Not everyone knows how to use the SSS R3 program a.k.a R3 Diskette Project properly to generate and input files. In this page, I’ve discussed the step-by-step ways on how to enter and post details of employer and employees updated SSS contributions and premiums.

Recently, SSS announced that they now require all employers to have an online employer account before submitting SSS R3. I think they implemented it to make everything else online and paperless.

It is so important to enter SSS contributions and update details to the SSS R3 file generator program because it is one of the requirements after paying SSS contributions. It is an assurance that each employee’s SSS premiums are posted properly at the SSS system whenever they pay or remit. SSS R3 displays the Contributions Collection List and gives a print-out of SSS Transmittal Certification and employee file. If you are a first time employer, you can read “how to pay and post employees SSS contributions.”

How to Download SSS R3 Program File Generator

Where to get the SSS R3 file download? After an employer or a company was registered at the SSS, they are usually given the SSS number plate and certificate plus the file containing the SSS R3 program. This file must be downloaded and installed by the employer to a computer –laptop or desktop.

Check the system requirements to be sure the program will run properly and faster. The file also contains the user’s manual which includes instruction on downloading the file. You can also download the file online at SSS website. Once you successfully installed it, you can start uploading your data and employer’s info for SSS contributions collections.

Follow the procedure below in entering your employees SSS payments and EC shares.

How to Use SSS R3 Program and Generate File

Steps in using SSS R3 Diskette Project

- Tap the R3 icon in your desktop.

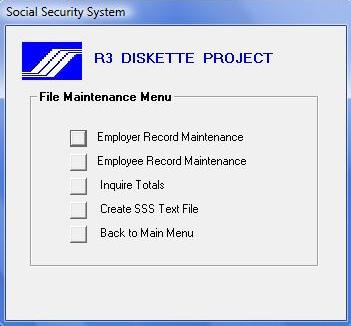

- Start by selecting File Maintenance in the Main Menu.

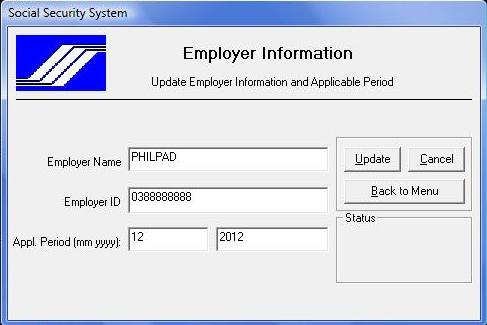

- From the File Maintenance Menu window, choose Employer Record Maintenance and enter your employer’s name, employer’s SSS ID number, and the applicable month of contributions. See the screenshot below as your guide.

- Then click UPDATE the Back to Main Menu.

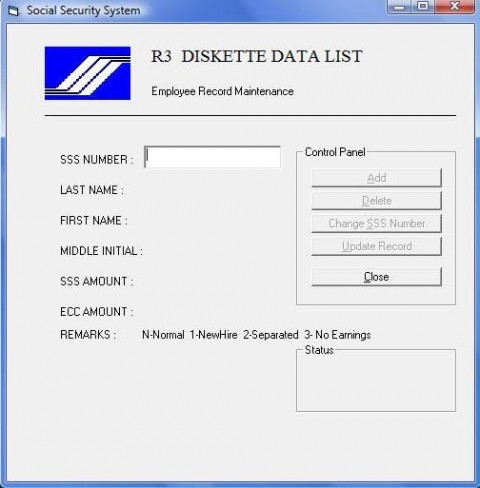

- From the File Maintenance Menu again, choose Employee Record Maintenance this time.

- Then enter your employee’s SSS number and other details such as last name, first name, middle initial, SSS amount, ECC amount and the applicable remarks for that employee (ie: N for normal employee) By the way, you can press enter whenever you are filling up the next info (ie: SSS number hit enter to proceed to last name…and so on)

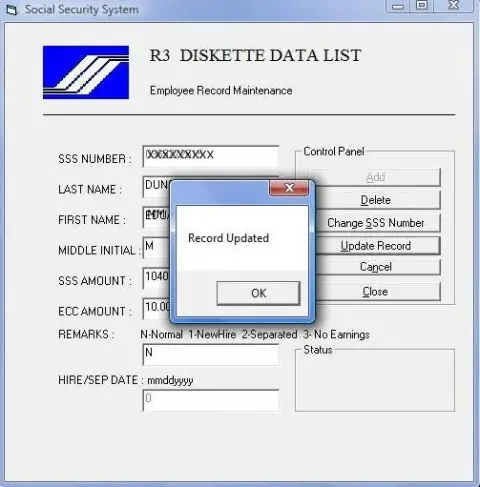

- Hit Update when you’re sure all data are correct. Double check all data before hitting update to avoid errors or wrong inputs.

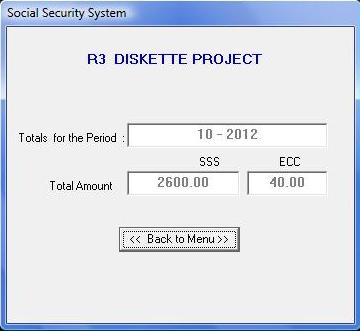

- Once you have entered all your employee’s contributions, go back to the File Maintenance Menu and choose Inquire Tools at this time. A window about your total SSS amount and ECC will be displayed then for the applicable month. Go back to the File Maintenance Menu if it’s correct.

- Choose Create SSS Text File at this time. Your computer will tell you that a copy was saved for your file. This file must be saved (copied) to your USB or diskette (whatever you are using) and must be brought to the SSS branch together with the applicable receipt for this payment and the print-out of transmittal reports discussed on the next step. Once this file was received by the SSS, all employees’ contributions and collections will be posted accordingly.

- Go back to the Main Menu and choose Report Generation.

- Print your Transmittal Certification and Employee File. Print 2 copies because the other copies will be left at SSS, the other ones will be your own file copies.

- You are done. Tap Exit.

When to submit the transmittal and R3 USB file?

You must submit them within 10 days after the applicable month of the payment. You can pay either monthly or quarterly. To avoid late payments, know the latest Deadline for SSS Contribution Payments.

Share your experiences about this software by commenting below. Thanks you!

Next article: How to Install the New and Latest SSS R3 Program

How to delete over all total of SSS example for the month of June 2019?

Ano po gagawin kase hindi ko maopen yung employee record maintenance naghaHANG na sya once pinindot ko then ayaw naman na maclose yung tab/window kahit irestart or shutdown ko yung laptop?

same problem here.

Ano po ba ang dadalhin kapag nagpass ng report sa sss? Transmittal report 2 copies?employee list and yong receipt? Original po ba and photocopy?

Nagcreate na ako ng SSS text file kaso pag mag print na ng transmittal sabi R3 may not been generated daw? Ano problema?

Hi. I already saved and created SSS files but the problem is nwala sila lahat. Ano po ang problem? Huuhuhuhu

Hello po..patulong nman.. How to Create report for the salary loans? Na.enter ko na po yung details ng employee tapus e LMS generate ko cya..oki nman..pero nag.permission denied cya..anu po ba ang dapat kong gawin ??hindi ko rin ma.print yung transmittal list at employees file. Thanks you in Advance..Sana matulongan nyo po ako..

Pano po magpost ng sss remittances using my.sss

kasi as per sss-sor branch di na daw po gagamitin yung USB flashdrive by posting remittances. online na din daw po.

Thanks!

Hi pa help naman, i was updating our 2016 r3 nung icheck ko yung inquire totals before i proceed to update the 2016 contribution may 1 employee agad n nakalagay panu po yun idedelete? yun ung old employee namen and wla n sya dito sa shop so do i need to delete him in our r3?

please help bakit lagi naghahang doon sa may employee record maintenance. kahit anong gawin kong download ng latest java. please help. all other tabs okay naman.

gud am, Paano po kung walang middle name and employee? ano po and i-encode instead? kailangan po kasi may input sa middle name to add and employee sa R3.

Thanks.

Gud pm . Paano po kung walang middle name ang employee? ano po dapat i encode sa middle name field?

kailangan po kasi may middle name para ma add ko ang employee.

thanks.

gud pm, Paano po kung walang middle name and employee? ano po and i-encode instead? kailangan po kasi may input sa middle name to add and employee sa R3.

Thanks.

Good day,

Insufficient r3 payment.

Php 686.00 – Amount paid.

What should i do?

Many thanks

Pwede ko nalang po bang ulitin ung sa april and may ko ? kahit na submit na?

Kasi hindi ko talaga maiprint yung transmittal 🙁 Nag eerror po kasi hindi daw generated what will i do? dalawa ng months eh

Will the R3 program work with Windows 8 or 10?

Yes, I’m using Windows 8.1 and 10 on another laptop, they are both working, no problem so far

mam fehl, bagong sss-lms po ba gamit nyo kac gumagana sa windows 8.1…kasi sa akin po, nagupdate kami ng OS, di po xa gumagana ung SSS loan program…pls help…thanks po..

gumagana po ang bagong r3 generator po. add ka lang po muna employee info under employee record maintenance po, after input sss number press enter po.

Hello. I am to print the transmittal certificate but there’s always an error: SSS file of this r3 file has not been generated, You may not continue creating reports.

Please Help.

Posible po, hindi mo pa naclick yung Create SSS Text File pero naclick mo na yung sa Report Generation sa Main Menu.

HI

RE: Salary Loan LMS program.

I always get “error 70 permission denied” whenever I try to save my salary loan payments in .txt file format. How do you fix this problem?

