Here’s how to get an SSS PRN number online quickly. We also share the easy guides and procedures on how to pay SSS contributions using PRN generated form for SSS voluntary members, self-employed individuals, and Overseas Filipino workers.

The Social Security System (SSS) now requires the use of a PRN-generated receipt for SSS contributions and loan payments. It makes transactions posted faster in real-time.

Eventually, the old payment forms will no longer be accepted because we now use our payment reference number when paying our SSS contributions and loans. SSS will start accepting only PRN-generated forms online, especially with employers.

Many members asked about SSS PRN registration and what forms to use, PRN generator, etc. The e-Center department gladly assists members wanting to know how to use a PRN.

What is SSS PRN?

SSS PRN means Social Security System Payment Reference Number. It’s a prerequisite in paying SSS contributions and loans regularly. The purpose of the payment reference number is for the real-time processing and posting of contributions and loan payments.

Why Do You Need to Use an SSS PRN?

Per SSS Circular Number 2017-010, SSS implements an electronic Collecting System (e-CS) to facilitate real-time recording and posting of SSS Contributions and payments.

For individual members, including self-employed, voluntary members, and OFWs, one of the requirements is the mandatory use of PRN (Payment Reference Number) to pay contributions through SSS payment centers or SSS bayad centers.

The use of PRN makes the posting of SSS contributions in sync because it’s real-time posting. If you check your actual premiums using your SSS UMID card or online account, you’ll see the posting automatically.

How to Receive SSS PRN (Payment Reference Number) via SMS or Text Automatically?

If you are an active SSS member, the Social Security System will send an SMS or text message to your registered mobile number. The message will contain your due SSS contributions payment, the schedule and deadline of payment, and your PRN (Payment Reference Number).

What You’ll Need Before You Generate Your SSS PRN (Payment Reference Number)

- My.SSS Online Account

- Valid Email Address

- Log in Credentials (Username and password)

6 Ways to Generate SSS Payment Reference Number

- SSS Online Account

- Get SSS PRN via Text (SMS)

- SSS Mobile App

- Through SSS Hotline

- Get PRN via email

- SSS eCenter Facility

How to Get SSS PRN Online (for Voluntary, Self-Employed, and OFW Members)

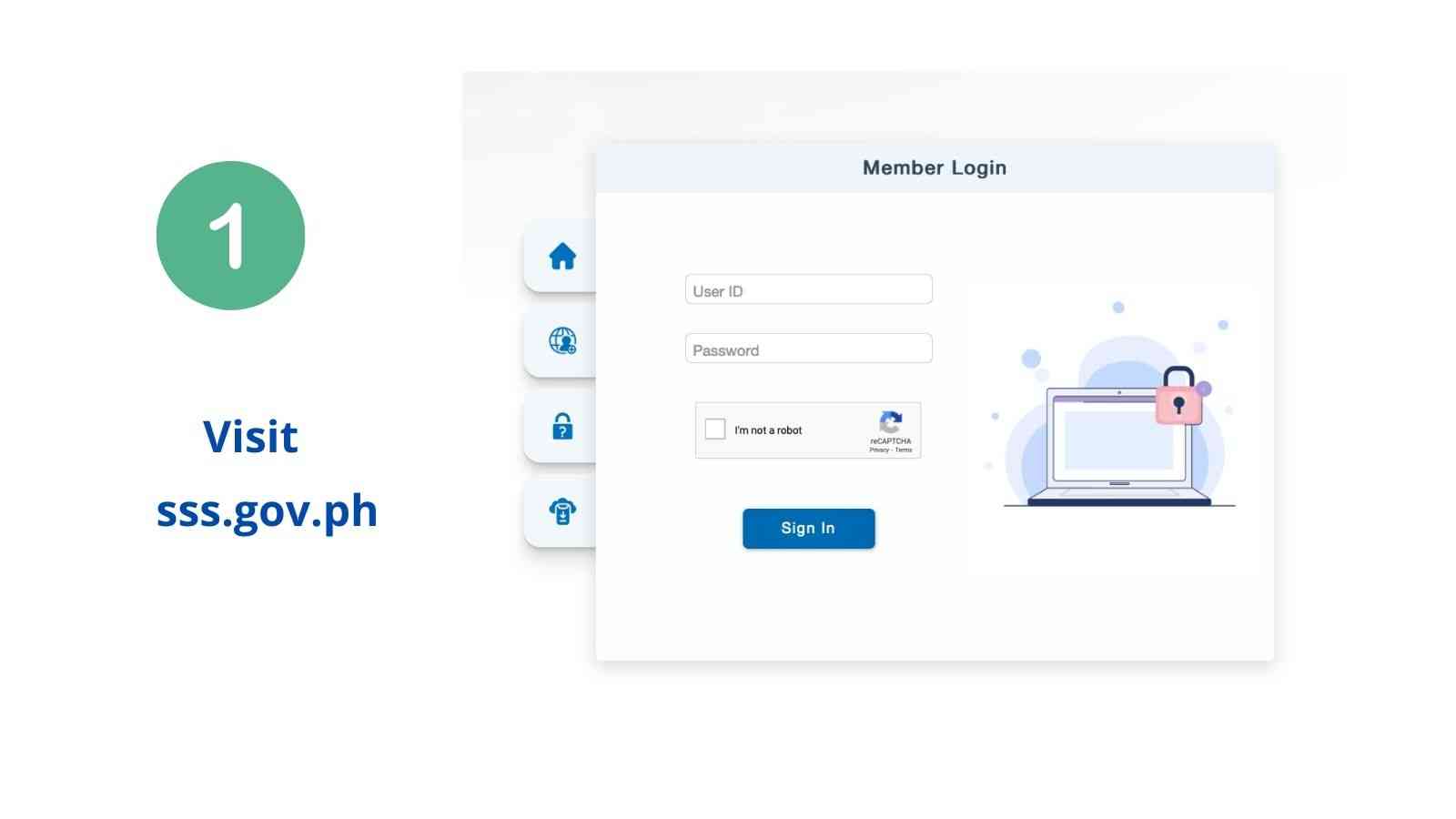

Step 1: Log in to your SSS online account

Before logging in to SSS online, make sure you have already registered for your My.SSS online account. If you still have no online account, please head to the “how to register for SSS online account” page.

