The Social Security System released the new SSS contribution brackets for 2024. Effective January 2024, SSS members must comply with the updated monthly contributions to maintain their active membership status.

Pursuant to the enactment of Republic Act No. 11199, which includes a provision that increases the contribution rate to 14%, the minimum Monthly Salary Credit (MSC) to P4,000, and the maximum MSC to P30,000, the new SSS Contribution Schedule of employers (ER), employees (EE), self-employed, voluntary members, kasambahay, and non-working spouse is issued and shall be effective for the applicable month starting January 2024. The minimum MSC for OFW is 8,000.

What is SSS Contribution Table?

SSS Contribution Table is the official contribution schedule issued by the Social Security System (SSS) in the Philippines to guide SSS members the specific amount of their monthly contributions according to their monthly salary credit or range of monthly compensation.

Advantages of the New SSS Contributions Schedule:

The new SSS contributions table and schedule highlight the addition of mandatory provident fund for members to implement the Workers’ Investment and Savings Program (WISP). These are the benefits of the new 2024 rates.

- Covers a larger percentage of member’s monthly income

- Ensures larger benefits and pension savings in the future

- Employer’s share becomes 9.5% while employee’s shares remains the same 4.5%

- Contributions starting at MSC above P20,000 shall go to the SSS Provident Fund called WISP (Worker’s Investment and Savings Program)

We thought to share the latest SSS contributions schedule 2024 here. It will be very helpful if you print it out especially if you’re an employer so you can update your employees’ contributions earlier and not rush doing it at the exact time of your payment.

SSS also advise voluntary members, self-employed, household employers and kasambahays to know the update and check the new amounts from the table to avoid payment errors.

By the way, all members of SSS including employers are now required to have an SSS online account. Apparently, the Social Security System is aiming to make everything online now which is great I think. Eventually, we don’t need to go to the SSS to transact or inquire about our account.

There are features on the online account such as viewing premiums, static information, and employment history download and PRN forms that are now working.

If you want to view and check your SSS account online, we have the ultimate guide here:

The New SSS Contribution Table in 2024

This table is the summary of the new SSS monthly contributions brackets in 2024. It contains the complete membership categories for employed, self-employed, voluntary, OFW, and non-working spouse.

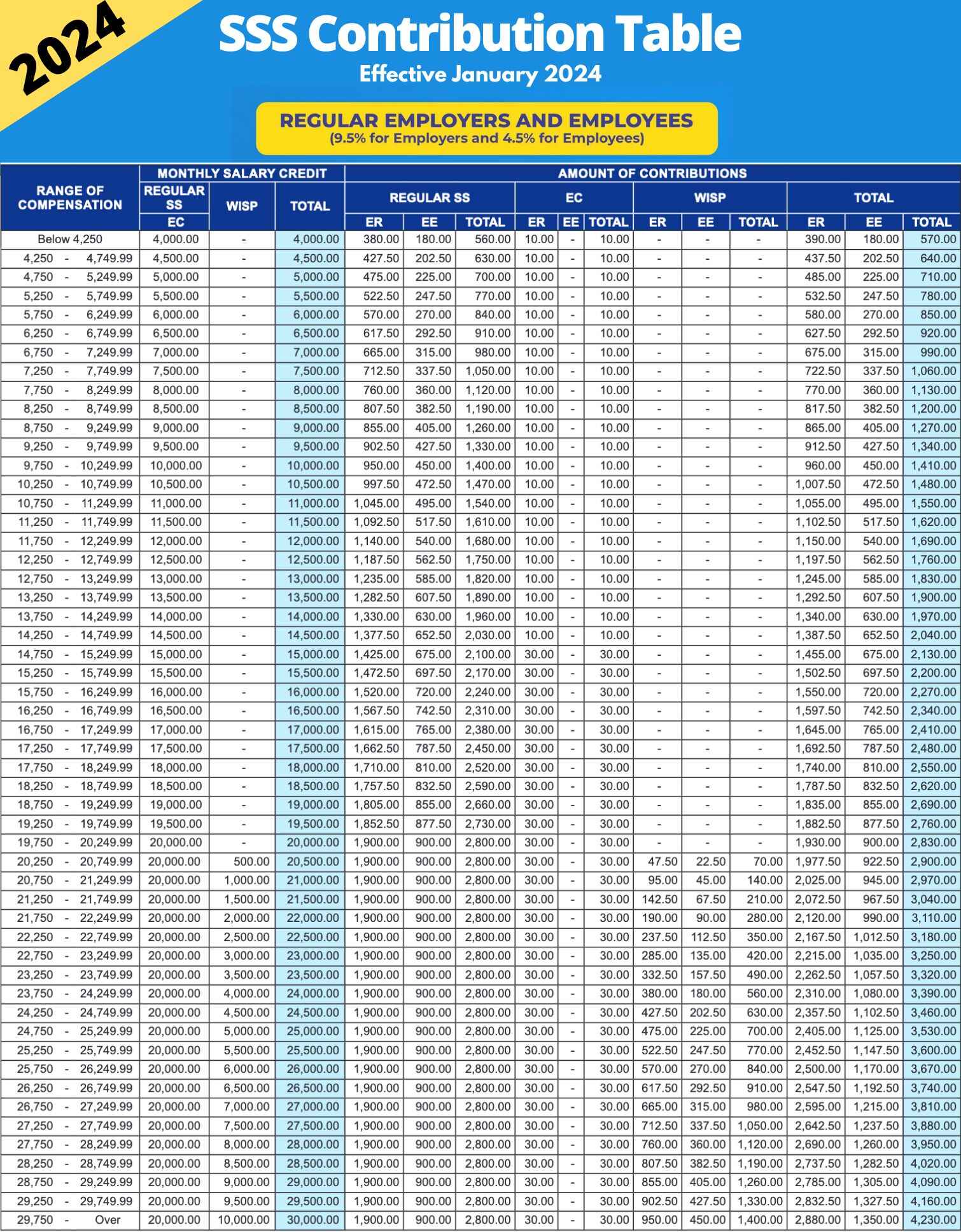

SSS Contribution Table for Employed Members and Employers in 2024

The SSS Table below will also guide employees and employers about their latest salary brackets and SSS monthly contributions. The data also sort the employee and employer’s share from the total contribution. Additionally, the EC amount is also listed from the table below.

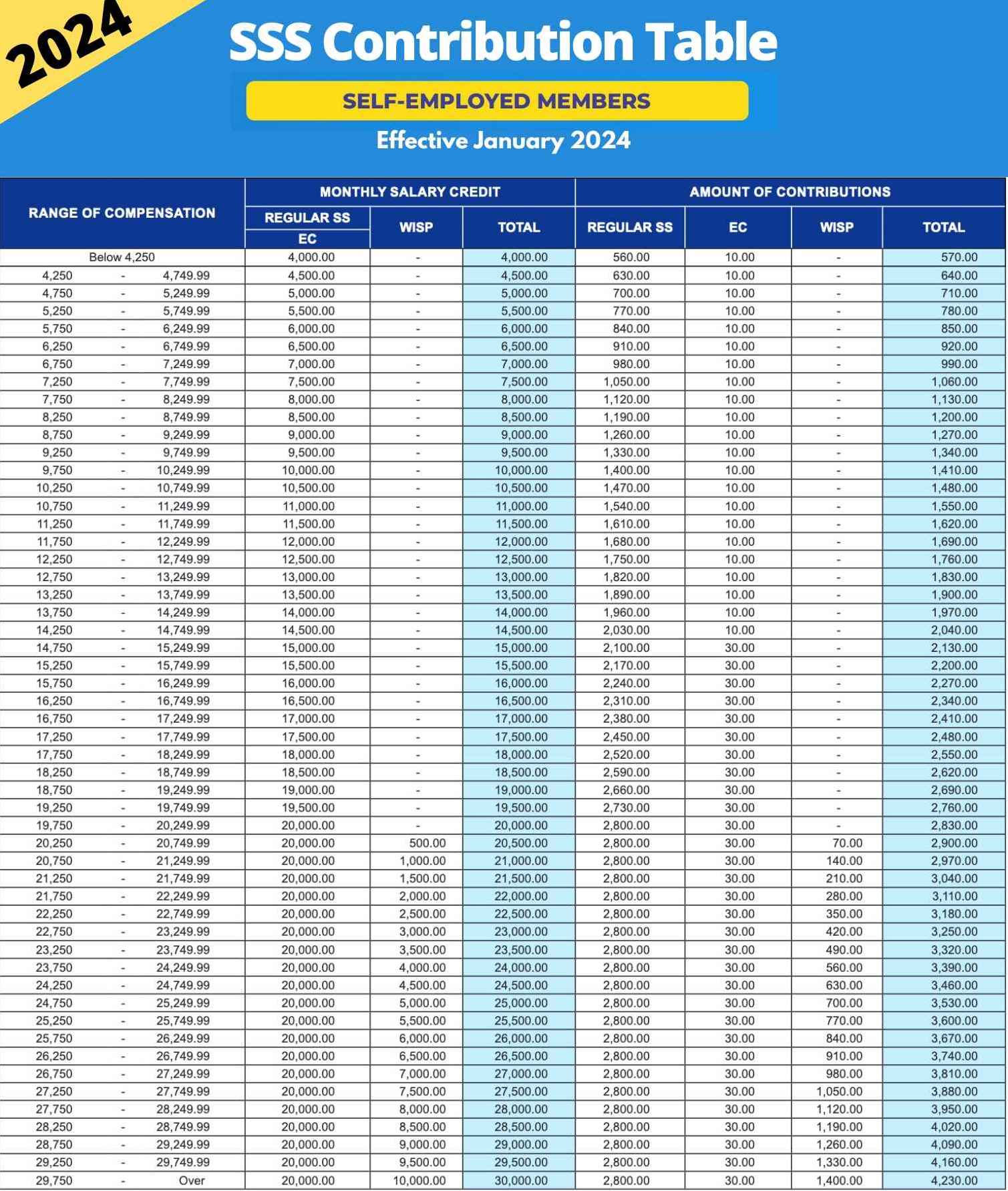

SSS Contributions Table for Self-employed Members for 2024

If you are a self-employed professional or a freelancer, you may also follow the contributions below. Self-employed with 20,000 monthly salary credit now has mandatory provident fund to pay.