Ano po ung meaning ng DTHRD?

Date Hired po siguro?

hi maam

ask ko lang po pano po pag yong sa R3 na list ay 800 pero pag na genarate sya lumalabas sa total 801 kaya po di mabalance. ilang check na po yong list na naipasok ay 800 lang naman. salamat po

File name : R30209362141042014.03032059

Employer name: BALOOGA CAFE/MARICEL SALAS Date: Mar 03, 2017

Employer No : 02-0936214-1 App. Period: 042014

PAYMENT INFORMATION

TR/SBR NUMBER : NOPAY

DATE OF PAYMENT : Mar 03, 2017

AMOUNT PAID : 2,735.00

ENCODED INFORMATION

SS AMOUNT : 2,695.00

EC AMOUNT : 40.00

TOTAL AMOUNT : 2,735.00

Total number of Employees: 4

CERTIFIED CORRECT AND PAID

RECEIVED BY : _____________________________

DATE RECEIVED : _____________________________

TRANSACTION NO: _____________________________

question po, bakit po nakalagay sa NO PAY?

INVALID VALUES

i paid for January February march, i was able to create transmittal for January but for feb and march i keep getting invalid values for applicable period -_-

FOUND A SOLUTION TO THIS PROBLEM.

From 04/2017 application period, I have to change it to 05/2017 but I keep on getting “Invalid values for applicable period” our date of payment was 05/30/2017.

I called the office of SSS and, it won’t be valid because we’re still in the month of May. If the month of june starts, that’s the time that the applicable period for 05/2017 will be valid. What I did was, I CHANGED THE DATE ON MY COMPUTER AND ADJUSTED IT TO JUNE 1 even if it’s the 31st of May and it worked! Hope I helped you guys.

That’s great 🙂

hi! pa help namn po. gumagawa po kc ako ng r3 report but the prob. is my underpayment po kmi na 10.00 so hindi ko matapos kc d namn mag gegenerate kapg di tally ung report sa receipt. anu po gagawin ko?

tnx

bakit po hindi makapag generate ng January 2017 applicable period.

Invalid value on applicable period ang error.

i have the same problem.. cant update the applicable period to February 2017. Pls help

sss txt files were created, transmittals & employer list were printed na po. but then when i try to make a back up, R3FILEfile [r3file.dat] doesn’t exist po lumalabas. Okay na po ba un? Please help. Thanks in advance!

Just save the .txt files sa USB instead then you’re fine

INCLUDE PENALTIES IN SSS TEXT FILE?

Hi po! we paid sss contribution arrears at the bank po. Do i have to input also the penalties in creating the SSS text file?

WHAT HAPPENS NEXT AFTER WE PAID THE SALARY LOAN ARREARS?

one more thing po that i would like to ask about…

(Late repayment of salary loan, nov 2014 to nov 2016 using only 2 receipts)

Nagpunta po kasi ako sa SSS branch para ipareceive yung binayaran naming salary loan pero sabi nya need daw po ilagay sa usb. Binigyan nya po ako ng file sa usb, isang LMS program at loan excel. Alin po ma’am sa dalawa yung gagamitin ko. Ang idinemo lang po kasi nya sa akin is yung loan excel pero di ko po alam pano magcome up ng kahit anong output using that. Ano pong documents yung kailangang iproduce para maconsider posted yung loan.

The Co. has only 6 employees, required po ba i-usb yun subsequent to payment.

Hope and need to hear from you asap. hehe

Thanks a lot in advance!!!

madam,

ask lang po if we still need to submit r-5 to sss if my employee is my spouse? husband and wife team po kasi un tutorial center po namin kya kami lang 2 ang nag papatakbo.

pls advice..

thanks po.

HI MS. Fehl,

Please i need help regarding SSS loans, LMS diskette, nakapag add na po ako and commit ng mga may mga loans after that nkapagprint na ako ng transmital, tpos ang problem ko pag magpprint na ako ng employee file lumalabas NO DATABASE found, panu po gagawin ko, pero nasave na din sya sa USB wla lang ako list ng employees. Thanks in advance

Hi, Jocelyn. You need to create SSS .Txt files para masave sila sa Document files mo before ka mag print ng Transmittal of Employee List.

“Operation is not allowed when the object is open.”

Yan po lumalabas pag tinatry ko magprint ng transmittal. help po. thanks in advance

I tried downloading the R3 generator program from the SSS website but a virus alert from my computer appeared.

Are there any other way of obtaining the gfenerator program.

Thanks

add us on Google + we share the R3 Generator installer there

Hello Sir/Mam,

pwde po makahingi ng SSS R3 File Gen. software. Thanks po.

GOOD DAY..

QUESTION: IF WE HAVE OVERPAYMENTS OR UNDERPAYMENTS FOR SSS R3, CAN WE POST OR SUBMIT IT THRU SSS ONLINE?

WE USED SSS ONLINE FOR SUBMISSION SSS R3, BUT THE MAIN PROBLEM.. kapag I-CLICK NAMIN YUNG UPLOAD COLLECTION LISTS.. THEN UPLOAD FILE,, HINDI MAKITA YUNG TEXT FILE? ANO PO BA DAPAT GAWIN BASTA LAGI GANUN ANG PROBLEM? WE TRIED ALSO, CREATE COLLECTION LISTS ONLINE, LAGI PO NAG EEROR AT BUMABALIK SA MAIN MENU? THEN KAILANGAN MO ULI MAG LOG IN? PWEDE NYO PO BA KAMING MATULUNGAN?

The easiest and fastest way to upload collection list and contributions is using SSS R3 program and uploading the SSS Txt files on a USB drive. Right now, slow ang online uploading so do not rely on it if you have many employees to upload

what if.. if i tap print transmittal certificate it appears… R3 file with applicable period. might not have been generated you may not continue creating reports. what can i do for i am done creating all my reports.

please help i am new encoder of sss.members for 70 employees.

thanks.. hoping for your prompt response GOD BLESS US ALL!!!!

anong amount ilalagay sa R3 Project — CREATE SSS TEXT FILE option kung 6months worth ung binayaran sa isang resibo. ung monthly amount or ung whole amount?

hi,

ask ko lang of there’s a way para ndi ko naiinput isa isa ung details ng employees..around 100 employees ksi kami sa company, hussle if isa isa ko silang ieenter sa employee record

Thanks!

bakit po “Wrong file format. No header record found. Loading is cancelled” ung lumalabas pag inag-aapload po ako. pahelp naman po 🙂

Please remove, delete and uninstall the program and re-install the software

help naman po nag post ako online na post q na po yung loan namin ng mnth ng january2016 pero ng i post q na yung february2016 lage nlang aq umuulit sa umpisa kasi pag dating lage ng pang 87employee q or 20+ lage na loading lng ng loading d ko matapos tapos:( help naman po anu yung procedure sa pag post ng loan yung madali po need q na po tlga salamat

hi , maam /sir pwede patulong po ako kung panu mag fill up ng R3 form pwede makahingi ng sample.

See the sample given above 🙂

Hi.. Pano po i-edit yung company information sa SSS LMS? Kasi if edit company information, naka gray na ung section ng sss number at company name.. how to edit po yan if nagkamali ng pag type? thanks.

good eve po. mali po kasi ung spelling nung name ng isang employee na na input sa r3 per tama naman po ung SSS number. okay lang po ba un or kelangan pa pong ipaayos sa SSS?

thanks!

Hi, I can’t install LMS .. upon installing it, just the user’s manual appeared?

Good day po, ask ko lng po bakit po yung R3 file na ang coverage ay nov 2015 ay yung notif eh invalid values for applicable period?

Many thanks! How about the LMS Diskette Program? Do you have any similar post?

Hi.. Gusto ko po sanang malaman how to make a request letter for r3 po

hi!

Im getting ‘Invalid values for applicable values’ when changing applicable period. July 2015 is fine but i tried Aug and Sept, Iam getting same response. Cant we generate file months Ahead? Im doing this today. Aug28,2015. Thanks

Hi Did Someone already answer you question?

hello! i badly need help? how to print reports? it keeps on saying error on printing employee details. also same with printing transmittal report. thank you

Follow us in Facebook and we will send you the R3 file sent to me by SSS that is working

Gandang araw po! May mga tanong lamang ho tungkol sa R3FileGen.

1. Pag i pi-Print na yung Transmittal at EE na na generate sa R3FileGen klelangan po ba magkasama sila sa isang typewriting or magkabukod?

2. TR/SBR Number. Ang ginagamit ko po dito ay yung Pay Ref# na nakalagay sa resibo ng R-5 ko. Tama po ba yun? Ex. D***12345678900

3. Sa Transmittal po sa bottom part ay may mga nakalagay na Received, Date Received, Transaction Number. Ako po ba ang mag fi-fill up neto since nakalagay naman dun sa resibo ng R-5 yung mga details nito.

4. Sa R-5 at Transmittal same lang ba yung Pay Ref# at Transaction Number?

5. Need ko po ng dalawang kopya sa mga printouts tama? One copy for SSS and another copy para sa akin. Pwede bang Xerox yung isang copy?

