The Social Security System launched SSS WISP Plus – a Workers’ Investment and Savings Program to help SSS members build additional retirement benefits. If you’re looking for additional investment that can earn higher interest rates with zero taxes, consider opening a WISP Plus account.

At any moment in your lifetime, retirement is going to come up. But how much will you get in the long run? Will your SSS monthly pension afford your primary needs? The earlier we start finding additional passive income, the better we’ll grow more funds for our retirement.

That’s why we want to share some helpful tips with you about producing more retirement savings with SSS WISP Plus program.

What is SSS WISP Plus?

SSS WISP Plus is a voluntary provident fund launched on December 15, 2022. It provides a tax-free savings option for SSS members, offering secure and competitive rates to earn more than traditional savings or time deposits. It’s a convenient and attractive investment to support SSS members’ retirement funds.

Benefits of Investing in SSS WISP Plus

Open for all SSS members

You can open an account as long as you’re an active member of SSS, regardless of your posted MSC (Monthly Salary Credit) or monthly income from your employer or business.

Affordable investment

You can start investing in SSS WISP Plus for a minimum of P500 per payment. There is no maximum amount of investment. Thus, you can contribute higher amounts anytime. However, payment guidelines of each SSS channel dictate how much per payment, the manner of payment (such as through a manager’s check), daily limits, and other details that contribution payments must follow.

Tax-free earnings that compound annually

Take advantage of tax-free earnings that compound every year. The SSS WISP Plus earnings are tax-free, unlike other funds on the market that charge withholding taxes. It means that your capital can compound more money in the long run, especially when you withdraw at the 5-year maturity period or the effectivity of your retirement.

Higher interest rates

Funds from the SSS WISP Plus will be invested in income-generating assets on the market, earning interests higher than a regular savings account or time deposit. The SSS objective is to preserve and grow capital by investing in fixed-income securities, corporate bonds, equities, money market funds, BSP-approved investment instruments, and pensioner loans.

Easy to monitor

You can view and check your WISP Plus contributions and earnings through your My.SSS account online. Register an online account if you don’t have one yet.

What are the requirements to Enroll in SSS WISP Plus?

- For employed members – with at least one (1) posted regular SSS contribution applicable in the latest 3 months

- For self-employed, voluntary members, and land-based OFWs – must have a posted regular SSS contribution for the current applicable month of payment

- WISP Plus may be paid together with the SSS contribution for the month

How to Enroll in SSS WISP Plus Program?

You can use the SSS online platform to enroll your account to invest in SSS WISP Plus. If you’re an active SSS member, follow this quick guide to activate your account.

