A beginners guide on How to fill out BIR Form 1701A for self-employed and professionals. We share here a simple and easy way how to compute and file annual income tax return for individuals earning income purely from business or profession under OSD and 8% flat rate.

Note that if you are availing Allowable Itemized Deductions (AID), you will have to use BIR Form 1701. The steps and guides in filing annual ITR for 1701 are posted on another page.

What is BIR Form 1701A?

BIR Form 1701A is the form used for filing Annual Income Tax Return for individuals earning income purely from business or profession subject to graduated income tax rates who availed the optional standard deduction (OSD) and those who availed the 8% flat income tax rate whose sales receipts and other non-operating income do not exceed 3 million pesos.

This BIR Form 1701A aims to simplify and assist taxpayers to file their Annual Income Tax Returns easily. BIR form 1701A has only 2 pages and is very easy to fill out compared to the old form with numerous pages. This new form also applies the new TRAIN Law and New Income Tax Table Rates 2026.

1701A is also now available at the eBIR Form Offline program. You can also fill out BIR Form 1701A PDF manually for your own convenience if you prefer that way.

However, we recommend using the eBIR Form because it automatically loads the values you need to fill out and blocks the unwanted parts that you don’t need to provide according to the tax rate (OSD or 8%) you have chosen.

Who should file BIR Form 1701A?

According to the Bureau of Internal Revenue, “The return shall be filed by individuals earning income PURELY from trade/business or from the practice of profession, to wit

- A resident citizen (within and without the Philippines

- A resident alien, non-resident citizen or non-resident alien (within the Philippines).

The return shall only be used by said individuals as follows

A. Those subject to graduated income tax rates and availed of the optional standard deduction as method of deduction, regardless of the amount of sales/receipts and other non-operating income;

OR

B. Those who availed of the 8% flat income tax rate whose sales/receipts and other non-operating income do not exceed P3M”

Procedures How to Fill Out BIR Form 1701A:

