Here’s the quickest way how to compute income tax in the Philippines. Whether you’re employed, self-employed, or a professional taxpayer, filing your income tax return (ITR) is mandatory.

It can be quite confusing to start the computation of your taxable income because there are different factors to consider in generating tax dues and tax credits. The types of taxpayers, allowable deductions, income sources, and other factors make it easy to let your taxes slip through the cracks.

No worries because this article provides a step-by-step breakdown of how to calculate your income tax payment using the latest BIR Tax Rates in 2026 (New Income Tax Table in 2026).

What is Income Tax?

Income tax is a type of tax imposed on individuals’ or entities’ income. Its purpose is to redistribute wealth and finance government projects. Tax payment of a person or company depends on their income level, salary, property value, assets, and other financial resources.

What is Income Tax Return in the Philippines?

An Income Tax Return (ITR) is a document that you will file at the Bureau of Internal Revenue (BIR) to declare your income and pay the corresponding tax. ITR is also known as Income Tax Declaration, Income Tax Filing, or the necessary BIR Form you must file every taxable year.

Who are Required to File Income Tax Return in the Philippines?

According to the Tax Code of the Philippines, the following must file Income Tax Returns (ITR):

1. Individual taxpayers

- Resident citizens receiving income from sources within or outside the Philippines

- Employees deriving purely compensation income from two or more employers, concurrently or successively at any time during the taxable year

- Employees deriving purely compensation income regardless of the amount, whether from single or several employers during the calendar year, the income tax of which has not been withheld correctly (i.e., tax due is not equal to the tax withheld) resulting to collectible or refundable return)

- Self-employed individuals receiving income from the conduct of trade or business and/or practice of a profession

- Individuals deriving mixed income (i.e., compensation income and income from the conduct of trade or business and/or practice of a profession)

- Individuals deriving other non-business, non-professional related income in addition to compensation income not otherwise subject to a final tax

- Individuals receiving purely compensation income from a single employer, although the income of which has been correctly withheld, but whose spouse is not entitled to substituted filing

- Non-resident citizens receiving income from sources within the Philippines

- Foreigners, whether resident or not, receiving income from sources within the Philippines

2. Non-Individual Taxpayers

- Corporations, including partnerships, no matter how created or organized.

- Domestic corporations receiving income from sources within and outside the Philippines

- Foreign corporations receiving income from sources within the Philippines

- Estates and trusts engaged in trade or business

Advantages of BIR TRAIN Law on Income Tax

The Bureau of Internal Revenue’s Tax Reform for Acceleration and Inclusion Act (BIR TRAIN Law) on Income Tax aims to simplify tax computation and payment procedures. This new law requires individuals and businesses who earn an annual gross income of more than P250,000 to file their income tax returns electronically.

It means you will no longer have to go through the hassle of submitting your physical documents or filing your BIR forms personally or via mail or courier service. Instead, you can file and pay taxes online through the BIR platform.

How to Compute Income Tax in the Philippines (Complete Guide)

Step 1: Determine if you’re exempted from tax

Under the tax reform law, employed individuals earning compensation income, self-employed, and professional taxpayers with annual taxable income of P250,000 or less are exempted from paying personal income tax.

Likewise, a person who’s a minimum wage earner or with taxable income amounting to P250,000 or less is not required to file an income tax return (ITR).

Step 2: Calculate your Net Taxable Income

Net taxable income equals annual gross income less allowable deductions or personal exemptions (de minimis benefits, 13th-month pay, rice subsidy, etc.)

Under the law, 13th-month pay and other benefits amounting to P90,000 are tax-exempt.

The formula to compute your net taxable income is:

Net Taxable Income = Annual Salary + Additional Pay – Mandatory Contributions

Step 3: Compute your Income Tax Due

Income Tax Due is the total tax payable for the year. To calculate the income tax due for 2026, follow the updated Income Tax Table in 2026. Taxpayers will have more benefits and advantages using the new tax rates and schedule for the year 2023 and onwards.

