Effective January 22, 2024, the Bureau of Internal Revenue (BIR) will stop collecting the Annual Registration Fee (ARF) from business taxpayers. This advisory is in compliance with Republic Act 11976, also known as “Ease of Paying Taxes Act.”

Business taxpayers are now exempt from filing BIR Form 0605 and paying the annual registration fee of P500 every year.

The BIR also said “business taxpayers with existing BIR Certificate of Registration (COR) that includes the Registration Fee will retain its validity. These taxpayers may choose to update or replace their COR at their convenience. This can be done at the Revenue District Office, where they are registered on or before December 31, 2024, by surrendering their old COR.”

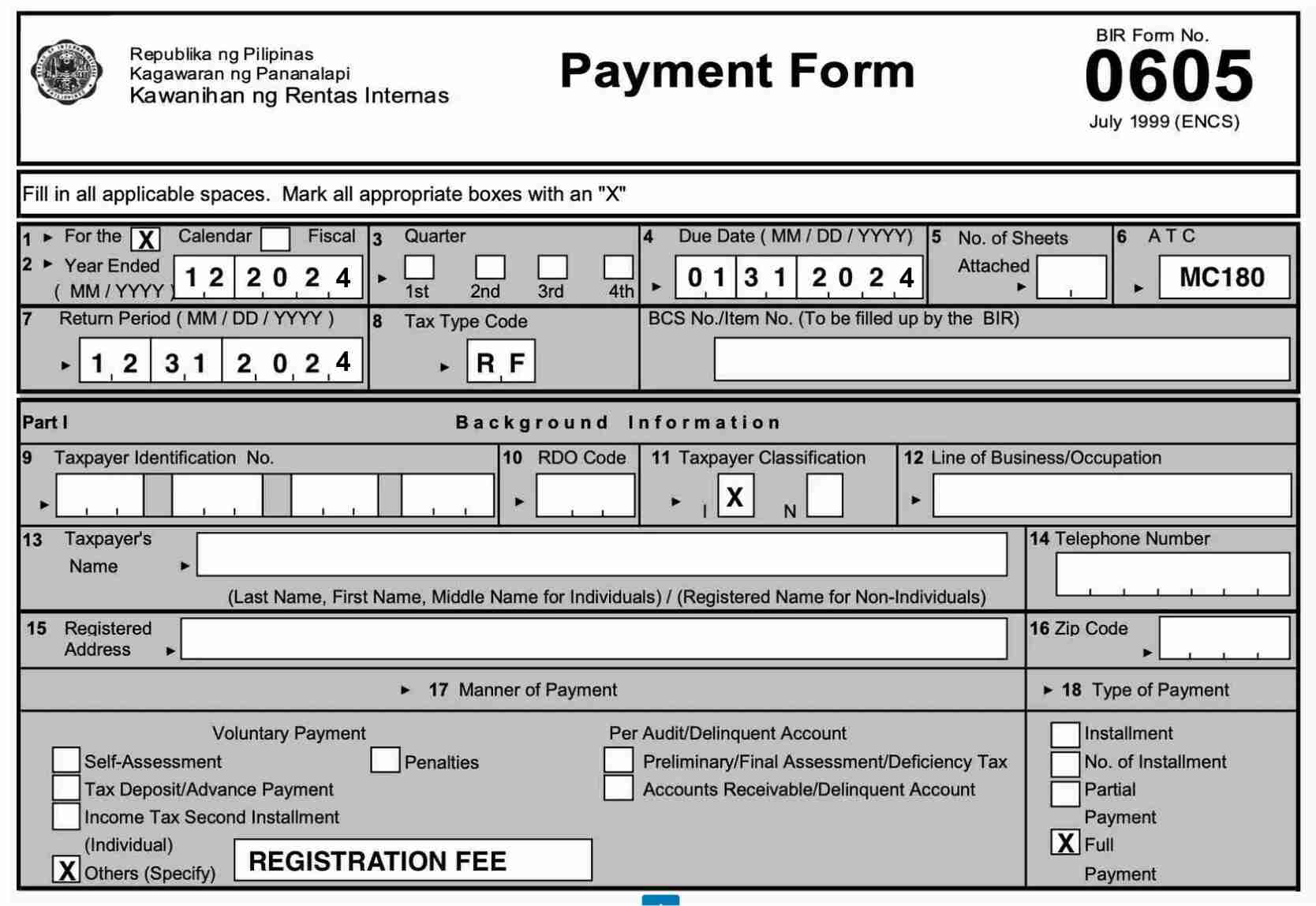

In the previous years, entrepreneurs, businessmen and professionals were required to file BIR Form 0605 on or before the first month of the year. Nonetheless, we are sharing here the complete guide how to fill out this important tax document for the purpose of other payments.

What is BIR Form 0605?

BIR Form 0605 is a Payment Form, thus it is used in filing for payment of taxes and fees which do not require the use of tax return such as second installment payment of income tax, deficiency tax, delinquency tax, registration fees, penalties, advance payments, deposits and installment payments.

When to File BIR Form 0605?

- Every time a tax payment or penalty is due or advance payment is to be made

- Upon receipt of a demand or assessment notice or collection letter from the BIR

- Income tax second installment for individual taxpayers

How to Fill Out BIR Form 0605 for Payment of Registration Fee:

UPDATE: Business taxpayers are now exempt from filing and paying annual registration fee. Thus the steps below will not be necessary in 2024 and beyond.

1. Use eBirForm or download the form

If you are using eBirForm software, you can conveniently fill out this document. Otherwise, download the PDF copy and print 3 copies before submitting the payment.

2. Fill out the necessary details

Data such as calendar or fiscal Year, year ended, due date, ATC, and your background information are very important. Make sure you provide true and accurate details for each section of the form. The BIR charges some fees for wrong filing of details.

Type your TIN Number and complete name or registered name, line of business, registered address, phone number, and zip code.

3. Put RF (Registration Fee) under the Tax Type Code

Since we are paying for our business annual registration, RF is the correct code in this section. See screenshot sample above.

4. Choose your manner of payment

If you are making a voluntary payment, choose the info suitable for you. If you are paying the whole amount, choose Full Payment.

