I invested 1 million in RTB (Retail Treasury Bonds), and this is what happened. I will share here why I invested in RTB and how much I earned with this type of investment. This is not to brag but to inspire fellow investors.

The stock market has not been performing well in the past few months, so I looked for other ways to diversify my money, and one of those ways I chose was to invest in Retail Treasury Bonds (RTBs).

Disclaimer: This post is from my personal experience and personal decision and should not be taken as professional advice and should not be used as a sole basis to invest your money. Every individual has their own risk tolerance, investment knowledge, objective, and goal, which should guide them accordingly.

RTB (Retail Treasury Bond) is one of the investments that produce fixed income or interest payments. The minimum amount to invest in RTB in the Philippines is P5,000.

Please check out this guide to learn more about RTBs: “How to Invest in Retail Treasury Bonds in the Philippines.”

Why Did I Invest 1 Million of My Money in RTB?

1. Because un-invested cash is not a great investment.

I was not born rich, but my parents taught me how to save money, work hard, and live simply. So the time arrived when I finally held a million of cash. I did not want to let it just sit there in my bank account for a regular deposit account.

For many years, I have been investing money in different investment wheels like mutual funds, stocks, and UITF. One of the things I learned is that un-invested cash is not an excellent investment. You either use your cash to capitalize a business or invest it.

2. I’m a fan of Warren Buffett’s 2 famous rules

Warren Buffett’s two famous rules: “1. Never lose money. 2. Never forget Rule No. 1.”

There is nothing to lose when investing in Retail Treasury Bonds because the government backs these types of investments. The guarantee is almost 100%. Furthermore, it’s doubtful that the government will go bankrupt or be out of money to sustain such investments.

I’m not saying it’s risk-free, but any investor who knows about RTB, I’m sure they will agree with me. I don’t know anyone yet who lost money by investing in RTB.

3. RTBs produce fixed income.

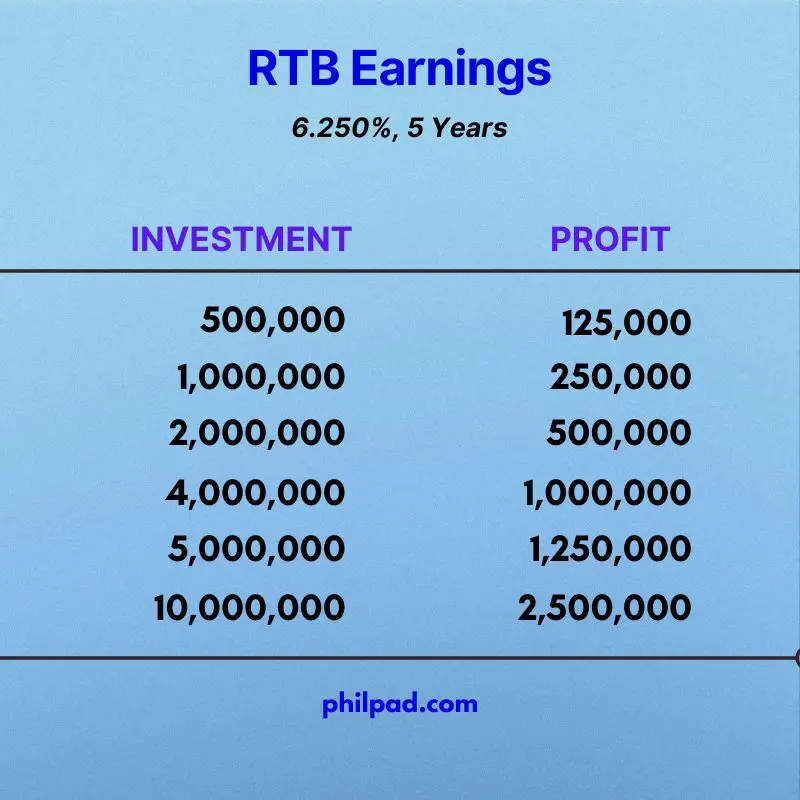

Retail Treasury Bonds produce fixed income. Whatever happens to the economy or the stock market, you will earn a fixed income. The recent Retail Treasury Bonds offering generates 6.250% interest per annum, meaning the government will pay me back a 6.250% income yearly from my investment.

4. A 5-Year Period is a Medium Term for Me

The latest RTB offering I got matures in 5 years. As an investor who monitors the stock market and equities, that is a very attractive offering. Usually, RTBs are offered in a tenor of 3, 5, 7, 10, 15, 20, and 25 years. The 3 and 5-year period are my favorites.

5. RTBs are stress-free investments

Unlike investing in mutual funds, UITF and stocks, you can have zero worries or zero stress when investing in retail treasury bonds because you lend money to the government. The government will pay back your money plus interests. The government won’t vanish, and it won’t abandon you.

How much did I earn by investing 1 million in RTB?

I earned 250,000 effortlessly by investing 1 million in Retail Treasury Bonds without monitoring the market or the economy as I do when I invest in the stock market. I also learned a new investment experience because it was my first time investing in RTB.

Some people with a truckload of net worth hoard their millions in Retail Treasury Bonds. Some people invest 5 million or more in RTB. Some people have 8 million but still don’t know about this. Now you know about this, this tip is worth a million.

Retail Treasury Bonds Philippines – Guides:

- How to Open Retail Treasury Bonds in the Philippines

- RTB Offering in 2024

- How to Invest RTB in the Philippines

The Bureau of Treasury offers Retail Treasury Bonds in the Philippines. You can open an investment through your commercial bank or ask your bank manager about the latest Retail Treasury Bonds offering.

Disclaimer: This article is for information purpose only and should not be taken as professional advice. All investments have risk. Always practice due diligence when investing your money.