Your ultimate complete guide of using PayPal in the Philippines is here. You will learn how to open and create a PayPal account and receive and withdraw funds from PayPal to any Philippine bank account on this page.

PayPal is among the most trusted and most reliable online payment platforms in the world today. We can use it to shop online, even without an existing credit card. PayPal is a necessity not only for shopping online and transferring money to anyone around the world.

Having a PayPal account is also a primary requirement to receive income, commissions, and salaries earned from online jobs and freelance work anywhere across the globe.

It’s so easy to set up and open a PayPal account. It’s worth mentioning that it costs nothing to open an account. All you have to do is follow the steps and guides below, and you are ready to receive and transfer money online.

What is PayPal?

PayPal is an open digital and mobile payment platform that enables consumers and merchants to receive money in more than 100 currencies, withdraw funds in 56 currencies and hold balances in their accounts in 25 currencies. Currently, Paypal serves over 325 million active account holders globally.

Benefits of Using PayPal:

- Simple and not complicated to use

- It is accepted in over 10 million online stores

- Secure and safe transactions

- Refunded returns service

- Features buyer protection

- Allows preferred card payments

- Accepts payments and earnings

Requirements to Open PayPal Account in the Philippines:

- Active email address

- Active Mobile Number

- Valid IDs for verification

- Bank Account in the Philippines

- Debit Card or Credit Card (optional)

- Business Documents (if you’re opening a Business Account)

Tip:

All your important information like name, address, and birth date must match on all your IDs, bank accounts, documents, and PayPal to avoid account limits.

How to Create PayPal Account in the Philippines in 2020:

- Sign up for a PayPal account

- Select which type of account you want to open (Personal Account or Business Account)

- Provide your accurate information

- Agree to the Terms and Policies of PayPal

- Confirm your email Address

- Link your Philippine Bank Account to PayPal

- Confirm your Mobile Number

How to Open PayPal Account in the Philippines – Guides with Pictures:

1. Sign up for a PayPal account

On your internet browser, visit paypal.com and tap the SIGN UP button if it is your first time using PayPal. You can use your desktop, laptop, tablet, or mobile phone as long as you have a steady internet connection.

Before signing up, we recommend you prepare your active email address and list down your PayPal login credentials (username and password) so that you won’t forget them in the future. Since PayPal is an essential account, make sure you prepare a strong password.

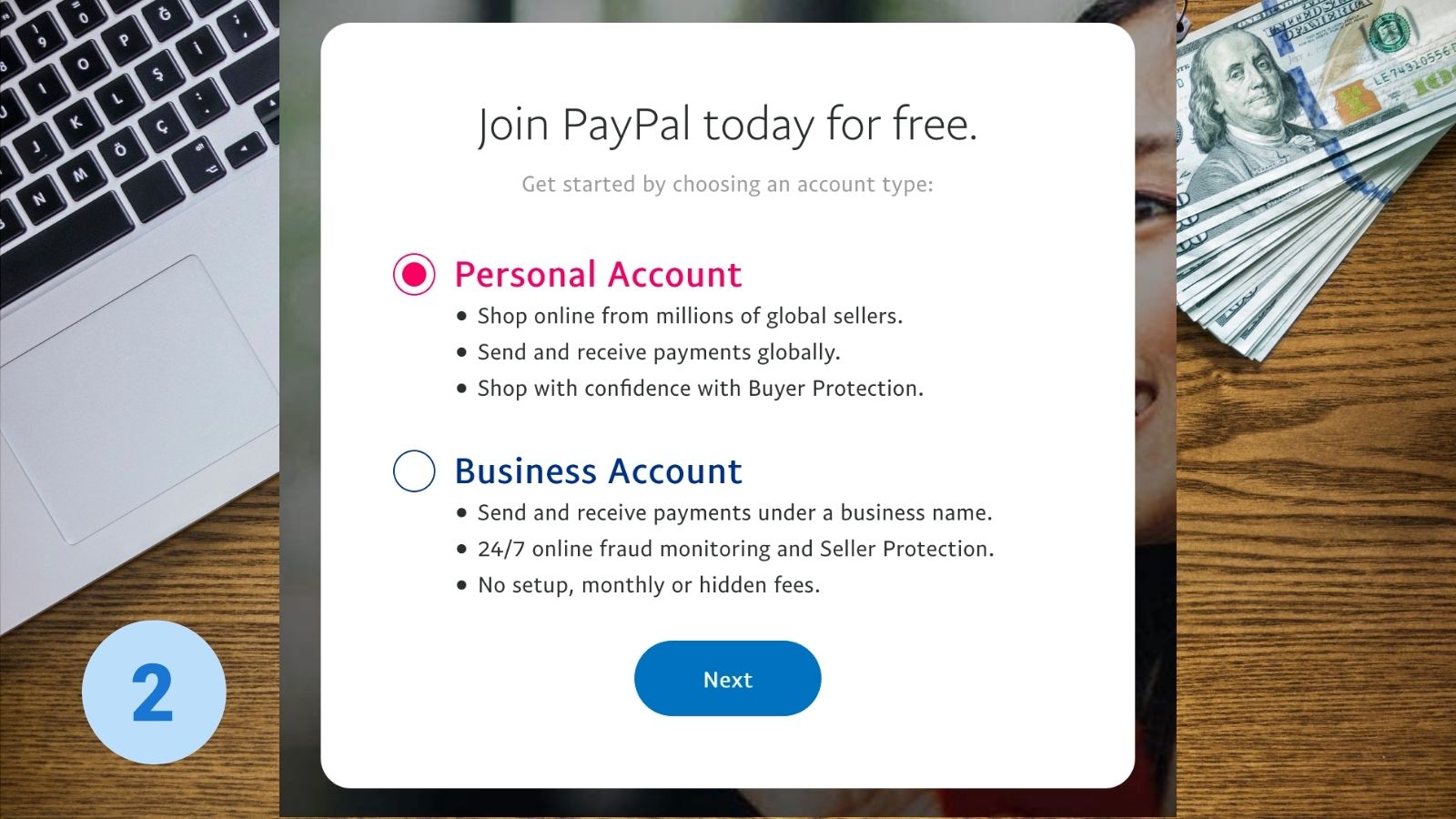

2. Select which type of account you want to open (Personal Account or Business Account)

PayPal offers two types of accounts: Personal and Business accounts.