New Income Tax Rates in the Philippines in 2026

| If Taxable Income is: | Tax Due is: |

|---|---|

| Not over 250,000 | 0% |

| Over 250,000 but not over 400,000 | 15% of the excess over 250,000 |

| Over 400,000 but not over 800,000 | 22,500 + 20% of the excess over 400,000 |

| Over 800,000 but not over 2,000,000 | 102,500 + 25% of the excess over 800,000 |

| Over 2,000,000 but not over 8,000,000 | 402,500 + 30% of the excess over 2,000,000 |

| Over 8,000,000 | 2,202,500 + 35% of the excess over 8,000,000 |

How to Compute Your Income Tax Due If You’re Employed?

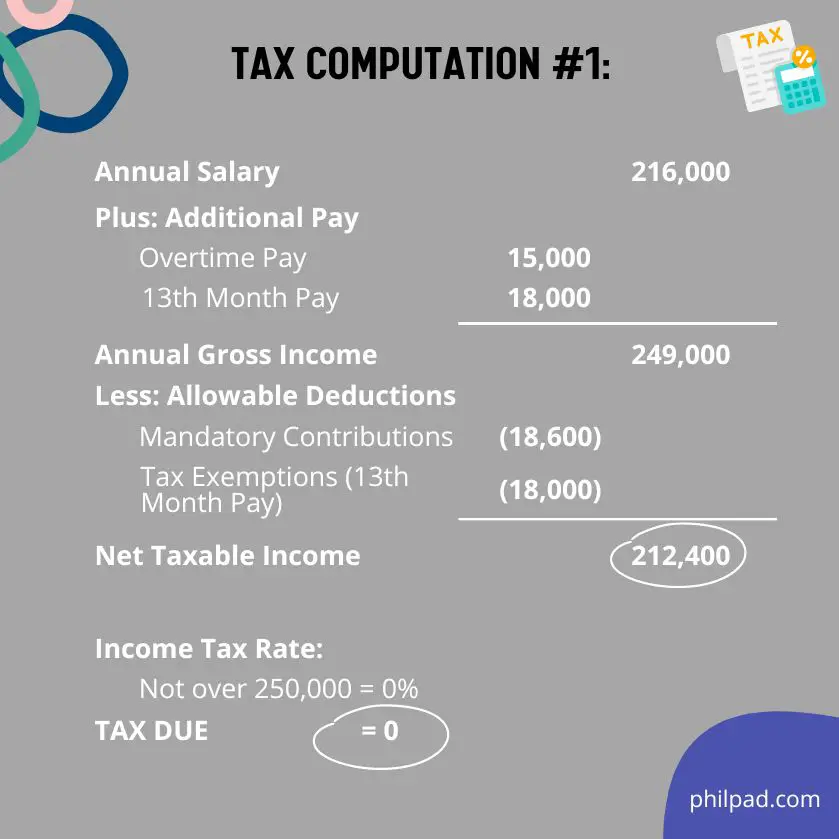

Sample Case 1:

Sam, a private employee, receives an annual salary of P216,000, a 13th-month pay of P18,000, and total mandatory contributions of P18,600 (SSS, Philhealth, and Pag-ibig Fund). In addition, he made a full overtime pay of P15,000. Here’s the breakdown and computation of his income tax payable:

The total income tax payment of Sam is zero since his Net Taxable Income falls below 250,000, which is considered free of tax. The 13th month’s pay is deducted from the computation above because, according to the TRAIN Law, 13th month pay and other benefits are tax-exempt when they fall below P90,000.

