The new Philhealth contribution table 2026 is set to follow the Universal Health Care Law (Republic Act 11223). All premiums are expected to follow the 5% premium rate for 2026.

Members can now pay using the new Philhealth premiums contribution schedule in the National Health Insurance Program. All Direct Contributors are advised that the premium rate for calendar year 2026 is 5% with an income floor of ₱10,000 and an income ceiling of ₱100,000.

If premiums payment will be made now, the 5% computation will apply in accordance to the law. If ever a suspension is declared by Malacañang, any excess amount paid by the member will cause adjustments to future contribution payments.

If you’re employed with a salary of ₱10,000, your monthly contribution will be ₱500 but you will only pay half of your contributions (₱250) since your employer is required to shoulder the other half.

The adjusted premium rate eventually takes effect in the Electronic Premium Remittance System (EPRS) and the Philhealth Member Portal. Members can also now pay thru GCash, debit, and credit cards.

Being a member of Philhealth has many significant benefits to support medical and health insurance for every Filipino and their beneficiaries. Another year has passed, are you planning to pay your Philhealth premiums for the year 2026?

What is Philhealth Contribution?

Philhealth contribution is the monthly premium paid by the members of Philippine Health Insurance Corporation for their medical insurance coverage. Employer and employee both pay half the monthly premium while senior citizens are automatically free for lifetime health insurance coverage.

It is very important for all members, their dependents and beneficiaries to know the latest and updated premiums because it is also important to have complete premium payments. Complete premium payments ensure all membership eligibility for benefits.

