If you want to apply or file your SSS retirement pension benefits online, here are the step-by-step guides and a list of requirements. It will only take a few minutes to complete the steps if the applicant has already prepared the needed documents below.

Before you apply for your SSS retirement claims, ensure that you first meet the qualifications we will share on this page. The Social Security System grants two types of retirement benefits to eligible members.

Read the details and information below as a retirement guide for SSS members to know your benefits.

What is an SSS Retirement Benefit?

SSS retirement benefit is a cash benefit in the form of a monthly pension or lump sum amount given to an eligible SSS member at the age of retirement or in the event that they can no longer work due to old age or mandatory retirement age.

What are the types of SSS Retirement Benefits?

1. SSS Monthly Pension Benefit

A monthly pension is a lifetime cash benefit paid to an SSS retiree member who has paid at least 120 monthly contributions before the semester of their retirement.

2. SSS Lump Sum Claim

SSS lump sum benefit is one-time cash granted to a retiree who has not paid the required 120 monthly contributions to the SSS. The lump sum amount is equivalent to the total contributions paid by the member and the employer, including the interests.

3. SSS 13th Month Pension

Retirees are entitled to receive a 13th-month pension payable every December. Effective January 1, 2017, all SSS retirement pensioners will also receive an additional cash benefit of P1,000.

Who are Qualified to Receive SSS Retirement Pension Benefit?

- An SSS member who paid 120 monthly contributions or more before the semester of their retirement:

- The member has reached the age of 60 and has been separated from his employer or has stopped being a self-employed, OFW, and household helper.

- Has reached the age of 65 years old while still working as a self-employed, OFW, or household service worker (technical retirement)

- The member has reached the age of 55 or 60 years old (technical retirement) for underground mine-worker whose actual date of retirement is not earlier than March 13, 1998

- The member has reached the age of 50 or 60 years old (technical retirement) for underground or surface mine-workers whose actual date of retirement is not earlier than April 27, 2016

- The member has reached the age of 55 years old for Racehorse Jockey, whose actual date of retirement is not earlier than May 24, 2016

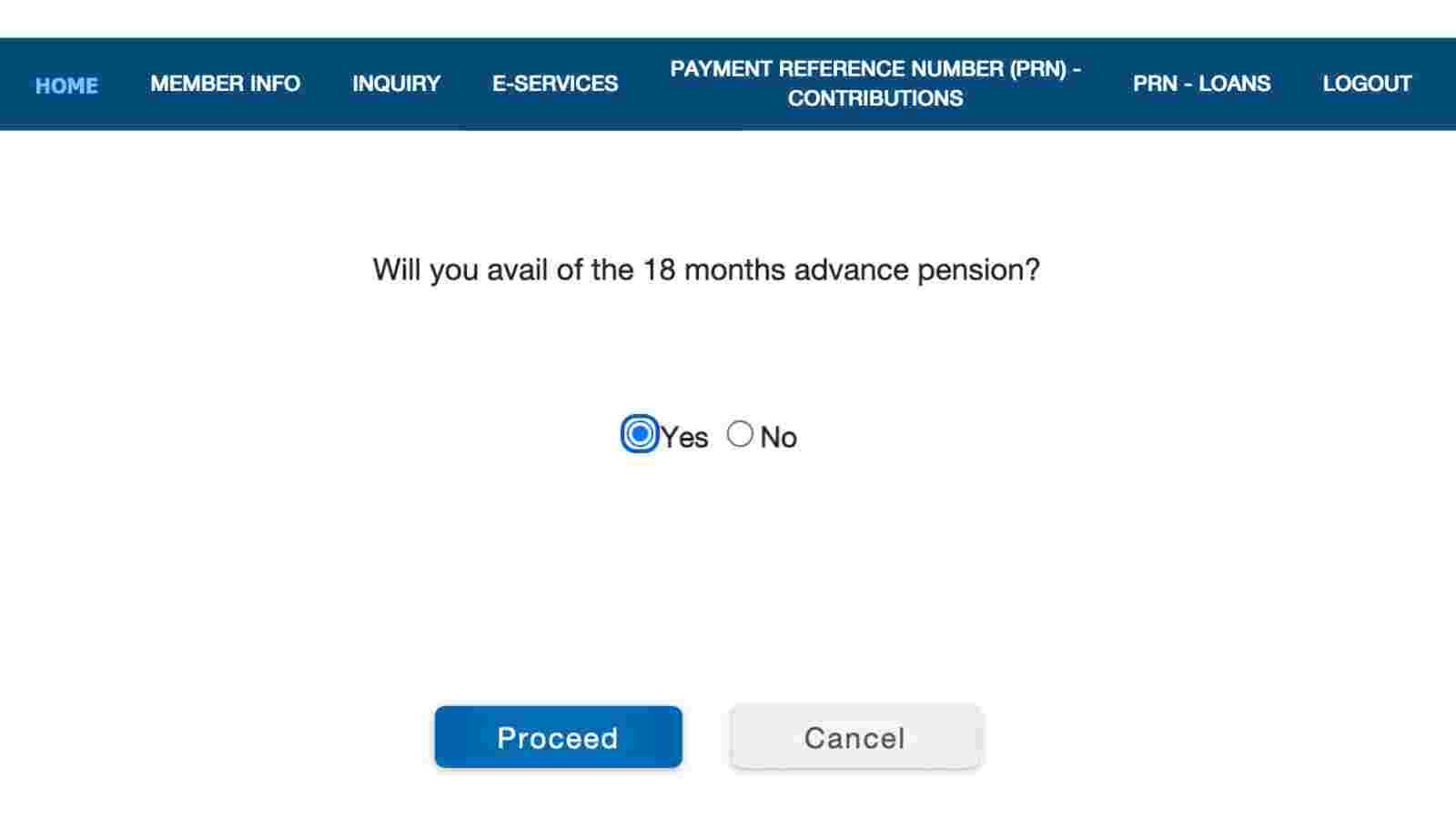

- A retiree SSS member has an option to receive their 18-monthly pension in advance as a lump sum amount. The Social Security System will discount the lump sum amount based on a preferential rate.

- A member who is 60 years old but not yet 65, who has paid 120 monthly contributions or more to the SSS, can continue to pay their contributions as a voluntary member (VM) until the age of 65 to generate a higher amount of retirement benefits.

Who are Qualified to Receive SSS Retirement Lump Sum Benefit?

An SSS member who reached the age of 60 years old (50 years old for underground or surface mine-worker) for optional retirement, or 65 years old (60 years old for underground or surface mine-worker, 55 years old for racehorse jockey) for technical retirement, and those members who did not reach the required 120 monthly contributions to the SSS.

A member who failed to complete the required 120 monthly contributions yet filed his application for retirement benefits will be given a chance to pay and complete the required 120 monthly contributions as a voluntary member (VM).

How to compute your SSS retirement monthly pension?

How much will be your SSS monthly pension benefit? SSS monthly pension is equivalent to the following computations and formula considering your AMSC (Average Monthly Salary Credit) and CYS (Credited Years of Service), whichever is higher:

- 300 + (20% X AMSC) + (2% X AMSC) X (CYS-10)

- 40% X AMSC

- Minimum pension of P1,200 if you have 10 CYS; or P2,400 if you have 20 CYS

What are the Requirements to File for SSS Retirement Benefits Online?

- Registered SSS Online Account (My.SSS account)

- Approved Disbursement Account or UMID card enrolled as ATM card

- Active email address

- Valid ID

- Must meet the following qualifying conditions:

- If filing for a monthly pension – they have at least 120 posted monthly contributions before the semester of online retirement claim application

- If filing for a lump sum benefit – they have at least 1 posted monthly contribution

- You must have no cancelled or multiple SSS Number

- You must have no outstanding loan balance under the:

- Stock Investment Loan Program

- Privatization Fund Loan Program

- Educational Loan Program

- Vocational Technology Loan Program

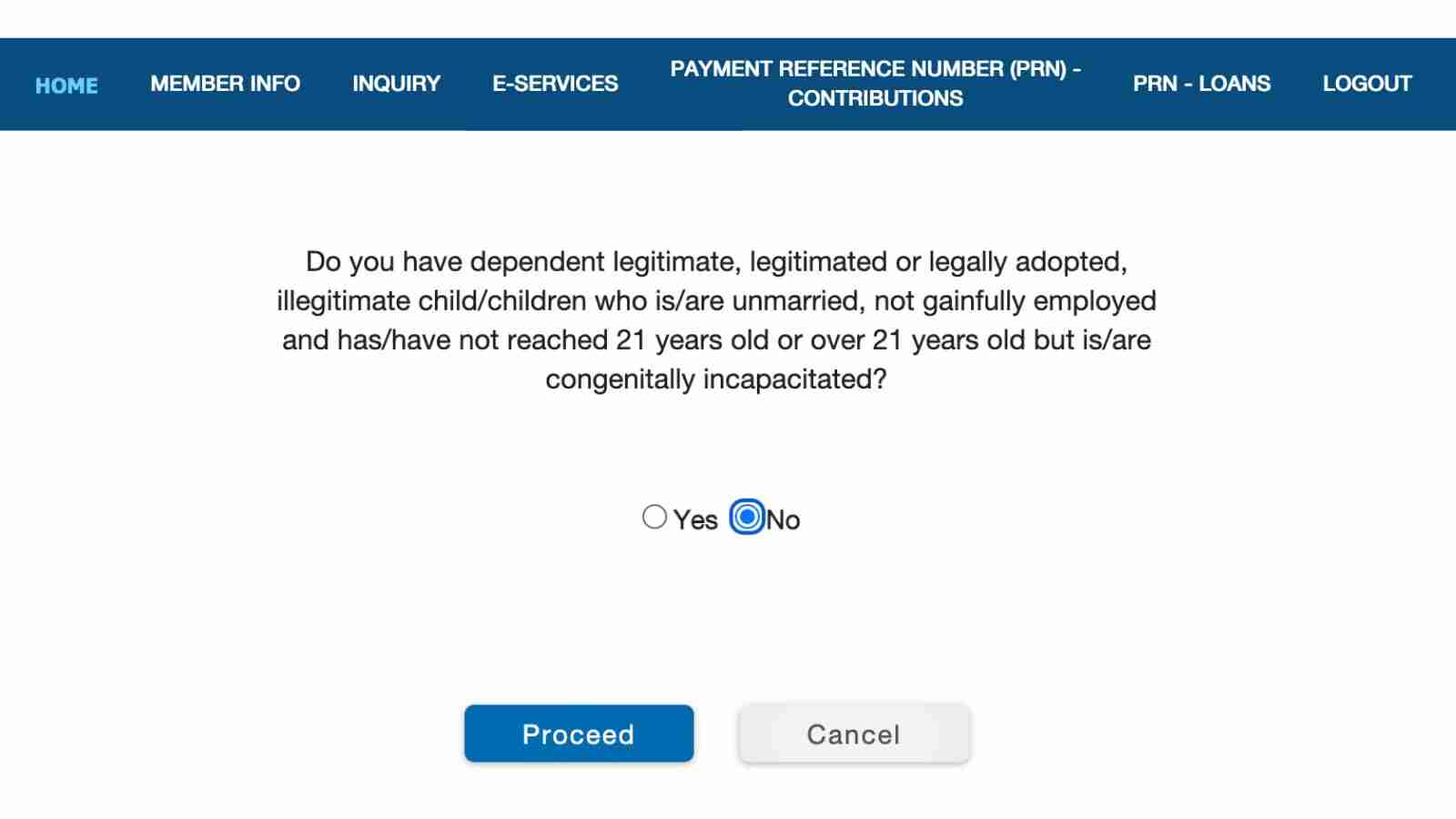

- Have no dependent child or minor children

Important Reminder:

SSS retirement benefits claims under the following conditions and cases shall be filed at any SSS branch office or SSS foreign representative office abroad:

- If the member has an outstanding Stock Investment Loan Program (SILP), Privatization Loan Program, Educational Loan, or Vocational Technology Loan balance

- The member has a dependent child or children under guardianship

- The member is incapacitated, under guardianship, or confined in an institution such as a penitentiary, correctional institution, or rehab center

- If the member is applying under Portability Law or Bilateral Social Security Agreements

- The member has application for adjustment or re-adjudication of claim

- If the member has unclaimed benefit from a deceased member

How to Apply for SSS Retirement Pension Benefits Online?

