We’re sharing here the complete list of SSS benefits. Are you a member of SSS (Social Security System)? Wondering what benefits you are entitled to avail or claim? Then, you must know the following list of SSS benefits.

Being a member of the Social Security System ensures us to have a secure future life and unexpected circumstances. In addition, pensioners, beneficiaries, and dependents can also benefit from having this support system.

If you are an employee, self-employed, OFW, voluntary member, household worker or kasambahay, and an active member of SSS, you are entitled to the following list of SSS benefits.

List of SSS Benefits in the Philippines in 2026:

- Sickness Benefit

- Maternity Benefit

- Disability Benefit

- Retirement Benefit

- Death Benefit

- Funeral Benefit

- Unemployment Benefit

SSS Benefits and Qualification Requirements:

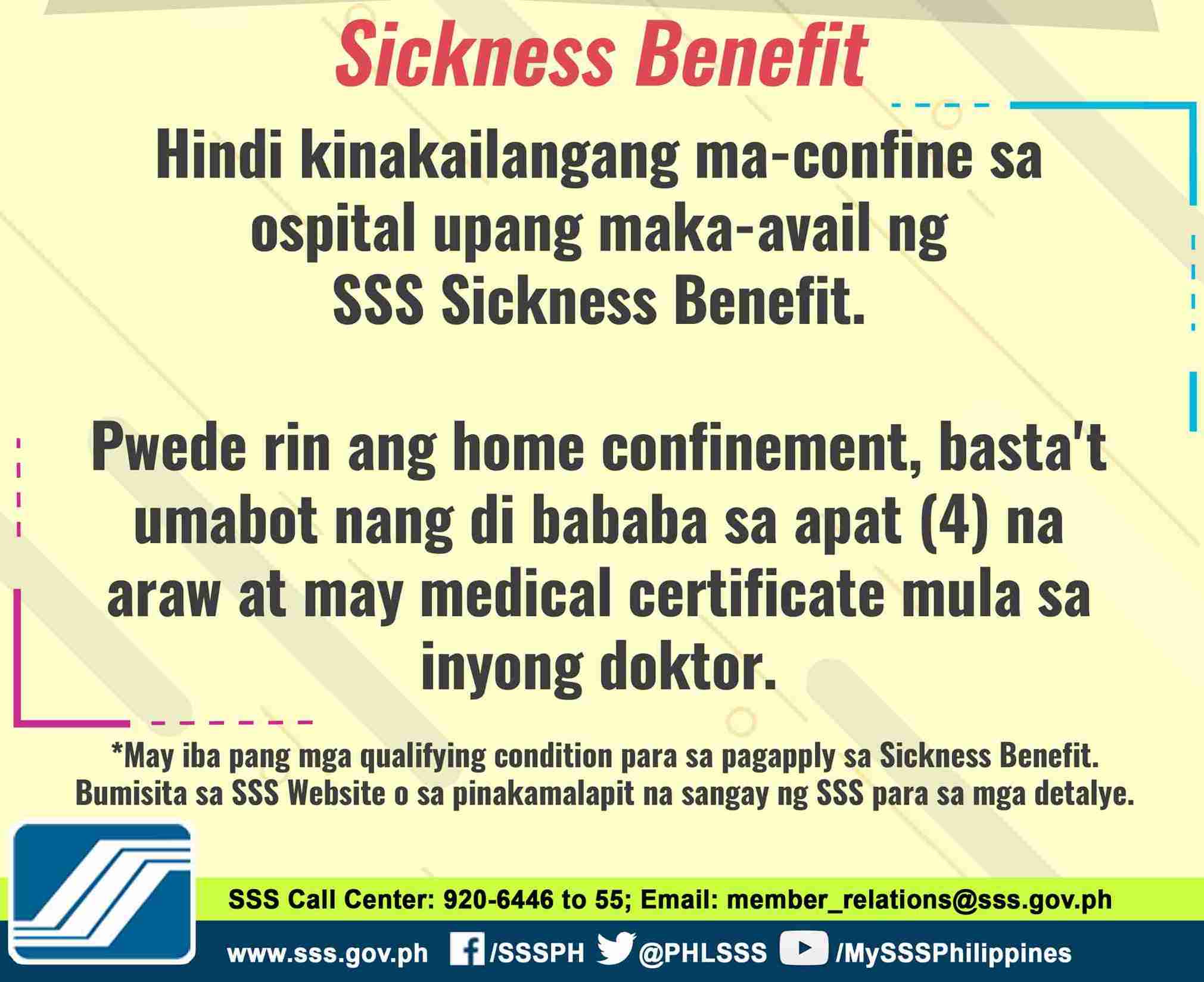

1. SSS Sickness Benefit

SSS sickness benefit is a daily cash allowance paid for the number of days an SSS member is unable to work due to sickness or injury provided the said member has been sick for 4 days or more and has a medical certificate signed by a doctor.