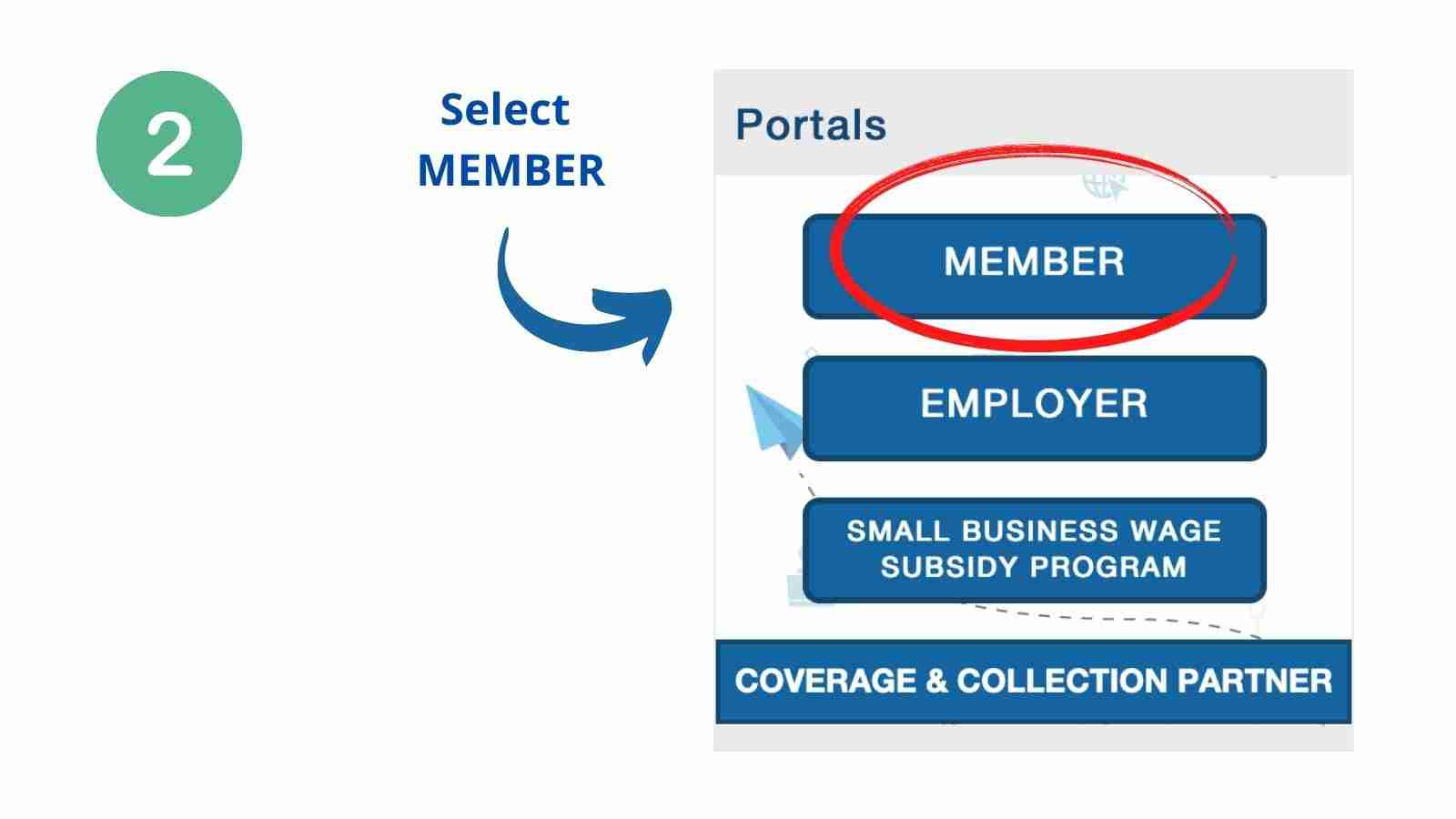

Step 2: Select the Member box

You must select the “Member” type if you are a voluntary member, OFW, and self-employed. If you are an employer, the instructions are also listed below.

