Effective January 2026, the new and updated Income Tax Table in the Philippines (BIR Tax Table 2026) will follow the revised rates following the new BIR TRAIN – Tax Reform for Acceleration and Inclusion Act implementing the Income Tax Provisions of the Republic Act 10963.

So if you want to compute your income taxes for the year 2026, you must now use and apply this tax table in the Philippines. Tax rates from the previous year 2025 are also the same with 2026 (unless revised).

The Tax Reform for Acceleration and Inclusion was introduced few years ago while the implementation started in 2018. Its objectives include reduction of tax rates, simplified tax system, expansion of VAT base, excise tax on sugary, automobiles, and petroleum products.

The Department of Finance also proposed tax reforms for estate tax amnesty, general tax amnesty, amendments to bank secrecy law, lower estate and donor’s tax rates, lower rates on transaction taxes on land, limit on VAT zero-rating to direct exporters, rationalization of fiscal incentives, VAT refund in cash, harmonization of capital income tax rates on deposits, investments, dividends, equities and other passive income to 10% and increase on stock transaction tax from 0.5% to 1%.

BIR TRAIN timeline started few years ago and the Bureau conducted seminars and training to properly assists people, companies and corporation for the implementation and execution of the new tax law. Package 1 started in 2018 while Package 2 which tackled introduction and implementation of Corporate Income Tax had a timeline from 2018 to 2019. Packages 3 and 4 tackled Capital Income Tax and other tax measures followed.