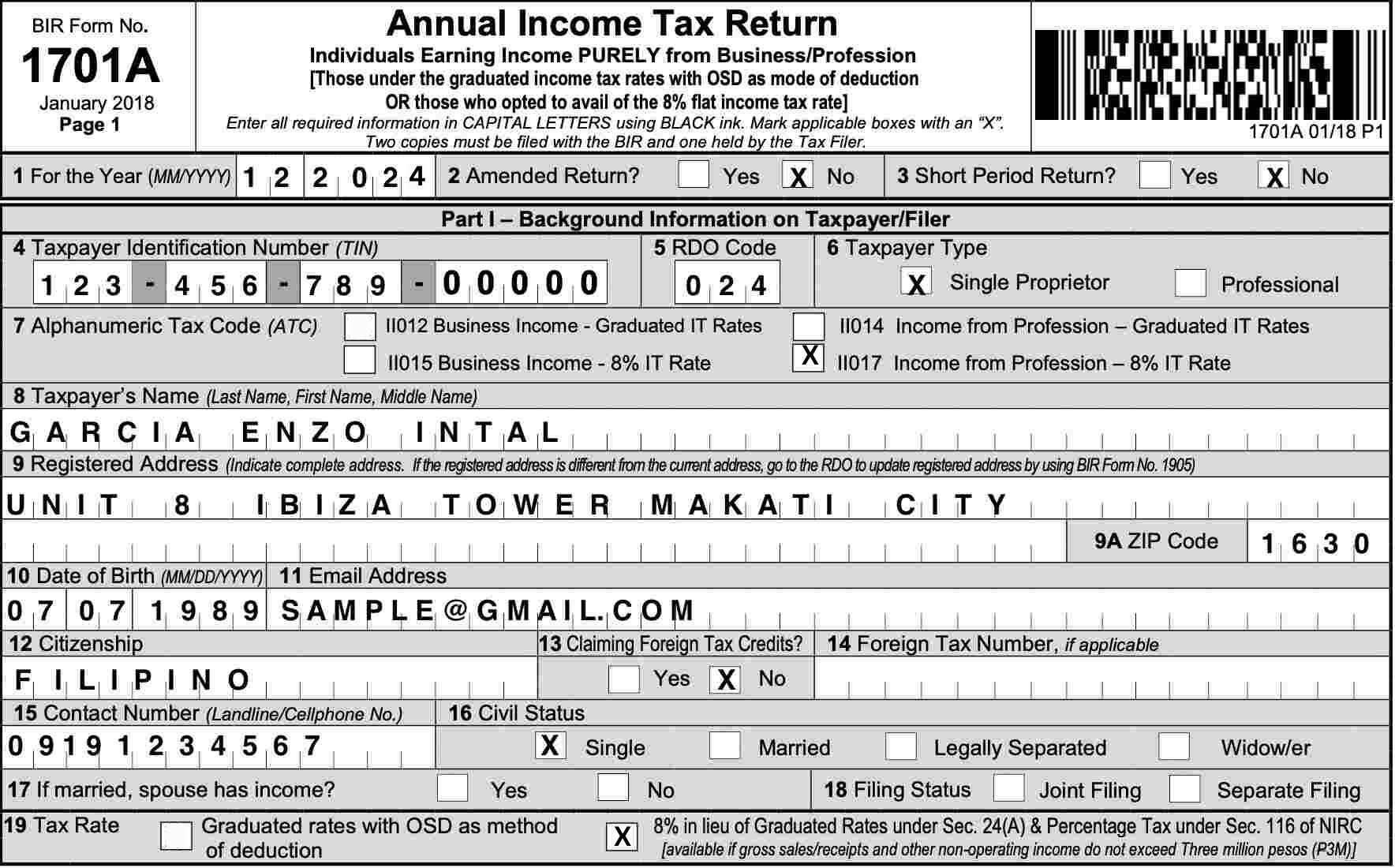

- Fill out Part 1 (page 1 of the form) and select your taxpayer type and Alphanumeric Tax Code (ATC) – Either 012 or 015 for Single proprietor and 014 or 017 for Professional

- Proceed to Page 2 for the computation of your income tax associated with the tax rate you have chosen (OSD or 8%)

- Enter any tax credit or tax payment you made previously

- Go back to page 1 and validate your entries

- Sign your ITR and pay your taxes

How to Fill Out BIR Form 1701A for Self-Employed:

Self-employed individuals include businessmen or single proprietors or any person earning income from their business, VAT or Non-VAT registered.

The example below opted for the OSD (Optional Standard Deduction) tax rate. You can also opt for the 8% flat rate IF you opted for it already when filing your first 1701Q for the year. Otherwise, opt for the Graduated Income Tax Rate just like from the example below.