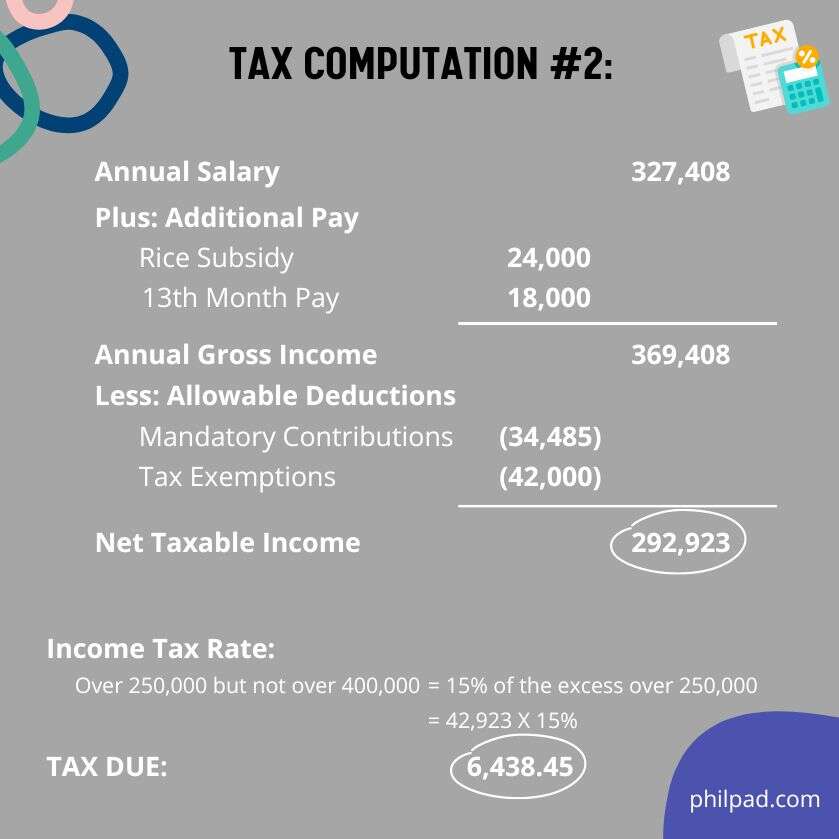

Sample Case 2:

Olivia is a government employee who earns a monthly salary of P27,284 with a total of P34,485 mandatory annual contributions to GSIS, Philhealth, and Pag-ibig Fund. She also receives a rice subsidy of P2,000 monthly and 13th-month pay equivalent to her monthly salary. Her total income tax due is computed as follows:

From the given tax computation, the 13th-month pay and the annual rice subsidy benefit of 24,000 are deducted from the annual gross income because they are exempted from taxes since the total amount is less than 90,000.

How to Compute Your Income Tax If You’re Self-employed and Professional Taxpayer?

Self-employed taxpayers are individuals who earn a living by working for themselves. They render services to others without being hired within a company. They can be freelancers, content creators, coaches, vloggers, and starting entrepreneurs.

Professional taxpayers, on the other hand, are those who generate income through their professional practice or business activities. They can be doctors, architects, lawyers, dentists, accountants, and other licensed individuals who make money through the course of their profession.

These taxpayers may be obligated to settle additional taxes, such as percentage tax or value-added tax (VAT), based on their yearly earnings and the type of business they operate.

Income Tax Requirements for Self-employed and Professionals whose Gross Sales/Receipts and Other Non-Operating Income Do Not Exceed the VAT Threshold of P3,000,000, the tax shall be, at the taxpayer’s option:

- 8% Income Tax on Gross Sales or Gross Receipts in Excess of P250,000 in Lieu of the Graduated Income Tax Rates and the Percentage Tax; or

- Income Tax Based on the Graduated Income Tax Rates

Income Tax Requirements for Self-employed and Professionals Earning Both Compensation Income and Income from Business or Practice of Profession

- For Income from Compensation – use the graduated income tax (IT) rates

- For Income from Business or Practice of Profession

- If gross sales and/or gross receipts and other non-operating income do not exceed P3,000,000 – select either an 8% fixed tax rate or graduated income tax (IT) rates

- If gross sales and/or gross receipts and other non-operating income exceed P3,000,000 – use the graduated income tax (IT) rates

How to Compute and Pay Income Tax Using the 8% Tax Rate Option?

Many taxpayers choose to apply the 8% flat rate to calculate and file their income taxes because it offers many benefits, including:

- Simplified tax computation – no need to deduct expenses or itemize deductions.

- Consolidated payment – pay both graduated income tax and percentage tax in one payment.

- Easier record-keeping – fewer documents to maintain since expenses are not deducted.

By following this guide, you can efficiently compute and pay your income tax using the 8% tax rate option, making the process more manageable and efficient.

Step 1: Determine Eligibility for the 8% Tax Rate Option

To be eligible for the 8% tax rate option, you must meet the following criteria:

- Your gross sales or receipts and other non-operating income must not exceed P3,000,000 in a taxable year.

