Here are the five easy steps on how to pay tax online in the Philippines in 2025. You can finish it in a few minutes.

The Bureau of Internal Revenue in the Philippines has made it easier and more convenient for taxpayers to file and pay their tax online ever since BIR TRAIN Law was implemented.

What are the Benefits of Paying Taxes Online?

Paying taxes online is faster and easier compared to traditional manual filing and payment. Additionally, the taxpayer can save and compile his or her tax returns and payment receipts electronically through a secure hard drive or online cloud storage.

How to Pay Tax Online in the Philippines in 2025:

- Prepare your Income Tax Return

- Fill out your eBIR Forms

- Validate your Total Tax Payment

- Save and Submit a Final Copy of your ITR

- Pay your Taxes at BIR Online Accredited Payment Centers

How to Pay Tax Online in the Philippines (Step-by-step Guide)

STEP 1: Prepare your Income Tax Return

The first step is creating and preparing your ITR (Income Tax Return). You can do this by installing the latest version of offline eBIR Forms on your desktop. The offline eBIR Forms software is used to assist taxpayers for the filing and computation of taxes. It is important to note that the current software is available for Windows version only.

STEP 2: Fill out your eBIR Forms

The second procedure to pay tax online in the Philippines is filling out your eBIR Forms. It depends on what type of taxpayer you have been registered in the Bureau of Internal Revenue. The following BIR Forms apply for the types of income taxpayers in 2025:

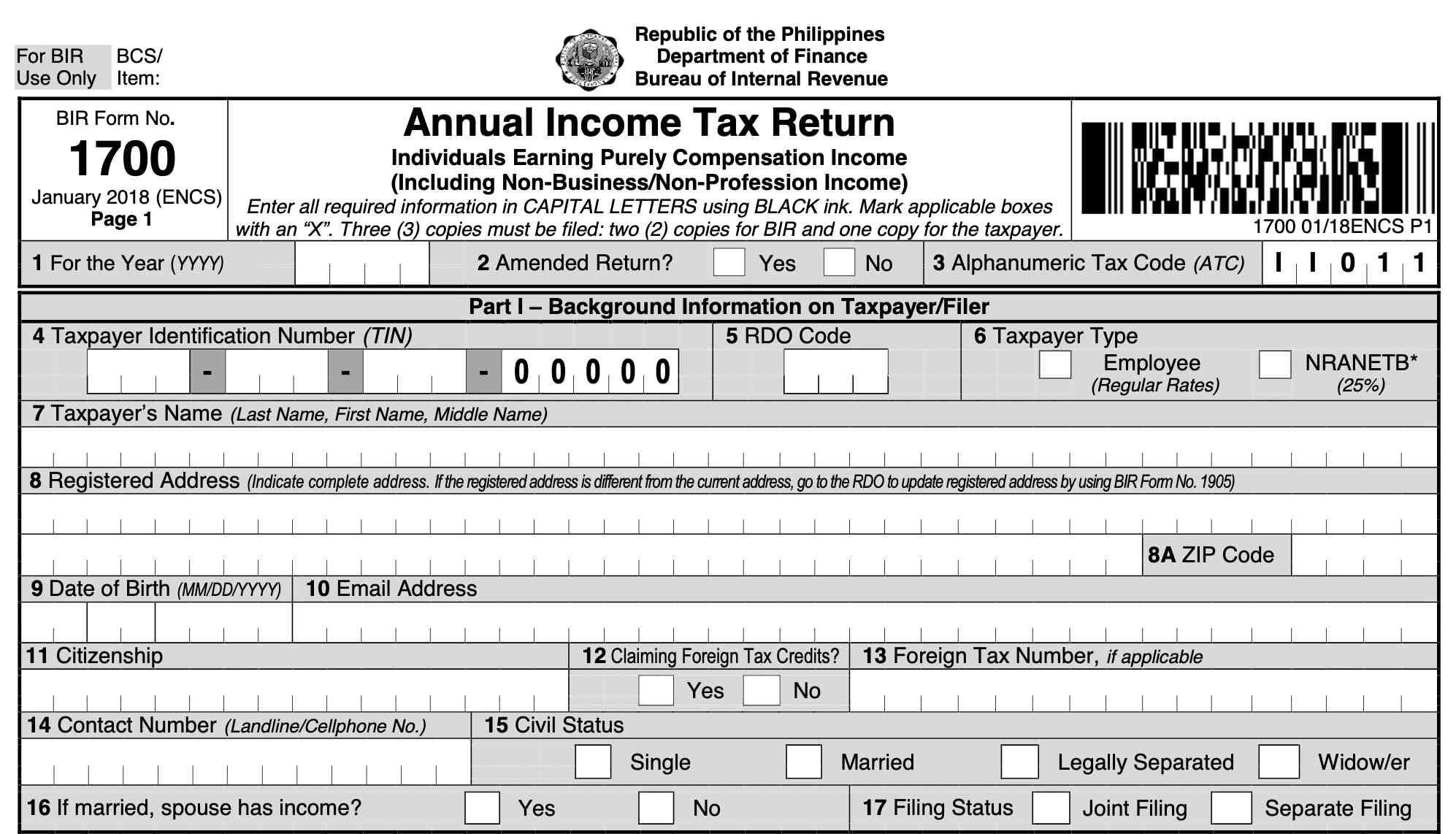

New BIR Form 1700:

New BIR Form 1700 is the Annual Income Tax Return for taxpayers earning purely compensation income. The deadline for filing this ITR is on or before April 15 of each year, covering for the preceding taxable year.

