirement every month. It’s only the minimum amount required to open COL Plus account. It’s yours and you have the power how will you spend it with stocks. Your future transactions will also be under your power and control.

Hi.

I’m planning on opening up an account but I don’t really have an idea on how stock markets work. Do i really need to be an expert before I open one up or just having a bit of an idea on how it works will suffice? Hmm. Thanks. 😀

No worries. You can learn the basics in 2 days straight just by reading our STOCKS GUIDES by going to the STOCKS tab in the navigation bar above. 🙂

Hello Fehl,

Glad that I’ve reached this post. Mayconcern lang rin kasi ako reg. this. I just bought my first stock using my initial 5K fund with COL- but I bought my initial fund without enrolling it yet sa COL EIP (same as what you did, I did the buying manually) pero napagisipan ko nadin later on to enroll sa COL EIP (manually) after I bought my initial fund para may additional reminder narin sakin to do the investing every month. Same company lang din naman. May magiging cons ba sa ginawa ko or oki lang? Sorry medyo newbie pa and learning parin on stock investing.

Thanks much!

Hi KC. I don’t really see big cons with it coz EIP not only helps and assists in investing but also helps us to be disciplined and sticking to our plan/goal 🙂 Honestly, it’s like having your own secretary who reminds you “hey, you’re scheduled to invest these stocks today. Remember EIP stocks are premium stocks.” Bless ya!

hi! been following ur posts and they are very informative! just want to ask you about the difference between shares and units..thanks po and more power!

I have just started Col financial as my broker in investing stocks. As of now i have 5k in my funds and planning to buy my first stock however there is no trading today so i decided to buy through their off-hours order but everytime i preview my order it says Account not yet enrolled. Anyone here encountered this problem??? Anyone help me please!!!!

I’ve never experienced that yet. I suggest you contact COL asap

Hi fehl,

I’m planing to open an account but i have some question.is COL EIP or PCA are the same?so is this a mutual funds that has a fund manager?if im wrong what account can you suggest?

Hi Rob. Yes using EIP is also using the PCA method. COL EIP is not a mutual fund if that is what you’re asking here. And yes, mutual funds have their own fund managers. It’s easier to invest on Mutual Funds that on stock market directly since you already have experts who do the fund strategy for you. I always suggest get mutual funds first before you start on the stock market directly. To learn more about mutual funds, go here: https://philpad.com/tag/mutual-funds

Good day mam, is the TIN number required when you invest in mutual fund or uitf

Thank u

Hi Fehl,

If I open a COL EIP account, do they work like UITF like they are the ones who chose which stocks to invest your money in or you can do it yourself just like the COL Plus?

Thank you.

How often do you change the stocks where your money is invested? I understand that there’s such thing as the Magic 10, but do you need to monitor them on a daily basis and how often does COL permit you to swtich stocks?

Thank you.

When they reached the Target Price, sell them and buy new stocks. Nope, you don’t really need to monitor them everyday but if you feel that the price is near your Target, you must pay attention to it coz you’re about to sell them. Not using EIP here. COL doesn’t control your stocks, you do. Everything runs in your permission. 🙂

Hi Valerie 🙂 COL EIP or not, you are in control of your stock investments. You’re just using COL as a platform. They don’t manage your funds. It’s like a car. You drive it and you can go anywhere you want. In UITF, you just ride the car. There is already a driver – the Fund Manager.

Hello, I just want to ask… Is COL EIP at par in terms of benefits and earnings with bank’s (ie. BDO, PNB, etc.) EIPs? I’ve been wanting to invest in BDO’s EIP/UITF but since I live abroad, I am unable to open the accounts.

Should I choose COL EIP considering I can do it online or should I wait until I go to the Philippines to open a BDO EIP account?

COL EIP is different with UITF EIP because in COL EIP, you need to know and learn the basic concepts and strategies of stock market investing while in UIIF EIP, you don’t really need that because you already have Fund Managers who are experts in building your funds. I suggest you open UITF or Mutual Funds first before you start investing directly in the stock market using COL or any other broker.

Thank you for replying.

I understand that it would be much easier or should I say less riskier to open a UITF or Mutual Fund instead of dabbling in stock market using COL especially for newbies like me for the reasons you stated. The problem for me is that I don’t have a plan to go to the Philippines in the next few years so I can’t open those accounts in the immediate future as there are no option, AFAIK, to open UITF/Mutual Fund accounts from abroad.

Do you think I should take the risk with COL EIP so I can start investing now, while learning about the stock market (start slowly)? Or should I wait some more years to open UITF/Mutual Funds bearing in mind that it may take at least 2 years before I can go to the Philippines and be able to open the accounts and start investing then.

Sorry for bombarding you with my questions. ^_^

Hi Yumi. Yes, in your situation open COL now instead of waiting for 2 years to open Mutual Funds. Time is money. You can start EIP and invest to 5 stocks every month and do it for long term. It will generate much income too just like Mutual Funds. Since COL have already recommended stocks, just choose and decide the 5 stocks you want to invest for long term 5 years or so and keep your faith and stick to it. The longer you invest, the more profit you will gain. You’re always welcome to ask and share anything here. God bless!

Thank you soo much Fehl. Have a good day!

Hi Fehl,

Greetings!

I am about to open COL starter with this EIP structure. I just want to ask if will they automatically deduct ( example P5000 ) to my account every month ( if I choose monthly )? If yes,so I’ll just make sure that my account has enough fund? Is this the scenario? Thanks a lot!

Nope, they won’t deduct you 5000 every month unless you have made and set EIP schedule to buy stocks from a certain company every month automatically. EIP has 2 types of schedule options: automatic or manual. If you selected the automatic, you will be deducted each month or each period you have scheduled. If you don’t want that, just invest manually by buying shares every month for your budget (example 5000). Yes, make sure you have enough funds in your account before you invest

hi fehl..

where i can find in COL site the schedule options if manually or automatic.hindi ko kasi marecall if ano ginawa kong options. thanks.

Hi fehl! I just opened an account with Col financial today under EIP. Im just waiting for my password so i can start buying shares. What companies can you recommend for example i will start to buy this coming Monday Oct 20 and i want to buy worth Php10,000 shares and I am planning to set aside Php3,000 monthly as an additional. What’s the best strategy?

If you are under COL EIP, you can invest a fix amount (example 5000) for a specific stock every month or every period you want. It’s up to you how much will be your fix monthly budget and what stock you want to invest every month or every period you set.