- You should be a self-employed individual or a professional taxpayer, not subject to other types of taxes like VAT or percentage tax.

Step 2: Calculate the 8% Tax Rate

To compute the 8% tax rate, follow these steps:

- Determine your total gross sales or receipts and other non-operating income.

- Subtract P250,000 from the total gross sales or receipts and other non-operating income.

- Multiply the result by 8% (0.08) to get your income tax due.

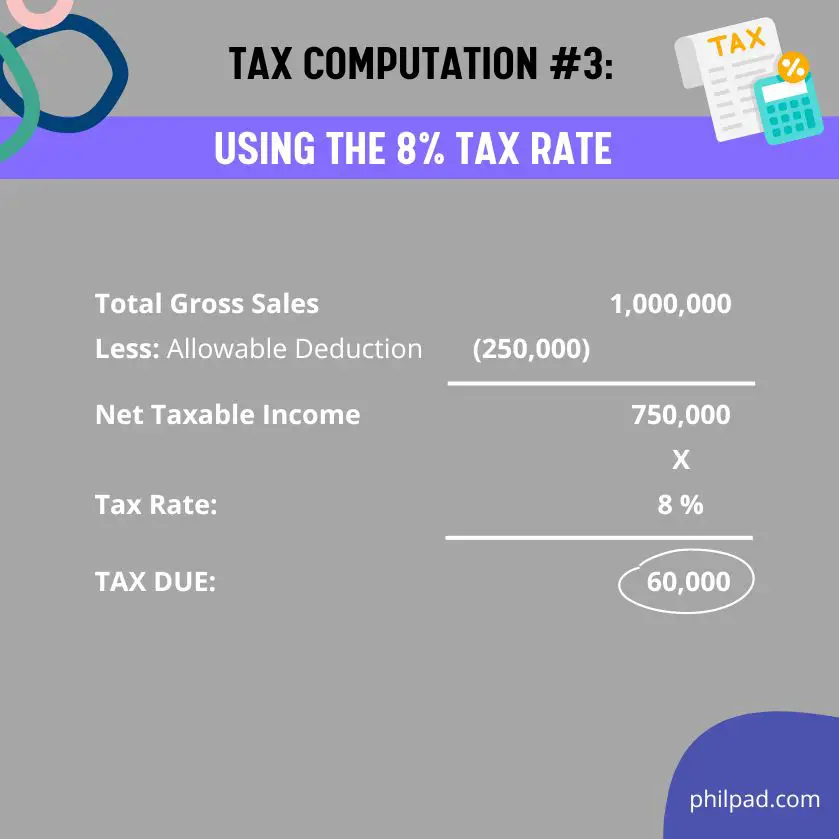

Sample Case 3:

St. James Enterprises reported total gross receipts of 1 million for the calendar year 2026. The income tax payable for its business is computed as follows:

Step 3: No Deduction of Expenses

When using the 8% tax rate option, you do not need to deduct various expenses from your gross sales or receipts. The 8% tax rate is applied directly to your income over P250,000.

Step 4: Filing and Paying Your Income Tax

To file and pay your income tax using the 8% tax rate option, follow these steps:

Fill out BIR Form 1701A (Annual Income Tax Return for Individuals Earning Income Purely from Business/Profession) or BIR Form 1701Q (Quarterly Income Tax Return for Individuals, Estates, and Trusts) as applicable.

Indicate that you are opting for the 8% tax rate option in the appropriate section of the form.

Compute your income tax due using the 8% tax rate, as explained in Step 2.

Submit the completed form and the required attachments to the appropriate BIR office or through the eFPS (Electronic Filing and Payment System) if enrolled.

Pay your income tax due on or before the deadline specified by the BIR.

How to Calculate Your Tax Due Using the Graduated Income Tax Rates

Follow these steps to compute your tax due using the Graduated Income Tax Rates for businesses with gross sales or receipts exceeding P3 million.

Step 1: Determine Your Gross Sales or Receipts

Compute your total gross sales or receipts for the taxable year. If the amount exceeds P3,000,000, you must use the Graduated Income Tax Rates for your tax computation.

Step 2: Gather Income and Expense Records

Collect all your income and expense records for the taxable year. These records will be necessary for computing your taxable income and allowable deductions.