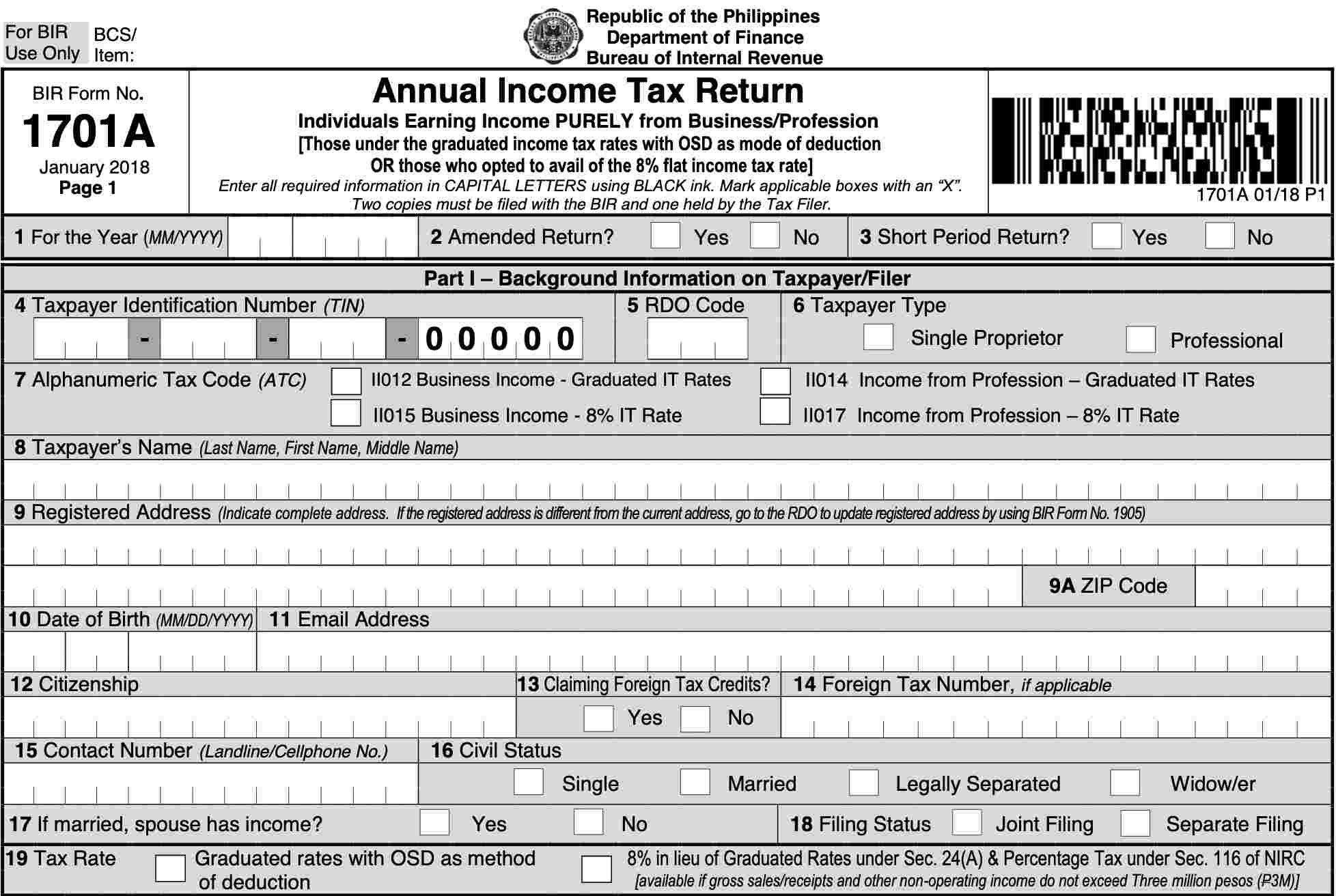

New BIR Form 1701A:

The new BIR Form 1701A was introduced since the launch of TRAIN Law. You must file this form if you are a professional or purely engaged in a business subject to graduated tax rates and if you are claiming for Optional Standard Deduction (OSD) as a mode of deduction; or if you are availing the 8% flat tax rate.

One of the simplest forms to file. Follow this step-by-step guide: “How to File BIR Form 1701A.”

