How to become a Millionaire in the Philippines in 5 Years? Can a Taho vendor become a millionaire in just saving P2000 periodically? Can a regular employee who earns 10,000 to 15,000 a month become a millionaire in 10 years? Can you earn 5 million pesos in 5 years? The answer to each question is YES. Take note networking and is not involved on this. I’m gonna share about becoming a millionaire here by investing in stocks using the Peso-Cost-Averaging method. There are other ways to earn millions but I’m NOT gonna talk about the ‘others’ here.

How to become a millionaire in the stock market?

Why invest in stocks?

Yes, invest not trade. There’s a difference between the two. I’m talking about investing in stocks for a long term here. Like 10 years or more. Trade is buying and selling stocks in a day or few. Investing involves long term. If you will be investing in stocks every month for let’s say 10 years, you’ll surely accumulate millions of pesos because your fund will grow through capital appreciation and dividends.

Time is Money

To understand it better, imagine you have an apple seed and you will plant it now. After many years, the seed will become a tree and will bear fruits. It will extend more branches and bear more fruits year by year. Soon you can have thousand of apple trees. Imagine the profit you have earned after few years. Time is money.

To understand it more, speaking of Apple, do you know the traded stock price per share of Apple before iphone came along on June 2007? It was trading around $200. In March 2013 it was trading around $444 and it was even trading around $700 at some point in September 2012. If you had hundreds of share and you do the math, you gained so much.

To get it even better, for example you became one of the major stockholders of Jollibee and owns now 10% of capital and Jollibee was worth 2 billion that time. After 10 years, it expanded globally and now worth 20 billion. Hey, remember you own 10%? That’s 2 billion now. That’s just an example. See the stock chart of JFC (Jollibee Foods Corporation) below

JFC Stock Chart (5 Years) taken from Bloomberg

Ok, I’m just trying to make a point there. Time is the most precious asset and choosing the right company to invest with is so important to earn profit in the future. Don’t just invest, be part of a huge company which will obviously be here after 10 years or more.

Another example why time is money:

Why do we contribute to the SSS or GSIS every month? Simply because to have a generous retirement fund in the future. The more years of contributions, the more our pension would accumulate. It’s kinda same thing with investment earnings through compound interest. As Einstein said,

Compound interest is the greatest mathematical discovery of all time.”

In pension, age is a big factor because your pension will be computed based on your CYS (creditable year of service) and some other factors like monthly salary or contributions.

So time value of money makes sense there right? The earlier you started investing, the more you will receive in the future. If you still can’t understand it, I suggest have a short break and indulge with Jollibee hot-fudge sundae. It makes my brain work well…perhaps it could do the same somehow. Besides, I have stocks at Jollibee (smiles).

Why Peso-Cost-Averaging?

- Because you don’t have to monitor the market constantly and you’re not an expert

- Because it’s not too risky

- Because reality is – trading in the stock market is dangerous. One day, economic growth could be amazing; the other day there could be crisis. In order to avoid losing your money and risking it, choose investing in stocks by using the Money-Cost-Averaging method. We call it peso-cost-averaging here since peso is our currency.

Peso-Cost-Averaging method involves investing a fixed amount of money at regular intervals over a long period of time. Example, you set aside a portion of your income, let’s say P5000 every month in a period of 10 years. You use that P5000 to buy stocks from a certain company that you believe will still be performing well after so many years. Companies like:

- Ayala Land, Inc.

- SM Prime Holdings, Inc.

- Jollibee

- PLDT (TEL)

- BDO

and many more. Choosing the right company is so important. Make sure you practice buying your stocks regularly from the chosen company regardless of the stock price. Choosing the right company will give you high returns in the future.

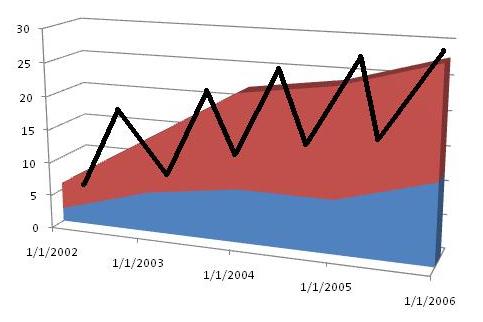

This graph demonstrates how peso cost averaging works. Whatever the status of the economy, whether stocks price are high or low, buy still and keep practicing the PCA, you will profit anyway.

2 Ways to Invest in Stocks using the Peso-cost-averaging Method

- Via online broker

Nowadays, we don’t have to call someone to invest or buy stocks from companies participating at the Philippine Stock Exchange. We can do everything online. Just choose your Online Broker and open an account with them. It’s so easy and much convenient. See the accredited online brokers in this page. BPI Trade and COL Financial are one of the well known online brokers. Personally, I follow the stocks from DailyPik coz I find them so effective and profitable. You can also choose brokers’ Easy Investment Programs that use Peso Cost Averaging or if you want, just open an account and practice the method yourself.

- Via UITF Equity Fund or Mutual Fund in Equity

Some banks like BDO offer Easy Investment Plan through UITF Equity Fund. That kind of UITF involves stocks. With this route, your investment is handled by a fund manager which monitors everything. They are experts and professional fund manager meaning they are already familiar with the economy and the market. They have their smart strategies for good results. Holding companies are also very good. You can always see your Equity Fund Performance Report every quarter anytime.

Mutual Fund in Equity is also another way to invest in stocks as it also focus on stocks. Know more how to invest in mutual funds in the Philippines.

Now answering the questions one by one:

Can a Taho vendor become a millionaire in just saving P2000?

Let’s say a Taho seller earns P300 a day and he works 26 days a month. That will give him 7,800 a month. And he may have a family to feed and support so let’s say he could just save 2,000 a month. If he could invest his 6,000 every 3 months regularly for 20 years, our Taho seller can surely have approximately 5 million or less. Since some online brokers require minimum of 5,000, he could just invest 6,000 in the stock market every 3 months and practice that up to 20 years. So the answer is YES. If you don’t believe me, you better read Bo Sanchez and learn the ways how her maids invest in the stock market.

Can a regular employee who earns 10,000 to 15,000 a month become a millionaire in 10 years?

Let’s say your salary ranges from 10,000 to 15,000 a month. You less your expenses, maybe 5,000 will remain. If you are a shopaholic, please stop reading this. If you love buying the latest gadgets and just earn this salary range, please forget about this. If you are not really serious in saving money and are not disciplined enough, just try something else.

Literally, 5,000 a month for 10 years would give you 600,000 if you save them on hand. If you save them in a bank, they would earn interest but that is not much. If you want to earn millions out of it, invest your 5000 a month in the stock market. If the Taho vendor earned less than 5 million from his investment, what more you? 🙂 So the answer is YES. Take note, time is money. If you want to earn more millions, extend your target period from 10 years to 15 years or more. How to become a millionaire starts with your mindset.

Can you earn 5 million pesos in 5 years?

I assume now you know the concept of this thread. I assume you are not a Taho vendor and you are earning more or double or triple of those salary ranges discussed before. Maybe you are an OFW so your salary when converted to pesos will amount to hundred of thousand every month. 5 million pesos in 5 years is so possible for you then.

If you will still try the PCA method 40,000 every month for 5 years could give you close amount to 5 million. But then again, I expect you are earning more than the average bracket mentioned before so hey, I’m sure you know other channels on how to get your millions in just a short time – not just thru stocks but also thru business, interest income, trust funds and other vehicles.

Assuming the examples above grow by 10% per year. This is only an example.

How to become a millionaire in the Philippines in one year?

How to become a millionaire in one year? That question is easy for you to answer now.

Conclusions:

- The earlier you invest, the more money you will earn in the long run

- Time is gold and time is money.

- The key to Peso Cost Averaging technique is choosing the right company where you will buy stocks, choosing to invest long term and following your chosen time and amount to invest regularly.

Remember, money is not everything. There are far more important things than money – love, friendship, health and faith in God. Have all of them and you would be happy a billion ways.” – Fehl

Want to start investing in the stock market? Go to our “Stock Market Tutorials and Complete Guide“ page.

hi maam fehl? are you stil Active to the investment? how to connect with you po?

Hi, yes 🙂 Feel free to message me here or on Facebook

Hi Ms. Fehl may i know your fb account? please

https://www.facebook.com/FehlDungo/

Is it ok to buy gma7 now abs-cbn is closed?