Salamat ho ng marami. ^^

1. Once na print mo ang transmittal, one per month yan so 1 bond paper per transmittal (per month)

2. Yes, use the receipt number on your R5

3. That is signed by the Authorized Representative. You must first file SSS L-501 form

5. Nope

5. Yes

Good PM po. Mag aaply po sana ko sa as Employer po sa SSS. ung company po na nghire saken is wala pa po employer registration sa SSS. so since ako po first employee nila ako na po sana mag aasikaso. question ko lng po since Corporation po ung company. regarding po sa SSS Specimen signature. pwede po ba na ako ung lalagay na na magsisign ng documents since ako naman po lagi ang pupunta sa SSS branch if ever may papasign na documents. the president and corporate secretary kasi would be busy to sign those. paano po kaya yun? thanks po sa reply

di po yan pwede kalangan po tlaga ang member.. tnxs

Gud pm gusto ko sana mg online na mg submit ng r3 ang kaso ndi ko alam ilalagay ko sa date of Coverage. Pano po kaya yun ngresign na kase yung date humahawak wala naman ako makita sa file ng ss-r1 form??

Good Day! How to post sa R3 File yung may under payment contribution?

PAANO MAGREPORT NG LOAN PAYMENTS ANG EMPLOYER THROUGH USB/FLASH DRIVE? binigyan ako ng r3generator ayaw naman gumana sa PC ko. Thanks. 🙂

pano po pag nawala ung SBR na copy ano po ggwin?

Request a copy at SSS

hello po ask ko lang po pano po ung separated na pag nilalagay ko o.oo and mga amount ayaw po error dw po dpat dw po kng 0.00 and amount dapat dw 3-no earnings dw ?eh ndi nman po pude un db? kaya nga po iseseperate pero ayaw tanggapin ng system ng sss need a reply asap…

DATE HIRED/SEPARATED

FYI, this area is actually asking for the first day of the applicable month of contribution. Medyo nakakalito lang kasi date hired/separated ang caption na nakalagay but as I mentioned, we need to input the first day of the applicable month of contribution.

I guess SSS should fix this ambiguity by not asking for it anymore since they already asked for the applicable period. Just sharing.

I agree 🙂

What if may dalawang registered na company pero isang tao lang may hawak ng R3file gen. Pano po yun? Do I have to delete all the files to update another? Hoping to hear from you, thanks

Use another computer

good pm guys, ganun din po problem ko pag epprint k ung employee file at trasnmittal list. sabi nung sa sss compatible lang daw poh ung downloadable sa website nila sa windows xp. hinge ka ng copy na compatible sa windows 7 at 8

Follow us in Facebook and we’ll send you the file

Hi Ms. Fehl, ask ko lang, ggwa na kasi ako ng transmital report for the month of April pero kapg iupdate ko na ung employer record sa April 2015 laging “Invalid Values for Applicable Period” paano po un? sana matulungan nyo ako. Salamat and Godbless!

Follow the SSS values (SS and EC) in the latest SSS Contribution Table

hi ms. fhel dun po ba sa create sss txt file ang ilalagay po sa TR/SBR# ay ung 15 digits na nakalagay sa R5 form na validated na ng sss, bale po yung katapat ng pay ref# sa resibo pag sa sss mismo nagbayad? pag sa bank naman po yung 6 digits number na nasa lower right corner ng resibo, tnx po so much sa reply:)

pano kapag may mga employees na kami na end of contract na/separated..

need pa po bang iupdate yung status nila sa company? kahit na nagbbgay kami ng R3 file,,, na may nakalagay na separation date dun…

Yes, you need to mark the status associated with the employee

Yes, it’s the Pay Ref. # in the R5 (15 digits). Not sure how many digit yung sa bank, just look at the reference number

Hi Maam, need some help.. I got the R3 program at SSS Office nagru run naman po siya pero pagdating dun Employee Record Maintenance nagha hang and hindi ko na magamit. Tumawag na rin po ako sa SSS and they advise me na idelete lahat ng una kong files and reinstall ulit.. pero ganun parin po sya upon reinstallment. don’t know what to do. by the way Ubuntu po pala yung ginagamit ko.

Looking forward from hearing you soon. Thanks po!

Try using Windows instead of Ubuntu

Magandang araw po…ano po ba ang kailangan program na dapat meron ang computer ko, para makagawa ng SS Loan report payment. Nakailang balik na po ako sa office ng SSS, pero ang sabi magpaturo na lang ako sa marunong.

May Usb na po ako n nilagyan nila ng SSS loan pero according sa kanila may kailangan raw po ako idownload sa cp ko pero hindi nila alam kung ano..

Please help po

cherry

Latest version of Java and Adobe PDF reader.

Good Day!

just want to ask what if po kung by quarterly po ang bayaran ano po ana gagawin sa payment record po?

then ask ko lang po by certain month po 5 lang po ung emplyado then the following may bago na pong empleyado po bali po mag uupdate po ako ng employee records po kea magging 6 na po sila then pag bumalik po ako sa mga previous months po ung mga months po na wala pa po si bagong emplyedo po bakit nag appear na lang po ung data nya po tsaka ang nakalagay number ng employee po eh 6 na po instead of five

You need to do the reports per month. Add the new employee on the month he paid his contributions. The system will automatically add that new member when you print out the transmittal

good evening

Ask ko lang po.sino po ba mag certified correct and paid sa transmittal.

is it SSS staff or ako po.

thank you in advance

The authorized signatory, it’s your HR or you if you are an authorized signatory

Hi, ask ko lang regarding sa r-5 form namin sa office, kasi instead month of june ang contribution nalagay ko is month of july. anong gawin?gagawa ako ng letter? pwede pahingi ng sample ng letter? thanks.

I am about to cry. Whenever I go to Report Generation and select on Employee File, I get an error that says “error printing employee details”. When I select on Transmittal List, an error that says “application-defined error or object-defined error appears. Please help.

Where did you get your R3 software?

Hi ms Fehl

It’s my first time using R3 and your blog really helped me a lot, thank you!

and I was trying to input the data for the employee maintenance but it keep on saying “INVALID AMOUNT FOR SS CONTRIBUTION. AMOUNT IS OUT OF BRACKET.” so it won’t update and kept saying to try again and I have no idea how to address the problem and i’ll be doing the sss contribution for the entire 2014. Any ideas on what to do? Thanks!

I have the same question. What did you do? Have you fixed this problem?

hi, good eve po… ask ko lang po kung pano e update ang bagong remittance amount. kasi tumaas po ang remittance namin. kaya lang pag nag encode na ako, ang old amount pa din ang lumalabas. ayaw tanggapin ang bagong amount. pls reply po as soon as u are available, kasi hindi pa kmi naka pasa ng transmittal and employee record beacause of this reason.

Thank you po… God bless..

You should use the latest R3 software 2014 to input the latest contribution amounts

hi maam, tanong ko lang po bawal na pla ang reconciliation sa sss contribution ngayon, kasi may mga payments kame na nagkamali ung date of posting, like for an instance, na double payment nmin july2014, instead for august payment dapat yun. At isa pa may employee kame na nkaligtaan payment nya intead na 7 employess dapat binayad ng staff namin is for 6 employess lang . please help paano ang pag reconcile nito, at anong procedure of input sa R3 program sa late payment..thankz

i will ask if only create sss test lang po ung save ko sa USB forb reporting coz its been 3 years ive made report and i forgot and maybe update na… but i rememeber dalawa ung print each file the inquiry tools and the list of members…

thanks in advance for ur reply

Gud day mam fehl… Mam tanong ko lang po bakit d po kami mkapag print transmittal certification at employee file gamit to SSS R3 ?

What is the message you receive when you print?

GOOD DAY PO!.,nag download po ako ng LMS sa website ng SSS. pero nagkaka error po. pag nag priprint ako ng report, “ERROR PRINTING DETAILS”pag sa employee list at sa transmittal ay “OBJECT ORIENTED ERROR” …pano po ba solution? need po kasi namin for our LMS report…tnx

Hi Ms. Fehl,

Good day!

I really have a problem regarding SSS posting (loan). Nakapost na po kami sa SSS, however, yong data na nailagay ng staff namin, may mali-mali po. There were errors in the Loan amount, date granted and others have errors in the Names. Paano po namin i.edit yong na.isubmit namin na posting. We posted it online. Thank you so much.

Go to the SSS personally and bring a copy of the uploaded reports, then request for correction. Also bring the SSS payment receipts

Okay Ms. Fehl,

Thank you so much. Usually, how long will it take to process such corrections? Actually, we were advised to post our payments online since sira pa po kasi yong system ng SSS for manual posting (posting through USB)…thanks again

A week’s time. The online system is mabagal naman and laging hang

Hello Ms. Fehl,

Okay po. Thank you so much for your prompt response. Godbless.

paano kung walang middle initial? ilegitimate. ayaw tanggapin sa R3 pag walang middle initial.

HOW TO SOLVE “OUT OF MEMORY” ERROR.

LAST TIME WE USED THE SSS LOAN SYSTEM EVERYTHING WAS IN GOOD CONDITION

UNTIL EARLY THIS DAY, THE ERROR POP-UP.

SSS website is actually experiencing memory and bandwidth issue and their IT people are fixing it now. Let us wait and be patient coz that is all we can do for now

hi guys i need help, ano po ba yung pwede kong gawin sa R3 Project kasi i have a problem regarding sa pag-uupdate dun sa EMPLOYER RECORD na under ng FILE MAINTENANCE everytime i tried to change Applicable Period for the month of September then when i click update may lumalabas na msg: INVALID VALUES FOR APPLICABLE PERIOD. anyone can help me! what would i do?? Thanks

It’s a usual problem especially when you upload many months for a day. Try uploading another time

Hi maam i need help.. why it appears that an error occured every time i upload my files. i had been doing it right previously. it only happens this time.please help. big Thanks!