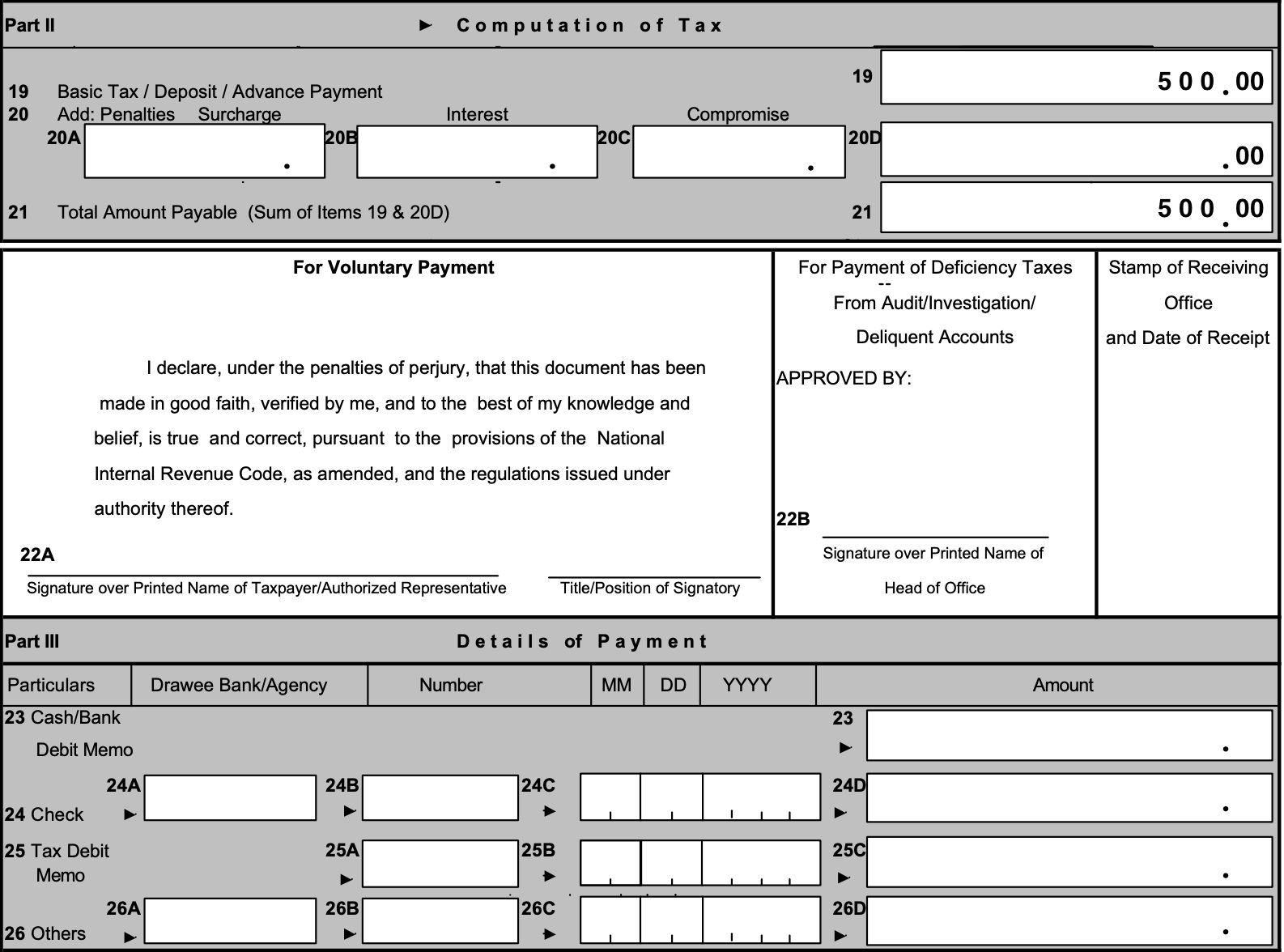

5. Provide the computation of tax

The basic tax due for annual registration fee is P500. You have to enter that amount. Add penalty if any. Then compute your total tax payable.

How to File BIR Form 0605?

Step 1: Fill out and accomplish the form completely

Provide the correct information such as tax type, RDO code and taxpayer classification according to your tax payment. The step-by-step guide to fill out this form is posted above.

Step 2: Print 3 copies of the form and attach the required documents

Triplicate copies are always required when filing tax payments. Always remember that when filing your taxes. You may add attachments if needed. Required attachments when filing this form are listed below.

Accepted Attachments for BIR Form 0605:

- Certificate of Registration

- Duly approved Tax Debit Memo (if applicable)

- Copy letter or notice from the BIR for which the payment form is accomplished, and the tax is paid whichever is applicable:

- Pre-assessment / Final Assessment Notice / Letter of Demand

- Post Reporting Notice

- Collection Letter of Delinquent / Accounts Receivable

- Xerox copy of the ITR (Income Tax Return) or Reminder Letter in case of payment of second installment on income tax

Step 3: Pay at any Authorized Agent Bank

Pay at any Authorized Agent Bank (AAB) under the jurisdiction of your Revenue District Office where you are registered. You may also pay directly at the RDO collecting officer or your Municipal Treasurer of the RDO where your business is registered.

BIR Annual Registration FAQ:

What does Taxpayer Classification I or N mean?

Taxpayer Classification I means Individual taxpayer while N means Non-individual

What is my RDO Code?

RDO means Revenue District Office. It is where you, as a taxpayer, are registered or where your business is registered. Please refer to the list of RDO Codes in the Philippines.