How to open SSS Flexi Fund account for OFWs? We share the complete details here – the requirements, benefits, and procedures to get a Flexi Fund account.

Overseas Filipino Workers (OFWs) work very hard for their families. They deserve all the earnings and the benefits they can get from their jobs abroad. The Social Security System (SSS) launched a special program for OFW to grow their money.

What is SSS Flexi Fund?

SSS Flexi Fund is a Provident Fund program exclusively offered to OFWs (Overseas Filipino Workers) to help them save and earn more money while enjoying SSS benefits at the same time. This type of fund is not mandatory. A member decides to avail SSS Flexi Fund or not.

We have a detailed review about it here: SSS Flexi Fund Program Review if you want to learn more.

SSS Flexi Fund Benefits:

- Tax-free earnings

- Higher income than a savings account

- Transparent

- Professional management

- Supports retirement

- No locked-in period

- Annual Incentive Bonus (for qualified savers)

Requirements to Open an SSS Flexi Fund Account:

- OFW SSS member

- Active SSS account

- Valid ID

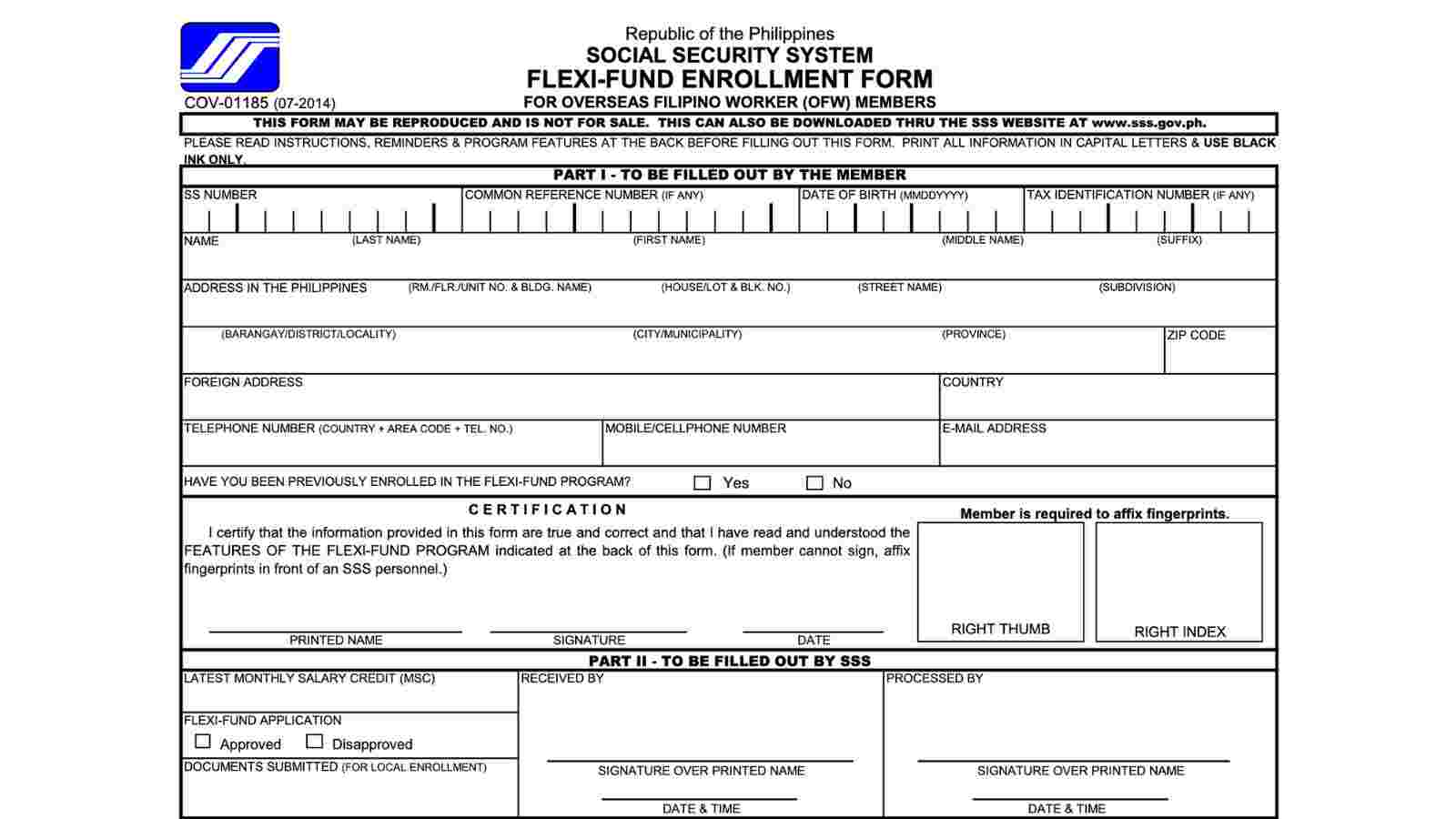

- Flexi Fund Application Form

- Money for your Flexi Fund

How to Open an SSS Flexi Fund for OFWs?

Step 1: Fill out an SSS Flexi Fund Application Form

Fill out the application form for SSS Flexi Fund enrollment. The form can also be downloaded online before going to the Social Security System’s office or branch.

Step 2: Enroll your Flexi Fund Account at SSS

Bring your valid ID and accomplished application form to any SSS office nearby or the SSS Foreign Representative office at the Philippine Embassy or Consulate office. Submit your documents.

If you’re in the Philippines, you can also submit it at the nearest SSS branch. Bring your valid OEC (Overseas Employment Certificate or E-receipt issued by POEA as proof of your pending deployment if you apply for Flexi Fund in the Philippines.