How much is SSS sickness benefit?

It is equivalent to 90% of the average daily salary credit (ADSC) of the SSS member.

Who are qualified to avail SSS sickness benefit?

- If you are unable to work due to sickness or injury and has been confined either in a hospital or at home for at least 4 days

- If you paid at least 3 months of SSS contributions within the 12-month period immediately before the semester of your sickness or injury

- If you used up all your current company sick leave with pay

- If you have notified your employer or SSS (if unemployed, voluntary member or self-employed) about your sickness or injury.

According to SSS, a member can be allowed sickness benefit for a maximum of 120 days in one calendar year. Any unused portion of that 120 days requirement cannot be added to the total allowed days for the following year.

Furthermore, sickness benefit shall be paid for not more than 240 days on account of the same illness. If the sickness or injury continues after 240 days, the claim will be considered a disability claim.

2. SSS Maternity Benefit

SSS maternity benefit is a daily cash allowance under the Expanded Maternity Leave Law. It grants 105 days paid maternity leave for live childbirth, regardless of the mode of delivery, and additional 15 days if the female worker qualifies as a solo parent under Solo Parent Welfare Act; and 60 days of paid leave in case of miscarriage or emergency termination of pregnancy.

This benefit applies in all instances of pregnancy, miscarriage, or emergency termination of pregnancy regardless of frequency.

How much is SSS maternity benefit?

It is equivalent to 100% of the average daily salary credit (ADSC) of the pregnant SSS member. Woman employee can also receive salary differential from her employers which includes the total salary during her maternity leave and the actual benefit provided by SSS.

Who are qualified to avail SSS maternity benefit?

- If you have paid at least 3 monthly SSS contributions in the 12-month period immediately before your semester of childbirth or miscarriage or emergency termination of pregnancy.

- If you have notified your employer about your pregnancy and the probable date of your childbirth, which notice shall be transmitted to the SSS in accordance with its rules and regulations.

3. SSS Disability Benefit

SSS disability benefit is a monthly pension or lump sum cash granted to members who cannot perform their jobs anymore due to body injury or impairment. This includes permanent partial disability and permanent total disability listed below.

Permanent Total Disability includes:

- Complete loss of sight of both eyes

- Loss of two limbs at or above the ankle or wrists

- Permanent complete paralysis of two limbs

- Brain injury resulting to incurable imbecility or insanity

- Other cases as determined and approved by SSS

Permanent Partial Disability includes:

- Loss of any finger

- Loss of one hand

- Loss of one arm

- Loss of one foot

- Loss of one leg

- Loss of one or two ears

- Deafness of one or two ears

- Loss of sight or loss of one eye

Who are qualified to avail SSS disability benefit?

Any SSS member with disability who have paid at least one month of contribution immediately before the semester of his injury or impairment are qualified for this benefit.

How much is SSS disability benefit?

Monthly pension for disability benefit is based on the number of contributions paid by the member before the semester of injury. The minimum monthly pension is P1,000 for those members whose CYS is less than 10. P1,200 is granted for members with 10 CYS andP2,400 is given for members with 20 CYS.

4. SSS Retirement Benefit

SSS retirement benefit is a monthly pension or lump sum cash given to retired SSS members provided the SSS member have completed payment of 120 months of contributions before the semester of his retirement.

Here’s the step-by-step guide: “How to Apply for SSS Retirements Benefits Online“

How to compute your SSS retirement benefit?

SSS monthly retirement pension is equivalent to the following computation whichever is higher:

- 300 + (20% X AMSC) + (2% X AMSC) X (CYS – 10)

- 40% X AMSC

- Minimum pension of P1,200 if the member has 10 CYS; P2,400 if the member has 20 CYS

Who are qualified to avail SSS retirement benefit?

