Here is the latest Pag-ibig Contribution Table or HDMF Contribution Table in 2026. The Home Development Mutual Fund helps Pag-ibig members generate savings, earn dividends, avail housing loans and other loans offered by Pag-ibig.

While the SSS increased their monthly contributions requirements in the past, the Home Development Mutual Fund (Pag-ibig Fund) also issued Circular No. 460 for their new contribution requirements in February 2024.

The contributions will still follow the same rates in 2026 to enhance member benefits and ensure the fund’s sustainability. There is no current announcement of another rate hike.

To sum up the new Circular No. 460, here are the things we should know:

- The Maximum Fund Salary (MFS) has increased from P5,000 to P10,000

- Contribution rate for MFS P1,500 and below shall be 1% (employee shares) and 2% (employer share)

- Contribution rate for MFS over P1,500 shall be 2% for both employee and employer share

- The maximum Pag-ibig contribution for both employers and employees will be P200

All employees, employers, OFWs, voluntary, non-working spouses, and kasambahay members must know their updated Pag-ibig monthly contribution to ensure income growth.

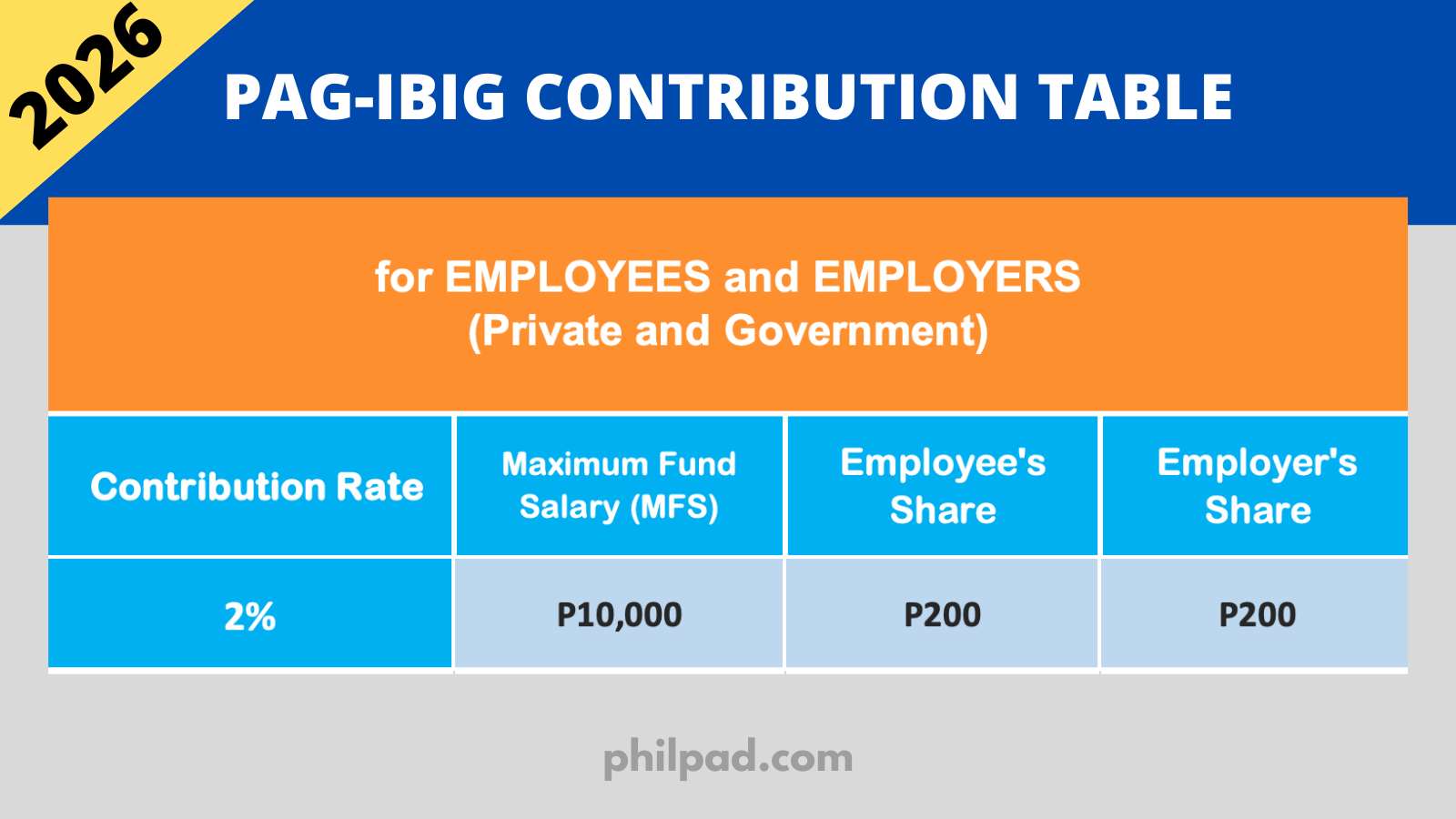

Pag-ibig Contribution Table 2026 for Employed Members and Employers

The 2% Employee Share and 2% Employer Share are based on a Maximum Fund Salary (MFS) of P10,000 according to the Pag-ibig Fund. In case the MFS falls P1,500 and below, employee share will be 1% and while the employer share will be 2%.

It is mandatory for employees to pay Pag-ibig Fund contributions every payroll or whenever they receive their monthly salaries. This is automatic and done by the employer on every payroll.

It is also essential for employers to remit and submit reports to Pag-ibig regarding their employees’ contributions.