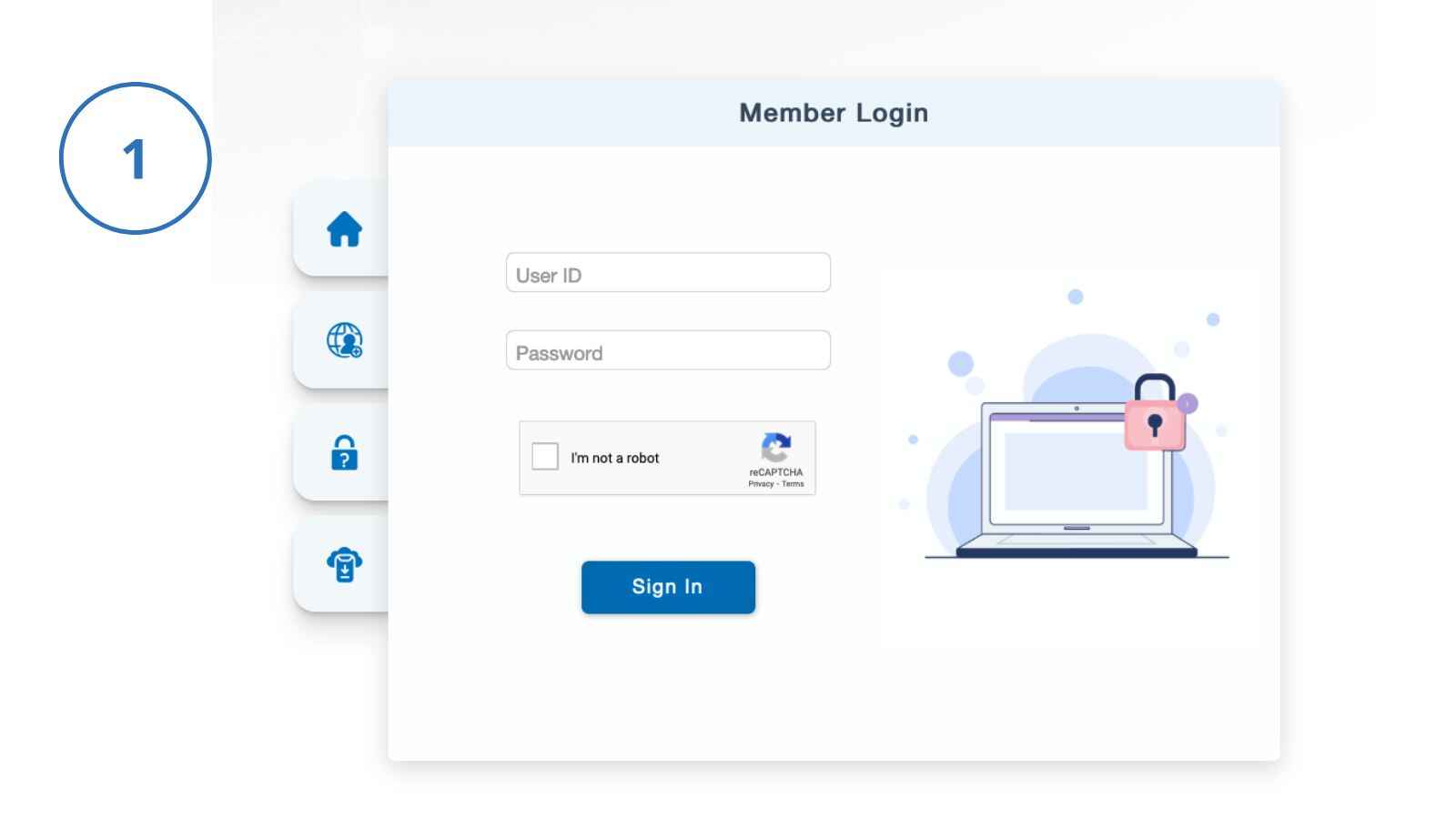

Step 1: Log in to your My.SSS Account

Sign in using your username and password. Always keep them secure. Your My.SSS account is your trusted access to view all your SSS contributions, membership status, application, social security benefits, and investments. It is now mandatory to have an SSS online account.