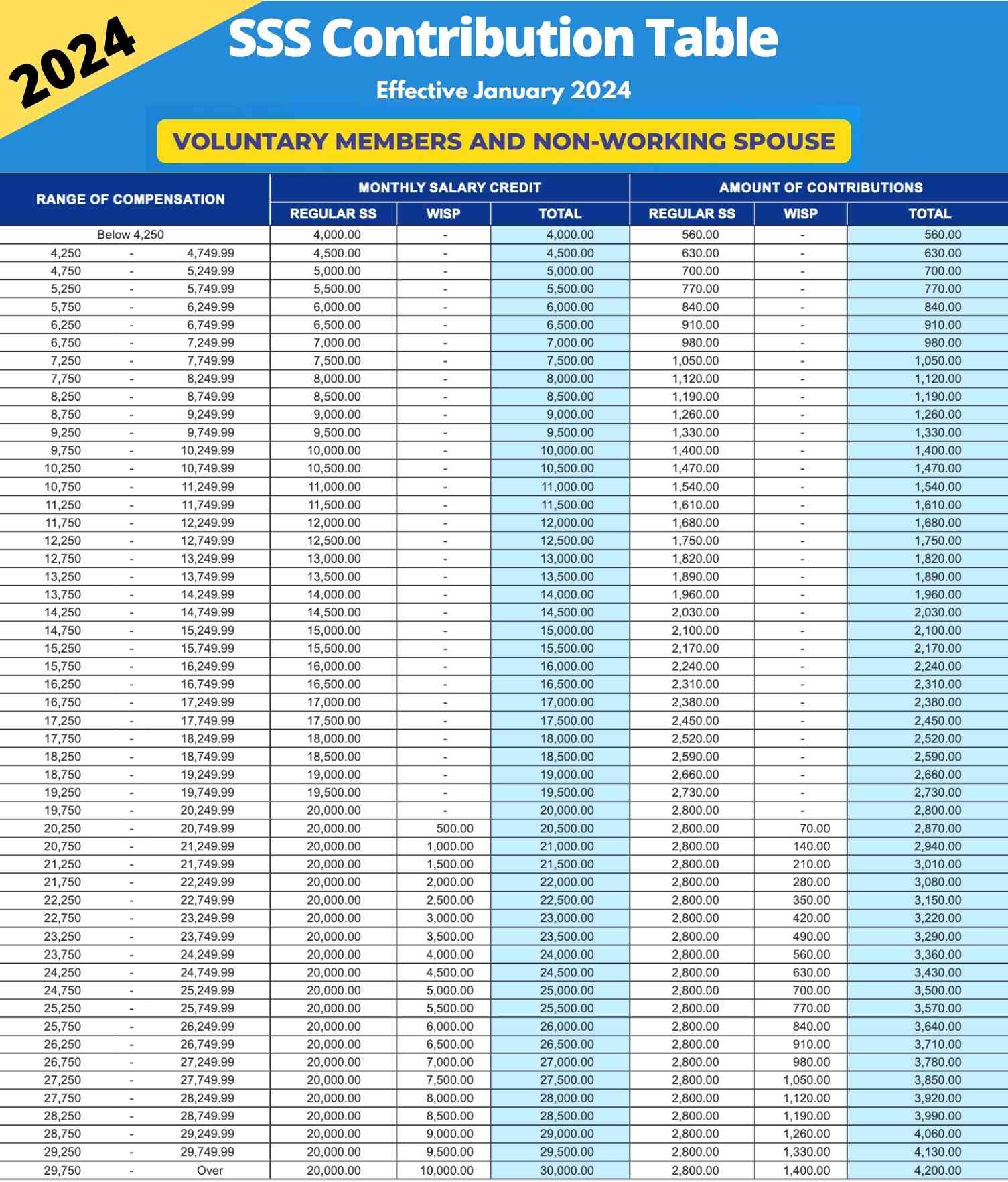

SSS Contributions Table for Voluntary Members and Non-working Spouse in 2024

If you are not an employee, you may switch into a voluntary member if you still want to resume your SSS membership. Likewise, if you are a non-working spouse and you want to retain your SSS active membership, you must follow the premiums below.

The minimum Monthly Salary Credit under this category is now P4,000.

According to SSS, the contribution of the non-working spouse shall be based on 50% of the MSC (Monthly Salary Credit) of his/her working spouse.

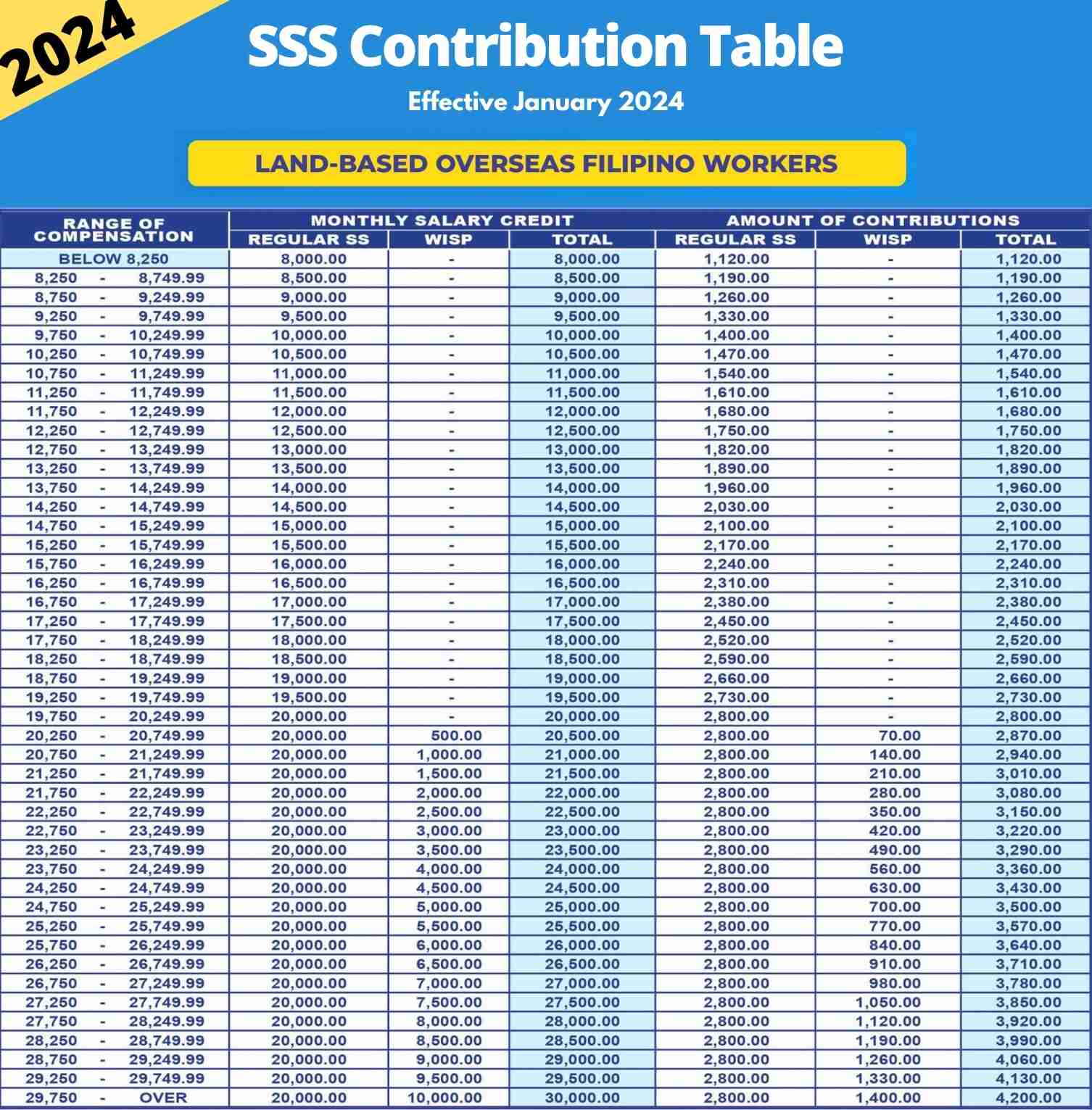

SSS Contributions Table for OFW in 2024

Land-based Overseas Filipino Workers who are members of SSS must pay their contributions following the amount below. The minimum Monthly Salary Credit for OFW member is P8,000.

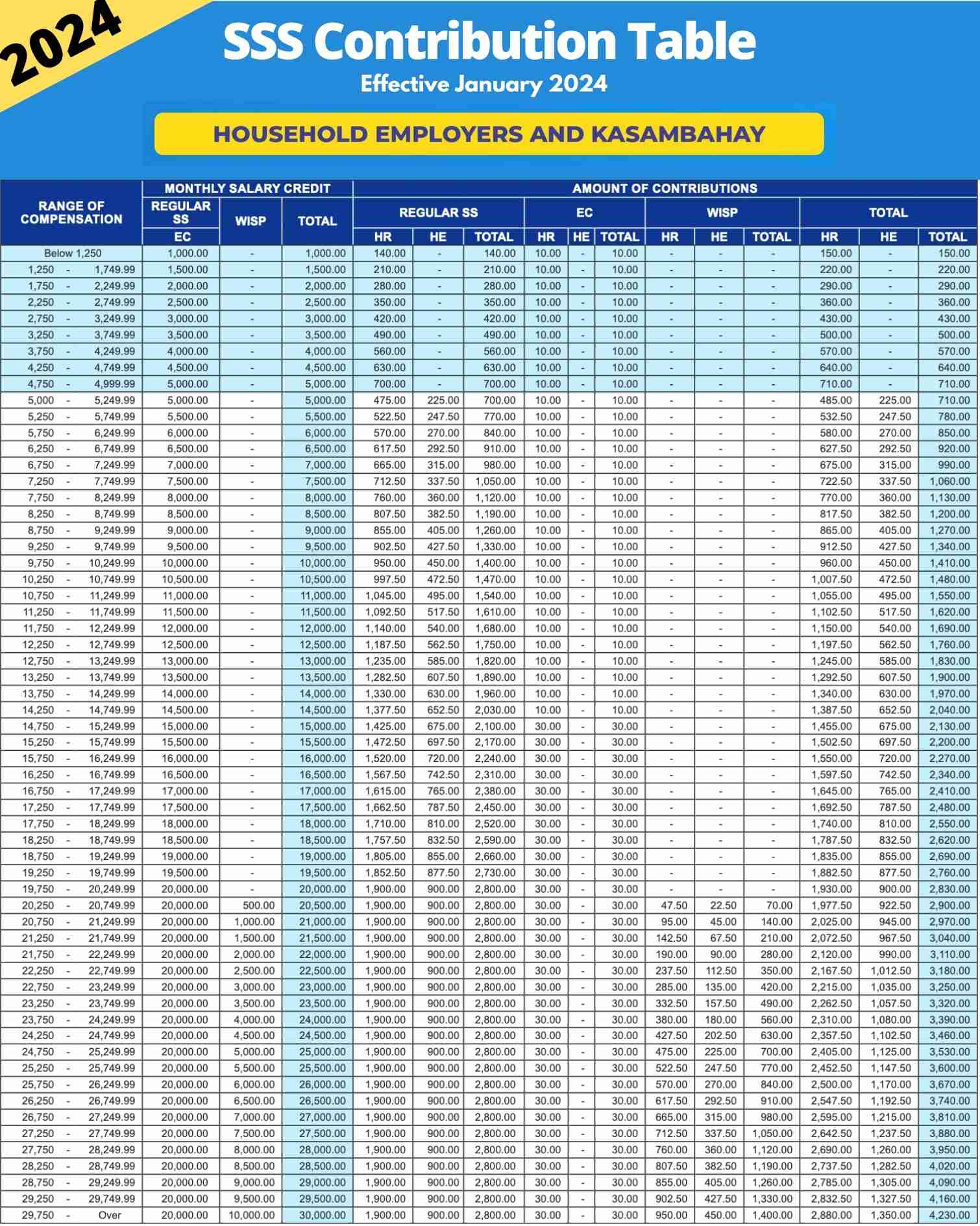

SSS Contributions Table for Household Employers and Kasambahay in 2024

Under Republic Act 10361 or the Domestic Workers Act or the Batas Kasambahay, the household employers pays the entire SSS contribution if the kasambahay earns less than P5,000 per month.

SSS Contribution Table PDF Version

If you want to download the PDF version of SSS Contribution Schedule, you may download the photos of tables above and save them as PDF on your computer or device.