Step 3: Refer to the Graduated Income Tax Rates Table

Use the BIR Tax Table in 2026 to determine the tax rate applicable to your taxable income. The table consists of different tax brackets with corresponding tax rates.

Step 4: Compute Your Net Taxable Income

To compute your net taxable income, follow these steps:

- Calculate your total gross income by adding all your income sources for the taxable year.

- Determine your allowable deductions, including expenses directly related to your business operations, such as rent, utilities, and salaries.

- Subtract your allowable deductions and exemptions from your gross income to arrive at your net taxable income.

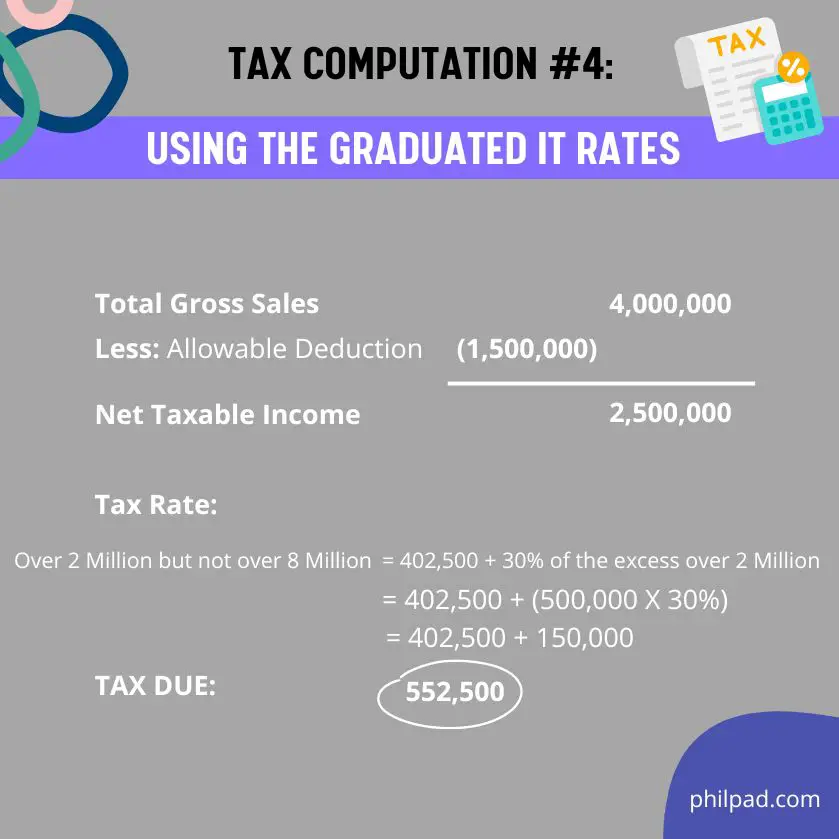

Sample Case 4:

Total gross income: P4,000,000

Allowable deductions: P1,500,000

Net Taxable income: P4,000,000 – P1,500,000 = P2,500,000

Step 5: Determine Your Tax Due

Using the Graduated Income Tax Rates table, find the tax rate applicable to your taxable income. Apply this tax rate to your taxable income to compute your tax due.

P402,500 + 30% of the excess over P2,000,000

=P402,500 + P150,000

Tax Due = 552,500

Step 6: Pay the Tax Due

Pay the computed tax due by the deadline specified by the BIR or every April 15. Submit the required tax forms, such as BIR Form 1701A (Annual Income Tax Return for Individuals Earning Income Purely from Business/Profession) or BIR Form 1701Q (Quarterly Income Tax Return for Individuals, Estates, and Trusts), along with the necessary attachments and proof of payment.

How to Compute Income Tax on Passive Income?

Passive income refers to earnings derived from sources other than active employment or business operations, such as interest, dividends, royalties, and rental income. In the Philippines, passive income is subject to different tax rates imposed by the BIR.