Personal Account is the primary account has the following features:

- Shop online from millions of global sellers

- Send and receive payments globally

- Shop with confidence with Buyer Protection

Business Account is used for Official Businesses and has the following features:

- Send and receive payments under a Business Name

- 24/7 online fraud monitoring and Seller Protection

- No setup, monthly or hidden fees

For this example, we are opening PayPal Personal Account, select it and indicate whether you are an online shopper, individual seller, and freelancer, or both. Otherwise, indicate if you are not sure about that. Click the NEXT button to proceed.

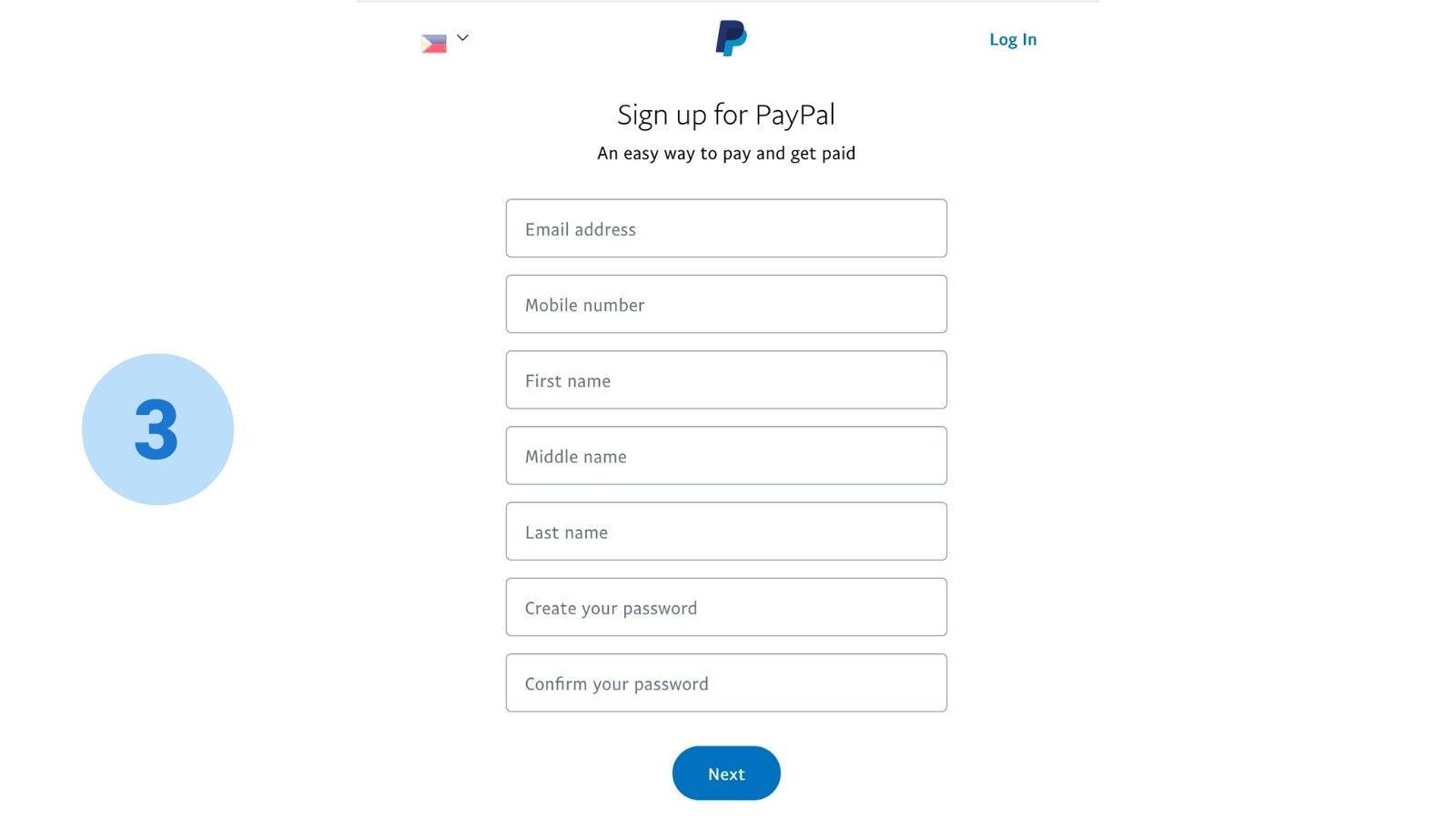

3. Provide your accurate information

Enter your correct information on the field provided. That includes your active email address, mobile number, first name, middle name, last name, and your preferred password. You must give only true and correct details here.

