It’s about time I share here about my personal stock market investing strategy called Magic 10. I know I should have published this post earlier but I decided I do it when I can also be able to share the 10 stocks from the list. 🙂 Before that, let’s talk about Magic 10 first and why I use it investing in the stock market.

What is Magic 10 Strategy?

Magic 10 is a passive investing of the best 10 stocks carefully selected by the Team of DailyPik. It also follows the concept of Cost-Averaging method wherein we invest and buy stocks slowly over a period of time and sell them on our Target Price or Target Period.

It is composed of the Big 5 stocks and the Fantastic 5 stocks.

Big 5 Stocks:

We call them Big 5 because of their big market cap, global expansion, strong balance sheet and large customers / consumers need. These Big 5 are permanent stocks and obviously compose half of our portfolio. Why should we have these permanent stocks? Because we want to see a big part of our investment growing and appreciating in real time. Investing is not about what ifs and what could have been.

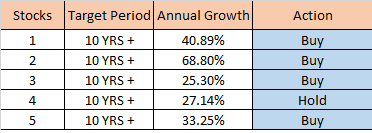

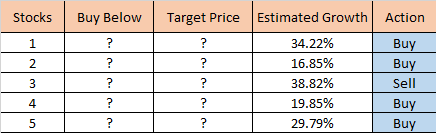

Fantastic 5:

These are also blue-chip stocks carefully selected by our financial specialists. We call them fantastic 5 because they will give us fantastic money. With their current performance and market valuation, in a few months or more, they will produce fantastic profit. Fantastic 5 are not permanent and can change and be replaced by other present recommended stocks.

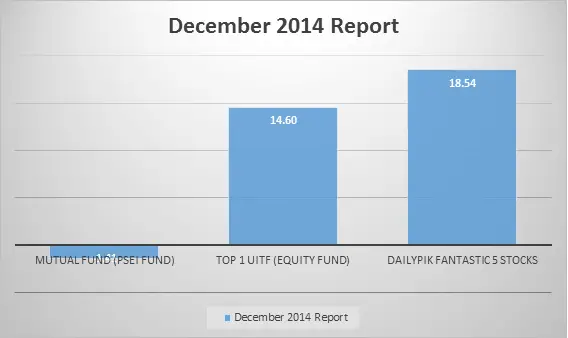

Mutual Fund (PSEI Fund) vs Top 1 UITF (Equity Fund) vs DailyPik’s Fantastic 5 Stocks last Dec. Performance

As you see in the figure above, we had an excellent gain of 18.54% from our Fantastic 5 stocks, last month. Our Big 5 stocks gained 21% giving us a total 39% gain from just last month performance alone. DailyPik shares monthly stocks report and regular stocks updates involving the financial and stock market world exclusive for members.

In a nutshell, Magic 10 is investing the Magic 10 stocks for 10 years or so.

Why I use these Magic 10 stocks investing in the stock market?

Investing in the stock market could make us multi-millionaire. Everyone knows that by now but everybody seems to always forget that investing in the stock market is very risky and there are only 2 ways to minimize risks: it is by diversification and it is by investing for a long term.

That’s the goal of Magic 10 strategy, to earn millions of money by investing 10 stocks for 10 years or so.

I use this strategy because I’m not a super-active trader who watches the stock market like a hawk. I’m not one of those swing traders. I just want my money work for me and earn more money while I spend most of my time doing my passion, traveling, work, family stuff and most of all making my babe happy.

Fantastic 5 stocks table sample:

Big 5 stocks table sample

You can now access Magic 10 stocks for FREE at DailyPik’s stocks page.

Disclaimer: Investments may give lots of money but always remember the risks involved.

Thanks a lot again Miss Fehl….you are really a great help to all of us new investors.

My pleasure 🙂

Miss Fehl, I’ve already started investing following your Magic 10. But there is one thing that’s bothering me… how can I know if the company I have invested in is still listed in the PSE? or it’s already down?Thanks again.

The PSE will post about it before they will de-list a certain company. The listed stocks in Magic 10 are selected and they are well established companies, meaning it would really be a worst case scenario, war or apocalypse if that happened. Don’t worry too much 🙂

Ms Fehl,

Is there any strategy wherein you invest in a really new company? Like really taking a gamble on your money. I believe it isn’t F5 since it is not a blue-chip company.

Buying shares on the IPO may work well if you study about the company and take opportunity at the period of speculation. I might share strategy about it on dailypik.com

Hi Fehl. Which site can I find that table which shows the Stock Price, BBP, TP, and Estimated Growth? I’d like to know the figures for the rest of the stocks.

dailypik.com

Hi Fehl, may error ba sa site ng dailypik.com? Can’t access it anymore. It’s a great help in my trading plan and always use your suggested stocks as my reference.

Thanks and God Bless..

Dailypik website is fine. Maybe it’s just your net connection. Check it here http://www.downforeveryoneorjustme.com/ and type the website if it’s down for everyone or just you 🙂

Hi! Can I ask which is better the Fantastic 5 or the big 5? thanks! long term investor here. God bless Ms. Fehl

gud pm po.. paano po pumili ng financial planner? may mairerekomenda po ba kayo ms. fehl? at pwede ba akong makapagsimula for as low as 1000 every month?. lalakihan q po ang investment ko pag me bonus at pag maluwag in between months.