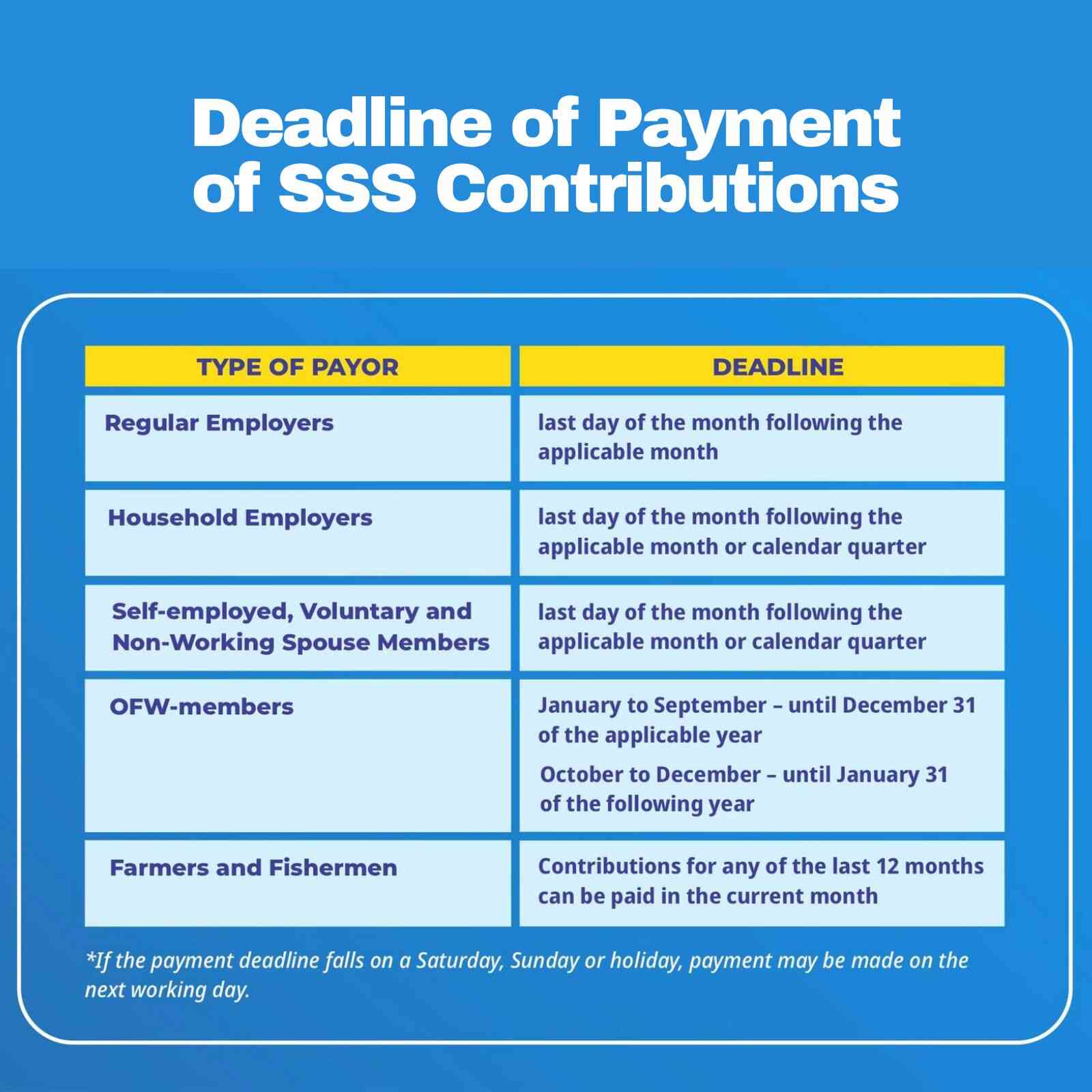

Updated Deadline for SSS Contribution Payment

The deadline for the payment of SSS contributions for regular employer is at last day of the month following the applicable month or period. The same is applied for household employers for the applicable month or quarter as the case may be. The following tables are the deadline schedule for voluntary members, self-employed individuals, OFW, non-working spouse, farmers and fishermen.

SSS FAQ:

How is SSS contribution calculated?

To compute SSS contribution for an employed person, just add Employer’s Share (ER) + Employee’s Share (EE) + WISP (if applicable). For example, if your monthly salary credit is 10,000, your employer will pay 960 (950 ER + 10 EC) and you will pay 450. A total of 1,410 is your total monthly contribution.

How can I see my SSS contribution online?

- Log in to your MySSS account

- Select Inquiry from the menu

- Choose Member Info

- Select Actual Premiums

- Check your Monthly Premiums from Past to Present

How much is the SSS contribution per month?

If you are self-employed, freelancer or professional, and you are earning 30,000 per month, under the new SSS contribution table above, you will need to pay SSS contribution of 4,230 per month including your share of mandatory provident fund. SSS also allows quarterly payment for more convenience.

Can I increase my SSS contribution?

Yes, if your salary has increased, your employer can update your monthly salary credit. The same is true with your monthly contributions. They will follow your updated salary bracket from the updated SSS contribution schedule.

Related articles:

- Philhealth Contributions Table

- Pag-ibig Contribution Table

- New Income Tax Table Philippines

- How to Pay SSS Contributions using PRN

- Complete List of SSS Benefits

Subscribe and receive the latest articles for FREE!

Accordingly, there is no significant difference on the monthly pension between 120 months or 240 months contributions. To have a bigger monthly pension compensation you should contribute the maximum monthly contribution five years before your retire.

Good day!

Just want to inquire ma’am/sir. I am an OFW now, but already had my 120+ months of contributions with SSS because I worked before with private companies. I’m not paying my SSS monthly contribution now as OFW because I heard that SSS only get the last 5 years of AVERAGE MONTHLY SALARY CREDIT. So I came up with a decision to just pay again maximum Voluntary Contribution if I reach 54 years old.

This is a good way to circumvent the AMSC. I’m paying for the contribution of my wife as self-employed. However, SSS came with a safety net that you cannot inflate once your close to the retirement age. For now you have the option to inflate the contribution by manually generating the PRN. Once you are closed to retirement, the max AMSC will not be available in the drop down list so I suggest you pay the max as early as 50.

Hi wala na pong bang way para ma monitor namin yung contributions namin online? nawala na kasi yung dating security shield na pag kinlick mo mapupunta ka sa page kung san mo pede makita ung posting ng contributions ng employer mo.

di naba pwede mag check ng sss contribution sa online page nila? nawala na kasi yung Inquiry function dun sa page ng SSS.

download ka ng application nila. Andun pa rin.

My PRN is not available since March, do you have any idea pano siya ma activate uli? coz very helpful talaga siya, paying my contribution tru bayad center is much easier. I sent email already but no response. Any idea please. Thank you

Hi 🙂 Yes, it’s easy. Just follow the steps discussed on this page: https://philpad.com/how-to-pay-sss-contributions-using-prn-generated-form/

Good day, ms fehl. ask ko lang what will i do kasi upon encoding at employee record, when i put the amount 2,400.00 ayaw tanggapin ng system. out of bracket daw. sa table naman 2,400.oo talaga ang SSS at 30.00 ang EC diba? thanks

Good day po. Nag bayad po ako contribution for VM 360 pesos at OFW 960 pesos nitong April 16, 2019 lang po ,yun po kase ang nakalagay sa PRN. before kase ang VM 330 pesos lang at OFW 550 pesos lang which is nag increase na nga pala.. then nung April 17,2019 morning naka tanggap ako ng confirmation text message galing sa SSS na posted na yung hinulog ko sa dalwang account for month of April ung 360 at 960 pesos. Ngayon po nag login ako sa portal sss para macheck kung posted na talaga un April contri.kaso nakita ko po ibang amount ung naka post hindi po accurate dun sa binayad ko at sa text confirmation sakin. ung sa VM po ay 330 pa din ang nakapost for April at yung OFW ay 880 pesos lang ang naka post. hindi ko po alam kung bakit ganon at wala po ako idea. sana po masagot nyo po yung issue ko. salamat po.

ask ko lang po ang monthly ko lang dati sa SSS bilang OfW is 550 pesos pero ngayon nagtext sakin ang SSS na ang babayaran ko for the month of april-june is 5220 pesos which is sobrang lake

I want to clarify po. My salary is 9500 monthly but yon bracket ko sa sss upon checking is 8500.

My boss deducted my share under 8500.

Ok lang ba yon?

Hi, Bea. Better to update and use 9,500 MSC (Monthly Salary Credit) sa next pay para advantage sayo 🙂

1st Formula

300 + 20% (16,000) + [ 2% (16,000) x (20yrs-10yrs)]

= 300 + 3,200 + [320 x10] = 6,700

Pension is 6,700

2nd Formula

40% × 16,000 = 6,400

Pension is 6,400

3rd Formula

less than 10 yrs = 1,000

10 yrs = 1,200

20 yrs = 2,400

Pension is 2,400

since the law grants the highest pension

you’ll get the 6,700 Pension

just divide that to how much you already paid to SSS

*remember you can also apply for lump sum ????

HELLO PO. HOW MUCH PO KAYA ANG MAGING PENSION K PAG 2400 MONTHLY ANG CONTRIBUTIONS KO, KASI VOLUNTARY MEMBER AKO IM 55 YRS OLD NOW

pano po kaya iupdate yung sa ams ccl editor? yung old contributions pa rin po kasi yung nakalagay dun e

Ano po ang dapat gawin ko sa SSS ko. Gusto ko po hulogan ulit Ang SSS ko kaso may manga anak na po ako gusto ko ilagay sila sa SSS ko. Kc noon pagkadalaga kupa Yan SSS.

Thank po

Hi, punta po kayo sa SSS office kasi kailangan nyo po update ang account nyo para ituloy ang hulog nyo and maging active na ulit ang status nyo as SSS member. Dalhin nyo din po ang birth certificates ng mga minor nyong anak para ma-add sila as dependents nyo.

Ano po pinagkaiba ng “Bilateral Labor Agreement” at “WITHOUT Bilateral Labor Agreement” para sa mga ofw?

Hi, Bilateral Labor Agreement is an agreement between the Philippines and the foreign country (where the OFW works) that aims to protect the labor rights and welfare of the OFW. To learn more about it, this post explains it well: https://news.mb.com.ph/2019/02/18/new-sss-law-to-ensure-welfare-of-ofws-upon-retirement/

Hello po. I’ve already paid my mother’s contribution for January 2019-March 2019 (still paid the old premium amount, which is from the 2018 sss table). How do I settle the underpayments?

correct me if im wrong.. ☺

since April 2019 yung start ng bagong Contributions Table…

yung payment for Jan to Mar 2019 covered pa ng old Table 2018..

dapat wala kang underpayments ????

This is helpful. Thanks! But just a tip also, if you’re using PRN (Payment Reference Number) you don’t need to manually submit R3 form to SSS. It will automatically reflect in the system once you paid and it is really hassle free.

This is really helpful. But, I want to tell you that I’ve been working as OFW for more than 10 years, from 2002 to 2018 with different employers, since then, I already a member only to find out that my employers wouldn’t pay my monthly contribution. What should I do?

you should pay your own contribution. Only locally employees are mandated to pay for their employees SSS, not foreign employers.

Hello insurance lng shoulder ng MBA foreign employers, kaw dapat pumunta sa Philippine consulate para yun sss mo transfer mo as ofw, then bayad ka sa remittance center…di shoulder ng foreign employers and sss insurance mo lng…

Good day! If nakapagcontribute na ba ang member for over 120 months contribution, qualified na siya automatically for pension when the member reached 60 years old? Thank you!

hi po mag 60 na po ako sa june 27 2019. puwde ko po ba ituloy ung hulog ko sa SSS..?

pwede po ba akong magpatuloy sa pagbayad ng sss premium ko na matagal na akong di nakapagbayad?

if an employee is earning 15,000 / month how much would be his monthly contribution as well as the employer?

Question as an employee:

Mandatory po ba na dapat merong counterpart and employer sa sss contribution ng isang employee?

Hi good eve. Just would like to clarify po just in case na ang contribution ko as voluntary member for the past 3 yrs ay nasa 550 pesos per month. I am 54 years old and turning 55 on july 27, 2019, di na po ba ako pwedeng mag maximum contribution ng P1,760 starting this march 2019? Thank you.

below 55 yrs old pwede mo mag max ng hulog…

sa July 2019 pa nman po kayo mag.55 pwede nyo po i.max yung contibution nyo po..

at dahil late ang reply ko 2400 pesos na po ang maximum as per bagong sss table ????

I am an OFW for more than 20 years and I am paying the maximum contribution of P1760 per month. Based on SSS Computation pension can be computed: as the sum of P300 plus 20 percent of the average monthly salary credit plus two percent of the average monthly salary credit for each credited year of service (CYS) in excess of ten years. My question is how could I benefit if I pay more than the minimum requirement of 120 months when all I can get is the additional 2% of average monthly salary credit for the extra years above the 10 years minimum, in may case that is only an additional P320 per month (2% of 16,000) for each year. I’m paying P1760 per month as self-employed and getting only an additional P320 per month, for one year I’m paying 12*1760=P21,120, it would take then 66 months to recover it 66*320=21,120 – for extra 10 years then, it would take 55 years to recover it. It appears that there’s not much benefit if I pay more than 10 years as self-employed. If I have an employer perhaps it’s okay. Please advise if my analysis is correct.

Hello, ilang months po ba dapat babayaran para makaavail ng maternity loan? I am planning to contribute 1760 pesos for the month April, May and June (second quarter ao) sa July 10 po ako magbabayad. Estimated Delivery date: katapusan ng October po. Makaka avail pa kaya ako ng maternity loan? if I will pay the 2nd quarter? Voluntary lang po. Badly needed your advice.

Thanks.

Puede po ako mag bayad ng advance for year 2019 ?

Hello po, for self-employed po ba. The total contribution is monthly or quarterly po ba yan?

