We’re sharing here how much 100,000 pesos would earn if invested on 3 investment wheels because a reader has requested a comparison of earnings between investing in a Mutual Fund vs UITF and VUL using his 100,000.

Note that this is for comparison purpose only and it’s not a mean to know which is better between the 3 because each product has different investment substance, fund allocation, strategy and management let alone every investor has different status, risk appetite and money goal.

If you’re not yet familiar with UITF, Mutual Funds and VUL, you can get to know them better by going to this post we made: “UITF vs MF vs VUL.”

But if you’d rather go forward this topic, go on and continue reading…

100,000 Investment Earnings Comparison from Mutual Fund vs UITF vs VUL

We used one of the best, most reliable, most established, and most decent funds in this comparison. Also we used the riskiest type of funds because we’re aggressive but we’re always keeping it calm 🙂

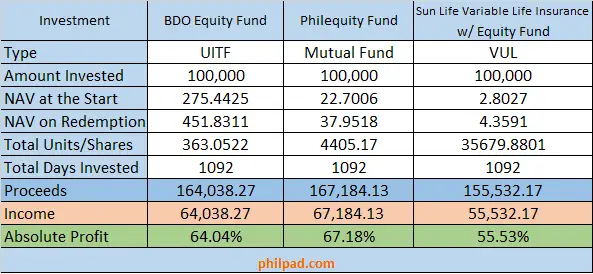

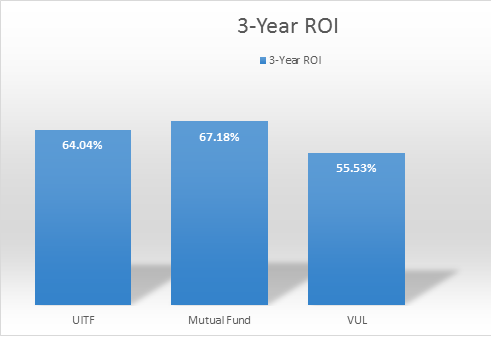

For Mutual Fund we used Philequity Fund, for UITF we chose BDO Equity Fund and for VUL we used Sun Life Variable Life Insurance that is tied up with Equity Fund.

In this comparison, we used 100,000 pesos invested for 3 years, from January 18, 2012 to January 18, 2015 to be exact.

We have used the 3-year period because Equity Funds are suitable for this investment horizon.

Here are the yields we have gathered for each fund.

Again this is just a comparison and it won’t guarantee future results. Each investment has different fund allocation and composition. Each may outperform the other any day. The bottom line here is all of them will give us money in the end.

If that is your revenue investing 100,000, what more if you invested 1 million or more millions? The return is awesome! It’s always the more you invest, the more you will gain. Yes, that is also why the rich becomes richer. They don’t let their money sleep on savings and time-deposits. They invest them or they use them expanding new business.

There are important factors you have to consider before you decide which investment wheel you will use such as your risk appetite, your financial goal and your financial status.

What is risk appetite?

For the sake of newbies here, it is how you can take risks. Investments are very risky. You may not always gain, you may also lose some. To combat risks, you have to invest for long term and diversify your money.

What is financial goal?

Simply how much do you want to earn. Do you want to become multi-millionaire? Perhaps you want to retire early? Or perhaps you want to use your money to build business.

What is financial status?

It will be answered by the following: do you rely on just regular income from your job? How much is your current networth? If you’re not employed right now, can your cash sustain your needs?

If you’re into investments now, it’s always best to diversify your money to different wheels. Make sure you don’t invest everything on one fund alone or on one account. Also make sure, it’s your 20% or 30% money and make sure you have many income generating assets that can shower you abundance in life.

What are these income generating assets I always mention? They are jobs, business and passive income. I will talk about more of them soon. Subscribe here so you won’t miss a new post. It’s free!

“It’s always better to invest some of your money than not to invest at all.”