Why should you invest in PNB AIP a.k.a. PNB Auto Investment Plan UITF? The answers and reasons are revealed here. If you are one of those people who are interested to invest in UITF regularly every month instead of one-time placement, I’m sure you already heard of PNB Auto Investment Plan.

I know a very well-known UITF from BDO called EIP (Easy Investment Plan) has gotten the attention of many investors especially beginners but since BDO had no online UITF account opening service, a lot of people went berserk.

Eventually they learned about PNB AIP and I started seeing happy faces. With PNB Online UITF service, any interested investor can open UITF account online anytime, anywhere.

It’s a pleasure to make a review about PNB AIP UITF here since many readers have requested for it.

What is PNB Auto Investment Plan?

PNB Auto Investment Plan is an investment plan wherein you can set aside a portion of your money or savings for automatic investment to any PNB UITF of your choice.

It’s literally saving money in the bank but unlike deposit account, your funds will roll over as regular UITF, meaning you will earn more than how much you can earn through regular deposits or time deposits.

Investing in PNB Auto Investment Plan UITF

PNB Auto Investment Plan is available for the following UITF:

PNB Auto Investment Plan UITF Requirements

You can either open AIP account online or at any PNB branch. You need a PNB account (savings, atm etc.) because this is where they will automatically get your UITF funds on the date of your choice, recurring, every month, your choice.

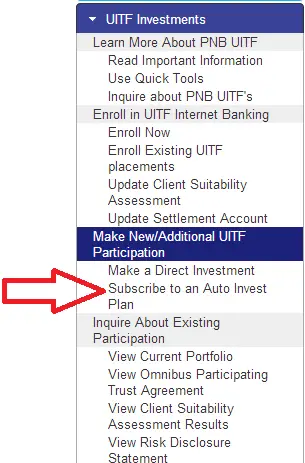

If you already have PNB online banking account, you can proceed to open your AIP online. Start by going to UITF Investments and select Subscribe to an Auto Invest Plan.

Select which type of UITF you want for your AIP. You also have the option to make future or recurring placements. PNB will issue you COP (Confirmation of Participation) once you reached the required threshold for the UITF.

PNB Auto Investment Plan UITF Benefits

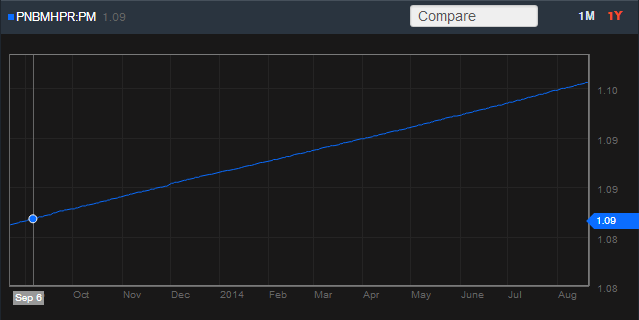

PNB Auto Investment Plan compared to other UITF investments, is not very risky because your funds are invested on fixed income instruments. As you invest periodically, every month for example, you are minimizing the risk from possible market downfall or bad economic point, instead you are maximizing profit because your funds continue to grow over time.

With Automatic Investment Plan, you are applying a time-tested and proven investment strategy used by many investors around the world, Cost Averaging. Hence, no matter how much the NAVPU is, you will gain eventually. To learn more about the advantages of investing using Cost Averaging, read about “Lump Sum vs Peso Averaging Investment.”

You can invest in peso or dollar, your choice, and you can also open an account online or at the branch. Account opening online is so quick. From experience, it took me just a day for the UITF account approval.

Online banking feature will help you, the investor, to monitor and check the performance of your UITF. Everything is safe online since PNB website uses https platform. You should know that by now, if you are banking or transacting money online, you must only use a site that starts with https instead of the typical http. If you’re not banking, using http is OK.

Why should you invest with PNB Auto Investment Plan?

PNB AIP is a great UITF investment plan simply because you have more earnings than risks. Regular savings account and time deposits have lower interest rates. In fact, your withholding taxes could be much higher.