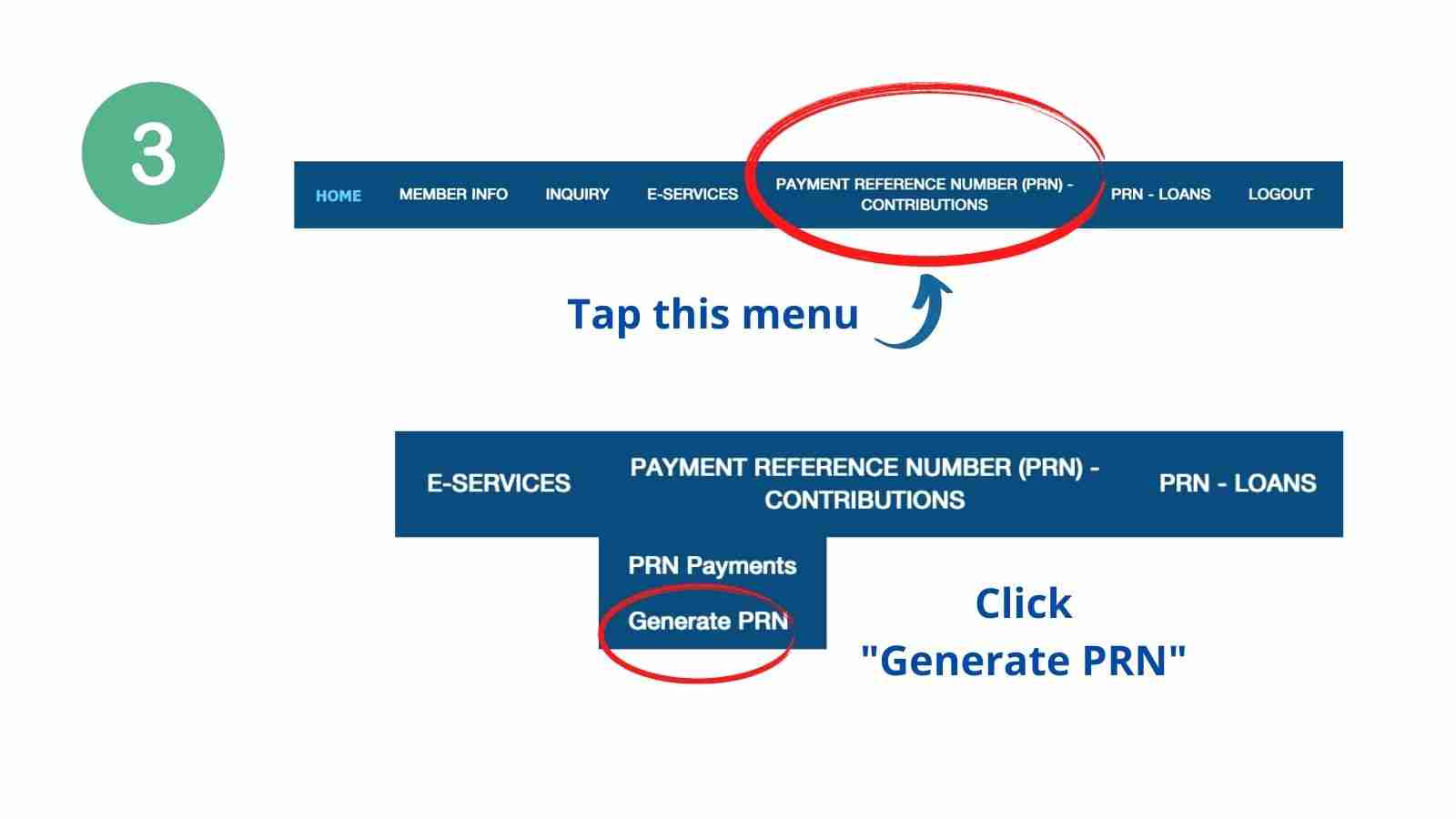

Step 3: Click the Payment Reference Number (PRN) – Contributions tab

The Payment Reference Number tab contains two options: your PRN payments and PRN generation. Your PRN payments display your paid SSS contributions history and your actual premium payments (APN). It summarizes your total EC payments and total SSS payments.

Step 4: Choose “Generate PRN”

