Here’s the step-by-step guide on how to use the new eBIR forms offline. You can download the latest version of the new eBIR Forms software at the official website of the Bureau of Internal Revenue.

The new eBIR form system is beneficial to make everything easier and faster for taxpayers and employers. There are two packages for the eBIR forms: offline package and online package. In this post, we share about using the offline package.

We made this post for people who prefer filing offline because some taxpayers find it more convenient to file their taxes and tax returns with this route. The procedures and requirements for the latest version are here.

What is eBIR Forms Offline?

eBIR Forms Offline is a software developed by the Bureau of Internal Revenue in the Philippines to facilitate taxpayers for filing, computing, editing, and printing their tax returns offline. The software helps taxpayers for more accurate and faster submission of tax forms.

eBIR Forms Offline Package Benefits

According to the BIR,

“Instead of the conventional manual process of filling up tax returns on pre-printed forms that is highly susceptible to human error, taxpayers/ATAs can directly encode data, validate, edit, save, delete, view, print and submit their tax returns. The package can do automatic computations and has the capability to validate information encoded by taxpayers/ATAs. After filling out the forms in this package, taxpayers/ATAs can submit it to the Online eBIRForms System.”

What BIR Forms are included in the eBIR Forms Package?

- Payment Form – 0605

- Monthly Remittance Return of Value-Added Tax and Other Percentage Taxes Withheld – 1600

- Remittance Return of Value-Added Tax and Other Percentage Taxes Withheld by Race Track Operators – 1600WP

- Monthly Remittance Return of Income Taxes Withheld on Compensation – 1601-C

- Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded) – 1601-E

- Monthly Remittance Return of Final Income Taxes Withheld – 1601-F

- Monthly Remittance Return of Final Income Taxes Withheld on Interest Paid on Deposits and Yield on Deposits Substitutes/Trusts/Etc. – 1602

- Quarterly Remittance Return of Final Income Taxes Withheld on Fringe Benefits Paid to Employees Other than Rank and File – 1603

- Annual Information Return of Income Taxes Withheld on Compensation and Final Withholding Taxes – 1604-CF

- Annual Information Return of Creditable Income Taxes Withheld (Expanded)/Income Payments Exempt from Withholding Tax – 1604-E

- Withholding Tax Remittance Return for Onerous Transfer of Real Property Other than Capital Asset (Including Taxable and Exempt) – 1606

- Annual Income Tax Return for Individuals Earning Purely Compensation Income (Including Non-Business/Non-Profession Income) – 1700

- Annual Income Tax Return for Self-Employed Individuals, Estates and Trusts – 1701

- Quarterly Income Tax Return for Self-Employed Individuals, Estates and Trusts (Including those w/ both Business and Compensation Income) – 1701Q

- Annual Income Tax Return for Use ONLY by Corporation, Partnership and Other Non-Individual Taxpayer EXEMPT Under the Tax Code, as Amended, [Sec. 30 and those exempted in Sec. 27(C)] and Other Special Laws, with NO Other Taxable Income – 1702-EX

- Annual Income Tax Return for Corporation, Partnership and Other Non-Individual with MIXED Income Subject to Multiple Income Tax Rates or with Income Subject to SPECIAL/PREFERENTIAL RATE – 1702-MX

- Annual Income Tax Return for Corporation, Partnership and Other Non-Individual Taxpayer Subject Only to REGULAR Income Tax Rate – 1702-RT

- Quarterly Income Tax Return for Corporations, Partnerships and Other Non-Individual Taxpayers – 1702Q

- Improperly Accumulated Earnings Tax Return – 1704

- Capital Gains Tax Return for Onerous Transfer of Real Property Classified as Capital Asset (both Taxable and Exempt) – 1706

- Capital Gains Tax Return for Onerous Transfer of Shares of Stock Not Traded Through the Local Stock Exchange – 1707