Yes, if you’re actively trading (not for long term in my opinion) it’s your advantage while the biggest competitor of GMA is suspended

hello good morning. May tanong lang po ako, what if nag invest ako ng 5000/month then after 3 months eh hindi na ako makainvest dahil natangal nako sa work anu pong mangyayari?

Hi, Jon 🙂 The present value of your investment will be equal to the present value of stock (total shares X the price of the stock)

Hello Ms Fehl,

I guess I found the initial answers to my first question to you. Ok lets say I am a taho vendor making 500 peso/day thats 15,000/month now I want to invest my 5000 peso in a stocks market. So my question now to you do you know any online broker that has a long term portfolio and a good track record of companies in the Phil stock market that I can sign up in order for me to invest my 5k/month that will give me lets say atleast 7% or more return/year? I hope we can chat in the future i am really interested to learn how to invest in the PSE in long term.

Thanks.

Hi, a well-known retirement investment in the Philippines is PERA. I will post an article about it soon to discuss it further. You can also invest on Mutual Funds that are good for long term like Balanced Funds and Index Funds. Check out https://philpad.com/tag/mutual-funds/

Hi Maam Fehl,

I’m interested to discuss with the subject above. can i get un email add then, if you have time.

Dexter…

Hi 🙂 You can email me at fehl25@gmail.com

hi Fehl,

I came accross your website and it’s so informative! I started investing just last year using PCA. I hold 3 stocks, MEG, ALI and SMPH investing qrtrly for Php15k. I have a question hope you can shed light. I am wanting to sell MEG so I can only focus and have more budget with just the other two. Do you think it’s a good idea po? Salamat.

Michael

Hi, Michael 🙂 Congrats with your investment! Yes, you can sell your MEG shares and realize the profit already, then buy other blue chip stocks. You can rinse and repeat the strategy as long as you choose the “best” companies that always grow over time. God bless!

Salamat sa reply. I’m just thinking not to add any more stocks as I have MF as well (xpeif).. But with only 2 stocks will I get the benefit of the PCA in the long run or is it preferred to have more than 2?

For US based OFWs, residents or even citizens, there is one best way to invest your hard-earned money, and that is through putting it to an indexed universal life insurance that covers not only your life but all unprecedented life events such as accident, chronic and terminal illnesses. At age 60, if everything is good (you have not used the money in any of the mentioned events) then you have the option to convert the policy into a lifetime income based on the accumulated cash value.

Hi Jill, How can we chat? I will disagree to this.. that is really a bad/wrong way to invest your money if you are in the US.

Interested

i’m from davao city, i want to invest my money..my question is how and where to address this transaction here in davao city. Please help me.

hi im at the age of 16 🙂 can I already invest in the EIP of any banks ?

you can advice me where to get seminar about investment, i am interested in investing my email

When you invest or trade in the stockmarket, invest only monies you can afford to lose! You will have losses in the stockmarket no matter how good a stock picker you are. I suggest saving a sum you can comfortably risk in the stockmarket. Peso cost averaging is actually a bad idea because stocks can go down for a long period of time and even go bankrupt. You do not add monies to a losing position. A better strategy is buying stocks establishing new highs and trading it and putting stop losses on that stock. I think you do not have the stop loss feature in the Philippine Stockmarket so, you have to use a mental stop or write it down in a piece of paper and stick it to your computer. It is the price you will sell your stock if it is hit. Buy high and sell higher! It is called trend following here in the US and I believe can be used profitably in the Philippine Stock Market as well! You only buy stocks going up and establishing new highs! Hedge funds with billions make a lot of monies doing the same thing here in the US. For the record, I trade stocks and options in the US stockmarket. I learned on my own and made a lot of mistakes. Learn how to trade stocks and I believe you will be better for it!

Great tip! Would subscribe to your blog site if you have one.

Good day po..tanong lang…let say bumili ako shares ko sa stock sa araw ng execution date..then kinabukasan sell ko din agad..entitled din po ba ako sa dividend?thanks po..

Nope..i have that experienced before. Not owning the stock on declaration will not earn you dividend. Its a basic one.

Thank you so much for this informative post!

I have a question. I have 2 years left of college and I want to have at least 500k waiting for me after I graduate. I’m investing long term. How much should I invest monthly? Thank you so much!

Hi, Thierry.

Following are the required monthly investment amounts depending on the projected rate of return per year over the next two years:

@ 10% return per year – P18,750 monthly

@ 7% return per year – P19,357 monthly

@ 5% return per year – P19,770 monthly

@ 3% return per year – P20,190 monthly

@ 0% (just keep it at home) – P20,833 monthly

You may have noticed that the differences are not that big. It’s because 2 years is too short. If you are investing for the long term, you should be looking at at least 5 years.

Thanks.

Hi Thierry,

I have few question that i need to be certain.

Let say, i have 2,000,000 and i want to invest in maybe for 2 years but i want to withdraw the interest every month. What should i do and what investment would you advice for my needs and how much a maximum interest can i get.

Thank you.

Hi, you may invest on Retail Treasury Bonds, fixed income will be given to you every quarter. The longer the maturity, the higher the rates

That is sound advice…BUT the problem with this hypothetical investment plan is that mutual funds dont earn 10% or more anymore. Back in the 80’s yeah, but now? It’s really more like 1 or 2% if you’re lucky.

I’ve been invested in different mutual funds for the past 3 years and so far I’ve averaged 0.65% return on my investments.

So No, you cant be a millionaire with initial investments of P5,000 per month. Besides, who saves P5,000 pe month these days?

I have to say the Golden Era for Equities has passed already but that doesn’t mean it won’t happen again. The concepts above can still work but we should not have big expectations

Investing in Stocks and Bonds would be an alternative from Mutual Funds. If you want to know more on how AXA does its Investment Portfolios, Feel free to message me

Magkano ang percentage of ROI ng AXA at papaano mag-avail? I heard and see AXA like life insurance. i don’t know meron po pala na investment sa stock market at bonds.

Ive found that investing directly on stocks using online brokerage has more chance of growth than leaving it in a mutual fund though it is riskier. I have just been investing for 9 months thru BPITrade directly to the PSE and my portfolio has already gained by 20%. Do your own research and learn tips from the experts. Financial knowledge/experience can minimize the risks.

How to invest stocks using online brokerage?

He just mentioned it: BPI Trade.

10% annualized return is still possible. Back in May 2016 the 3-year return of many stock mutual funds were in negative territory. A lucky few managed a measly 0.7%-1.5%. However, as of August 1, 2016, the 3-year returns of the best performing stock funds have gone up to more than 6% per year. And if you look at the 5-year annualized return of the top three stock funds, the rate is 11%-12% per year.

So yes, 10% annualized is still very much possible. Hold your investment long enough and you will realize better returns. Three years, to me, is somewhat short.

Thanks.

There are different types of mutual fund i guess you are investing in bonds or government securities kind of mutual fund which offering low risk…

Good morning ms Fhel,

ganda nmn ng page mo nakakainspire at parang gusto ko na agad maginvest, isa po akong OFW pabakasyon po ako ng October 2016 balak ko po mag open ng account sa BDO at invest pwede po ba na mag laan ako ng isang bagsakan na 100k and leave it there for 3years (alin po maganda kuning investment na mas malaki ang kita yung Mutual Fund or UITF) i need your advise madam para po mas malinawan ako sa papasukin ko na investment.

Maraming salamat po at nawa ay palawigin pa ng Panginoong Dios ang buhay nyo na nagbibigay pag-asa sa mga taong naghahanap ng mapaglalaanan ng kanilang pinaghirapan na di masayang kundi ay lumago.

Hi, isa po akung OFW gusto ko pong mag invest pero wala po ako idea paano mag start sa investment…Please advice

Mag mutual fund or uitf best for beginner.

im already 21 years old . can i invest in my age ? 1k per month ?

Yes, 18 and above can open investment accounts

Please send me info if how to do the investment starting small less of risk

hi ms.fehl, been reading your blog for the past few days snd nksksinspire talaga..though my mga paghihinayang ako that i did not start early..can i clarify if i use the PCA for 10yrs buying stocks without selling it would there be a problem selling it coz sobrang laki na? hope mclarify nyo po..thanks and Godbless

Hi. Thank you. I don’t see a problem selling, check out the daily transaction at your broker’s platform to have idea how big do you want

Hi po! bago lng po aq at Gsto ko po sana magregister sa COL Financial, ung 5k/month ung longterm PCA.tanong ko lng po,every month po b ako bibili ng shares s

napili ko pong company katulad ng JFC??? at gaano po katagal ang long term investment??pg tumagal po ako ng 10years kilangan ko po ba ibenta ung shares ko para makuha ko ung ininvest ko lahat lahat??? salamat po ms. fehl matulungan nyo po sna ako about d2.