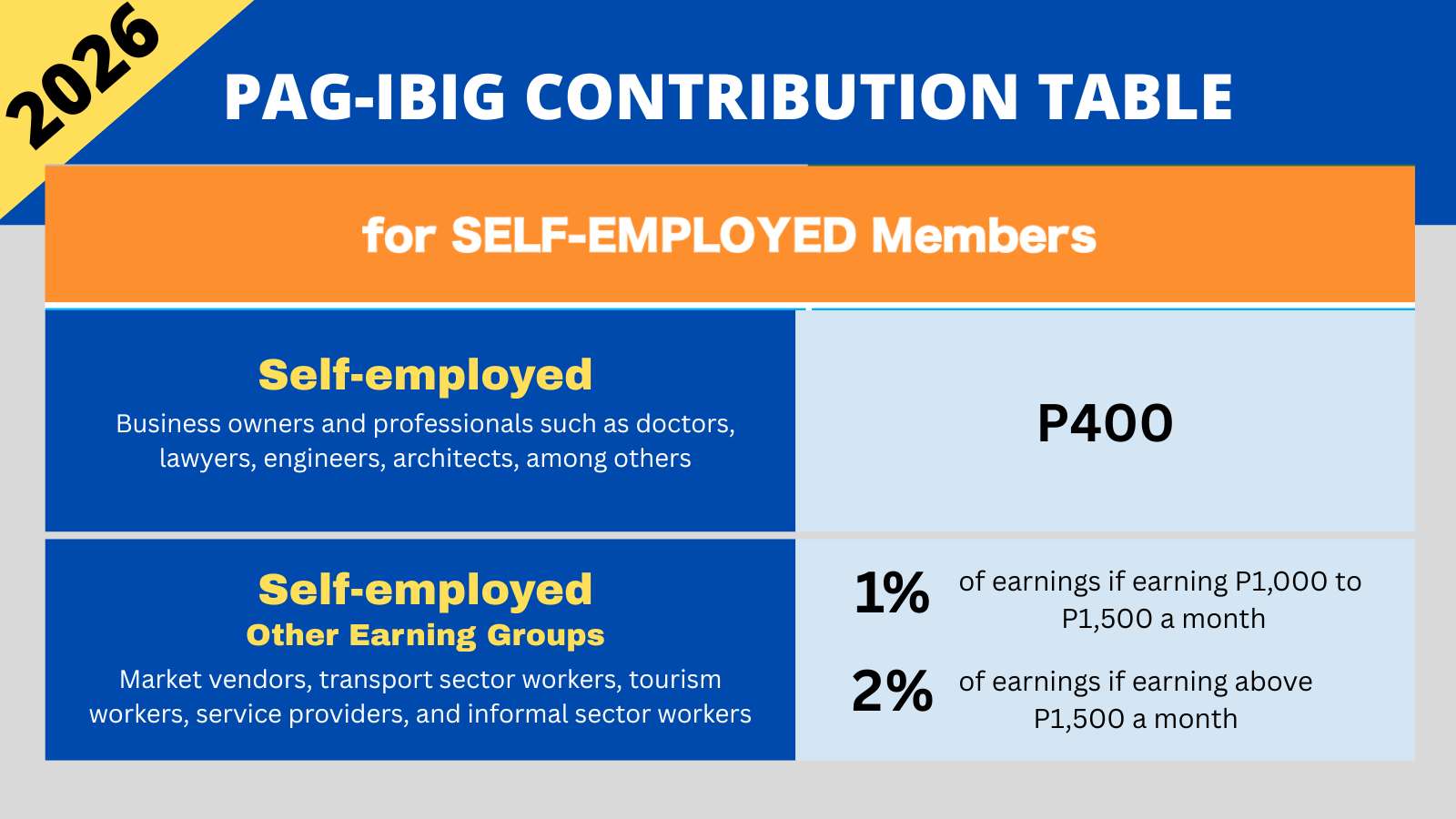

Pag-ibig Contribution Table for Self-employed Members

Self-employed members will pay or shoulder the entire Employee and Employer share.

HDMF monthly contributions of professionals, entrepreneurs, freelancers, and other individuals considered as self-employed members must apply the contribution rates shown on the table above.

Self-employed professionals include doctors, lawyers, engineers, architects, Certified Public Accountants, and business owners. The Other Earning Groups under this category include market vendors, transport sector workers, tourism workers, service providers, and informal workers sector.

Pag-ibig Contributions Payment for OFW Members in 2026 is Now Mandatory

HDMF monthly contribution for OFW Members is now subject to mandatory coverage. The Department of Migrant Workers (former POEA) would not issue the OEC (Overseas Employment Certificate) if the OFW member did not pay their HDMF contributions for the year.

All OFWs registered through the POEA e-Registration facility can fill out their Pag-ibig MID Number online on their OFW Information Sheet.

1. HDMF Monthly Contributions for OFW Members whose employers are subject to mandatory coverage

An OFW whose employer abroad is required pay a share of his Pag-ibig monthly contributions following the rates below. Such members include Overseas Filipino Seafarers (employed by a Philippine manning agency). The maximum monthly compensation for OFW members is P10,000.