It’s normal for online uploading that is why I just rely on submitting R3 USB personally most of the time

Hi again, please send me the older version of r3filegen through my email. it may just be the answer to my problem regarding the unposted items from 2000 onwards. thank you. have a great day!

Please contact us for the file

hi again, i did send a message to philpad via contact us. hope you got it, thanks

Hello, I am also a first time user of the R3filegen, 2014 version. We have unposted payments dating back as far as year 2000. We also just recently paid contributions that were overdue, 2008-2009, 2011-07/2014. I have not been able to make the reports as I am having difficulty with the program.

Question is, can the payments still be posted to the proper SSS numbers, esp the ones dating back to year 2000? If not, what is our recourse?

Is it possible for us to submit a regular R3 form (paper) for the payments made from 2013 to 2000? Again, what can we do if this is no longer accepted?

Thank you for your kind assistance.

Hi there! I suggest you verify and check first at the SSS if the contributions back from those old years were already been posted so that you know if you still need to submit reports. The old R3 programs are not the same with the new one, 2014 and contribution brackets are very different. You cannot upload old contributions dated back before 2014 using the new R3 program 2014. The first thing you need to do is check the contributions at SSS if they’ve been posted by any means. Then make actions.

thank you for the reply. actually, the said payments have not been posted that was why i was told to report it and was given the program. the person did not explain that it’s a new program and thus, useless if doing postings earlier than the current year. he was aware of the problem and yet wasn’t pro-active in helping.

may I request kindly, for a copy of the older program be sent to me via email so i can rectify/resolve the problem.

should the old program not work either, could i just give them the R3 paper copy and get them to upload/update our records in their system?

your help is much appreciated! more power!

Contact us and we will send you the old R3

Hi miss Fehl,

can i have old R3 too?

Big thanks po.. Godbless

hi ms fehl??

ok lang po ba na hindi na gagamit ng R3 file Generator disket kc pwede naman makapag-create online.. tapos at the same time, i can print it without using the Wordpad statement under R3 file disket.. at kailangan po ba na 2 copies parin ang e-print??

tnx

Yes, if you are paying monthly, you can already use the online uploading feature. No problem coz they send confirmation. 🙂 You must print the confirmation though so you have copies.

my mali kc sa ginagwa ko sa R3 file ayaw maregister or ma add ung mga employees na inaadd ko, tas pag naglalagay ako ng ss amount at cc invalid dw ee.. un lng naman ung nkita ko sa report nun naunang admin na my hawak sa mga SSS ng employees nmin… tnx

hello po good afternoon….pano po pag ang amount sa R5 is greater than or less than sa R3?? mali kc ang amount na binayad namin SSS at ngayon lang namin nalaman when I posted it sa R3 diskette… pwde po ba yon? if ever may sobra, pwde pa ba un makuha? or if ever may kulang pano po bayaran? ano po pwde remedy.? kindly answer po…thank you.

Hi po..pwde po mg install ng r3 sa windows 8?

Yes, I’m also using Windows 8 and it’s working fine

Ms. Fehl paano po namin sya maiinstall? once po kc na mgpunta kami sa site ng sss, at idadownload po namin ung r3filegen.exe..ayaw n po mgpatuloy bigla po nwawala..ng extract po tas mwawala

Please read the instructions we discussed in our latest article about SSS R3 File Generator 2014

Hi po, tanong ko ulit mam, sa lms po, pg po mgpprint kami sa report generation, sa employee file ang lumlitaw po ay “error printing employee details..” bakit po kaya?

hi ms Fehl, tanung q lang kc im generating r3… ung employees poh nung april ay 25 then ngaung may ay 20 nalng poh.. nag update poh aq ng separated but ung total of employees sa inquire totals ay 29 for may na dapat poh ay 20 lang.. should i delete the records of employees sa employee record maintainance who were separated last april para mmaging 20 ung total? or may iba pong procedure na dapat gawin? thank you poh…

Repeat your inputs and don’t include the 9 separated in your employee file maintenance. Result will be ok 🙂

Thank you ms fehl…

hi maam .good day ask ko lng po this i my 1st time to file in usb .and every time po na nsa create text file na po ako at ineencode ko na po ung date of payment ung sbr/tr and the amount ay nag eeror po sya nkalagay ay “invalid values for input string july 8 2014, ung kasi ang date kung kelan ako nagbayad for aplicable month of june..tnx po pakisagot po.

Try again to encode the July reports in the first week of August.

good day po. ask po ulet bat po ganun nasi-save naman po sa USB, pero pagsinalpak na sa ibang computer nd na po nakikita ung mga file. lahat po nabubura na. thanks po sa sagot. 🙂

Maybe that other computer doesn’t have the proper program to read the file?

Haha. medyo magulo po kase. pero Thankyou po ng marami. Godbless. 🙂

Good evening Ms Fehl, based on my R3-R5 recon, i have accumulated a lot of overpayments. What form would i use to apply the overpayments to next monthly contributions? Could you please show a sample computation.

Thank you.

Good Day Ms. Fel.., I am working with r3 collection list through online, I already created a text file and already confirmed it and was successfully sent. But the saddest thing was, i forgot to print out the employees remittances, the only thing i had was a validation with transaction number , what would be the possible or easy way to reprint or retrieve the employees remittances? please help..,thank you 🙂 God Bless!!!

No worries, you have the confirmation already. Your R3 collection will be automatically posted in the SSS. If you want to print the employees report, you can log in your Employer’s SSS online account and print it out

Hi Fhel.

Thank you for the file..its very much appreciated.

God bless!

You’re very much welcome!

thanks po. ask ko lng po panu pu ba ung sa applicable month? yun po ba ung record every month na papareceive? example po april-june di pa namin napapareceive, iisa-isahin pa po ba/ na april muna tapos gwa ulet ng may? tapos june? ang gulo po. hehe. :3

Yup make a report to each month and submit files for each month. naguguluhan ka kasi sabay-sabay ginagawa mo. relax and breathe honey!

good day! ask lang po bat nd ako makapagtype dun? hanggang SSS# lang ng employee yung the rest nd namin ma fill up. tnx po

It’s a common problem. I had same experience too. My R3 hungs up when I enter the data. the solution is install the new R3 2014 and follow the steps I did here: https://philpad.com/new-sss-r3-program-2014-installation-using-new-r3-file-generator-library/

Hi po! Pwede hong makahingi ng new r3 program? thanks po! 🙂

Sure connect with us in G+

May I request for a copy of the R3 file generator, I cannot download it from the SSS website.

I have the old file but I cannot open it.

Thanks,

Betsy

Sure, add us in G+ and we will share it there 🙂

hi ms. fehl,

tnung ko lang po kung ano dapat gawin. underpayment po ung january contribution nmin, sa bank po kmi lage nagbbyad, tpos ngaung month ko plang po ibbyad ung kulang nung january. ano po b dapat ko ilagay s R5 at pano ko po un gagawan ng transmital kung magkaiba yung sss receipt no.?? pls help me po!! tnx po!

Hi! I have the same problem 🙁 What did you do??

Gusto q lang po sana itanong na if ever po b na napalitan po ung coverage status q from voluntary to employed ngayong June tapos hindi q p po nababayaran ang monthly contribution q from April to June pero that time po under parin po aq ng Voluntary. Pwede q po bang bayaran ang month ng April to June na voluntary rate? Tapos un pong month ng July start n po as employed?

I suggest you do so you never missed a month.

Dear Ms. Dungo,

Greetings!

I just wanted to ask you for a small favor. Can you please send me a copy of the R3 program via email? I did not bring a USB stick with me when I registered the company, so I did not get the R3 program.

Thank you very much!

Sure. Add us in Google+ and I will send it there

Hi there. For instance, my employee status before is voluntary and then we updated his status as employed last week.. As his employer, When can we start our Employee contribution if we already updated our Employee Records in SSS R1A last week? Thank you in advance.

You can start his June contributions

how do i print previous employee files?nakalimutan ko kasi iprint after ng transmittal certification. and anong program ang recommended to open the SSS text file?d ko kasi ma.open after creating. thanks!

Exit the menu and Generate Reports again and print Employee File it will appear again. You don”t need to open the SSS text files, you only need to copy and paste them in your USB to submit to SSS. The SSS text File contains the same info like the Transmittal and Employee Files

Hi Ms Fehl,

Ask ko lng we are filing our contributions kasi meron nang Transmittal report and Employee file generated sa R3 program nila pero may hinihingi pa cla na report ng mga contributions.Ano po ba yung format nun and papano gagawin,typing lng ba sa excel or kelangan generated din sya sa R3 program?Hope masagot nyo po…thank u!

Log in to your SSS EMployer’s account, you can print that report from the Static Info. Browse and you’ll find the list of employees contributions then print it out. Or just get a firm sa SSS and write them down one by one.

ano gagawin if may overpayment sa sss contribution?

Go to SSS and reconcile your account. Bring your receipts

Bakit invalid po yung SSS number ko eh tama naman?

Type it without spaces or dash

Hindi po nagmatch ang R5 contribution ko SA R3… Over all ng 3pesos Ano po gagawin ko?

Thank you so much for your help. I was able to received the R3 file generator that I requested from you. Thanks again.

paano ko po ilalagay sa usb ung binayaran namin na contribution ng isang worker namin ay late na. sept 2013 to feb2014 .ngaun june 5 ,2014 lang kami nagbayad.nagpenalty kami .nakwenta ng sss.kaso ang pag input sa usb ang nahihirapan ako.

