As requested, I’m sharing here a review of COL Financial EIP (Easy Investment Program) and their stocks list in 2023.

I also discuss the reasons why you should invest using COL EIP Easy Investment Program and who should not invest in this program? Find out in this article.

COL Financial Easy Investment Program is among the unique features of one of the leading stockbrokers in the Philippines. Before you invest, here are my insights about it.

What is COL Financial EIP?

COL EIP (Easy Investment Program) is an investment plan designed for stock market beginners wherein you can invest a fixed amount of money to buy shares of stocks (listed in the COL EIP program) regularly over some time following the concept of Peso-Cost-Averaging method.

Who should invest using COL Financial EIP?

COL Financial EIP is suitable for investors with a long-term investment plan and traders who don’t want to monitor the market and don’t want to buy regular stock manually. COL EIP will let you automatically buy stocks according to your EIP schedule.

Your EIP schedule will depend upon your chosen stocks (companies), amount of investment, and time of investment (month, quarterly, etc.)

How to pick stocks as a beginner in the stock market?

As a starter and beginner, COL Financial has already chosen the best premium stocks in the COL EIP list. All you have to do is choose which one to invest in and fit into your portfolio.

There are currently 18 stocks you can choose from, and the companies listed in the EIP are expertly chosen and analyzed according to impressive growth and performance in the market. These companies are expected to still exist for many years and decades.

COL Financial EIP Stock List in 2023:

- Ayala Corp. (AC)

- Ayala Land, Inc. (ALI)

- Aboitiz Power Corp. (AP)

- Banco de Oro (BDO)

- Bank of the Philippine Islands (BPI)

- DMCI Holdings, Inc. (DMC)

- First Metro Phil. Equity ETF (FMETF)

- GT Capital Holdings (GTCAP)

- International Container Terminal Services (ICT)

- Jollibee Foods Corp. (JFC)

- Metrobank (MBT)

- Metro Pacific Investments (MPI)

- Manila Water Company (MWC)

- Robinsons Land Corp. (RLC)

- SM Investments Corp. (SM)

- SM Prime Holdings (SMPH)

- PLDT (TEL)

- Universal Robina Corp. (URC)

Why you should invest in COL Financial Easy Investment Program?

COL Easy Investment Program is designed for long-term investment goals and passive traders. If you want to invest a fixed amount of money no matter the market and economic status, this strategy is for you.

Easy Investment Program is a time-tested strategy. Many investors, beginners or experts, are still using this to mix some funds in their portfolios because they want to minimize risk and maximize their return using the cost-averaging method.

Watch this video presented by COL Financial to learn more.

Why you should not invest in COL EIP?

Every investor is different. The COL Financial Easy Investment Program may not be for you if you are an investor who wants to trade actively at your own pace. If you have more time to study and analyze the market, you should follow your own trading methods.

As an investor, I believe you don’t just want to let your money and stocks grow, but your skills, knowledge, and technical know-how, too.

“You cannot be on EIP forever. When you’re in the stock market, you don’t want to have boundaries.”

– Fehl Dungo

I still recommend using EIP for one or two stocks while investing in your strategies. I will share my strategy here in another article soon. But I’m going to share one here that is related to EIP.

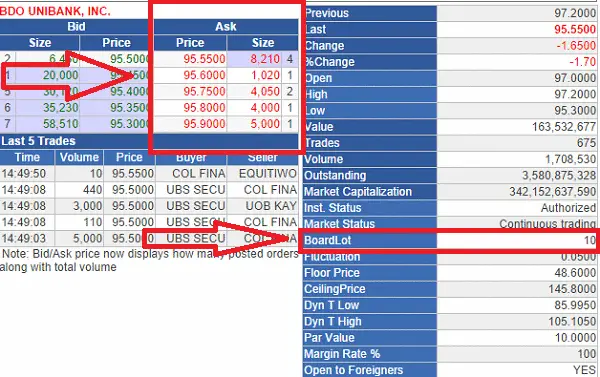

Instead of regularly using and following the EIP concept of investing a fixed amount regularly, I buy stocks monthly using my monthly budget of P10,000. My monthly budget can or can’t buy shares using P10,000 because of the Board Lot requirement.

Instead, I buy shares close to my budget of 10,000. It can be more or less than 10,000 as long as it’s close to that amount. Sometimes, I use the 10,000 budget to buy stocks from two companies instead of one.

Board Lots make trading more straightforward through buying or selling in 5, 10, 100, 1,000, 10,000, 100,000, and 1 million shares. In Tagalog, “bawal ang butal o gansal”

That’s why I prefer buying manually and not using the EIP schedule. Then again if you don’t have enough time to buy stocks, just make your schedules and use the Easy Investment Program.

What are your thoughts about COL EIP? Share them by commenting.

Want to learn more about investing in the stock market? Go to our “Stock market Tutorials and Tips” page.

Disclaimer: This article is for information purposes only and should not be taken as professional investment advice or endorsement of a particular asset. Trading in the stock market is risky. Always apply due diligence.