Do you want to earn a fixed income this year? Then you should read these guides we shared here about how to invest in Retail Treasury Bonds in the Philippines, also known as RTB.

Retail Treasury Bonds are one of the most attractive investments because they generate fixed income. Investors who prefer to rely upon low-risk but rewarding investments choose RTB over other securities and financial assets.

What are Retail Treasury Bonds?

Retail Treasury Bonds are medium to long-term debt securities issued by the Philippine government through the Bureau of Treasury. RTBs are types of fixed-income investments and are part of the government’s savings mobilization program to make securities available to small investors.

Retail

It means that they cater to the retail market or small investors. Small investors can benefit from RTB offered by the government as they reward fixed income.

Treasury

The Bureau of Treasury administers RTBs in the Philippines. The bureau always announces RTB offerings before they become available to the public or accredited banks.

Bonds

RTBs are types of bonds, and they pay a fixed amount of interest per annum with a predetermined maturity date.

In a nutshell, you lend the government your money, and in return, the government will pay your cash on the maturity date plus fixed interest income every quarter. How is that sound?

Why should you invest in Retail Treasury Bonds?

Unlike stocks, mutual funds, and UITFs, RTBs are low-risk investments because they are fixed income and backed by the full taxing power of the government. To summarize the benefits and reasons you should invest in RTB, see our retail treasury bonds benefits list below.

What are the benefits of investing in Retail Treasury Bonds?

Very Low Risk

As mentioned, Retail Treasury Bonds are low-risk investments to the point that many people call them “risk-free” investments.

But of course, there is nothing like a risk-free money wheel. Since RTBs are backed up by the government, it is almost impossible to lose your money because the government will always find a way to issue cash or do some ways to earn some.

Affordable

You can invest RTB for as low as P5,000 in the primary market. Keep in mind that since RTB is low-risk, you should not expect higher interest rates or earnings. What matters is the more you invest, the better.

Easy to Open

Retail Treasury Bonds are easy to open. The Bureau of Treasury authorizes our well-known banks to issue and offer RTB to the public. All you have to do is find out the offer period for RTB and go to your bank to reserve how much you want to buy.

Regular Earnings

When you have this type of investment, you will receive interest payments quarterly based on the principal market rate you have signed up.

How to Invest in Retail Treasury Bonds in the Philippines?

Step 1: Check out the latest RTB offerings

First, find out if the Bureau of Treasury is offering upcoming Retail Treasury Bonds. Because these are huge opportunities, we made the latest list on this link: “RTB Offerings in the Philippines.”

Step 2: Open your RTB investment

If there are available RTB offerings, proceed to your bank and approach a Trust representative or any staff under the Asset Management Group or Trust Group. Tell them you are interested in investing in Retail Treasury Bonds.

Step 3: Submit your documents

Bring some docs like your valid IDs and your bank account (usually your settlement account), and make sure you know your TIN (Tax Identification Number). Opening a Retail Treasury Bond account requires many papers and documents to be filled out and signed, so make time for it.

The bank agent will give you the documents you need to fill out and sign. They are usually the ones listed below.

Step 4: Receive your fixed income

Retail Treasury Bonds usually pay quarterly fixed interest income in the Philippines. The investor will receive his fixed income on his chosen settlement bank account. The settlement bank account is provided during the opening of his RTB investment.

Step 5: Receive your capital on the maturity date

When you reach your Retail Treasury Bonds’ maturity date, your original investment fund will be paid back to you in full. The cash will be credited to your bank settlement account.

Requirements to Invest in Retail Treasury Bonds in the Philippines:

- Bureau of Treasury (BTr) Investor’s Undertaking

- Special Power of Attorney

- Client Suitability Assessment Form

- Risk Disclosure Statement

- Client Agreement

- Checklist

- Order Ticket

- Data Privacy Form

- Others as may be required by the Issuer or bank

The RTB issuer or the bank usually provides the required documents above, and you need to fill out your information and sign the papers.

How much would you earn if you invested in Retail Treasury Bonds?

Since RTB are low-risk investments, they also generate low returns and low-interest rates compared to stocks, mutual funds, and UITF investments. The latest RTB issue rate we got was 6.250% per annum. That could reward you high income if your principal is 1 million or above. For example, if you invested 1 million, you would get 250,000 effortlessly.

If you invest in RTB, you earn a fixed income for medium-term investment. You don’t worry so much because the guarantee you will have your money back plus interest is almost 100%.