You can still input R3 files even if they were late. Follow the correct salary and SSS brackets in the SSS table and you will be fine 🙂

hi thanks so much. i got your email already. GOD bless…

Hi Fehl,

Got the file.

Thank you so much.

Pano po mag delete yung total ng inquire total?

It won’t save unless you create SSS Text File so it’s ok if you don’t delete it. If you created SSS Txt file, just go back to the SSS Employee file and edit whatever is wrong then UPDATE

maam can send me a copy of r3 program old version and latest po 2014 version. salamat po

Hi po.. Ma’am nagka problema po kasi ako sa posting ko po.. Kasi hndi po nagkatugma ang payment ko sa salary bracket ko.. Everytime i try to encode my employees name my lalabas na.. “The salary bracket did not match your payment”.. Ano po dapat gawin ko? Sana mka reply po kau..

Download the new version of the R3 and use the new SSS Contributions (see SSS Contribution Table 2014)

Hi,May I request a copy of the latest R3 Gen? Thank you.

Bakit ganon, invalid values for Applicable period? Nakapaginput naman ako ng March 2014 after nun sa April2014 ayaw na? I hope maayos at maimprove naman un system nyo na may bugs, anyway i hope someone helps me regarding this problem.

Ok na, thanks even there are no reply regarding in my problem. Ill keep you updated if I encounter some errors. Thanks anyway.

hi ano po yung ginawa niyo para maayos?

Hi! 🙂 Can I also request for a copy of the latest R3 Gen? Thank you. 🙂

itatanong ko sana mam ung sss nmin oct to january n2014 hnd pa n post s contribution, nag sama kc sa isang resibo ang 3 months na payment at my nag resign at my pumasok, ayaw nman mag send sa online, tas binigyan ako ng r3 file sa usb, pag dting sa bhay ginagawa ko, pagdating sa sss office hndi nbabasa, pabalik balik nlng ako dun, ganun pa rin, ano po ang gagawin ko. sana matulungan nyo po ako, salamat po

There is a new R3 program for 2014 since iba na ang brackets and SSS contribution amounts for 2014. If you are reporting the 2013, you must use the old R3 program. If you are reporting the 2014 contributions, then you must use the new R3 program.

Hello! Can I request for a copy of the latest version of R3 Gen? As per encoding of the SS and EC values, it shows “Out of bracket”.

mam good day! tanong ko lang po bakit ayaw tanggapin ung s remarks na “separated”. kc po ngresigned n ung employee namin. kapag 0.00 po ung ss amount g error po.

when i click file maintenance there’s a message that appears “out of memory”

Check your computer and clean all your browser cache. Also check your available memory (disk space). Sounds like a pc issue to me

Ms Fel, good day. can I also ask for a copy of R3 gen for 2014.? hope you could send me a copy.

By the way, could you help me with my problem regarding sss contributions and how to encode it in the R3? Our February 2014. was paid but during encoding, i noticed that may 2 employees na may double deduction sa summary na ginawa. When I asked about it, they informed me na double yung binayaran sa 2 employees kasi di sila nadeduct nung month of Jan 2014. so ibig sabihin, ung contribution for 2 employees na binayarn for the month of February is both for Jan and feb 2014. ang problem ko kasi Ms Fel is how to encode it in the R3? kasi if i use the actual contribution for the month of Feb, di sya magmatch sa total amount sa SBR ko for Feb 2014 and di macredit yung for Jan 2014 nya?

Ano po ba ang dapat kung gawin.?i’m new to this so i dont know how to solve this.

Hope you could help me kasi nanotcied ko mas madaling maintindhan kasi ang pag instruct mo.

Many many thanks.

God bless.

I sent it in your email today. You need to enter 1 month at a time. If you did an error in payment, you can request SSS office to make the other one for the next month para di double

Ms Fel, I already got the R3 file.i will install it later. Thanks a lot for your help.

Our employer says bayad na daw sss namin pero tinatamad lang daw sya mag pa usb kaya wala post ng payment namin pag nagchecheck kami online sa contribution namin.nag aalinlalangan kami kung bayad na nga talaga nya yung ilang buwang contribution namin.

If your employer is tamad and is not submitting USB SSS reports every month or quarter, your SSS contributions will never be entered in the system. It is a responsibility of your employer. Go personally at the SSS and request them to call your employer so they will do their job.

good eve.. please send me a copy of r3 gen…. ang hirap magdownload online..

thanks. i need it asap.

bakit poh invalid applicable period abg message , kapag 032014,kc nagawa ko namn po ang 012014 at 02014,tapos ung susunod na mga month na binayaran ko, ayaw na,,kindly reply poh asap..thnks

That is weird. Make sure you have the latest Java installed on your pc and try again the program

already receive thanks…

Pls. send me a copy of R3 file Gen 2014. Thanks

good day po! ask ko lang po kung papano ko ma solusyonan ang prob ko sa pag fill up ng form sa R3 kasi parang nagkamali ata ako nang nag fill up ako sa mga names ng mga employees kasi pitong pangalan ang ang inilagay ko doon pero ng che ni check ko ang total walong employess ang total doon sinibukan kung ulitin ang pag fill up ng form pero babalik at babalik ang una kung mali na na gawa ko sana matulungan nyo po ako salamat……….

good day, ask ko lng po kung pano mg-update ng sss contribution for increase, employed, registered n ho online and i can see up to date nmn payment, can i do it myself or ung employer mismo mg-update?

Your employer must do the update and reports 🙂

I’ve used this for several months already without a problem until now wherein an error message appears when i change the employee’s contribution.. it says “Invalid amount for SS contribution. Amount is out-of-bracket. Correct the error and try again.” Regardless of amount entered (P1.00 to P1,000) the same message appears. Pls help. Thanks

There is a new update for the R3 program for the new SSS contributions 2014 brackets. See the post on our homepage. I shared how I made my R3 reports for January 2014 successfully. 🙂 The steps and procedures are discussed on that post.

Mam Fehl,

Please send me r3filegen.jar file pls. hang pa rin po talaga… kahit ung r3filegenerator na installation after install hang na sa file maintenance.

pls send pls. maraming salamat mam.

Ramon

sysad Claret school

Just follow the instructions above. Save the 2014 File I sent on your email instead and follow the steps we discussed in the article

I already download, extract the file u send, but still i can’t open it.

what should i do?

thanks,

You must have WinRar to open the file

Miss can u send me another 2014 r3 coz i cannot open the EMPLOYEE RECORD MAINTENANCE its always gets hanged…this is my email add

“the sss text file of this R3file with Applicable period 1-2014 might not have been generated. you may not continue creating reports” this messages appear everytime we click “PRIINT TRANSMITTAL CERTIFICATE”

Please see our new post about New R3 Program 2014 with new brackets

na install ko na po yung r3gen sa computer.. successfully installed naman pero bakit ndi ako makapg fill up sa mga field…? yung sss # lang nalalagyan ko ng info.. the rest ayaw ;c

nasira po kc ung usb ko sa sss tapos sabi ng sss sakin eh pwede daw po akong mag download sa website nila panu po un di ko alamm naloloka n ako…..pwede bang bumalik dun tas sila nlng mag down load?will it takes a long time?

Yup you can download the software from the SSS website or if you go to the SSS personally. Just make sure though may USB ka if you will go sa SSS and tell them what pc you use – Vista or Windows 7 or 8

Nagbago po ng SS contribution amount yung mga employee namin this Jan. 2014, from Php 988 to 1045 na..bakit po kaya nag error? File generator says” Invalid amount for SS contribution. Amount is out-of-bracket.”

Pls. help.

uninstall the old program.. then download the R3 program from sss.gov.ph

yung SLERP payment ko po hindi napopost…anu po ba ang Loan Type na ineencode sa LMS Diskette ng SSS…

Thank you for this article. It really helps me a lot. Hope marami pa ang matulungan nito especially to first timers…

hi po…im working on the R3, the company has overpayment of P1560.00, when i tried to generate it using R3, it prompts “insuffucient payment” because the contributions is amounting to P10852.00, anu po pde gawin? your response will be highly appreciated. thank you.

Yan po ang lumalabas na error sa SSS LMSTD program pag Windows XP gamit ko :

“employee details report application-defined or object-defined error”

“error printind employee details”

pero pag W7 naman ang gamit “Out of Memory” ang error na lumalabas

hi po, panu po gagamit ng usb instead of diskette sa pagcreate ng sss text file? lagi po kasing insert diskette in drive A yung lumalabas.. thanks.. 🙂

hi mam ask ko lang po kong where i can download the old version of r3

panu po maedit un inquire totals sa r3? ksi po naupdate na eh di pa pala napalitan. panu po xea mapalitan. please help. thanks

Hi Ms. Fehl,

Can’t open the old version of R3 its in a .jar format

Download the java file

panu po maedit un inquire totals sa r3? ksi po naupdate na eh di pa pala napalitan. tnx

Hi Ms. Fehl, please help… I got a copy of R3 File Gen from SSS pero nung i copy q n cia s computer nmin s ofis ayaw nyang gumana kahit follow ko n un procedure, sv sakin s SSS copy/paste q un R2 USB program s desktop ginawa q nman, then follow q dn other instruction pero same d pa dn ndi gumana.. so kol aq s SSS and sv sakin mgdownload n lng aq.. pareho dn nun instruction pero ganun p dn ayaw gumana. nang tumatawag aq ulis s SSS office busy n mag ppa-aasist sana aq s IT nila.. Can you please help… Thank u very much

What Windows are you using? If they sent you the latest program, we also have a post about the step-by-step instructions for that. Find that post by going to SSS tagged topics

Hi mam,

We have already paid both contributions and late penalties last May 2013 for Dec 2011 up to March 2013.