Updated Tax Rates on Passive Income for Citizens and Resident Foreigners in the Philippines:

| Passive Income | Tax Rate |

|---|---|

| Interest from currency deposits, trust funds and deposit substitute | 20% |

| Royalties (on books as well as literary & musical compositions) | 10% |

| – In general | 20% |

| Prizes (P10,000 or less) | Graduated IT Rates |

| – Over P10,000 | 20% |

| Winnings (except from PCSO and Lotto amounting to P10,000 or less) | 20% |

| – From PCSO and Lotto amounting to P10,000 or less | exempt |

| Interest Income from a Depository Bank under the Expanded Foreign Currency Deposit System | 15% |

| Cash and/or Property Dividends received by an individual from a domestic corporation, joint stock company, insurance or mutual fund companies, Regional Operating Headquarter of multinational companies | 10% |

| Share of an individual in the distributable net income after tax of a partnership (except GPPs)/ association, a joint account, a joint venture or consortium taxable as corporation of which he is a member or co-venture | 10% |

| Capital gains from sale, exchange or other disposition of real property located in the Philippines, classified as capital asset | 6% |

| Net capital gains from sale of shares of stock not traded in the stock exchange | 15% |

| Interest Income from long-term deposit or investment in the form of savings, common or individual trust funds, deposit substitutes, investment management accounts and other investments evidenced by certificates in such form prescribed by the Bangko Sentral ng Pilipinas (BSP) Upon pre-termination before the fifth year, there should be imposed on the entire income from the proceeds of the long-term deposit based on the remaining maturity thereof: Holding Period | Exempt |

| – 4 years to less than 5 years | 5% |

| – 3 years to less than 4 years | 12% |

| – Less than 3 years | 20% |

To compute taxes on passive income, determine the applicable tax rate based on the passive income type (refer to the tax table above). Then, calculate the tax payable.

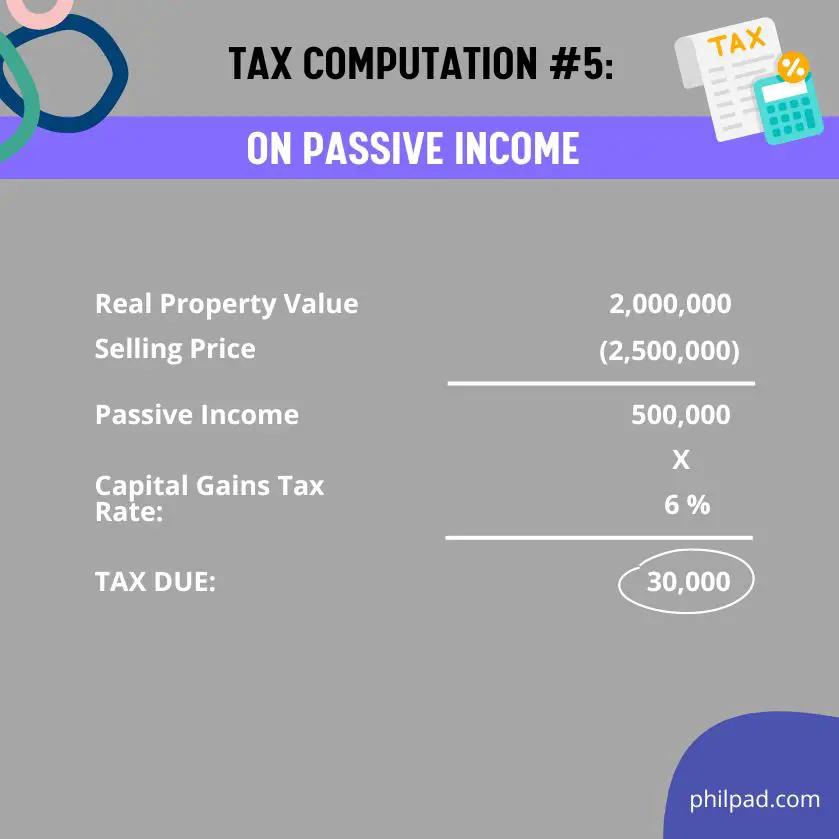

Example Tax Computation (Capital Gains Tax):

How to compute income tax in the Philippines when you sell a real estate property? Assuming you have acquired a real estate property worth P2,000,000. You decided to sell it for P2,500,000. Under the law, you must pay 6% Capital Gains Tax (CGT) for the sale of your capital asset. Thus, you will pay P30,000 to the BIR.