- An SSS member who have contributed a minimum of 120 months of contributions before the semester of his retirement and meets the following qualifications:

- If you are 60 years old when you separated from your employer or when you stopped being self-employed, OFW, or household helper

- If you are 65 years old and still employed, self-employed, an OFW or household helper (this is considered as technical retirement)

- If you are 55 or 60 years old and an underground mineworker whose actual date of retirement is not earlier than March 13, 1998 (also considered as technical retirement)

- If you are 50 or 60 years old and an underground or surface mineworker whose actual date of retirement is not earlier than April 27, 2016 (also considered as technical retirement)

- If you are 55 years old and a racehorse jockey whose actual date of retirement is not earlier than May 24, 2016

- An SSS member has an option to receive an initial lump sum payment equivalent to 18 monthly pension with some discount approved by SSS

- An SSS member who is 60 and below 65 years old, who has contributed 120 months or more, has an option to continue paying his monthly contributions as a voluntary member until he reached the age of 65 in the hopes of receiving higher monthly pension benefits.

5. SSS Death Benefit

SSS death benefit is a cash benefit given to the beneficiary of deceased SSS member. A monthly pension will be granted if the deceased member has contributed 36 months before the semester of his death. While lump sum amount is given if the contributions are below 36 months.

How much is the death benefit given by SSS?

Monthly pension is equivalent to the following computation whichever is higher:

- 300 + (20% X Average Monthly Salary Credit) X (Credited Years of Service – 10)

- 40% of AMSC

- P1,000 minimum pension is given if the CYS is less than 10. P1,200 is given if the CYS has reached 10. P2,400 is given if 20 CYS has been reached

If the deceased SSS member has contributed less than 36 months, lump Sum amount will be given for the primary beneficiary equivalent to the following computation whichever is higher:

- Monthly pension equivalent to the number of monthly contributions before the semester of death

- 12 times the monthly pension

The secondary beneficiary will receive lump sum amount equivalent to the following:

- 36 times of monthly pension – if the deceased member has paid 36 months of contributions before the semester of his death

- Monthly pension equivalent to the number of monthly contributions or 12 times the monthly pension

Who are qualified to avail SSS death benefit?

The primary beneficiary of the deceased SSS member are entitled for death benefit. Beneficiaries include the legal spouse (as long as he/she will not remarry), legitimate or illegitimate child who’s below 21 years old, legally adopted child, and incapacitated child or a child with disability who cannot support himself.

6. SSS Funeral Benefit

SSS funeral benefit is a cash benefit given to a person who paid the funeral service expenses of the deceased SSS member or pensioner. The minimum benefit of P20,000 has increased to P40,000 maximum, depending on the number of contributions of the member and his Average Monthly Salary Credit (AMSC).

7. SSS Unemployment Benefit

SSS Unemployment benefit is a cash benefit granted to all employees, including kasambahay, and OFW (sea-based and land-based), who lost their jobs or has been separated from their job involuntarily.

How to compute SSS unemployment benefit?

Unemployment benefit from the SSS is equivalent to 50% of the AMSC (Average Monthly Salary Credit) for a maximum of 2 months, subject to the rules and regulation under Section 14-B of the Republic Act 11199.

Who are qualified to avail SSS unemployment benefit?

- If you are not over 60 years old at the time of involuntary separation from your job except:

- In case of underground mineworker or surface mineworker not over 50 years old

- In case of racehorse jockey, not over 55 years old

- If you paid at least 36 SSS monthly contributions, 12 of which should be in the 18 month period immediately before your unemployment or involuntary separation

- If you did not receive an unemployment benefit in the last 3 years before the month of your involuntary separation from work

- If you lost your job because of but not limited to the following:

- big economic crisis

- calamity or disaster

- company retrenchment or downsizing

- closure of company or bankruptcy

- disease or illness

- other reasons of involuntary separation from job under the Labor Code of the Philippines

Which from the list of SSS benefits do you think needs more coverage? Share you views in the comments box.

Other SSS Helpful Guides:

- How to Pay SSS Contributions Using GCash

- How to Pay SSS Contribution Using PRN Generated Form

- New SSS Contribution Table 2026

- How to Apply for SSS Retirement Pension Benefits

SUBSCRIBE for FREE!