Check out this step-by-step complete guide on how to register a business in BIR for sole proprietorship, partnership, and corporation.

The Bureau of Internal Revenue has simplified the registration of business in the Philippines. Now, applicants and registrants do not need to go from one counter to another to submit the documentary requirements.

Having your own business is a lucrative way to expand your reach to generate more income. Earning income will also task you an obligation to pay proper taxes. Thus, registering your business in BIR is mandatory to run a profitable company in the Philippines.

How to Register a Business in BIR?

In this article, we are sharing about the procedures and requirements on how to register Sole Proprietor Business, Partnership, and Corporation in the BIR. Proceed to the Regional District Office (RDO) where your business is located and do the following steps.

How to Register a Business in BIR for Sole Proprietorship?

- Fill out Application of Registration Form (BIR Form 1901)

- Submit photocopies of the required documents:

- DTI Certificate of Registration

- Mayor’s Permit

- Barangay Business Clearance

- Contract of Lease (if you’re renting)

- Proof of Ownership (if not renting) – TCT or Certificate of Land Title

- Original Copy of PSA Birth Certificate

- Original Copy of Marriage Certificate if married

- Sketch your location of business

- Fill out BIR Form 0605 and Pay Annual Registration Fee

- Pay Documentary Stamp Tax

- Register your Book of Accounts

- Register your Official Receipts and Sales Invoices

- Attend the seminar in filing and tax payment

- Claim your Certificate of Registration

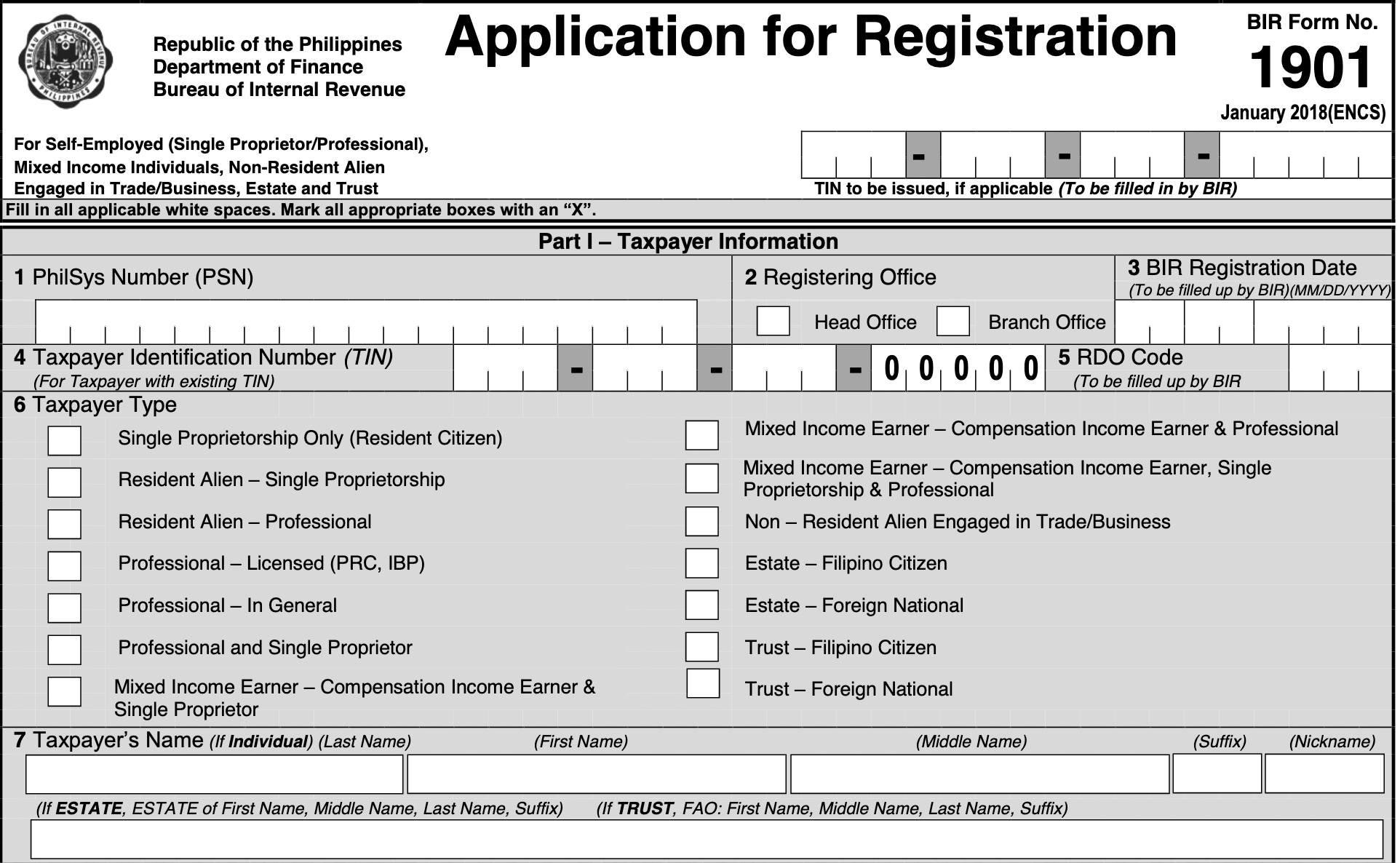