In the online inquiry tool we can already see the payments.

However when trying to post contributions online, we are geting the ff error:

The following problems were found in trying to submit this report:

Payment details entered are currently not found in the SSS Cash Collection File.

Please submit the collection list online once payment details are posted

in your account which is accessible from your My.SSS’ Online Inquiry Module.

Will we be charged additional penalties while we have not yet posted the contributions list due to this errror? (The SBRs are appearing in our online account though)

Please advise how we can proceed with this issue as we are afraid we might be incurring more charges as well as our employees are not seeing any contributions posted to them.

Thanks!

hi,

i encounter that problem, i have been waiting for my payment to be posted online but no posting for 1 week since i made my payment… so i have to wait another 3 weeks, if it is not yet posted then i have to go to the office to ask…. so hassle 🙁

Hi mam,

I have a question regarding the 10day rule to submit the R3 payments.

We’ve just paid the payments/late penalty charges last May 2013 for the months of Dec 2011 up to May 2013.

However, it seems that the online submission of the Contribution Collection list because even if i see the SBRs in the online inquiry, it’s not letting me submit the R3 payments stating that:

The following problems were found in trying to submit this report:

Payment details entered are currently not found in the SSS Cash Collection File.

Please submit the collection list online once payment details are posted

in your account which is accessible from your My.SSS’ Online Inquiry Module.

Please advise. Thanks!

na install ko na un r3 gen then na input ko na un employer details ang tpos sa eployee record na aq pakatpos ko mainput un sss number un details ng last name,first name and goes on ayaw na magtype gumana anu ba ang prblemA help me nmn thnx

what do you mean ayaw gumana? You mean it’s hanging?

Hi,

Please help, whenever i tried apploading the r3 gen file on sss online using the employer tool, lagi sinasabi ng file Data error in the header record section of the file being uploaded.

Loading is cancelled. Pero before naman nakakapag submit ako ng R3 online sa mga previous months.

paano po kung tatlong buwan yung babayaran, ano po ang kinalabasan na transmittal report, tatlong kopya o magbabago yung nasa isang kopya, medyong gulo lang po sa applicable period at sa mga amount na ilalagay?

sana sagutin niyo po yung tanong ko. Salamat.

dapat gawin mo yung report every month using the program(month by month), di pwidi quarterly mag report using the R3 generator

Wrong file format.

Data error in the header record section of the file being uploaded.

Loading is cancelled.

anung format po ba dapat ang kelangan ng website? pag nag generate ako sa r3 then pag i-uupload ko na I encounter this problem. Pls help thanks

i got the same problem, “Data error in the header record section….” i have been using the same program (sloppy program) for a year now. and when they decided to change on how to enter the SBR # from an 8 digit to 15 digit in the program, all errors break lose, and they (SSS) didnt even bother to tell us.

i went to SSS this afternoon, telling them my problem, “Data error in the header record section…” and nobody knows about the error, and nobody knows how to fix it, they just told me to install the program again, really?

the problem is in the program, (inside the file that you need to upload) the header is crowded with the new and long SBR # e.g. F00023234450091, its overlaps the date,

I’m having same issues. When I try to upload R3 online the thing loads so slow so I always end up canceling what I’m doing. I think it needs a very big fix. And we have to wait for now.

got the same problem here. I’m just doing the same procedure before and smoothly finished posting the contributions. what is wrong now 🙁

Hi Ms. Fehl may i know if this problem resolve.. the file header error

i got the same error, i just called the SSS office here in iloilo this afternoon…

he said…. open the file in notepad program, then find the payment date and the SBR number, adjust the spacing, it should have 22 spaces between the payment date and SBR number… after adjusting, you save the file then try submit it online…. mine works perfectly… hope this could help…

i have talk someone from SSS. then she said that the SBR no. character count should be 30..if sbr no is less than on that number spaces should be added.

SBR is Special Bank Receipt number. You only use it if you’re paying in Banks (Metrobank, BDO, Etc.) If you paid at SSS, you’ll use the SSS receipt number /Payment Ref. Number which is (right now) 15 digit. If you want to register as employee, you can go to the SSS personally. Go to eCenter to register. It’s free and they will help you if you’re having problems in registering 🙂

Will the r3 program work on a macbook?

I doubt coz I only read Windows and Linux

hi ms fehl, when i try to upload the r3 text file to sss website of our employer,it says,wrong file format.diba yun yung na-generate sa r3 program pag kinlick mu yung create sss text file???bat wrong file format xia???thanx poh

I encountered the same problem recently. You’re not alone. I will give the update soon once I asked SSS and resolved my problem too 🙂 If you have resolved it sooner, please share it with us here. 🙂 Thanks!

hi ms fehl, i got the same problem, hope to find solution here. thanks

my question is, i copy the whole folder of r3 and transfer it to other computer. The program seems working properly, but i click the report generation it prompted run-time error. (i save it to my partition hard disk)

hope you can help me. thanks in advance

You need to re-install it again, not copy. Delete all files with R3 from your computer before you re-install. After you installed, reboot your pc. What R3 version are you using?

i dont know what version it is but i think it is made with visual basic not with java(based on what i see on sss website) i dont have the installer that i’m using, how can i download it and also how can i sync the files that i did into new installed r3. thanks you so much…

Luckily, we have the complete steps here. See the next article entitled “How to Install the New and Latest SSS R3 Program” We put the link on the article above. God bless!

thank you ms. fehl, it already resolved my problem. thank you so much. god bless you

San po ba makadownload ng old version ng r3 file generator?

hi miss fehl..

kababayad ko lng sa sss and pinagawa ako nang transmittal certificate. kaso di ko alam ang format, may binigay sakin na file na r3 inisave sa usb ko. kaya ginawa ko ganito nalang (shown below)..i dont know kung tama ba yan..di ko rin alam ibig sabihin nag DTHRD kasi kinopya ko nalang yan sa usb..

sa sample na nilagay ko na SANTOS KYLIE 3mos. ang binayaran ko nakapenalty nayan kasi delay ang contribution ko..di ko rin alam san ilagay ang penalty dyan sa transmittal certificate..kaya i need your help miss fehl..

SAMPLE

DELA CRUZ JUAN [null]

Date: Sept. 26, 2013

FAMILY NAME GIVEN NAME MI SS NUMBER S.S. E.C. RMRK DTHRD

SANTOS KYLIE B 1********3 1872 30 JULY-SEPTEMBER

MENDOZA REY D 0********1 624 10 SEPTEMBER

GOMEZ NICK V 0********5 520 10 SEPTEMBER

Total Number of Employees: 3

one thing pa miss fehl..dun sa R3filegen under employee record maintenance, sa kaso pa rin ni SANTOS KYLIE, hindi acceptable kung pagsabayin ko ang total na binayaran ko for 3mos. sa SS AMOUNT and EC AMOUNT it will say “amount is out of bracket” but acceptable yung per month na contribution..

Tanong ko lang san ko ilagay yung the two other months na binayaran ko sa employee record maintenance ko.. pls reply..thanks

hi…tanung ko lng san ba naku2ha ung sbr/tr number…tinanung ko kc sa sss office sv nila ung R-5 un ..ehhh nun tiningnan ko sa web wla nmnang number ehhh….sorry bago lng po sa ganitong system bank kc dati ung nagba2yad sa company nmn…tnx in advance po

hi, compatible ba siya sa windows 8? tina-try ko kase install kaso ayaw e, anu ba dapat ko gawin. Salamat

Hello! po Mis Fehl…

Tanong ko lang po. Yung file po kasi ng R3 nang employer ko, pag-nag-i-inquire ako nang totals, @ employees daw kami kahit ako lang naman yung employed sa kanya. May isa pa siyang employee dati pero na-i-report na na separated last year pa. Ang kaso nga lang, parang nasa record parin ng employer ko ngayon yung separated employee niya. Ano po bang dapat gawin para ma-correct na 1 employee lang po at hindi 2? Sal;amat po..

If you don’t include it on the present R3 reports, then you won’t see it anymore. Input only one employee

Mam Fehl, kapag po ba nag send ako ng employee list, need ko pa isama yung mga resigned na?

Pero binayaran na namin yung contribution nila. And may I know din po what are the requirements if close na yung company, how to process it on SSS? Thank you po.

Hi Fehl,

Pls advise what to do if if made payment for the same month of my kasambahay (After how many tries naintindihan ko na din yung r3 project nila) ngayon naman nagbayad ako sa bangko ngayon ko lanh napansin mali yung nailagay na applicable month dapat july ginawang june hay . . . manual kasi ang recibo sa bangko unlike sa mga bills payment ng malls. Pls advice

Tina

You need to go to the SSS branch and update the payment. Bring your receipt and let them apply the correct month associated with the contribution payment. Ingat!

Hi Fehl, ask ko lang panu ba yung dalawang beses mo napagbayad yung employee mo ng monthly contribution. Sa akin june yung double kaya walang july ng contribution yung employee ko. Inform ko pa ba ung branch ng SSS. Thanks and Godbless.

Tina

Hi Fehl,

I really need your help. I cant print the Employee Text File List. An error occur that amount remitted is larger than than what is encoded. Please tell me what should I do?

Many thanks!

