Here’s the step-by-step guide on how to use the new eBIR forms offline. You can download the latest version of the new eBIR Forms software at the official website of the Bureau of Internal Revenue.

The new eBIR form system is beneficial to make everything easier and faster for taxpayers and employers. There are two packages for the eBIR forms: offline package and online package. In this post, we share about using the offline package.

We made this post for people who prefer filing offline because some taxpayers find it more convenient to file their taxes and tax returns with this route. The procedures and requirements for the latest version are here.

What is eBIR Forms Offline?

eBIR Forms Offline is a software developed by the Bureau of Internal Revenue in the Philippines to facilitate taxpayers for filing, computing, editing, and printing their tax returns offline. The software helps taxpayers for more accurate and faster submission of tax forms.

eBIR Forms Offline Package Benefits

According to the BIR,

“Instead of the conventional manual process of filling up tax returns on pre-printed forms that is highly susceptible to human error, taxpayers/ATAs can directly encode data, validate, edit, save, delete, view, print and submit their tax returns. The package can do automatic computations and has the capability to validate information encoded by taxpayers/ATAs. After filling out the forms in this package, taxpayers/ATAs can submit it to the Online eBIRForms System.”

What BIR Forms are included in the eBIR Forms Package?

- Payment Form – 0605

- Monthly Remittance Return of Value-Added Tax and Other Percentage Taxes Withheld – 1600

- Remittance Return of Value-Added Tax and Other Percentage Taxes Withheld by Race Track Operators – 1600WP

- Monthly Remittance Return of Income Taxes Withheld on Compensation – 1601-C

- Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded) – 1601-E

- Monthly Remittance Return of Final Income Taxes Withheld – 1601-F

- Monthly Remittance Return of Final Income Taxes Withheld on Interest Paid on Deposits and Yield on Deposits Substitutes/Trusts/Etc. – 1602

- Quarterly Remittance Return of Final Income Taxes Withheld on Fringe Benefits Paid to Employees Other than Rank and File – 1603

- Annual Information Return of Income Taxes Withheld on Compensation and Final Withholding Taxes – 1604-CF

- Annual Information Return of Creditable Income Taxes Withheld (Expanded)/Income Payments Exempt from Withholding Tax – 1604-E

- Withholding Tax Remittance Return for Onerous Transfer of Real Property Other than Capital Asset (Including Taxable and Exempt) – 1606

- Annual Income Tax Return for Individuals Earning Purely Compensation Income (Including Non-Business/Non-Profession Income) – 1700

- Annual Income Tax Return for Self-Employed Individuals, Estates and Trusts – 1701

- Quarterly Income Tax Return for Self-Employed Individuals, Estates and Trusts (Including those w/ both Business and Compensation Income) – 1701Q

- Annual Income Tax Return for Use ONLY by Corporation, Partnership and Other Non-Individual Taxpayer EXEMPT Under the Tax Code, as Amended, [Sec. 30 and those exempted in Sec. 27(C)] and Other Special Laws, with NO Other Taxable Income – 1702-EX

- Annual Income Tax Return for Corporation, Partnership and Other Non-Individual with MIXED Income Subject to Multiple Income Tax Rates or with Income Subject to SPECIAL/PREFERENTIAL RATE – 1702-MX

- Annual Income Tax Return for Corporation, Partnership and Other Non-Individual Taxpayer Subject Only to REGULAR Income Tax Rate – 1702-RT

- Quarterly Income Tax Return for Corporations, Partnerships and Other Non-Individual Taxpayers – 1702Q

- Improperly Accumulated Earnings Tax Return – 1704

- Capital Gains Tax Return for Onerous Transfer of Real Property Classified as Capital Asset (both Taxable and Exempt) – 1706

- Capital Gains Tax Return for Onerous Transfer of Shares of Stock Not Traded Through the Local Stock Exchange – 1707

- Donor’s Tax Return – 1800

- Estate Tax Return – 1801

- Documentary Stamp Tax Declaration/ Return – 2000

- Documentary Stamp Tax Declaration/ Return (One-Time Transactions) – 2000-OT

- Excise Tax Return for Alcohol Products – 2200A

- Excise Tax Return for Automobiles & Non-Essential Goods – 2200AN

- Excise Tax Return for Mineral Products – 2200M

- Excise Tax Return for Petroleum Products – 2200P

- Excise Tax Return for Tobacco Products – 2200T

- Monthly Value-Added Tax Declaration – 2550M

- Quarterly Value-Added Tax Return – 2550Q

- Monthly Percentage Tax Return – 2551M

- Quarterly Percentage Tax Return – 2551Q

- Percentage Tax Return for Transactions Involving Shares of Stock Listed and Traded Through the Local Stock Exchange or Through Initial and/or Secondary Public Offering – 2552

- Return of Percentage Tax Payable under Special Laws – 2553

How to Use eBIR Forms Offline to File Your Taxes?