You can schedule the 5k monthly in Col Financial. You will just look on how to do it using the Col Financial website. But be sure that you can put 5k monthly in col financial. I usually do it using my BPI account where in I schedule 5k to be transfer monthly from my BPI account going to Col Financial. Try iy.

Hi Good day.! Ms fehl Ask ko lng po f pwde po ba 2 or 3 compnay na nsa blue chips stock ayun nag pag iinvesan ko for 10 to 20 years tnx..!

Hi fehl what happens to my earnings in stock market will this be rolled over every month to buy more shares for the same stock investment? Or can i use my earnings to buy other stocks to diversify my investment? Thanks

Hi. It’s up to you how will you gonna spend it but I recommend buying other quality stocks that are cheap at present and selling them when they reached your Target. Keep the money rolling

hi. how to know that set target? papanu po yan Number of shares na target po ba?? investor mo pa mg seset nun?

Every investor has his own choice of target kasi iba iba tayo ng risk profile and objective so iba iba din ang Target. Your Target can be:

Target Price (of the stock)

Target Profit (% gains)

Target Term (years)

hi po..! Is it important na maglagay monthly ng money to buy stocks? thanks 🙂

Only if your strategy is Peso-Cost-Averaging

hi Ms. fehl

I just want to know how PCA differ from UITFs? and in your opinion which is better? Thanks

You can also apply PCA with UITF by buying units every month

Hi fehl… i am interested to enter this kind of business under peso cost averaging investment.. may i know how much starting capital in its share? to whom i approach to make my plans possible..

Hi. You must decide what investment suits you. Is it mutual fund, stocks, or UITF. Then invest monthly or periodically and aim to do it for long term

Hi Ms Fehl,

I am an aspiring young professional with mind in business, and heart in passion and arts. I am honestly enlightened by your financial techniques and guides, cheers.

I just wanted to ask something, I’m 21 years old and just got my first job, I am seriously considering doing the col starter investment plan, but as you have mentioned, investing on stocks is for long term. What if I wanted to get gain something within the span of less than 3 years, are there other alternatives?

I mean, I want to build my wealth for the future; but is it also possible to have an alternative, that while I’m investing for long term, I also have something that I could get gains within a year or 2, and maybe use the profit there for establishing an alternative form of income aside from employment?

I am also scared because if my long term investment is going to consume 5000 a month, and then I am also investing on a short term basis, I am doubtful that there’ll be anything left for my fixed expenses.

Hope to hear from you soonest,

God bless and more power.

Regards,

Joshua

Hi. Yes, Equity Funds from Mutual Funds and UITF are also suitable for 3 years. You’ll likely see income already for that period. They maybe risky but they are professionally managed by investment experts. Invest regularly and you can redeem in 3 years or so, or any time you plan to. The longer, the better

Do u have any articles about Equity, Mutual and UITF and how risky they are?

Yes, just go over our menu above under MONEY

Hello mam fehl. If ever po mag open ako UITF pag nag invest ako ng 100k good for 5yrs maturity will it gain or loss din po b?if ever will loss mkukuha ko parin po b yung 100k ko?

My father and lolo were business men, shop keepers in USA. Middle class. Six children. I leaned 3 things that have turned out to be true. I am now 67, little time left for me.

1) NEVER use your HOME as collateral…NEVER!

2) Figure out, to the Peso, how much money you will need to open your shop, then double it. It has worked out EXACTLY for me seven times in my life.

3) You will never get rich until you have lost it ALL, 3 times. It is in the losing that you learn you best lessons, and never make them again. The good times are the SMALL REWARDS, for the LOSING you went though to make you who you are TODAY>..never belittle your lose, they are you BEST TEACHERS.

In the PSE, five years ago, I started out with 350,000 P…I know have 125,000P. ARE MY LESSONS LEARNED? I feel I have GROWN, but lessons MUST BE APPLED, REMEMBERED.

Maybe you will have 5 million in 50 years, but what it the VALUE of that money in 50 years. MY mother was forced to sell out family home 40 years ago…for $20,000…a good price. I just saw our same home on the market for $450,000. It will now take me 20X the money to buy the same house as I grew up in…My mom had a teachers job, starting 4800 US year…40 yrs ago…it now pays $50,000 starting pay…same job. So when you go for million in 50 years, YES, you can, and you WILL if you work hard at it…but…WHAT IS THE VALUE OF THAT 5 MILLIION in 50 years?. Maybe you got NOWHERE. THINK ABOUT IT. the VALUE of your money is SHRINKING in VALUE each year by inflation…the IMF world wide money people tell us that the US DOLLAR has lost 97% of its VALUE, BUYING POWER, since 1930..what was ONE DOLLAR 86 years ago. Now buys 3 cents worth of product.

THE RICH GET RICHER, the POOR GET MORE POOR. In the past 8 years, in the US, the largest money shift has taken place…30% of the wealth of the nation has moved into the RICH PEOPLES HANDS, and left 30% less for the common citizen. Now, 1% of the people in USA hold 60% of all the money…more Millionaires have been made in the past five years than any time in history…yet, 5 as many people have become POOR.

The Catholic Church of Manila is now the richest Catholic Church on earth. If it were a nation, it would be the 17th largest valued country in the world. They did not get that away by GIVING the money away. IN Yolanda…the Manila Catholic Church GAVE NOT A SINGLE CENTAVO to Yolanda victims. Very much against the teaching of Jesus Christ…who tells us that what you GIVE, you get returned to you 10X…what you TAKE, you lose 10X over time.

As President Nixon used to say years ago…’get em by the Balls and their heads and hearts will follow.

WHO DO YOU WANT TO BE?

Poverty, IS NOT ABOUT MONEY>

Tithing is NOT ABOUT MONEY…10% of what GOD HAS GIVEN YOU, is to be GIVEN BACK TO COMMUNITY…God has Given you TIME>

Very well said and thank you for sharing. If only people spend more time having conversation with people like you, I think life would be better. God bless!

nakalock in ang pera ko ng 5 years? pano kung 6 months lang ang gusto ko for now???? may chance ba na lumago ang pera ko? pano -kini-claim ang perang lumago?

so pano yun, 5k every month ako maghuhulog? tama ba?

Hi Ms.Fehl,

I’m a beginner po in investments and still studying its foundation. Would you advised to invest in UITF,MF and to buy stocks freely ng sabay sabay? Thanks po and God bless you more. Dame nyo po naeenlighten sa blogs nyo, especially to those who are willing to learn. 🙂

Hi, thanks for visiting. I advise to start with either MF or UITF then study about stocks. If you’re ready then invest in the PSE. You can also follow our guides at dailypik.com. We share about tips in investing stocks and MF there

HI MAM..I am interested to invest my stock how can I start. Do i need to take some seminars?Thanks

Pag mag invest po sa stock.. Anu ang mas OK. Mag fix lng ako sa iisang company or spread ko yung investment ko

Diversify to minimize risks 🙂

Diversify in time not only in stocks meaning you buy different stocks at different periods of time!

I just turned 20 last March and I’m already working. I’m into our family business. Aside from our business, I really wanted to invest into other business. I want to try the PCA method and would like to invest sa JFC. Can you help me?

Sure. Follow our guides by going to the STOCKS Menu above

Hello madam. I have here a series of questions 🙂

1. If I’d do the PCA, is it advisable that I buy twice the usual number on September to October to take advantage of the market. I plan to invest monthly. Or should I just stick the same amount so that it won’t disrupt the routine?

2. For example, I’d do the EIP for for a company for 3 years then I’m happy with my stocks, then can I stop buying and hold them “forever” or no? Situation: The stocks are playing well.

3. Is it hard to withdraw money from Colfinancial?

4. Which is better fund manager or broker?

5. Are equity funds encouraged for starters?

6. Suggestions for short term financial plans.( 6 mos-1 yr)

Thank you.

1. It’s still your decision. Your profit will still average. You can take that opportunity to buy more shares since the prices of stocks are lower.

2. Yes, you can hold them and keep them until you want to keep them

3. It’s very easy in my experience

4. Fund managers are different from brokers. Fund managers manage the fund so that they will perform well. Brokers get clients or investors.

5. Equity Funds are encouraged for all investors who understand and can take bigger risks

6. Money Market, Bond Funds, Balanced Funds

Hi, i have existing uitf equity ask ko lng po kng ok lng

Po ako mg invest sa stock market?

