Have you ever thought about how banks transfer funds across borders easily? It all comes down to one important piece of information: bank swift codes.

SWIFT codes are the backbone of international money transfers because they provide smooth and secure transactions between countries with different exchange rates.

Whether you’re an individual looking to send money abroad or a business operating globally, understanding bank swift codes and BIC (Bank Identifier Code) is essential for navigating the complex world of cross-border finance, especially when using SEPA (Single Euro Payments Area) for transactions.

So, if you want to know how banks ensure speedy and accurate money transfers across continents, read the guides we share here using BIC bank swift codes in the USA.

What is the meaning of SWIFT Code?

SWIFT codes, or Bank Identifier Codes (BIC), are unique identification numbers assigned to banks worldwide for money transfers. These codes, also known as BIC or SWIFT transfers, consist of letters and numbers that help identify specific financial institutions for bank transfers.

Think of the BIC code as a bank’s unique “address” in the global banking network. BIC codes play a crucial role in facilitating international banking transactions.

SWIFT Code/BIC vs. Routing Number

Unique Swift Code

A unique SWIFT code, or a Bank Identifier Code (BIC), is a set of alphanumeric characters identifying a specific bank or financial institution.

Each bank in the United States uses a unique SWIFT code for international wire transfers, which directs the funds to the correct recipient and enables accurate bank account transactions.

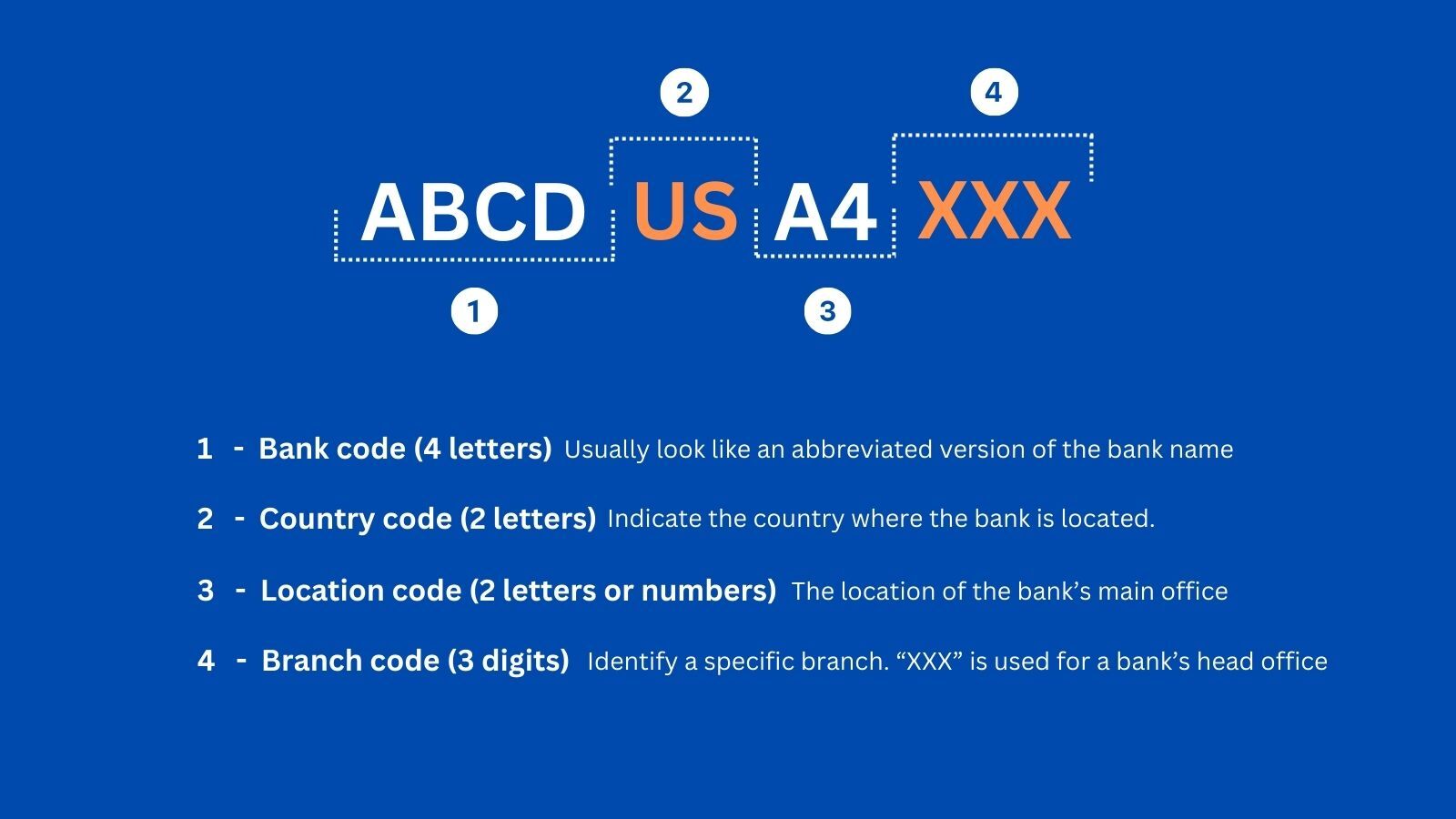

The Bank Identifier Code (BIC) is an internationally recognized standard for identifying banks and financial institutions. It consists of either 8 or 11 characters and comprises four components:

SWIFT/BIC Code Format:

- The first four letters represent the bank’s name.

- The following two letters indicate the country location of the bank.

- The subsequent two letters signify the location of the bank’s headquarters (HQ).

- Finally, if there are three additional digits, they represent a specific branch of the bank.

Routing Number

In addition to SWIFT codes, US banks also use routing numbers for domestic transfers within the United States. A routing number is a nine-digit numerical code the American Bankers Association (ABA) assigns to each financial institution. Thus, it helps identify the financial institution and the branch where an account is stored.

List of Bank SWIFT Codes in the USA (BIC Codes for Main Banks)

| Bank | SWIFT Code |

|---|---|

| JPMorgan Chase Bank | CHASUS33XXX |

| Bank of America | BOFAUS3NXXX |

| BOFAUS6SXXX (foreign currency) | |

| Wells Fargo | WFBIUS6SXXX |

| Citibank | CITIUS33XXX |

| US Bancorp | USBKUS44IMT |

| Capital One | NFBKUS33XXX |

| HSBC | MRMDUS33XXX |

| Fifth Third Bank | FTBCUS3CXXX |

| PNC Bank | PNCCUS33XXX |

| Santander | SVRNUS33XXX |

| BMO Harris Bank | HATRUS44XXX |

| USAA Bank | UFSBUS44XXX |

| Trust Bank | SNTRUS3AXXX |

| TD Bank | NRTHUS33 |

How to Find the Correct SWIFT Code for US Banks?

Online Search Tools and Official Websites

One of the easiest ways to find a specific bank’s SWIFT code is by using online search tools or visiting your bank’s official website. They have comprehensive databases that allow you to search for the SWIFT code by entering the bank’s name or location.

Mobile Banking Apps and Customer Service

Another option is to utilize mobile banking apps or contact customer service at your bank. Many banking apps now include features that provide quick access to critical information, including SWIFT codes. Reaching out to customer service can provide you with the necessary details.

Verifying Accuracy Before Transferring Funds

Once you obtain a SWIFT code, verify its accuracy before initiating any international transfer. Mistakes entering the code can lead to delays or even loss of funds.

So, double-check all the numbers and characters in the code to ensure it matches the intended recipient bank. It’s better to be confident than sorry.

Comprehensive Directories

There is a comprehensive list of SWIFT codes for all US banks. These directories compile SWIFT codes from various banks into one convenient resource, making finding the specific code easier.

Impact of Incorrect or Missing SWIFT Codes on Payment Processing Time-frames

SWIFT codes can significantly impact payment processing timeframes. If you provide the wrong code, the receiving bank may need help identifying the destination bank and branch.

As a result, your payment may experience delays or even be rejected. It’s important to double-check the accuracy of the SWIFT code provided by the recipient to avoid any unnecessary delays or complications.

Benefits of Using the Correct Bank SWIFT Code

Using correct SWIFT codes offers several benefits when conducting international transfers. Here are some advantages:

- Reduced Costs: By using accurate SWIFT codes, you minimize the chances of errors or failed transactions that could result in additional fees.

- Increased Transparency: Using proper SWIFT codes ensures transparency throughout the transfer process. You can track your payment’s progress and have peace of mind knowing where your funds are at each stage.

- Efficient Processing: With accurate information from a valid SWIFT code, banks can process your international payment swiftly and accurately.

Exploring the Role and Security Measures of SWIFT Codes

The Role Played by Correspondent Banks in Validating Swift Code Information

Correspondent banks act as intermediaries during inter-bank transactions, vital in validating swift code information. When a payment is initiated from one bank to another, correspondent banks verify the authenticity of the SWIFT code used for routing purposes. They confirm that the recipient’s bank exists and matches the provided swift code.

This additional validation layer helps prevent errors or misdirected payments, ensuring that funds reach their intended destination securely. Correspondent banks act as gatekeepers, verifying swift codes before processing any transactions.