Pano po yun pag self employed. Mali nalagay ko 10000 a month nalagay ko! Pwde pa ba yan ma bago salamat po

Gud evening po..panu po ba ako makakakuha ng sss id ? Hindi rin po ako member at regiter yet ng sss.ngayun lang po ako nagtry mag online sa sss at nag fill up po.at magkanu po ang bayayaran ko ? Para makakuha ng sss ?? mga ilang buwan po mkukuha yung sss id ?

Pa help naman po sir/mam..tks !

Makakakuha ka lng po nang ID kapag nahulogan mo na po yung sss mo. Pag nahulogan mo na po, Punta ka sa sss office para magpa-ID. Wala ka na pong babayaran. 3-4months makukuha mo na sss id o UMID mo.

hi po, sa sss ko po kasi siguro 1 month lang ang hulog, pwede ko po ba ituloy ang hulog as self employed?…

thanks… ill w8 for your reply…

yes.

Dapat sa voluntary di na lumagpas ng 500 a month lalo na sa wala work na pinaskakasya lang ang bigay ni mr.

hi sir/maam,

first loan ko nung nagwowork po ako s first company ko po for 4years. nag stop po ako magwork for about 1month wala po akong hulog that time then nahire din po ako after. now pwede na po ulit ako magsecond loan, so im expecting my maximum loan will be 30k but sa online registration po same amount lang din po yung nakalagay na pwede ko iloan which is 15k po. ano po pwede ko gawin para maging 30k po yun? or talagang 15k lng po talaga maloloan ko.. thank you so much po sa magrereply.

yung 2-month salary loan ay ma-avail lang po kpag nkapagcontribute na kayo ng total of 60 contributions or 5 yrs.

Hi po. Tanong ko lang po kung pwede pa ko makakuha kung ang babayaran ko is April-June. Duedate ko po is July pa. Counted pa po ba yun kung bigla akong manganak ng June? Thanks!

hello po, may SSS number na po ako kinuha ko pa nung 2015 pero wala po akong hulog ngayon gusto ko na po hulugan, active pa po ba yun?? tsaka makakakuha po ba ako ng UMID ?? thanks 🙂

Hello

Ask ko lang po self -employed po ako 550 po ang binabayadan ko per month so mag wowork po ako so pag binagay ko sa employer ko ung sss no. Ko automatic naba na sila na mag cocontinue nun o kailangan mag pa change status pa ako? Self employed to employed?

Thanks

Once na naipasama mo na sa employer mo. Try mo verify sa SSS if naging employed na yung status.

I have the same situation. Na wala pang hulog. They will accept the payment pero i hohold lang nila. Its either employed ka or self employed lang po. First hulog mo dapat mag fall ka sa dalawang yan.

YES STILL ACTIVE AT KAILANGAN MO MAHULUGAN PARA MAKAKUHA KA NG UMID CARD.

Hello po! Ask ko lang po, kasi ung employer namin kinakaltasan ung mga kasama ko sa trabaho pero di naman po nila hinuhulog kaya po ako di na nagpakaltas kasi di naman po nila hinuhulog. Ngayon po need nila mabayaran yung mga contributionko at yung penalty nun..ask ko lang po kung ako ba magbabayad ng penalty pata sakin kahit willing akong icontribute yung years na hindi ko pinakaltas sakanila? sakinkaya lang naman po di ako nagpakaltas kasi hindi sila maghuhulog..sana po masagot nyo po tanong ko..salamat po! God bless!

Good morning po!

I’m planning to get an SSS ID po pero wala pa po akong hulog, if mag huhulog po ba ako for at least one month (110php) pwede na po kaya akong ma releasan ng ID?

Thank you po.

Nope, kelangan yung unang hulog mo galing either sa employer or self employed ka.

According to sss hindi sila mag bbgay ng UMID or SSS ID if wala kang hulog under employed or self employed status. I hohold lang nila contribution mu.

hi po,

pwede ko bang dagdagan ang contribution ko bali 2 step forward po ako, instead 935 ang contribution ko last year po 2018 then e upgrade ko ang contribution ko to 1045. pwede ba yon?

Medyo same question din po sana itanong ko kung paano po gagawin if gusto iupgrade na yung contribution from 770 to maximum 1,760. Pwede po ba ito or kailangan 1 step forward lang yearly? Tnx for ur reply.

Ask ko lang, anong kaso ang pwede ireklamo sa employer pag may kaltas sa

BASIC SALARY PER DAY

5.00/minute ang late

50.00 pag nakalimutan mag in/out (morning & afternoon)

25.00 pag walang in/out sa lunch

for example:

basic salary 400.00

nalate ng 5mins 5 x 5.00 = 25.00

ang basic salary mo that day ay 375.00

so computation ng 13th month , apektado.

sa computation ng sss kc

kasi di ba magbebase ang computation ng 13th at sss contribution?

please help, thank you

Regarding your complain. Try mo sa national labor relations commission provided with your proof.

deductions specifically tardiness, failure to log in and out is based on the companies handbook/employees code of discipline.Deductions are legal bsta nakalagay sa payslip except sa mga tulong like birthdays,member of the family na namatay or others but not related by laws.Yes apektado yan kasi diyan ng base sa gross compensation.

Good day. Pinachange ko po sss ko from employed to self employed. Tapos 550 daw po yung contribution ko. Dapat po bamg exact 550 ihuhulog ko? Saka sabi mo 3 weeks from now pa daw ako dapat maghulog. Di po ba pwedeng 1 week from now na po? Need ko po kasi ng umid. Thanks.

Papaano ka po nag palit into self employed? May business ka po ba? Lucky, for some na nakuha nila i.d nila ng 2 weeks. Normally, mga bound to taiwan lang nakakakuha ng UMID ID ng mabilis.

Hello po.. Un mother ko po kc 62 na ds year peru kulang p un contribution ng 25 monts pude po byarn n lng un remaining pra po mka pension n xa..kng sakali po mgpension mgkno po mtatanggp nia 440 / mon n binbyrn nia po.. Thanks in advance s sagot po

Good day!

Naghulog po ako sa SSS 1 year and 8 Months. Tapos natigil po ang paghulog ko (6 moths) dahil naglipat ako ng trabaho. Ano po ba ang maging solusyon o tamang gagawin ko para maipatuloy ko po ang monthly payment ko? Pakireply po. Maraming Salamat.

if you are still working in a company still ipag paptuloy with the counterpart from the employer pero pag may sariling business ka ipag papatuloy din po but yong stataus mo is self employed.

hi po

ang tatay ko ay 58 yrs old na wala na pong work since 2011 gusto namin na hulugan ulit ung sss nya para mka receive sya ng benefits kahit paano pag abot nya ng 60 yrs old. Di ko lang alam kung ilang taon na sya si nakakahulog dahli kailangn muna daw nyang bayaran ang kanyan loan 5k sa sss last 2005 na umabot na ng 18k sa interest.

ano po kaya pwedi nyang gawin at hangang anu edad po ba pwedeng maghulog sa sss.?

HELLO PO PWEDE NYO PO ITULOY YUNG CONTRIBUTION NG TATAY NYO,TAPOS PO UNG LOAN NYA BEFORE I FILE NYO PO NG CONDONATION PARA PO MABAWASAN INT. AT PENALTY

AT PWEDE RIN PONG HULUGAN YUN DEPENDE PO SA INYO KUNG HOW MANY YEARS.

Pwede po ba na pg mghulog ako ng contrubution ko uli ngaung April ilgay ko ung bgo na adress sa form na fill upon ko pg mgbyad ng contribution,pwede b un bgo adress kc lumipat ako tirahan pro ung nklgay na adress sa umid ko ung adress ng tirahan ko dti ..pro di ko na un oa change kc bka mmya mgmove nnman ako uli…at may itnung ako uli pnu kng ung member sa ibang bansa na titira at di na maconntinue ung hulog ko contribution wla b mttanggap na pension pg tanda….?hehehe

may nabilataan po kami na okay lang naman na minimum lang ang monthly contribution at mag-max na lang 10 years before retirement kasi same lang naman daw ang matatanggap kapag nagretire na. totoo po ba yun?

Normally, yung last 5years ng hulog mo or 60months ng contribution mo yung i cacount nila depende sa laki ng hulog mu.

magandang gabi! tanung ko lang if what if gusto ko mag voluntary contribution, susundin ko pa din ba rubrics ng self employed? kasi if ever ang babayaran ko is 1700+ pero ang gusto ko lang is somewhere between 600-800 .tapos ilan kaya ang minimum contribytion para ma consider as pentioner after 60? salamat po sa mga sasagot

you will then be categorized as voluntary member where the minimum contribution is 110 based on the table above. but this will determine the amount of your pension. u have to be wise. if you want to just pay the 120 contribution eligible for pension when you turn 60, then i suggest you should pay the maximum contribution for the last 60 months.

Sir/madam,

Tanong ko lng po kung anu ang requirements para po mkakuha ng maternity.

RE: Voluntary Contributions

How much is the minimum payment accepted?

Voluntary contributions po how much the monthly contribution salamat po

Based from the table above the minimum contribution is 110 .

Bakit po kaya nung nagtanong ako sa SSS branch kung anong minimum na contribution for voluntary members, ang sabi nung isang staff, P330. Pwede naman pala 110.

330 Na po ang mimimum contribution.

Good am po ask ko po kung may katotohanan n ok lng di mag pakita sa sss bgo mg bdy .. Pag 80+ nalang daw po ulit saka mag papakita totoo po ba tnx

Ask ko lang po. Nung first quarter ng 2019, 330/month lang po ang premium ko. Since magtataas na po this Aril 2019, magkano na po kaya ang premium ko per month? Salamat

Sir if ever na i will continue my contribution to self employed from private com. My last contri is last pang 89 months contribution..then i will pay my contribution from jan to june 2019..w/ minimum 330 contribution how much if ever i want to avail for a loan?thanks..

hello po….SSS member po ako way back Dec 2010 ata or 2011 until Feb. 2013…tapos po ngstop po ako……I already have my ID…tanong ko lang po kung yung contribution ko po for those years ay nandoon pa ba kahit di ako formally ng follow up for stopping my contribution…tapos,,,yung SSS ID natin pwede po ba yung gamitin as an ATM gaya po ng mga nasa GSIS na pwede pong icheck at iwithraw yung laman ng GSIS fund nila…and if yes, how po?

Below is from the SSS FAQ:

“Can a member withdraw membership with the SSS?

No. When a person registers and is covered for SSS membership, he/she becomes a member for life.

Even during such time that the member fails to remit contributions, the benefits and loan privileges provided by SSS can still be availed of, as long as the member meets the qualifying conditions for entitlement thereto. “

Hi po. I’m planning na hulugan yung SSS ng parents ko. 54 years old na sila and hindi pa sila SSS member. Pwede pa po ba sila mag member sa SSS and ma-qualify for retirement benefits? Possible din po ba na hulugan yung 4 years nila since 54 na sila ngayon para at their age 60, may makukuha na silang pension?

Thanks po in advance.

Hi!

It’s a noble thing to pay for your parents’ sss for their retirement. However, in order for a retiree to be qualified for benefits, they need to pay at least 120 months of contribution.

Thank you.

Hi there.

Is it possible to pay SSS contribution for 6 months or a full year?

If yes, is it possible to pay over at SM Business Centers?

I hope somebody can answer.

Thanks heaps.

Gusto ko lang malaman magkano kaya makukuha ko sa maternity ko 1 month lang ako naka work at nacontribute ko lahat 4 months lng . Anyone there who knows.

In order for you to be eligible for the maternity reimbursement, you need to have at least 3 monthly contribution within twelve months before the semester of your delivery.

For normal delivery it is P 11,000 and P 15,000 for Csection.

You may ask for more assistance to your HR.

Thanks

No you can no longer pay for the missed quarter nor do an advance payment.

Thanks

Self-employed and voluntary members may pay their monthly contributions prospectively or in advance, but never retroactively to cover month/s when no contribution payments were remitted.

Yes, you can pay at SM Business Centers.

Hi SSS,

Pano pag ang employer ko gusto nalang po nilang irefund ang mga MANDATORY benefits na kinaltas samin, For 3yrs. and 5months employed at their company. Since Sept. 2013 – Feb. 2017 po, 1 year lang ang naremit nila sakin Jan. 2104-Dec. 2014 lang, and worst hindi pa nila sinama ang Sept. 2013-Dec. 2013 ko. I have a copy of my contract and payslip spreadsheet, so pwede ko pa pong ihabol na mabayan ang 3months ko right ?