What is margin trading, treasury bills and treasury bonds?

Hello.I’m still a student and I plan invest in stocks. However, I’d just like to know if investing in stocks would also mean that I should pay taxes annually? I am of legal age atm. Also, I’d like to know which one is better, Colfinancial or BPI? Thank you

Hi. If you’re into stocks listed in the PSE, taxes are handled and reported by the stockbroker already thus they require TIN when opening an account. I can only comment on COL as I’m using it. It’s been excellent and I like their research and updates. BPI is also great according to users.

Hi Madame Fehl,

I am an OFW working here in QATAR and I am not growing any younger. I have read your advises about investing on PCA and I am very much interested. Please advise me on some points as follows;

1. If I want to invest for a long term of 5 years and on the end I want to earn 5 million pesos, which company would you recommend and how much amount would I use to buy every month to reach my target;

2. Suppose I have already chosen the company(the one you will recommend), Is it advisable to get one single stock for the whole 5 years or I could buy different stocks under the PCA to reach my target; and lastly

3. Could my monthly be variable, I mean instead of a steady P5,000 per month or P10,000 per month, It could vary depending on the availability of funds. Maybe P10,000 for the first month, P5,000 for the second month and so forth.

Thank you in advance for your great advise. God blessed you to be a great blessing to others.

Have a nice day.

3.

Hi. Thanks for visiting. 1. There are many good companies to invest with but the decision will still be from you, as how much do you believe in that company. Supposed the value of the stocks grows around 15% per year, you need to invest 60,000 every month to make more than 5 million in 5 years. Of course that is a very conservative approach.

2. Like I said, the final decision and strategy will be on you because you are the investor. Yes, you can invest on different stocks your choice 🙂

3. Yes, you can do that in the stock market. God bless! 🙂

Hi Pre, Investor ka na ngayon ah … uly

hi Fehl, stocks prices are very high nowadays (psei at all time high?) do you have idea if there’s a correction coming? from your experience do prices go down or up during election year… i’m waiting for prices to go down before buying… is this a good idea? thanks a lot!

Hi, PSEI is going down these days so prices are lower. Market forecasts say it won’t move up faster anytime soon. It’s because of market correction and high interest rates

Hi Fehl,

If I invest say in Jollibee or Ayala Land through PCA 30K per month just for one year (360-400k total investment), how much return do you think I will gain? I know its not long-term, I am just trying to save for my masters degree.

Thanks

It depends upon the performance of each company. No one really knows but estimated 1-year return for ALI is around 28% while JFC around 30% looking at Bloomberg right now

Hi Fehl,

Salamat at unti-unti ko na din naiintindihan ang concept ng investment. Pero ang diko na lang naiintindihan ay kung paano related ang sinasabing compounding interest ng investment sa PSE? Karaniwan kasi ibinibigay sa mga examples ang rate of return compounded annually, meron bang ganoong concept sa stock?

Thus, I only learned investment dealing with the appreciation of stocks and dividends and yet no compounding interest being mentioned here.

Thanks in advance.

Compound interest is a very broad subject and you must not base your stocks on it. I only mentioned it as an example how it relates to time value of money and how something appreciates in value over time. Stocks in the stock market are very unpredictable.

Ma’am Fehl, i also have read about compounding and simple interest upon investing in the stock market but there is no further explanation on how to get profit on this. If my investment will earn interest, either simple or compounding, how often it will be? tnx

Can you blog about variable life insurance as an investment? I invest in stocks and variable life insurance and I have got good returns in 2 years. A lot of people don’t seem to know that it is also investing in government bonds, Philippine stocks and managed by professionals. Thanks.

Yes, check we have some articles about VUL. Check them out at our MF and UITF archives

Hi Ms Fehl, I am confused about how compounding works in instruments like stocks. And is it true that compounding does not work in UITFs? Please enlighten me. Thanks.

Compounding is a very broad term and it will only confuse you if you base profit of UITF to it. UITF profit is based from the UITF performance. There is no specific percentage of compounding rather your gains will be based from NAVPU which is of course based from the performance of the fund

Hi Ms Fehl! I have read on some other blogs that UITFs unlike stocks don’t have compounding interest. Is that really true? And some says the compounding in UITFs does happen yet it is “within”. I can’t recall the exact phrases. I am now confused. Can you enlighten me?

UITFs are based on NAVPU (Net Asset Value per Unit). I think I answered same question from your other comments here

Hi! I’m so interested and desperate now in investing stocks. Actually, i’ve been searching for articles about stock investments to gain more knowledge and, of course, to earn profit. But the thing is, I’m only 18 years old, will i fit with this kind of business? i have no stock market experience yet, but im eager to involve in any transactions about stock market, especially for good investments. any thoughts? what should i do first?

Hi. Yes, you can start investing stocks now. You’re 18 and you have so much time to earn more than those who didn’t do it earlier 🙂 Read all our guides at the STOCKS tab to how to start. God bless!

Hi fehl!

I’ve been reading your articles and I’m very interested in investing. . However, I would like to know more about investing before jumping into it. . Do you have an in depth article about PCA? If I will chose COL as my online broker, what are the requirements needed to start? What kind of documents do I need to prepare?

Thank you so much for giving us a lot of value through your articles. . I love them so much. . I read one article per day. . 🙂 Take care always and God Bless you. .

P.S.

Have you read about intelligent investor by Benjamin Graham? It’s the same book that warren buffet studied for many years. .

rose:)

Hi, yes we shared PCA and COL requirements in opening an account and easy guides on our STOCKS page. You can go there by going to our STOCKS menu. Thank you and God bless. 🙂

i dont know how to invest when to start but i’m very saving man when it comes in money. sorry for me ucpb shares can’t claim coz dont have insurance person who holds stockholders.

Hi Ms Fehl. Way back 2013 may natanggap na check (actually 2nd check na nya ito) ang mother-in-law ko galing sa PLDT. Pinagtatawanan pa nga namin at binibiro ang mil ko na share holder cia ng PLDT. Wla naman dw kc cia matandaan na nag-invest cia dito.

My question is pwde pa kaya namin malaman if active pa ang share nya sa PLDT? Pano kaya namin malalaman kung cno ung broker na may hawak ng acct nya? TIA

i find this post helpful. TY

Do they really refer to someone who has over a million pesos, a millionaire? I figure it would have to be at least 44 million.

Some of your information regarding Apple stock is incorrect. After checking NASDAQ, Apple share prices never even breached $120 at their highest close in Nov 2014. In March 2013, the highest close was $69.

Yes, because those were the prices of Apple stocks when I wrote this post. I didn’t put the exact figure but I mentioned “around”. I remember it went around 700 on Sept. 2012

Hi Fehl! Thank you for your very informative blog. I invested in Security Bank’s UITF Equity Funds. I heard that Security Bank was the best performing bank on Peso Equity UITF funds last 2014. However, i haven’t noticed anyone commenting about Security Bank. Have you heard about this bank’s performance? I am aware that these kinds of funds are not covered by PDIC.

Yes, there are comments about Security Bank’s UITF from our Mutual Funds posts here. 🙂 We post the best MF every year in Philpad. Check out the latest for 2015, it’s also posted already

good article, i’ve been investing in stocks since 2005 (when i was 20). Been using PCA since i’m not into technical analysis and I never intended to trade. Started investing via citiseconline then moved to bpitrade

Started investing monthly with the very little extra cash i had then (my starting salary in 2005 was 18,000). The best stock i bought to date was Jollibee – JFC (it was just P26/share then).

I didn’t know much about stocks pero i loved Jollibee products and i know a lot of Filipinos also feel the same, so it’s only logical to think that the company will grow eventually, so with this very basic principle in mind, i accumulated a generous amount of shares over the years (like your advice here, i invested monthly and never stopped). Today, JFC share prices are at the P210-211/share 🙂 i have a diversified portfolio of companies, i never sold any shares since then and I plan on holding on to them til I’m in my retirement.

My monthly income had increased tremendously (from fees from my consultancy and the income from the 2 companies i started) pero di nagbago yung prinsipyo ko of really investing monthly. 🙂 I have a diversified portfolio of investments now which includes long term government bonds and other instruments and real property.

So yes, if you really want to get “rich”, ditch your plan of replacing your iPhone 5S for an Iphone 6 Plus and start investing (and starting a business to grow your basket of investment money)! anyway, good luck to everyone 🙂

P.S

Fehl, Is your article based on your own investing experience?