- Donor’s Tax Return – 1800

- Estate Tax Return – 1801

- Documentary Stamp Tax Declaration/ Return – 2000

- Documentary Stamp Tax Declaration/ Return (One-Time Transactions) – 2000-OT

- Excise Tax Return for Alcohol Products – 2200A

- Excise Tax Return for Automobiles & Non-Essential Goods – 2200AN

- Excise Tax Return for Mineral Products – 2200M

- Excise Tax Return for Petroleum Products – 2200P

- Excise Tax Return for Tobacco Products – 2200T

- Monthly Value-Added Tax Declaration – 2550M

- Quarterly Value-Added Tax Return – 2550Q

- Monthly Percentage Tax Return – 2551M

- Quarterly Percentage Tax Return – 2551Q

- Percentage Tax Return for Transactions Involving Shares of Stock Listed and Traded Through the Local Stock Exchange or Through Initial and/or Secondary Public Offering – 2552

- Return of Percentage Tax Payable under Special Laws – 2553

How to Use eBIR Forms Offline to File Your Taxes?

Step 1: Download the latest version of eBIR Forms Offline software package

The eBIR Forms Offline software is available to download from the official website of the BIR. We recommend you get this only from their site to ensure it’s the latest version. It’s free to download, and all taxpayers can use the software.

Step 2: Install the software on your computer

The eBir Forms software currently can’t run on Mac computers. You can install the software if you are using Windows. To install, download the software, then click the file. It will automatically start the installation.

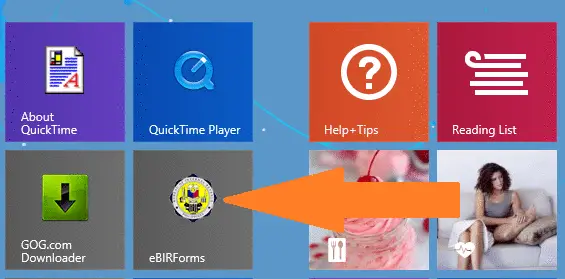

Step 3: Click the eBIR Forms icon on your computer or desktop

To begin using the eBIR Forms system, click the icon to open the program. You may find it on your Windows “Programs” or installed “Apps.” Similarly, you can click the search icon and type “eBIR Forms,” and you will be redirected to the application.