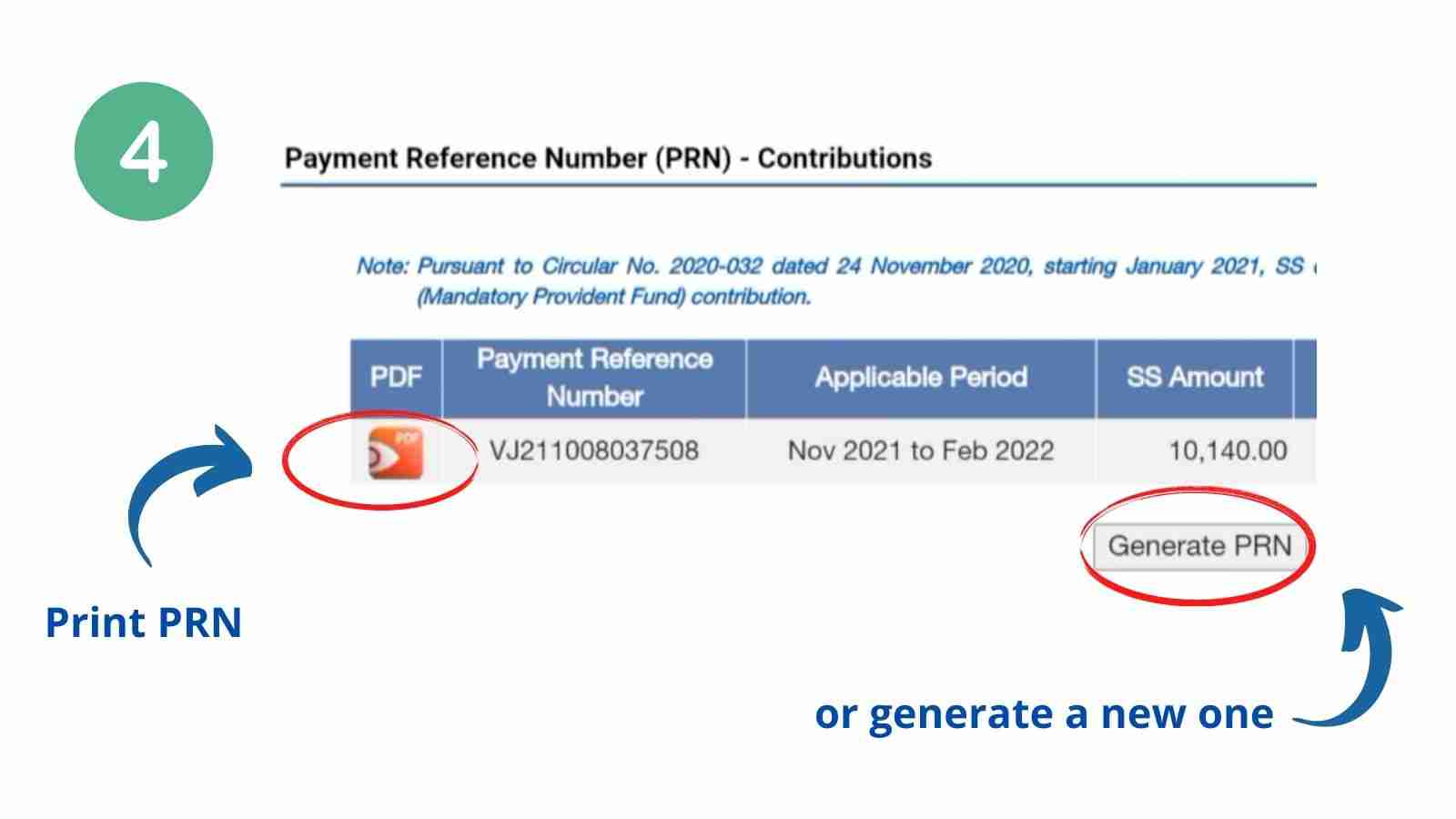

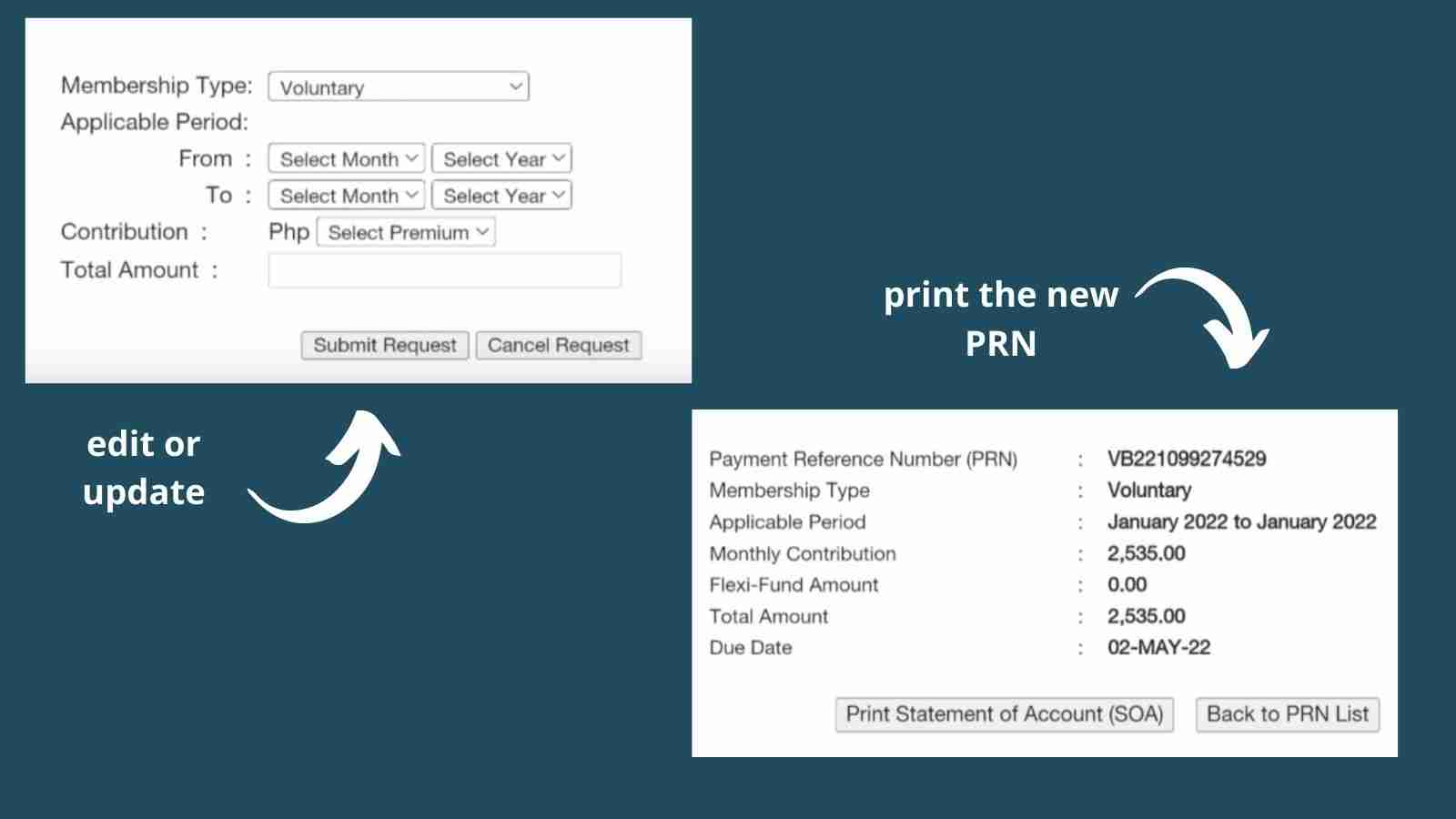

If you have paid your contributions previously using a PRN, the screen will now display your payment reference number, membership type, applicable period, monthly contribution, SSS Flexi Fund amount (if any), total amount to be paid, and the due date or deadline you need to make the payment.

Once you are sure the information is correct, tap the PDF tab to print your Statement of Account (SOA). If you want to change or edit the applicable period, amount of monthly contributions, and membership type, you can click the “Back to PRN List” instead and generate a new PRN.