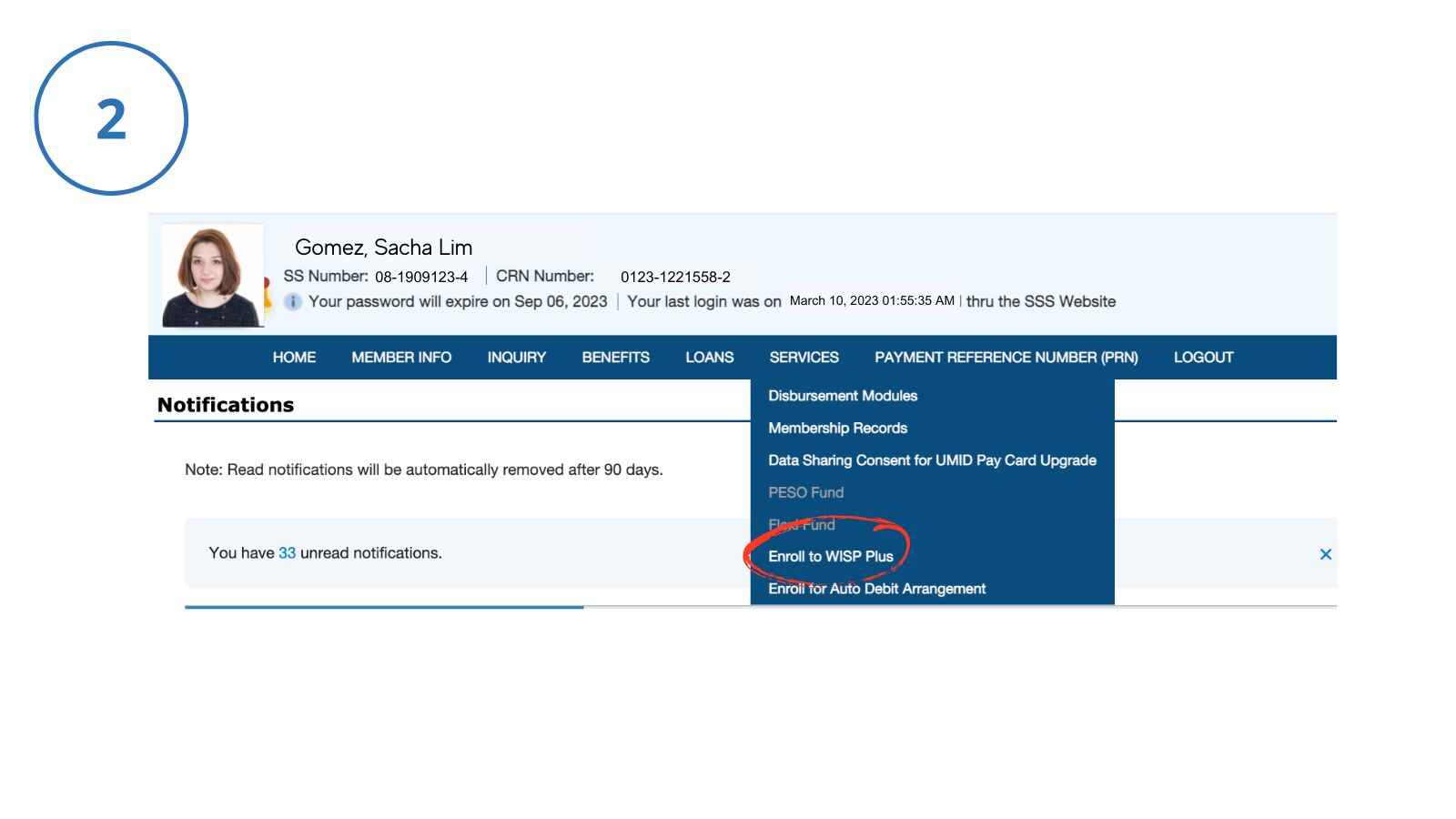

Step 2: Select the “Services” tab

Click the “Services” tab on the navigation menu. It contains social security services that you can apply for, view, enroll in, and monitor.

Step 3: Select “Enroll to WISP Plus”