Step 1: Download the latest version of eBIR Forms Offline software package

The eBIR Forms Offline software is available to download from the official website of the BIR. We recommend you get this only from their site to ensure it’s the latest version. It’s free to download, and all taxpayers can use the software.

Step 2: Install the software on your computer

The eBir Forms software currently can’t run on Mac computers. You can install the software if you are using Windows. To install, download the software, then click the file. It will automatically start the installation.

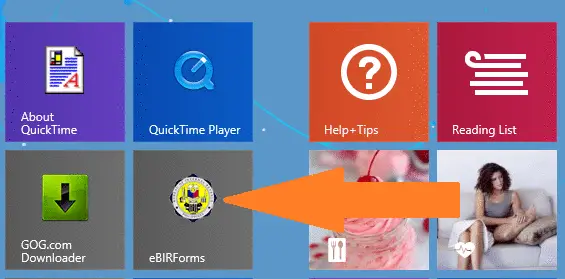

Step 3: Click the eBIR Forms icon on your computer or desktop

To begin using the eBIR Forms system, click the icon to open the program. You may find it on your Windows “Programs” or installed “Apps.” Similarly, you can click the search icon and type “eBIR Forms,” and you will be redirected to the application.

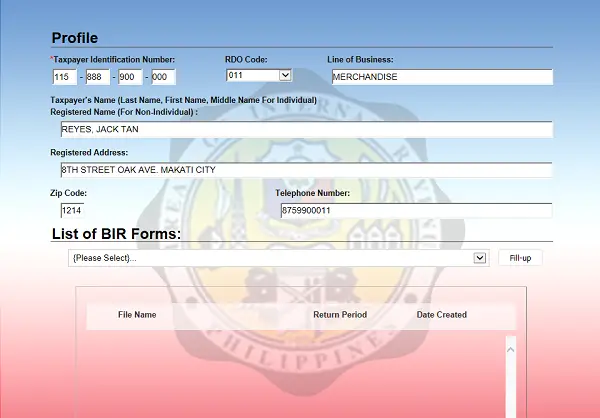

Step 4: Create your Taxpayer Profile

Start by creating your taxpayer profile. Type the details required, such as your TIN (Taxpayer Identification Number), RDO Code, Line of Business, full name, registered address, zip code, and phone number. We made a sample screenshot below:

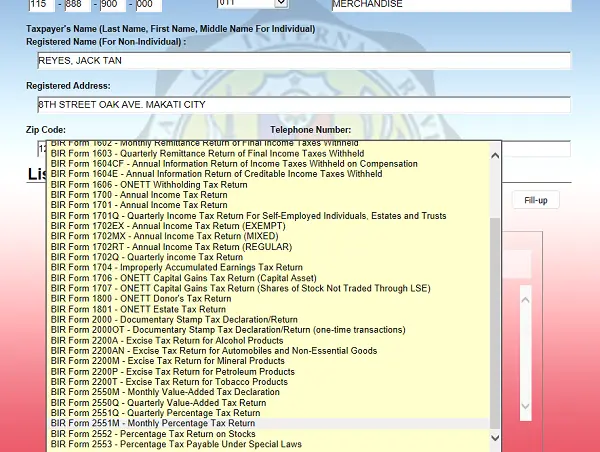

Step 5: Choose your eBIR Form

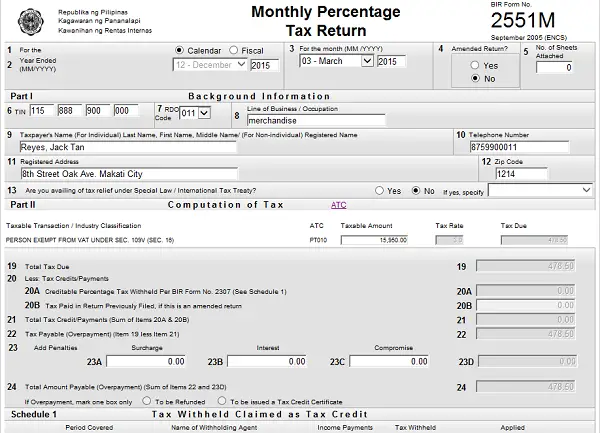

Select the eBIR form you want to file and click FILL-UP. In this sample, we’re making Form 2551M for Monthly Percentage Tax Return.

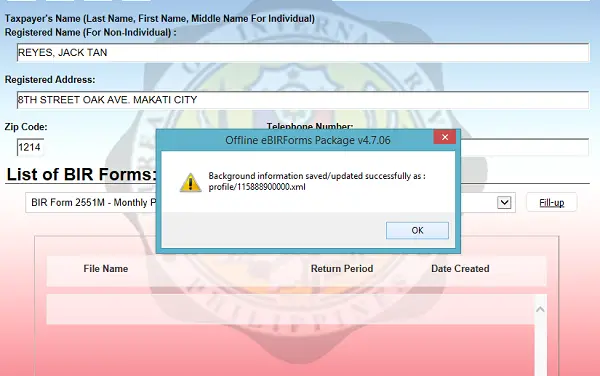

Step 6: Save your Tax Profile

The system will now save your background information, so the next time you input your Tax ID Number, all your tax profile info will load on the page. Your data will now be saved and you’ll see a message box like the one below. Tap “OK” to proceed.