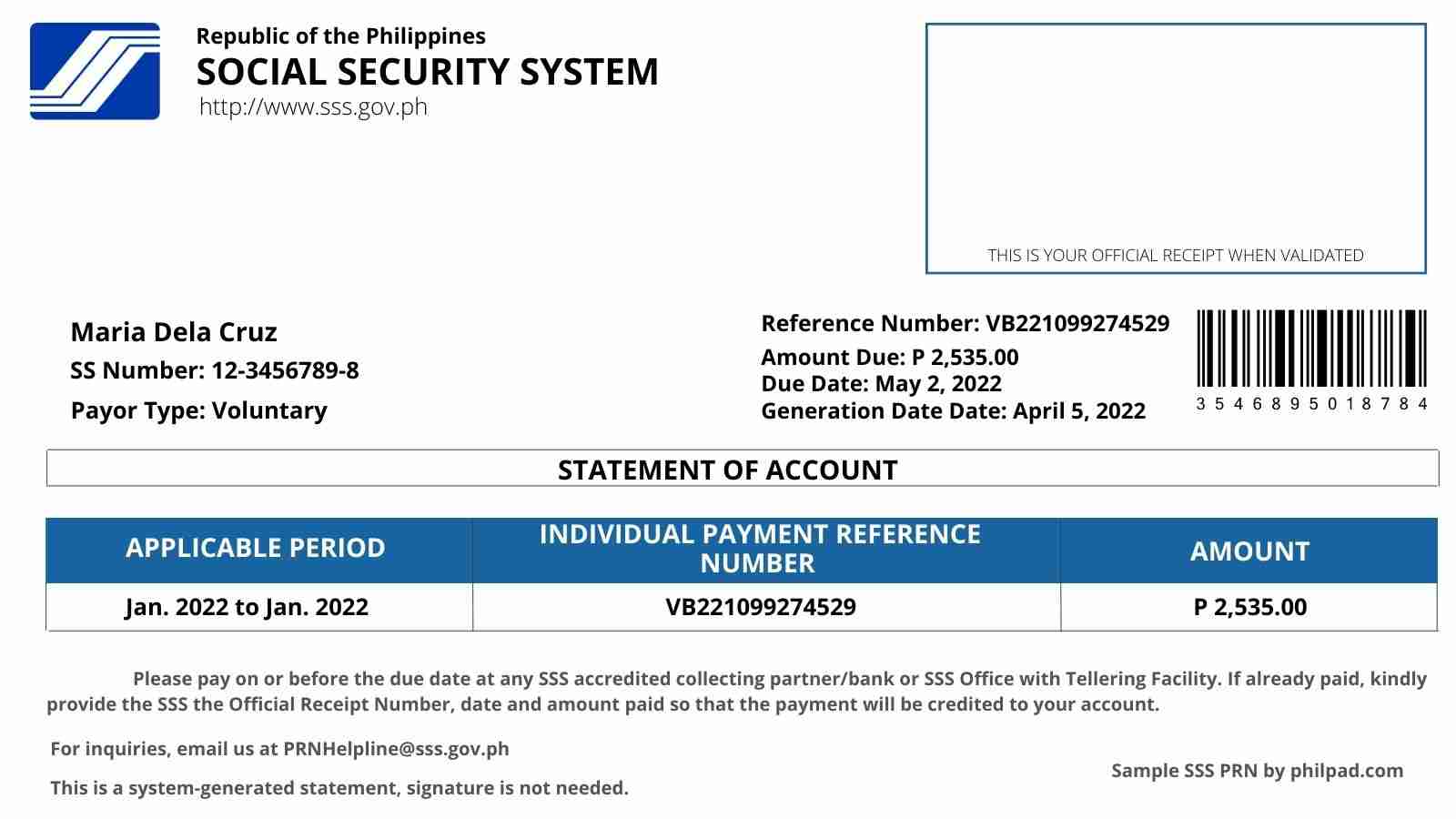

Step 5: Print your SSS PRN form

The system will generate a payment form for you. Your SSS payment reference number form will be in PDF format. Print it out before paying your contributions. Your SSS contributions will be posted in real-time upon successful payment.

You need to bring this form and submit it to the SSS payment center when paying your SSS contributions. When paying your SSS monthly contributions, you can also present your PRN-generated form to any SSS accredited bank partner.

How to Get SSS PRN Number Online for Employers?

Step 1: Log in to your SSS online account

Make sure you already have an existing SSS employer’s account. Otherwise, you need to register for an online account at My.SSS platform. An employer’s account is different from a member’s account.

Step 2: Select the Employer box

Click the “Employer” button to sign in as an employer registered in SSS. As an employer, you can monitor, track, and transact your employees’ Social Security benefits and records on the SSS online platform. Type your user ID and password to log in to your account.

Step 3: Click the Payment Reference Number (PRN) tab

Inside the Payment Reference Number tab, employers can view their employees’ SSS contribution payments in the past and generate an SSS contribution collection list. All the past transactions are also recorded and saved in the system.

Step 4: Generate your SSS PRN

Click the “Generate PRN” button to start creating your employees’ contribution collection list for the month. The Social Security System offers three options for employers to build their employee’s contribution collection list.

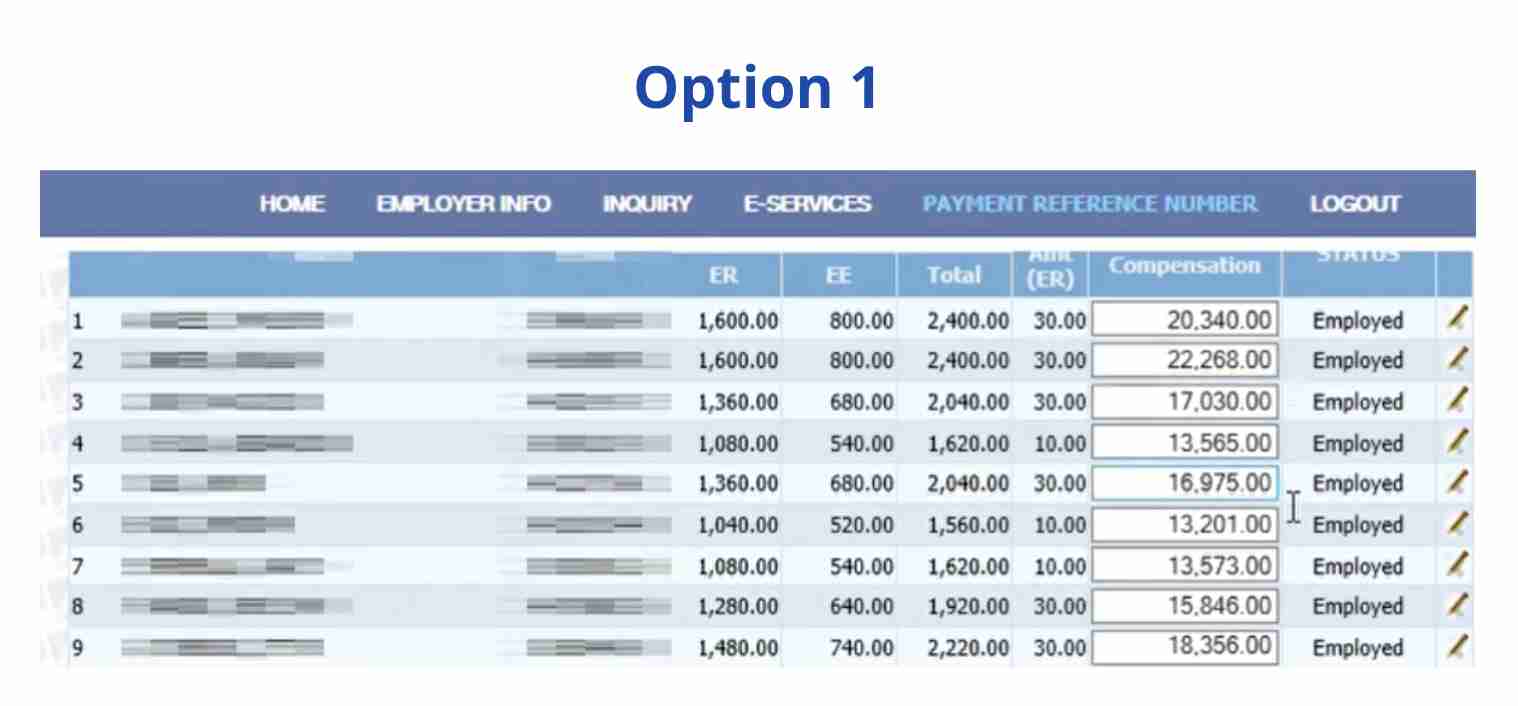

Option 1: Select Records from the SSS List

An SSS employer can use this option to create a collection list using the SSS online program. If you prefer to use this option, make sure you have a rapid internet connection and a fast computer. Follow the steps below to build your employee’s data.