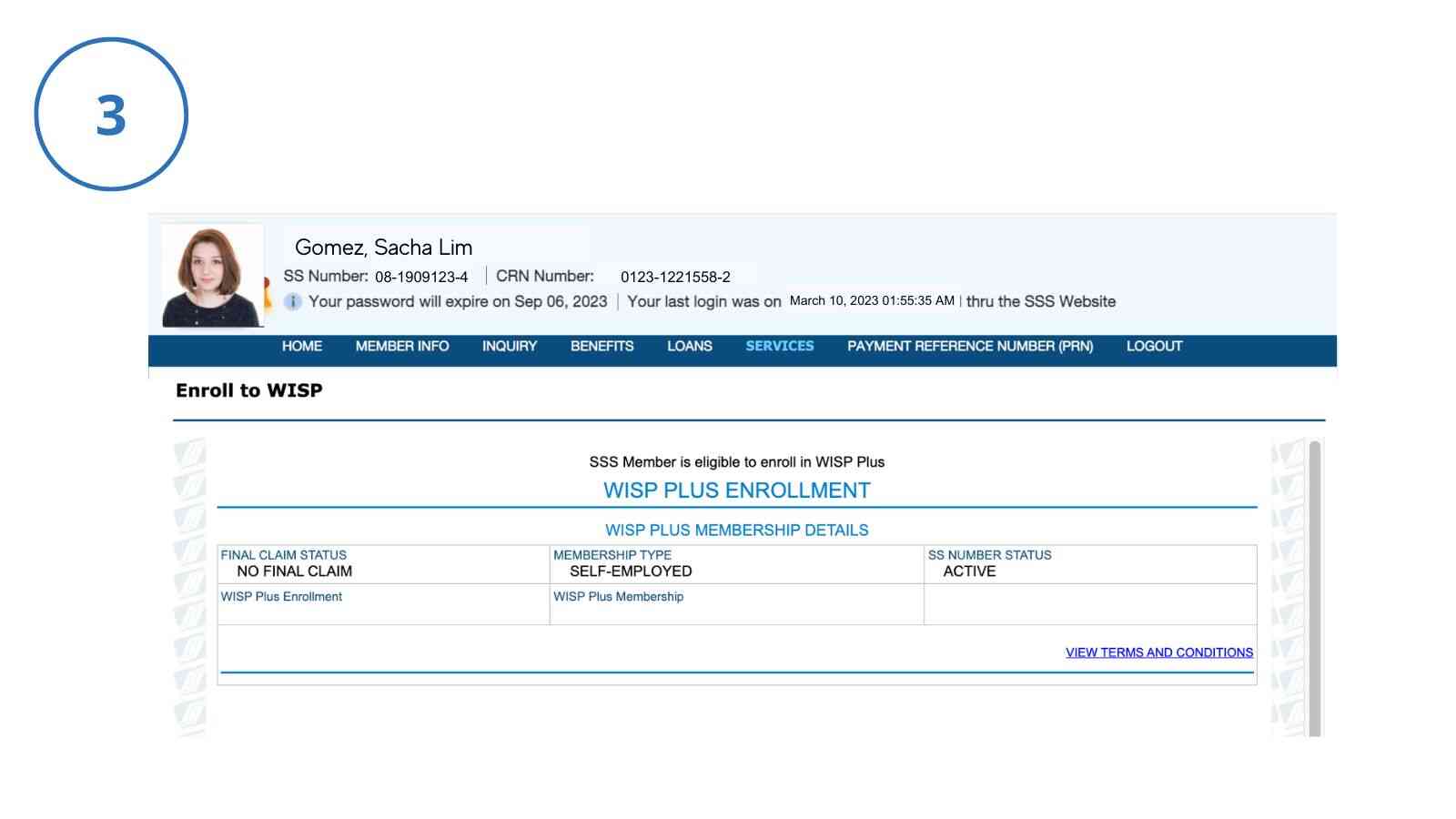

A series of services will appear on the menu. Click the “Enroll to WISP Plus” and you will be redirected to the first phase of WISP enrollment.