How much is the amount on your receipt? How many employees do you have?

The total amount is 131,668.00 pesos. And we have 147 employees.

bakit po ba kasi kailangan pa magubmiot ng naka usb… d nyo ba magawa kaya gusto nyo ng short cut, kami ang gagawa instead na kayo.. kaya nga my receing copy kau.. ang hirap nyo pang mag update…

mam ask ko lang kasi mag bulid-up po ako ng soft copy ng r3 report for the previous month e.. march 2013 nung ininput ko na ung date of payment, TR/SBR number at total amount ito ung lumabas invalid values. correct the values and try again. for input string “4/12/2013”. thank you so much.

Good afternoon po , I have a problem in creating SSS Text File when I encode the date of payment the program did not accept it, there is a note that I entered invalid values of date. What should I do?

Hi, ask ko lang po. ang gamit po namin ay BPI Express link payment lahat contributions and loans. Kelangan po pa ba magsubmit R3 thru USB sa SSS. Sabi kasi pag naka Expresslink no need to submit R3 in USB.

Please reply,

Thank you

Hi Ms. Fehl

Just want to ask how to use the SSS LMS Program. Nainstall ko naman na po siya sa computer ko, nakakapag input na din po ako ang kaso kapag nagbaback up file ako or copy billing sa usb hindi po siya nagana ang tanging lumalabas ay ” PERMISSION DENIED”..tapos kapag magpiprint po ako ng transmittal report at employee list ndi po ako makapagprint kc ang nakalagay po is ERROR bad file ganun ganun..Nagpunta na din po sko sa sss para magpaturo kung paano,tinuro naman po nila lahat,kaso pagdating na sa actual kahit na sabihin na natin na sinunod ko naman lahat ng instruction , ganun at ganun pa din ang nalabas.. Hindi ko na po alam kung ano gagawin ko at nababahala na din po ako ksi baka mapatawan na kami ng penalty… Please sna matulungan nyo po ako..Thanks.

I think the only solution for your problem is – bring your laptop at the SSS office and let them install the SSS R3 program for you and let them do the first uploading and reporting on the R3. make sure you see and understand what they are teaching you. Don’t be shy. They will gladly help you. 🙂

hello fehl, paano ko po malalaman kung binabayaran ng employer ang salary loan ko?thanks

Hey there! I know this is kind of off-topic however I

needed to ask. Does running a well-established blog like yours require a massive amount work?

I’m completely new to running a blog however I do write in my diary on a daily basis. I’d like to start

a blog so I will be able to share my experience and thoughts online.

Please let me know if you have any recommendations

or tips for brand new aspiring blog owners.

Thankyou!

Hi there. Yes it requires massive amount of time and work at the start however, after you built the layout, security and needed plugins, you can focus on your content which depends on you. It took me 3 years to learn the stuff in blogging. My tips for you are: write what makes you happy and enjoy what you’re doing, write original evergreen topics, love your audience. Because I’ve got more tips, I will just post them in a new article here soon. Thanks for dropping by!

Just wanna ask why the records are not saved? if ever for the next month we need again to encode the names? Is there any way that we will just edit so for the next payment?

I’m gonna post the latest R3 program software tomorrow or Friday.

You need to follow the steps one by one in order to not missed a thing. Create SSS Text File to save the Transmittal Reports and Collection list for the month. I’m currently doing the post about the latest R3 program and will post it tomorrow or Sat.

Good day Ms.Fehl,I’m updating our company’s R3 files for the month of May to June 2013,but as I put the period covered Month 05 Year 2013, it says that it is INVALID VALUES FOR APPLICABLE PERIOD…what should i do about it?hope for your kind response Mam.thanks.

That is strange. Is your software installed properly? Have you used it before or it’s your first time?

How long is the posting of payments? I have downloaded R3 or the payment details yesterday? Thank you.

They will be posted automatically once you upload them in the SSS database or you submit the files at SSS

hi,

tanong ko lang possible ba na di tanggapin ng r3 system yung sss no. ng isang employee?

I think yes if the SSS number does not exist or has never been registered. If you are not sure about the SSS number you input for an individual, don’t input it. Verify it at the SSS to avoid major problems in the future

Hi Po Ask KO lang po kung panu Gawin ang R3 Form

Best Regards.

Thank you

Jm.

Maam ask ko lng po,, kung nkabayad nb ang bookeper nmin ng contribution sa sss,, maipopost po ba agad un? Cnsbe nia kc bayad na at dated jan.17 2014… ung pyment for jan to aug. 2012

They won’t be posted unless your employer/company submit R3 records to SSS

mam,, i would like to ask,, because we pay already the r5,,we will submit it online,, our problem, same po ang sbr no. and sbr date di po namin ma submit ang ibang aplicapble months online sa sss,, what should i do?

Gud day po! ask lng po pno ko input yung 1 employee na wlang middle initial. kasi po d ako maka generate if out of braket cya?

Thanks!

Please contact SSS and ask about the middle initial thing. I haven’t encountered same problem before

hello mam, ask ko lang po panu po magdelete ng nagkamaling report…kasi po we are using sss online system reporting…yung report po napost ko sa july 2013 dapat june 2013 pa sana…kindly help me mam tnx…

gud day mam our co.start 2008 and 4 kaming empleyado .we started paying our mos.contribution since jan 2008 till now.by 2009 sabi nila we have to post our payment thru R3.SO ANG NAKAPOST LANG AY HANGGANG JUNE 2009 THE REST HINDI.kasi that time wala kami internet.now that we have nagproduce kami ng USB at ginawa ko ung sabi nila nagprint at nakafile sa usb.nang pinapareceive kona.year 2011 onwards lang daw tinatanggap nila.pano naman ung fr.july 2009 till dec.2009 at jan to dec 2010.hanggang ngayon dipa nakapost pati ung 2011 to this date dipa nila nirereceive what shall i do mam?

ask ko lng po kung nka pag post na ng r3 sa online kelangan paba yan e pa recieve sa sss? and what if nag increase ng salary so dba magbabago ang salary bracket, ano po gagawin ko sa online para d mag discrepancy sa salary bracke? thank you

Your employer will be the one to upload the R3 through personal filing or uploading them via employer online account

Maam Fehl, anu po ba system requirements na angkop sa r3 po na ito?kc po myron akuh windows 7 starter 32bit d sya ng rurun or naiinstall ng mabuti..yun lang po tnx.

Windows 7 is fine I think since it’s the latest Windows last year. You might need to install Winrar to read rar files

Maam, my ng pop-up po na error eh. “run time error 424” object required.

automation error specified module could not be found,,yun po tnx poh.

sounds so technical and scary. Try restarting the program

hi! i just want to know how to encode the employer contributions on the r3 program? my prob is my dad paid the whole yr of 2013 and of course we only have 1 reciept and its not applicable online. Because through online, it only accept monthly payments. So i have to encode it manually on this friggin system/program of sss the r3 diskette which is so not a friendly user! hopefully u can help me i dont want to go back to the sss office again and again! thanks in advance!

In the version I’m using, we dont need to input the receipt number so your inputs will be fine as long as you do each month

my brothers are voluntary members..they will be paying their contribution quarterly..now can they post their payment thru this posting system? or this is exclusive for employers only? if they this applicable for all members then how can i get a copy of this system? thank u…hope to hear from u soon…

hi good day, ask ko lang if how can i open my file given by the sss. they extracted on my usb flash drive but i i cant open the file any program can i use it..sana matulungan nyo ko thanks..

ate fehl ganda. Ask ko lng po qng pde ung DATA folder nlng ung submit sa sss? then dpat every month of one quarter ba ung data folder?

Hi, ask ko lang po regarding sa posting ng contribution at loan payment. Bank express online po ang payment namin automatic na daw po yun na mag aappear sa sss. kelangan pa rin po ba ang usb to download ang mga files para submit sa sss para ma upload ang mga payment ng employees namin.

Thank you

Yes I think if you’re on AUto Debit Arrangement, all else is automatic. That’s the benefit of ADA

alam na ba ni SSS kung sinong mga members na binabayaran mo?

hi fehl.. ask lang bkt ayaw gumana ng r3 file sa windows 8? kahit naginstall na ako ng java.

It may work if the new R3 software is compatible with the new Windows 8. Since it’s so fresh pa, maybe we need to wait for SSS to provide the new software for Windows 8 users

Payments are made for a quarter, so 1 receipt for three months. doing the R3 generation and uploading does not work because the SBR (receipt number) cannot be repeated. so i was only able to do it for january. feb and mar would no longer be accepted. What do i do?

You may be using the new software for Vista and latest OS. I’m suing the old version of R3 and there is no need to input SBR on it so everything is working.

hi po,

bakit po parati INVALID VALUES FOR APPLICABLE PERIOD ang lumalabas? pls help…thnx!

ask ko lang bakit dun sa under employee record,yung sss number lang na input ko.di na mailipat yun g cursor sa

ibang box maliban sa close?

Good evening! we have already installed the r3gen.jar but the problem is that we cannot proceed to the next steps. If I encode the sss number of our emlpoyee it failed to update or save. What should I do? pls tell me. Thank you so much for your effort.

God bless you! more power.

A blessed day Ms. Fehl. We have our problem regarding to our R3 we cannot download nor open the file for the submission. We are asking for your help regarding with this matter .

Thank you so much hope you can help us . GOD BLESS YOU!

Maybe the file in rar format so you must have a program in your computer to unzip the file. Try WinRar or install or download WinRar

This is such a helpful entry. Thanks Fehl for sharing all these SSS info with everyone.