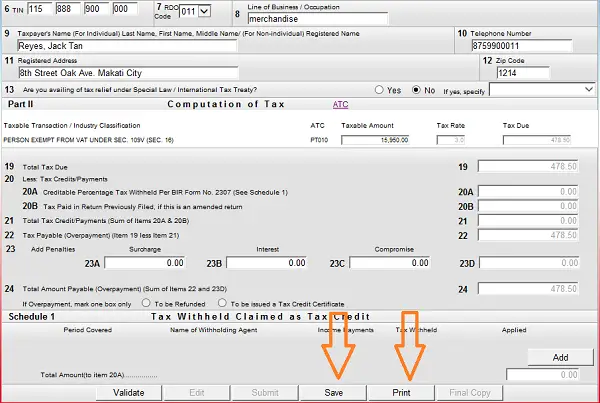

Step 7: Complete your BIR Form

Your BIR form will now load, and your details will automatically be filled in the form. You should now complete the required data on each section. Choose the date applicable (Calendar or Fiscal) year and for the month. Remember to double-check the details you have provided.

Step 8: Check your Tax Computation

Proceed to the computation of your taxes by providing the required amounts. eBIR Forms program will automatically compute your taxes after you encode the numbers on the boxes.

In the sample above, we put the taxable amount for the monthly percentage tax, and the required tax due has been automatically computed in the form.

Step 9: Validate and save the forms

Now that you’re ready to submit and file your taxes click the “VALIDATE” button so the system will verify, check, and compute your taxes.

Once validated, click the “SAVE” button. The forms will now be saved on the system and your computer. You can access the tax forms again whenever you need them.

Step 10: File and Submit your BIR Forms

To file your taxes, submit your BIR Forms and pay your tax dues. You can submit and pay manually at the BIR accredited banks, BIR offices, or online using the Online eBIR Forms System.

To submit manually, print out the forms by clicking the “PRINT” button. Remember to print three copies of the documents because the BIR requires triplicate copies when filing taxes. BIR will give you a copy of your ITR or BIR form.

Hi! nagbackup po kasi ako ng files sa onedrive and hindi ko na maopen yung BIR. Upon login po instead na magproceed, nagoopen po yung file explorer and required na magselect ako ng file to proceed. After selecting random file nag iincorect username and password siya.

ngyari din saken ngayon lang. may nareceived na ako confirmation. i was thinking nagerror lang nung issave ko file after ko masent bir. okay lang kaya un?

eBIRFOrms not opening/loading on Windows 10 Pro 64 Bit i7-7500U 8gb RAM after downloading and installing latest update

I also tried it using 3 laptops, all failed loading. The solution, use Windows 8. I discovered that eBIR Forms only runs properly using Windows 8 as of now.

I already knew how to use it. My only problem is: Why is it “Undefined” that put in the blanks instead of TIN and other details? Cramming here

same problem here.

did someone answer you? I also got the same problem…

Hi, did someone answer you too? Please!

Same problem. how to resolve?

Try re-installing the software and use Windows 8. Newer versions of Windows won’t work from my experience

I installed v7.4.2 on my new computer and it says it cannot validate/save/print 2018 and up. It says I need to download new version. The one on their website right now is v7.4.2. I think it’s the latest version already. What shall I do now?

since last week i started filing thru the new ebirforms 7.3 and i even tried the 7.4 after sending the final copy and it says successfully filed to BIR…….but no tax confirmation received from bir until now

is anyone here encouter the same ?

pano po ginawa nyo

Hi! Offline eBIR successfully installed in my laptop but it won’t open. What seems to be the problem? Am using Windows 10 on Asus X441S. Please help!

Hi Ms.Rizza Im also encountering the same problem using the latest version 7.4.2 it would always prompt “undefined”. May I ask if you were able to resolve the issue? Thanks!

Hi Ms. Shie! Sad to say, I haven’t resolve it yet… 🙁

The tax table in the new versions released are not yet updated. How come?

Hi, eBIR Forms and eFPS are not yet fully updated following the new tax rates under TRAIN law. Some are updated, some not yet. We are advised to use manual return in filing. According to BIR Memo, once returns and forms are available from eFPS and eBIRForms, they will issue and post an ISSUANCE (at their website) to announce the availability of the revised forms.

Pano po mag lagay ng printed name at mag sign ayaw kasi sa ebir forms

I made a mistake on this year’s 1701a. It’s my first time filing for ITR and I didnt know where to put the 250 000 amount for the 8% (I didn’t exceed 250 000 and just had sales of 100 000). Do I need to put Php 100 000 on the “Less” portion? I’m afraid I didn’t fill that part up as I didnt know how to file the new form and submitted it already on eBIRForms and promptly received the email confirmation. Is there a way I can still less the deduction? Please Help before the filing ends.