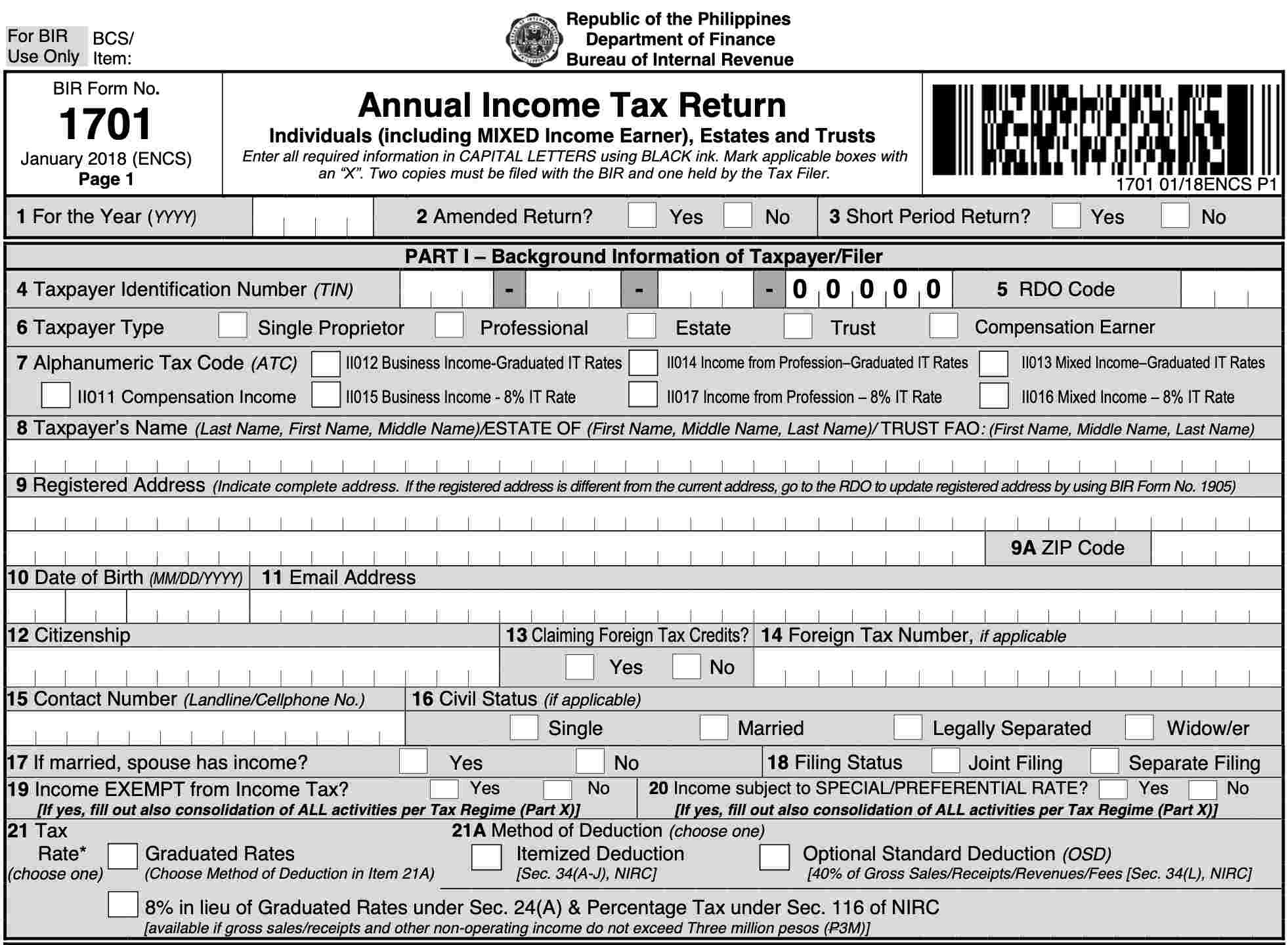

New BIR Form 1701:

The New BIR Form 1701 is the annual ITR for taxpayers, including mixed-income earners or professionals engaged in a business subject to graduated tax rates and using Itemized Deduction as a mode of deduction. The deadline of filing is on or before April 15 of each year covering income for the preceding taxable year.