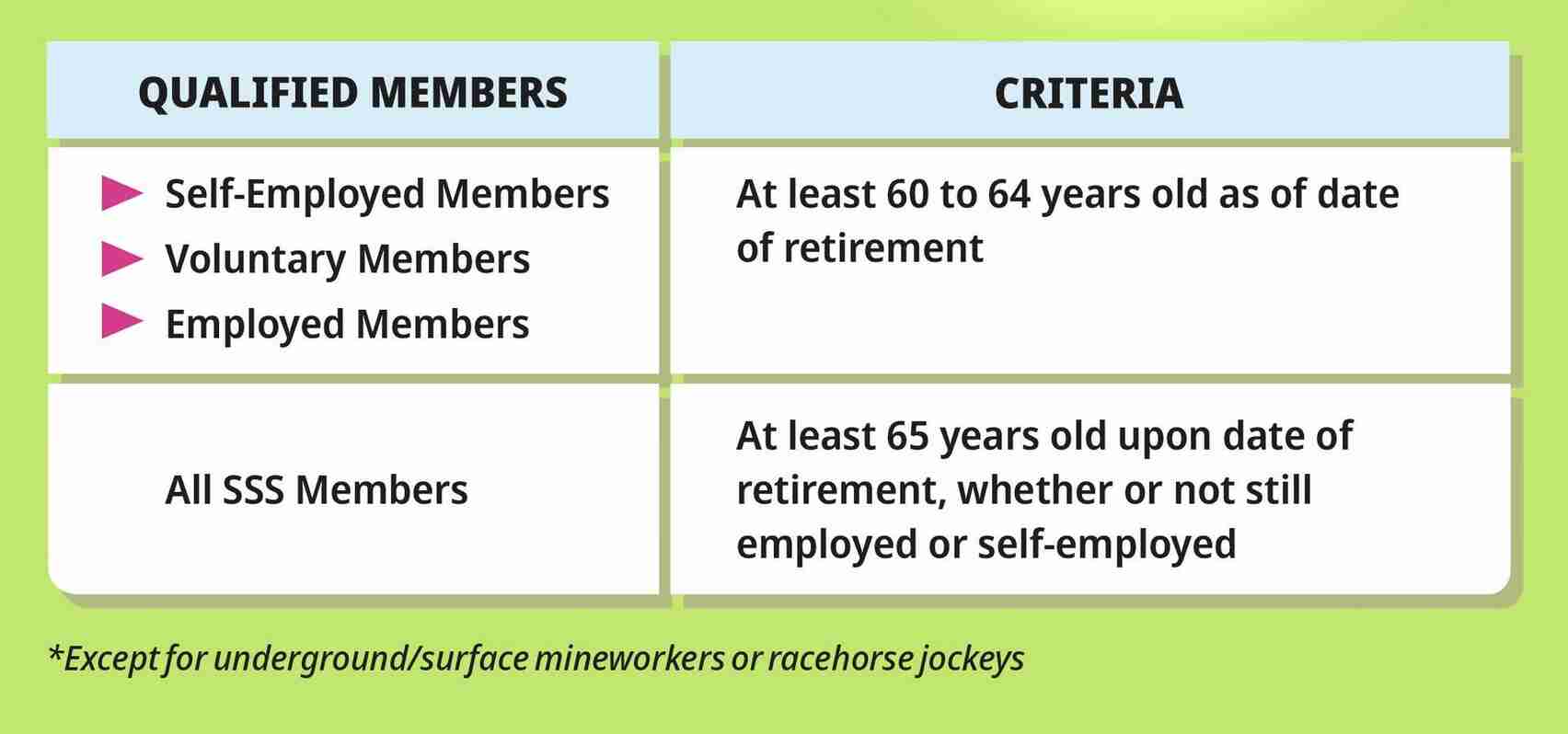

Step 1: Check if you meet the qualifications

Employed, self-employed, OFWs, and voluntary members must be at least 60 to 64 years old as of the date of retirement. All SSS members who are at least 65 years of age upon the date of retirement application, whether employed or not, can apply for SSS retirement claims.

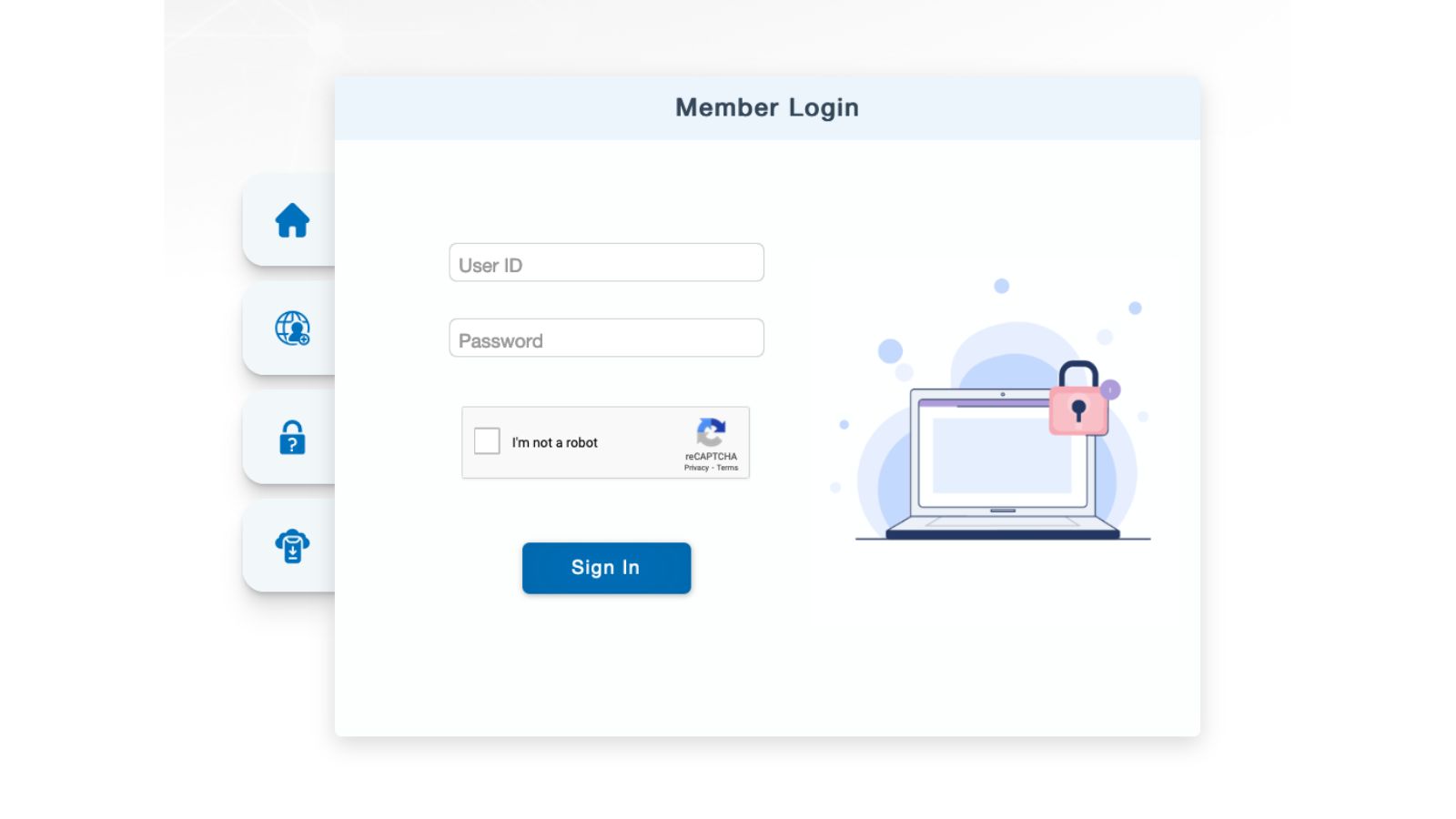

Step 2: Log in to your SSS online account

Next, sign in to your My.SSS online account as a MEMBER. Your membership details and records can be viewed inside your online account. This is also where you will file your SSS retirement claims or apply for your retirement pension benefits. If you don’t have an SSS account yet, you may follow the procedures on how to register for an SSS online account.

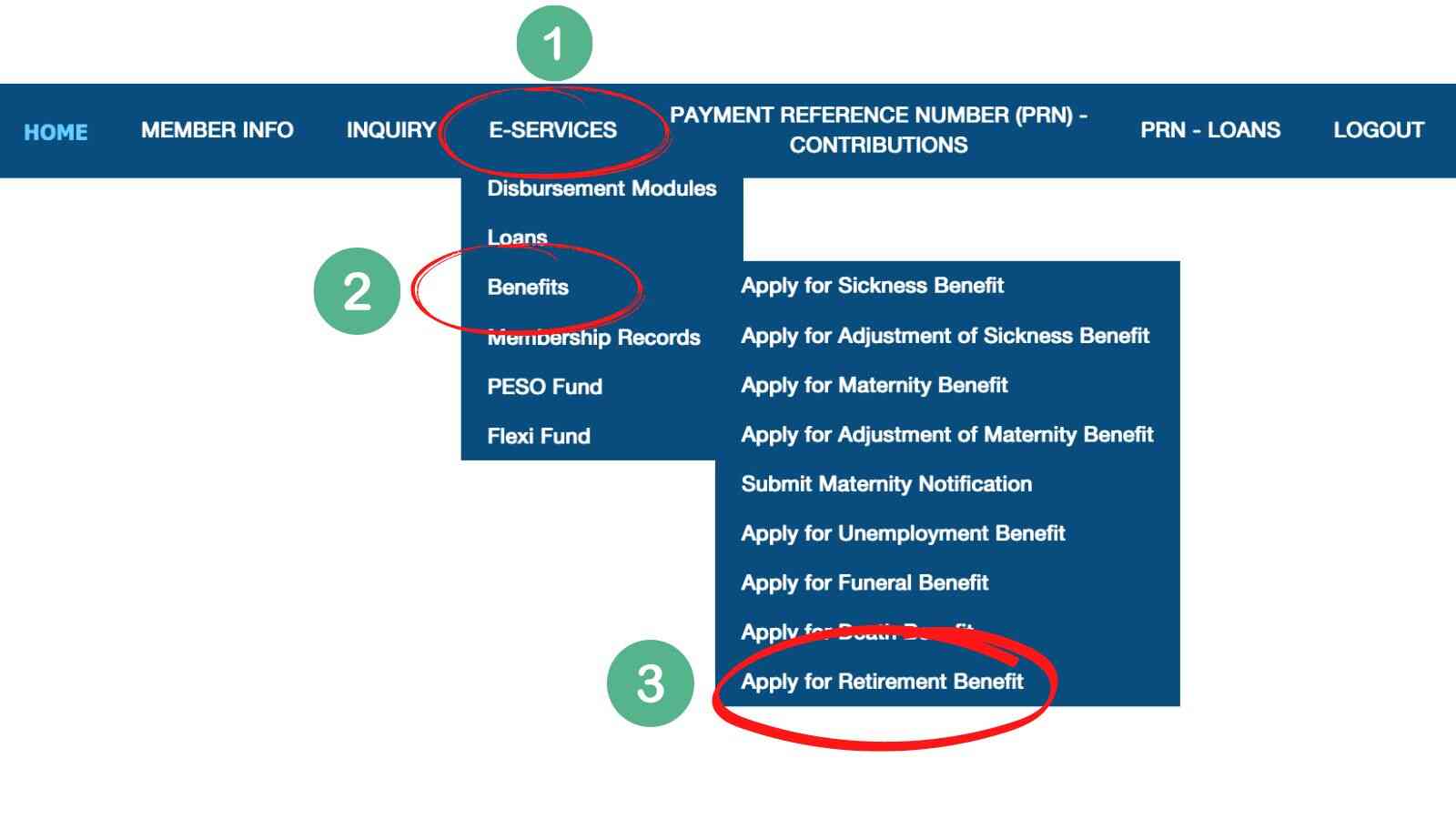

Step 3: Choose “Apply for Retirement Benefit” under the E-services tab on the menu

On the navigation menu, click the E-Services tab and “Benefits” then click the “Apply for Retirement Benefit” link.

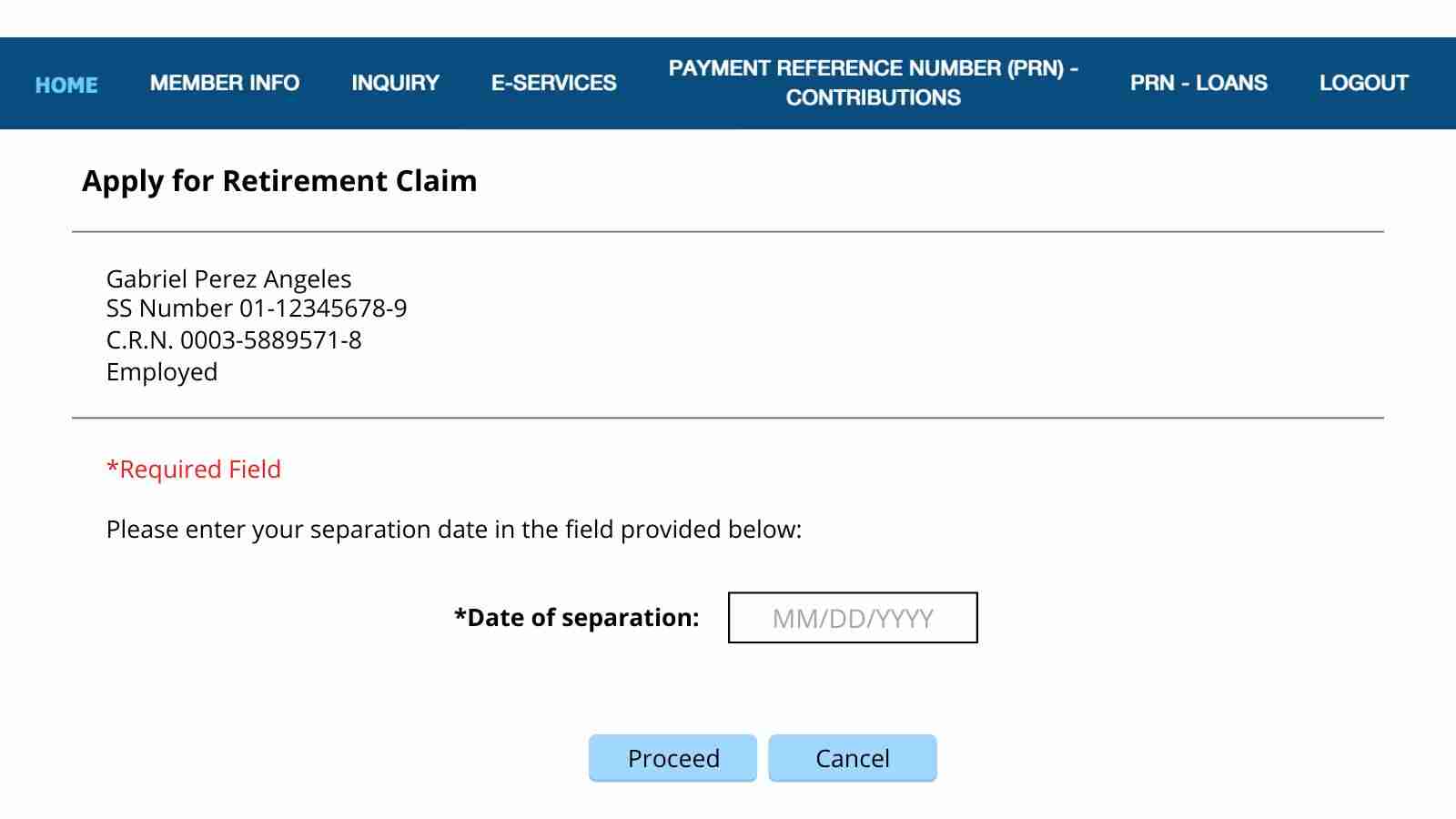

Step 4: Indicate your Date of Separation or Date of Retirement

If you were employed, provide your date of separation from your employer or the last date you worked for a company. If you’re self-employed, OFW, household service worker, or voluntary member, indicate the date of your retirement or the date of your last monthly contribution to the SSS prior to your retirement application.

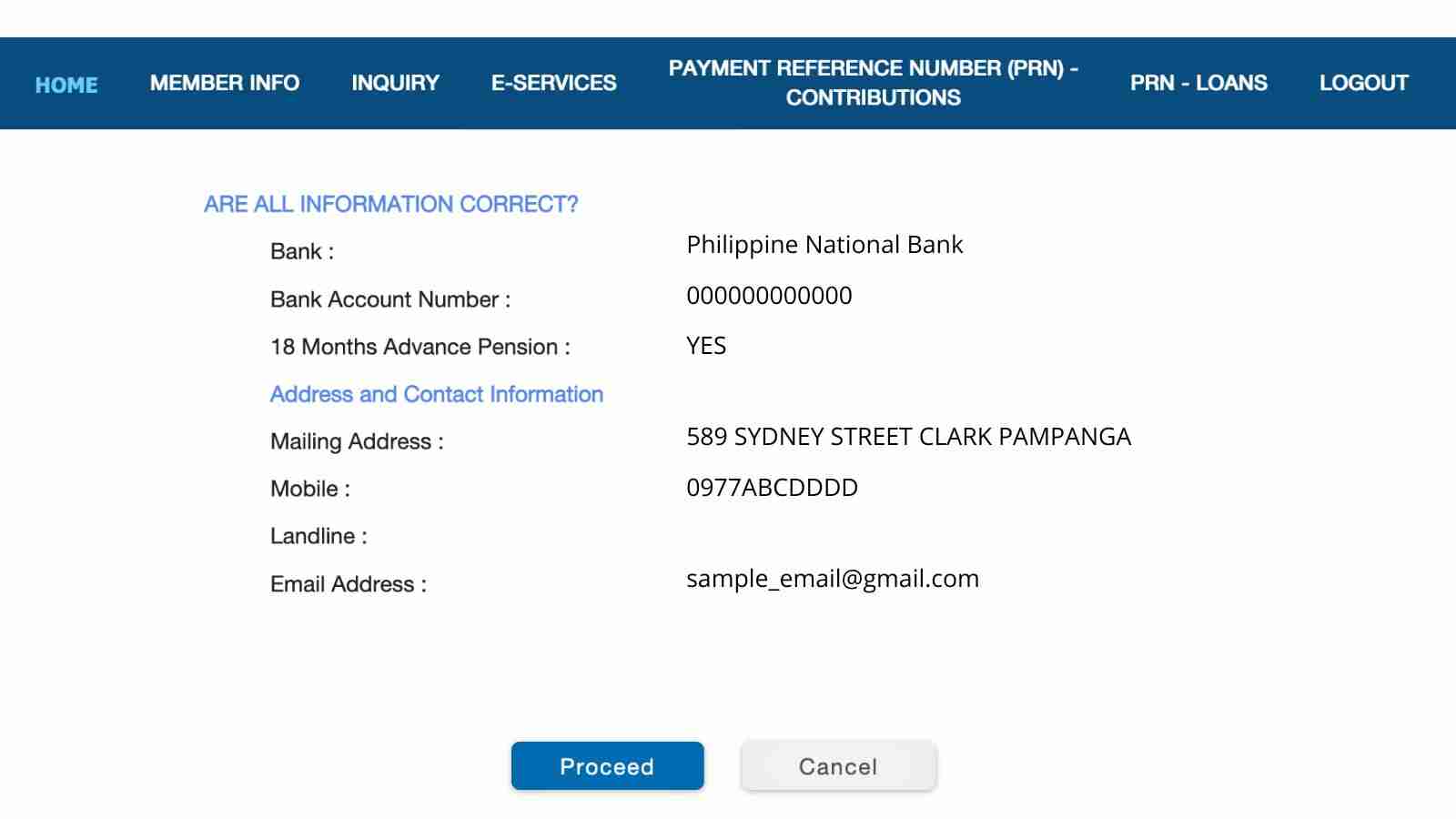

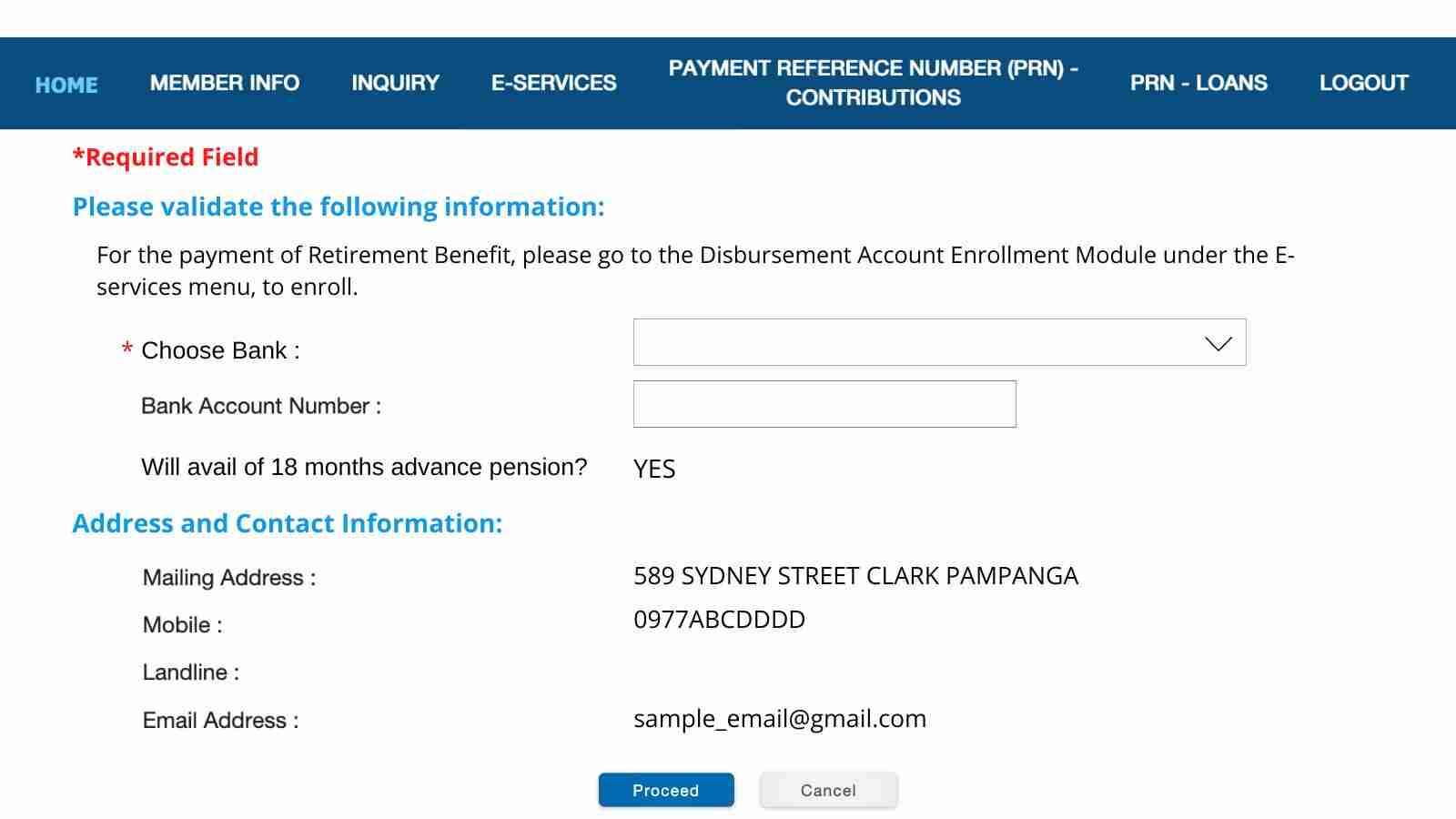

Step 5: Review your SSS retirement claim information and contact details

The next screen will display your SSS basic profile information and contact details. Ensure that your mailing address, email address, mobile number, and bank account number (disbursement account) are all accurate and active.

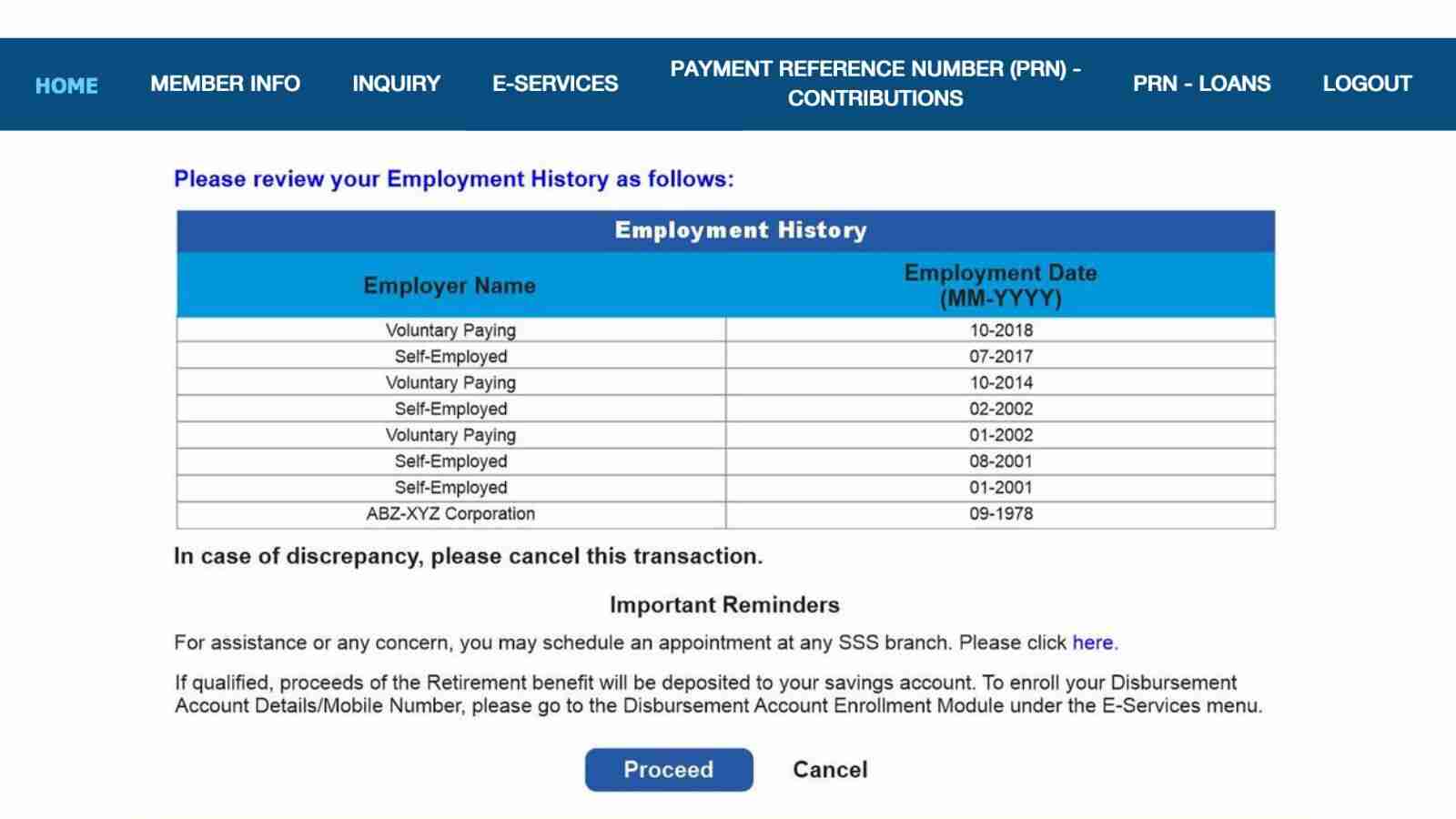

Step 6: Review your Employment History

The next screen will show your employment records. It contains the companies where you’ve been employed in the past and the date of your employment. Likewise, you have been contributing to the SSS during those dates. If you find any discrepancy, you may set an appointment at any SSS branch office to reconcile your membership records.

Step 7: Answer some Questions for Verification

Answer some questions regarding whether you’re a mine-worker or racehorse jockey. The Social Security System will also need to know if you still have dependent children.

Step 8: Indicate your Chosen Bank Account for SSS Retirement Pension

Choose your approved bank account for your SSS retirement pension benefits. Likewise, ensure that your account number is correct. After your successful retirement application, any lump sum or monthly pension benefits will be credited to your preferred bank account.

Step 9: Indicate whether you will avail 18 months advance pension

Eligible SSS retirees may avail the 18 months advance pension. Confirm if you will opt to avail this privilege. This option is not available for retirees with at least 15 months of accrued pension benefits.

Note that the 18-month lump sum pension will be discounted at a preferential interest rate to be determined by SSS and deducted from the first payment of your retirement benefit.

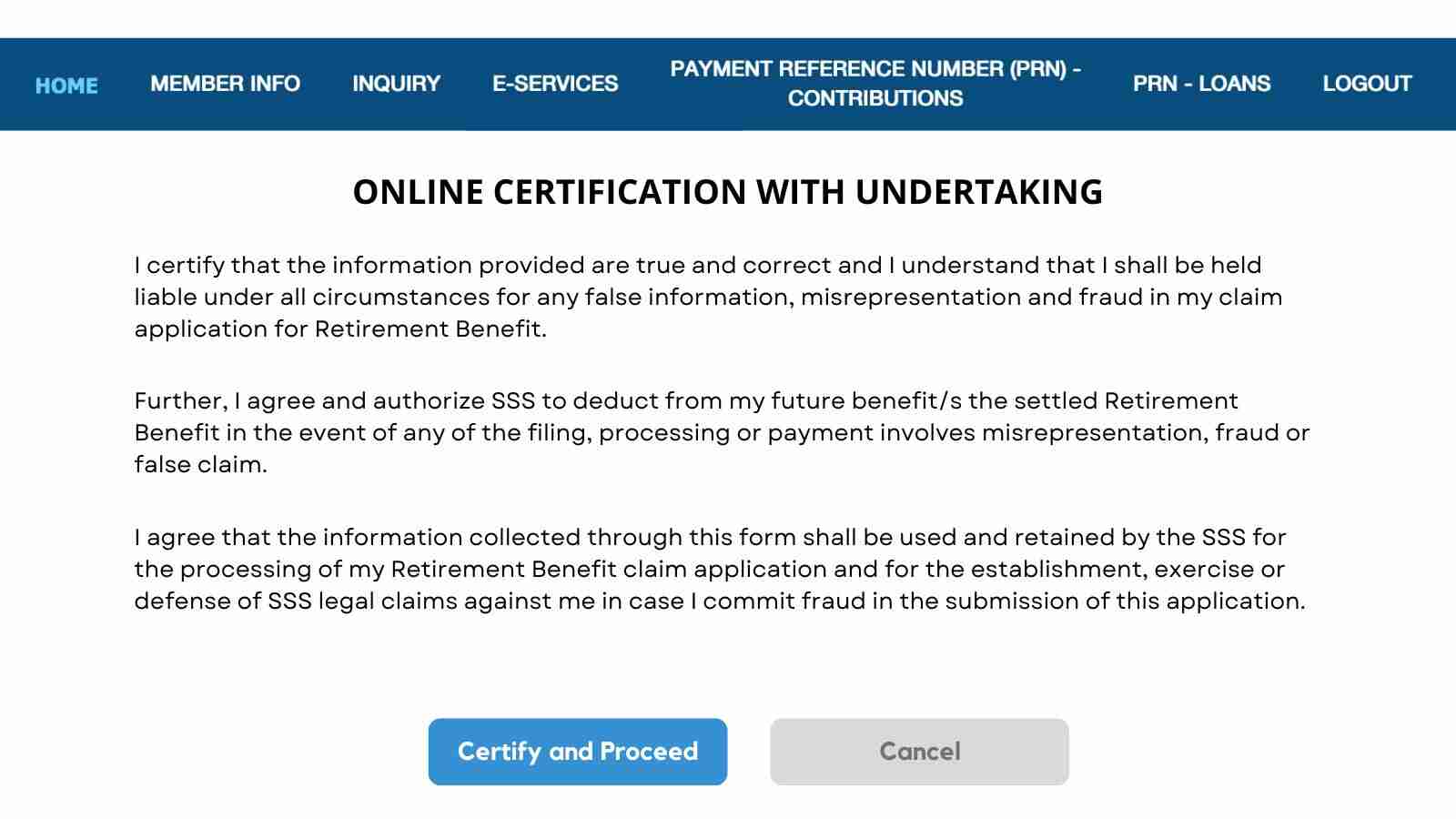

Step 10: Confirm your submission for retirement

Confirm your submission for retirement claims by certifying that all the information you have submitted are true and correct. Read the terms carefully and agree to proceed to file your online retirement application.

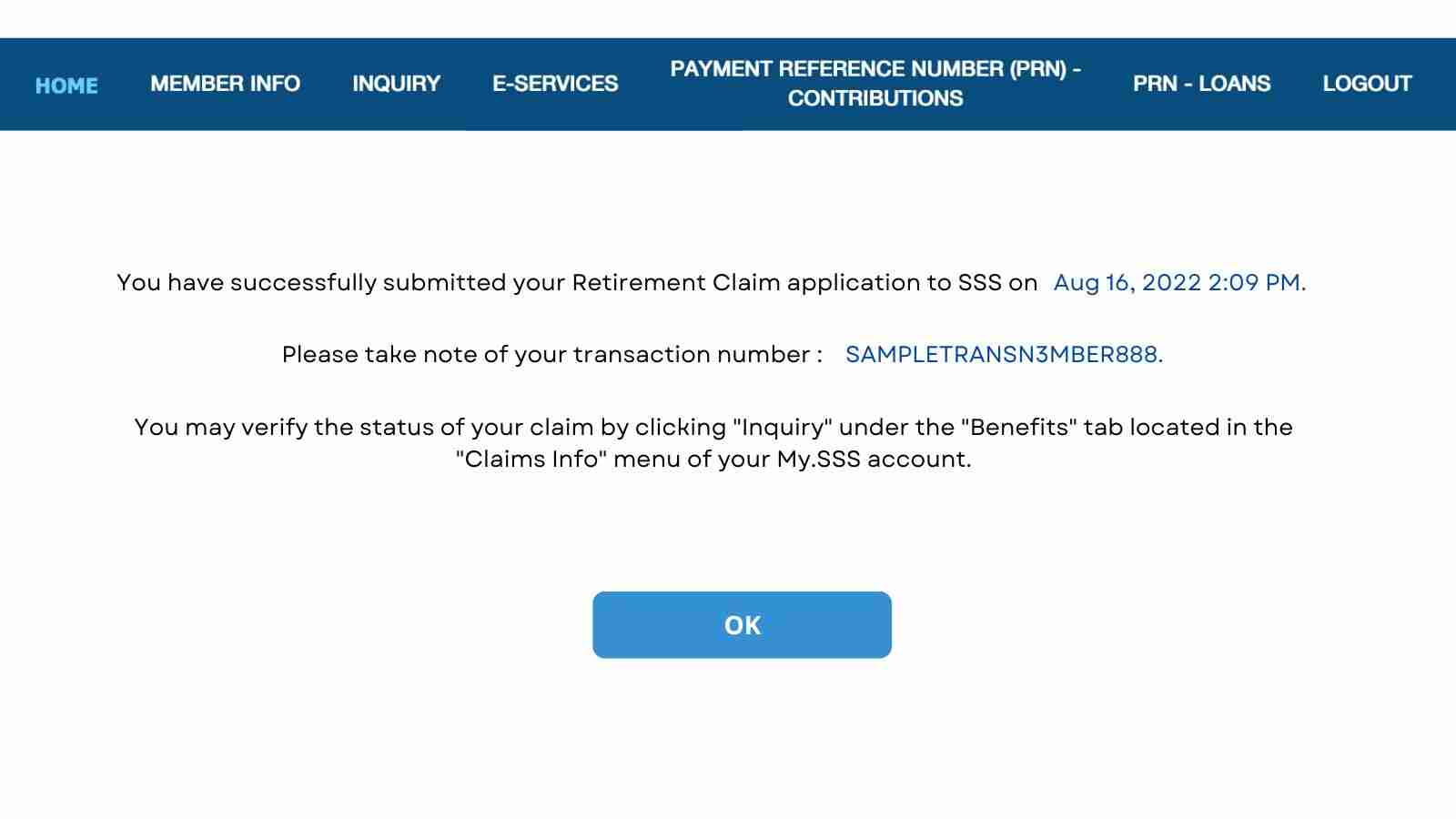

Step 11: Keep your SSS Retirement Benefit Application Notice

The next screen will show a confirmation message indicating your successful SSS Retirement Benefit Claim Application. You will also receive an email with a similar message, the date of your submission, and the transaction number.

Step 12: Receive your SSS retirement pension

After the submission of your SSS retirement pension application, you may verify the status of your claim by logging in to your SSS online account, then navigate to the “Inquiry” on the menu under the “Benefits” tab located in the “Claims Info” menu.

Also read: “15 Reasons Why You Should Retire in the Philippines“

FAQs About SSS Retirement Benefits:

How to receive your SSS monthly pension?

SSS monthly pensions are paid and remitted through the designated pensioner’s bank account or ATM card. Once the application for retirement benefits is approved, the SSS will send a notice voucher to the member containing information and the date when the pensioner can withdraw their cash benefit.

What are the requirements for an SSS lump sum claim?

A retiree has the option to receive the first 18-months pension in a lump sum, discounted at a preferential rate of interest determined by the SSS. This option can be applied only upon filing the first retirement claim. The retiree will receive the regular monthly pension on the 19th and every month after that.

Who can receive a dependent’s pension from the SSS?

The legitimate, legally adopted, and illegitimate children – conceived or adopted on or before the date of retirement of an SSS retiree member will each receive a dependent’s pension. Only 5 minor children, beginning from the youngest, are entitled to a dependent’s pension.

How much is an SSS dependent’s pension?

The SSS dependent’s pension is equivalent to ten percent (10%) of the retiree member’s monthly pension, or P250, whichever is higher. The dependent’s pension will stop when the dependent:

- dies

- reaches 21 years old (unless congenitally incapacitated, or while still a minor was permanently incapacitated and incapable of self-support, physically or mentally)

- gainfully employed

- marries

- enters into a common-law relationship at 18 years of age

What will happen to an SSS retiree’s monthly pension when they die?

Upon the death of an SSS retiree pensioner, the primary beneficiaries will be entitled to 100% of the monthly pension and the dependents to the dependent’s pension.

Suppose the retiree pensioner dies within 60 months from the start of the monthly pension and has no primary beneficiaries. In that case, the secondary beneficiaries will be entitled to a lump sum benefit equivalent to the total monthly pensions corresponding to the balance of the five-year guaranteed period, excluding the dependent’s pension.

What will happen if the SSS pensioner is employed again?

The monthly pension shall be suspended upon the re-employment or resumption of self-employment or a retired SSS member less than 65 years old. The member will be subjected to compulsory coverage. At 65 years old, whether employed or not, they can already claim retirement benefits.

Can I withdraw my SSS contribution after 10 years?

Members cannot withdraw their SSS contributions after 10 years like that of HDMF (Pag-ibig Fund) because SSS is a retirement fund with insurance and social security benefits while HDMF is a mutual fund. SSS aims to provide retirement benefits to old-age pensioners and their eligible dependents.

What is the mandatory retirement age in SSS?

SSS members who reach 60 years old can already apply for retirement benefits, but they have the option to work still or contribute to the SSS. The mandatory retirement age for SSS members is 65 because once a member reaches 65, they must file their SSS retirement benefits whether working or not.

How long is the SSS retirement claim processing time?

When members submit their retirement claim applications online, they will receive a confirmation email with a transaction number in a few minutes. The application will start to process after the successful online submission. The average processing time to receive the approval and result takes around ten to fifteen working days.

Other Helpful Guides for SSS Members:

- List of SSS Benefits Every Member Must Know

- How to Check SSS Contributions Online (in 2 Minutes)

- New SSS Contribution Table 2025