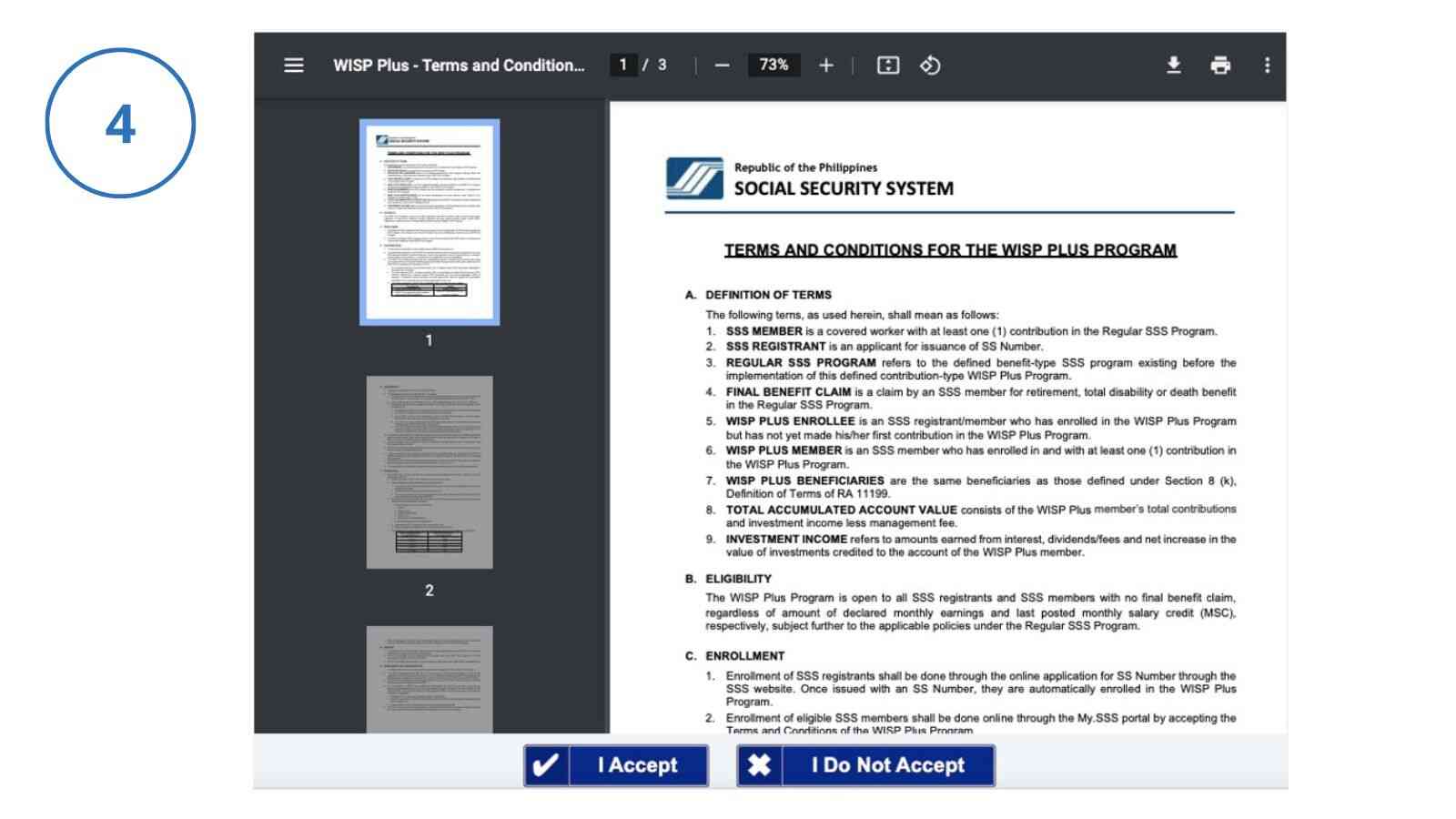

Step 4: Read and Agree to the Terms and Conditions

Everything you need to know about the updated WISP Plus policies, terms, and conditions is stated in this document. Hence, you must read and accept the terms to proceed with your enrollment. After accepting the terms, your WISP Plus account will be enrolled automatically.

Step 5: Pay your WISP Plus Contribution

You must pay your first WISP Plus contribution so that your membership in the program will take effect. The minimum contribution is 500, but the more you invest, the more chance your funds will grow over time.

SSS WISP Plus Calculator & Estimated Earnings

The estimated ROI (Return on Investment) when you contribute to SSS WISP Plus is 6% annually. If you keep on investing consistently every month and hold your funds untouched, your contributions, including earnings, will compound yearly. It’s an excellent way to build your retirement funds.