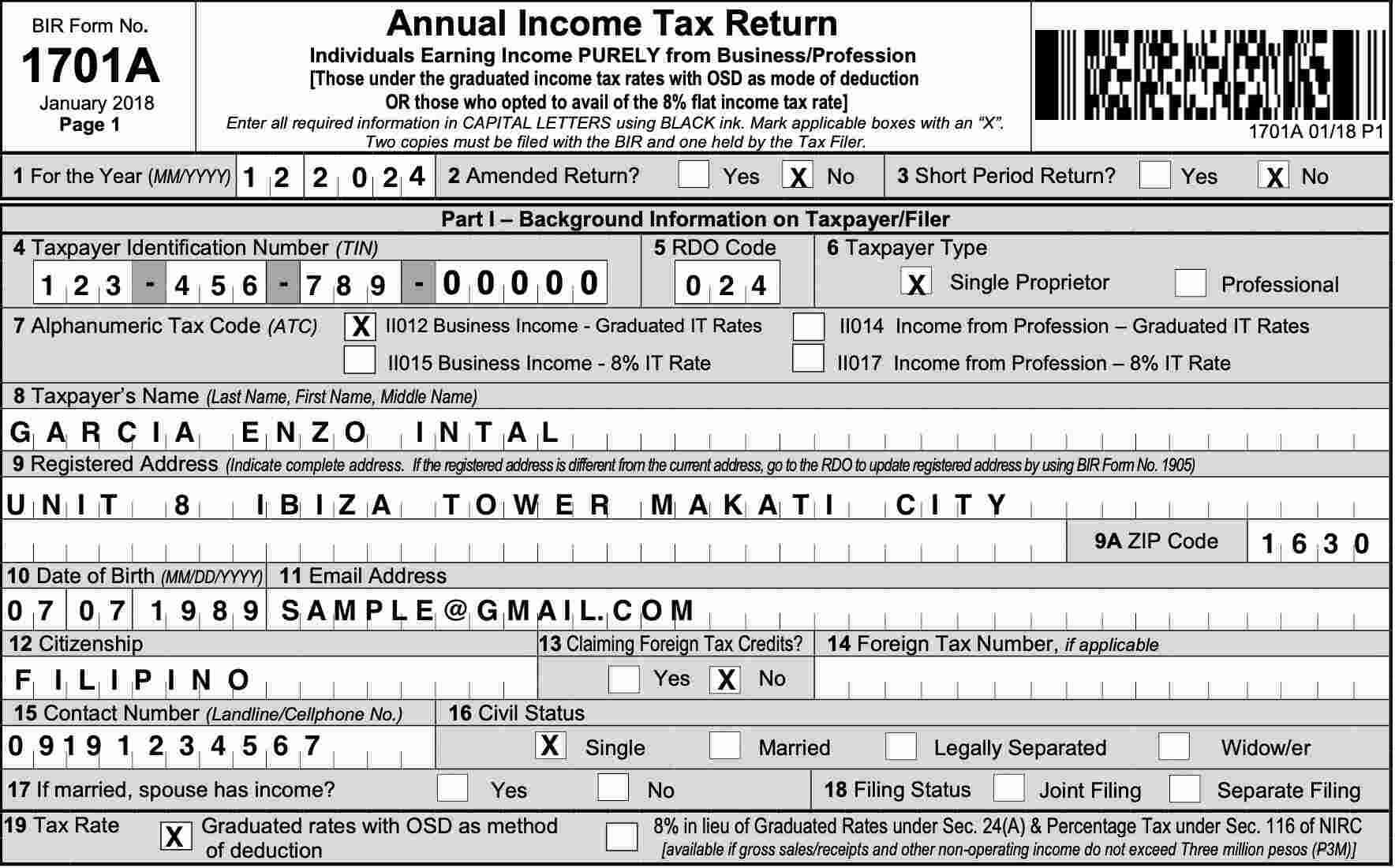

Step 1: Provide your taxpayer information

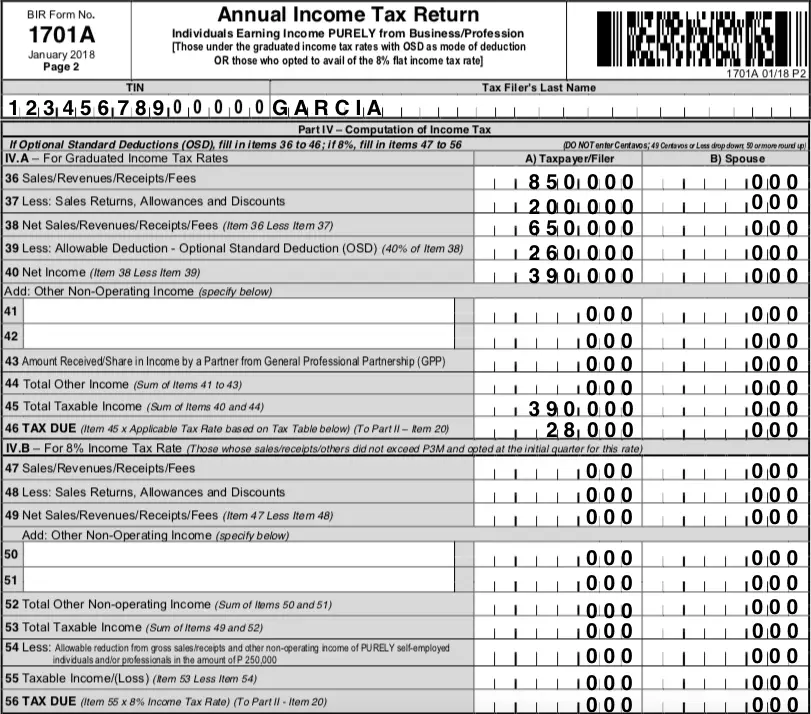

Fill out the Part 1 section (screenshot above) then proceed to the next page (page 2) and provide the details for the computation of your income tax. Since our example opted for the Optional Standard Deduction, we must fill out the details for section IV-A.