- Add each employee’s SSS records, including their SSS number

- Provide the employee’s current monthly compensation

- Click the “Submit” button

- Click “Collection List Details”

- Check your employee’s details and the breakdown of their total contribution for the applicable month

- Tap the “Prepare Collection List” button to create your Contribution Statement

- Confirm the Partial Contribution Collection List

- Download the Electronic Contribution Collection List (e-CCL)

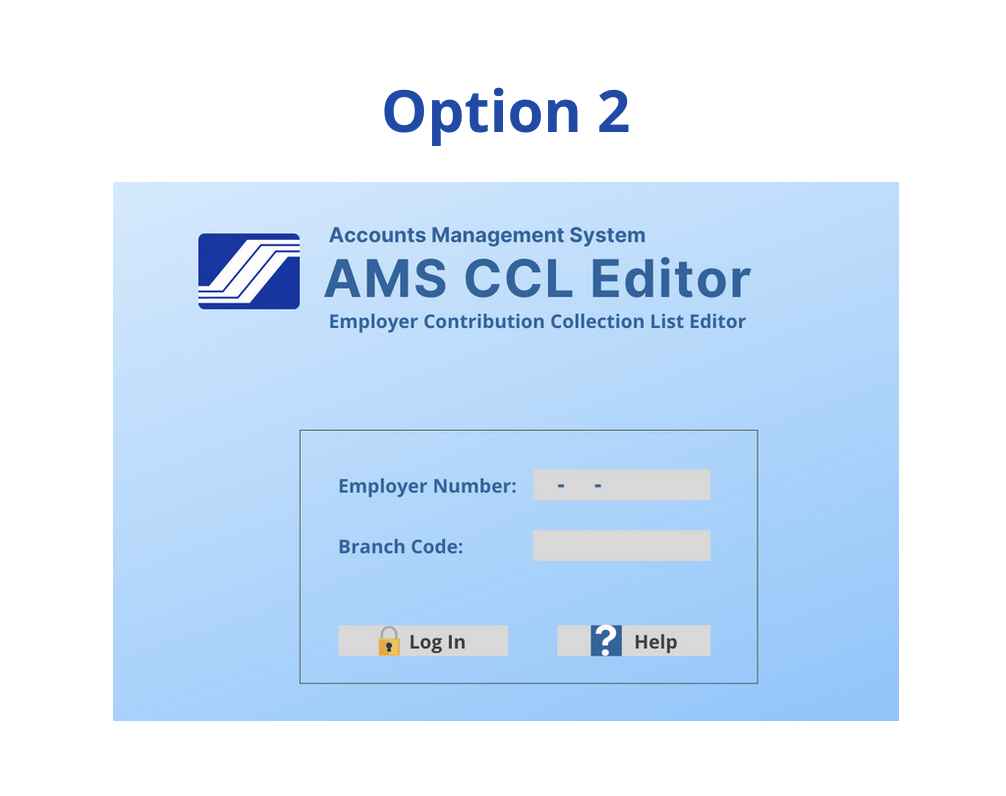

Option 2: Download the SSS List using AMS CCL Editor

An SSS employer can use the SSS AMS CCL Editor to create an SSS collection list offline. Many SSS employers find using the AMS CCL Editor more convenient because it doesn’t act up and the system doesn’t hang or stop. Follow the steps below to generate your PRN as an SSS employer.

- Install the latest version of SSS AMS CCL Editor on your computer

- Log in by using your SSS Employer Number and SSS Branch Code

- Type your Employer Name and click “Save”

- Click the “Add Record” icon

- Provide the details of each employee

- Click the “Create Employer List” icon

- Tap the “Create Transmittal” icon

- The Contribution Collection List will be saved on your computer

- Upload the CCL text file on your SSS Online account

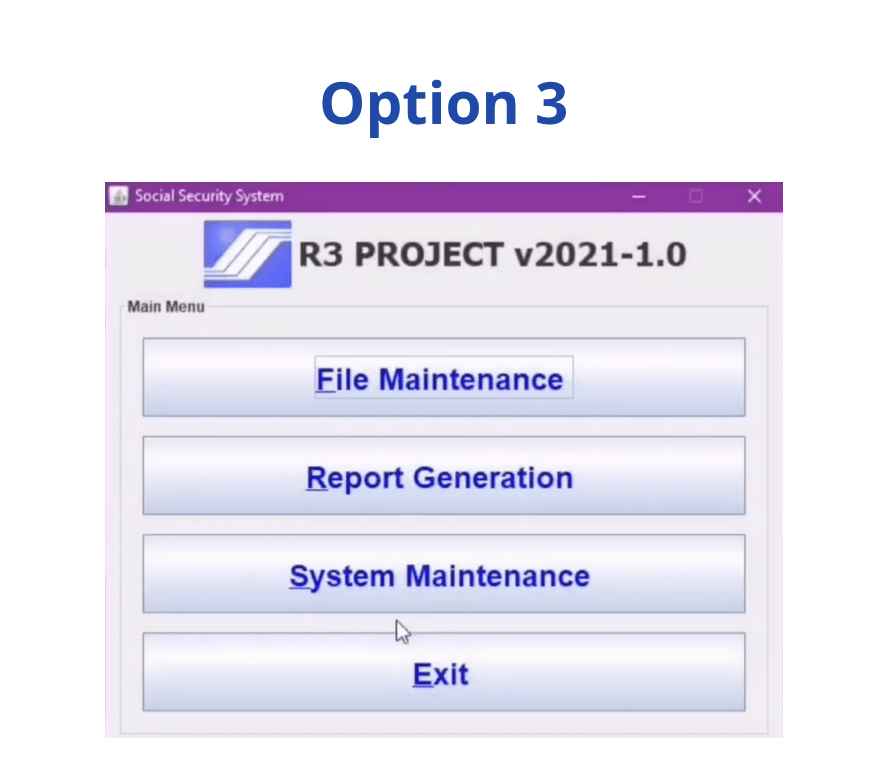

Option 3: Upload the Employer Prepared List according to the SSS file format requirement

- Install the latest version of the SSS R3 program

- Type your SSS employer Number and Employer Name

- Click the “Update” button

- Select the applicable month and year of contribution

- Encode your employee records

- Create SSS Text File

- Upload the file to SSS

How to Get SSS PRN via Text-SSS (SMS or Text)

Another convenient way to generate SSS PRN (Payment Reference Number) is by SMS or text message service. The Social Security System launched Text-SSS to let SSS members get information via text message or SMS service. Follow the steps below to get PRN via text.