Then, the remaining years po ay hindi ako papayag na irefund lang nila yun, i want them to settle my sss contri. anong pwede kong gawin para po maupdate nila agad ang contri. namin ?..

Thanks,

Cess

Hi! Hello po ask lang po nacheck ko contribution ko sa SSS online, then may missed na isang buwan na ka zero, sa Table ng contribution ko, may proof po ako ng payslip na tinago ko pa at may kaltas sila. Resign na po kasi ako, sa dati kong employer, kaya now ko lang check yung contribution. Paano po ang gagawin. thanks ng marami.

Hii. I need help po regarding dito sa pagssave ng employee record. I’m having a hars time to save because when i fill out the form, laging sinasabi out of bracket po. Is anyone experience this kind of problem? Tama naman po lahat pero out of bracket padin po 🙁 please help

pwede nio habaulin yun mam para maibalik yung nahulog nio.. kausapin nio previous employer nio po. para mainform sila at para malaman nio kung san may mistake sa employer ba o sa sss..

hello po good day po!pwede po ba na magself employed oh ako nalang po maghulog ng sss ko at ilan po hulog bago po makakuha ng umid id

isa po aqng teacher, na hired po aq nung july kea start po ng contribution q sa sss is july kc every kinsenas kinakaltasan na po kmi, nanganak po aq nung september 20, subalit di po aq naka pag pasa ng notification form for maternity benefits kc po 1st tym q at wala naman pong nakapagsabi na may bagong guidelines na po pla sa sss na at least 3 months, un na avail q po ung 3 months contribution pro di q naereport pro alam naman po nila sa skul na buntis po aq paano po kaya un??? thankyou

Ofw ako. Mtgl akong hnd nkpg bayad ng sss. 3 years den. Tpos nung ntpos kontrata ko, hnd ako nagtrabho for 1 year. Ngayong nsa abroad n uli ako, gus2 kong mlaman kung magkno bbyaran ko kung magsisimula akong magbayad ngayon. Tska may penalty b kong makukuha for not paying my sss on time? Thank you sa sasagot.

Hello! Kaka punta ko lang philippine consulate… no penalty.. just inquire and pay anytime.. no hasle and very convenient.. just go there.. 2nd floor ng philippine consulate general.. inquire there..

kung mag voluntary member ako after contributing 122 contribution, as self employed meron bang amount for self employed?

Hi poh..ask ko lng poh kng 24months ung contribution ko sa sss as employed up to february 2014 lng…nahinto na poh ako maghulog kz ndi na ako nag wowork tapos poh nung january 2017 nagstart ako maghulog as voluntary 330 poh monthly contribution ko…tapos nabuntis ako nung february actually poh nakapanganak na ako nung oct.22 magkano poh kaya mkukuha ko na maternity benefits…salamat poh

Ma’am pano po magkaroon ng sss kase po pag nag ponta ako sa sss .sabihan lang po nila ako ng mag online lang daw ako ..pro diko po kase alsm pano gagawin… tankz po

Hello, tanong ko lang po.. Kasi matagal ko na po hindi nahulugan yung sss ko, last hulog ko pa po is nung 2012.. Makakakuha po kaya ko ng maternity benifets kung huhulugan ko po sya ngaun, buntis po kasi ako 1month na

hi grace mukhang hindi po kayo pasok doon s maternity benefits kc po hindi kayo active sa loob ng 18 months pabalik bago kayo mag buntis.

Good day!

My wife is self-employed before but she’s now an OFW . She’s been contributing the minimum amount of Php550/ month. She would like to increase it at least double. How should we go about it.

Please reply. Thank you.

Ask ko lang this DEC 2016 nahulugan ako ng employer ko 1 month sya lang and this year preggy ako pede ko ba hulugan voluntary para maka pag file ako ng maternity at maliit lang kc kinikita ko OK. Lang ba 330 per month lang sa quarterly.. Thanks sa sasagot

Hi ask ko lang po binayadan kopo sss contribution para sa month ng april, may and june thru gcash pero ang nailagay ko lang sa covered month ay june pero ang amount na binayad ko equivalent sa 3 months. Sa june lang po ba lahat yun mapupunta? Maililipat kopo ba yun sa april at may?

Hello Ma’am, Good day.Paaano po ba ma input ang latest ss contribution sa R3 file.?

kasi itong latest ss contribution may additional na 11%.

so for example 495 x11%= 54.54 + 495= 549.45 yan ang nilagay ko sa SS Amount

kaso pag e click mo ang update

sa right side na MESSAGE May nakalagay na Invalid amount of ss contribution.

amount is out of the bracket.correct the error and try again.

Pwede ko po bang malaman magkano ang contribution ng OFW in one year?

Ms. Jackie,

OFW sample computation of contribution per year

At minimum salary credit, PhP 550 x 12 months = PhP 6,600.00 in a year.

At maximum salary credit, PhP 1,760.00 x 12 months = PhP 21,120.00

Hello po. Ask ko lang. Kasi dati kmuha ako sss. So meron na akong E1. Problem is never ko pa nahulugan un kahit isang beses. Hnggng sa nawala ko pa e1. Though alam ko na kung pano mkakakuha ng kopya ng e1 ko. Ang question ko ngaun eh. Magkano ba pwede ko ihulog sa sss? Self employed po ako.

IF:

MONTHLY (magkano)

QUARTERLY (magkano)

ANNUAL (magkano)

Thanks po sa sasagot.

Good day po. Depende po sa declared income niyo. Tapos tignan niyo po sa bracket. Halimbawa po 5000 = 550 po ang monthly niyo. Hnd po ako taga sss pero nagbabayad din po as self employed.

tanong ko lng po pano po un naghulog po ako ng sss voluntary 330 per month for 6 month tapos tinanong ko po kung magkano ang maloloan ko sabi nila 3k lng pano po un previous n hulog ko sa SSS for almost 7year wala nmn po ako utang? pati po un sa asawa ko na almost 17years na naghulog sa SSS ngvoluntary din po cya ganun din sa akin 3k lng ang mololoan? bale wala lng un previos n hulog?

bakit invalid po sa er3 ang 7,250 -7,750 na bracket?

8,250 – 8,750 po pala.

Hi sa may mga nakakaalam po sana masagot po yung tanung ko ..

Last year Feb . 2016 nagstart ako magwork tapos na endo po ako july so nagaapply po ulit ako at nakpasok ng september untill feb. 2017 tapos nalaman ko pang buntis ako nung feb., yung calculation po ba ng makukuha kong maternity benifits simula feb 2016 to feb 2017 tuloy tuloy po ba yun ? ok lang po ba kahit may isa o dalawNg bwN di ako nhulugan , tuloy parin po ba calculation nun para sa maternity ko ?

Hi Fehl

I have a question;

I am an OFW and i know that the minimum contribution for us is like 5400 yearly. can I pay more than this let say 20K. and can i still pay contribution even its more than 120 months?

Thanks

Yes, follow the latest contribution table for OFW listed above.

If you are an OFW, upon reaching the age of 50, please make sure to start increasing your premium annually and you should be paying the maximum premium upon reaching 55 years of age.

Calculation of pension is based on the last 5 years contributions. Other years bear a minimal effect whether you pay the minimum or the maximum, both have the same effect, otherwise a small difference only.

So this means that it is better to pay from minimum and amd increase it yearly and pay maximum for the last five years rather than paying maximum from the very beginning? Is this a witty step doc?Because if it is a smart way then I will do that step because I am planning to start my SSS this year.. Thank you

Hi Ms. Fehl,

Thank you for the updates,

I’m an OFW it seems that there is no change on our contribution, currently I’m paying the maximum.

I have a question. I only have less than 10 months to complete my 120 months required contribution to received a pension when I retire. .

After it I’m planning to pay 1 time each quarter this means that I will only pay 4 times in a year, to insure that my account will be active.

Do you think this is fine ?

By the way the reason that I’m going to do it because I’m going to use the money to invest with other investment.

thank you,

Regards,

jerry

can i ask for a copy of SSS Program R3 please po? thanks

Hi bakit kaya yung company namen since nagumpisa yung february kada sahod may kaltas ng SSS? Same amount padin sya ng isang buwanang kaltas. For example before nakakaltasan ako ng Php490.50 sa isang buwan. Ngayon kada kinsenas 490.50 padin. So sa isang buwan Php981.00 ang kaltas. Still waiting sa Feb and March na mapost sya online. Medyo lito na kami ng mga kasama ko bakit ganun ang kaltasan nila.

Siguro po hinati nila sa 15-30 ang kaltas nyo para hindi mukhang mabigat. Nung employed pa po ako, 1320 ang kaltas nila sakin per month. so yung P981 po ay normal. 🙂

My opinion, mukhang doble na po yung kaltas sa inyo. Ang maximum na monthly contribution ng employee is 581.30.

Kung nasa 13500 yung monthly salary nyo, 490.50 ang kaltas kada buwan. So kung hahatiin yun sa dalawang kinsenas, dapat ay 245.25 lang po.

Magandang tanungin nyo po yung HR nyo, dahil baka nga nagkamali lang sila.

Everify mo sa sss kong magkano bracket mo. Itago mo ang pay slip.

Hi. tanong ko lang pwede bang magbayad ng voluntary sss contribution na pang buong taon or kahit 2 quarters agad? Thank you.

pwede po

Makakakuha pa po ba ng pension yung age na 59 years old if ever magapply palang ngayun ng SSS Self employed.? Magkano po kaya ang babayaran na contributions para makapagavail ng pension. Thanks.

Ms. Cherry,

Yes but after completion ng 120 contributions. Please refer sa table sa para sa contribution per month. Minimum premiums means minimum pension per month.

Hi. Employer po ako ng isang business. Pede ko pa kaya mabayaran yung contribution ng mga employees ko from last year 2016? Thanks in advance.

Hindi na po, Sir. Ang pwede niyo nalang pong bayaran ay ang current month onwards, Sir.

Ma’am/Sir, How many times na pwede mka avail ng Condonation Payment?

Is the given table a MONTHLY or YEARLY CONTRIBUTION? Thank you.

monthly

Hello. Ask ko lang po matagal ng hindi nahulugan ang sss ng papa ko. Last october namatay siya possible ba may matanggap pa din siya kahit hindi updated yung contribution? Thank you

possible po na may makuha kayong burial and death claim. ganyan din po case ng kay papa

Opo. As long as may contribution even one month lng pwde n mkaclaim ng funeral benefit amounting to 20K and death benefit of 12K. Process lng po kyo ng papers nyo to the nearest sss branch

good day,

mag tatanong lang po sana ako kong pano po yong bagong payment online po. di ko po kasi alam kong pano yong online payment po paturo po sana ako kahit pa type nalang po step by step po para di na po ako pupunta sa sss po.

salamat,

Good day SSS,

May latest contribution list na rin ba ang SSS for this year 2017? or still the same 1760 is the high.

Thank SSS

CETO

As mentioned above, same contribution table padin and gamit for 2017

Hello po, ma Tagal na pod ako Hindi nagbayad ng sss ko kasi unemployed na for 5 years. Tanong ko lang po, pwedi kaya magbayad ako as voluntary para maka avail ng maternity benefit. Buntis po kasi ako 1 month na. Salamat po.

Ma’am Marife, opo pwede kayo mag bayad muli ng SSS nyo, pls visit sa nearest SSS branch po para makapag start kayo mag hulog and at the same time mag declare na buntis kayo para ma-avail nyo maternity benefit. Na stop din ako mag hulog ng contribution from April 2005 to Aug 2015, pero simula Sept 2015 nag start ulit ako mag hulog then tuloy-tuloy pa din till now. Thank you

Hi Janice, tanong ko lang kung ilang month ba dpat ang hulog bago maka avail ng maternity? 2 months po kase akong preggy tapos ngayon palang po ako mag sstart ng hulog, makaka avail paba ko? Thanks

Makaka kuha ka pa din basta may anim na hulog ka makakakuha ka ng maternity yun kasi ang ginawa ng friend ko nung buntis xa

Hi, May I know if where to deduct the benefits such as SSS. Is it on the entire salary or the base salary only? Thank you.

Base salary per month

Good day!