Wow, congrats on starting so early. I’m sure your portfolio is looking so good right now. Yes, this post is based from my personal experience and personal lessons I learned. Cheers and happy investing to everyone!

Thanks Fehl! Your post is inspiring. i have my share of really bad losses pero that’s the beauty of long term investing and PCA, makakabawi ka for sure in the long run, unless you purchased a really bad company.

Just felt that i also needed to share from experience as I really am advocating smart investing, and investing in stocks as it may sound complicated at first and very risky, pero at the end of the day, if you have the right reasons for getting in the market (investing not short term trading) e you can really beat the yearly inflation and also profit. Hindi siya kasing kumplikado as it seems. cheers!

Thank you Momoys. Yes, it’s all about patience and not being greedy 🙂 Why not share you experience here in a post. Would be happy to guest post you so it will also inspire many Filipinos and hardworking people. I’m sure they will be thrilled because you have invested so early 🙂 Contact me and I will assist you everything you need. Cheers!

In the Philippines, you really would have to start your own business to be able to reach financial freedom. Employment is a stable, but limited source of income and usually would not suffice to really save-up. In my case, I have an online business with same coming from free classified ads site such as OLX AYOS and MYBENTA. I do not have to maintain high fixed costs, since I do not have a brick and mortar store. I suggest those in employment should also start doing business, its an additional source of income on top of their stable wage.

Yeah, great source of income is a must 🙂

Fehl ,

Pano malalaman kung anong companies is the best para mag invest?

if i only have 10,000 php

ilang stocks makukuha ko? 10k im sure un na pnakamaliit for investments.

please do help me i want to know more about it 10k for me is quite big.

tsaka ung divident is 5 years pa?

or some companies offered one year para makakuha ng divident?

email me nman po

thank you! your a big help

Hi Theo. You mean 10K a month? You can start buying 3-4 companies from the 10K every month. You’ll surely build your stock portfolio then. As to dividends, you can earn them as long as you have shares of stocks on the ex-date (can be tomorrow or any day NOT after 5 years) 🙂 Coz bluechip companies always issue dividends every now and then

Hi Madame Fehl. I am interested in this investment in stock market. I am however working here abroad. Is there a way that I could invest in stocks while I am working here? Please advise how. Maraming salamat po.

Hi. Yes, you need to open first your stockbroker’s account. I recommend COL Financial because you can open one even if you live abroad. Go to their website and select to open COL Plus account. You can fund it using iRemit

Thank you very much for the info Madame Fehl. Godbless

Hi,magkano po’ ang initial kapag jollibbe ang kunin kong stocks

Jollibee stock price is in teh range of 210ish right now. Following the minimum boardlot, you need around 2100 fr 10 shares

Hi. im betty, may i know , which is better investment for me as new to this business.. Trading or EIP stock.?

I prefer investing than trading because trading is for active traders whilst investing is buying stocks and selling them when they earned on your target. For newbies, EIP is advisable. God bless!

Hi, 🙂

What company should I go to regarding the investment of 5k a month and will get 20m in return after retirement. 🙂 please reply. thanks

Invest directly in the Stock Market 🙂 Learn the easy guides by going to our STOCKS tab above.

Thank you ms. Fhel

Hi there fehl,

I just bumped to your blog because of searching of investing my 10k earned from my bonus. I want to change my life. Would you give me some advice about this cause I dont have any idea about these things. I want also want some reliable broker that I can invest my money because I’ve been a victim of pyramiding scam and takes a hard time of trusting others. But I want to take an investment for my future and for my family. Thanks

Hi James. It depends upon what type of investment you are, your goal and your financial status. Are you aggressive and can take risks? Are you investing for long term? Is that 10K is all you want to invest and do you have regular source of income?

Hi Ms Fehl, your post is very liberating suddenly I felt I could have much control over my future. I have few questions though I’m hoping you find a time to answer. 🙁 I am a business owner, I’d say a small scale at this point..only been up for almost a year now but just opened an office for like 5mths now. The business is running about 250k worth of transactions on a good month, where 35-40% of that will be the income. With all the business expenses, such as office rental, transportation of goods (pickup and delivery), home expenses, debts, miscellaneous, basically we are not saving anything. At this point that the business is still new, all our money are out. I am positive that the business will grow, but, I’d like of course to find ways too to save and it seems like with investment that is possible even if it’s clear I dontwhave the means yet. So my question is, how will I invest in a way that I am not required to put in the same amount of money or none at all on months where money is tight? And, currently, what should be the best company to buy stocks from? Thank you in advance for your reply. Cheers and Merry Christmas!

Hi Angel. Well, you can invest on stocks by buying directly at the PSE through online stockbroker (choose 1) like COL Financial, Philstocks, BPI Trade etc. whenever you wish: every month, every other month or whenever you have the money. Invets in long term so you can build more money. If you want to know the bets stocks to invest daily, join dailypik.com Merry Christmas!

and totoo po bang kahit 1 thousand lang po daw po ung inilagay sa stocks ng jollibee magiging 20 thousand after a year? thanks! 🙂

If you will invest at Jollibee, you’ll get around 20% return in a year. So P1000 will not become 20K in a year because that’s around 2000% growth. Unrealistically too big

hi miss fehl my friend told me about the jollibee stocks and i am interested but i dont know how to inquire can you help me?

You’ll surely know everything if you read all the guides here: https://philpad.com/stock-market-tutorials-philippines-complete-guide/

i’ve been reading blogs and books about investments, because I really wanted to learn. As of now, I started investing in UITF EIP in BDO, and I’m planning what will be the next… Which is better to go first, MF or Investing in the Stock Market? and what do you think about cooperative? Is it a good way of investing too?

thank you for your response..

Hi. It’s better to start with either MF or UITF before you invest directly in the stock market because the latter needs enough knowledge and awareness about stock investing and trading. MF and UITF already have fund managers while in stocks trading, you’re in full control of everything.

I really like your blog. I learned so much from it. It add knowledge aside from my Colayco & BoSanchez reading materials. I am now ready to invest 🙂

Keep it up!

I hope you don’t get tired of sharing you knowledge…because it will touch and help improve the lives of the Filipino people.

Thanks Nor 🙂 I’ll do my best to continue adding more investment posts

ms fehl,cge po cgro try ko subukan ung snsbi mong philam strategic growth fund ok lng po ba un as a beginner na gya ko?..nbsa ko dn kc ung comparison between mutual funds and uitf. kpg nginvest po ba ako dun ms fehl every month po ba obligado akong mghulog every month? kc every 3 months lng vacation ko plgi pno po kng nkskay nko ulit sa susunod? tnx po ms fehl pls advice me po..

Hi Rex. For Mutual Funds, great reputation ng Philam (PAMI), Sun Life, Philequity, ALFM here in the Philippines. It depends upon the investments you have chosen: you can invest single placement or do periodic (monthly) placements. Mutual Funds companies usually require personal appearance when clients open an account. Once you have an account, you don’t need to be here physically to make periodic placements or additional placements. It’s usually set up as ADA (Automatic Debit Arrangement). All you have to do is make sure your source bank account has enough funds so every time your Mutual Fund gets money from your account, you’re sure you have enough funds.

ok po ms fehl..tnx po for the info…dmi ko pong ntutunan..nga po pla pno ko po mlalaman na nkakuha na ung mutual funds ko sa account ko? may confirmation dn po ba akong mrereceive sa mutual funds na nag bwas cla ng pera gling sa account ko?

Yes, you will see the debit on your account (source fund). I suggest you have online banking instead of relying on personal bank updates from your bank.

Hi! Can you teach me how ? I want to invest a 5000 Nextweek. Please give me a feedback to my email address. Thanks

Sure. Just go to our easy guide page at: https://philpad.com/stock-market-tutorials-philippines-complete-guide/

ms fehl, mg iinvest sna ako sa bank, sa BPI premium bond fund..s tingin mu po ba ok dn un na idea pra mplago ko ung pera ko? sa ngayon po kc nsa barko ako bnbalak ko snang gwn un pgbaba ko..pls pa advice nmn po..tska ok lng po b kg hndi ako monthly mkpg invest kc 9 months po ang cntract ko bgo bmba sa barko.tnx po ms fehl..

Bond Funds are very good although profit is not much compared to Equity Funds. It’s suitable for investors with moderate risk

Can I make millions within 2 years by trading P50,000 in the stock market?

Only if you bought penny stocks of P1/share and it became P40/share in 2 years time, you could have 2 million then.

Hi Ms. Fehl, may I ask for a tip on how to determine if the IPO is a good buy or not? Thank you for your usual support.