I suggest you increase your budget coz it’s hard to find worthy stocks to buy using 1000/month.

ok, salamat po ms fehl. anong financial planner ang maganda?

Hi Ms. Fehl,

Thank you for sharing your thoughts and insights to us especially for newbies like me. I am also planning to invest in stocks and I’d also read about Mr. Bo’s TRC SAM strategy however I also wanted to learn about your own strategy in Dailypik. How do we go about it? I already sign up for updates in my email and waiting for any post. Do we need to pay for that or it will be posted here automatically? Thanks and God bless!

Hi Joanne. It’s free and you don’t have to pay anything 🙂 We use Magic 10 and Flipping strategy. Both were posted in the site together with the daily stock picks

Thank you fehl and belated happy birthday

Hi Ms. Fehl,

Good day!

Do i need to pay for daily.pik to become a member? or in order for me to received daily update? Thanks

Nope. Everything is free at dailypik

hi ms fehl! i’m just gonna ask why is there no buy below and target price on the big 5 , how should i know when to buy stocks or to sell them , when the time comes..

Because there is a Target Term rather than Target Price for the Big 5 stocks

Hi Fel,

I live in Australia but I funds sitting on Term Deposit for the past 4 years with one of the major banks. I am thinking of taking the cash out from TD and investing the funds in shares instead. However I don’t really know where to start. How do I get hold of the company’s annual financial report? Who do I go to to research the financial situation of a company I plan to invest in?

Hope you point me in the right direction.

Kind regards

Marilen

Hi Marilen. Stockbrokers usually share stocks, companies and market updates to all their clients. You can find them on your online account. Or you can join DailyPik.com

Hi Fehl

I forgot to tell you that my funds which has been sitting in term deposit wth BPI. I am visiting Manila next month with the intention of pulling the funds out of from TD and investing the funds in stocks and shares instead. Can you tell me if you use some kind of formula to decide when to buy.

Kind regards

Marilen

Hi. Yes, I first have the 10 stocks from DailyPik which also show the Buy Margin and Target Profit of each stock. I buy shares monthly coz I’m into investing more than trading 🙂

ask ko lang po, ok lang po ba na bibili ng shares ng 5 different companies sa oddlot every month following PCA? lalo na kung limited lang ung budget.kung di kaya ung board lot amount. ganon po kasi iniisip kong gawin since I have 5 companies at tumataas na ung presyo nila eh fixed budget lang po ako monthly (5k), like 1k per company at kung ilan ang kayang shares sa amount na un, hope to get a response 🙂

Yes, that’s ok but note that stock prices offered in the Oddlot are higher than those in the Boardlot.

salamat!

Hi Fehl,

I opted to paying offline to dailypik but Im not receiving any payment details. I messaged them already but no response yet. I wonder if they are in a holiday vacation too. J

Let me know.

Thanks

Hi Marian. 🙂 Happy New Year! We are a partner of DailyPik and I replied to your email and FB message 🙂 Always happy to assist anyone here

hi po ulit ms fehl.

I just want to ask something ulit, can you recommend charting software that able to give data/quotes within 5 minutes interval? Right now, I’m using Chart Nexus and it can only give daily interval quotes. I also checked PSE site, also daily interval. Mam, how about COL, does it gives 5 minutes interval? And does it has limited number of transaction per day.

Thank you again ms Fehl. God bless..

COL gives as short as 1 sec feeds in their charting feature, last time I checked 🙂 I wish tech engineers create something we can download just like the ones available for US Traded stocks which we can use to filter stocks according to specific indicators, margins and requirements of our choice

Thank you very much ms Fehl.. More power. I’m excited to read your next post. God bless..

Hi Fehl.

I just want to ask if I buy certain stock, does my holdings/portfolio will update instantly, I mean real time? Or I have to wait for another trading day for it to update. And also how about selling stock, how long does it takes to update my holdings/portfolio?

I’m asking this, because I want to try day trading using COL Financial. Does COL has limited transaction (buy/sell) per day?

Sorry for too many questions.

Hi Ruel. Yes, they are updated in real time if you’re orders have been executed. In milliseconds you’ll see movements of everything. You’re in the stock market after all 🙂

Please read our post about buying and selling stocks to learn more. God bless 🙂

Thanks ms fehl. I also asked this in your other post, pls ignore them. I will continue reading and stop by here regularly. Thanks again..

My pleasure 🙂

Fel,

Thank for sharing your strategy. Really love your blog, it’s very informative and helpful for a newbie in investing like me. Being an OFW, I don’t have enough in time in looking the stocks daily especially that the time zone is different. I am like an investor than a swing or position trader and your recommendation from DailyPik is very helpful. How to join in DailyPik?

Thanks and keep on posting. God bless.

Hi Juby! Thank you for visiting my posts here. You can join at http://dailypik.com Happy Holidays! 🙂