Hi! Your webite is very helpful. Are employers paying for their kasambahay (in compliance of the the kasambahay law) also required to have this usb? We just registered them today and my helper who processed it did not mention anything about usb. Thank you!

I don’t know if Kasambahay are also required with the R3 project. Siguro no need na

hi ms fehl. bago lang po ako sa r3 hindi pa po ako nakapginput since oct 2010 up to this date june 2013, magsisimula po ba ako magiinput sa oct 2010 and by month? pero ang payment ko sa sss quarterly. hope you will reply thanks 🙂

The R3 is for employers. If you didn’t input in the past, chances are the contributions wont be posted. I suggest you check your contribution records by going to SSS. If you found out missing posts, you can then ask them to register your employer’s account online. You must be a signatory of your company to do the registration by the way.

Hi ask ko lang po panu po mag encode ng interest sa R3 project po.

hello ask ko lang panu pag naglalagy ako ng SS number nkalagay dun SS number doesnt exist eh yun gngmit ng parents matagal na khit nung wala pa ung r3 project please help

hi! ask ko lang bakit di ko ma update yung applicable month for this may 2013….INVALID VALUES FOR APPLICABLE PERIOD?…Nag bayad na kmi (R5) so need ko transmittal certificate

para maipasa ko sss yung R3 for may 2013

ma’am, pnu pu b pg wlang middle initial ung isang empleyado..pnu la2 toh sa r3?

Ms. Fehl are you also using the LMS software of SSS? I can’t find a step-by-step tutorial as good as this one that you made for the R3. Can I have the link if you do have a tutorial for LMS? Thanks!

I’m not using the LMS as I encountered errors with it. I’m using the older version of R3 and it’s doing good – no hassle, no error, no problem.

ma’am / sir pwede pobang saan pwedeng makuha ung r3 file generator at para maidownload kopo at magamit kopo sa pag submit ng mga recodrs namin sa SSS saang web kopo kuhanin ung ung file na r3 sir pls…….

It’s available at the SSS website at sss.gov.ph Make sure you though you check the system requirements before you install the program on your computer. You can also ask the SSS for a copy of the software. Bring a USB so they can save it there. I asked one and they also gave me an instruction printed on a paper. They are so nice 🙂

Hi Ate Fehl,

Ask ko lang po if kasama pa yung R5 sa pag submit ng transmittal at employee list sa SSS. Thanks po!

Yeah the R5 Employer Contribution Payment Form is important as it is the receipt or proof you have paid. Attach it when you submit R3 reports

is it correct that my saved file names was R30390393320082004.02101439

and how to open or recheck them? because its not possible to open those in wordpad, notepad it always shows codes only

i have same file name format. can’t open it too, it’s asking for a software or anything…

ms fehl pls helps us. thnx

hi ms. fehl….

im somehow having problems and trouble in installing the r3 file generator program po…. do u have any idea po bah, why is this so??? ano kaya kailiangan ko pang programs sa PC ko para mka-pag run ng r3…. thank you po..

Hi Fehl. Helpful site.

I am however having problems with the LMS project. You don’t happen to know why I can’t print transmittal form. Also, some people are saying I should install the old version of R3 Diskette project but I can’t find it anymore maybe you would know where I could download one?

Your help will be greatly appreciated. All SSS personnel can’t seem to help me. I wonder why?

Thanks in advance!

Nikki

Hi, Nikki. I’m using the old version of R3 because it’s the one I have mastered. Besides, what really matters is the data are being entered successfully and correctly in the SSS system. I’ve recently register an employer account coz SSS requires that now. There’s a function and feature in the employer’s online account about Uploading R3 data. I think soon all employers will use that. I’m making a post about that now and I hope I could publish it here this week. Thank you for dropping by here!

gud day.

bago lang sakin 2ng R3 ..

Ask q lang pag dating sa module ng “Report Generation”

at mag click ako dun its either “Print Transmittal Certificate” or “Print Employee File”

wala ng nag pa-pop up. kaya hindi ko ma print.

Any idea lang po para magawa o ma troubleshoot e2ng concern q. tnx!

pwede cd na lng ipasa sa sss kesa usb or floppy disk?

Hi Fehl,

Good thing I’ve found this article of yours about SSS R3 concerning the usage of this SSS application.

I just have minor concerns and I’d certainly appreciate if you can help me understand the following.

1. I’m trying to restore a backup “.mdb” file extension from version 2.0 diskette to R3 Generator (latest version). Is it possible?

2. Question is, how am I able to transfer the backup file generated by the version 2.0 diskette application “.mdb” extension file into the R3 Generator when it says or according to the manual of R3, it requires a “.dat” extension file.

3. Was able to load the “.mdb” into the R3 but I’m not able to open the files from the previous diskette 2.0 application.

Does it make sense? Please help.

Sorry I’m not yet familiar with the new software so I don’t know what to say about the back up using the new R3 software

Problem solved at error input string…

ganito kase ang ginagawa nyu:

(mmddyyyy) 02-21-2013 – wrong!! di nyu kase na gets ung naka parenthesis na date wala naman nakalagay na high pen (-)

ganito dapat:

(mmddyyyy) 02212013 – Correct!! ^___^

gets gets gets nyu na ba? hehehe ako tagagawa ng ganan sa business namen di kase marunong sila tita sa computer.. ^^

no need to download d older version if tama ung mga ginagawa nyu.. 😀

How can I post SSS employees monthly contributions online via sss.gov.ph

Hi, asko ko lang, paao yung sa loan contribution. paano ang input nun sa r3 program. thanks!

Hello po,

Bakit hindi ko ma-open ang R3fileGen? Binigyan na ako ng SSS ng program pero di ko magamit ang R3fileGen.

What should I do?

You can download the file from the SSS website if the file given to you is not working

Hi! Is it possible to PRINT the TRANSMITTAL CERTIFICATE and EMPLOYEE FILE in just one page? aksaya sa papel… Please say YES? 🙂 Thanks.

Hi po. Just want to ask how to input the SSS number if Unified Multi-Purpose ID ang gamit na ID. Usually po 10 digits un SSS number pag Unified Multi-Purpose ID and gnamit it already consists of letters n numbers. panu po un SSS R3 system? Thank you po. 😀

Check your SSS number from your E1 form, not from the UMID

hi maam. I just want to ask kung paano po pagsasamahin ang mga transmittal reports monthly. Ung isang page lang ang transmittal report instead na 2 pages monthly.tenx po:)

They are 2 pages because one page is SSS Transmittal Certification, the other one is Employee File

Hi Fehl, from your earlier reply about separated employees you said you have never tried ticking No. 2.

I use an updated version of the R3 program and I can’t figure out what to do with a separated employee. If I delete the employee after declaring him separated he gets deleted from all previous months. if I just declare him as separated and pick No, 2, the following month and input 0.00 in the EC and SS amount the values are invalid. I don’t think picking No. 3-No earnings would be correct because the employee is already separated and technically picking No.3 would mean that he is still employed. Do you have any updates on how to go about this? I checked the manual again but can’t find any instruction on this. Would appreciate any help from you and your readers. Thanks!

I think you may just not include him anymore on that period. His new employer will have to tick him as newly hired and SSS will recognized that.

Hello po Mam Fehl.

Mam, ask ko lang po why po kaya may lumalabas na error kapag nilalagyan ko po yung sss amount. Ang error po ay out po bracket daw po yung value. Nautusan lang po ako e, hinahabol namin yung report ng R3 mula pa ng 1998.

it means you have entered a wrong value/amount. You must consider the EC amount when you enter the values. (eg: less P10 to a SSS total contribution of one person). Someone also asked same question before. See the previous comments to know more

The same problem Ms. Fehl.. maaari mo po ba akong turuan? i already encode the employees but the problem is the sss text files and transmittal, kasi po ung company 2011 up to now hindi pa nagagawan ng Payment record. paano po umpisahan ung recording? kakabayad lang po kasi last october. sabay sabay kasama ung penalty? i really thanks to you, sana matulungan mo ko.. Godbless po

Hi Fehl. This site is really informative.

I have a question regarding R3 program. Whenever I put a value in SSS amount of my employee, it says “out of bracket value” why is that so? I am using windows 7 and old version of R3. Ang problem nito ay nautusan lang ako.hehe 1998 pa yung hinahabol ko up to now. I hope you will help me. Thanks!

ask ko lang paano hal. yung isand employee ay resigned n?pano ko mababago ang no. of employees at para hindi mag appear ang name sa employee list?..thanks

Don’t include it on the list if he has no contribution for that period anymore

even if i did’nt include him on the list he still appear, because i was already submit his profile before he resign..example 2012 he was still active and february of 2013 he resigned..and the no. of employee still the same..do i have to press the delete? thanks

same problem din po…paano nio po ginawa miss fehl and ms anna

I’m doing SSS text File.. after I fill up the required info

there’s an error .invalid values for input string “April 10, 2013”

What’s wrong with my work?

usual error encountered by others if using the new R3 software. That’s why I chose to use the old version which has no complications and errors.

im doing the SSS text file and when I entered all d required info needed if I will already update it..it has an error daw..sa date of payment..invalid values for input string April 10, 2013..whats wrong wt my work?

mam ganun ba talaga? pag nagsesave po ako, employee list lang ang nasesave? bkit po wala ung transmital report?

hello po.. bakit po pag pumupunta ako sa report generation para magprint. ang sinasabi, ” can’t open transmital report?