How to apply for SSS OFW Housing Loan, and what are the requirements? Here is the step-by-step procedure on how to get approved for an SSS housing loan if you are an overseas Filipino worker.

Did you know that SSS allows a maximum loanable amount of 2 million pesos through their Housing Loan Program? Well, we are letting you know now. SSS has a very generous benefit for all of us, and this one is created to back us up in the construction of our dream house.

Instead of applying for a housing loan from your favorite bank, why not ask SSS help instead? I’m sure you’ll love their easy and flexible terms and, most of all, their lower interest rates compared to some loan institutions like banks.

What is SSS Direct Housing Loan Facility for OFW?

SSS has a Direct Housing Loan Facility for OFWs. The Social Security System program and loan facility for OFW is designed to support the Government’s shelter program, which aims to provide socialized and low-cost housing to overseas Filipino contract workers.

SSS OFW Housing Loan Requirements:

You are qualified and eligible for the SSS OFW Housing Loan if you meet the following requirements according to SSS:

- Member is a certified Overseas Filipino Worker;

- Member is a voluntary OFW member of SSS;

- Member has at least 36 months contribution and 24 continuous contributions in the period prior to application

- Member is not more than 60 years old at the time of application and must be insurable. Members age 60 years at time of application will have a maximum loan term of 5 years

- Member was not previously granted an SSS housing loan

- Member has not been granted final SSS benefits

- Borrower and spouse is updated in the payment of their other SSS loan(s), if any

The spouses of an existing borrower may still qualify for an SSS housing loan if the loan of the existing borrower was obtained prior to the date of marriage and the loan is not delinquent.

Purpose of the Housing Loan

SSS also noted that they allowed certain purpose for an OFW to be able to apply for this type of loan. Check out the required purpose below.

- Construction of a new house or dwelling unit on a lot owned by the applicant free from lien/encumbrances;

- Purchase of a lot and construction thereon of a new house or dwelling unit; and

- Purchase of an existing residential unit which may be a house and lot, a condominium unit or a townhouse.

Note:

The property subject of the loan must be occupied by the owner-borrower or his/her immediate family member upon purchase of the unit.

SSS OFW Housing Loan Application Procedures:

There is a simple process for SSS Housing Loan for OFWs. First, you need to gather all the documents required (listed below). Then you can file your SSS OFW Housing loan application at the nearest SSS branch or the Housing and Business Loans Department, 5/F SSS Building, East Ave., Diliman, Quezon City.

- Original copy of the following:

- Mortgagor’s Application for Housing Loan with 1” x 1” ID pictures of Principal Applicant and Spouse

- Certificate of Loan Eligibility (CLE) – (P100 Service Fee)

- Certification from POEA/DOLE/OWWA/ SSS Foreign Representative Office or Philippine Embassy/Consular Office

- Deed of Sale or Contract to Sell with statement of latest balance for purchase of lot or house and lot

- Appraisal Report from Home Guaranty Corporation accredited appraisal companies

- Certificate of Acceptance and Occupancy duly signed by the borrower if house is 100% complete at the time of loan filing

- Duly notarized Special Power of Attorney (if filing is through a representative)

- Original and Photocopy of the following:

- Latest Contract of Employment and latest Employer’s Certification duly authenticated by Phil. Consulate

- Owner’s copy of the TCT/OCT/CCT

- Certified true copy of TCT/OCT/CCT issued by the Register of Deeds

- Latest Property Tax Declaration and Realty Tax Receipt

Note:

- Present original and submit one (1) photocopy of required documents for authentication purposes

- Applicant and spouse must be up-to-date in the payment of all existing loan accounts with SSS subject to verification by the SS

- SSS reserves the right to require additional documents if deemed necessary

- Application Fee – ½ of 1% of loan amount or P500 whichever is higher but not to exceed P3,000.00 to be deducted from the first loan release.

- Inspection Fee – P500 for both within and outside Metro Manila

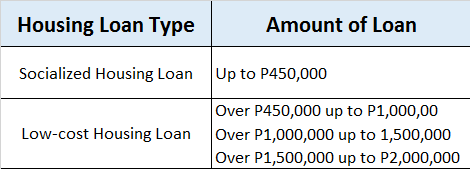

SSS OFW Loanable Amount, Terms, and Conditions

How much can an OFW apply for a housing loan at SSS?

The maximum loanable amount is P2,000,000.00. The loan amount granted shall be the lowest amount based on the following factors:

- Appraised value of collateral of at least 70% but not to exceed 90%

- Borrower’s capacity to pay

- Actual need of the borrower based on the contract to sell/scope of work and bill of materials evaluated by the SSS

A maximum of three (3) qualified SSS members may be tacked-in for a single loan up to the combined maximum individual availment for the loanable amount secured by the same collateral, provided they are related within the first (1st ) civil degree of consanguinity or affinity.

How long is the term of SSS Housing Loan for OFW?

The loan is payable in multiples of five (5) years up to a maximum of fifteen (15) years.

However, the loan term shall be subject to the following:

- The principal borrower’s age shall not exceed 65 years old at the time of loan maturity; and

- The loan term shall not exceed the economic life of the building as determined by the SSS appraiser.

Collateral for SSS Housing Loan

The collateral for the loan is the Transfer Certificate Title/Original Certificate of Title/ Condominium Certificate of Title (TCT/OCT/CCT) issued by the Registry of Deeds in the name of the principal borrower free from liens and encumbrances.

The loan shall be secured by a first Real Estate Mortgage (REM) on the house and lot to be financed. The REM shall be annotated on the member borrowers TCT/OCT/CCT and shall be registered with the appropriate Registry of Deeds. The loan shall also be covered by an HGC guaranty.

In case the purpose of the loan is the purchase of residential condominium unit prior to actual construction (pre-selling), other residential property acceptable to SSS shall be submitted as collateral to secure the loan.

The following are not acceptable as collateral:

- Land type other than residential

- Less than 15 sq. meters floor area, in case of condominium units

- Less than 32 sq. meters lot area

- Road right of way is less than 1.5 meters

- Free/Homestead/Miscellaneous Sales Patent Titles

Insurance Coverage

- Mortgage Redemption Insurance

- Fire Insurance

- Home Guaranty Corporation Coverage

The insurance premiums shall be shouldered by the borrower.

Manners of Payment (List of Overseas Payment Centers (For OFWs)

- PNB electronic overseas bills payment

- i-Remit online branches

- Ventaja online outlets

- WDS-Lucky Money online branches

- Metrobank online branches & subsidiaries

- BDO Remit Services

- RCBC Telepay Service

- BOC Remittance tie-ups

- AUB Ginto Hatid Express

- Bancnet online payments (www.bancnetonline.com)

- Branches or remittance tie-ups of accredited collecting banks