Robust Security Protocols within the SWIFT Network

The SWIFT network employs robust security protocols to protect sensitive information during transmission. It utilizes encryption techniques to secure data exchanged between financial institutions worldwide. This ensures that any communication sent through the network remains confidential and cannot be intercepted or tampered with by unauthorized parties.

Furthermore, SWIFT has implemented several layers of authentication to ensure that only authorized users can access their system. Two-factor authentication is commonly used, requiring users to provide something they know (like a password) and something they have (like a physical token or mobile device) to gain access. This adds an extra level of security, minimizing the risk of unauthorized access and fraud.

Additional Security Measures by Banks for Swift Code-Based Transactions

In addition to the security measures of bank SWIFT Code network, individual banks also employ additional security measures to protect SWIFT code-based transactions. They may utilize advanced fraud detection systems that analyze transaction patterns and identify suspicious activity.

Banks may also offer their customers secure online banking platforms with built-in features such as transaction alerts, real-time monitoring, and account verification processes. These measures help ensure the integrity and confidentiality of swift code-based transactions, giving customers peace of mind when conducting international payments.

Alternatives to SWIFT Codes for International Bank Transfers

If you think SWIFT codes are the only way to make international bank transfers, think again! There are alternative payment systems available that offer faster and cheaper cross-border transfers. Two popular options include Ripple and TransferWise.

How Alternative Payment Systems Work

Unlike traditional correspondent banking networks used by SWIFT codes, these alternative payment systems operate on different principles. Ripple, for example, utilizes blockchain technology to enable real-time settlements between financial institutions. This means that transactions can be completed in seconds rather than taking several days, as with traditional methods.

TransferWise takes a different approach by using peer-to-peer transfers. Instead of relying on multiple banks to facilitate the transfer, TransferWise matches individuals or businesses looking to send money internationally with others who want to receive funds in the same currency.

TransferWise can offer competitive exchange rates and lower fees by eliminating unnecessary intermediaries.

Advantages and Limitations of Alternative Payment Systems

When comparing SWIFT codes with alternative payment systems like Ripple and TransferWise, it’s essential to consider the advantages and limitations of each option.

Advantages:

- Speed: Alternative payment systems often provide faster transaction times than SWIFT codes. This can be especially beneficial when you need to send money urgently.

- Cost: Traditional bank wire transfers can come with hefty fees. In contrast, alternative payment systems may offer more affordable rates or even charge no fees.

- Transparency: Some alternative payment systems provide greater transparency by allowing users to track their transactions in real time. This can give you peace of mind, knowing where your money is during the transfer process.

Limitations:

- Accessibility: While SWIFT codes are widely accepted by most banks worldwide, not all financial institutions may support alternative payment systems like Ripple or TransferWise. Check if the recipient’s bank is compatible before choosing an alternative method.

- Currency Support: SWIFT codes can handle transfers in various currencies, whereas some alternative payment systems may have limitations on the currencies they support. Ensure that your desired currency is available with the chosen provider.

- Network Size: As traditional correspondent banking networks have been established for many years, they often have a more extensive network of partner banks than newer alternative payment systems. This could impact the ease of making international transfers to specific locations.

Considerations When Choosing Between SWIFT Codes and Alternative Methods

Deciding between using SWIFT codes or alternative methods for international transfers depends on several factors:

- Urgency: If you need to send money quickly, alternative payment systems may be more suitable due to faster transaction times.

- Cost: Consider the fees associated with each option and choose the one that aligns with your budget.

- Recipient’s Bank: Check if the recipient’s bank supports alternative payment systems before initiating a transfer.

- Destination Country: Research which option has better coverage in the country you send money to.

FAQs

What happens if I use the wrong SWIFT code?

Using the wrong SWIFT code can send your funds to the wrong recipient or get delayed in transit. It’s crucial to double-check the accuracy of the SWIFT code before initiating a transaction to avoid any potential issues.

Can I use a SWIFT code for domestic transfers within the USA?

SWIFT codes are primarily used for international bank transfers. You typically need an ABA routing number instead of a SWIFT code for domestic transfers within the USA.

Are there fees associated with using SWIFT codes?

There may be fees associated with using SWIFT codes for international bank transfers. Both sending and receiving banks may charge fees for processing these transactions. It’s advisable to check with your bank regarding their specific fee structure.

How long does it take for a transfer using a SWIFT code?

The time it takes to transfer using a SWIFT code can vary depending on several factors, including the participating banks and any intermediary institutions involved. Generally, funds can take one to five business days to reach their destination.

Can I trust alternative solutions over traditional SWIFT codes?

Alternative solutions to traditional SWIFT codes are gaining traction in the financial industry. While they offer potential benefits such as faster transactions and lower costs, it’s essential to research and evaluate these alternatives carefully before trusting them with your money. Consider factors like security, reliability, and regulatory compliance when deciding.

Related Article: