Looking for the best stocks to invest in the Philippines in 2025? I’ve shared my exclusive list here.

The Philippine Stock Exchange offers great opportunities if you know where to look. With a recovering economy, stable inflation, and projected growth in key sectors, 2025 is shaping up to be a promising year for long-term investors.

Here’s a look at the best stocks in the Philippines in 2025 that you should consider adding to your portfolio today.

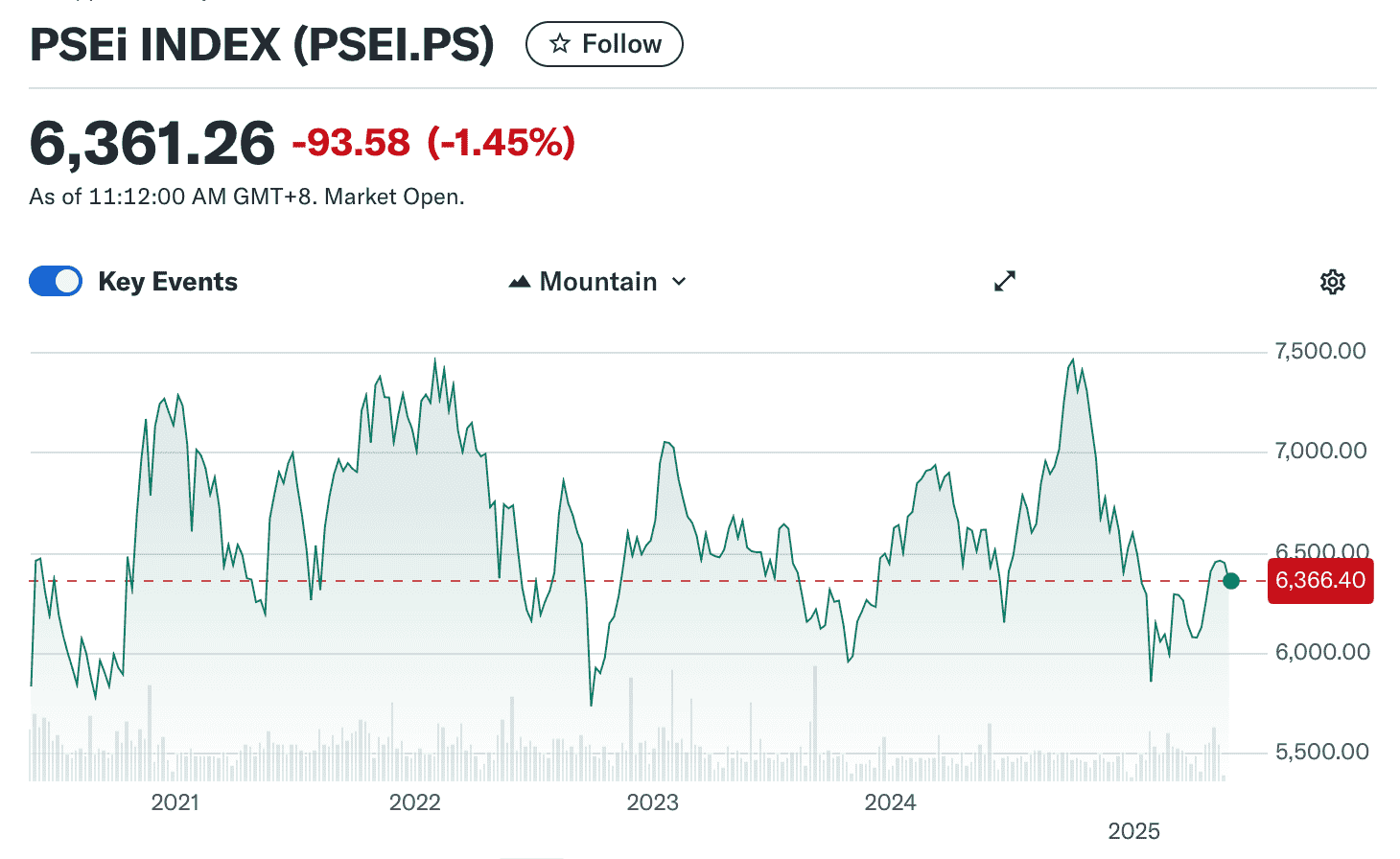

PSEI Forecast in 2025

Here’s what the experts are whispering over coffee and quarterly reports: the PSEi—that’s the Philippine Stock Exchange Index—is looking like it might actually behave this year. With GDP growth expected between 5.9% and 6.5%, inflation on its best behavior, and interest rates possibly softening their edges, there’s cautious optimism in the air. It’s not champagne-popping season yet, but it’s not a red flag, either.