May questions po ako re sa unpaid salary loan ko. Niloan ko po sya nung 2011 pa, 10k po less interedt in advance na nasa 500 pesos po yata. Then on, wala pa po ako nagagawang payment kahit isa. Gusto ko pong malaman kung magkano na po yun ngayon kasi gusto ko na po syang bayaran at the same time gusto ko rin magvoluntary member. Freelance online job na lng po kasi ang work ko ngayon. May dapat po ba kong gawin para maging voluntary member at pano ko masesettle yung loan ko?

Pay your overdue loan now dahil may condonation ang SSS, if you pay now until April 2017 wala kang babayarang penalty only the principal amount and the interest. Just visit any SSS office it can be explained to you better.

punta k po ss… apply ka condonation… bigyan ka nila terms for your loan balance.. sayang kasi baka lumaki pa masyado.. hanggang end ata ng feb ung condonation program nila.

ask ko lang mam…. pwede ba ako mag hulog nang sss bilang self employed kung ang trabaho ko ay isang kargador? salamat

Pwedeng pwede Bro kahit anong uri ng trabaho basta marangal at naaayon sa batas.

Panu po mam pag ung sss ko eh ang ng file po jolibe compny then suddenly d aq nka isang bwan non..kc bakasyon po un at d nahulugan sss ko…kc po nag aral po ulit ako nun…pwede po bang aq nlang maghulog ng sarili kong sss..pero anu kukunin kong form pag magbbyad ako..at magkanu po payments..kumbaga i convert q xa sa self employed po…

hi, yes you can update as voluntary member. Punta ka lang ng SSS and update your account as voluntary member

Hi ask ko lng po ung sss ko last 2016 ko nbayaran minimum lng now nkabalik uli ako s abroad pwd ko b abyran cya ng maximum amount

HI, I would like to file a salary loan. However,in my online account the contribution is still not yet updated. Can I show the certification with receipt number to SSS to prove that I have contibution and it’s updated for me to file a loan?

Hello Madam,

OFW po ako, year 2015 po ang hulog ko is 880 pesos tapos po nung 2016 ginawa kong 990. Mam ok lang po ba yung ganun na dinagdagan ko hulog ganung di ko po inapdate ang account ko SSS Office dahil nasa ibang bansa ako?

ok lang kahit magkano hulog mo up to maximum 1760/month. pwede ka maghulog anytime tulad ko naghuulog lang ako tuwing December every year P21,120.

Hello! Is there any difference between 2017 and previous SSS contribution table?

naka 36months na po ako maghulog and ung total amount po at 19,549.00 pesos, magkano po makukuha ko kpg nag-apply ako ng salary loan?

Is a law or amendment to the law required to be passed in Congress before SSS contributions can be increased or raised?

Hi po, ask ko lang po.. 32 months pa lang po ako nakapagbayad sa sss, gusto ko sana magloan, pwede ko po ba advance yung 4 months na bayad ko to avail salary loan?

Is the range of compensation after taxes or before taxes? thanks 🙂

before taxes

Hi,

I currently have an outstanding salary loan balance, can my contribution be used to pay for this balance?

Thank you,

Michael

Hindi po pwede. Our contribution is the basis of our membership, loans, benefits, etc. You should pay your loan thru salary deduction via your employer or kung hindi ka employed sa bangko. Ako sa bangko ako bumayad kasi naging government employee na ako.

I am 59 yrs old and already completed the 120 months required contributions,can I still continue my contributions or pay let say portion of the previous yrs that I stop my payment before my retirement 10 months from now?

Yes, you can continue your contribution till you reach 65 years old.

it is mandatory retirement when you reach 65 years old.

can i ask for the updates on SSS this 2016?

mam ask q lng poh self employed poh aq,last payment q poh is august..panuh poh kya un..wat month aq mgsstart ng payment.tnx

Pls visit the nearest SSS office po sa lugar nyo to verify if pwede nyo pa mabayaran from Sept till date.

So far kasi as OFW/self employed, ung contribution till Sept, deadline ng bayad is every 31st December and from Oct to Dec, deadline is 31st Jan.

Hi,

Question po – my mom originally registered as self employed and is paying P330. Pde po ba sya mag upgrade ng babayaran monthly or need pa magpa update sa SSS?

Thanks

You need to make an update at SSS before you pay a new bracket

Hi. Do you know about the other SSS bayad centers such as Savemore service center? I tried to pay my mother’s voluntary contribution of PHP 1,760 but the teller said it was an invalid amount. Tried to pay it at another bayad center same thing. It resulted in me missing the deadline October 20. I don’t have the time to go to SSS and I checked the contribution table so I’m wondering why the amount is invalid.

1,760 is a valid amount for Voluntary and Self-employed. Perhaps your mom’s record is not updated? To find out the real problem, I suggest she check out her SSS record or update her account at the SSS office

Hi mam,

How many years should I pay 1,760 monthly in order to have benefits afterwards? Thank you.

Hi,I am paying my sss contribution since 1988.I am 57 yrs old now and I plan to retire at my age of 60.My monthly contribution is 1,790.How much is my sss pension at the age of 60?

You can have tentative computation by checking your account at SSS. They need to see your whole records

My name is Diana. when checked on SSS online, it does say this, ” Application ineligible for the following reason/s:

* Loan balance is greater than 50% of the total Principal. Outstanding Loan balance : 16,271.05 should be less than or equal to 15,500.00″.

Now my employer said that they had already filed in my contributions for the month of July 2016, just this August 10, 2016. Is it possible that my loan balance is already less than or equal to 15, 500.00?

Please help. Thank you, much.

Hi, the only way to know is to check your account at SSS and print it to reconcile with your employer

maam panu po makukuha yung sss.static info? kasi po kinukuha samin yun kung nahuhulogan po??

hello po! ask ko lng 2014 p po last paymnt ko s sss, ngaun po gus2 ko sna ulit ituloy this year pgbbyad. paano po un? bbyran ko po b ung lapses or start ulit ng panibago? pwede rn po b byaran thru remittance? kz ofw po ako. i will be glad to accept reply from u. Thanks.

Tanong ko kang po kung ilang monthly contribution bago ka magkaroon ng pension?

Resume mo lang to pay the present months. Go to SSS muna to update your status and your account

Hello Maam Fehl, ask ko lang po how to compute for pension kung unemployed ung member. Say they’re paying 550 monthly, san ibbase ung monthly salary credit nila na gagamitin for computation if wala silang work?

2002 pa ako kumuha ng SS number and hindi ko nahulugan then nag work ako around 2013 and gave my ss number to work. tanong lang po need ko bang ipa activate yung number ko since nakaltasan na ako or automatic na maactivate yung account ko? ngayon ko lang kasi naisip kung hindi activated ang account ko at nakakaltasan ako e sayang naman.

Update your SSS account according to your new status right now (employed or voluntary member) and pay your contributions

hi poh,

ng aaply ako ng SSS q nong march 2016 till now d poh pah nahulugan. Plano q pong mghulug ngaun july 20. What month q poh pedeng hulugan

salamat

Hi. ngsubmit ako online registration. ngkamali ako ng pagsulat ng monthly income. gsto ko sana mapalitan kase instead of 4digits, ang naisulat ko is 5digits as income. pano ko po kaya mapapalitan un? salamat po.

Can an employee, who has been contributing maximum, has move to a new employer continue paying maximum contribution with his new job even his new salary does not meet the range for maximum contribution? What if he shoulders the difference?

How about a voluntary contributor who has been paying maximum suddenly secures a job but with a lower salary still continue to contribute maximum even he shoulders it?

good afternoon! nag apply po ako ng loan sa sss..may check number na akong nakikita sa online ko. tanong ko lng po kung keilan darating sa akin ung check? or pwedeng for pick up nalang sa branch..thanks you 🙂

Hi,pano po ma activate again ang account ko sa MY.SSS?

hi maam/sir, naka loan po ako sa sss ko po nong July 2014 tpos kinaltasan po ako sa sahod ko from August to june 2015 pero ang naremmit lng po sa sss loan ko po ay 6 months lng kinaltas nila sa akin po every month 438.38 yong 5months po na kinaltas sa akin ay hndi po nila na remmit sa sss loan po… anu po ba ang dapat kong gawin po kasi wala na ako sa agency ko ngayon po… please tulungan nyo po ako kong anu ang dapat ko pong gawin sa sss loan ko po

maam ask ko lan if nakapag contribute na ko ng 1040 pesos monthly for 10 years parehas lan ba yung makukuha ko pag nag 60 ako kung 1040 pesos monthly ang na contribute ko for 20 years?

Hello po!

Ask ko lng po about sa sss online contribution ko po, hindi po kc updated. Hanggang December 2015 lang po yung nandito sa system online. So nandito parin po ako sa company until now . The question is Sino po yung hindi updated? yung sss online po ba? o Yung employer?

same experience explanation ng accounting namain hindi daw sila updated ang window explorer nila to IE version 11 kaya hindi daw po naaupdate yung hulog namin sa online..mmmm

Hi po, Question ko lang po kung magkanong amount po ang makukuha ko for my first time loan. my monthly contribution with my company is 1760. Thank you

3 years exact po ang contribution ko.

It will be equivalent to your 1month salary

Hi!, po, eligible po ba ang retired dual citizen sa benefit, I became a member from 1987-91, tapus po hindi na naka hulog, puede ba continue?

Thanks po

Question, if the bank failed to remit the monthly contribution due to system error on their part and past the cut off date and I know retropayment is not allowed. What can a member do? Should the bank be held liable for making a missed payment for that month? If the bank send a report to SSS, will SSS honor and fill in the missed month? How would that affect the computation of all benefits? I never missed a contribution month until recently. Can SSS shed light on how a gap on contribution affect the pension and other benefits? I appreaciate if there’s a link or any information online. I think other members may experience same situation. Please reply.

panu po ba yung mali kasi yung middle initial na pinasa ko sa sss ko. ee gusto ko na pong ipabago yun. anu po kaya yung requirement para po pag punta ko dun dala ko na po yun. tska bakit po ganun ang hirap makaregisted dun sa online niu para makita yung inquiry. paki ayos naman po salamat much !

goodday 🙂

You need to submit NSO Birth Certificate to support your request and valid IDs, prepare also photocopies of them

hi, ask lang po namin if pwede po bayaran yong mga previous months na hindi nahulugan? my sister is an ofw since 2013 at namiss namin bayaran ang 2015 nya na contribution. thanks

We can only pay the previous month, present month and the following months

BUNTIS AKO. LAST PAYMENT KO PO SA SSS YEAR 2013 OF DECEMBER. GUSTO IPAGPATULOY PARA SA PANGANGANAK. 2 MOS. AKO BUNTIS NGAYON THIS MY FIRST BABY SOON. SELF EMPLOYED PO AKO HOW MUCH COST THAT I PAY? PARA MAKA AVAIL AKO SA MATERNITY BENEFITS. (PLEASE DO NOT SHOW MY EMAIL ADD.)

You must have paid at least 3 monthly contributions within the 12-month period immediately preceding the semester of her childbirth or miscarriage

ask q lang po . june 8 po ang expected delivery q .. nagpunta po aq ng sss last feb29’16 .. pero ndi po nila inaprove un file q ng m1 kc dpat dw my hulog ung june 2014 ko .. ang start po kc ng hulog q is june 2015 up yo jan.2016 .. nagresign n pp aq sa trabaho etong feb .. mgvvoluntary nman po aq after q mgresign .. pero sbi ndi dw po abot .. ilang months pu b tlga ang requirements pra mksma sa maternity benifit ?

plan ko mag apply ng salary loan, pero kulang pa ko ng 6 months contribution to avail it. can I make advance payment for 6 months para makapag loan agad ako? Thanks, pls response

hello po. ilang araw ang dapat hintayin para makapag apply ng UMID ID. kakahulog ko lang po as self-employed. Bago lang po.

hello po. Never pa po akong nakakabayad ng SS first time ko mag bayad ng contribution as a self-employed. Tanong ko lng sa branch po ba ako maghuhulog? may kailangan pa ba akong i-submit meron na akong ss number. salamat po.

Update your account and pay at the branch near you

Tanong ko lang po mam, ung mother ko gusto may apply for sss..

she’s 54 now and baka daw hanggang 60 yrs old lang nya mahulugan.. so it means 5-6 yrs lang ang contribution..pwede po ba un?

hindi ko kasi sya beneficiary since hindi pa sya senior.. and nastop din ang contribution ko for awhile. Thanks!