Retail Treasury Bonds Calculator

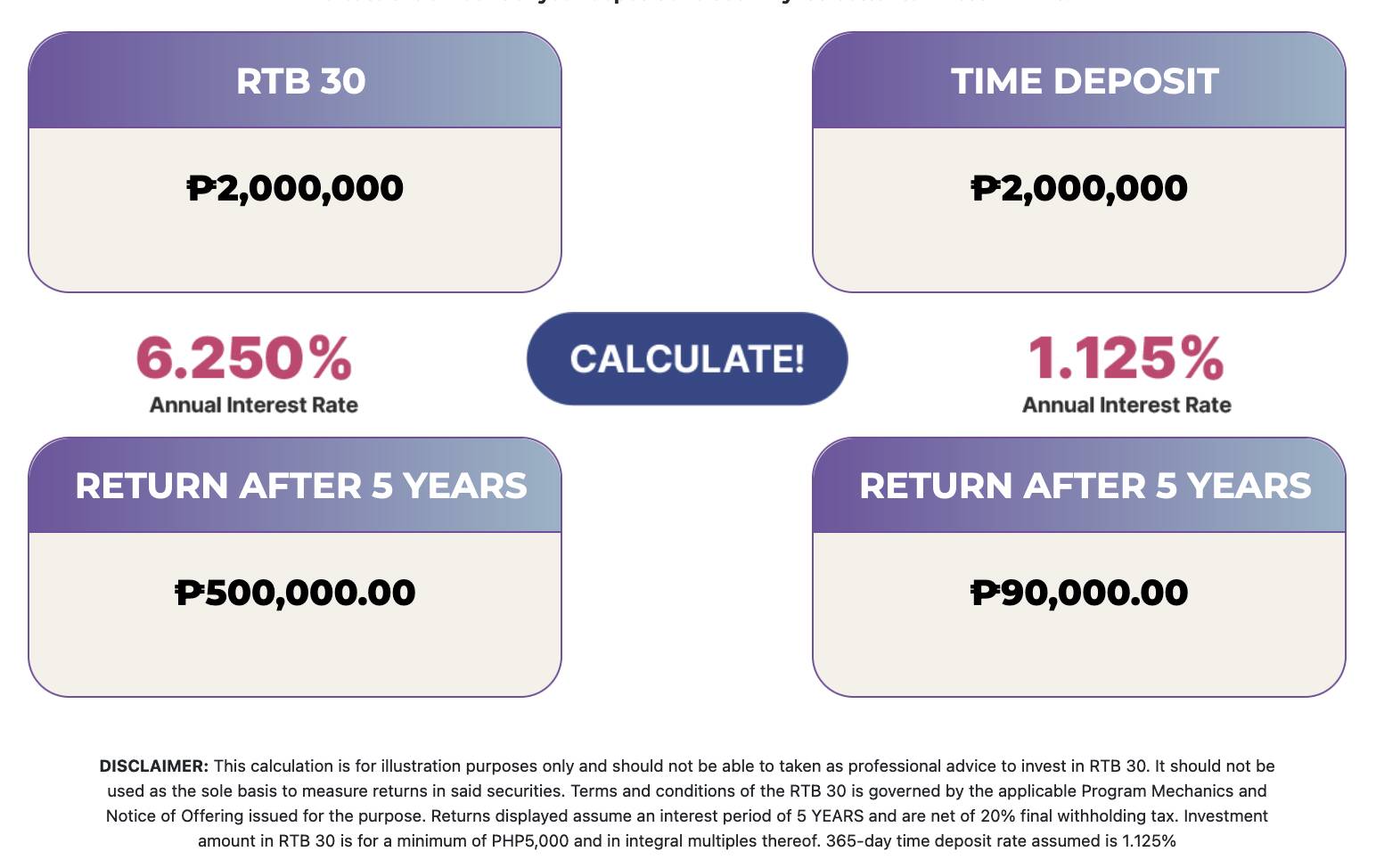

Here’s a sample calculator from the Bureau of Treasury using the current interest rate we availed. Returns displayed assume an interest period of five years and are net of 20% final withholding tax. 365-day time deposit rate assumed is 1.125%.

Where to open RTB investment in the Philippines?

The following universal banks offer Retail Treasury Bonds in the Philippines. The Bureau of Treasury authorizes these banks to cater to people interested in investing in Retail Treasury Bonds (RTB).

- BDO

- BPI

- PNB

- Metrobank

- Landbank

- Security Bank

- Bank of Commerce

- China Bank

- DBP

- PB Com

- RCBC

- Unionbank

What are the risks of investing in RTB in the Philippines?

Liquidity

Although you may withdraw your investment before maturity or in times of emergency, there is a possibility of incurring losses due to immediate conversion of your RTB with limited interested buyers.

Interest rate

The prevailing interest rate in the market may affect the value of debt instruments. Bonds are also exposed to the uncertain market value of funds and investment portfolios because of market price fluctuations.

Inflation

Potential returns of Retail Treasury Bonds can be very attractive, but higher inflation can diminish the worth of your earnings. Always choose RTBs with higher rates than the current inflation.

- I Invested 1 Million in RTB, This is What Happened

- How to Open Retail Treasury Bonds in the Philippines

- How to Invest in the Philippine Stock Market