They updated it and still 1701v2018 form does not automatically computes my tax payable. Anyone encountered this same problem?

Thank you

Yes, the new 1701v2018 is not automatically computing for tax. Even the itemized deductions are limited to few accounts. Wondering what happened, parang minadali.

Ebirforms 7.4.1 1701v2018 is NOT computing the tax automatically! It seems to be broken

Just downloaded the latest version. 1700 is not updated. What is our option? Fill-out downloaded form and file?

7.4 package use the old tax rate in 1701. For Over 500,00 — 125k fixed plus 32% over 500k.

Kindly fix. Thank you!

Use the new BIR form 1701, it’s now updated and applies the TRAIN LAW 🙂

di na po updated yung tax table for BIR form 1700, yung v7.4.0 na na-download sa BIR site

bakit po hindi gumagana ito sa laptop ko kahit ok na man sa computer shop. Ang probs kasi sa shop ay hindi naka connect ang printer sa computer na ginagamit ko mismo kaya mahirap ito iprint. Di katulad sa ibang file na pwede sya i save file as document para ang attendant mismo ang mg print don sa system nila.

Try printing it as PDF.. Save the PDF file on a flash drive (USB) and hand it over to the cafe attendant for actual printing.

how to access the saved bir form?

You can select the type form again then tap VIEW. Your saved form will load again

Hello! I opened my saved file only to be welcomed by ‘Undefined’. 🙁 What happened? I was about to print it and had already sent it.

I downloaded and installed the new version on my laptop. A script error window keeps popping up and the RDO code drop down doesn’t work. I tried installing on a different laptop and it’s still the same. What seems to be the error? Is it the program or the laptops used? Need help badly. Thanks!

7.2.1 ver 1601c asking to install newer ver kahit installed na

same here. na download ko na din 7.3.1 na version ayaw pa din.

same sentiments. There’s always a dialog box saying that if I would like to file for my 2018 returns, I should download the latest version. The latest version is 7.3.1 based on the BIR Website.

what if no email confirmation is received?? please reply

hello, the submission of my return filed was successfully sent but i did not received a confirmation from BIR. Do i need to file again and submit? please reply

ganito din naging problem ko… last day of submission pa naman ngayon… 🙁

Until now wala pa ring confirmation email sakin

Hello. I would like to ask how do i move my ebir files from one computer to another? I also installed the updated program to my new computer.

bakit po sabi dito sa bank hindi na sila tumatanggap ng 2551m form?

paano gagawin ko?

tanong ko lang po kung ano problem kc wala or ayaw gumana ng print button and final copy salamt po

Hi. Hope this will help to those having issues with submitting online. Tap the TOSA hyperlink then tap agree. Then submit.

for the year 2017, i closed my small business but havent totally closed my bir permit.. have been filing no transaction since january 2017… how to file for annual ITR? and what form to use? tnx for the help

Hi,

Paano po ba isave to PDF or excel yong returns? Kasi sa bahay lang ako nagfile ng eBIR form tapos wala kaming printer. Sa net cafe ko sana plan mag print ng returns. Salamat po sa makakatulong.

hi, if you forgot your username and password for online filing. how do you retrieve it?

Bakit di ma-retrieve ang saved files? Paano mag-retrieve para di paulit-ulit magfillup?

Hi. Just wondering if u find a way how to retrieve it?

Palagi pong lumalabas “An error has occurred on this page” kaya di ako makaproceed sa pag fill up ano pong gagawin ko?

Bakit hindi po ako maka final copy pag pipindot ko yun sabi no internet connection ehhh malakas naman internet ko????

I have the same problem po, hindi ako makapag submit 🙁

Same issue with me.

nawala po id card ku pwide kumuha uli

bakit invalid TIN ang lumalabas eh tama naman ung nilagay KO??

Anyone here encountered a prompt “Slow Internet Connection”? Do you know how to resolve this? Thanks!

Hi, encountered the same problem, have you solved the issue? Thanks.

Try connecting using LAN.

Same Issue sa akin, Ok naman internet connection ko, anyone solved this issue?

Hi ask ko lang kung anong gagawin kung nagkamali ako ng filing? Imbis for the month of october yung iffile ko, nafile ko siya for november. Nasubmit ko na eh. I really dont know what to do. Salamat sa sasagot

ako din last saturday I filed 2550m using eBirforms then nreceive ko ang validation sunday ng gabi na but yung isa ko pang finile na return which is no transaction, wala pa yung validation or confirmation. ayun pa nmn ang importante.

HI. Ako nga late file na. Nov 23 lang ako naka submit ng 2550M pero till now walang ereceipt email confirmation. Sayo ba meron na dumating? Ilan days inabot? Thanks

Can you pls help me to used ebirforms new bznz plang po ako retailers ng house hold products

Nasagot na po ba to?

What to do if no confirmation receive from BIR and where can I email the file. Thanks.

Hi, Dinownload kopo yung Offline eBIRForms Package v6.3 sa Computer ko.. Tas pag na install then i rarun na yung program.. Walang lumalabas… Me sira ba yung Program o di lang Compatible, Os ko po window 10 pro.

Hello po, nasolve na po ba yung problem nyo? Ako din white window lang ang lunmalabs.

pero before nagagamit ko ung app.

May problem ata sa online filing lately. 3 years na ako nagfifile using eBIRFORMS wala namang problema pero this month wala akong nakuhang email notification/confirmation. Try ko iconfirm sa end ng BIR kung may problem sa side nila.

Anybody having the same problems?

Me too, same problem

Same here.. Successful naman iyong submission sa Offline eBIR software pero until now wala pa rin akong email notification/confirmation. Twice ko pa ginawa. 2 iyong finile kong form 2550m and 1702q pero iyong 1702q meron notification iyong isa wala..

Meron bang balita kung anu gagawin?

Re install nyo po yung app or palitan nyo po email ad nyo.

No confirmation email received from BIR. What is alternative step for filing? Since yung email submission ay disabled na since 2015 pa. Paano malalaman if natanggap ng BIR yung sinubmit na form?

I have the same issue. Waiting sa bir email reply pero wala. May balita ka ba sa confirmation mo sa BIR? thanks

Same here. May balita na po ba sa BIR kung bakit walang ereceipt email confirmation?

Also has the same problem.

me too po the same problem…how po?…thanks po…

What will I do, if doesn’t the application or the ebirexe.?

Sa 1601E ko po ng kmli po ng type ng email pano po un??

Pwede po ba mg submit uli ng isa pa?

pano pong ginawa nyo? same problem here :/ nagkamali ako ng email na nalagay.

hello bakit po hindi ko ma open ung xml.BIR Form sa laptop ko. tnx

depende po sa gamit n laptop or ios. sa macbook air ng boss qo ayaw gumana. pero sa asus qo ok nman.

San nakasaved yung .xml na file ?

Hello, I have a small business with my brother which we recently registered as partnership. We’re bring required to submit Form 2551M via BIR’s online system. However, I can’t seem to figure out what ATC I should use. FOr our previous manual forms, we’d leave ATC blanks. FOr the electronic version, should we choose PT010 (persons exempt….)? Even if we’re filing as partnership?

bakit napapalitan palagi ng “undefined” lahat ng type ko sa boxes ng main screen?? dati nman hindi ganun.. nakailang restart at reinstall na ko, ganun padin.. 🙁 help!!!

same here maam grace. Nagawan nyo po ba ng solution ito? Salamat po

Hi. Please help… May solution na ba kayo sa “undefined” error ng ebir forms? Until now ganun pa rin ang error sa PC ko pero dati nagagamit ko naman.

Salamat sa sasagot

UNDEFINED issue solved pero may troubleshooting service charge..

I have the same problem on ‘undefined’ which replaces all data in the main menu of the eBir forms. Saan ba pinatro-trouble shoot ito?

Pano po ung lagi undefined?pasagot naman po.salamat

I encountered this, quick fix: go to ebir folder, users folder, delete the user you are encountering undefined issue.

open file location>open profile> delete the TIN showing undefined when you input it> try logging in again> input same details(don’t worry your previous filed returns will not be deleted)

-Hyperdrive16

Good day. Ang business ko po is Computer Shop. Ang ginawa ko po is I printed my 2551M without submitting it through EBIRForm then I went to the bank and paid my percentage tax. My question is, is it already filed upon payment to the bank? Thank you for your answers.

Ganun din sakin.. Nagprint lng ako ng form, then bayad sa bank.. Nka file n kaya un?

Tama daw ba?

Thoughtful analysis ! I was enlightened by the facts , Does anyone know where my assistant could possibly get access to a fillable Profit & Loss Statement Sample form to fill out ?

Sana po mag post kayo ng online tutorial para sa mga barangay na Monthly nag sa Submit ng 1600 & 1601-E sa BIR pero hindi lahat ng barangay treasurer alam mag online application ang dami pong barangay sa buong Pilipinas.. . tnx

I;m unable to submit VAT -2550Q return due to prompted with error that over rely restrictive firewalls and Slow internet connection. To resolve this issue, we tried to upload in personal laptops instead of company laptops. Still problem not resolved. Please suggest how to overcome this issue.

we have the same issue, have you resolved this one already? thanks

Hi, in order for you to avoid that issue you need to submit it ahead of time. Instances like that are very common if the deadline is near.

I would like to ask po if may offline E-BIR po ba na applicable for Mac users and pwde ma download? Thanks a lot!

Not sure if eBIR Forms will work on Mac. Only tried it using Windows. I’ve checked BIR site and there is no specification for OS

gud morning po ask ko lng po 2 po kasi business ng ate ko boarding house saka convenience store kelangan po b 2 ang fill up kong 2551M o pwede ko n syang pagsmhin.thank you po sana masagot.