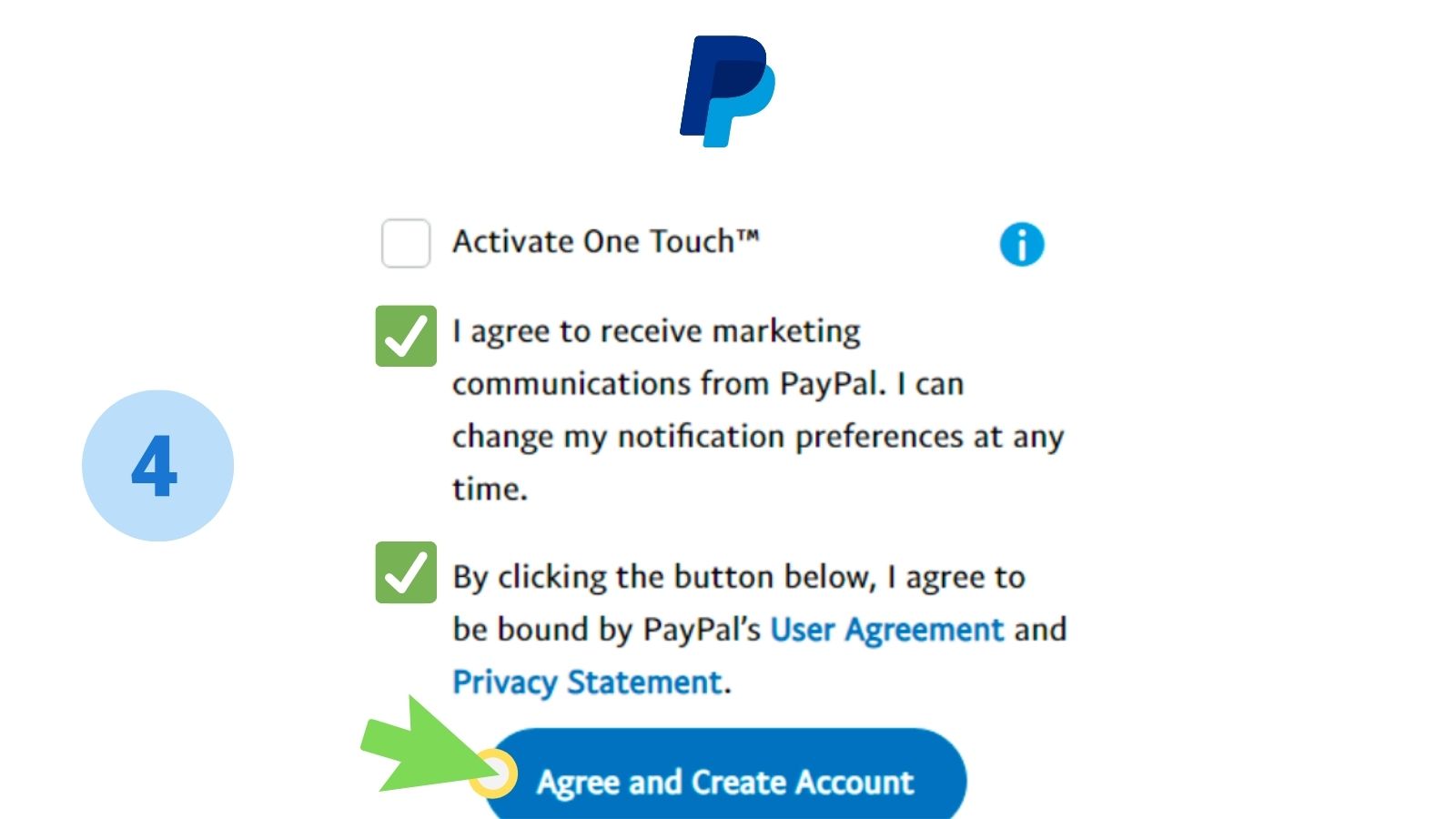

4. Agree to the Terms and Policies of PayPal

You will be given an option to activate One Touch, a feature in PayPal that allows you to check out faster without logging in or filling out your billing information. You may skip that feature if you want to activate it later.

Confirm that you agree with PayPal’s User Agreement and Privacy Statement to proceed to the next step.

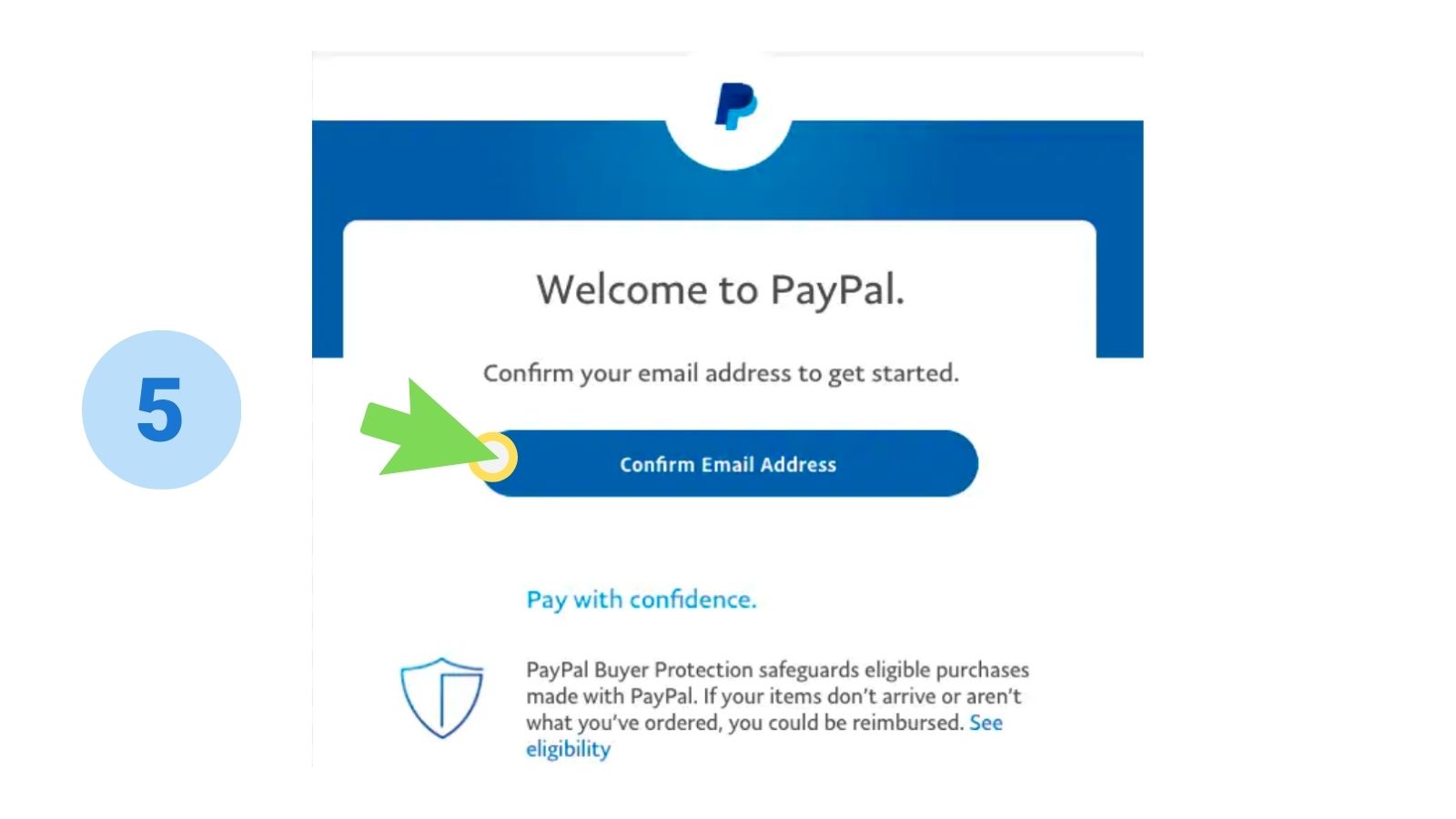

5. Confirm your email Address

Open your email and look for the email notification from PayPal. You have to confirm your email address so that PayPal can verify your identity. Then you can start using your PayPal account.

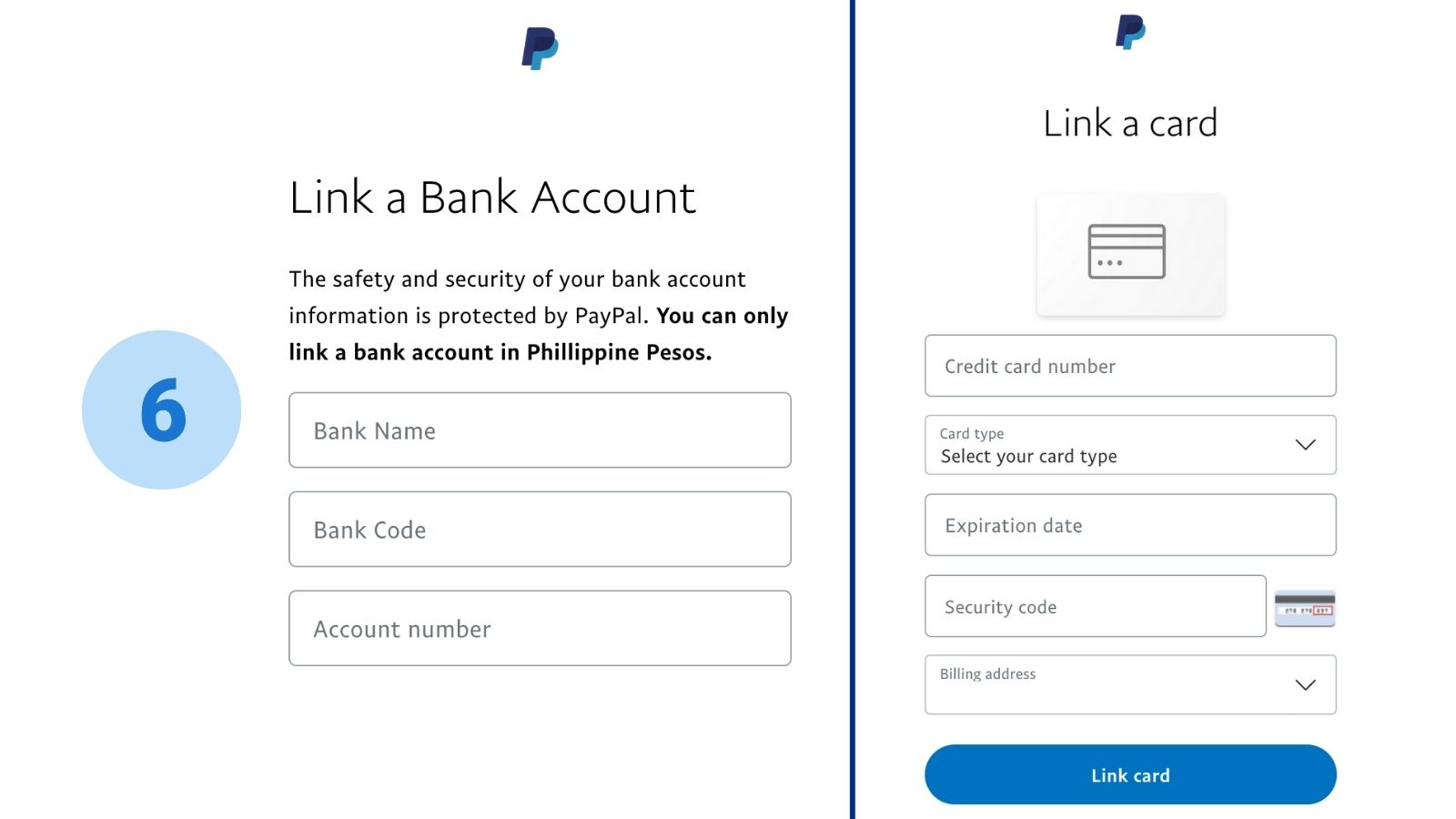

6. Link your Philippine Bank Account to PayPal

To fully use all the features of PayPal, you need to link any of your existing bank accounts to PayPal. You can use your regular savings or deposit account in the Philippines or any current debit card and credit card (Visa, MasterCard, American Express, Discover, Union Pay).

To link a regular deposit and savings account to PayPal, select “Link a New Bank Account” from the menu or your profile settings. Provide the name of your bank. The bank code will automatically load. Indicate your account number.

To link a debit card or credit card to your PayPal account, select “Link a New Card” from the menu tab or your profile settings. Type in your card number, choose your card’s type, indicate its expiration date and security code. Your billing address must match with your card account details.

In addition, you can also link your GCash and PayMaya account to PayPal. The complete instructions to do that are listed below.