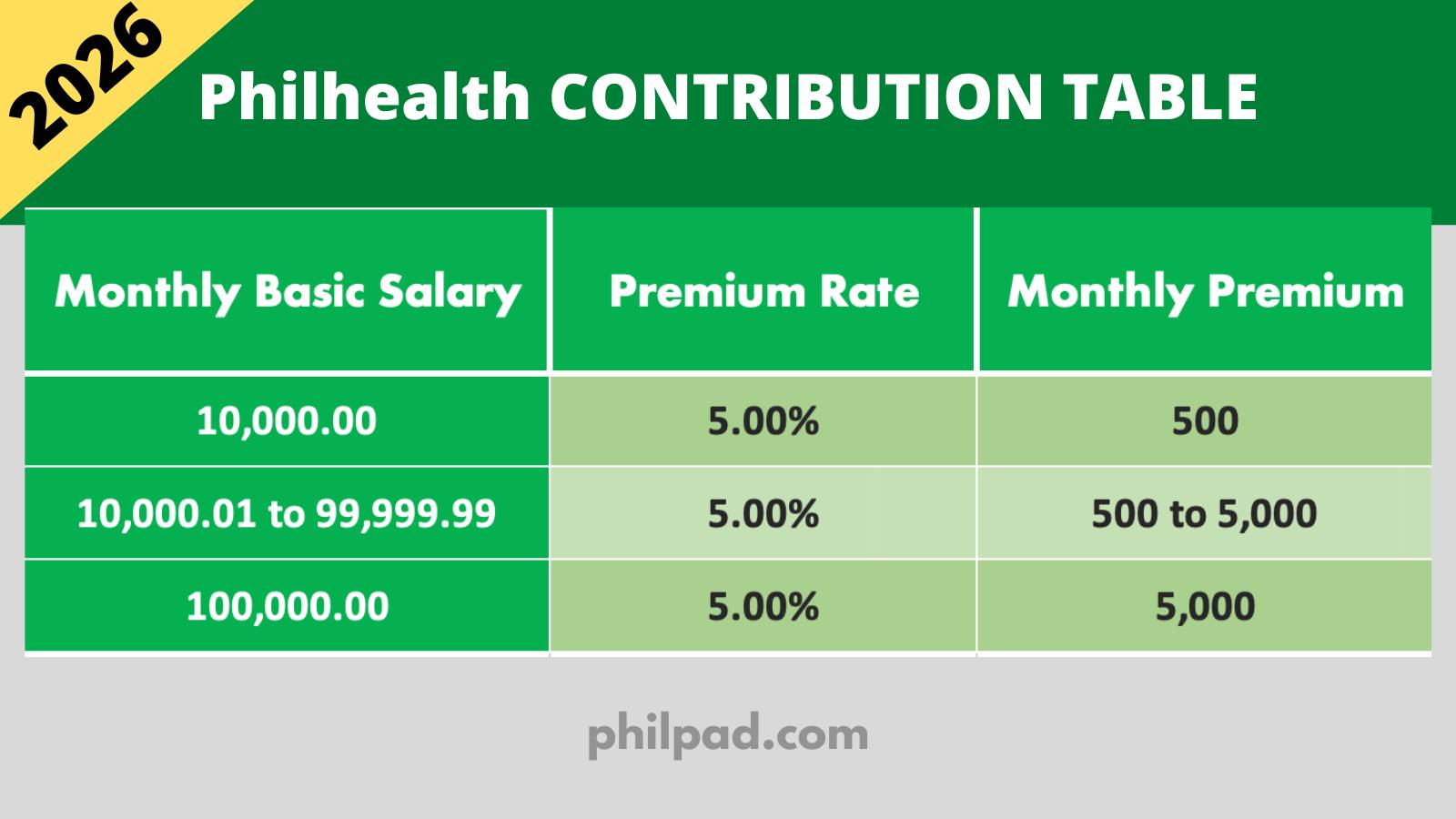

Philhealth Contribution Table in 2026

Philhealth members can now follow the premium rate of 5% in accordance with the Universal Health Care Law and Philhealth premium contribution schedule.

PhilHealth can now collect premiums from direct contributors using the 5% rate and will follow the ₱100,000 monthly basic salary ceiling set for 2026.

Philhealth Monthly Premium Rates for 2026

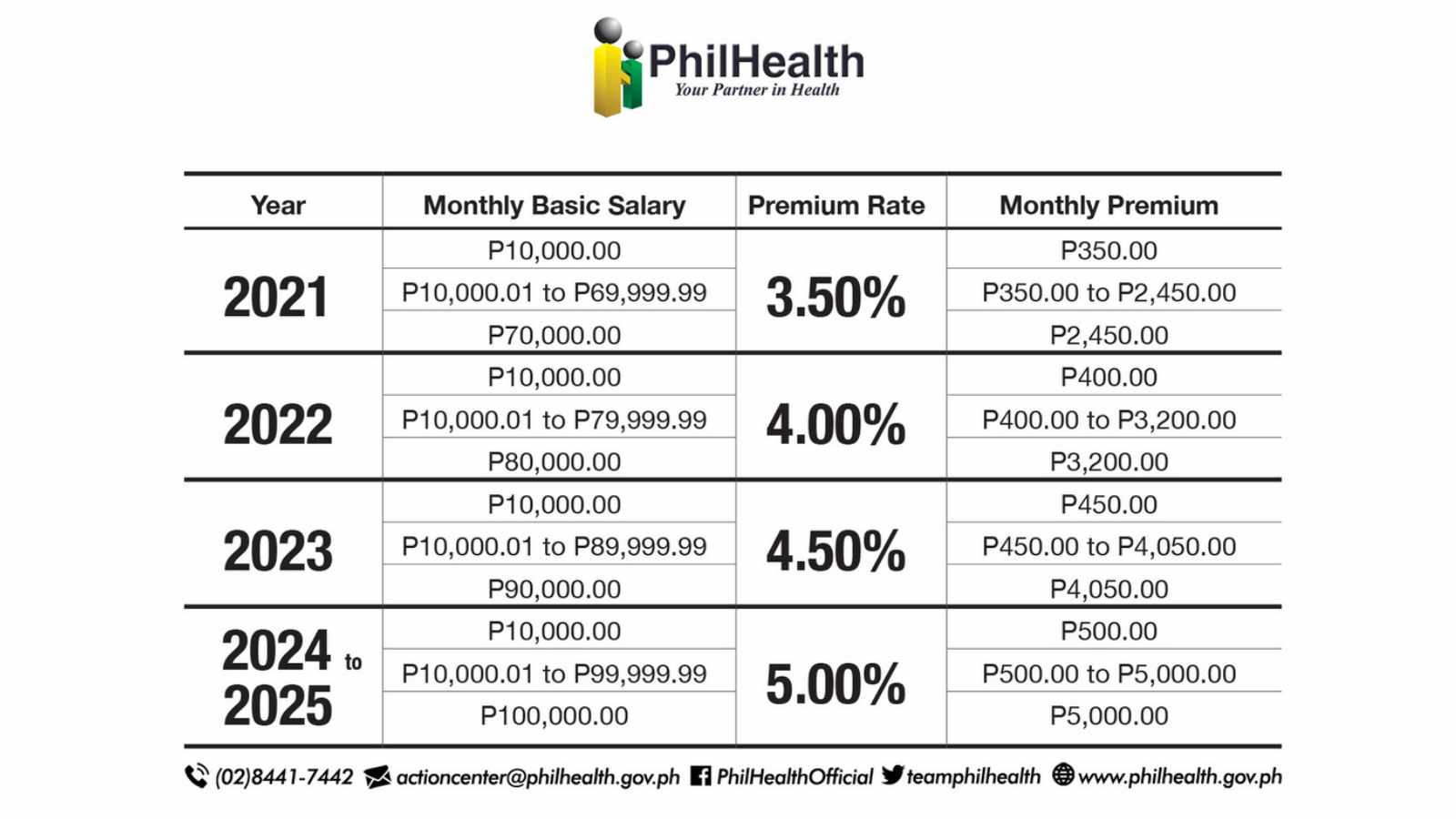

According to the Universal Health Care Act of the Philippines, Philhealth monthly premiums for direct contributors for five years will be based on the rates of this chart below.