Hi, if hiwalay sila nakaregister sa BIR, hiwalay din ang pag-file

hi

po maam

pwedi mahingi contact number mo

Hello. i filed for 2550M last Thursday, zero transaction po kami. I reached the Submit part and got the notification that it is subject for validation and that an email will be sent.

I have not received any email yet and it’s been 2 days already.

May mali kaya ako nagawa? or is there a way to check if anong kulang?

Can I resend the form using a new email address?

Thank you.

Ask ko lang po paano ko makukuha sa on-line ng BIR iyong 2307 for our suppliers

Help ano ba dapat kong gawin nung iclick ko na ung final copy for 2551m ang lumalabas NOT SUBMITTED…NO INTERNET ETC ung dialog box na lumabas.

download po kau ibng version ng app nila. ganun din kc ang una qng ndownload. no internet connection din

pare-pareho po tayo ng problema dito. Iyong kapatid ko ganyan din pag “NO Income” filing. Dapat sumulat na tayo kay President Duterte. Let’s reach out to him, kasi hindi efficient yung system na ginawa ng BIR.

Kaya nga po. hindi ako makapag enroll sa efps ko. 1 week na .

Please use Internet Explorer version 11 or above

ang nasa instruction dapat daw IE 9 or 10 and windows vista o 7 pambihira talaga sabi ginawa tong system na to para maging madali sa publiko eh kung papano kung wala kang access s net o d k marunong maghahanap k p ng marunong o may access lalo n kung wala naman bayaran dapat daw ebirform filing at d pwede yong bir form na pwede mo lang sana hingin sa BIR. mas lalong pinahirapan tayo ang daming issue katulad ng mabagal na net may problema d b? at aalamin mo pa lahat ng tech reqts? para lang malaman mo kung compatible o mapiprint mo o makaka access ka sa labas. pambihira! isa pang issue yang e-lounge hindi lahat ng lugar available o meron metro manila lang ata pano sa probinsya ni di mo ma access s mga internet cafe kc dapat compatible. sus!

Wala sa option ng ATC’s ung Pure Business Income. Bakit ganun? Need pa ba un? Or okay n ung email ng BIR? Please help. Thank you!

TO BIR:

Ang hirap pong mag file ng NO TRANSACTION ” oNLINE fILING.

Step: 1 : go to EFPS home page

2: Click Enrol to below LOG In

3: Enrollment Form will Appear

4. Fill it up

5: then wait for the Enrolment Validation Result

Pls Takenote this results:

Tin/or Branch Code you entered does not exist in the eFPS Data Base. Pls email contact_us@cctr.bir.gov.ph

SANA PWEDE NA LANG MAG MANUAL FILING.

Thanks po.

Same here, this eservices is a kind of difficult.

i have the same issue sa ngayun 🙁 ! Mandatory na daw kasi na via Online na talaga pag mag file nang mga No Transaction and Transactions.! Help! kung sino man yong nakapasok through Online.

mandatory daw eh pinapahirapan naman tayo pag file yan nga walang transaction pero mahirap mas maigi pang may bayaran kc bigyan k ng form nila manual.

Same here. Paano nga ba?? 🙁 I need to file via online kaya lang ang hirap. sino ang nakapasok na? pa help naman po!

i cannot print 2551M even if I press Print appearing at my upper left corner of the page.

I was able to print the eBIR form but it printed like print screen, you can see the links and icons on the print out. Is this the one that we will submit to AAB together with the email confirmation and payment?

hi,

will it run to mac?

I am doing the filing thru offline eBIR form. This is my first time. After validation, I pressed the send button. I kept receiving a prompt that I do not have internet access although my pc is connected. What should I do to complete the process of efiling. I am doing this after 6pm. Is there a time frame on doing this? Please help me as the deadline is already on May 19. Thanks.

I have the same problem!! Is there another way how to file the BIR form? Mine is due today.

ganon din ako. nakapagsubmit ka na ba?

It seems to me that this is a common problem. Because BIR will not accept a “no payment” return manually, ang naging advice sa akin ay magsubmit na lang ako with a voluntary payment. I paid one hundred pesos para lang di ako ma penalty for late filing.

same here ganun din ang lumalabas … You dont have an internet connection , kahit pa meron naman ako connection..

hindi po ba pwede na optional na lang yung eBIR? mas madali para sa akin yung mag-fill up ng form manually (handwritten) then i-submit sa mismong BIR office.

paano mag print ng 1701? eh ayaw naman lumabas nung PRINT sa may baba? please paturo naman?

i-validate mo muna bago ka makapag-print/ma-highlight ang ‘print’

Hi,

Ask ko lang po if nagkamali ako ng pagsubmit ng final copy of Form 1700 online kasi mali yung ibang figures na nakalagay dun kasi nagbased ako dun sa binigay ng BIR Binan, pwede pa po ba macancel yun or pa re-submit ulit? Please advise naman po. Salamat.

hello sir/madam:

during my submission, i am prompted with this info: “The service is unavailable due to SMPT connectionservice. your ITR was not submitted online.”