Hi mam! Good day! Ask ko lang po about sa benefit n makukuha ng dad ko my dad died 9 yrs ago and he is a member of sss for more or less 25 years ngaun po ang nakuha lang nmin is lump sum are we entitled for monthly pension?

Thank you in advance!

Good morning ma’am, ask ko ko lang po.voluntary member ng SSS kasi ang mama ko.last week pa po cya na confined sa hospital hanggang ngayon..pwede po ba mag fill ng sick leave?at ano po ang mga requirements? Sana mabasa nyopo message ko..Thank you

Pensioner po ako.ng sss dahil sa.namatay kong asawa, ako po ay member din ng sss, pag nagfile po ba ako ng retirement tuloy pa din ang pension ko as beneficiary ng aking yumaong asawa?

Yes, you will become old age pensioner (if eligible for retirement pension) and a survivor pensioner (from your husband)

ask ko lang nahinto kasi ako sa paghulog ko mga two years tapos nagkawork ako ngayon and may 6 months na ako magkano kaya ang pwede kong maloan? di pa ako nakakapagloan simula ng naging member ako. bali 37 months na ang nahulog ko. thanks!

bakit di gumagana ang inquiry? may lalabas lang na temporarily moved. Di naman cguro araw2x na temporarily moved.

hi maam 🙂 tanong ko lang may bayad po ba kapag magpa SSS ID?

It’s free but you need to be an active SSS member

Good day po!

Ask ko lang po nag simula po ako ng hulog sa sss nong march 10

Ask ko po kung anong date po ulit ang hulog q sa april? Thank u po:)

Please check out the deadline in this page: https://philpad.com/sss-deadline-of-contribution-payments-for-employers-self-employed-voluntary-and-household-employers/

if free ang magpa sss id, pwede bang 3 months na hindi update ung sss contributions ko? pwede prin ba magpa i.d? 20 displayed namn ung laman ng contributions ko.

Hello.. I just wanna ask..

I paid my sss contribution from 2007 – 2013 (October). When I came here in Saudi, I stopped paying already. If i’m gonna continue my contribution, do I need to pay the other months where I became inactive? If not, does that mean, my previous contribution would automatically converge to my present contribution? Thanks.

You must update your current status as OFW if you are an OFW right now and resume your present contributions.

D poh ba mababaliwala ung mga naihulog n dati kahit ng stop s pghuhulog? Magaad ba un s panibagong contribution as existing? Or kailangan ko mgumpisa ulit s umpisa para mabuo ang 120 months? Thanks

They are counted as long as those contributions have been posted

Tanong ko lang po.namatay mother ko last dec.2014.sabi sa sss, naka-22 contri lng sya kaya di qualified sa pension, lump sum daw pwede.how much kaya makukuha namin and ano requirements? Thanks!

Hi. Only SSS can compute the exact amount of her lump sum benefit coz they need to check all her account

Hi po,

Ask ko lang po kung bakit same lang ang retirement benefits ang makukuha ng isang minimum wage earner contribution rate vs maximum contribution. I think unfair naman na ang laki ng kinakaltas dun sa may mga maximum contribution tapos pagdating ng retirement eh same lang sila ng matatanggap.

Meron po bang advantage na nakukuha yung may mga maximum SSS contribution vs sa mga hindi naman?

Thanks.

Those who pay maximum amount of course will receive more retirement pension than those who pay only lower contributions.

hello po, ask ko lang po kung pwede ko po bang e continue ko yung sss ko pero as voluntary na po , nag stop po aq sa work last dec2014, pwede ko po bang e continue ang sss contribution ko? pero may bal pa po ako sa salary loan, pwede po ba contribution ko lng po muna ang babayaran ko this time na wala pa akong trabaho?

slamat po

Yes, update your account as voluntary

Hello. I get my SSS 2 years ago as voluntarily member .. I just paid 3 times contribution.. I’m planning to continue on paying my SSS now. What will I do? Should I pay all the months that I never paid for the past years. And if I start paying again, are those 3 months that I paid before are still be counted. Thank you.

You cannot pay the months you have missed long time ago but you can pay the current month, present month and following months.

Good day! I would like to increase my husband’s monthly contribution (being self-employed). Do i need to fill up any form or just pay directly following the schedule and just keep the official receipts? Thank you!

Update his account first so SSS will be aware of the new adjustment of contribution

hi po…i paid my voluntary contribution last oct-dec amounting to 5280 kasi when i asked the guard incharge that day sabi nya depende sa sahod which i thought based sa previous employer…since it was my first time nagtiwala ako…i filled up rs-5 form then paid that amount and realizing now na pwede pala 495 lang pay ko since its voluntary naman and no work ako now…will be possible po na ung nabayaran ko na ay mareadjust to compensate my next few months? instead of 1760 eh 495 na lang po…medyo mabigat po kasi sa bulsa….thamks po

hoping for a positve responce from u

If you want to adjust or change something in you SSS account, file an update before you do anything

There is a discrepancy between the SBR and the actual remittance of contribution for our employees. There is an excess of 1, 788. Can we request sss to credit it for our next month’s contribution.

thanks.

Aileen

Hello..nalaman ko po na im pregnant this feb..kung now pa lang po ako kukuha at maghuhulog ng sss makaka avail po ba ako ng maternity benifits sa sss??tanx

my contribution in the hall year 2014, I paid1760 per months; this year 2015 I paid as maximum for 6 months

from Jan. to June. but i made mistake my payments I paid only 1650,instead 1760 can i recover my previous payments to 1760 per moths its posible? what shoud I do?

Go to SSS to settle the wrong payment

Walang refund ang philhealth

my partner just transfer her SSS contribution from employ to voluntary with a 330 monthly my question can we pay higher amount so that the maternity benefit we will get would be higher too?

Update your account at SSS if you want to increase contributions so that you’re sure everything is updated when you use benefits

Mam pwede po bang every month akong magbayad ng contributions ko..Then last year po di ako nagbayad the whole year..tama po bang mag umpisa na lang po ulit ngayon year..

Yes, resume your being active and never miss any month again

Mam good day po, ask ko lng po if oct. 1, 2014 po ako nahire pero ang nilagay po ng hr namin sa r1-a form po is january 5, 2015 ang date of employment ko, noong february 5, 2015 nia lng pinass ang r1 namin sa sss. Tpos ndi nia pa po napapareceived ang reportng ng transmittal namin, first job ko po kc ito, ano po kayang magiging effect noon sa contribution ko sa sss,

If they didn’t submit transmittal and R3 reports, your contributions may not be posted and updated

GOOD AFTERNOON PO!

ASK KO LANG PO,WAT IF PO KONG ANG SAHOD KO IS 4,000 THEN YUNG BINABAYARAN PO SA SSS IS 440..PAANO PO IF BABAAN KO PO YUNG BABAYARAN KO GAGAWIN KO PONG 330 KASI PO WALA NA PO AKONG TRABAHO?ANO PO BA DAPAT GAWIN? THANX PO.

Update your account at SSS

Hi Mam, i just found out that my loan wasnt paid by my previous employer. I just checked and its with a 6k penalty already. Is there anything that SSS can help me with this? I can pay the principal amount. Also i am interested into getting another loan. How am i gonna fix this? Thank you in advance.

I suggest po go to SSS to reconcile your account properly and do receive the best solution by the SSS staff. God bless!

gud am po balak ko po sanang mag voluntary conribution sa sss , ask ko lang po yung forms of payment , talaga po bang monthly o pwedeng quarterly

You can also pay quarterly for convenience

How long do i have to pay my voluntary contribution im 40 yrs old now tnx?

It will really help you have good pension if you continue paying until 60 or until retirement age

bakit po matagal mapost ng sss ang payment naming samantalang nakapagbayad na kami nung January 5, 2015 para sa October, November at December 2014? d tuloy ako makapagloan tagal kasi mapost ng sss

You can ask your employer if they submitted SSS contribution list for those months

Question po, yung Father ko po matagal na po sa Saudi as an OFW. Mahigit 15 years na po. May nabanggit po kasi yung nakilala ng Mother ko, na malaki na daw ang makukuha ng Father ko sa SS. Turning 63 na ata ang Father ko this year… possible po bang may makuhang cash at pwede kaya ang Mother ko ang mag process at makakuha non? Urgent kasi po na need ng family namin ng huge amount. Thanks in advance!

He better check his SSS account. May makukuha siya if he’s really an active SSS member assuming for the past 15 years continuously

3 years na po kami ng live in partner ko sabay kami kumuha ng E1 tapos hanggang ngayon wala pa kming hulog pero ngayon nasa saudi sya balak kong hulugan yung ss ko panu po ba wala po akong work thank you po .

Hindi ko po alam kung nahuhulugan ng asawa ko yung sa kanya

You need to update your SSS account into voluntary member before you make contributions para ok lahat.

My mother is self-employed,her monthly contribution for year 2014 is P330.00 we want to upgrade it to P550.00, we only pay at bayad center. What shall we do,do we need any documents for the changes?Thank you.

Update her account at SSS

Hi Good day.. my wife is pregnant now 1month i want to continue her SSS contribution as voluntary so that we can avail maternity benefit.. she only had her sss number but no past contribution..

what to do so that we can continue contribute her sss? what are the requirements?

Help her to update her account at SSS. Then resume her contributions.

Hi good day po, tanong ko lang po kon pwede ako mag change status, married ako sa isang foriegner, at dito na siya sa pinas titira habang buhay, so ano dapat ko gagawin para maka gamit din cya ng benefit sa SSS in case emergency . Thanks a lot and I need ur reply , ,and advice as soon as.

HI ask ko lang if pede pa bang mag avail nang maternity benefit kahit hindi na ako nkapaghulog for more than 3 years na kasi hindi na ako nakapagtraho. I availed my first maternity benefit last 2011. Pede bang bayaran ang past 3 months ko last 2014 and then 3 months for this year? May kasi ako manganganak eh. I’ve been separated from my old employer and since that separation I never had the chance to work again and failed to pay my contribution.

Good Pm.

Hi po. Meron po bang SSS Contribution Calculator for 2015 (Excel format) po? Meron po kasi akong na search na SSS Contribution Calculator (Excel format) pero hindi po latest. Since 2013 pa sya eh. Tnx po.

HI.. can i have the updated steps on how to file a loan online? any sites gives me the old steps and its not really helpful, i tried to check if its under e-services, i clicked on “Apply Salary Loan” but it keeps giving me a blank page,,, any reply would be highly appreciated.. thankyou

That service is not yet fully functional. It actually pisses me off too that I can’t even log in at SSS as of now.

thank you po mam Fehl! one more question po, maaari po ba na sa kapatid ko na lang ipa-update ang sss account ko? hindi po kasi ako makaliban sa trabaho. masagot nyo po sana ulit…

If you have complete docs regarding the update and authorization letter and copies of your valid IDs and your sister’s valid IDs,, I think pwede

Hello po. Paano po pag di nabayaran ung ibang r-5 of 2014, pwede pa po bang bayaran yun ng 2015??

550 po ang monthly ko since 2014. Ang problema sa buwan June lng d i ko na byaran April at may nadoble.thank u po!

my current monthly contribution is P1,220.00. i have no job right now and i would like to continue my sss contribution. am i allowed pay P110.00 for sss vlountary contribution?

Check out the SSS Contribution Table 2015 to see the applicable amounts for Voluntary Members. You need to update your account into voluntary if you’re no longer employed

Ask ko lang ho,,,kc nag stop ang asawa ko sa payment ng loans kc nag resign at nangibang bansa,,,paano ho ang mangyayari at pede bang ako ang maghulog ng contribution nya para tuloy2 ang hulog,,,ano mga documents ang need,,,thankz

Yup, you can do that. Go to SSS first and have his account checked. It will be helpful to you too if you have Statement of Account so you know the remaining balances and penalty dues if any. It will help you if you bring authorizing letter and valid IDs

Ako poy OFW GUSTO KULANG MALALAMAN NA SAAN NAMIN PUYDI IPASA ANG AMING NEW SSS APPLICATION A=NA KAMI ANDITO SA MALAYONG BANSA SA DUBAI NA DINAMIN ALAM KUNG SAAN NAMIN PUYDI IPASA ANG AMING APPLICATION

You can find SSS representative in the Philippine embassy or consulate there po

I forgot my SSS user ID and password online, kindly advise in order to retrieve and know more about my account. Thank you!