If political and global market conditions remain stable, the PSEi could reach 6,500 to 7,000 by year-end, making now an ideal time to invest in blue-chip stocks.

Of course, not all things that come overseas are glamorous. Trump’s dreaded tariffs rattle global trade like a bad breakup. If U.S.-China tensions rise again, supply chains could tighten, and emerging markets like the Philippines might feel the sting. But thanks to our local demand and steady remittances, we may ride out the storm in style with a well-diversified portfolio.

Export-dependent sectors, such as electronics and semiconductors, may face headwinds, while inflationary pressures could re-emerge due to costlier imports. Still, the Philippines’ strong domestic demand and growing service sectors may overcome these external shocks.

Best Stocks to Invest in the Philippines in 2025

1. BDO Unibank (BDO)

BDO remains the largest bank in the country, offering a strong balance sheet, consistent profit growth, and a large customer base. With rising interest margins and a digital revamp that’s turning heads, BDO remains a safe—and smart—bet for 2025. It also pays regular dividends.

2. Security Bank Corporation (SECB)

If BDO hosts the banking empire party, SECB is the quietly intelligent guest who brings homemade wine. Understated but impressive. It’s trading at a discount, which means you get more value for your peso. And with its renewed focus on retail and tech, SECB is slowly stepping into the spotlight.

3. Aboitiz Power Corporation (AP)

As the country transitions to cleaner energy, Aboitiz Power is positioned to lead the charge. With ongoing investments in renewable energy projects and consistent dividend payouts, AP is a defensive and sustainable choice. Its diversified power portfolio provides stability amid fluctuating energy demand and market volatility.

4. International Container Terminal Services Inc. (ICT)

ICT isn’t just a local stock—it’s a global brand. With port operations in 19 countries, the stock can serve as a hedge against peso fluctuations, thanks to its dollar-denominated revenues. With trade volumes expected to rise in 2025, ICT is set to deliver another year of strong growth.

5. SM Investments Corporation (SM)

SM is practically part of our DNA. Malls, supermarkets, banks—it’s everywhere, and that’s a good thing. As people go out, shop more, and travel again, SM’s diverse businesses are ready to cash in. It’s the largest company in the Philippines in terms of market cap. SM stock is an excellent choice for long-term investing.

6. Citicore Energy REIT (CREIT)

CREIT offers stable income through long-term lease contracts with renewable energy producers. As the first renewable energy REIT in the Philippines, it appeals to ESG-conscious investors. With a 6.1% dividend yield and expanding solar projects, CREIT provides the potential for passive income and capital appreciation in 2025.

Key Drivers and Risks

What’s working in our favor?

- Slowing inflation and lower interest rates

- Strong domestic consumption (Filipinos love to spend!)

- Government spending on infrastructure

- Renewable energy and tech sector growth

- Remittance-driven peso stability

What should we worry about?

- Global slowdowns and trade tensions

- Geopolitical drama (again?)

- Policy curveballs post-elections

- Natural disasters—because, of course

While 2025 holds a lot of potential, it’s important to stay diversified and monitor macroeconomic indicators closely. Investing comes with no guarantee.

Final Thoughts

They say don’t put all your eggs in one basket—but what if the basket has BDO, SM, CREIT, and a few other dependable names? In a year that still feels like a reset button, investing wisely might just be the grown-up version of a vision board.

So, here’s to taking control of your finances one stock at a time. Not just because it’s the smart thing to do—but because it’s one of the few things in life that actually grows when you give it time, patience, and a little trust.

Investing in the best stocks in the Philippines in 2025 can give you a head start toward your financial goals. Don’t wait—start investing today while prices remain attractive and let your money work for you.

Don’t miss reading:

Top 15 Best Insurance Companies in the Philippines

Best Credit Cards in the Philippines

Disclaimer: This article is for informational purposes only and reflects the author’s perspective and opinion. Stocks carry risks and may result in the loss of money. Past performance is not a guarantee of future results. Always do your own research or consult an expert before making investment decisions that align with your financial goals and risk tolerance. The author has no business relationship with any of the companies mentioned.

Subscribe to receive FREE posts and updates!