Sir/madam, what would be my action to this or what am i gonna do with this? thank you.

hi naexperience ko din po ito. try loading it using internet explorer. sa Chrome po kasi ganyan ang lumalabas. baka lang po makatulong. 🙂

Sa 1702-ex po, items 16 – 19 ay not applicable kaya po wala po ako sinulat pero pagnagvavalidate na po ako, ayaw, kailangan daw po i fill up yung mga items na yun, so nilagay ko na lang po NOT APPLICABLE…ang problema naman po ay yung date sa item 19…paano po yun?

good day!! nagfile ba kau ng tax exemption? so, you receive certificate of tax exemption. there u find the data that u can post on that specific box…..tax exempt cert. commence and expire 5 yrs.

how can i get tax confirmation receipt if i use offline?

Hello! Hindi po kayo makakareceive ng email confirmation from ebir kung hindi ka online. Need nyo po magonline para makapagsend s eBIR tpos, saka lng po kayo makakareceive ng email from eBir.

you can get a confirmation receipt on your registered email.

Hi po pag may payment po ba, at sa bank nag babayad kelangan pa din i *Final copy?? Thanks

Hi, would like to ask, what exactly do I need to put on LINE OF BUSINESS for Individuals Earning Purely Compensation Income

Hi! ask ko lang po yung sa 20A paano po iattached yung form 2307 at saan po makakakuha nun? wala po kasi sa list ng form sa eBIR. Thank you.

ask ko lng po , nag pa register kame ng business this feb 15, 2016 rental , mag bayad po ako ng percentage tax for the month of february and march ,, panu po pag sa 1701Q? panu po sya madededuct dun? thanks pls help

paano po pag nagkamali ng napadala. dapat bang magpadala na lang ng bago.

HI ask lang po if you have a step by step guide in fillinf up 1701 form? 12 pages kase. Anhirap sagutan. Thanks po

pano mg submit online bir para maka kuha tax confimation receipt,…need help..

Hello Jean Rose! After filling out the required data on the form correctly, click on the “VALIDATE” button at the bottom of the form. It will then ask you to confirm your TIN and email address (twice). After that, a dialogue box will prompt and ask you if you are registered with eBIRforms. Click Yes if you are and No if not. Just follow a couple more steps after that until another box will appear saying you return has been filed. The confirmation email will be sent to the email you indicated on the form after a couple of minutes. 🙂

Hope this helps. 🙂

Hi! After that, do I need to print the email and 1701 and go to the BIR office to let them receive it?

Hi Pam! Yes, if your 1701 has attachments (e.g. financial statements). If none, you don’t need to anymore. Just keep your email confirmation for future reference. 🙂 Deadline of submitting the return + attachments is 15 days after your electronic filing. 🙂

hi i submiitted my 1701. Pressed submit via EBIR entered my username and password. The screen seemed like it froze. I accessed my form again.. and tried submitting I got a message box that said Final Copy Generated. Does that mean it has been submitted? I did not receive an email notification. HELP!

Good evening. I tried to use offline eBIR FORM, there is no box below taxable amount, how can I file my tax update?

hi ma”am good morning po ask qlng po paanu po makita ung b.i.r form po?para po makakuha ng tin # online salamat po

how will i download it to my macbook instructions please for OS X macbook pro

Mga tga BIR kulang ang instruction.Hindi sila willing to help people. Sana sa bir office may booth para sa online system nila .

Hi, i am a sales agent, sa payment form 0605 ano ang dapat i select sa item 6 ATC at sa item 11 taxpayer Classification? what is I and N stands for? ayaw mavalidate if these items aren’t filled out.

individual po and non individual

help,bakit po skain walang lumalabas n slot for taxable amount?…

How to file 2551m with no operation? Thanks

hi mam…panu po mag file ng no transaction…every month and quarterly..thank u po

can you please tell me how to file the efps of itr for non-stock non profit organization (religious organization)? what form exactly to use? is it the 1702EX? Many thanks.

question ko lng po?? kapag nafile na po kami ng monthly at may confirmation ng bir..

kami po ay “NO TRANSACTION”. Kailangan pa rin po ba pa recieve sa BIR yung na print kong na file…

Hi. Im a newbie here. Can someone teach me how to process 1601c-e-f?

Thank you.

nagbabayad po ako monthly ng percentage tax monthly using 2551M form. kailangan po ba ng 2551Q every quarter at can i have sample of filled up form of 2551Q ? hindi ko po alam mag fill up nun but i already saw the form.