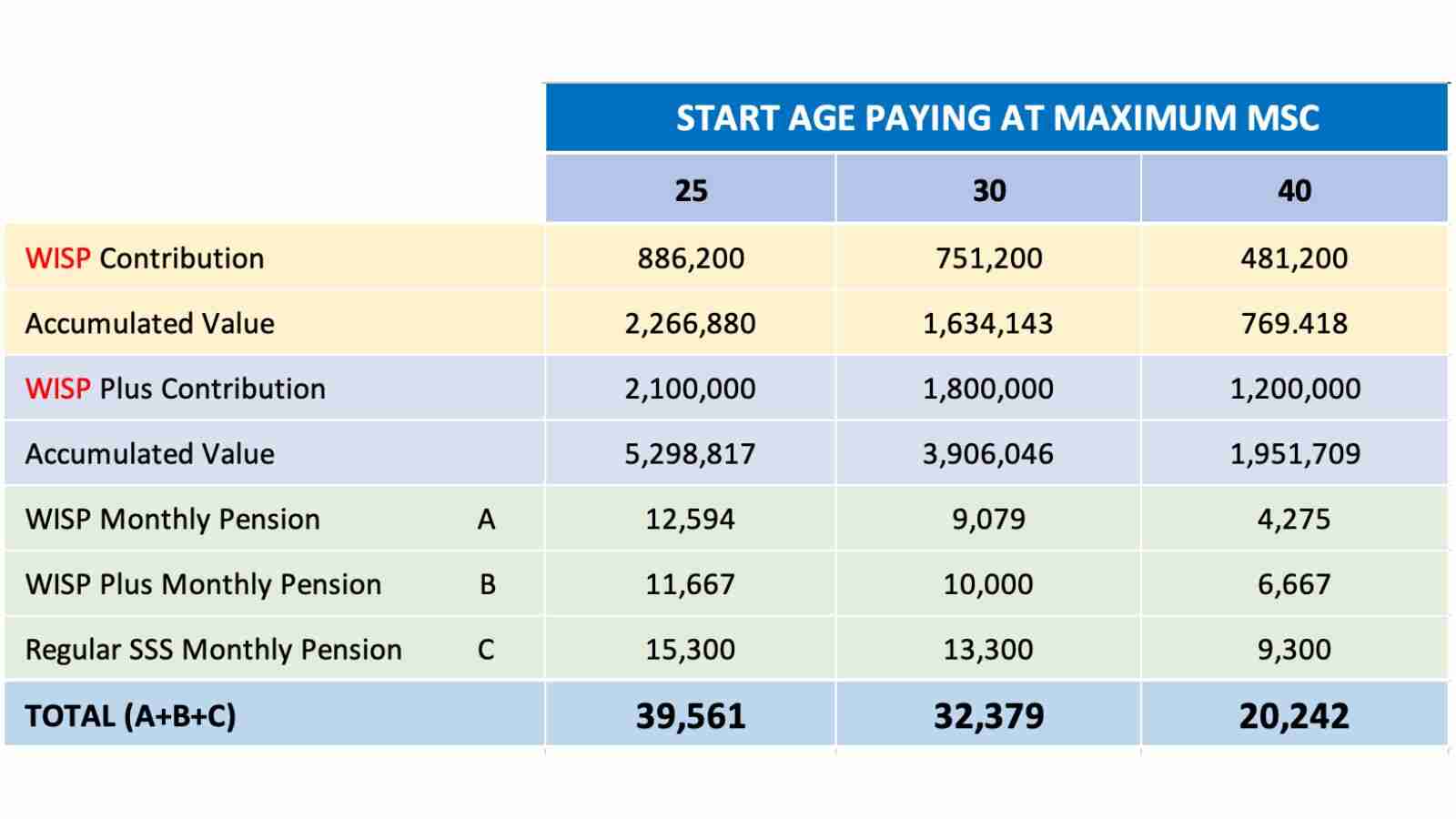

How much will your monthly pension be when you contribute to SSS WISP and WISP Plus?

Aside from your regular SSS contributions, supposed you will contribute to both WISP and WISP Plus every month until age 60. Let’s demonstrate the computation of your estimated pension or how much you will receive when you retire.

The sample computations above are based on the following assumptions:

WISP Investment:

- The retirement age is 60

- The member started contributing at the indicated start age and maximum Monthly Salary Credit (MSC) in Jan. 2021 and will continue contributing until retirement

- Maximum MSC is P25,000 in 2021, P30,000 in 2023, and P35,000 in 2025

- Annual ROI is 6.39%

- The management fee is 1% per annum

- Monthly annuity + Account value at retirement/180

WISP Plus Investment:

- The monthly contribution is P5,000 or P60,000 per year

- The member started contributing at the indicated start age in Jan. 2023 and will continue contributing until retirement