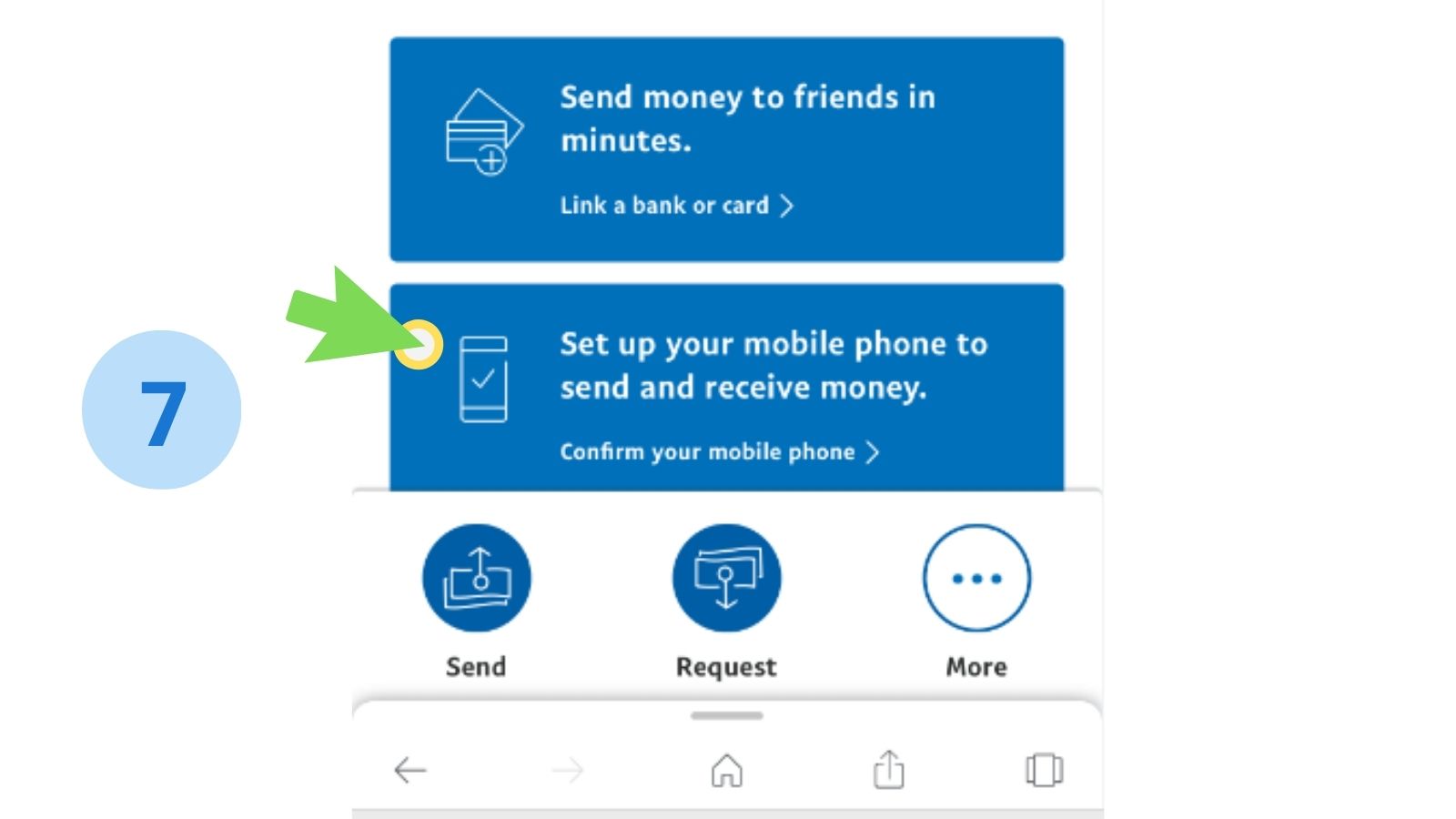

7. Confirm your Mobile Number

Mobile number confirmation is another layer of account protection and security feature. PayPal will send a security code to your mobile number. Type in the code to confirm your ownership.

That being said, make sure you have entered a correct mobile number upon signing up and make sure your smartphone is within a strong network signal.

How to Verify PayPal Account in the Philippines?

Verifying PayPal account is a must, especially for newbies and beginners, because PayPal is one of the most secure ways to pay and get paid online. If your PayPal account has sending and withdrawing limits, you need to verify it by logging in and clicking the Get Verified tab found in your account or profile overview page.

How to Create PayPal Account Without a Bank Account and Credit Card?

If you don’t have any existing bank account and a credit card at present, and you would like to open and activate a PayPal account, you can still do it by opening a PayMaya account.

If your account has a decent cash balance of P100 or more, you can upgrade it and get a free Online Payment Card. You can then link that card to PayPal to verify your PayPal account.

Another way of opening a PayPal account without a credit card or bank account is using Payoneer. If you are a student or a freelance worker, Payoneer is an alternative way to use and link PayPal.

To learn more how to link PayMaya to Paypal, follow the procedures below.

How to Verify PayPal Account Using PayMaya?

PayMaya is another online payment app in the Philippines used to send and receive money. May Filipinos also depend on PayMaya for fast and secure bills payment transactions.

PayMaya can also be linked and be used to verify PayPal account. Ensure your PayMaya account has an existing cash balance of P100 or more, as PayPal will charge a fee for the verification. No worries, though, because this fee will be refunded back to your PayMaya cash balance.

Remember, your billing address on PayPal must also match with your address info from your PayMaya account to have a successful verification and linking of accounts. Follow the procedures below:

- Log in to PayMaya App

- View your Online Payment Card Number

- Log in to PayPal

- From the menu, select Link a Card or Bank

- Enter your Card Number

- Select your Card Type

- Provide the card expiration date

- Type in card Security Code

- Tap Link Card

- You will receive an SMS with PayPal approval and reference number

- Copy your Reference Number

- Visit your PayPal Account and Card Page

- Select Confirm Card

- Paste your Reference Number

- The refunded fee will be credited back to your PayMaya account

How to Link PayPal Account Using GCash?

GCash is one of the most reliable mobile payment apps in the Philippines. It is a virtual wallet you can use to pay and receive money in the Philippines. Before you can link your PayPal account to GCash, make sure your GCash account has a decent cash balance and is fully verified.

- Log in to GCash Mobile App

- On the Menu Icon, select “My Linked Accounts“

- Choose PayPal

- Enter your PayPal email address

- Tap the “LINK” button

- Authorize your PayPal account to link to your GCash wallet

How to Receive Money in PayPal

- Log in to PayPal

- Select Request Payment from

- Type in the email address of your sender

- Click “NEXT” to confirm

Tip:

Up to 20 people can pay you back, even if they don’t have a PayPal account. Just use their email or mobile number to request payment.

How to Withdraw Money from PayPal to a Philippine Bank Account

- Log in to PayPal

- Select “Transfer Money“

- Choose between Instant or Standard Transfer

- Instant lets you transfer money to your bank or debit card in minutes for a 1% fee (minimum P10, maximum P500)

- Standard lets you transfer money to your bank in 1 to 4 days for free with a minimum of P7,000 transfer

- Select your Recipient from your linked accounts

- Tap NEXT to proceed

How to Close PayPal Account in the Philippines

- Log in to PayPal

- Select Profile Settings

- Under Account Options, choose Close your Account

- Enter your bank account number if requested

- Tap Close Account

I need help, hindi po ako makaka pag login sa paypal account ko, access denied po kahit i reset password mag access denied pa rin po.