Nakakinis kasi dapat itong e-form na ito lahat ng form ay may sample ang BIR how to fill out. Kahit gustong-gusto kong magbayad, di ko naman alam i fill-out ang 2551Q. Kapag tiningnan ko link ng ATC ang mga pagpipilian lang percentage tax on caberet, cockpits, jai-alai, etc. ni isa wala ang flower shop or retail industry, ano ang pipiliin ko, di naman vices ang negosyo ko. Alam nyo Mrs. BIR, since you made this e-form nagkaleche-leche na filing ko sa taxes ko lalo na kapag quarterly. Kapag magtanong ka sa BIR-RDO mo, tatanungin ka rin,:”…di ba may bookeeper ka? dapat alam nyan ng bookkeeper mo…” Parang sinabi na mag hire ka ng bookkeeper. Mrs. BIR, ang iha-hire ko ng bookeeper, ibabayad ko na lang ng tax sa inyo, kaya turuan nyo na lang kami kung paano mag-fill-out, please… Di naman kami malaking kompanya para magpasuweldo ng tao ang minsan lang sa isang buwan magtrabajo.

Yes, required ka po mgfile ng quarterly returns.

GOOD DAY!

Is it okay if I haven’t printed the Filling Reference No.of 2551M on my monthly 3% Percentage Tax every time I pay? All I printed and brought to the bank was the eBIR Form and the Tax Return Receipt Confirmation. Please teach me how to have a copy of my previous payments and be able to get a copy of paid Filling Reference No..

Thank’s and God Bless

i am looking for form 2307. how can i get a copy of form 2307

if you dont have a printer… just use the “print screen” of your computer then paste it to word…

sana katulad sa philhealth na database napakadali mga taga BIR employees hindi clear magbigay ng instructions.huhuhu.

I have been trying my luck to register eBIRForms online but it keeps on reporting “INVALID TIN”. I also have tapped the assistance of your

required talaga ang telephone e walang line ng telephone s lugar namin?

So how would I print the forms in one page only?

pano po mag file ng no payment or no operation using ebirforms ? (percentage monthly po kami)

salamat po

Ung package 5 di ko na kailangang mag email for 1601e.. Bukod dun sa validation email?

Wala po kaming printer, paano po ma-print yung form sa computer shop?

hello po. same query . paano po magprint ng form sa computer shop. til now we cant provide a print out of our filed forms for documentation.. hoping for assistance pls. thank you..

hi po bakit po wala dumadating na validation email sakin, ang dumating lang po ay ang subject for validation of BIR?

ito po procedure ginawa ko.

1.DL package

2. install package

3. fill up form

4. email (attached ebir generated form)

may mali po ba?

EReg is under maintenance last time I heard

Hello po ask ko lng po pnu po yung case ko my tin number na po ko nung ngwork ako company ko po yung ng asikaso kso po due to my personal reason di na po ko pmsok sa company ko .. wla pa po kong nkukuhang tin id .. paano po ko mkakakuha nito ..

Hi! Pwede ba masave ang form sa flashdrive para maiprint gamit ang ibang computer?

Yung offline form nagamit pa nung isang araw. kahapon nungmagf-file na sana ayaw na bumukas nung application. blang page lang. kahit antayin or ire-launch, same thing.any thoughts?

atsaka pano mag online, paano nakukuha yung username at password? anak lang ako dito, gets ko naman yang offline di ko gets ay yung sa email part na iaattach

Madam, ask ko lang po, hindi po ba pag magbabayad sa bangko may iaattached na printed validation email? paano makukuha yun?

Hi, yung dadalhin mo sa bank is yung printed eBIR Form mo using the steps above in 3 copies

Kailangang ng validation if 1) kapag yung babayaran mo eh nirequire na i-alphalist like monthly rentals, and withholding taxes.. 2) kapag no transaction ka for the month

Good day!

Please us the email address of the ebirform 1601-C in order for us to send the report of ours the LGU Tubajon eBIR report please send us immediately thru to my email address or to my cellular numbers 09235883763… please bare with. thank you and more power

email address in sending 1601C would be 1601C@bir.gov.ph however, it is important to provide a correct and/or proper subject which is RDO_1601C_TIN_taxableperiod..

Example email subject:

064_1601C_999999999000_062015

pno po ang attachmnt s 1601c, ung list of payees, san iencode un? and bat wlang 1601c form s alphalist data entry nila?

hindi nman maka pasok sa EBIRFORMS june 15 ang dedline?????? anu gagawin???

sabi po s district email daw namin sa ebirforms kapag no operation? e hindi ko nman po mcopy yung forms para i attach sa email, ano po ba tamang proseso?

what should i do if the offline ebirforms doesn’t responding? Is there any options on how to file the returns.

Do the online ebirforms filing instead

how to file online ebirforms is there a procedure for that tnx.

Why is that it’s not printing?

Select the Print button at the upper right tab of the page

saan po napupunta ung file kapag punindot ung save ??

C: eBIRForms folder under SaveFile

bakit po pag inopen ko ung save file dko makita ung naffilupan kong form.at paanu ko sya save sa flASHDRIVE kasi wala kmi printer?thanx