- Annual ROI is 6%

- The management fee is 1% per annum

- Monthly annuity + Account value at retirement/180

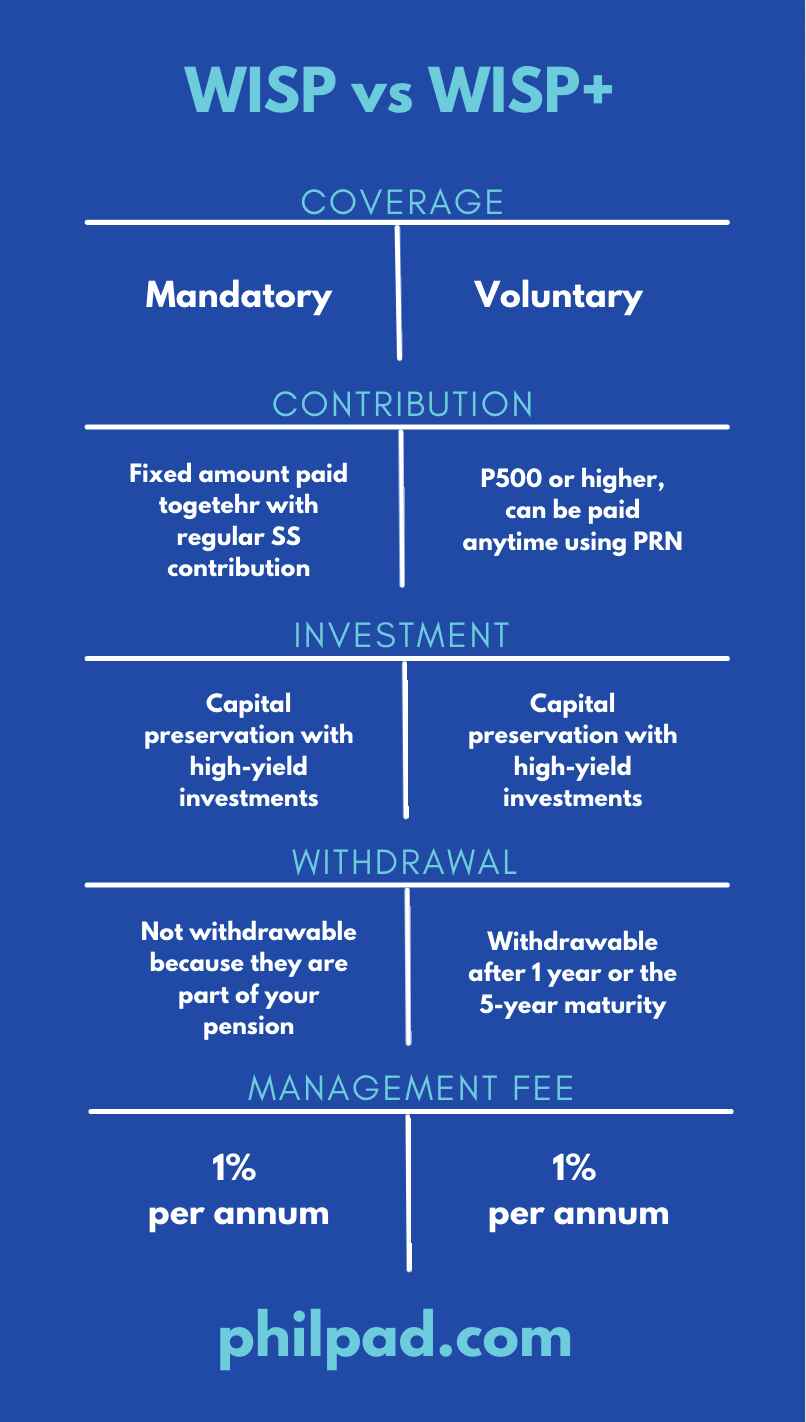

SSS WISP vs. WISP Plus (Detailed Comparison)

Coverage

WISP is a mandatory provident fund, while WISP Plus is a voluntary provident fund. All SSS members whose MSC (Monthly Salary Credit) exceeds P20,000 are automatically required to contribute to WISP. On the other hand, all SSS members, regardless of MSC, can invest in WISP Plus

Contribution

WISP contributions are fixed and always paid together with regular SSS contributions. In contrast, WISP Plus investments can start as low as P500, go higher beyond that amount, and be paid anytime using PRN.

Investment

WISP and WISP Plus aim for capital preservation and invest in mixed fixed-income securities, equities, bonds, money market funds, and other income-generating assets.

Withdrawal

WISP investments are part of a member’s pension. Therefore they’re not withdrawable anytime. However, WISP Plus earnings and capital are withdrawable after 1 or 5-year maturity.

Management Fee

WISP and WISP Plus charge a management fee of 1% per annum.

How to Pay Your WISP Plus Contributions Online?

Step 1: Generate a Payment Reference Number (PRN)

WISP Plus contributions are paid strictly through a PRN (Payment Reference Number). Therefore, you must first generate a PRN associated with your WISP Plus transaction. According to SSS, generated PRN for WISP Plus shall have the following validity:

Step 2: Pay your WISP Plus Using your PRN

Copy the exact Payment Reference Number and indicate the applicable period and amount of your WISP Plus contribution. You can pay through Gcash and other payment channels accredited by the Social Security System, like Bayad Center and accredited banks nationwide.

You can also pay your WISP contributions at the SSS branch near your residence. Don’t forget your PRN copy.

Step 3: Contribute More WISP Plus Payments

If you can consistently do it monthly or quarterly, do it because the more WISP Plus contributions you invest, the more funds you accumulate over time. The longer you hold your WISP investment, the more your money will compound.

How are Funds Invested in WISP Plus?

WISP Plus follows a benchmark that prioritizes capital preservation. The investment must be consistent with Section 26 of RA 11199 (Investment Reserve Fund) and will be guided by the following mix:

- At least 15% in government securities, which can be increased up to 100% of the investments;

- Up to 20% in corporate or multilateral institutions and equities;

- Up to 25% in short- and medium-term loans to WISP Plus members, such as salary, educational, livelihood, calamity, and emergency loans; and

- Up to 40% in money market funds and other BSP-approved investment instruments with the same intrinsic quality as those allowable in the Charter.