Real Property Value: P2,000,000

Selling Price: P2,500,000

Passive Income: P500,000

Tax Rate: 6%

Capital Gains Tax: P30,000

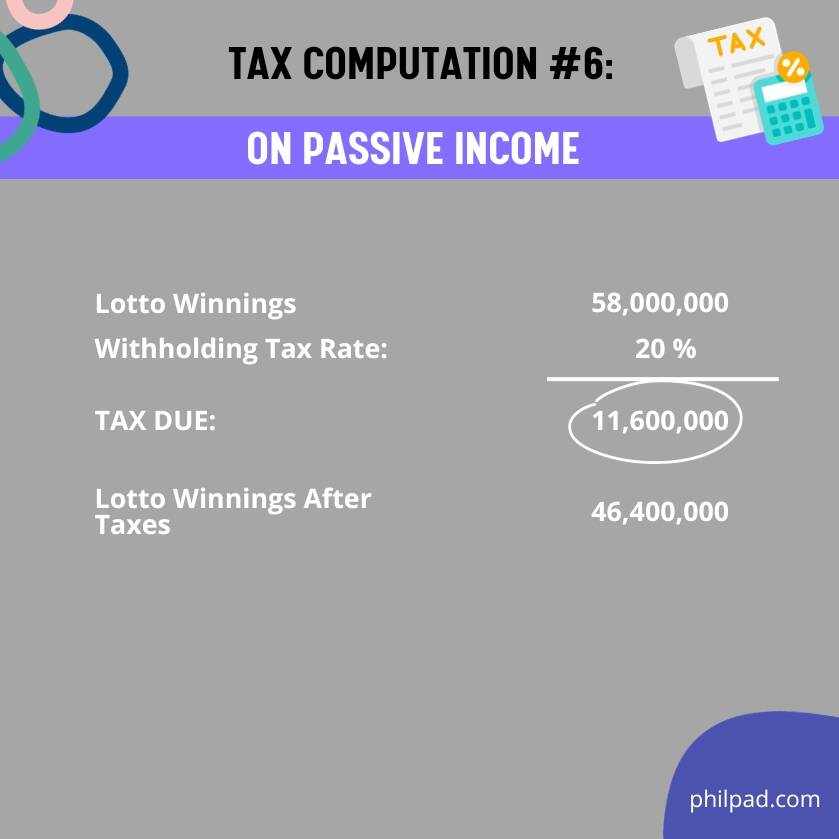

Example Tax Computation (Lotto Winnings):

How to compute income tax in the Philippines from PCSO Lotto winnings? Suppose you have won the PCSO Lotto jackpot worth P58 million. You still need to pay your taxes because PCSO Lotto winnings are only exempted from taxes if they’re worth less than P10,000. No worries, because it’s no hassle. The PCSO will apply the necessary 20% final withholding tax before issuing your cheque.

Lotto Winning: P58,000,000

Withholding Tax Rate: 20%

Your lotto winnings after taxes: P46,400,000

Filing of Income Tax Returns in the Philippines and Payment of Taxes:

- An individual whose taxable income does not exceed P250,000 is not required to file an Income Tax Return.

- The ITR shall be composed of a maximum four pages in paper or electronic form.

- Substituted filing of ITR by employees receiving purely compensation income by employers will be evidenced by the Certificate of Withholding filed and duly stamped “received” by the BIR. It shall be tantamount to the substituted filing of ITRs by the said employees.

- The rate of withholding tax at source shall not be less than 1% but not more than 15% on the income payment

Also check out: How to Pay Tax Online in the Philippines

Final Thoughts:

Computing income tax in the Philippines is not as difficult as it may sound. With a clear understanding of the tax rates, exemptions, tax withheld, and a step-by-step guide, anyone can calculate their income tax accurately. You don’t need to be a Certified Public Accountant (CPA) to manage your taxes effectively. By staying organized, keeping accurate records, and following the guidelines, you can confidently navigate the income tax computation process and fulfill your tax obligations in the Philippines.

Disclaimer: This article serves as a general informational resource and should not be considered a replacement for expert tax advice. Some data may change after the publication of this post.