Hello po good morning!My friend from Dubai sent money for me through paypal.I don’t have a bank account where could I withdraw the said money?He sent to me last April 9 until now I did’nt claim because they said they don’t have paypal.I went to BDO,BPI,Western Union,LBC,Cebuana Lhuillier.I was already felt annoyed and tired of finding offices and services where to withdraw the money which my friend sent to me.

Hi 🙂 I use UnionBank EON to withdraw money from my Paypal account. Follow the steps I discussed in the article above

Hi po, how much is the payment for UnionBank EON card account that can be use to withdraw funds from Paypal.

Hi pano kapo makakapaglagay ng pera sa paypal, thanks .wala po akong credit card

ask ko lang po only bank lang po ba pwede mga withdraw through paypal accnt .pano po mga withdraw without bank accnt or debit / credit card.

Hi po, pwede po bang gumawa mg paypal account kahit na wala pong bank accounts?

Gusto ko Sana mag open Ng PayPal account per naghahanap siya Ng national ID. Just wanna ask if pwede Po ba Yung government ID? Like Baranggay ID? 18 Lang Po Kasi ako and Ayun.. I hope masagot tanong ko ?

kahit lagay mo lang na NA sa National ID iaaccept naman ng paypal. CHEERS!

Thank you! So helpful it really worked 😀 God bless!

Hello po, paano po ba makakapag claim Ng cash if ung kukuhain mo from PayPal account? And if need Ng ID pwede Po ba gumamit Ng Government ID?

hello po. miss fehl, tanong ko lang po kung anong mga I.D. ang Allowed na gamitin sa payapl? inilagay ko po kasi ay Philhealth number pero ayaw mag proceed.

UMID number yung gamit ko.

May service fee po ba ang paypal?

Hi Fehl!

I’m starting to consider being a freelancer and Paypal account has been the usual go-to platform for payments. I do have a Personal Account with a link to my debit card. Do I still need to “upgrade” or “create” a Business Account just to receive payments?

Thanks in Advance! 😀

If you are doing business online, it’s better you use Business account sa Paypal to enjoy the features. But if you don’t have a business yet, use muna the Personal account. Cheers!

hello po ask sana ako kung pwede po ba gamitin ang paypal account ko na mag recieve nang payment sa ibang online job ko, kahit ibang online job ang naka register sa bank account account ko? Thank you po

Hi, yes online jobs only require your Paypal email address in sending payments. I’ve been using Paypal for 5 years and did not have any problem about it. It’s very convenient 🙂 Cheers!

Nakakareceive din po ba ng payment for online job ang personal account sa paypal?

Hi,

Inadd ko ung BPI account ko s paypal, kso ang nakalagay checking account, eh savings account nmn ung card ko. Ano dapat ko gawin?

Thanks

HI! I am signing up for a paypal account and it is asking me to present an Identity document. Passport, Driver’s License or a National ID. Does the National Id refers to something like the National Id of US or it is referring to any valid/ primary ID issued by the government? I have Postal ID and TIN ID. NBI is accesssable. Hope you can help clear this out as I am stumped in my paypal application 😀

Hi, there is no National ID right now in the Philippines so you can submit a copy of your SSS UMID or GSIS UMID instead

Good morning… I want to sign up for a PayPal account. It states here that a document number is needed to sign up. I don’t have driver’s license and passport. Can I use my insurance card number?

Hi 🙂 You need to provide primary IDs like UMID Card, Voter’s ID, PRC ID. Insurance card is not accepted as primary ID

hi fehl, nag sign up ako sa paypal, wala ako driver’s licens pero nilagay ko dun yung voter’s id number ko. na accept naman sya, ok lg poh ba yn taz hnd magkaka problema?

hello, hindi po ako maka-open ng premier account, personal and business account lang kasi ang option? paanu po kaya yun?

Thank you.

Open Personal Account instead the upgrade to Business when your account was approved na

student pa po ako maam panu po mag karoon ng paypal ccount? ala pa po ako drivers license at mga sss etc

hey fehl pls reply me im wondering if i link any passbook bank for withdrawal only 7k? no charge fee? and its allow to receive money? i have eon 4yrs now but i didn’t try different bank like passbook..for withdrawal

HI! im trying to create a paypal account, i choose business kasi pde daw po toh mag receive ng payment,,, Ano p[o ilalagay ko sa business kc my nkalagay po don tell me about your business..?

and pde po ba gamitin na card is yung galing sa pag ibig fund na card? CITI bank po sya and my nkalagay nman po na VISA pde po b un? thank you

Choose Personal account instead of Business account .

hi ms fehl I have a union visa debit card do I need to deposit 200 pesos for enrolling paypal?

Hi can anyone help me with my case? Pending pa din kasi yung money na finorward sakin ng friend ko as payment ng utang nya sakin. Feb 8 yun and sabi sa paypal aftr 21days marelease. Supposetedly ngyon yun but wala p dn. Di naman ako merchant. Can anyone help me with this matter?

Hi. What is the usual timeframe for withdrawals to Security Bank? I usually use my BDO account to withdraw from Paypal. I just tried to use my Security Bank Checking Account for withdrawal since I am planning to close my BDO account na. Withdrawal was made last Friday and was completed in Paypal by Saturday morning. Thanks

HI, Bakit indi ako maka gawa ng paypal account? anong state ba ang Philippines? wala naman kasi sa options eh.

Hi can I used my Unionbank UMID card to link Pay Pal

You can try linking since it is from Unionbank. Follow the steps in linking mentioned above

Hello

Im having problem

Nag pay kasi ung tao sa akin thru my paypal account and may confirmation na na ung payment nasa paypal account ko na pero naka pending unless mg bigay ako sa paypal ng tracking number or shipmemt number

Nag sell kasi ako ng items sa OLX and ung buyer payment thru paypal. Wala ako paypal so nag register ako

Successful naman ung pag register ko now may email sa akin ung paypayl na ung payment ng buyer naka pending sa paypal account ko

Hi ask ko lang kung naging okay na yung sayo ?