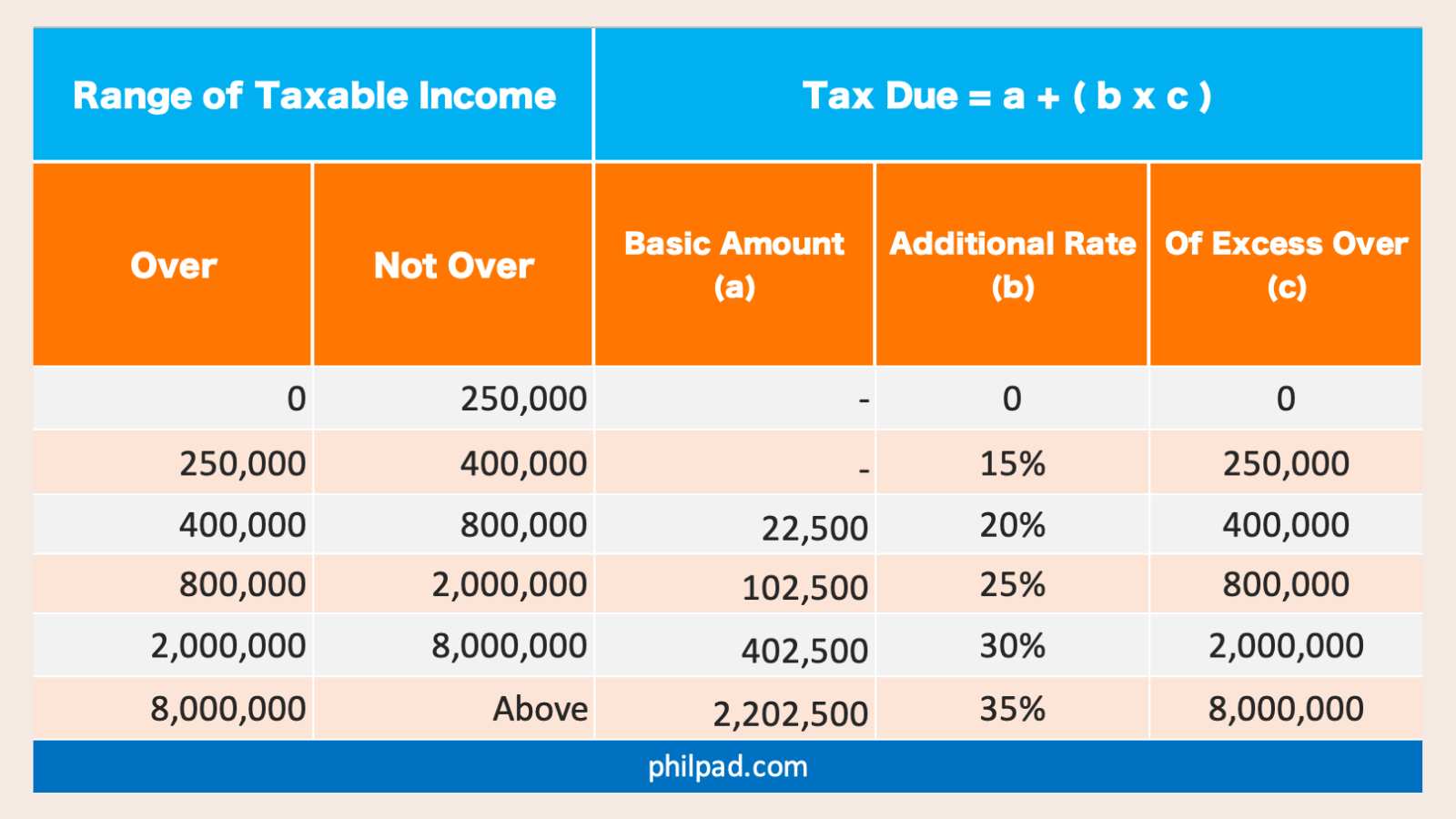

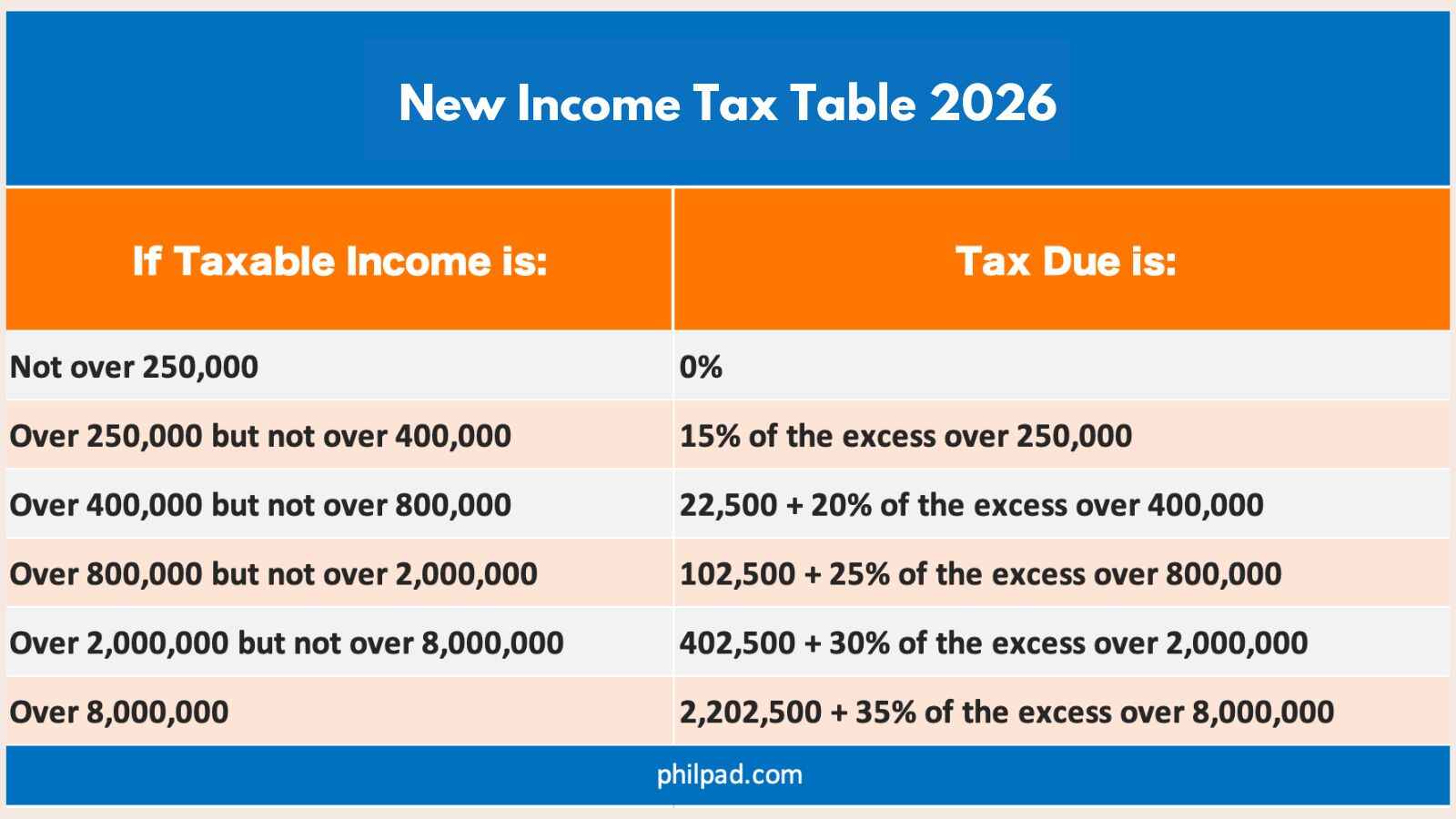

New Income Tax Table in 2026 (BIR Income Tax Table 2026)

Annual Income Tax Table (for the Year 2026)

If you want to compute your income tax for the year 2026, the following tax rate shall apply for annual income tax for individual taxpayers defined under R.A. 10963. We simplified the table to guide taxpayers easily.