It is a good buy if it’s a monopoly business or the first ever to have that kind of business. Like Facebook, Google, and the like.

hi, Is the Mutual Fund(Exp: PhilEquity) using Peso Cost Averaging? or it is only for investings Stocks?

There are Mutual Fund products that use PCA and there are others that don’t. Philequity that is on Equity Fund involves and focused more on stocks.

tnx 🙂

let say fehl i decided to choose bdo or sb uitf equity fund,

1. then i decided to do it a monthly of 5000php after initial of 10kphp;

– option din ba to pay monthly in cash sa bank?

– cash or auto debit, what if magfail ako magbayad on agreed date? may fine ba?

– pag nagagreed ba na 5000php/month meaning dapat lg 5000php/month babayadan? or pwd lower sometimes?

– pag agreed ba na monthly 5000php pwd magbayad ng above let say may pera ka that time?

🙂

Banks have 2 options of funding of UITF: 1-time placement or single placement and the second one is periodic funding. If you want to invest monthly in BDO UITF, open EIP (Easy Investment Plan). It’s auto debit arrangement. Read our post and review about BDO EIP to learn more

Hi Fehl. Good afternoon! I would like to ask your expert opinion on retirement planning. I am 37 years old. I am a working single mom. Right now, this is what I have for my retirement portfolio.

1. Philam Asset Builder – 5 pay policy. I opted to pay for six years to grow my money.

2. SLAMCI Equities – I invest monthly and have accumulated more than P100,000 already.

3. FMETF – I started investing on FMETF this year every month and have 830 shares already.

I won’t be making any additional payments anymore to my Philam Asset Builder. Would it be

better if I solely invest in the stock market? Currently, I am allocating P16,000 monthly (FMETF and SLAMCI equities) for my retirement. If yes, which stocks would be good for my retirement portfolio? I am in a catch-up stage for my retirement.

Hi there! You are doing the best coz you have different investments already. If you could invest in teh stock market directly, that would be great too since the more money trees, the better 🙂 Even if it’s just 5000 monthly invested alternately to 5 big companies. Your goal is retirement so long term will give you millions in the long run.

Hi Fehl. Thanks. So, if I want to re-allocate my money, which company would you recommend? So that’s P16,000 a month. I will continue investing in FMETF. May I have a recommendation?

Join our FB group. We share some stocks picks every now and then 🙂

Hi Ms. Fehl,

I’d like to join your FB group. May I have the name to search for?

Regards,

Katherine

https://www.facebook.com/stock.daily.picks

hi fehl; 🙂

ano magiging pagkakaiba na maginvest sa UITF Equity Fund ng BDO by

100k pesos(isang bagsak ng peraone time) in 10 yrs period vs. ung

magbibigay lng ng monthly dun sa UITF Equity Fund ng BDO?

The answer to your question is found in our post entitled, “Lump Sum Investing vs Peso Cost Averaging” We provided comparison of the two methods and real time examples

hello po magandang gabi…tanonong ko lang po…if i have already an online broker ..lets say philstocks.com..which requires 5,000 to open this account…kailangan pa po bang maglaan pa ng another amount of money para makabili na ng stocks?…*** pasensya na po student pa lang po kasi ako at wala pa talagang full knowledge in investing ( i am an accountancy students pero curious po ako on how to invest earlier)..because it might be helpful for me if start investing at a young age..im 17

Hi Nina. The money in your online broker platform is like your wallet. It is all yours and you can use it to buy stocks. Of course it depends upon the price and the fees for every transaction. You may need to add more funds in your account if you need to buy more stocks. Yes, you can already use the 5000 to buy stocks but you need to maintain enough funds in your wallet. Read our STOCKS post here coz I share some posts for beginners. God bless!

Hi i need your suggestion/advise where to focus my investment:

currently im investing in stockmarket through col almost 2 years and the stock i choose is LRI.

also im currently investing capital contribution through psslai (applicable only for pnp) which gives dividend 18% interest per year

im confused if i focused on stock market or continue the capital contribution which gives 18% interest per year or focused both of them? my stocks presently is LRI which gives dividend but the gain is still little. hehe.

tyvm

I suggest you have them both. 18% per year is already impressive. A smart investor have different money wheels. In your case you already have 2 wheels. 🙂 You can have more like Mutual Funds, UITFs, apartments, business

great page, thank you so much youre a big inspiration. god bless you always.

ms fehl,sa loob ng 20-30yrs andito kpa kaya sa blog mo?inisip ko kc sa mga binigay mo na mga advised sa lahat at higit sa lahat sa akin about investment,time will tell darating ang panahon sa mga taon na yan na binanggit ko kung maganda ang takbo ng investment ko cgurado milliones na ang investment ko,hehe paano kita pasasalamatan o kayay mabigyan kita ng shares sa blessings ko sa investment ,na sa puso ko kasali ka sa mga ito dahil ikaw ang inspired sa akin o sa iba na mabuksan ang isipan pra sa investment na ito,alam ko hindi mo a kailangan ng balato pro may kasabihan nga tayo na,masamang tumanggi sa grasya..hehe kung maging millioners ako bigyan mo ako ng acct no.mo at depositohan ko…at kung malugi man ako sa investment ko ito yong acct.no.ko balatohan mo nalang ako sa mga investment mo..hehehe…salamat ms fehl..mas lalo akong naging korepot ngayon.hehe

Yes, my website is still here in 20 years or so I will be adding posts every now and then. I’m currently making a series for Stock Market Tutorials and Tips which you can find here: https://philpad.com/stock-market-tutorials-philippines-complete-guide/ I also created a Facebook page about Stock Daily picks where I post my personal stocks picks. Equities and stocks are down right now and are expected to be down for this month since there were recent typhoons and Mayon Volcano is one hot expected calamity LOL This is a perfect time to buy shares and stocks. 🙂

Wow, thank you for the gift. I appreciate it already LOL Can I say I appreciate your visits and all my readers’ visits, comments more than anything else? I’m sure as chocolates we can all be muti-millionaire in 10 years or so if we continue to invest the way I always share here.

which MF do you prefer, BPI,BDO or SunLife? Thank you for your usual support.

BDO has no Mutual Funds right now. They have UITFs. For MF, I prefer Sun Life, PAMI, and Philequity

Hi Fehl, can you please show us how did you arrived on those 7.7m after 30yrs with 5k of investment for 10years. Thanks!!!

eto yun eh..

up for this one ms fehl.

I mean BPI Trade or COL? which one do you prefer?

I use COL right now. Maybe if I had bank account in BPI, I opened thru them but since I had no account in BPI, I chose COL.

Good day Ms. Fehl! As of now, i’m trying my best to gain knowledge regarding investing in stocks. Way back years ago, i kept on searching in the web on how can i invest in stocks. While establishing my knowledge about investing in stocks, i set aside certain money on savings account,then by the time i had equiped my self of such i will invest my money on my saving accounts. A little knowledge in stock market is risky however i am willing to take risk-the higher the risk the higher the return. That’s why just want to be sure of myself before investing my money in stocks. Here are the things i want to clarify:1. What web-site should i look into to know the best performing company in 5 years, 2. How can i buy stocks of international company like apple,3. What advisable month to invest. Thank you so much Ms. Fhel for very informative web-site you have. Although i’m always busy at work and taking care of my 1 year-old baby, i find time to finish reading your article.i even wake -up late at night until morning just to read your article 🙂 . More power.

Hi Clara. Thank you for reading my investment posts here. I actually just created a special series of posts recently for my readers like you which contains concepts, tips, strategies for beginners and intermediates to investing. I know in the long run, we can be experts too 🙂 Your questions will be answered per post there. I made the posts chronological since I believe we all go through to every stage. You can bookmark this page coz I will be putting posts every day and week. https://philpad.com/stock-market-tutorials-philippines-complete-guide/

Hi Ms Fehl!

I just love your blog! Very informative and educating especially for beginners like me. But still I have some follow up questions po, say for example with COL Financial.

1. Is COL Starter (5K) the same as COL EIP?

2. Will I be required to invest 5k monthly under this program?

3. What if i wanted to have the COL plus (25K) as starting. Will that be allowed and will it still be considered as EIP?

Thanks,

Lucky

1. COL Starter requires minimum of 5K initial fund and yes, it has EIP feature.

2. No, you have the option when and how much to invest periodically under your EIP account. You can also invest quarterly instead of monthly if you don’t have 5K every month for example.