According to PhilHealth, contribution rates will remain unchanged starting January 2026, marking the end of the five-year gradual increase under the UHC Law.

Thus, premiums for 2026 is set to follow the 5% rate same as the previous year (unless revised by law).

What are Direct Contributors?

Direct Contributors refer to those who are gainfully employed and bound by an employer-employee relationship. In addition, Kasambahays, self-employed individuals, practicing professionals and Overseas Filipino Workers belong to this membership category as well according to Philhealth.

How much is Philhealth Minimum Payment?

For those earning below the salary floor of ₱10,000, contributions are computed using the minimum threshold of ₱500; while those who earn the set ceilings/limits shall pay premiums based on the set rates. This policy shall also apply to seafarers.

Philhealth Contributions for OFW and Individual Paying Members

Premiums of individual-paying members (voluntary members), self-employed professionals, and land-based OFWs are computed straight based on their monthly earnings and paid in whole by the member.

For this category and to ensure accuracy in computation, PhilHealth will require submission of proof of income such as the following documents:

- Financial Books / Records

- Latest ITR (Income Tax Return) received by the Bureau of Internal Revenue

- Duly-notarized affidavit of income declaration

- Overseas Employment Contract

Failure to submit any of the document above, the contribution of the said member will be based on the highest computed rate.

Philhealth Contributions for Kasambahay and PWD

In accordance to RA 10361, the premium contributions of the Kasambahay shall be shouldered solely by the household employer. However, if the Kasambahay is receiving ₱5,000 monthly salary or above, the Kasambahay shall pay his/her proportionate share or be deducted of their equal share in the monthly contribution.

In cases of employed Persons with Disability (PWDs) listed in the Department of Health’s PWD registry, their contributions shall be equally divided between their employers and the National Government for their personal share.

Health is wealth. Remember that in order to be eligible to benefits, we must always pay our premiums and avoid missing a month or months of unpaid contributions.

Philhealth always require active membership and payment of premiums in availing benefits. It is always important to know our benefits and the requirements even if we are not availing them.

We hope though these premium requirements will not increase as much as those private insurance companies. Nonetheless, they must also increase health benefits packages and coverage.

Philhealth FAQ:

What will happen if I missed payment of my Philhealth premiums?

Starting January 2020, unpaid Philhealth contributions shall be billed for the unpaid premiums with interests (compounded monthly) and penalties of at least 3% a month for employers, sea-based OFWs, and Kasambahays. On the other hand, self-employed, voluntary members, professionals and land-based migrant workers shall incur a maximum interest of 1.5% for every month of missed payment.

How is Philhealth contribution calculated?

The monthly premium contribution shall be at the rate of 5% computed straight based on the monthly basic salary. With the new premium schedule, computation shall be based on the table above. Employee pays half the monthly contributions while the other half is shouldered by the employer.

How can I check my Philhealth contribution online?

- Go to the Philhealth website.

- Log in to the Member Inquiry facility by entering your PIN and password (from the activation email.)

- Answer the security question.

- The Member Static Information page will appear.

How to update Philhealth contribution?

- Fill out Form PMRF (Philhealth Member Registration Form)

- Tick the Updating Box

- Enter personal information properly

- Send the PMRF to any Philhealth office near you

Can I continue my Philhealth contribution?

In the event of resignation or any circumstance that stopped you from paying for your Philhealth premiums, you can still resume your active membership by updating your account into individually paying member. You may do this by submitting PMRF to Philhealth before paying your premiums.

What are Sponsored Program Members?

Sponsored members whose premium contributions are fully or partially subsidized by their sponsors such as LGUs, Private Entities, Legislators, and National Government Agencies are under this category.

According to Philhealth, all sponsored members and their beneficiaries shall be entitled to identified in-patient hospital care (including the Z Benefit Package), out-patient care services, and other health care services provided by accredited health care centers and providers. They shall also be entitled to the No balance Billing (NBB) Policy for health care services provided by accredited government health facilities in a non-private accommodation. Likewise, they shall also be entitled to the Primary Care Benefit 1 (PCB1) Package to be provided by their accredited Primary Care Benefit Provided where they are assigned and enlisted.”

Related articles:

- New SSS Contribution Table 2026

- New Pag-ibig Contribution Table 2026

- New Income Tax Table 2026

- How to Get Philhealth MDR Form Online

Do you prefer Philhealth or do you prefer other health insurance companies? Share your views in the comments.