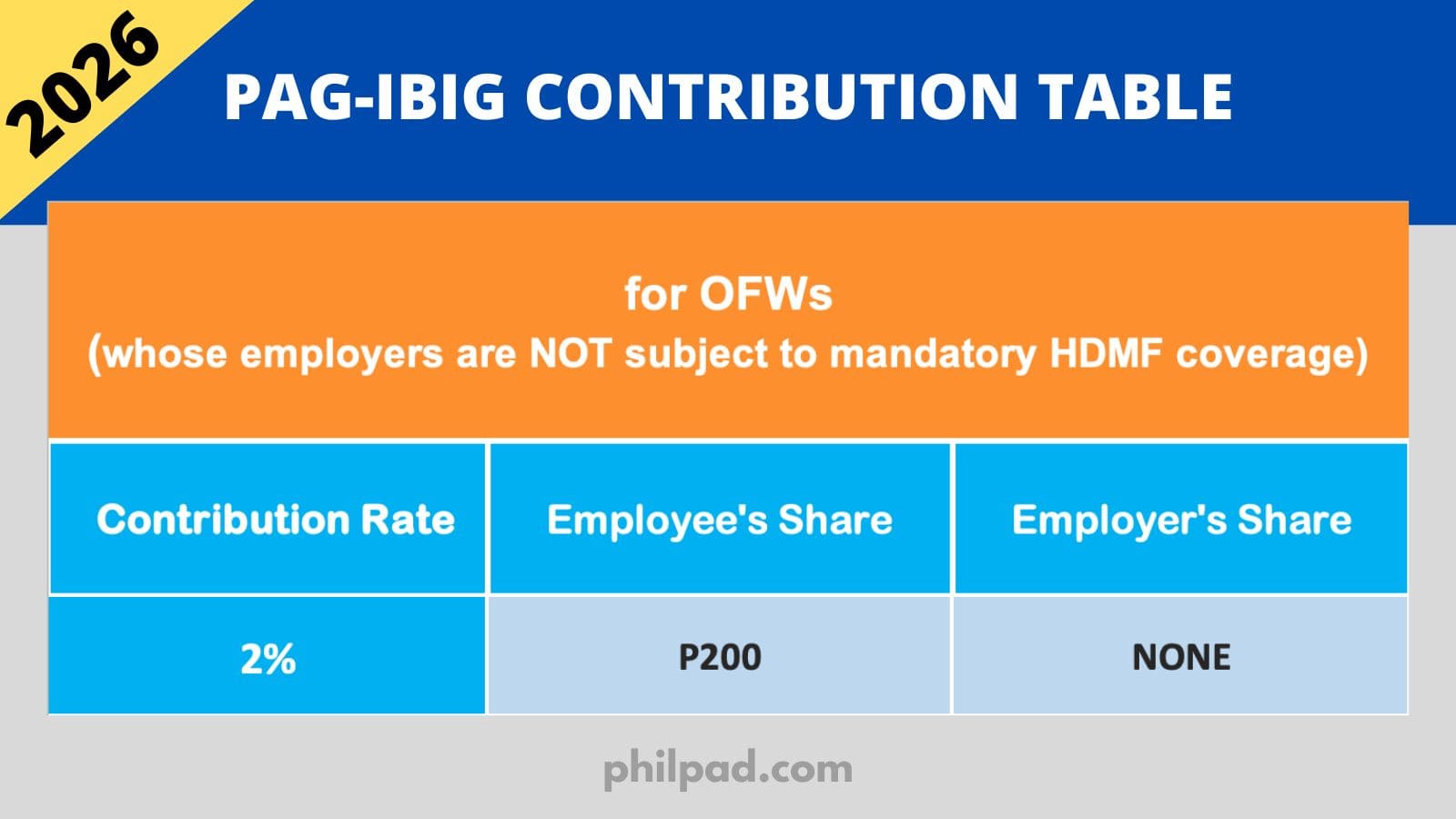

2. HDMF Monthly Contributions for OFW Members in 2026

An OFW whose employer is not subject to mandatory coverage shall contribute an amount equivalent to 2% of his or her monthly salary. The said employee may opt to pay the employer counterpart according to HDMF circular 391.

Pag-ibig Contributions Monthly Payment for Non-Working Spouse

Non-working spouses including full-time housewives can also save through the Pag-ibig Fund. To compute your monthly contributions, take half the amount of your working spouse then apply the corresponding rates above. The non-working spouse member is not required to remit the employer counterpart.