ATM charges could be much higher. Don’t rely on low interest rates while you have UITF products that could give you more profit. Let your money participate on investments. Let your money appreciate in value. Let your money work for you.

hi ms fehl,

is the AIP of PNB cost averaging like bdo or a lump sum?

Godbless and more power

Yes, Peso Cost Averaging

nag subscribe ako sa PNB AIP, paano po palitan ang recurring date po para auto debit sa Savings ko? thanks

Pwede rin po ba dito ang ofw loan? magkano po kaya interest sa 100k for 12 months?

PNB Auto Invetsment Plan is UITF invetsment and not a loan

miss Fehl sa Pnb peso power alin po don ang maganda? thank you.

PNB Peso Power Accelerator Plus is a good insurance and investment, you have to select the coverage that suits your needs

Hi Ms. Fehl! I just want to say thank you for all the insights you have given to us about handling money and how to make it grow through investment. I have been your silent reader since 2014. Keep it up and thank you for sharing. God Bless.

Thank you KJ and God bless you, too.

ah ok po.which bank po recommend nyo for UITF? Compound interest din po ba sa UITF? Or sa mutual funds lang yun? Thanks so much.all the best!

UITF gains/loss are based on NAVPU. I recommend BDO, PNB, SECB

Mam, yun po bang sa pnb global filipino money market fund monthly din yun pagdeposit pra sa participation?

The monthly placement is your choice 🙂 It’s not a requirement

Hi fehl! Ask ko lang kung aling UITF equity ng PNB ang the best para mag-invest? Kelangan ko pa ba maghintay na bumaba navpu bago mag-open ng UITF para mas maganda??? Yung iba kasi nakikita ko -naghihintay Sila ng pagbulusok ng navpu bago mag-invest sa kahit anung UITF equity ng mga bank. Thanks a lot!

In terms of earnings, Equity Fund or High Dividend Fund. The earlier you invest, the better since UITFs in Equity choose the best performing stocks naman. It’s up to you if you want to miss an opportunity or wait for uncertain opportunity. 🙂 Time is money, equities grow.

Hi miss fehl..ask ko lng if pede ko ichange un direct placement ko sa global filipino fund into auto investment plan.ngstart na kc ako dun kya lng direct gnwa ko.ms ok ba aip or preho lng.tnk u so mch.

Hi, you need to redeem and open another account if you want a change

I am really glad that i found your blog @ i learn a lot from you fehl.you open my mind bt investing.im your avid reader from now on..hope you will not get tired to share your knowledge to us..many thanks!

Thank you Sweet angel. Nice name btw 🙂

Hi Fehl,

I’m away from pinas coz I’m an OFW at balak kong mag-venture sa UITF or MF. But upon searching the internet, parang ung PNB’s Global Filipino Funds lang ang angkop sa akin since online application lang ako puwedeng maka-avail nito. Gusto ko sana ng Equity Fund either sa BDO or PNB but I can’t personally apply for it kasi andito ako sa ibang bansa. Can you advise me on how and what can I do?

Thanks and regards.

Not all UITFs are offered to non-residents because of rules. You can open online in PNB if you have existing PNB savings or ATM account. BDO still requires personal appearance sad to say

hi miss fehl,

i recently got interested in investing for my kids’ future. i actually have a lot of options, bpi, bdo, and now even pnb. one challenge i have is that i will not be able to monitor this regularly like those that i know who are always online to check the stock market. having said so, may mabibigay ka bang advice on which one should i start investing especially for me na i work in IT industry plus the fact that i am a mother of 2, a wife and a sister to a 8yo kid. i heard about UITF and mutual funds. i researched and found both interesting, yun nga lang i do not know how it works. hope u can respond. thanks. 🙂

For starters, I recommend Mutual Funds in Equity or UITF in Equity although they are very risky, they give the highest earnings. Besides, the top MF companies and top banks have excellent fund management teams so there is nothing to worry. If you have MF or UITF already, then you can add more investments by starting direct stock market investing. The more investments you have, the better. Since you have kids, I also suggest you open each of them an account for MF or stocks even if you will only just be investing 2000 a month for each of their account, they could be rich when they’re 25 assuming of course the funds grow 15% or more every year.