Kasi saken direct nung buyer paypal to my bank account.

hi my sister is Philippines has account with BDO. Is its linked with PayPal yet?

hi ms.fehl ask ko lng po sana ,sbi ng manager nmin na kapag business accnt paypal ang gamit it will take many weeks para makuha ang pay sa paypal.She advised to use personal account in paypal. Is that true? Im a bit confused , im a newbie, and i have paypal account na business account. Thanks

Depende sa sender ng money. If mabagal magprocess and sender mo, mabagal din matatransfer sayo. I am using Business account and I get my money instantly

Hi, Is it possible for me to register in Paypal using my school ID as my National ID? I’m still a student and I still don’t have driver’s license nor passport code. Please answer. Thanks.

Yes, if your school ID is still valid and bears updated info about you, it can be used

paano po mag nakalagay na add bank at credit card ano po gagamitin nmin student rin po

pwede pa ba akong mag open ng premier account, personal and business account lang kasi ang option?

Is postal ID number allowed? Thank you so much.

i just wanna know if its ok to link paypal in bpi dollar account..

tnx..

Thanks a million for sharing this info. Since Paypal’s registration options were updated, I’m confused whether I should choose the “buy with paypal” option because it says, “You can only accept payments monthly and up to five credit or debit card payments annually with your Personal account”. I just wanna be sure that my salary does not fall within the “payment” in the aforementioned statement. Or do I choose the “receive payments with paypal” option and merchant fees will apply to my salary?

Hi, if you will use Paypal to send and receive money, I recommend signing up for Business account to enjoy the benefits of both buying and selling

pano po pag walang creadit card. and wala namn bussiness. for receiving money lng talaga

Hi, pwede gamitin ang voters id number sa national id pag register ng account sa paypal? wala kasi akong passport at drivers license

Pwede pero according sa site nila dalwang ID ang kelangan pag voter’s ID ang gagamitin mo. So you need another ID besides your voter’s ID. I suggest na NBI clearance na lang gamitin mo kung wala kang ibang ID.

https://www.unionbankph.com/eon-faqs/list-of-valid-ids

Yes, voter’s ID is accepted

is it possible to transfer the money to western union from Paypal… i dont have paypal account yet but plan to register it and on how to withdraw the payment from an online job from paypal to western union. i have my western union card.

Hi, not possible as of now. You can only use a debit card or bank account to transfer or withdraw money from Paypal. Unionbank and Security Bank will do.

thanks po

hi tanong ko lng po pwd b ilink ung bdo kabayan savings account sa paypal? link ko sya pero ang tagal ng confirmation, pg inopen ko checking lgi nkalagay,tenks po.

Didn’t try BDO yet but I will and will make a post about it here. You can link UnionBank and Security Bank with Paypal, it works

nag Open po kami ng Paypal choose namin yung business kaso po need ng category, kahit anung category at sub category piliin ko ayaw mag push ng pag sign up ko sa paypal, I need for it my homebase job thanks

That’s strange

Hi, Can I use my SSS number in Paypal for the identification number?

For proof of ID, you can submit SSS UMID card, passport or recent credit card statement

hi….po ..paano po gamitin yong sss id?ano po ang pipiliin ko?yng nation id po?

SSS ID is accepted at nation ID as it is issued by the government

Hi miss fehl, ask ko lang po sana ano national ids ang pwede ilagay sa paypal reg, nagtry ako mag reg pero ayaw po tanggapin yung postal id num ko at voters id num ko, please need ur answer thank u

Security Bank accepts Paypal > https://www.securitybank.com/personal/accounts-savings-account/paypal-account/

how can i put some money (US$) into my Paypal account without linking any bank accounts? is it possible? would really appreciate ur reply.

Hi, Miss Fehl! I just want to ask..

I got a BPI EXPRESS TELLER DEBIT CARD.

Can I link it to my Paypal Registration?

I heard BPI can also be linked to Paypal. Just follow the steps on linking and wait for few days to check it

Hi I transferred money from PayPal to my BPI Express Teller Debit Card.. PayPal said it was completed but I still haven’t received anything .. Do I have to get it over the counter or will I get it through my ATM card? or will I ever get it? Please reply.. Thanks

It will take 2-3 days for banks in the Philippines. You can track it by using BPI online banking o check if the transfer has been credited already on your account.

Hello po. I want to create a PayPal acct for online job to receive payment/income but when I accessee the PayPal website I only have 2 choices to create – 1. buy with PayPal who primarily want is to buy online and 2. Received Payment with PayPal who primarily want for business. Which one should I choose?

If you will use it for income, I suggest you choose the Business account. I am using it and I can Buy or Sell or do Business with Paypal

I also doing an online job, how can we get our money without using a link in banks, I dont have enough money to get that card (union bank)

You really need to link a bank account to withdraw your money from Paypal

Hi, I recently linked my savings account (BPI) on paypal. I have received funds and I requested for a bank transfer. Status shown that is was completed already but it does not appear on my BPI account yet. Is there anyway to easily resolve this? Though I don’t have any credit card registered on Paypal?

Will really appreciate if any one help me sort this without prolonging the agony by contacting Paypal or BPI

Has anyone tried Auction Essistance for a PayPal vcc to verify my account?

Can I use BDO kabayan account to link with paypal here in the phils.?

Na.activate nyo po ba ang paypal nyo gamit ang kabayan savings account? Sana mag reply po kayo. Parehas po tayo ng account.

how can I get the 4-digit Pay Pal code to verify my card?

Hi I just process my BDO Debit Card with MasterCard Logo a while ago and I’m planning to link it on paypal for paying purposes. Will Paypal Accept it?

Verify first at BDO about the bank code for Paypal then you can do that

Do you think it is a good idea to buy a PayPal vcc from Auction Essistance if I cannot get my own card?

What card can’t you get? EON?

Hi Mam,

May BPI passbook account po ako. Gusto ko pong mag-apply ng paypal, kailangan po ba na magkaroon muna ako ng DEBIT account sa BPI bago po ako mag-register ng paypal?

salamat

You can register a Paypal account even if you don’t have a bank account yet. You may need the cards later

Maam ano pinahkaiba ng debit card sa other atm card?

And ok lng po ba gumawa ng paypal accnt kahit wala pa akong unionbank EON card?

Thank you po

Debit card is a funded card you can use in shopping while ATM card can or cannot be used in shopping. Yes, you can open Paypal account even if you don’t have EON card

Im from Philippines but my PayPal account is us, they email me to have a debit card from u.s because my card is not applicable, my card is Metrobank debit card. Can I use union bank to transfer the funds in my account?