Step 1: Register for TextSSS feature

First, register and send to 2600 following this format SSS REG <SSNUMBER> <BDAYmm/dd/yyyy>

Example: SSS REG 1450888559 02/14/1989

Step 2: Receive your Personal Identification Number (PIN)

Upon successful registration, the Social Security System will send your PIN (Personal Identification Number) that you will use when sending text inquiries to SSS.

Step 3: Receive your PRN by text

To get your Payment Reference Number, type SSS PRN <SS Number> <PIN> <BDAYmm/dd/yy>

Often, there is no need to request your SSS payment reference number if you have been paying your previous contributions using a PRN because SSS will always text your next PRN on your registered mobile number.

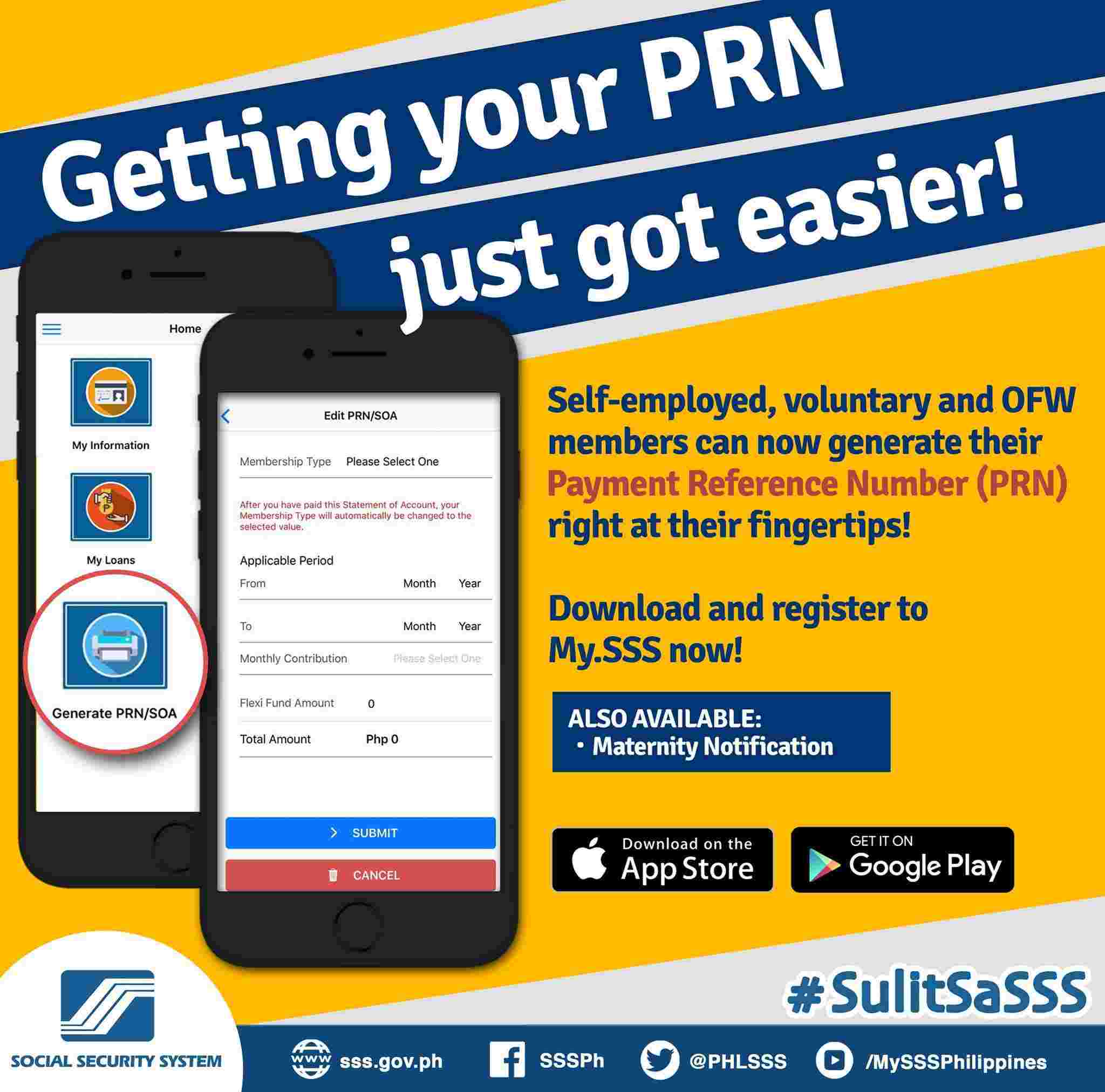

How to Get SSS PRN Using the SSS Mobile App?

Step 1: Download the SSS Mobile App on your phone

The Social Security System launched a mobile application for SSS members and employers. It’s available on the App Store (for iOS devices) and Google Play Store (for Android devices). It’s free to download the app.

Step 2: Type your My.SSS username and password

After installing the SSS mobile app on your smartphone, log in using your My.SSS username and password. Remember to always keep a copy of your login credentials in a secure place like a notebook or journal to avoid hackers’ access.

Step 3: Click “Generate PRN/SOA”

The Payment Reference Number feature has a shortcut button. Click the “Generate PRN” button on the menu to request your PRN.

Step 4: Choose your type of membership

You need to provide your SSS membership type (voluntary or OFW). All active voluntary members and Overseas Filipino Workers can request a PRN using the mobile app.

Step 5: Select the applicable period of contribution

Choose the applicable month and year that you want to generate your contribution payment reference number. Every period will have a corresponding PRN.

Step 6: Select your monthly contribution amount

Tap the arrow to select your Social Security contribution. You can also use the updated SSS contribution table as a reference.

Step 7: Click the “Submit” button

The SSS mobile app will then automatically generate the total amount for your contribution payment for the applicable period you have provided. Confirm your request by clicking the “Submit” button.”

Step 8: Save your Payment Reference Number copy

The next screen will display your Payment Reference Number or Statement of Account. You can download a PDF copy and print it later. When paying at the SSS office or SSS payment centers, bring the printout copy of your current PRN.

How to Get SSS PRN by Calling the SSS Hotline?

The Social Security System staffs are always happy to cater to members’ inquiries. Members can call the SSS hotline thru their call center phone numbers, member’s assistance channels, and international toll-free services at the following numbers:

How to Get SSS PRN via email?