Step 1: Fill out Application of Registration Form (BIR Form 1901)

Accomplish BIR Form 1901. Print or write each detail legibly using capital letters. Mark all appropriate boxes with “X”. You must also know your TIN (Tax Identification Number) in accomplishing your BIR business registration.

Step 2: Submit photocopies of the required documents

Before you register your business in BIR, you should have taken the prior steps such as getting your DTI Business Name Registration, Mayor’s Permit and Barangay Business Clearance. Getting those documents are easy. You can get them all in a day.

Step 3: Sketch your location of business

The BIR also requires sketch of the location of business. A simple sketch of your workplace would help the bureau’s tax mapping activities if there are any in your area.

Step 4: Fill out BIR Form 0605 and Pay Annual Registration Fee

Annual registration fee of P500 is required for new registration of business. Similarly, you need to file this payment form again on or before January 31 of each year as long as you are doing a business.

Step 5: Pay Documentary Stamp Tax

Business registration in the Bureau of Internal Revenue also requires payment of documentary stamp tax. No worries, because you won’t need to pay much especially if you are processing your registration for single proprietorship business.

Step 6: Register your Book of Accounts

Books must be registered before the commencement of the business or upon the registration of a new business in the BIR. Book of accounts and other accounting records must be kept at the office. Additionally, they must be updated and must maintain up-to-date recording of business transactions.

Step 7: Register your Official Receipts and Sales Invoices

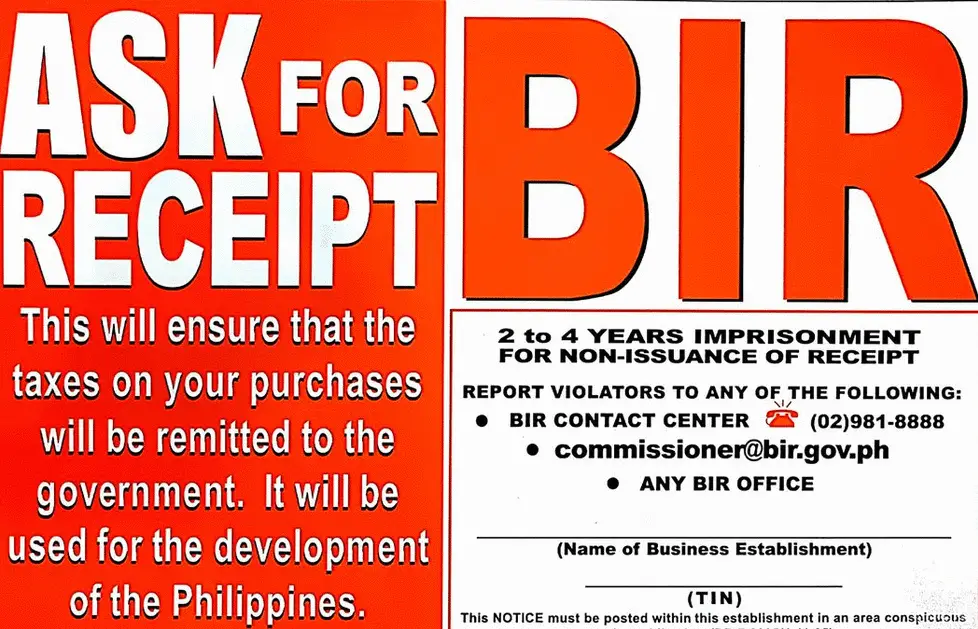

All businesses that render services and offer sales are subject to internal revenue taxes. Therefore, they must issue receipts or sales invoices authorized by the BIR.

Likewise, the use of POS machines for the issuance of receipts must also be authorized by the Revenue District Office (RDO) where the business is located.

Every registered business must comply to the BIR rules and regulation including the posting of the Notice for the Issuance of Sale / Commercial Invoice and/or Official Receipts at a visible place at the taxpayer’s place of business.

Step 8: Attend the seminar in filing and tax payment

The business owner or anyone who is responsible for your bookkeeping and accounting can attend the seminar about filing and payment of taxes. Since the TRAIN Law was executed, tax payments are now lower and easier. The same is true with filing of income tax.

Step 9: Claim your Certificate of Registration

At the final step, the BIR will issue your Certificate of Registration (BIR Form 2303). This is an important business document. All the types of taxes the taxpayer or business owner must pay in the calendar year are also displayed in this document.

In addition, the BIR Certificate of Registration must also be posted in a visible place at the location of the business. Keep a copy of it for yourself in case you need it for banking or visa application purposes.

BIR Business Registration Procedure Time Frame

How long is the processing time to register a business in the BIR?

The entire business registration process in BIR takes around 10 minutes to complete depending whether you have provided all the information on the forms correctly. It will help you to speed up the process of registration of your business if you have submitted all the required documents and permits.

How to Register a Business Partnership in BIR?

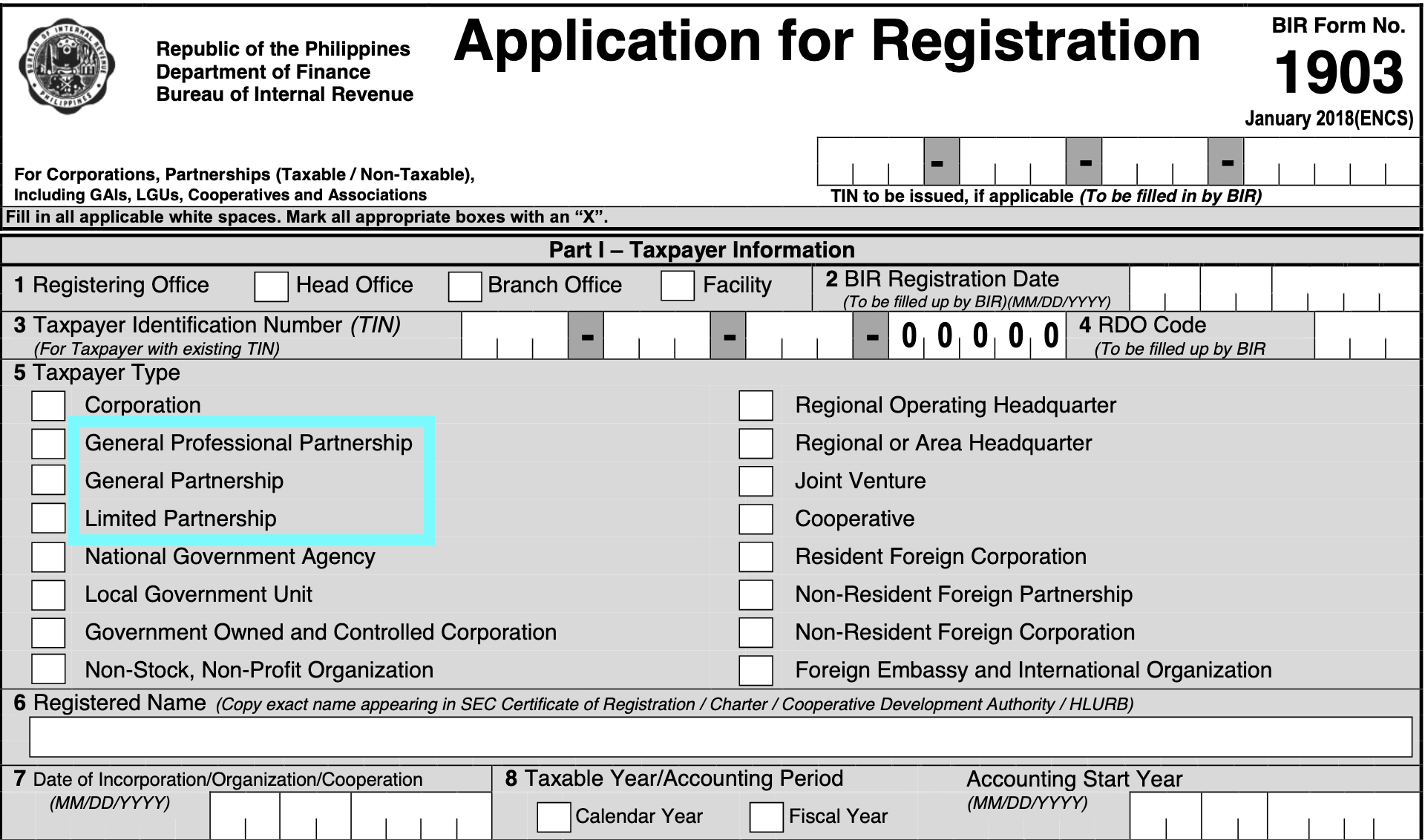

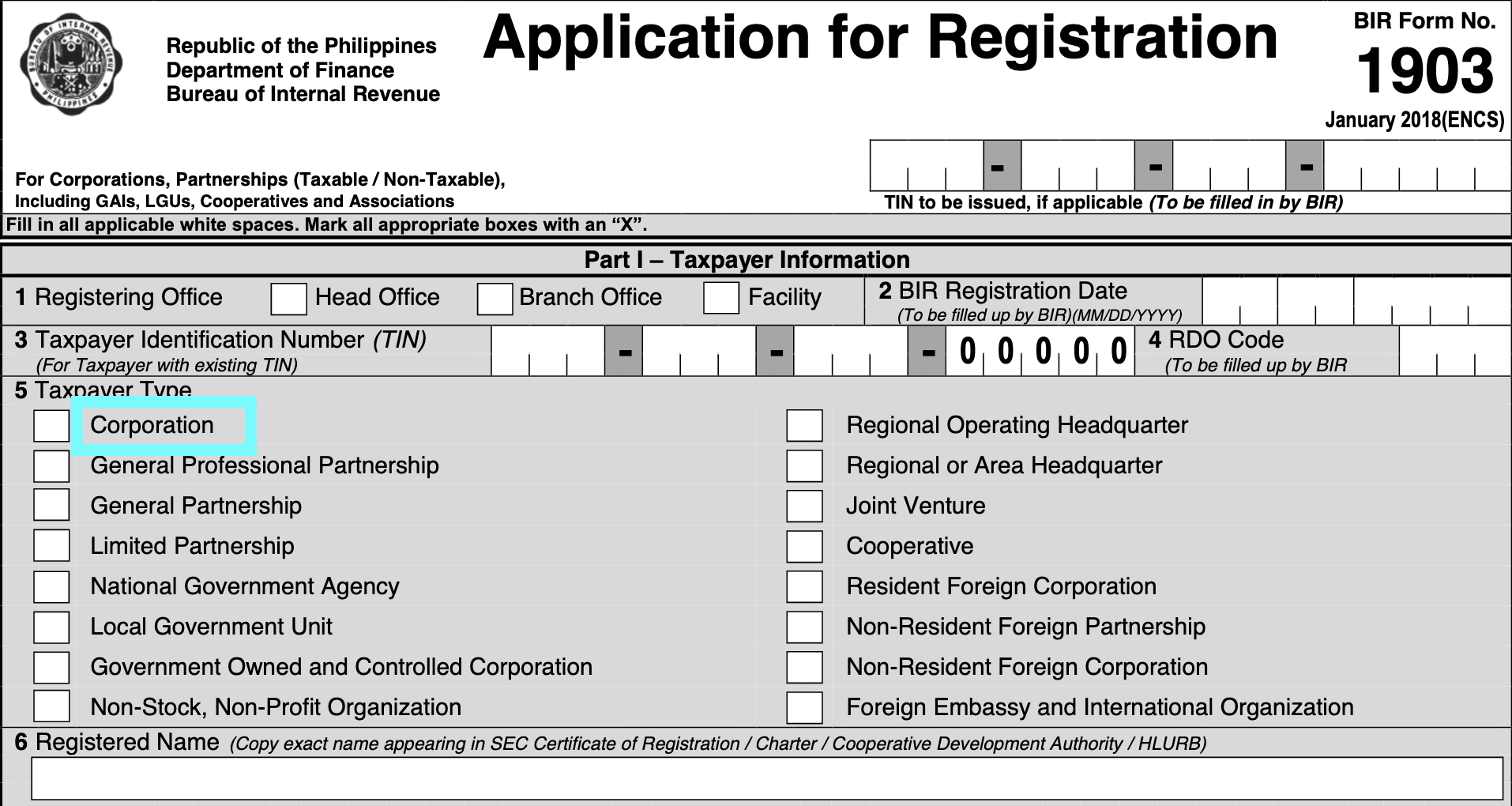

- Fill out Application of Registration Form (BIR Form 1903)

- Submit photocopies of the required documents:

- Articles of Partnership SEC

- Mayor’s Permit

- Barangay Business Clearance

- Contract of Lease (if you’re renting)

- Proof of Ownership (if not renting) – TCT or Certificate of Land Title

- Sketch your location of business

- Fill out BIR Form 0605 and Pay Annual Registration Fee

- Pay Documentary Stamp Tax on Lease

- Register your Book of Accounts

- Register your Official Receipts and Sales Invoices

- Attend the seminar in filing and tax payment

- Claim your Certificate of Registration

A partnership is a legal form of business between two or more persons who share skills, management, and profit. There are three types of partnership recognized by the BIR in the Philippines – general partnership, limited partnership, and general professional partnership. Moreover, this type of business helps in expansion and wealth generation.

If you are planning to start up a partnership, the procedure for registration of partnership business in BIR is similar from the sole proprietorship except on the forms and requirement for the Articles of Partnership from SEC.

How to Register a Corporation in BIR?

- Fill out Application of Registration Form (BIR Form 1903)

- Submit photocopies of the required documents:

- Articles of Incorporation SEC

- Mayor’s Permit

- Barangay Business Clearance

- Contract of Lease

- Sketch your location of business

- Fill out BIR Form 0605 and Pay Annual Registration Fee

- Pay Documentary Stamp Tax on Lease and Subscription

- Register your Book of Accounts

- Register your Official Receipts and Sales Invoices

- Attend the seminar in filing and tax payment

- Claim your Certificate of Registration

A corporation is a legal entity of a company or group of people authorized to act as a single entity. A corporation is required to be registered at the Securities and Exchange Commission (SEC). While corporations always produce more income, they are also the most complex type of business.

If you want to register a corporation at the BIR, the application and procedures are listed above. Articles of Incorporation is one of the documents required. The registration of corporation in BIR is also similar with other types of business.