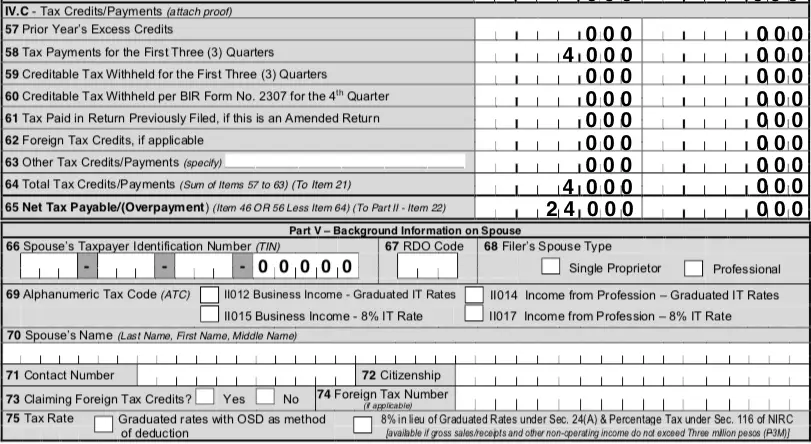

Step 2: Encode any tax credits or tax payments

Next fill out the section for tax credits or tax payments if any. After you have encoded the values in this page, click the validate tab and proceed to page 1.

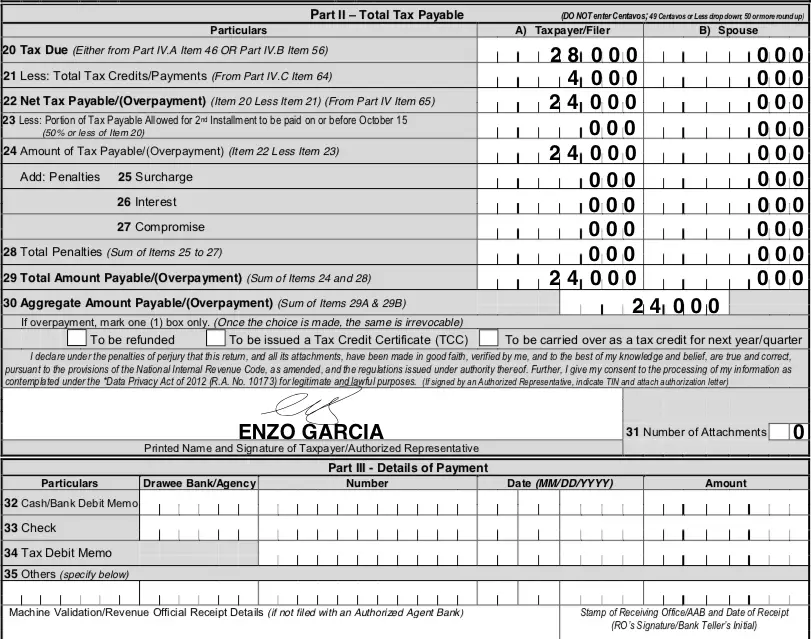

Step 3: Validate your entries

Validate your entries and go back to page 1. Write your signature. Double check all the entries you have provided and all your personal details before printing out the document.

You are done with your ITR. So easy right?

How to Fill Out BIR Form 1701A for Professionals:

Professionals include doctors, lawyers, CPAs, architects or any individual earning income from the practice of their profession.

In the example below, we opted for the 8% in lieu of Graduated Rates under Sec. 24(A) & Percentage Tax under Sec. 116 of NIRC (available if gross sales/receipts and other non-operating income do not exceed three million pesos.)

To demonstrate with you another option, you can use this ONLY if you have opted for the 8% flat rate already when filing your first quarter income tax or first quarter percentage tax return.

Step 1: Fill out your tax profile

Accomplish Part 1 section just like that of the above screenshot. Again, you must enter the correct information and options relevant to your status and background as a taxpayer.

Step 2: Compute your tax due

Proceed to page 2, Part IV-B for the computation of your tax due. Remember you are computing for the 8% income tax rate.

Step 3: Provide your tax payments from the previous quarter

Enter any tax credit or payment made from the previous quarters. That’s it, you’re done with the steps on how to fill up BIR form 1701A. You can now pay your taxes at any accredited bank, LGU or at the BIR.

The deadline for submitting and paying annual income tax is still April 15.