All employers and SSS members can now enjoy and make use of the amazing SSS Online Inquiry System. It’s free and so helpful and you can view your account anytime even without office hours provided you have internet connection or wifi and you are a registered user. In this post, I’m gonna share how to submit SSS online reports for R3, ML2 and H3 which are the usual hectic work of an employer.

R3 generates Transmittal Reports and Employee Files, ML2 is for submission of Loan Collection List while H3 involves Contribution Collection List.

Before you can do any of the work mentioned, make sure you have registered your online account successfully in the SSS. Take note there are 2 kinds of SSS Online Account – Member and Employer. I’m going to discuss Employer’s account here since it involves R3, ML2 and H3.

If you are a Member, you can skip this and just head over “How to View and Check SSS Online Account.”

How to Submit SSS Online – R3, ML2, H3

It is easy and simple because all the tabs are there once you log in. There are important notes to consider first before you successfully submit, post and upload R3, ML2 and H3 online. Read the official note emailed by SSS below:

Please be informed that the SSS Website is now checking if the Payment Reference Number (Special Bank Receipt or Over the Counter Receipt Number) being entered during online submission of Collection Lists is in the SSS Cash Collection File. This enhancement, which was implemented effective 10 September 2013, aims to ensure the validity and accuracy of the payment details being submitted in the SSS Web.

If the Payment Reference Number is not yet posted in the SSS records, the SSS Website will not accept the contribution collection list (R-3/H-3) or loan collection list (ML2) being submitted and the following onscreen message will be displayed by the SSS Website:”

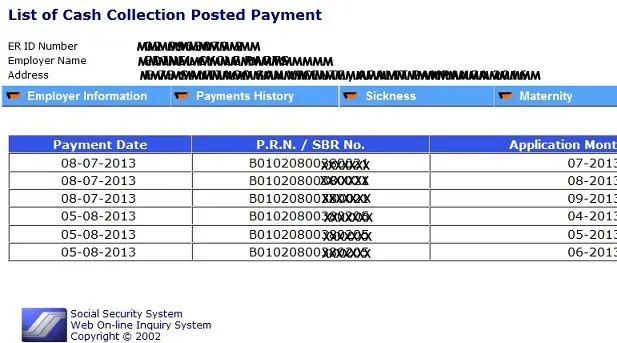

“Payment details entered are currently not yet posted in SSS records. To verify posted payments, you may access “Online Inquiry”, select “Payments History” then “Cash Col Posted Payments”.

“If payment is already posted in the “List of Contributions/Loans Payments”, you may submit the Contribution/Loan Collection List online.”

We, therefore, advise that before submitting your collection list online, please verify first from your web account’s Online Inquiry if the PRN issued for your contribution or loan payment is already posted. If already posted, you may submit the R-3/H-3/ML2 online. For contributions/loan repayments paid at SSS branches with teller services, the complete 15-character PRN must be entered in the field for “Receipt Number”. For payments paid at SSS partner banks, the complete 8-character SBR Number must be entered.

You may, however, still opt to submit your Collection Lists to your SSS servicing branch through USB, using the R-3/LMS File Generator Program.”

It is so clear that you might commit an error message and unsuccessful uploading and posting to submit SSS online reports if the 15-digit PRN and 8-digit SBR number is not yet posted in the SSS records. In the below example, I checked and made sure the PRn for the corresponding months were already posted in the SSS record and online system.

This is taken from the actual reports I have made. Please don’t copy my PRN and SBR because every company has their own. This is only an example.

I posted some screenshots how I did the steps in uploading contributions of employees online. Just head over here:

Share your experience and views about SSS Online Submission by commenting. Thanks!