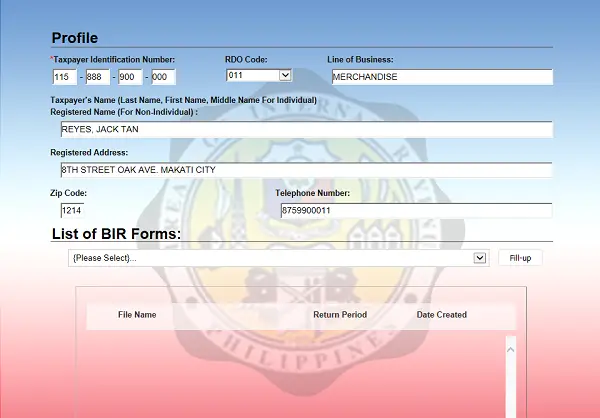

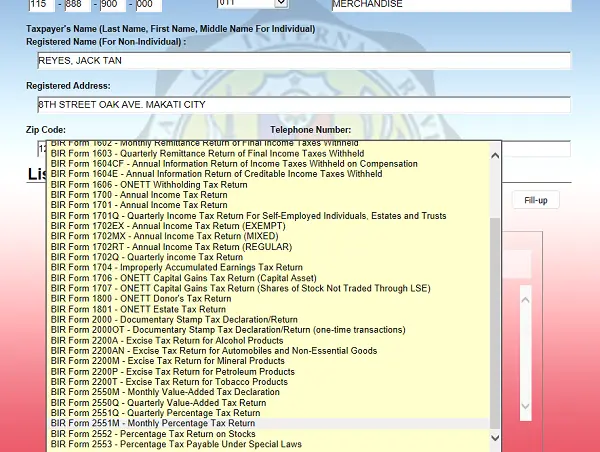

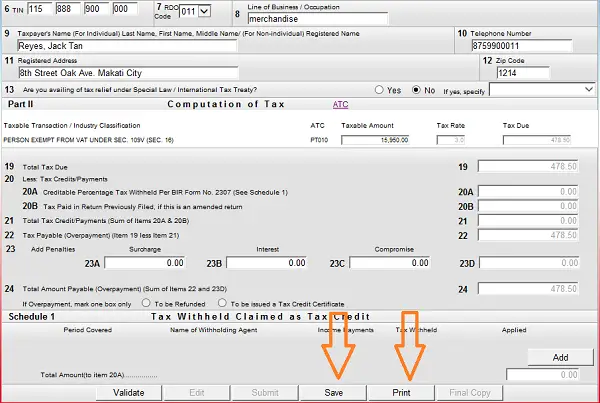

Step 4: Create your Taxpayer Profile

Start by creating your taxpayer profile. Type the details required, such as your TIN (Taxpayer Identification Number), RDO Code, Line of Business, full name, registered address, zip code, and phone number. We made a sample screenshot below:

Step 5: Choose your eBIR Form

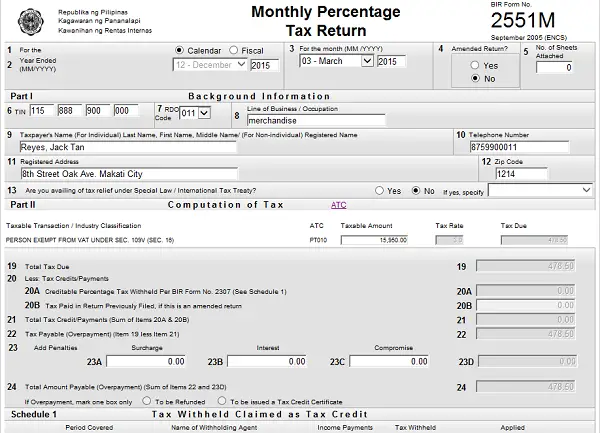

Select the eBIR form you want to file and click FILL-UP. In this sample, we’re making Form 2551M for Monthly Percentage Tax Return.

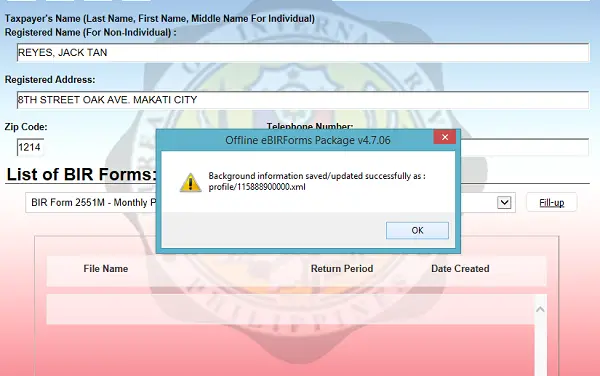

Step 6: Save your Tax Profile

The system will now save your background information, so the next time you input your Tax ID Number, all your tax profile info will load on the page. Your data will now be saved and you’ll see a message box like the one below. Tap “OK” to proceed.

Step 7: Complete your BIR Form

Your BIR form will now load, and your details will automatically be filled in the form. You should now complete the required data on each section. Choose the date applicable (Calendar or Fiscal) year and for the month. Remember to double-check the details you have provided.

Step 8: Check your Tax Computation

Proceed to the computation of your taxes by providing the required amounts. eBIR Forms program will automatically compute your taxes after you encode the numbers on the boxes.

In the sample above, we put the taxable amount for the monthly percentage tax, and the required tax due has been automatically computed in the form.

Step 9: Validate and save the forms

Now that you’re ready to submit and file your taxes click the “VALIDATE” button so the system will verify, check, and compute your taxes.

Once validated, click the “SAVE” button. The forms will now be saved on the system and your computer. You can access the tax forms again whenever you need them.

Step 10: File and Submit your BIR Forms

To file your taxes, submit your BIR Forms and pay your tax dues. You can submit and pay manually at the BIR accredited banks, BIR offices, or online using the Online eBIR Forms System.

To submit manually, print out the forms by clicking the “PRINT” button. Remember to print three copies of the documents because the BIR requires triplicate copies when filing taxes. BIR will give you a copy of your ITR or BIR form.