- Up to 70% in pensioner loans provided the total exposure in other loans, including loans to pensioners shall not exceed 30% of the Investment Reserve Funds as prescribed in the Charter, Provided further that collateral shall secure such loans.

How to Withdraw Your SSS WISP Plus Earnings?

Step 1: Enroll your Disbursement Account through My.SSS

SSS WISP Plus contributions and earnings will be credited to your approved disbursement account. To enroll, log in to your My.SSS online account and select “Services” then hover your mouse to “Disbursement Module” then click “Disbursement Account Enrollment Module.”

Step 2: Comply with SSS Withdrawal Conditions

According to SSS, a WISP Plus member can withdraw their Total Accumulated Account Value (WISP Plus contributions + earnings) anytime under the following conditions:

- They have been a WISP Plus member for at least one (1) year;

- Partial withdrawal shall be allowed, provided further that:

- The amount shall be based on the total accumulated account value posted before the month of partial withdrawal

- Partial withdrawal shall only be once a month

- The remaining balance in the accumulated account value after partial withdrawal shall not be lower than five hundred pesos (₱500.00)

- Partial or complete withdrawal within the first year of WISP Plus membership shall only be allowed for extreme hardship conditions as follows:

- Critical Illness of the member, limited to:

- Cancer

- Organ failure

- Heart-related illness

- Stroke

- Neuromuscular related illness.

- Involuntary separation from employment;

- Repatriation of OFW members from the host country; and

- Other similar conditions as may be determined by the SSS.

- Critical Illness of the member, limited to:

- The WISP Plus member shall receive adjusted earnings based on the following proportions:

| Years of Membership in the WISP Plus | Percent of Earnings to be Received |

| 1 to < 2 | 60% |

| 2 to < 3 | 70% |

| 3 to < 4 | 80% |

| 4 to < 5 | 90% |

| 5 or more | 100% |

Step 3: Receive your WISP Plus funds

SSS will send you a message when your WISP withdrawal has been processed. You may also check your bank account (disbursement account) to see if the funds have been credited.

Step 4: Re-enroll your WISP Plus account

After fully withdrawing your Total Accumulated Account Value (TAAV), you must enroll in a WISP Plus account again to start a new investment. WISP Plus re-enrollment is subject to the guidelines and policies of the program.

FAQ About SSS WISP Plus Program:

Which is better, Pag-ibig MP2 or SSS WISP Plus?

In terms of investment, both programs have an objective of capital preservation, and they allocate their portfolio in fixed income securities, money market funds, corporate bonds, and other assets to generate higher returns than traditional deposits and treasury bills. Thus, ROI can range from 6% or higher depending on the performance of the funds invested.

WISP Plus is new, while Pag-ibig MP2 has already been here for a few years. While it has already impressed a good track record, it doesn’t mean Pag-ibig can outperform WISP Plus.

Is WISP Plus a safe investment?

Yes, WISP Plus is a safe investment because its goal is to preserve and grow capital by investing in less risky funds on the market. WISP Plus adheres to the laws of Sec. 26 of Republic Act 11199 and abides by the principles of safety, high yield, and liquidity, and is benchmarked against the average rates of Treasury Bills or any good market yield indicator.

How much money can you earn in SSS WISP Plus?

The projected return on investment (ROI) for WISP Plus is 6% per annum. Depending on the entire investment’s performance, you can earn higher if you hold your contributions until retirement because the effect of compound interest will accumulate more remarkable results.

Who can open WISP Plus account?

An SSS member with at least one (1) posted contribution without a final claim under the regular SSS program is eligible to open a WISP Plus account. Likewise, a newly registered SSS member whose SSS number has been approved will also be enrolled automatically in the Workers’ Investment and Savings Program.

What will happen to SSS Flexi Fund and PESO Fund?

The Social Security System will consolidate all their voluntary provident funds, like Flexi Fund and PESO Fund, into one substantial fund – the SSS WISP Plus. Eventually, all existing Flexi Fund and PESO Fund accounts will be transitioned to the WISP Plus. Account-holders are given six months to elect an option:

- Transfer their Total Accumulated Account Value (TAAV) to the WISP Plus

- Have their TAAV withdrawn (disbursed)

More SSS Guides: