The following are the best UITF in the Philippines in 2024. The data includes a complete list of best-performing UITF for equity funds, balanced funds, bond funds, and money market funds.

If you have Unit Investment Trust Funds (UITFs), you must be updated with the periodic ranking of UITF to know how your investments performed in the last months, quarters, or periods compared to other UITF.

What is UITF?

UITF means Unit Investment Trust Fund. UITFs are pooled investments of different funds, companies, corporations, invested and diversified to other investments, stocks, bonds, securities, money market, and other funds managed by fund experts and investment firms.

UITFs in the Philippines are regulated by the BSP (Bangko Sentral ng Pilipinas). That means you can open or start your UITF investments in your local bank nationwide.

Are UITFs the same as Mutual Funds? To answer that, please read “Mutual Funds vs. UITFs – Similarities and Differences: Advantages and Disadvantages.”

Benefits of Investing in UITF in the Philippines

- Diversification

- Affordability

- Expert Fund Management

- Liquidity

- Transparency

- Regulated by the Central Bank

Why should You Invest in UITF?

This question is always asked so many times on the threads and forums, so it will be great to share the answers in this post.

Suppose you have extra bulges of money and want to invest them to earn some cash (higher than Time Deposits), and you are aware of the risks involved. You phone your banker and ask about any investment product that could give you that. In that case, they will surely give UITF as one of the options.

Unlike Mutual Funds, UITFs are now easy to open. The Philippine National Bank (PNB) started the UITF Online account opening in the Trust banking empire.

Eventually, other commercial banks like BDO, BPI, Metrobank, and other leading banks offer UITF through online banking. We can now open these investments online and enjoy paperless transactions.

As long as you have an existing bank account and available funds on your online banking account, you can open or enroll your UITF and redeem or withdraw your funds any banking day.

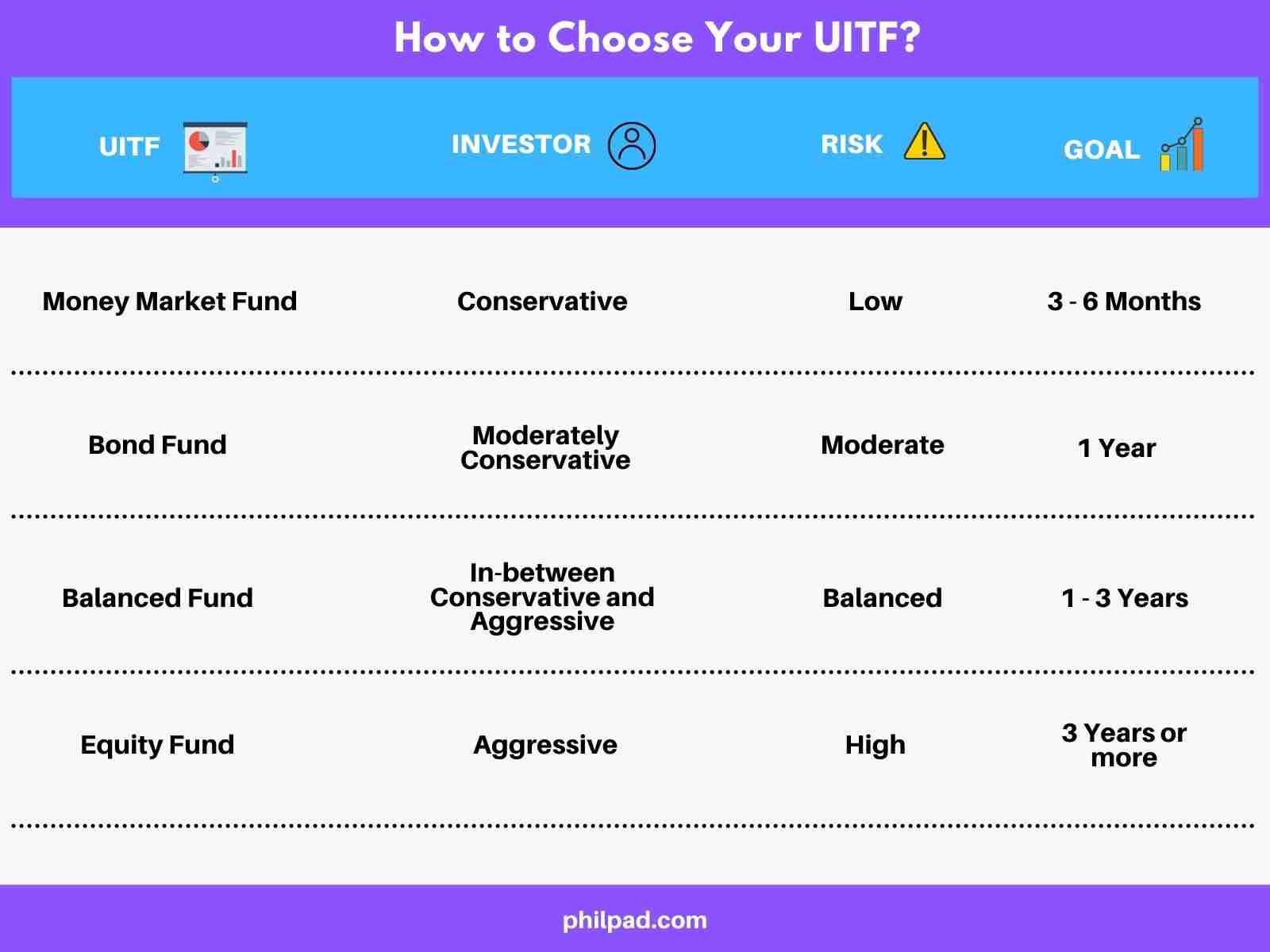

How to Choose the Best UITF that is Right for You?

To choose the best UITF suitable for an investor like you, you must know your investment goal and risk appetite. Decide by knowing your main objective. Why do you invest? Do you want to grow your capital for a long term, or do you want to invest for a year or two?

Likewise, you must know how much risk you can tolerate for your investment. How comfortable are you about market uncertainties, economic slowdown, and possible losses with your investment?

Best UITF in the Philippines in 2024

Top-performing UITF in the Philippines. Data will be updated every quarter. We gathered the list based on YTD (Year to Date) Return.

The financial market’s performance was not impressive in the previous year because the global market declined due to Fed hikes and inflation. Fear of recession also contributed to the fall of investments. But the economy started to recover with mass vaccination and re-opening of many businesses.

Financial experts and investors are still confident about the future growth of the economy, which will eventually lift other businesses and investments in the country.

Top 15 Best Performing UITF Equity Funds in the Philippines:

Performance YTD (Year to Date) as of July 13, 2024.

- Manulife Asia Best Select Equity Fund (Unhedged Class I) – 20.34%

- Manulife Asia Best Select Equity Fund (Unhedged Class A) – 19.36%

- Metro High Dividend Yield Unit Paying Fund – 15.97%

- AB Capital Equity Fund – 14.70%

- ATRAM Philippine Sustainable Development and Growth Fund (Y Unit Class) – 12.94%

- ATRAM Philippine Sustainable Development and Growth Fund (A Unit Class) – 12.49%

- RCBC R25 Dividend Equity Fund – 9.55%

- BPI Philippine High Dividend Equity Fund – 9.35%

- Chinabank High Dividend Equity Fund – 7.95%

- Landbank High Dividend Equity Fund – 6.74%

- AUB Equity Investment Trust Fund – 6.21%

- AIA Peso Equity Fund – 6.18%

- Manulife Equity Wealth Fund (Class I) – 4.61%

- SB Peso Equity Fund – 4.59%

- PNB High Dividend Fund – 4.55%

Top 10 Best Performing UITF Balanced Funds in the Philippines:

Performance YTD (Year to Date) as of July 13, 2024.

- Manulife Global Multi-Asset Diversified Income Feeder Fund (PHP Unhedged Class I) – 10.70%

- Manulife Global Multi-Asset Diversified Income Feeder Fund (PHP Unhedged Class A) – 9.35%

- Manulife Global Preferred Income Feeder Fund (PHP Unhedged Class I) – 8.39%

- AB Capital Balanced Fund – 8.07%

- Manulife Global Preferred Income Feeder Fund (PHP Unhedged Class A) – 7.35%

- Landbank Balanced Fund – 5.07%

- Chinabank Balanced Fund – 4.34%

- PBCOM PHP Multi-asset Fund – 3.99%

- PNB Multi-asset Fund – 3.66%

- Landbank Growth Fund – 3.22%

Top 5 Best Performing UITF Bond Funds in the Philippines:

Performance YTD (Year to Date) as of July 13, 2024.

- PNB Profit Peso Bond Fund – 2.63%

- Manulife Stable Income Fund (Class I) – 2.55%

- EastWest Peso Intermediate Term Bond Fund – 2.17%

- Manulife Stable Income Fund (Class A) – 2.15%

- Chinabank Intermediate Fixed Income Fund – 2.13%

Top 10 Best Performing UITF Money Market Funds in the Philippines:

Performance YTD (Year to Date) as of July 13, 2024.

- Manulife Money Market Fund (Class I) – 2.86%

- Chinabank Money Market Fund – 2.76%

- SB Peso Cash Management Fund – 2.73%

- AB Capital Short-term Fund – 2.68%

- AUB Peso MOney Market Fund – 2.65%

- PBCOM PHP Money Market Fund (Class I) – 2.65%

- Chinabank Short-term Fund – 2.62%

- PBCOM PHP Money Market Fund (Class E) – 2.62%

- Manulife Money Market Fund (Class A) – 2.59%

- BDO Short Term Fund – 2.58%

Like other investments, UITFs have risks. Make sure you never put your money in one basket. It is essential to diversify your capital and to have regular income sources.

To learn more about UITFs, visit our UITF articles here.

Other UITF Guides:

- BDO Easy Investment Plan UITF Review

- How to Redeem UITF Onine in PNB

- Investing 100K in Mutual Fund vs. UITF vs. VUL Earnings

Disclaimer: This article is for information purposes only and should not be considered as professional advice or endorsement of a particular investment. Past performances do not guarantee future results. UITF and other assets have risks. Risk only the capital you’re comfortable to lose. Always do your own research before investing your money.