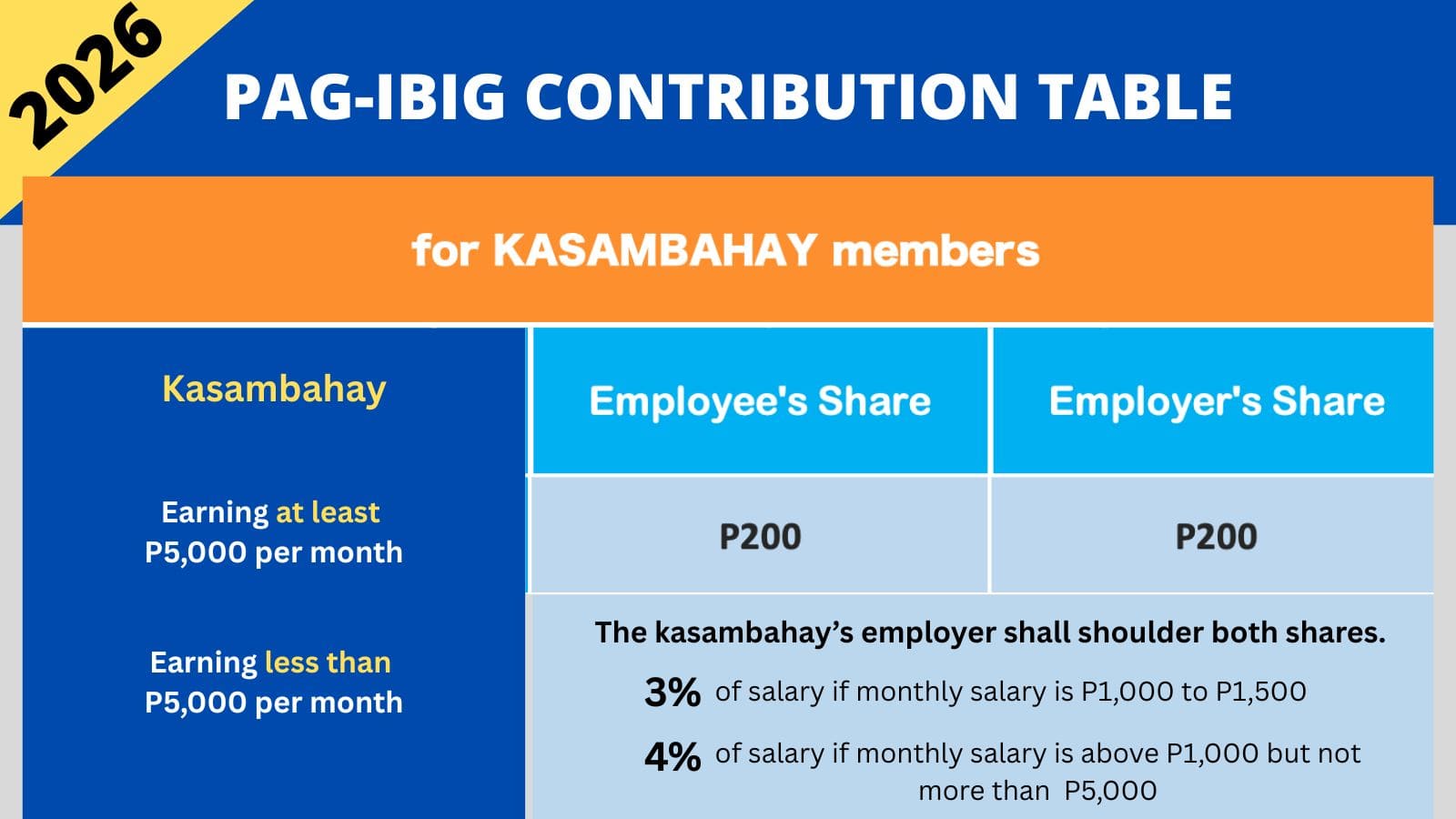

Pag-ibig Contribution Rates for Household Employers and Kasambahay Members

Household workers or kasambahays include the following:

- General household helper

- Yaya (Nanny)

- Cook

- Gardener

- Laundry person

- Any person who regularly performs domestic work in one household on an occupational basis

Kasambahay members will pay no share of their monthly HDMF contributions if their monthly salary falls below P5,000 because household employers must shoulder their full contributions. Otherwise, the kasambahay, will pay a 2% share (when earning 5,000 above).

How to compute Pag-ibig Contributions?

The maximum monthly compensation allowed to compute each employee’s Pag-ibig contribution is currently set at P10,000. It means that the maximum contribution a member can pay per month is currently P200 and the employer’s share applied to that maximum contribution is also P200.

If you are employed and receiving more than 5,000 every month, you will be deducted 200 every month to cover your employee share. Your employer will also pay 200 to your Home Development Mutual Fund (employer share).

How Pagibig Fund earns money?

Pagibig (HDMF) is a mutual fund. All the money you will contribute to the HDMF will be pooled and invested in different financial instruments, usually government funds or money markets. These Mutual funds then will earn income from those investments. As a member of the Home Development Mutual Fund, you are entitled to that income.

Learn more about Mutual Funds and earn more money by going to this page: Mutual Funds Guides

How to increase your Pagibig Contributions?

Pag-ibig, a.k.a. HDMF, allows members the opportunity to earn more income and dividends from the Fund by increasing their Pag-ibig savings. You can check out this post to learn how to do that: “How to increase your Pag-ibig Savings.”

Related Articles:

- New SSS Contribution Table 2026

- New Philhealth Contribution Table 2026

- New BIR Income Tax Table 2026

Subscribe for FREE to receive our latest posts!