3. If you opened COL Plus like I did, you can also invest EIP or invest just the way you like (own strategy) 🙂

Hi Fehl,

Which method do you think is the best? Via UITF Equity Fund or Mutual Fund in Equity or Via online broker? Is one riskier than the other? I would love to earn millions by investing in stocks. Btw, thanks for this great write-up. Enjoyed reading it and has inspired me to be a millionaire someday.

All of them are best investments since they are all involved with stocks. As a beginner, I recommend Mutual Funds and UTIFs in Equity because you don’t need to monitor or manage your funds using financial knowledge and skills as you have experts already who manage the funds for you. If you have either MF or UITF, it’s about time then that you go for direct stock market investing by opening your broker’s account. I recommend COL Financial since I personally use it although you can use other brokers. I’m making a step-by-step guide here about stock market investing which I personally adopt and use even when I was a beginner and until now. Happy to share money-making tips 🙂

May guide/advice po ba kayo para sa dividend investing? Thank you

You can earn dividends when you have stocks, when companies declare them. In the Philippines, you can also earn dividends when you are a member of the GSIS. Dividends are not huge money if you don’t have huge investment in a company.

Good afternoon Ms.Fhel, ask ko lang ano po mas malaki ang roi ng investing sa PCA vs Build plus peso ng Bpi philamlife? Im currently investing sa Bpi philamlife my annual premium is 101k php… Long term investment din ang gs2 ko para mas high return. Sa BPI Philamlife kasi insured pa ako, nde ko lang alam kung sa COL financial kung insured din ang mga investors… thanks po madami ako napulot sa thread mo.

Some investments have also tied-up insurance like VUL. Those from COL Financial or other online brokers, has no insurance coz you are investing in stocks.

Ms. Fehl, can you do me some kindness by just explaining more about Peso cost average. on this article it said, Whatever the status of the economy, whether stocks price are high or low, buy still and keep practicing the PCA, you will profit anyway. how come po? how can i still get profit if the stocks are low? thank you in advance po, Ms. Fehl.

Hi John. If you’re using PCA, you are building your investment more because you add up funds periodically, regularly whether the economy is in a peak, recession or recovery. You are not getting emotional or greedy, you are investing in value coz you believe the stocks will accumulate and grow over time anyway. I know you can also learn from this post: https://philpad.com/lump-sum-investing-versus-peso-cost-averaging/

“how can i still get profit if the stocks are low?”

John, the idea is you buy low and sell at a higher price for a profit. I personally do not advise PCA, but it can be beneficial, depending on how you invest.

Good morning Ms.Fehl, pano po naddetermine ung gain/loss pagkabli ng stocks? example 30 ung bli ko tpos ung last price pagkaclose ng market ay 31. Thank you

Gain or Loss will reflect on your account portfolio accordingly

great post fehl.

but how do fund managers profit from us mutual fund equity investors?

By means of the fees we pay and don’t forget our money are being held by them MF companies so it’s rolling out and generate income we never imagine :p

Hi Ms. Fehl,

I’m sorry if my questions will seem so dumb, but I’m quite confused about something.

I was wondering if investing through a bank means i’m investing my money to the bank’s stocks? Or does it mean if i invest through a bank, they will manage and invest my money to other companies stocks?

Also, is buying/trading stocks different from investing in stocks? And lastly, is it possible to invest/buy stocks directly from big companies like Jollibee or SM for example.

Hi there! UITF investments are available in major banks but that does not mean you invest in that bank’s stocks. Please read our posts about UITF to know more about it. Can’t tell you everything in the comments here as we have easy guides available which you can read now 🙂 If you invest on Equity Funds, you are also (in some ways) investing in stocks as these funds have usually stocks involvement. Of course there are differences with investing with UITF, Mutual Funds and directly investing in the stock market.

Yes, you can also invest directly to big companies if you open an online broker. You’ll learn more about it by going to our posts categorized as UITF, Mutual Funds, Stocks. Just browse them. Have a frappe when you read so you’ll enjoy and learn more 🙂

I will! Haha Thank you Ms. Fehl!

Hi, may I ask how did you compute the 20M for 40 yrs of investment for 5k per month? Do you have an excel template for it? Thanks

Capital appreciation until age 65 assuming investment grows 10% every year, you’ll get that value.

hey this is cool. . i want to start my investment plan too. . i think i’ll see more a lot of this. .i want to learn this stuff. .

Good morning! Hi Ms. Fehl may I ask for an advice on which broker to choose for starters in stocks? COL or Philstocks.ph? Thank you.

They are both great but I personally like COL Financial

Hi Ms. Fehl.. i just funded 5k thru COL and recently buy stock MWC for 100 shares. i want to use PCA 5k a month, how can i use all the 5k to buy in MWC since you can buy only per board lot. naguguluhan ako..can you please clarify it for me..thanks.

COL has EIP feature for PCA lovers. You can either automatically assign 5K or manually do it. They have video guide on their homepage. It will be helpful if you watch it to know how it works. God bless!

Hi Ms. Fehl, I downloaded the Bloomberg app, pero I don’t understand how to use it.

Can you guide us on how to monitor PSE. There was an option for Holdings, when I try to add PSE to watch list, with the fields, Position ____ and Purchase price ______… What do I put in there?

Hi, i’am only 18 and i earn 20k in a month, for you where should i invest?

It’s up to you really. 🙂 Assess yourself if you are conservative or aggressive type of investor, how long you want to invest, what part of your income you want to invest. Then, you can invest.

Hello. i have here 67 shares of the capital stock of legaspi oil company, inc. The question is i dont know how to claim this shares or sell it. how to sell this? it is worth millions? this shares owned from my great grandfather.

Contact the company directly to inquire about the capital stock worth. They will tell you further the info

Hi Ms. Fehl! Stumbled upon your website when i was researching about the CS exam. I thank God that i found this. 🙂 I just want to ask if i start an investment of 20-30k in Equity funds and then deposit about 10k/month, is it possible for me to accumulate 200k or more in 1 year? Actually, i plan to try investing in stocks and also trading. do you think it is a good idea?

That would be 150 in a year. I would say, it’s possible but I would assume the most possible scenario would be 160K – 165K IMO because a year is so short and your investment is monthly not 150K in a single placement

thanks Ms. Fel! now i know that i know that it is possible, i’m more fired up to invest. 🙂

It’s a pleasure 🙂

Hi I’m 21 years old graduating student this October 2014 and we have our own family business which is doing great , I want to invest in stocks as early as possible when I graduate and stumbled on your blog and get inspired, thank you !! 🙂 new reader here!! 🙂

Hi Alyssa! Thanks for dropping by and reading our Investment posts. You are always welcome here! Best of luck and happy investing!

Hi! I’m john and I’m still studying in high school. What tips can you give me because I’m now trying to venture in more about stocks using my own savings. My parents are actually also helping and encouraging me not only to save but to invest.

Let your parents open trading account for you so you can invest or trade stocks. If you reached 18, they can update your account in your name so you have all the power and control

but I’m still confused about the whole system…

When you invest to a company does it require you to pay like every month or could it be like “isang bagsakan na”.

Ang ideal every month dapat para lumago ang investments mo. ang importante marami kang shares na nabili para when time comes you will reap your gains in stocks ay worth multi millions. Kung isang bagsakan lang tapos 5k lang capital mo forever, don’t expect you will be millionaire in 10 yrs or 20 yrs,

You can do both – invest at once or periodically. It’s your choice. I just highlighted the periodical investing here because it’s what most people can afford and I see it as more convenient no matter what the financial status of the person is.

maam ano po ba ibig sabihin ng splits sa dividend, and yong preferred stock, FGEN kasi nagbigay ng preffered tapos may cash then splits sa dividend chart

Shares of stocks in a company can be Preferred or Common. If you have preferred stocks, that means when the company or corporation has excess cash or earnings, they distribute them in the form of dividends. If you have preferred shares / stocks, you will be prioritized.

Hi fehl are you familiar to Life Extreme Protect of BPI-Philam? I just enrolled with them for 20k annually. This is my first time to invest. What can u say about the product mam?

I’ve read about it before but has no personal experience about it yet. I know it’s Investment + Insurance rolled into 1. The investor can make placements to their available peso funds professionally managed by BPI-Philam and paying insurance premiums too. With investments like this, you’ll pay for premiums + you put funds to your chosen investments. You’ll earn and you’ll be insured at same time.