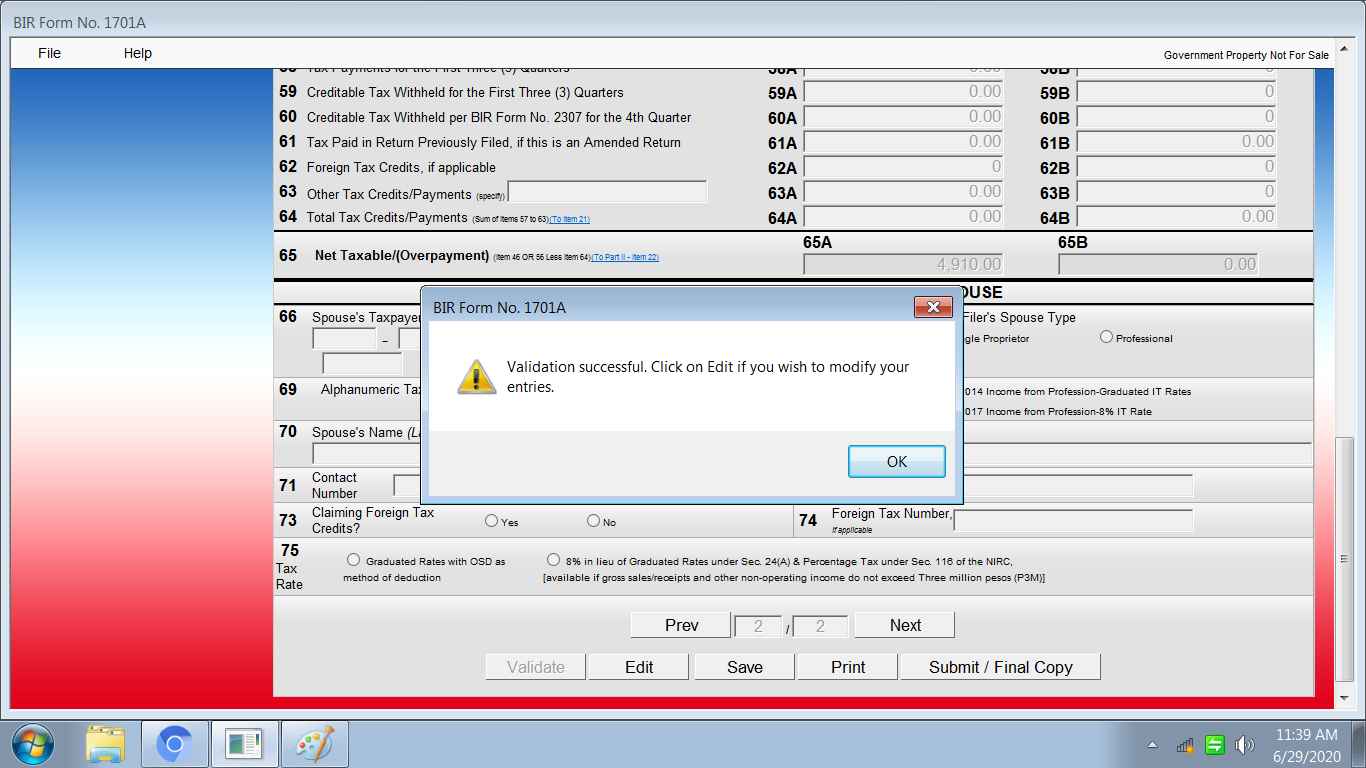

STEP 3: Validate your Total Tax Payment

The next step is validating your total tax payment. Once you have filled all the necessary details on your eBIR forms, the software will automatically compute your total tax dues. The software will prompt a message warning if you have given an incorrect detail or if you have missed providing information.

If you have finished, click the VALIDATE button at the lower part of the form. You will receive a successful validation confirmation.

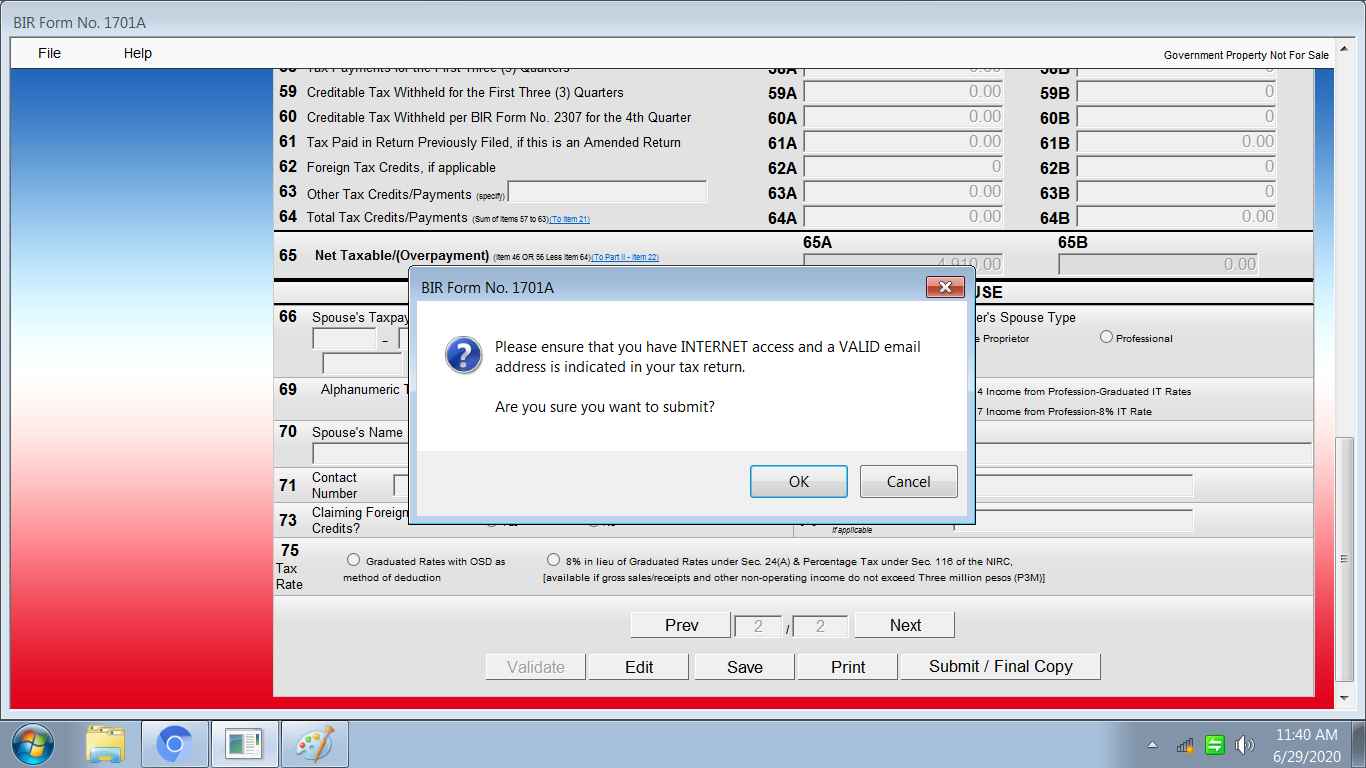

STEP 4: Save and Submit a Final Copy of your ITR

After you have validated your income tax return, that means you are entirely sure all the details and values are correct and accurate. The next thing you need to do is saving and submitting a final copy of your tax forms. Select the file folder or drive where you want to keep your final copy of ITR on your computer.

STEP 5: Pay your Taxes at BIR Online Accredited Payment Centers

The Bureau of Internal Revenue accepts tax payments online through electronic online payment channels, including the following:

- Landbank of the Philippines (Link.Biz Portal)

- Development Bank of the Philippines’ Pay Tax Online

- Unionbank Online Web and Mobile Payment Facility

- GCash App Bills Payment

- PayMaya Bills Payment

How to Pay Income Tax Online Using Landbank Link.Biz Portal?

Landbank Link.Biz Portal accepts online tax payments for LBP ATM account holders, Bancnet ATM, Debit, and Prepaid Cardholders and also depositors of RCBC and Robinsons Bank. Follow the procedures below to pay income tax using the Landbank Link.Biz Portal:

- Visit the official website of BIR and select ePay

- Choose the Landbank icon and tap “PAY NOW” button

- You’ll be redirected to Landbank’s portal

- Complete each step until the tax payment confirmation

How to Pay Income Tax Online Using DBP?

The Development Bank of the Philippines (DBP) also accepts online tax payments through their online platform. All Visa and MasterCard credit cardholders are allowed. Similarly, all Bancnet ATM and Debit Cardholders are also entitled to use DBP online tax payment facility. Follow the steps below:

- Go to the BIR official website and select ePay

- Select DBP icon

- You’ll be redirected to DBP website

- Complete each step and provide your account details

- Pay your income tax

How to Pay Income Tax Online Using Unionbank?

All individual and corporate Unionbank account holders can pay their taxes online using Unionbank web and mobile payment facility. You must have an existing online banking account and do the following procedures:

- Visit BIR ePay page

- Choose Unionbank

- You’ll be redirected to Unionbank platform

- Log in to your Unionbank account

- Complete tax account details

- Submit tax payment

How to Pay Income Tax Online Using GCash?

- Install the GCash Mobile App

- Create an account and log in

- Fund your GCash account

- Select Pay Bills icon

- Choose Government as the category

- Select BIR

- Enter tax account info

- Receive an SMS payment confirmation

How to Pay Income Tax Online Using PayMaya?

- Install PayMaya Mobile App

- Sign up for an account and log in

- Fund your PayMaya account

- From the Home screen, select Bills

- Choose Government as the category

- Type BIR in the search box

- Enter the required information

- Confirm tax payment

- Receive an SMS payment confirmation

Other Tax Payment Procedures in the Philippines:

- How to Register a Business in the BIR

- How to Fill Out BIR Form 0605

- Income Tax Table 2025

- List of BIR RDO Codes 2025