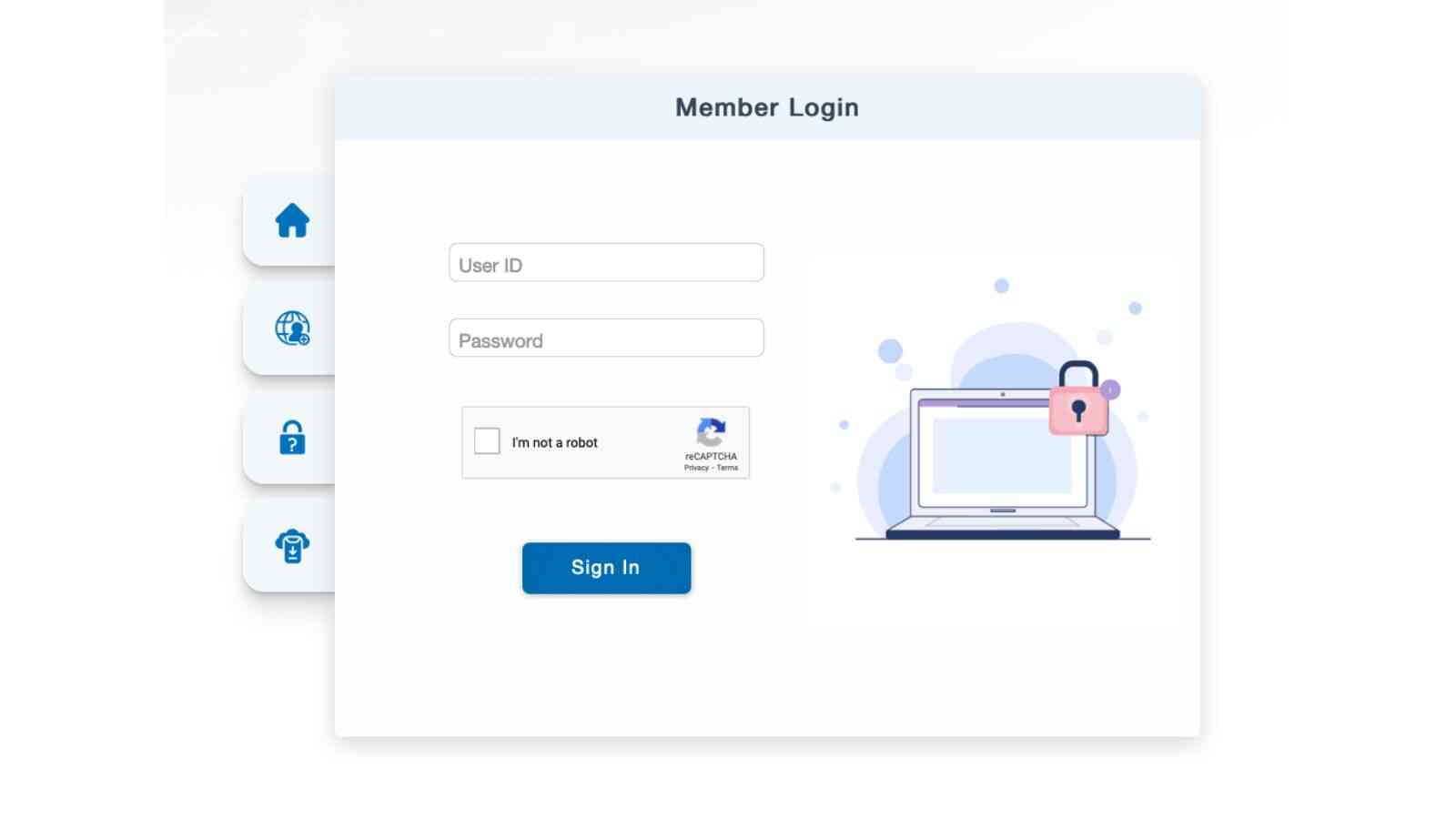

You may also log in your SSS online account and enroll your Flexi Fund if you are eligible.

Step 3: Pay your Flexi Fund Contributions at the SSS

After you enroll, your Flexi Fund account will be created, and you can start adding funds to it to earn interest income over a long time.

How to pay SSS Flexi Fund for OFW?

SSS Flexi Fund payment is also the same as remitting regular SSS contributions of an OFW. Submit your SSS Form RS-5 (Contributions Payment Return) and fill out the data. Don’t forget to tick OFW as payor type.

Another way is by paying excess funds in your monthly contributions. Any excess (P200+) from it will automatically go to your SSS Flexi Fund. Simple as that. SSS stated that any excess of P200+ from your monthly contribution would go to your fund investment.

Step 4: Maintain your Flexi Fund investments to grow more earnings

Although SSS Flexi Fund investment is not required to pay monthly, just like SSS contributions, regular payments can accumulate more earnings over time. Flexi Fund earns income thru fixed-income government securities where all investors’ funds are invested.

You can add funds to your account whenever you want (monthly, quarterly, annually, or anytime you want); that is why it is Flexi (flexible). But for easy remittance, we suggest you pay it the same way you pay your SSS contributions.

FAQ About SSS Flexi Fund:

How much is SSS Flexi Fund contribution?