Hello mam fehl. Thanks for your prompt reply. Nabasa ko rin sa mga blogs mo gusto ko rin sana mag invest sa BDO equity ang problema d pa sila pwd online application sayang ung time next year pa po kasi ako mkakauwi sa pinas. Again salamat Ms. Fehl. -Jay

Hello Jay! If you have account in PNB, you can also open UITF Equity Fund wherever you are. PNB has online UITF account opening unlike BDO. Choose PNB High Dividend Equity Fund.

Hello Ma’am Fehl, After reading your blog, I decided to invest today but I’m still a contractual and a totally beginner so, I invest in ALFM mutual fund but I cant decide if what mutual fund should I choose. THERE IS GROWTH FUND, PESO BOND , DOLLAR BOND AND EURO BOND IN BPI ALFM MUTUAL FUND. WHAT SHOULD I CHOOSE?

You must get to know about Mutual Funds first. In investing, you must have the following:

Knowledge

Money

Goal

Risk-appetite

You’ll have the first thing by reading this: https://philpad.com/how-to-invest-in-mutual-funds-in-the-philippines-make-money-make-millions/

i’m 19 years old and I can save 2k per month is it possible to increase my monthly investments if someday ill have my job?

Yes it’s possible. You can update your account to add placements per month

Hi Ms. Fehl,

Thank you for this informative blog. And can I ask you for some advice?

I already got a VUL insurance in sun life, but I still want to invest more. My financial advisor told me to open a Mutual Fund in Sun Life…but I’m a having a second thought because I’m kinda interested in BDO UITF… and para maiba naman hindi lang sa Sun life ung investment ko.

Do you think it’s a good decision to just open a UITF in BDO? UITF and mutual funds both have charges right? Ano ba ung may lesser charges? Which fund is better? Equity, balanced, or bonds? I’m planning to invest for 5 years, 10k initial and monthly 1k.

Thanks.

Hi there! Having many investments is good and personally I prefer having some on different funds. You knows “Don’t put all your eggs in one basket”

I personally like BDO Equity Fund and Sun Life Prosperity Phil. Equity Fund. Equity Funds have the highest risk. To know more about the comparison, advantages and disadvantages of Mutual Funds versus UITFs, read this page: https://philpad.com/mutual-funds-vs-uitfs-similarities-and-differences-advantages-and-disadvantages/

Hi Fehl!

Thank you so much for your posts. I just started reading books, talking to people re their experiences/accounts and everything with their banks (lucky me because i have someone who is really doing it for the past several years). There are blogs out there but not like this one. A newbie like me can get the info, (which at first I really have no idea nor clue). After reading your post over and over (lol), when i went to the bank…at least i have a little “baon” of information na. Even the comments really helped a lot.

We have an account in Bdo but i opened an account in Bpi instead (equity index). M planning to invest on both banks (equity and index) kahit pakonti-konti lang. I already opened a “settlement account” in BPI and just waiting na bumaba ng konti the the price as per bank officer’s advise. I’m positive about these and M looking forward to read your posts.

Thanks so much for reading my mahabang comment and may God bless you always…

Hi Mon! Gosh, thank you for the nice message here! BPI has very good investment products too. I’m posting upcoming page about the best UITFs in the Philippines. Hope to see you there. Cheers!

Hi Fehl!

I have an account in BPI and very much interested to invest my extra money, but don’t know where to put it exactly.

I was advised to go to Mutual Fund as I don’t have any idea about stock market.

Can you please give me your honest opinion?

Regards,

Jhojo

If you want to invest Mutual Funds with stocks participation, choose Mutual Funds in Equity. I recommend 2: Sun Life Prosperity Phil Equity Fund and Philam Strategic Growth Fund – Equity

Thanks for the recommendation Fehl, will try to enquire both.

Just want to get your opinion about BPI ALFM Peso Bond Fund, I appreciate to hear your response…

Thanks and God bless…

You’re always welcome and I’m happy when regular readers engage here in the comments 🙂

A cousin of mine works at sun life.

She conducts seminars..

i texted her right after i read your blog and she called me a minutes ago 🙂

she is setting an appointment with me…

i need a mentor dw.

if you want to be rich,you need to talk to someone rich

If you are thinking about business,talk to a businessman..

Fehl,you are a mentor 😉

Tnx sa blog mo.

May money ba sa blog making? Wala lng naisipan ko lng itan0ng,(Sideline!! haha) i might write one sa progress ng pangarap kong millions… to help inspire din.

You’re very helpful

Keep it up 🙂

Wow it’s gonna be a brighter future for you now Yhanzky. This is the start. Enjoy it! Thank you for the kind words. Regarding to your second question, yes there is money in blogging. However, it would take years of learning the curves and how the online world works. You need real bloggers who have real experience to teach you how. *Hint* I shared some ways if you find some of my posts in the MONEY section of Philpad. I’m currently putting up a complete guide for blogging and the launch will be soon…

Hi fel,i was browsing the net,googling how to start a business with10k capital and i found your blog.

im working 9yrs and wala ako naiipon.

Lately ive been thinking working abroad nalang pero kulang educati0n background ko sa salary bracket na gusto ko

May 25t ako sa atm ko ngaun and gusto ko sana mag business uli.kaso ive tried it already last year burger stand xa,hndi nag click kc panget ung locati0n.Ska wla pa aqng katul0ng mag operate.nasayang ung puhunan q..

Thats why im thinking of alternative kung pano lalago ung pera ko.

Honestly i dont understand stocks.

And shy to approach the bank regarding buying stock..

il just read m0re of your post.

Thank you sa ideas.

Hey Yhanzky! Thank you for dropping by. You did the right thing by thinking of putting up a business however it needs right timing and location. Maybe you can try again when you’re fully ready. Best of luck and I hope our MONEY post will help and guide you through your financial journey

How I wish to become a millionaire someday, and since I have already an account to one of the Best Bank you mentioned, I want to make it sooner! I am an OFW, glad to know that you have this kind of blog to enlighten us where to put our hard-earned money. Thank you very much!

My pleasure to share this

Hi Fehl, thanks so much for the reply. I’m 42 years old and 7 years here abroad. I don’t wanna be greedy Fehl, I just want my life a bit easier when I get older. I just finished building my house, that’s why after reading your article about money, I had lots of thoughts running through my mind. I plan to invest 30k a month via the BDO EIP. Thanks a lot and more power to you!

You must also consider Sun Life Strategic Growth Fund in Equity. It’s a Mutual Fund not UITF and can give you dividends.

Hi Ms. Fhel i am so happy for you to give us advices and ideas about investing..

Hi, I’m turning 18 on August and I really want to invest already for my future. I’m planning to use my saving which is about 30k. How much do I have to pay monthly? Please help me. Thank you!

It depends with your situation. You have to consider if that 30K is all you’ve got for now. Consider your needs and do something to have steady and regular income like a regular job and business so that your fund would grow and you’ll have extra money for your needs. Make sure you are really prepared to invest not only mentally but also financially. Before you invest, ask about these things:

Time

Money

Goal

Risk

Please send me post about stocks, mutual fund and UITF.

Just go over to our Millionaire page: https://philpad.com/tag/millionaire/

hi fehl

your articles are very helpful.just want to ask if you know some companies in our country that offers direct investment plan.i am having trouble in searching about it.does it exist?

Hi there. What direct investment plan specifically?

Hi Fehl,

Thank you very much your website really helps me a lot. I know its not too late for me to invest because Im 22. I will start the Easy Investment Plan through UITF Equity Fund. Ill inquire first for me to have more knowledge and start investing. Thank you very much.. 🙂

My pleasure. Our new post is about Easy Investment Plan – Equity Fund. Check it out so you know more 🙂

Hi Ms. Fhel,

Wow! Thank you very much for awakening me from sleeping for too long. I and my husband are OFW for 6 years and have not saved any penny at all. We’re both bread winners and still supporting both sides.

We have a house purchased thru bank financing in BDO for 15 years term and we are still on our 2nd year of payment. Got 2nd hand car but still thru loan, purchased farm lot but still not completely paid (with 200k balance). We invested in a condo but we got the wrong sales agent and we wasted almost 300K for nothing. We did this strategy as we thought that it will be rewarding for us to see where we are putting our hard earned money. We joined lots of investments scheme but none of them succeeded. We failed so many times but still we keep on believing to some word of mouth. Recently we joined PRULIFE UK (sort of insurance with savings). Working abroad is not that easy and sometimes you feel like quitting but you have no choice. Been hearing too much about stock market but don’t know how to start wit it. Like you and Mr. Al was saying, knowledge or learning is the most important thing to do. Well at least now I know that I can rely on BDO for UITF and Mutual Funds.