Now that we have installed the latest SSS R3 Program, it’s time I share here how to use the R3 program to generate files, download, upload and print reports such as Transmittal Certificate and Collection List. All employers are required by SSS to submit such report for posting of employees SSS monthly contributions.

Recently, SSS also assigned employers to register for online account to easily facilitate and access SSS employees’ files including contributions and history records, premiums, loans and other profile records.

Before you read further, make sure you have installed correctly the latest SSS R3 software. If you did, give me a high five and let’s proceed.

Take note, this software is for employers only; employees must not use this unless they are authorized signatory.

Why should we use the R3 Program?

- To submit R3 Files to SSS – Collection List, Transmittal Certificate

- To make sure employees’ SSS contributions are posted and updated

- To facilitate in the online employer account of uploading and reporting

When should you use this software?

After payment of SSS contributions every month or every quarter, whichever you use. You can look at the SSS payment receipt at the back to know more about R3 submission.

Step-by-step Procedure in using SSS R3 Program

Click on the R3 Employer’s icon on your desktop.

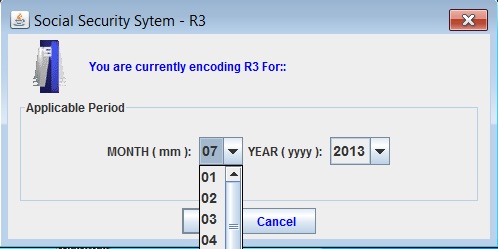

A new window “you are currently encoding R3 for:”will appear. Choose the applicable period and hit save and continue.

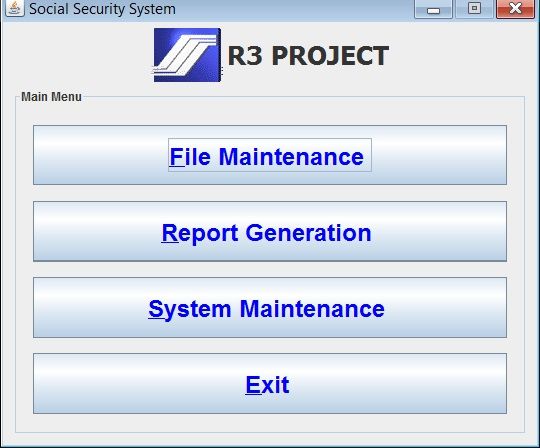

You’ll be brought to the Main Menu window. Select the first widget which is File Maintenance.

Inside File Maintenance, you’ll have these 5 Tasks and you need to go through them one by one. Start from Employer Record Maintenance. Since you’ve done that, proceed to the next.

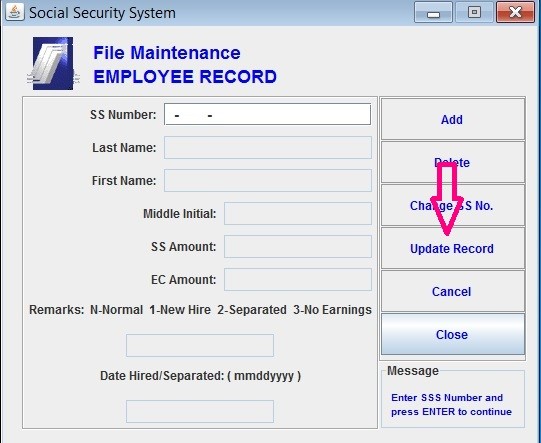

Type your employee’s SSS info. Take note that you don’t have to put comma on the SS amount and EC amount. Just hit enter whenever you go along each box. Double check everything you have typed. If correct, select Update Record.

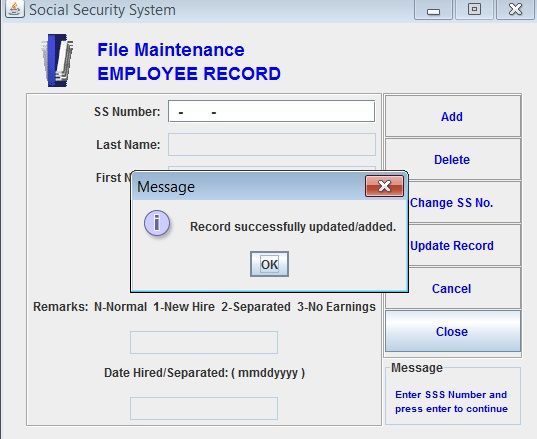

You’ll see then the following message:

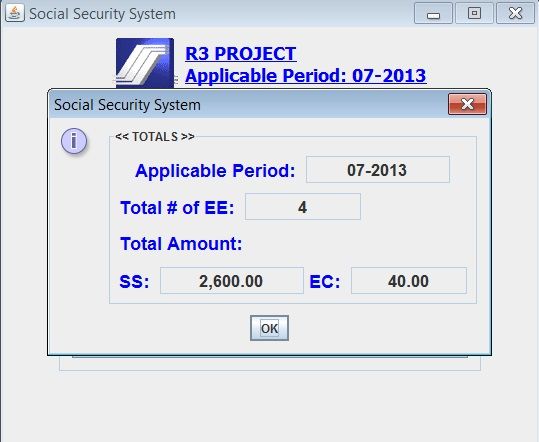

Now select Inquire Totals. You’ll then see the total number of employees together with the total SS amount and EC amount for the applicable month you are encoding. If it’s correct, click OK and proceed to the next step.

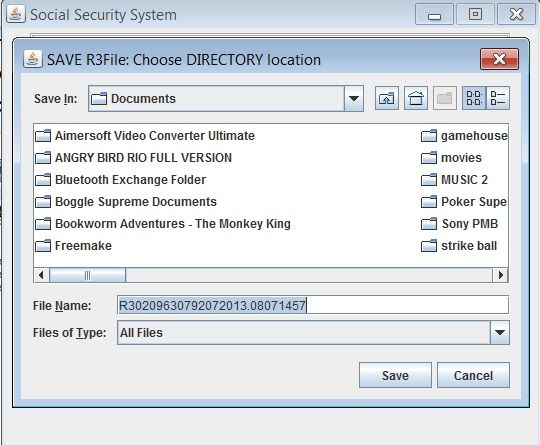

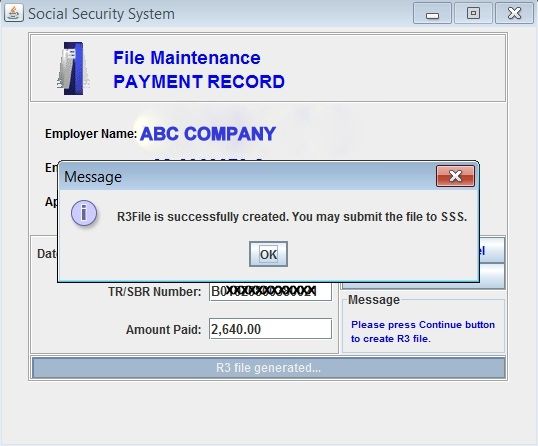

Select Create SSS Text File. Save the file in your computer. Choose the folder you desire and hit SAVE.

You’ll then see a message like this. That is the file you need to submit to the SSS. You can save and download it in your USB flash drive or upload it on SSS Employer Online account.

Return to the Main Menu and select Report Generation to print transmittal certificate and employee file.

You’re done. It’s so easy right? Share your experiences with this software by commenting. Thanks!

Must read:

Disclaimer: I’m not affiliated with SSS. I’m a member like you and I’m using this SSS R3 software for my company. I’m just sharing it here to help others. If you have personal questions or inquiry regarding your SSS account, contact SSS.