Thanks for your reply Ms Fehl. How does UITF and MF differ and respectively, can you please advise me which companies are good to invest with. Thank you for your help. 🙂

The answers are all in our post entitled: “Mutual Funds vs UITFs: Similarities and Differences, Advantages and Disadvantages” juts browse in our UITF category and you’ll see it. 🙂

i see.. PNB has UITF online ung tlgang account online.. but BDO pwede rin palang ma monitor ung UITF online pero wala nga lang UITF online sa BDO.. hmm…

Yes, you can monitor your UITF accounts in BDO online but you cannot open (make a new) UITF account online. BDO requires personal appearance. Maybe they will launch that feature online soon. PNB doesn’t require personal appearance for online UITF account opening.

hi po…just want to ask if it’s ok to invest in BPI UITF…nppansin ko kc puro BDO lng…thanks and more power to you Ms Fehl 🙂

Of course 🙂 BPI is another leading banks here in the Philippines. I just shared more about BDO and PNB since I have personal experience from them. I will be putting more about the other banks here too in the coming days.

hi, thanks for this informative blog you have tyrone.i’m currently working in dubai and thinking of investing some of my savings in mutual funds.as a newbie, where do you think, as per your experience, is the best mutual funds to invest to? kasi if ako ang tatanungin, gagayahin muna kita and pagpa-practice-an ko ang sun life and maybe i’d know where to go next. but where do you think is the best to invest to as of now and for a newbie?PS- also, i’m still trying to absorb some of the info for stocks and bonds. but for now, mutual funds muna ang pag-aaralan ko.

I recommend Sun Life and Philam Asset Manmagement, Inc. if you want to invest for Mutual Funds

Hi fehl, i just want to ask about bdo UITF. They don’t have yet an online UITF so how do investor monitor their investments with them? Is it availble through their online banking if registered in online banking? Thank you.

BDO has no online account UITF opening yet but they do have online banking for everything including UITF account. You can monitor your UITF performance online anytime, anywhere if you have internet connection. We have a post about monitoring BDO UITF account online here if you want to see it 🙂

Thank you so much Ms. Fehl

God bless & more power!

Hello Ms. Fhel,

What is the difference between actively managed fund & passively managed fund.

I don’t understand between the two.

I have a uitf at bpi ( bpi Philippine equity index fund) now i am looking at onother investment from bpi also, it is called bpi Philippine high dividend equity fund.

Which is better from the two? It says that the bpi phil equity index is passively managed fund & the bpi phil high dividend equity fund is actively managed fund.

Thank you ms fhel, i am your avid reader and learn a lot from your blogs.

By the way, i am a 43 years old employee, trying to save for my retirement

Hi Eva! From what I see in actively managed funds, they usually focus and actively participate in the management of these investments to perform well wherein passively managed funds, they don’t need to put more effort or actively be involved in the funds management because you’ll earn from the investments anyway. It’s like passive vs active income, in passive income, you’ll earn income eventually even without doing anything; while in active income, you need actions to earn it.

Fund manager doesn’t play an active role in Equity Index Funds thus it’s passively managed. They just buy stocks based on the specific market index that the fund follows. On the other hand, fund managers need to be active on monitoring and participating on stocks from great performing companies that usually declare dividends. Thus, Hugh Dividend Equity funds are usually actively managed.

I hope I didn’t say so much there. heheh Both are great investments since they have high earning potentials 🙂

Ang balance at equity fund ng PNB ay di pwede sa OFW? Pwede rin ho bang ienroll

under AIP? Magkakaroon ba ng sariling Trust savings account number after na nakapagsubsncribed ka sa susunod na placement mo?Please advise po!

PNB Auto invetsment Plan is currently available for Money Market Funds (see the list in the article). I hope they will add more funds like Equity Fund soon

Nice post po.. I’m an avid reader po kc about finance, investment and financial literacy in general kaya po thank you po.. Keep sharing your idea.

My pleasure to share this. 🙂 Thank you for always reading. God bless you!

ur welcome po.. atleast na compare po namin ang BDO and PNB,,

I’m glad we all learn from the comparisons of UITFs and insights of everyone 🙂