You can reset it using your email address. Tap the “Forget my password” link and go on

natigil po ang pagcontribute ko sa sss dahil sa pansamantalang nawalan ako ng trabaho, nais ko pong mag contribute muli ngayon bilang self-employed. maaari ko bang ipagpatuloy ang paghuhulog sa dati kong sss no. o mag-aapply muli ako ng panibago? sana po ay masagot ninyo. salamat!

You only need 1 SSS number for life. You must resume your contributions using the same SSS number. Update first your account at SSS (as SE or Voluntary) then resume your monthly contributions

Hi. I resigned from my job in March 2014 and my last payment was in February 2014. Now my employer requires that I update my contributions from March to December 2014. Since I was unemployed from March to December, how much will I pay to update my account? Thanks.

Hi po Ms Fehl, pwede ko po ba maclaim agad yung check ko for my salary loan basta may check number na ko? kasi super tagal bago matanggap ng company namin yung check? any suggestion po kaya ng fastest way para makuha ko na yung check agad. pwede kaya sa post office? thanks po.

self employed ang membership ko sa sss.. less than 1 year plng contribution ko @ 330… pwed ba ako maka avail ng maternity benefits khit wla pa 1 year ang contribution ko… thanks

According to SSS, a member is qualified to avail of maternity benefit if:

-She has paid at least three monthly contributions within the 12-month period immediately preceding the semester of her childbirth or miscarriage. Semester means 2 consecutive quarters ending in the quarter of sickness.

-She has given the required notification of her pregnancy to SSS through her employer if employed; or submitted the maternity notification directly to the SSS if separated from employment, a voluntary or self-employed member.

Hello would you know if I still have to present affidavit of loss because I lost my old id before requesting for new one bearing my maiden name now that im annulled? Thanks..

E1 lang ang kinuha ko pero nung ngtrabaho ako mula march 2014 to september 2014 nahulugan ng employer ko yung 6 months na yun makakahabol pa kaya ako due on january 2015 and ano yung mga kailangan kong gawin dahil nga E1 lang yung kinuha ko at wala pa kong I.D ..

I retired last April 13, 2014 and I received 18 months lumpsum. Can I still receive 13th month bonus this year? How much po if my monthly pension is approx. php 7000. Thanks po.

I retired last April 13, 2014 and I received 18 months lumpsum. Can I still receive 13th month bonus this year? Thanks po.

Pwede ko na ba itigil ang paghuhulog ko ng aking SSS contribution kapag naka-120 minimum contribution na ako?

And when i reached 60 years old ay makakapag lump sum pa rin ako at makakakuha ng pension?

Pwede po ba yun?

Please go to our post about SSS benefits. God bless!

Hello. Just wanna ask dati po akong employed until april2014 updated po yung sss contribution ko until march hindi na pala hinuhulugan ng company namin yung sss ko starting april to june dahil naka early mat ako then I decided to continue nag voluntary ako for july to sept. Contribution ko before is 770 nung employed ako den binabaan ko ng 330 ngayon nagvoluntary ako. Ask ko lang po is it possible po ba na makakuha ako ng benefits eventhough hindi ako nakapagbayad ng april to june? My duedate is january2015. And possible ba tumaas pa makukuha ko kung ibabalik ko sa 770 yung contri ko ng oct to dec?

Hello po.. ask ko lang po pano magchange from employed to voluntary? kasi po nung nagpunta ako sa SSS branch malapit sa amin sabi po wala raw po ako kailangan ayusin, basta raw po magfill up ako ng contribution form at icheck ang voluntary. tama po ba yun? nagwoworry po kasi ako na baka hindi lang kami nagkaintindihan nung SSS employee. Thank you po =)

how can i register to check my sss contribution if there is a required field wherein they ask for the receipt number of my last payment. but i dont know that because my employer did that payment for me and i dont have my employer’s i.d.. how to check instead?

You can ask your employer for the receipt number

yun po bang 10th or 5th ng sss ang tlagang bgayan not based on the date of birthday? thank you

Based on the last digit of SSS number na ngayon

Thank you maam Fehl…maam ang last digit po ng sss numbaer ko ay 9. twing kelan po kaya ang pasok ng pension ko?

Maam Fehl censya na po dito nannaman ako. confused po kasi ako kasi po nung nag check ako sa atm ko after only a month of filing my retirement sa SSS nagfile po ako September, meron na po pumasok na sa pgkakaintindi ko yun na ang pension ko na retro na for two months… kasi di po ako nag file ng lump sum… pero ngtataka po kasi ako after that wala na po uli pmasok na pension sa akin hangang ngayon December. Normal processing po ba yun? Paki reply lang po kasi confused po talaga ako thank you…

I suggest you request a print out of your Statement of Account to know the amounts that have been credited to you and what are they..to clarify everything lang po 🙂

good pm po… ask ko lang po anung date po ba ng month pmapasok ang sss pension? 60th birthday ko nung nagfile ako…. 28th ng month ng birthday ko…. every 28th po ba ang pasok ng remittance ko kung sakali? pls reply kahit sa email ko po kasi baka di ko mabasa dito agad kung wala pang mgrereply…. kung meron po thank you

All I know sa GSIS, every 8th of the month. I’m not sure about the pension for SSS. Maybe 10th or 5th

thank you po sa reply last question na lng po…. yun po bang 10th or 5th ng sss ang tlagang bgayan not based on the date of birthday? thank you

I stopped paying my SSS when I become an OFW like 12 years ago. I also remember that I made a loan before that. My question is if its possible to continue my SSS now and how would I go from here.

Yes it’s possible. You need to update your membership record and status by going to SSS and become active member again. Pay your loan balances and pay your present monthly contributions

Good day po

Ask ko lang po if ever po na magswitch po ako to Voluntary Memeber at gusto ko pong maghulog ano po ba ang gagawin ko po ?

Go to SSS and update your membership status into voluntary member, pay your monthly contributions following the SSS Contribution Table

ask ko lng po..anu po kaya dapat kong gawin para palitan ang apilyedo ko sa SSS , at sunudin ang apilyedo q ng BC NG NSO ko, kce ang nklagay sa SURNAME ng SSS ko ay sa papa ko. dahil nung kumuha po aq ng NSO ko surname ng mama ko ang nakalagay Po, sa civil registrar ang sunsme ng papa koang nkalgay .. kaya sinxe ng aral aq ginmit ko apilyedo ng papa ko.. pero savi ng papa ko inayos n nya un sa lawyer pra mgamit ko na ang apilyedo ng papa ko.. sana po matulungan nyo po aq..

Go to SSS and request for correction of name. Make sure you bring your NSO BC and valid IDs

Hi good day!tanong ko lang po pwede ba mag apply ng umid i.d kaya lang wla p pong hulog sss ko pero willing naman ako maghulog.ano po dapt gawin?pwede ba ko voluntary para makapag apply, requirements po ksi sa inaaplayan ko abroad?thanks in advance

Pay your monthly contributions muna to become active member, then apply for UMID card

paano po ang computation ng sss contribution kapag merong dependent?

Magkaiba ba ang computation ng single sa married? I have my 5 years old kid. Thanks

Contributions are based on salary brackets not on the member’s dependents or status. Maybe you’re talking about benefits

I just retired last may 2014.will I receive a 13th mon inmy bank acct?

If you retired by pension, then you’re entitled for a 13th month pay. If not, then nothing.

God day po,,,tanong ko lang po kasi nag stop na po ako mag work den gusto ko po ituloy ang paghuhulog ko sa sss ng ako lang po,,ano po pwede ko gawin about dito,,thanks po

Update your membership into voluntary member then pay your contributions

Also i just want to ask Kasi po yung asawa q ngloan last 2009 at mgmula ngayon ndi pa nya po nahuhulugan may intrrest po b un.anung step pede nya gawin salamat po…

Gusto ko lang din itanong nung kumuha ako nang SSS number nung 2012.. d pa ako nagbibigay nang contribution.. Ngaun balak ko na siya hulugan? May penalty po ba?? Magkano?

Sobrang late na non. Just resume the present month and the following months. SSS is an insurance.

Kaya nga po eh! Pero ngaun huhulugan ko na siya.. Gusto lang din pla malaman nang mama ko matagal na kase siya member nang SSS at wala naman siya palya sa pagbabayad. Gusto niya malaman if hanggang kelan siya magbabayad para maging pensionado.. Self employed po siya.. Ska magkano po ung makukuha niya?

Retirement pension starts at age 60. If you have completed 120 months of contributions, you will be eligible for retirement pension.

ah ganun po ba? tinatanong din nang mama ko if panu pag nag stop siya maghulog sa sss niya.. ano mangyayari dun sa mga hinulog niya??

Please go to our page about SSS benefits.

Walang penalty yan. Resume with your contribution and update your date of coverage anytime. You can pay from January – December 2014 if you wish to.

Hi! ask ko lang kung makakapag loan ba ako kung hindi updated ang surname ko pero active member po ako ng sss. As far as i can remember nag pa change of name and status na ako pero nung nagregister ako online ayaw tanggapin yung married name ko ang tinanggap is yung maiden name ko. panu po yun my plans po ako na magloan makakaapekto po ba yun.

I suggest you follow up the update of your change of surname first so your account is updated and following your present status.

ok tnx so much!

sa mga kinauukulan…paano po ba mapipilit na magbayad po ang isang employer para sa contribution sa sss, mahigit na pong isang taon silang hindi nagbabayad ng aking contribution…sa tuwing magsasabi ako ay palagi na lang sinasabing aasikasuhin daw, pero sa tuwing magbe verify ako ng contribution ay ganun pa din at walang nagyayari…ano po ba ang dapat naming gawin

Report your employer at SSS

An employer who does not report temporary or provisional employees is violating the SS law. The employer is liable to the employees and must:

A). pay the benefits of those who die, become disabled , get sick or reach retirement age;

B). pay all unpaid contributions plus a penalty of three percent per month; and

C). be held liable for a criminal offense punishable by fine and/or imprisonment.

i am now 39 yrs old and self employed i am paying the maximum amount of 1760 per month for voluntary SSS contribution, i want to determine what will be the amount of my pension if i pay this amount until at age 60.

Hi. July 2014 lang ako naging member ng SSS and nakapaghulog ng contribution, due date ko ng delivery is February 2014, mkk avail ba ako ng maternity benefit? Thanks!

Hey. Thanks for your post!

SSS Carmona, Cavite.

Good Evening po!pasend naman po ako ng authorazation letter ng 32 months contribution ko sa SSS Camiling Tarlac.as soon as possible po.

Thank you po!

tnung ko lng po kung my hulog na po ba ang mahogany general services inc. sa sss contribution ko.

Mam ask ko lng po..nag register po aq sa sss ng self – employ.. At mag start pa lng po aq naun oct . how much pi b ung babayaran ko after 2 weks daw po.

Please see the New SSS Contribution Table to know the amount you can afford every month

Hi maam, may I ask why there is a huge difference between SSS and GSIS contributions? I am currently working for the government, but I’m planning to transfer to a private company. Currently, my GSIS contributions amount to P5k+ including government share, but if I were earning the same salary in a private company, I will only be contributing only P1k+ to SSS. Does this mean that GSIS offer more benefits to its members? I hope you can enlighten me on this. Thank you. 🙂

Also, if I’ll be employed by a private company, what will happen to my GSIS contributions? Will I be able to withdraw them? If yes, when?

Hi, Scarlett. The reason why your contribution in GSIS is much higher is because retirement benefits are also higher. Also GSIS members are given dividends every time the board declared them for members. Growth of funds in GSIS is higher than that of SSS. It’s like the logic of investing, the more you invest, the more you will profit in the end. I can say yes, GSIS offers more benefits than when you are in the SSS because in SSS, the employers are private firms while in GSIS, your employer is the government. Bankruptcy is very impossible if you’re employed in the government. What happens to your GSIS benefits if you transfer to a private company? You may avail benefits if you’re entitled. Read https://philpad.com/list-of-gsis-benefits-in-the-philippines/ to know what benefit applies to you.

Thank you so much for your immediate reply! 🙂

Maam, magtatanong lang po ako about sa SSS ID, nawala po kasi iyong lumang ID ko, pwede po bang makapagpakuha uli ng panibagong SSS ID? Paano at saan? Thanks and God Bless!!!