The easiest and fastest way to get TIN online, a.k.a. Tax ID Number using BIR eReg. The BIR eReg has excellent features for taxpayers providing convenient services like issuance of TIN online, Payment of Registration Fee, and generation of Certificate of Registration.

On this page, we share how to get TIN online if you’re a self-employed individual, entrepreneur, professional, proprietor, or businessman.

What is a TIN ID?

TIN is an acronym for Tax ID Number. A Tax ID Number in the Philippines is issued by the BIR (Bureau of Internal Revenue). TIN is used for tax purposes in the Philippines and abroad.

Who can register a TIN ID online?

Registration of Tax Identification Number online is also called eTIN. It allows the following types of individual taxpayers to apply for a tax ID number:

- Self-employed Individuals (such as Sole Proprietors and Professionals)

- Mixed Income Earners (those who are both employee and sole proprietor and/or professional at the same time)

- Employees

- Those who are qualified under Executive No. 98

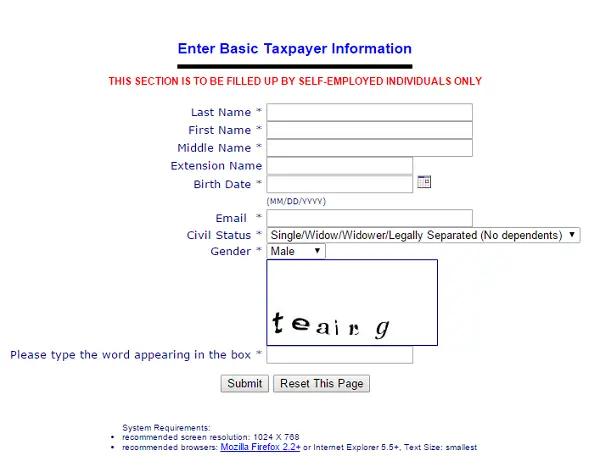

How to Get a TIN (Tax ID Number) Online if You’re a Self-employed Individual?

- Go to BIR eReg page

- Enter your taxpayer profile information. Make sure every detail you provide is accurate.

- Double check each detail and select “SUBMIT“

- Wait for an email from the BIR regarding the issuance of your TIN

Note that you only need to do this registration if and only if you never have registered a TIN before. It is prohibited by law to register more than one TIN. In short, we are only allowed 1 tax ID number for life.

You must prepare a valid email address before registering your TIN because BIR will send your tax identification number registration status and confirmation.

Requirements in Getting a TIN ID Online

- Valid email address

- Accurate profile details

- Fast internet connection

- New eligible applicants

Tips in Getting a Tax ID Number Online

If you forgot your TIN or you lost a copy of your TIN ID card, you can retrieve it by following this guide: How to recover lost Tax ID Number.

Do not get another TIN again if you already registered one before. If you forgot you had applied for a TIN in the past or if you’re not sure you got one already or your employer has gotten you one, you can verify it at the BIR.

Keep your Tax ID Number because you will need it wherever you work or have business with and whenever you earn income.

If you are getting your TIN for the purpose of a bank account and you are not employed or working as a professional at present, it is recommended to get your TIN at your BIR RDO office to avoid some problems.