The SSS also caters to PRN requests via email. If ever you want to send a message, you may send your PRN request to their email address at prnhelpline@sss.gov.ph with the subject line: “Request for PRN Generation.” Include your complete name, SSS number, applicable month, and contribution amount. Attach your last payment receipt, valid ID, or SSS UMID card.

This route may not be as quick as the other methods of getting an SSS PRN, but it can also cater to your needs, especially if you’re not very techy.

How to Get SSS PRN at the SSS Office?

Suppose you forgot a copy of your payment reference number and you’re already at the SSS office or SSS branch. In that case, you can approach the SSS eCenter section or any SSS payment collecting partners who accept PRN payments to request your latest SSS PRN.

SSS collecting agents located at some SSS offices can also provide your PRN when paying your SSS contributions. Just present your payment form for the applicable month, and your contribution payments will be posted in real-time.

How to Pay SSS Loans Using PRN (for Voluntary, Self-Employed, OFW Members)?

Step 1: Generate your SSS Loan PRN (Payment Reference Number)

To pay your loans in SSS, you must first get a payment reference number. To get one, choose any of the six methods discussed above. The quickest way to get a PRN is through the My.SSS portal or the SSS mobile app.

Step 2: Log in to your SSS online account

To log in to your SSS account, visit the My.SSS portal. Provide your username and password to access your SSS account. Tick the box to confirm you’re not a robot and click “Submit.”

Step 3: Click the RTPL tab on the menu

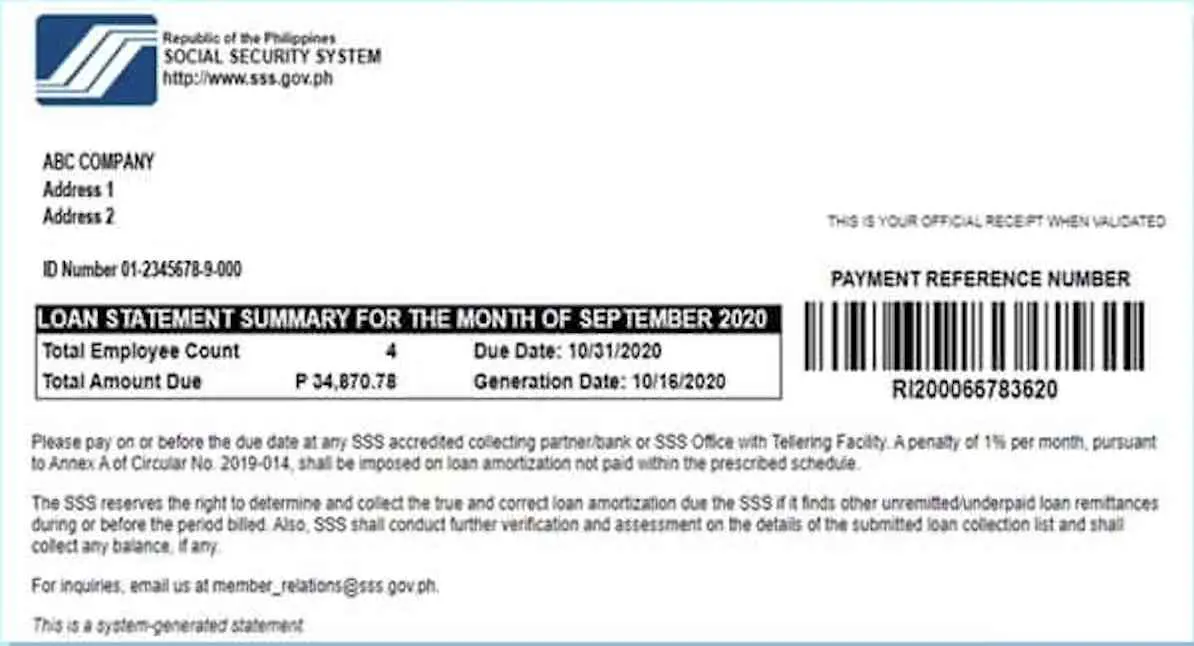

Select the RTPL (Real-Time Processing of Loans) tab to view your active Payment Reference Number. The RTPL also displays your Loan Statement Summary for the latest month. It includes the total amount due, the due date of payment, and the generation date.

Step 4: Check the amount to be paid

According to SSS, by default, the “Amount to be Paid” portion is equal to the “Amount Due.” You may edit the “Amount to be Paid” by typing your preferred amount. It’s important to note that you may choose to pay an amount more or lesser than the amount due, but it should not be more than the amount of your “Outstanding Balance.”

If you enter an amount greater than the outstanding balance, you will encounter an invalid month, or an error message will appear on the screen.

Step 5: Click the “Savel All” button

Once done editing, click the “save all” button to save all the changes made to your payment form. SSS will update your payment reference number details and summary.

Step 6: Print two copies of your PRN

Click the PRN box to view and print out a copy of your updated payment reference number. The SSS office requires two copies of your PRN: one for the payor and one for the SSS.

Step 7: Submit your PRN when paying at the SSS

Present your PRN when making SSS loan payments at the SSS office or RTPL-compliant SSS collecting partners. After successful payment, you will receive a confirmation on your registered mobile number or email address.

FAQ About SSS PRN (Payment Reference Number)

Can I pay SSS contribution without a PRN Number?

The Social Security System implemented mandatory use of PRN for loan payments. The use of Payment Reference Number (PRN) is required for salary, calamity, emergency, and restructured loan payment transactions.

It’s still possible to pay SSS contributions for voluntary and OFW members, provided they will pay at the SSS office or SSS collecting payment centers who can generate the payment reference number for them that will facilitate the real-time posting of their SSS contributions.

Can I get PRN in SSS online?

Yes, to get your PRN in SSS online, you can use My.SSS portal or the SSS mobile app. Log in to your account and click the “Generate PRN (Payment Reference Number)” on the menu.

Does SSS PRN expire?

Yes, SSS PRN will expire five days after the payment due date. All SSS members must pay their contributions and loan payments before the deadline. Ensure you don’t miss any unpaid months to maintain your good active status and ensure your eligibility for SSS benefits.

What should I do if I lost my SSS PRN?

Log in to your My.SSS account online or use the SSS mobile app to view or generate your new payment reference number. Save a PDF copy to use later.

More SSS Guides:

How to Invest in SSS WISP Plus (Benefits and Earnings)

How to Apply for SSS Retirement Pension Benefits Online

How to Get SSS PRN (Payment Reference Number)