Want to invest and grow your income this 2024? The following are the best mutual funds to invest in the Philippines in 2024. We have completed the list and written them down per fund classification – equity fund, balanced fund, bond fund, and money market fund.

Mutual funds are among our favorite types of investments because experts professionally manage them. Besides their different asset classes and compositions, mutual funds are also great options to diversify our portfolio.

We’re sharing the top-performing mutual funds in the Philippines right now. If you are a beginner or an experienced investor, knowing the excellent mutual funds to invest today will help guide your investing journey.

What are Mutual Funds?

Mutual funds are pooled investments managed by professionals and financial experts. These pooled funds are invested in different assets such as money market funds, fixed-income securities, and equities. There are different types of mutual funds that match every investor’s financial goal and risk profile.

Benefits of Investing in Mutual Funds:

- Affordability

- Diversification

- Liquidity

- Expert Fund Manager

- Profit Potential

Why should you invest in mutual funds?

Earning Potential

Many investors rely on mutual funds to earn and gain income, especially risk-takers who prefer stock funds or equity funds. Mutual funds generate higher returns than regular savings accounts or time deposits.

Professionally Managed

You don’t need financial expertise to manage mutual funds because these investments already have professional and excellent fund managers who will do the technical tasks and investment strategies to grow the fund.

To Beat Inflation

Prices increase now and then, but people’s regular income barely rises. We must invest our extra funds and venture into income-generating assets to beat inflation. One way to do that is by investing in mutual funds.

Additional Retirement Fund

Mutual funds can also support us in our retirement by investing long-term. The funds that we invested some years ago can grow over time. We can redeem our mutual funds when we retire and use the capital and profit as additional savings.

These types of funds and investments have risks and it is very important to get to know them better, get to know your status as an investor, and diversify your investment wheels.

Different Kinds of Mutual Funds Available Right Now

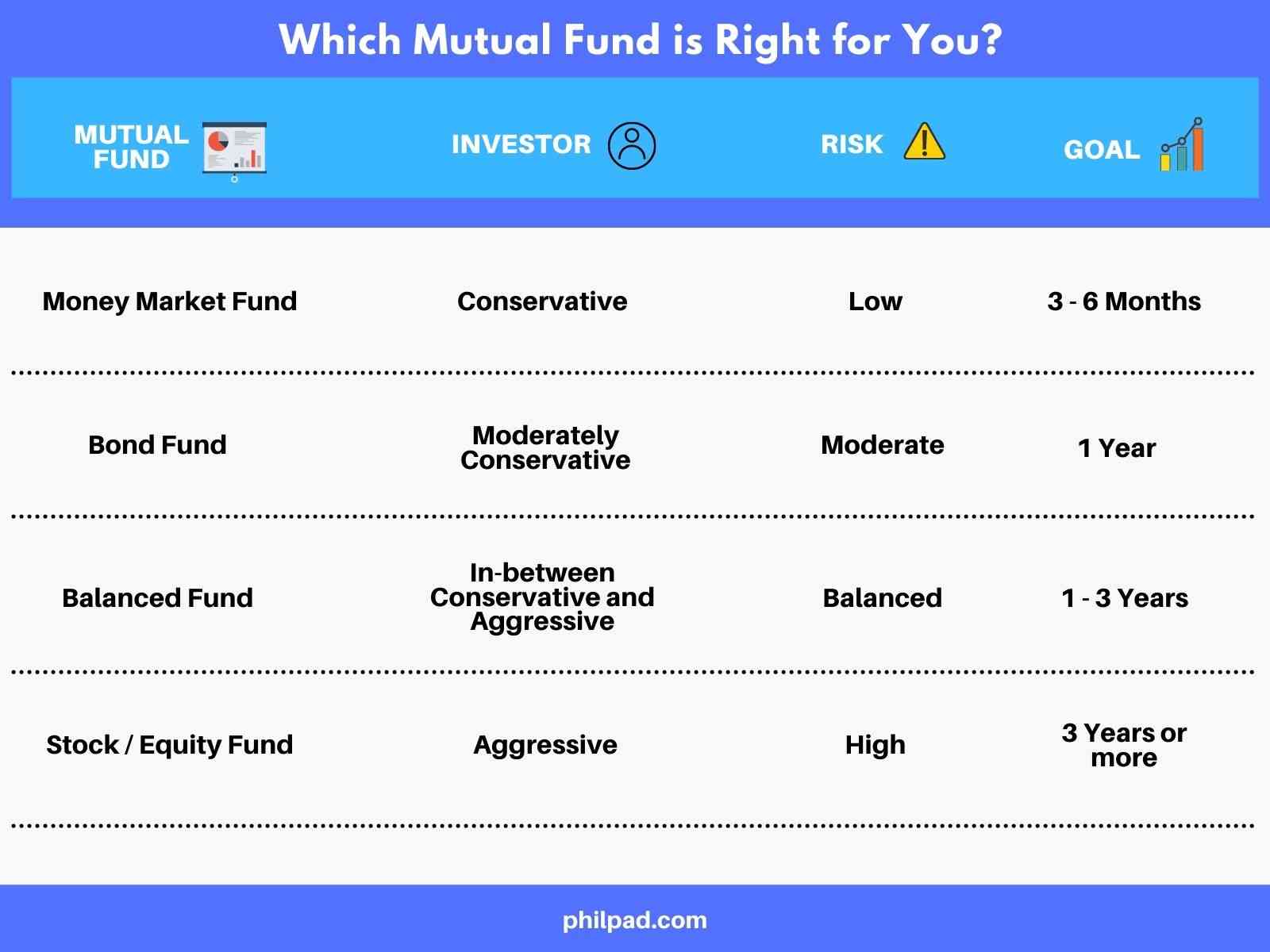

The following are the different kinds of Mutual Funds available in the Philippines right now. Always remember, the higher the risk, the higher the earning potential.

We classified the available mutual funds according to the type of investor, risk, and goal.

Best Mutual Funds in the Philippines in 2024

If you are already eyeing the best investments for mutual funds, here is the latest data on their performance in a year. The stats are taken from the Philippine Investment Funds Association.

The early bird usually catches the yummy worm. These are the top mutual funds that performed well with higher returns. And as usual, we will update the data again in the coming months and the next quarter.

Top 15 Best Performing Equity Funds in the Philippines:

NAVPS Performance as of July 13, 2024. Data shows Year to Date (YTD Return %).

- Sun Life Prosperity World Voyager Fund – 15.25%

- Philequity Dividend Yield Fund – 11.03%

- ATRAM Alpha Opportunity Fund – 9.21%

- ATRAM AsiaPlus Equity Fund – 6.75%

- Climbs Share Capital Equity Investment Fund – 6.18%

- Sun Life Prosperity Philippine Equity Fund – 4.57%

- ALFM Growth Fund – 4.47%

- Philam Strategic Growth Fund – 4.19%

- Philequity MSCI Philippine Index Fund – 3.89%

- Philequity Fund – 3.68%

- Philequity PSE Index Fund – 3.68%

- Philippine Stock Index Fund – 3.60%

- Sun Life Prosperity Philippine Stock Index Fund – 3.51%

- COL Equity Index Unitized Mutual Fund – 3.51%

- Philippine Stock Index Fund – 3.50%

Top 5 Best Performing Balanced Funds in the Philippines:

NAVPS Performance as of July 13, 2024. Data shows Year to Date (YTD Return %).

- Sun Life Prosperity Dollar Advantage Fund – 10.10%

- First Metro Save and Learn FOCCUS Dynamic Fund – 9.61%

- PAMI Asia Balanced Fund – 6.56%

- Sun Life Prosperity Dollar Wellspring Fund – 4.32%

- Solidaritas Fund – 3.40%

Top 5 Best Performing Bond Funds in the Philippines:

NAVPS Performance as of July 13, 2024. Data shows Year to Date (YTD Return %).

- Philam Managed Income Fund – 3.67%

- ATRAM Corporate Bond Fund – 1.78%

- ALFM Peso Bond Fund – 1.73%

- Philam Bond Fund – 1.62%

- Ekklesia Mutual Fund – 1.59%

Top 5 Best Performing Money Market Funds in the Philippines:

NAVPS Performance as of July 13, 2024. Data shows Year to Date (YTD Return %) including dollar securities.

- ALFM Money Market Fund (in units) – 2.24%

- Sun Life Prosperity Dollar Starter Fund – 2.17%

- First Metro Save and Learn Money Market Fund – 2.05%

- ALFM Money Market Fund (in shares) – 2.03%

- Sun Life Prosperity Peso Starter Fund – 1.75%

If you are into investments, we are sure you are diversifying your capital by having more paper assets while also investing in other assets like real estate properties, businesses, and passive-income investment wheels.

Mutual Funds are just one of the many investments you can start to have financial abundance. There are also other rewarding paper investments like UITF, ETFs, and stocks. Remember to invest according to your risk appetite, financial stability, and goals.

FAQs About Mutual Funds:

Are mutual funds exempted from tax?

Yes, as amended in the National Internal Revenue Code of the Philippines, gains realized upon redemption of shares in a mutual fund company are exempt from income tax. This law is amended to encourage more Filipinos to save and invest money.

Can I lose money investing in mutual funds?

Mutual fund investments carry risks. An investor must study the mutual fund’s prospectus, evaluate his risk tolerance, financial status, and objectives before investing in a mutual fund. An investor could lose money in mutual funds if he failed to execute the right time and strategy for his investments.

What is NAVPS in mutual funds?

NAVPS is an acronym for Net Asset Value Per Share. It is used to measure the value of one share of a mutual fund. Investors can buy or sell shares of a mutual fund according to the NAVPS, which changes every trading day.

Other Investment Guides:

- 5 Reasons Why I Got Sun Life VUL Insurance in the Philippines

- Investing 100,000 in a Mutual Fund vs. UITF vs. VUL Earnings

- How to Earn Dollar Dividends in the Philippines without Trading the US Stock Market

Disclaimer: This article is for information purposes only and should not be considered as professional advice. Investments in mutual funds have risks. Historical performances don’t guarantee future results. Always do your research before investing your money.