Contact Paypal and tell them you want to change your account into Philippine account so you will be allowed Philippine fund transfer

hi

scenario :

if i am not a paypal member / holder.. and

i need to transfer money or check to PERSON A.

however person A doesnt have bank here in philippines

he only has PAYPAL atm sort of thing…

how to do i transfer it?

Either let Person A to open a bank account in the Philippines or let yourself open a Paypal account or use Western Union. Problem solved.

pano po ako. college student. di ko po matapos ung application form kasi wala po ako TIN/SSS/UMID kasi estudyante pa lang nga po ako ang source ng money ko lang po is ung allowance ko.

Pwede rin ba yung prepaid debit card i-link sa paypal (pra lang maiwasan ang hassle sa pag-open ng bank accnt. 🙂 gusto ko kasi i-try ang online job)

I think so. Try it 🙂

hi ..! can I link my unionbank E pay card with paypal?. 🙂

hi, want to verify paypal if client made payment. receipt no. was given. where can i check it. please give contact no. email will take too long, need to sent it asap. thanks.

hi! Can I use this UnionBank EON Visa Electron to received payments from paypal? I will be using it for my online selling. Thanks!

In my case, I just need to put MONEY on my PayPal acct to book a hotel as I dont want to get a credi car. Will this procedure do? Put money on Union bank card, trnsfer it to Paypal?

can i use my BDO Debit card ATM ?

I wanted to create an account at Union Bank, I didnt manage to settle up my account online because some fields aren’t field with information because I’m still a student and it actually requires something like TIN Number.,etc? and Is there a payment required to create this account? Please do reply. Thanks!

Paypal is free to create. UnionBank EON card requires 350 annual fee.

hello i have just regestered to eon and have not yet picked up but i already have paypal account is it necessary to have a linked bank account inorder to start receiving payment from paypal? or is it only needed when i want to withdraw the payments

It’s not yet necessary, you would only need to link a bank account if you will withdraw any amount from your Paypal money

Hi! I was able to link my Landbank debit card to my Paypal account.

That is cool 🙂 I’m glad Landbank can now also be linked to Paypal

Are you using Current account or savings account??

is RCBC can be linked to paypal?

Didn’t try RCBC yet

How can i change my profile coz when i signed up, i incorrectly created for business but i am supposed to make it premier only.pls help. Thanks

That’s very easy. You can either call Paypal via the ‘Call Us’ link or email Paypal. You can do that by logging in your Paypal account and find the Contact Us page. Be sure to include in the message your Paypal account details. Paypal then will reply and help you change your Business account into Personal or Premier account

thanks for this.. very helpful. initially, i am planning to open metrobank account, but i will consider unionbank as you suggested. thanks a lot. stay blessed….

UnionBank is a sure Paypal link 🙂

I come to Union bank, camarin caloocan, they say they are not connected or not processing debit account connected to paypal, I dont have credit account? Im already a senior citizen? please reply to email

I got my UnionBank EON card and it can be connected to Paypal. See this from Unionbank:

That’s the card you will need to apply at UnionBank. Once you have that card, connect it to your Paypal account using the steps we shared in the article above. Have a nice day!

Hi ms. Fehl,

Thank you so much for this Article and Forum that you’ve opened, very helpful, especially for Newbies like me. I have created my PayPal account already but my Business Set up is still incomplete. I still have to choose HOW WOULD I LIKE TO SET UP PAYPAL ON MY WEBSITE? How do you go about this? I mean which Payment Solution did you choose then, when you opened your PayPal, ACCEPT PAYMENTS ON YOUR WEBSITE or ONLINE INVOICING?

I will use this for my Homebased Freelancer Job.

Thank you in advance for your help.- Cheryll

For some reason, i dont know why my debit card is not link to my paypal account . i tried to verify it but paypal will say card link is not available .my debit card is Easwest bank.will you please help me linking my debit card?

There is only one bank account that I know that can be linked to Paypal, it’s UnionBank

Can I linked my gcash mastercard to PayPal?

how can i get the 4 digit verification code if my account dont have statement since this a atm debit card only.

You can enroll an online banking for your debit card so you can see transaction history including the 4-digit verification code

Ma we have an account in paypal the money that send as in paypal we cant tranfer it to our account metrobank …how can i whitdraw the money in my paypal to my bank account

Open UnionBank EON card account, you can use it to withdraw funds from Paypal. YOu can also open an account at RCBC, it’s also fast in withdrawing Paypal

I got an error linking to my rcbc load wallet card visa..

How to link my rcbc load wallet?

I don’t know if RCBC is allowed to link to Paypal. Have you asked your banker in RCBC about it? I only use UnionBank as it officially allows Paypal linking

RCBC is also connected to paypal

Hi, I just want to say thank you for the info. I will follow your instruction… I will to UnionBank.

Regards,

Dolf

My pleasure 🙂

Hi, i just wanna ask how can i verify my paypal accnt if i dont have a credit card. i only have BPI EXPRESS TELLER. and the card type is neither VISA nor MASTER CARD.

Thanks,

To verify Paypal account, you need to submit copies of the documents Paypal is requesting (they are mentioned in the email sent to you by Paypal)

i’m an ofw here in brunei, can i link my Land Bank savings account to paypal to receive my earnings when i start my job online?

I don’t know if Landbank can be linked to Paypal. I just know UnionBank works hundred percent for Paypal linking and withdrawing Paypal to UnionBank account 🙂

FYI peeps. BDO is connected with Paypal for shopping purposes ONLY (and not for accepting payments from clients) so you need to enter your BDO credit card details with Paypal to get verified and if you want to use Paypal for this purpose.

How about the metrobank debit card? Is it connected to paypal?

There is no official confirmation from Metrobank yet

Thanks for the heads up 🙂 I wish BDO can be linked to Paypal as well like UnionBank Eon

i got denied applying for eon because i only showed digitized voters and tin ID, and I scheduled my pick along pasig not in manila. sucks to be me. :-p

Sorry to hear that but voter’s ID is accepted. Maybe you needed to laminate it. TIN ID is not usually accepted, maybe you must have submitted passport instead

how about metrobank?can i link it to have a paypal account?thanks

I’ve never tried any other bank yet because UnionBank bank has the proper instructions with Paypal.

@rhose

Have you tried the metrobank debit card?

You can now use the RCBC wallet card visa. I got mine tonight 🙂