According to the Social Security System, OFWs can contribute any amount, not lower than P200, paid in excess of required SSS contributions. Qualified members can also opt to pay a higher amount according to their choice.

How can I withdraw my Flexi Fund in SSS?

Members can withdraw their SSS Flexi Funds anytime they want or in times of urgent need. However, a pre-termination fee is applicable for early withdrawal or when you withdraw your money in less than one year of placement.

What is the difference between SSS Peso Fund vs. Flexi Fund?

SSS PESO Fund is a Personal Equity and Savings Option program for all SSS members, while SSS Flexi Funds is a provident fund program for SSS Overseas Filipino Workers members.

How can I view my SSS Flexi Fund earnings online?

To check and view your SSS Flexi Fund earnings online, you must log in to your SSSS online account. Then click the “E-Services” tab on the menu. Select the “Inquiry “option, then “Premium Payments.” Finally, click “Flexi Fund Premiums.”

How much is the interest rate of SSS Flexi Fund?

SSS Flexi Fund is invested in short-term placement and 91-day treasury bills. Earnings will be generated, whichever is higher from the placement. According to the Bangko Sentral ng Pilipinas, theinterest rate of91-day T-Bills in the Philippines was 2.095% in July 2022.

Disclaimer: This article is solely for information purposes and does not constitute investment advice. All investments carry risks. Past performance doesn’t guarantee future results. Always practice due diligence before investing in any asset.

Other SSS Helpful Guides: