We’re sharing the updated list of the top 35 best credit cards in the Philippines in 2026. We compiled the best credit cards according to different categories, such as the best credit cards for beginners, for travel, zero annual membership fee, rewards, cashback, and the most expensive credit cards for Filipino card holders.

If you’re looking for a new credit card, you want to make sure you get the best deal possible. Here are some of our favorite credit cards that offer great rewards, incredible perks, and outstanding customer service from their issuing banks in the country.

What is a credit card?

A credit card is a payment card issued by banks and financial institutions like Visa and Mastercard. It allows consumers to borrow money from their bank accounts using a revolving line of credit with a preset limit for transactions.

Why Should You Get a Credit Card?

Having a credit card is very helpful and convenient for everyone. Nowadays, cashless transactions are growing in numbers. Whether you are shopping, booking a flight, or having your favorite cappuccino, credit cards are lifesavers. That being said, anything we want to purchase, use, or avail online now requires credit cards.

Best Credit Cards With No Annual Fee in the Philippines

The following are the best credit cards in the Philippines with no annual fee. Yes, that means you won’t need to pay annual fees ever and for life. Having a bank account with the card issuer is a helpful and convenient way to get these credit cards.

PNB Ze-Lo Mastercard

PNB Ze-Lo Mastercard is the only no-annual-fee credit card in the country with the lowest finance charge. From the name itself, Ze-Lo means zero annual fee and low-interest rate. This is a must-have card for all wise spenders because cardholders can save a lot of money using this card.

- Annual fee: Zero forever

- Interest Rate: 2.5% (lowest among all credit cards)

- Minimum income requirement: ₱120,000 per year

- Best features and benefits:

- Zero annual fee

- Zero late payment fees

- Zero over-limit fees

- Lower finance charge of 2.5%

- Lower minimum amount due

- Free annual fee for all supplementary credit cards

- Global acceptance

- Contactless payment

How to apply for a PNB Ze-Lo Mastercard?

Send your email at dungoLMP@pnb.com.ph and apply! You must be 21-65 years with an annual income of ₱120,000. Employed, self-employed, and foreigners can apply online through the Philippine National Bank website. Save a PDF file of your government-issued ID, supporting documents, and a selfie holding your valid ID.

Security Bank Wave Mastercard

Perhaps your next credit card will be Security Bank’s Wave Mastercard because it has all the amazing perks and benefits of a free credit card. We adore the unique design of this card, too. I don’t know about you, but it brings a balance flow of money for me.

- Annual fee: Zero forever

- Interest Rate: 3%

- Minimum income requirement: ₱480,000 per year (for first-time cardholders), ₱360,000 per year (for those with existing credit cards)

- Best features and benefits:

- 1% cashback on online spend (a minimum of ₱1,000 spend is required to earn)

- Lower interest rate of 3%

- Worldwide acceptance

- Access to local airport lounges at preferential rate

How to apply for a Security Bank Wave Mastercard?

New clients with existing credit cards must have a minimum gross annual income of ₱360,000. First-time cardholders must have at least ₱480,000 gross yearly income. Valid IDs and proof of income are also required. Submit your application online at Security Bank’s website.

Metrobank M Free Mastercard

Metrobank M Free Mastercard is another leading free credit card in the Philippines without an annual fee. It’s accepted nationwide and worldwide. Grab discounts and great deals, and share your benefits with your supplementary members.

- Annual fee: Zero forever

- Interest Rate: 3%

- Minimum income requirement: ₱867,000 per year

- Best features and benefits:

- 0% installment program

- Chip card for added protection

- Secure online shopping

- Perpetually waived annual fee for both principal and supplementary members

How to apply for a Metrobank M Free Mastercard?

You can apply via the official Facebook Messenger of @MiaOfMetrobank. The virtual assistant of Metrobank. Likewise, you can also visit your Metrobank branch and fill out an application form. Attach your valid IDs and proof of income.

Chinabank Freedom Mastercard

Chinabank Freedom Mastercard is one of the newly launched credit cards in the Philippines without annual fees. Do you know that it also rewards (1 ) Rewards Point for every ₱30 qualified spend? Another secret we like to share using this card is the zero-installment monthly payments for eligible products and services.

- Annual fee: Zero forever

- Interest Rate: 3%

- Minimum income requirement: ₱250,000 per year

- Best features and benefits:

- Worldwide acceptance

- Security Features

- Virtual Card

- 0% Installment Options

- Earn One (1) Rewards Point for every PHP 30 qualified spend

How to apply for a Chinabank Freedom Mastercard?

Twenty-one years old and older new and existing cardholders, can fill out the application form which can be downloaded online. Submit the application at Chinabank. The minimum income requirement for applicants without a credit card is ₱250,000. You’ll need a valid government-issued ID, e-mail address, mobile, and landline number.

UnionBank U Credit Card

Unionbank has introduced a no-annual fees for life credit card with added excellent features like no late fees, no over-limit fees, and 10% interest back. Yup, it allows the cardholder to receive 10% rebate when you pay at least your minimum amount due on or before the due date.

- Annual fee: Zero forever

- Interest Rate: 3%

- Minimum income requirement: ₱180,000 per year

- Best features and benefits:

- Earn 10% interest back on your total cash and retail interest when you pay at least your minimum amount due on or before the due date

- Enhanced shopping security

- No over-limit fees

- No late fees

- Available for Visa Platinum and Platinum Mastercard

How to apply for a UnionBank U Credit Card?

You can apply online for a free UnionBank U credit card by. Select if you want a Visa Platinum or Platinum Mastercard. Visit the official website of UnionBank to start your application.

PSBank Credit Mastercard

Pay no annual fees with PSBank Credit Mastercard. It’s enhanced with embedded chip technology that ensures secure transactions. This credit card also offers balance transfer, cash advance, 0% installment scheme.

- Annual fee: Zero forever

- Interest Rate: 3%

- Minimum income requirement: ₱350,000 per year

- Best features and benefits:

- Worldwide acceptance

- 24-hour customer service

- 0% installment program

- Paperless statements (MSOA)

- ‘M TXT facility (for available credit limit, statement balance, and outstanding balance inquiries)

How to apply for a PS Bank Credit Mastercard?

Call their customer service hotline or visit any PSBank branch near your residence. Fill out a credit card application form and attach a copy of your valid ID and proof of income (Payslip, ITR, DTI, or SEC business registration if self-employed). Foreigners can also apply and submit a copy of their visa and Alien Certificate of Registration (ACR).

HSBC Premier Mastercard

The HSBC Premier Mastercard is exclusive for HSBC Premier bank account holders only, but interested clients can apply if they meet the eligibility requirement. Similarly, this card also gives exclusive privileges for travel, dining, shopping, and leisure here and around the world.

- Annual fee: Zero forever

- Interest Rate: 3%

- Minimum income requirement: ₱300,000 monthly deposit into your HSBC account

- Best features and benefits:

- Earn 1 mile for as low as ₱25 spend

- Membership to more than 1,300 airport lounges worldwide

- Free Purchase Protect insurance coverage

- 6% rebate on your first Caltex fuel purchase or 3% rebate all year round

- Worldwide safety and security

- Contactless card

- 0% interest installment plan

- Cash installment plan

- Card balance transfer

- Card balance conversion plan

How to apply for an HSBC Premier Mastercard?

Only HSBC Premier clients can get the HSBC Premier Mastercard. To qualify for HSBC Premier status, you must maintain a TRB (Total Relationship Balance) of ₱3 million or its foreign currency equivalent. You also have the option to deposit and maintain your monthly salary of at least ₱300,000 or its foreign currency equivalent. Lastly, you can have the card if you have an approved home loan of at least PHP 6 million.

Best Credit Cards for Beginners and First-Timers in the Philippines

The best credit cards in the Philippines for starters, beginners, or first-time users are next on our compilation. If you are looking for credit cards that are easy to open, you may apply for these cards. In addition, they are also known for fast approval and lower minimum requirements.

If you are a beginner in using a credit card, we recommend the cards listed below because of their outstanding features, wonderful benefits, and low annual fees. Above all, these cards are perfect for both first-timers and experienced users.

PNB Visa Classic Card

PNB Visa Classic card is the most affordable credit card for beginners in the Philippines because it has the lowest annual fee compared to classic credit cards in the country. You’ll also get most of the awesome features of having a visa card. Plus free annual fee for life for all your supplementary members.

- Annual fee: ₱300

- Interest Rate: 3%

- Minimum income requirement: ₱120,000 per year

- Best features:

- 1% rebate on your revolved interest

- Low annual fee, just ₱300

- Free annual fee for life for all your Supplementary credit cards

- Upgraded security with Card Protect

- Free Purchase Protection Insurance up to ₱250,000

- Free travel insurance up to 1 million

- Fraud transaction insurance up to ₱250,000 for only ₱120 per year

- Pay your bills in Peso even for overseas transactions

- Global acceptance

- Contactless payment

- Zero % Installment plan

- Cash advance up to 30% of your credit limit through PNB ATMs and BancNet

How to apply for a PNB Visa Classic Card?

Apply online, call the PNB hotline, visit any PNB branch near you, or email dungoLMP@pnb.com.ph. The annual income requirement is ₱120,000. Applicants must present copies of their valid IDs and proof of financial status.

Blue from American Express

Blue from American Express is the first transparent credit card in the Philippines. Ranked among the top, it gives prestige and incredible perks even though it is a beginner card in line with the AMEX credit cards available in the Philippines. You can get this card in BDO or read my post: How I Got My First AMEX?

- Annual fee: ₱150 per month

- Interest Rate: 3%

- Minimum income requirement: ₱15,000 per month or ₱180,000 per year

- Best features:

- A unique selection of year-round savings and offers in dining, shopping, and accommodations worldwide

- Earn 1 Membership Rewards point for every P45 spend

- Frequent Flyer Program enrollment

- 300,000 travel accident protection insurance

- Cash advance up to 30% of your credit limit

- Buy Now, Pay Later Program

- 0% interest installment

- 24-hour American Express customer service

- Annual fee waiver once you hit ₱15,000 monthly spend

How to apply for a Blue American Express?

You must be at least 21 years old, a Filipino or Philippine resident, and have a minimum annual income of ₱180,000. Submit the requirements. For instance, submit proof of income, valid ID, and existing credit card statement if any) at any BDO branch or AMEX online card application.

PNB-PAL Mabuhay Miles NOW Mastercard

PNB-PAL Mabuhay Miles NOW Mastercard is one of the best credit cards in the Philippines in 2026. I can’t leave the house without it because it tops most factors when looking for the perfect card – travel incentives, exclusive perks, lower fees, and generous credit limit.

The annual fee is also free for the first three years of owning this card.

- Annual fee: free for the first 3 years; ₱1,000 per year

- Interest Rate: 3%

- Minimum income requirement: ₱120,000 per year

- Best features:

- Free 1,000 Mabuhay welcome gift

- Earn rewards points and redeem them for Mabuhay Miles at 1 point = 1 mile

- Exclusive year-round PAL online discount

- Free Purchase Protect Insurance up to ₱250,000

- Travel Insurance up to ₱1 million

- Free annual fee for life for all supplementary cards

- Global acceptance

- Contactless payment

- Cash advance up to 30% of a credit limit

- Zero % interest installment plans

How to apply for a PNB-PAL Mabuhay Miles NOW Mastercard?

Employed, self-employed, and foreign nationals aged 21 to 65 and earning an annual income of at least ₱120,000 can apply online or at any PNB branch nationwide. Likewise, you may send a message to dungoLMP@pnb.com.ph to apply.

RCBC Flex Visa Card

RCBC Flex Visa is among the best balance transfer credit cards in the Philippines. It’s famous for its flexibility; hence it refers to the name Flex. You’ll control your earned points redemption and manage your budget better.

- Annual fee: free for the first year; ₱1,500 per year

- Interest Rate: 3%

- Minimum income requirement: ₱250,000 per year

- Best features:

- 2x Rewards Points in 2 preferred categories – dining, clothing, travel, or transportation

- Switch preferred categories every billing cycle

- AirMiles Program enrollment

- Free travel insurance when you charge all your international travel expenses to your card

- Balance conversion and balance transfer

- EMV chip technology

How to apply for an RCBC Flex Visa Card?

You must be 18-65 years old. Visit RCBC’s official website and choose Flex Visa. Accomplish the online application form and attach your documents. Verify yourself digitally. RCBC will contact you for verification and delivery of your credit card.

BPI Edge Mastercard

If you see a cutting-edge colorful credit card, it must be a BPI Edge Mastercard. Both newbies and experienced cardholders like the benefits of this vibrant card, such as one of the lowest Forex conversion rates of just 1.85%.

- Annual fee: free for the first year; ₱110 per month

- Interest Rate: 3%

- Minimum income requirement: ₱180,000 per year

- Best features:

- Earn 1 rewards point for every ₱50 spend

- Low Forex rates 1.85%

- Cash advance up to 30% of your credit limit

- Year-round special deals

- Buy Now, Pay Later installment

How to apply for a BPI Edge Mastercard?

You can apply online or visit a BPI branch near your residence. Indicate if you’re a BPI client or not. Choose the card from the given selection. Complete the application form. Prepare your valid ID and proof of income. BPI will contact you for verification if you’re a new client.

Security Bank Fast Track Secured Credit Card

If you’re in a rush to get a credit card, then get the Fast Track Secured Credit Card from Security Bank. SB’s Fast Track program allows clients to open a savings or time deposit account bundled with a credit card. You’ll receive your credit card quickly in 3 banking days upon receipt of the documents.

- Annual fee: free for the first year; ₱150 per month

- Interest Rate: 3%

- Minimum income requirement: ₱25,000 for a savings account and ₱100,000 for time deposits

- Best features:

- Credit limit that is 80% of your savings or time deposit account

- Earn rewards and rebates for every transaction

- Build up your credit history and credit score

- Waive annual fee for the first year

How to apply for a Security Bank Fast Track Secured Credit Card?

New and existing clients can open a savings or time deposit account at Security bank through the Fast Track program. It may require a personal appearance since opening a bank account in the Philippines must be done face-to-face.

BDO Visa Classic Card

BDO Visa Classic card is among the most valuable credit cards for beginners in the Philippines. It doesn’t charge a membership fee for the first year and provides Visa Exclusive year-round perks and discounts.

- Annual fee: free for the first year; ₱150 per month

- Interest Rate: 3%

- Minimum income requirement: ₱180,000 per year or ₱15,000 per month

- Best features:

- Buy Now, Pay Later deals

- 0% installment scheme

- BDO discounts and freebies

- Visa exclusive promotions

- Secure online shopping

- Worldwide acceptance

How to apply for a BDO Visa Classic Card?

Principal members must be at least 21 to 60 years old, while supplementary members must be at least 13 years old. The minimum fixed monthly income requirement is ₱15,000. Applicant must have at least one landline phone.

Best Credit Cards in the Philippines for Travel

These are the best credit cards for travelers, globetrotters, and jet-setters accepted abroad and worldwide. Similarly, these cards have astonishing low point-mile system conversion, airport lounge access, free travel insurance coverage, premium concierge assistance, priority check-in, and, most importantly, exclusive travel deals.

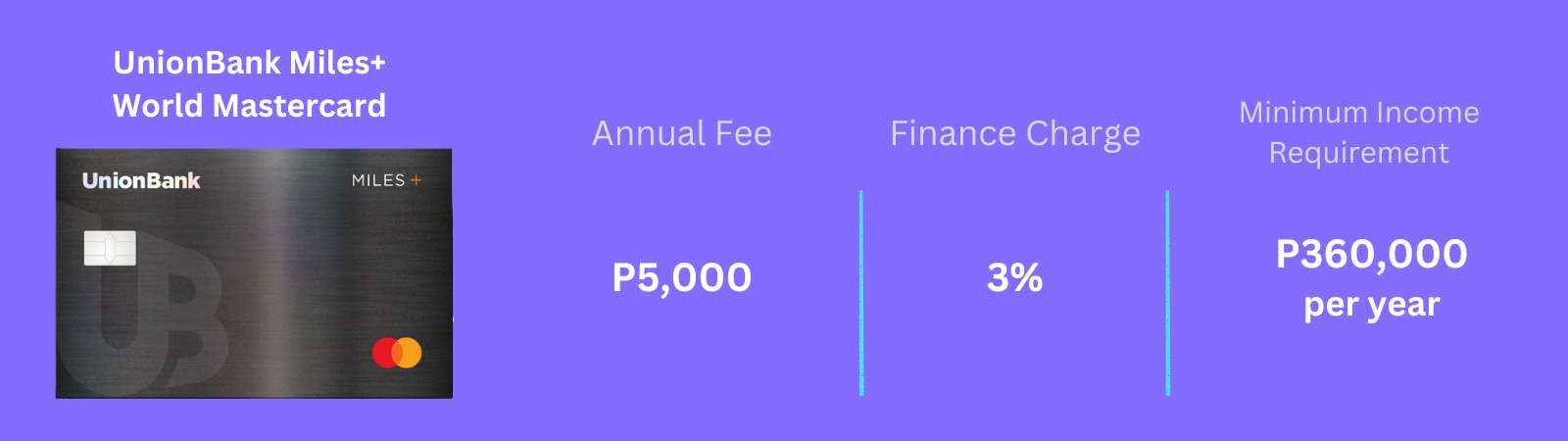

UnionBank Miles+ World Mastercard

Like to redeem airline miles and cashback? Then get the Mile+ World Mastercard from UnionBank. It lets us earn 1 never-expiring UB mile for every ₱30 spend. You can redeem your points as airline miles, cashback or fee waivers. Cardholders also get VIP lounge access at selected lounges in the Philippines and abroad.

- Annual fee: ₱5,000 per year

- Interest Rate: 3%

- Minimum income requirement: ₱360,000 per year

- Travel benefits:

- Free DragonPass Membership and 2 complimentary visits per year

- VIP Lounge Access here and abroad

- Travel insurance up to ₱1 million coverage when you charge your airline tickets to your UnionBank Miles+ World Mastercard

- Global acceptance

- Flexible monthly payments

- Earn 1 UB mile for every ₱30 spend

- Complimentary 30-day purchase protection

How to apply for UnionBank Miles+ World Mastercard?

UnionBank online is very accessible and fast to process your application. Visit their website, select Miles+ World Mastercard, and indicate if you have already owned a credit card in the last six months. Upload your supporting documents and wait for the application result.

PNB-PAL Mabuhay Miles Platinum Mastercard

If you like traveling with Philippine Airlines, getting a PNB-PAL Mabuhay Miles Platinum Mastercard would be an excellent choice. You’ll receive 2,000 Mabuhay Miles as a welcome gift, plus additional 10,000 Mabuhay Miles when you use your credit card at Philippine Airlines.

- Annual fee: ₱3,000 per year

- Interest Rate: 3%

- Minimum income requirement: ₱1.2 million per year

- Travel benefits:

- ₱48 = 1 rewards point = 1 Mabuhay Mile

- Receive 2,000 Mabuhay Miles when you activate your card

- Get additional 10,000 Mabuhay Miles when you spend at PAL

- Exclusive year-round PAL flight 5% discounts

- Worldwide acceptance

- Contactless payment

- Cash advance up to 30% of your credit limit

- 0% interest installment up to 24 months

- Up to ₱3 million travel insurance coverage

- Get cash advance up to 30% of your credit limit from ATMs

How to apply for a PNB-PAL Mabuhay Miles Platinum Mastercard?

You have three options to apply: through PNB online platform, the PNB hotline, and a PNB branch. Principal cardholders must be earning at least ₱1.2 million annually. PNB might contact you and offer you a platinum card if you maintain a large bank account at the Philippine National Bank.

Metrobank Travel Signature Visa

Use your Metrobank Travel Signature Visa card for airlines, hotel accommodations, and foreign currency transactions and earn miles faster. This card also rewards unlimited lounge access in the Philippines for eligible locations and program coverage.

- Annual fee: ₱5,500 per year (first year is free)

- Interest Rate: 3%

- Minimum income requirement: ₱700,000 per year

- Travel benefits:

- Earn 1 mile for every ₱30 spend on all purchases

- Free airport lounges access at PAGSS and Plaza Premium lounge in the Philippines

- Zero annual fee for your first supplementary card member

- 1.68% low FOREX transaction fee

- 24/7 Visa Global Worldwide Assistance

- 24-hour Worldwide Visa Concierge

- 0% installment program

How to apply for a Metrobank Travel Signature Visa?

Visit the Metrobank website and select the credit card you want. Indicate that you have a Metrobank credit card, an MBT deposit account, or you’re not an existing Metrobank client. Fill out your personal and employment details. Upload your documents. Metrobank will keep in touch regarding the delivery of your card.

HSBC Live+ Credit Card

The HSBC Live+ Credit Card lets you earn 8% cashback on dining transactions at restaurants here and across Asia, 5% on shopping, movies, and 2% on selected categories including fast food. It’s suitable both for travel and cashback fanatics. Besides that, you get ₱10 million free travel insurance coverage when you used your card for travel fare.

- Annual fee: ₱5,000 per year

- Interest Rate: 3%

- Minimum income requirement: ₱400,000 per year

- Travel benefits:

- Exclusive privileges from HSBC Visa offers

- Free travel insurance coverage up to ₱10 million

- 6% rebate on your first Caltex transaction

- 3% rebate on Caltex fuel purchases

- Cash advance here and abroad

- 8% cashback on cashback on dining transactions (2% on fast food)

- 5% cashback on shopping and entertainment

- 0.20% cashback on all other transactions

How to apply for an HSBC Platinum Visa card?

You must have an existing credit card issued in the Philippines owned in the last 6 months and a minimum annual income of ₱400,000. Apply online by typing your personal and employment details. Type in the SMS-OTP and verify your identity through face verification (selfie and video), then upload your valid IDs.

BDO Diners Club Premiere

BDO Diners Club Premiere is among the best credit cards for travel in the Philippines. It provides free global Wi-Fi- access in over 200 countries worldwide. Cardholders can also earn 1 travel mile for every ₱30 spend and double travel miles when enrolled in Dual Currency feature, earn two (2) Travel Miles for every $1 spend.

- Annual fee: ₱4,500 per year

- Interest Rate: 3%

- Minimum income requirement: ₱77,000 gross fixed monthly income

- Travel benefits:

- Earn 1 travel mile for every ₱30 spend

- Diners Club airport lounge access

- 2 free airport lounge access per year

- Free travel insurance up to ₱20 million coverage

- World-class Diners Club privileges

- Buy Now, Pay Later deals

- 0% interest installment plans

How to apply for a BDO Diners Club Premiere credit card?

BDO Diners Clube Premiere requires a minimum gross fixed monthly income of ₱77,000 for interested clients who want to own the card. Likewise, foreigners are welcome to apply. Apply online or visit any BDO branch, bring your valid IDs and supporting documents to prove your financial capacity or income.

Security Bank World Mastercard

Security Bank World Mastercard lets you explore the world and earn special benefits like worldwide airport lounge access, free travel insurance, and amazing deals. Earn 3 (non-expiring) points for every ₱20 spend on all purchases.

- Annual fee: ₱5,000 per year

- Interest Rate: 3%

- Minimum income requirement: ₱3 million per year

- Travel benefits:

- 6 complimentary airport lounge access for cardholders and guests (1,300 lounge access in over 500 airports worldwide)

- Unlimited local lounge access

- Free travel insurance of up to USD100K with COVID-19 coverage for you and your family members

- Non-expiring rewards points

- Free annual fee for life for your first supplementary card

- Exclusive Mastercard promos

How to apply for a Security Bank World Mastercard?

You must earn an annual income of at least ₱3 million and show proof of your income when you apply for the card. Present one photo-bearing government-issued ID. You must have a landline number and email address.

UnionBank Cebu Pacific Gold Credit Card

If you’re a frequent traveler and always fly with Cebu Pacific, the Cebu Pacific Gold credit card may be suitable for you. You can earn 1 Go Rewards point for every ₱100 spent in Cebu Pacific and 1 Go Rewards point for every ₱200 spent on other transactions. Points are automatically credited to your Go Rewards account.

- Annual fee: ₱3,000 per year

- Interest Rate: 3%

- Minimum income requirement: ₱360,000 per year

- Travel benefits:

- Earn 1 Go Rewards point for every ₱200 spent

- Earn 1 Go Rewards point for every ₱100 spent in Cebu Pacific

- Exclusive access to Go Rewards and Cebu Pacific sale events

- Automatic points crediting

- Free 4kg baggage allowance

- 24/7 banking

- Longer credit terms

- Travel discounts

How to apply for a UnionBank Cebu Pacific Gold Credit Card?

Prepare some photos of your valid IDs and proof of income. Choose a credit card from UnionBank’s website. Complete your application form and upload your documents. Receive your credit card and activate it.

RCBC AirAsia Credit Card

Get this distinctive red RCBC AirAsia credit card and indulge yourself with free flights from AirAsia when you exchange points. You’ll also be entitled to priority check-in, boarding, and Xpress baggage when using this co-branded credit card.

- Annual fee: ₱300 per month (first year is free)

- Interest Rate: 3%

- Minimum income requirement: ₱250,000 per year

- Travel benefits:

- Welcome gift of 10,000 AirAsia points when you spend at least ₱20,000 within 60 days when your card was issued

- Get an extra 200 AirAsia Monthly Bonus Points for an accumulated retail spend anywhere of at least ₱30,000 each month

- Earn AirAsia points for every ₱22 spend

- Instant upgrade of AirAsia membership to Platinum and enjoy priority check-in, priority boarding,, and Xpress Baggage for you and your travel companion

- 0% installment on purchases abroad

- Lower Forex fee of 2.50% on international purchases, both in-store and online

How to apply for an AirAsia Credit Card?

Apply online at RCBC by selecting your card and completing the credit card application form with your details. Upload a copy of your valid ID and proof of income. You will receive a message from RCBC for the delivery of your card.

Best Credit Cards in the Philippines for Rewards and Cashback

If you want to apply for a credit card that lets you earn cashbacks for every spend, these selections may be suitable for you. Majority of commercial banks in the Philippines offer these cards.

BDO ShopMore Mastercard

- Annual fee: ₱150 per month (first year is free)

- Interest Rate: 3%

- Minimum income requirement: ₱15,000 gross fixed monthly income

- Best Features:

- Get 2x Peso Points from everyday everywhere purchases

- Convert your points to Cash Credit, or transfer to SMAC or BDO Rewards points

- Buy Now, Pay Later deals

- 0% interest installment plans

- BDO exclusive freebies and discounts

Security Bank Complete Cashback Platinum Mastercard

- Annual fee: ₱3,000 per year (first year is free)

- Interest Rate: 3%

- Minimum income requirement: ₱780,000 per year

- Best Features:

- 5% cashback on groceries

- 4% cashback on gas

- 3% cashback on utilities

- 2% cashback on dining

- 1% cashback on shopping

- Up to ₱13,200 year-round cashback

- 5-tiered rebates

- Exclusive Mastercard promos

- Worldwide acceptance

- Unlimited access to local airport lounges

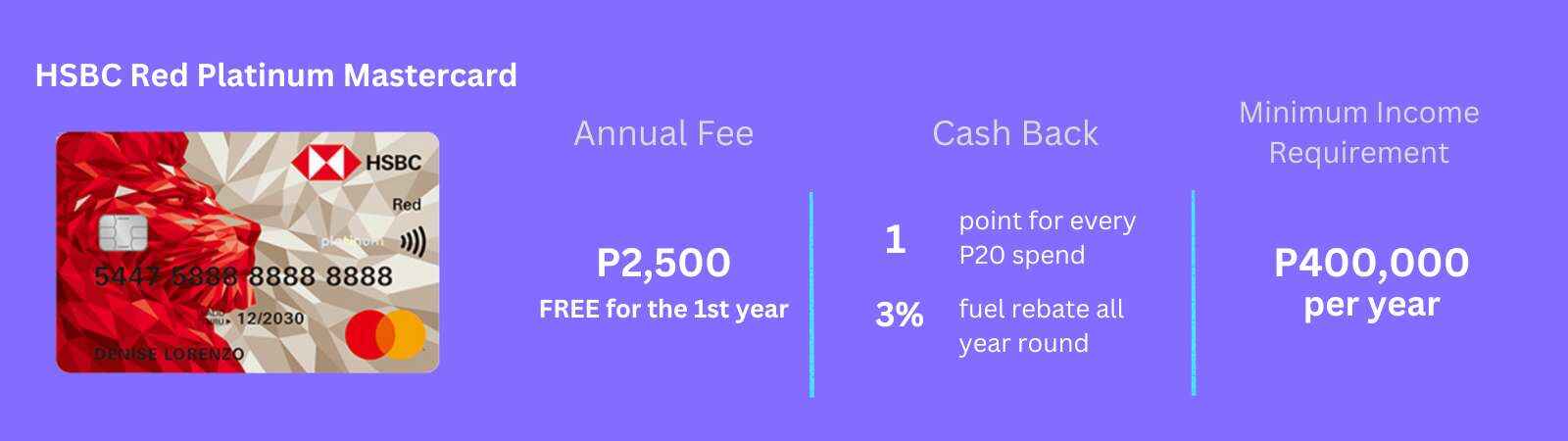

HSBC Red Platinum Mastercard

- Annual fee: ₱2,500 per year (first year is free)

- Interest Rate: 3%

- Minimum income requirement: ₱400,000 per year

- Best Features:

- Earn 1 bonus point for every ₱20 spent

- 0% interest installment deals up to 36 months

- 6% rebate on your first Caltex fuel purchase plus 3% rebate all year round

- Cash advance

- HSBC exclusive travel deals worldwide

BPI Amore Cashback Card

- Annual fee: ₱2,050 per year

- Interest Rate: 3%

- Minimum income requirement: ₱15,000 fixed monthly income

- Best Features:

- 4% cashback on supermarket purchases

- 1% cashback on health and personal care essentials and utilities

- 0.30% cashback on all other local purchases

- 0% Installment Plans and Buy Now Pay Later deals

- 1.85% low Forex rates

Metrobank Cashback Visa

- Annual fee: ₱3,500 per year (first year is free)

- Interest Rate: 3%

- Minimum income requirement: ₱180,000 per year

- Best Features:

- 5% rebate on groceries, Telco bills, school, and bookstore spend

- 0.20% rebate on all other purchases

- Exclusive Metrobank promos and discounts

Eastwest Everyday Titanium Mastercard

- Annual fee: ₱2,800 per year

- Interest Rate: 3%

- Minimum income requirement: ₱480,000 per year

- Best Features:

- 5% cash rebate on supermarket, drugstore, and gas purchases

- Global acceptance

- Special perks and privileges year-round

- Easy cash advance access facility

Most Expensive Credit Cards in the Philippines

BDO World Elite

BDO World Elite is the most expensive credit card in the Philippines because it has the highest annual fee, $1,500. Anyone cannot just apply for this card because it’s “by invitation” only. That means only elite and high net-worth clients are granted that ownership advantage. The World Elite bestows the highest credit card limit in the Philippines.

- Annual fee: $1,500 for the principal card, $750 for the supplementary card

- Interest Rate: 3%

- Minimum income requirement: “by invitation only”

- Best features and benefits:

- World Elite Mastercard Concierge

- Private Jet Program

- Chauffeured Car Servives

- Luxury Hotels and Resorts with complimentary daily breakfast

- Global Dining Program

- Cruise Program

- Comprehensive travel accident and medical insurance up to $2 million

- Up to $3,000 Purchase Protection Insurance

PNB-PAL Mabuhay Miles World Elite Mastercard

PNB-PAL Mabuhay Miles World Elite Mastercard is among the most prestigious and rewarding credit cards in the Philippines. Its low point miles conversion is a fascinating advantage of having it (1 reward point = 1 Mabuhay mile). This powerful card will reward you with free flights and non-flight treats.

That’s not all, as an elite cardholder, you’ll get a complimentary upgrade to Premier Elite Mabuhay Miles membership and exclusive year-round PAL online discount and 5,000 rewards points on your every birthday.

- Annual fee: ₱50,000

- Interest Rate: 3%

- Minimum income requirement: “by invitation only”

- Best features and benefits:

- 10,000 Mabuhay Miles Welcome Gift when you activate your card

- Additional free 30,000 Mabuhay Miles when you reach ₱150,000 worth of transactions at PAL within 3 months from card issuance

- Automatic upgrade to Premier Elite Mabuhay Miles membership

- Birthday gift of 5,000 rewards points every year

- Year-round exclusive PAL online discount

- 10 free shared lounge access per year via Mastercard Travel Pass

- Mastercard Travel and Lifestyle Services

- Travel and medical insurance benefits

- Purchase protection up to $3,000

UnionBank Reserve Visa Infinite Credit Card

UnionBank Reserve Visa Infinite card is a top-notch credit card from UnionBank. It boasts exceptional benefits all over the world. This credit card is reserved only for VIP clients as it’s an invitation-only card. It requires an annual fee of ₱12,000 for the principal cardholder (₱6,000 for the supplementary cardholder).

- Annual fee: ₱12,000

- Interest Rate: 3%

- Minimum income requirement: “by invitation only”

- Best features and benefits:

- 5x Rewards Points on shopping, dining, and overseas spend

- Never-expiring points

- 24/7 Global Concierge Service

- Global lounge access through Priority Pass with 4 complimentary guest passes each year

- Elite Airport Service (unlimited access to over 1,500 airport lounges worldwide through Priority Pass)

- Complimentary fourth night stay at any hotel booked through Lifestyle Concierge up to 2 times a year

- Up to ₱20 million insurance coverage when you used your card for travel tickets

- 30-Day Purchase Protection

Metrobank World Mastercard

Metrobank World Mastercard is one of the best credit cards for Metrobank clients. It offers a credit limit that almost sets no borders giving you the benefit of additional buying power anytime you need it. It’s loaded with premium perks such as automatic purchase protection and traveler rewards.

- Annual fee: ₱6,000 (waived on the first year), no annual fee with minimum annual spend of ₱800,000 or monthly spend of ₱67,000

- Interest Rate: 3%

- Minimum income requirement: ₱1.5 million per year

- Best features and benefits:

- 1 air mile per ₱17 foreign currency spend online and hotel stays

- 1 air mile per ₱50 spend on other categories

- 1.85% low Forex fee

- 50% off on luxury deals here and abroad

- Unlimited local lounge access

- Complimentary 2 global lounge passes per year provided by Mastercard Travel Pass

- 24-hour VIP customer service

- Get 3 rewards points for every ₱20 spend on Forex, online and hotel stays

- Earn 1 point for every ₱20 spend on all other purchases

- Perpetually waived annual fee for your first two supplementary cards

RCBC Visa Infinite

RCBC Visa Infinite is the first and only RCBC credit card with a metal core. You can get this for free for the first year, but you have to meet the minimum income requirement to own this metallic card. It is packed with wonderful benefits.

- Annual fee: ₱6,000 (the first year is free)

- Interest Rate: 3%

- Minimum income requirement: ₱2 million per year

- Best features and benefits:

- 100,000 Welcome Rewards Points

- Earn Rewards points for every ₱30 spend

- Earn 3x points on local online purchases

- Earn 5x points on overseas in-store and online transactions

- Complimentary Priority Pass membership

- Free unlimited access to the PAGSS Lounge in Terminals 1 including 1 guest

- E-Commerce Purchase Protection up to $1,000

- Free travel insurance coverage up to a maximum of 15 days per trip

- 24/7 Visa Concierge Service

BPI Visa Signature Card

BPI Visa Signature is an exquisite card that offers exclusive privileges curated explicitly for your lifestyle. Avail 50% off signature deals on dining, hotels, resorts, fitness studios, and wellness centers. Make use of its terrific rewards and discounts all year round.

- Annual fee: ₱5,500 (the first year is free)

- Interest Rate: 3%

- Minimum income requirement: ₱100,000 fixed monthly income or ₱1.2 million per year

- Best features and benefits:

- Visa Signature exclusive deals

- 24/7 Worldwide Concierge

- Annual fee is free for life for your 1st supplementary card

- Complimentary airport lounge access for you and 1 guest at PAGSS International Lounges at NAIA 1 and Marhaba International lounge at NAIA 3

- 1.85% low Forex conversion rates

- Ayala Rewards Circle

- Earn 2 BPI Rewards Points for every ₱20 spend

- Free travel insurance coverage up to ₱20 million

- Convert your credit limit to cash and pay it in installment up to 36 months

RCBC Black Card Platinum

RCBC Black Card Platinum is one of the best black cards in the Philippines. The Black Card is a superior world card that signifies elite status, power, and elegance.

The RCBC Black Card Platinum credit card has all the fantastic benefits you could ask for. The annual fee for this black card is ₱3,600 per year. I think that is the cheapest annual fee rate for a black card in the country right now.

It’s available in peso and dollar variants. Considering the fantastic perks you’ll be entitled to owning this black card, it’s a must-have black card for millionaires.

- Annual fee: ₱3,600 (the first year is free)

- Interest Rate: 3%

- Minimum income requirement: ₱1 million per year

- Best features and benefits:

- Flexible and non-expiring rewards points

- Free travel insurance up to ₱1 million and purchase protection

- Airport access to PAGSS Lounge in Terminal 1

- Worldwide coverage up to $200 for international and local purchases via Mastecard eCommerce Purchase Protection

- Zero annual fee for supplementary cards (maximum of 5)

- Worldwide acceptance

- 0% installment on purchases abroad

Other Banking Related Articles:

Best Banks in the Philippines in 2026

Best Frequent Flyers Programs in the Philippines

Disclaimer: This article is for informational purposes only and is not intended as financial advice. The details provided about credit cards, including terms, fees, and benefits, are subject to change at any time without prior notice. We recommend verifying the latest information directly with the credit card issuer or financial institution before making any decisions.