Here’s how to Open UITF Account in BDO together with the Requirements Application Procedure. If you want to grow your savings in hundreds of thousands and millions, UITF and Mutual Funds are the top options and alternatives since SDA (Special Deposit Accounts) offered in local banks in the Philippines were gone.

If you want to open UITF account in BDO, you must first know the requirements, instructions, and procedure so you will have the idea what will you do and what to submit in the bank upon opening your Trust Fund account. I opened mine in BDO so I’m sharing here my experiences.

BDO requirements to open UITF account. Application of Equity Fund, Bond Fund, GS Fund, Money Market, Fixed Income Fund and Balanced Fund are shared in this page.

I assume you already know what UITF (Unit Investment Trust Funds) are even if it’s your first time opening one. If not, you can always read our special posts (listed at the end of the article) about this investment and other related wealth building wheels.

UITF can give you higher return and earnings compared to ordinary savings and deposit accounts. However, there are risks attached because these funds participate to different financial instruments, securities, bonds, stocks, and other funds. UITF can give you thousands or hundred thousands or millions depending on your fund and its performance.

How to Open UITF Account in BDO?

BDO has been the number one among the best banks in the Philippines in terms of deposit, capital, and investment. Their Trust Funds have been and are performing well so it’s my first choice for UITF. If you want to finish your transaction or finish creating your account for the day, come at the bank before 11am because majority of their trust funds have a cut-off time or dealing period before noon.

Bring the following BDO UITF requirements:

BDO UITF Account Requirements

- 2 valid IDs with photocopy (back and front)

- TIN (Tax Identification Number)

- Your money for your Trust Fund

BDO UITF Application Procedure in Opening an Account

Go to the Trust representative or employee (not teller) and tell them you want to open UITF. They will check your requirements and give you UITF Application Kit which you will need to fill out and accomplish. The application kit contains the following forms and statements:

- Investor Profile Questionnaire (IPQ) /Client Suitability Assessment (CSA)

- Client Investment Suitability (CIS) /Investment Policy Statement (IPS)

- Risk Disclosure Statement (RDS)

- Omnibus Participating Trust Agreement (for new applicants)

Take your precious time and don’t rush reading and understanding the forms because it is important to you as an investor. Remember, opening an investment is a serious business. Don’t worry about filling the forms out because it’s only like opening a bank account except of course the questionnaire which will be your assessment on what type of investor you are based on your investment objectives, risk appetite, financial requirements and goal. The questionnaire and forms will help you understand everything including the different types of BDO UITFs offered to you. There is no right or wrong answer on the questionnaire so don’t you worry.

Types of BDO UITFs and their Minimum Investment and Holding Period

- Peso Money Market Fund – P100,000 (no holding period)

- Peso Bond Fund – P100,000 (30 days)

- GS Fund – P100,000 (30 days)

- Peso Fixed income – P10,000 (30 days)

- Peso Balanced Fund – P10,000 (30 days)

- Equity Fund – P10,000 (30 days)

- Dollar Money Market Fund – $2,000 (45 days)

- Dollar Bond Fund – $2,000 (45 days)

- Medium Term Dollar Bond Fund – $2,000 (45 days)

Investing to UTIFs and Mutual Funds involve risks. Financial experts say the higher the risk, the higher the return. Among the types of funds, equity fund is the riskiest because they are invested in stocks of well-known big companies in the Philippine Stock Market/Exchange chosen by the fund manager. They have high risk because they are too volatile and the market is very unpredictable. You could earn millions in a snap or you could lose some. It depends. How can you earn anyway? No worries, if you maintain your investment for long term period, you will likely win in the process.

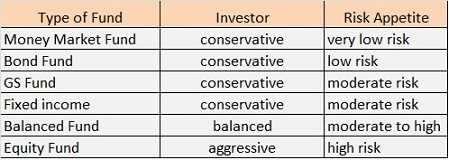

What type of fund is recommended for you? Below I have summarized the suited fund according to type of investor and risk appetite.

Remember you are the best person who knows what you need and what type of investor you are and you are the one deciding your financial goal.

You will be given Certificate of Participation (COP) indicating your Trust Fund account. You will use this certificate when claiming your redemption at the time you decided you withdraw your funds and the profits attached. Profit or loss, I always wish it’s profit.

Use your CMN (Client Master Number) to enroll your UITF account in BDO Online Banking facility so that you can easily monitor your fund performance. Happy investing!

Don’t miss reading about:

- Mutual Funds vs UITFs – Similarities and Differences – Advantages and Disadvantages

- UITF BDO Equity Fund – Benefits, Review, Experiences

To sum up,

How to Open BDO UITF Account

- Prepare your valid ID, Tax ID No. and money

- Fill out the documents in the BDO UITF Application Kit

- Choose your UITF

- Receive your COP (Certificate of Participation)

Disclaimer: This article is only for information purpose and is based from experience. It’s not meant to endorse any investment or a company. Remember, all investments have risks so decide wisely before you invest.

Share your insights about investing in UITFs and other funds by commenting below. Thank you!