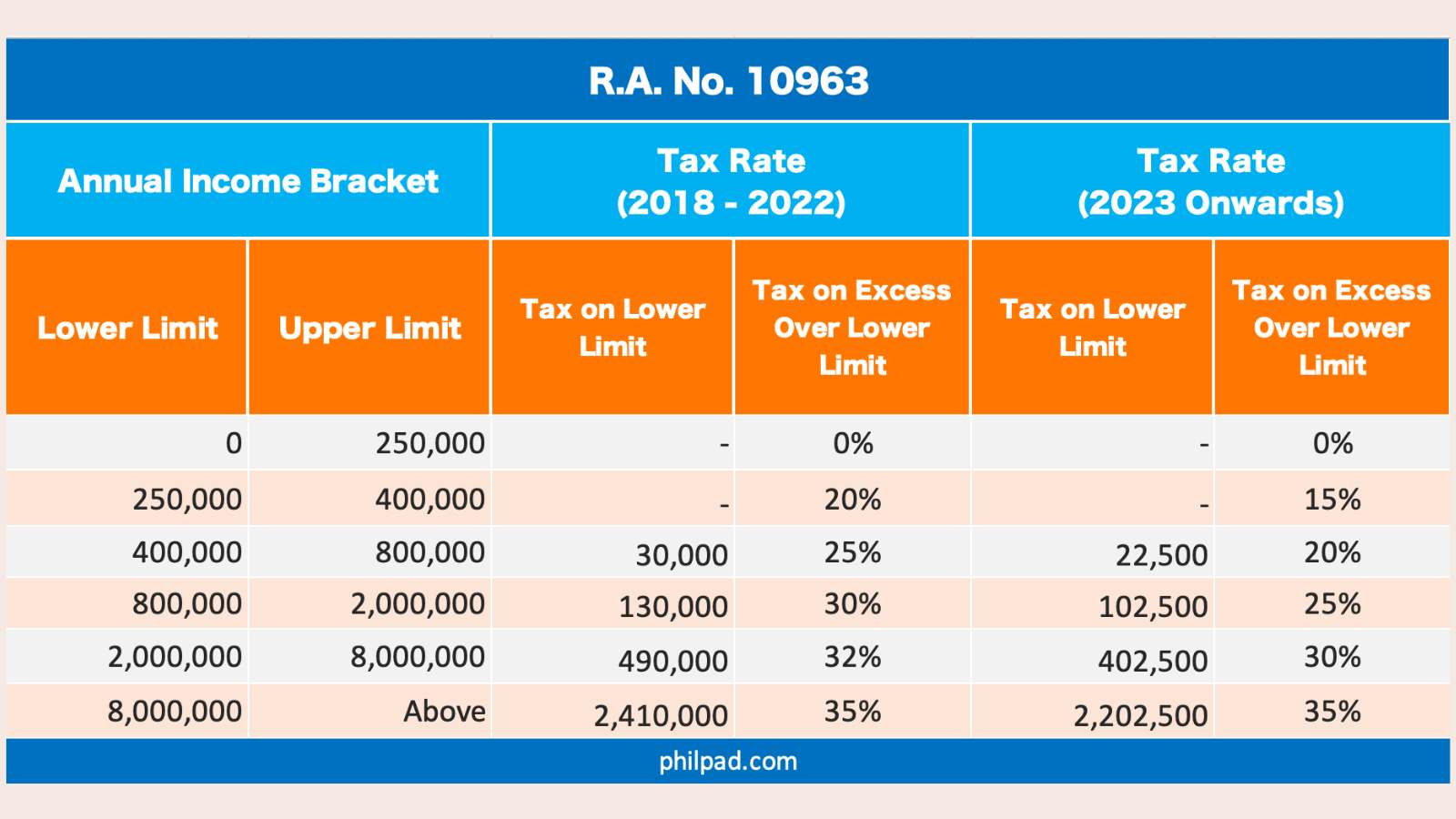

What has changed in the new BIR Tax Table 2026 vs. the previous year?

Compared to the previous year, the 2026 BIR tax rates will again favor taxpayers since the same rates will also apply. Rates from 2023 onwards are applied (unless revised). This will benefit us all amidst inflation and global economic challenges.

Income Tax Calculator Sample for 2026

From the new Tax Table 2026 above, we got a sample following income computations.

If taxable income for the year for example resulted to 1,000,000, tax due will be 152,500.

1,000,000 falls under the 800,000 lower limit bracket. Basic amount will be 102,500. The excess 200,000 should be multiplied by 25%. You’ll get 50,000. Therefore,

102,500 + 50,000 = 152,500 tax due

Individuals Earning Purely Compensation Income shall be taxed on the income tax rates prescribed above.

There is an increased threshold for non-taxable 13th month pay and other benefits, from 82,000, the exemption is now 90,000.

Taxable income for compensation earners is the gross compensation income less non taxable income/benefits such as but no limited to the 13th month pay and other benefits de minimis benefits and employee’s share in the SSS, GSIS, PHIC, Pagibig contributions and union dues.

Husband and wife shall compute their individual income tax separately based on their own taxable income; if any income cannot be attributed to or identified as income exclusively earned by either of the spouses, the same shall be divided equally between the spouses.

Minimum wage earners shall be exempt from the payment of income tax based on their statutory minimum wage rates. Holiday pay, overtime pay, night shift differential pay and hazard pay received by minimum wage earners are likewise exempt.

To further read the complete TRAIN law, please visit the full text of BIR Tax Reform for Acceleration and Inclusion.

BIR Income Tax Table for 2026

Here’s the non-summarized table from the BIR. Effective January 1, 2023 and onwards.