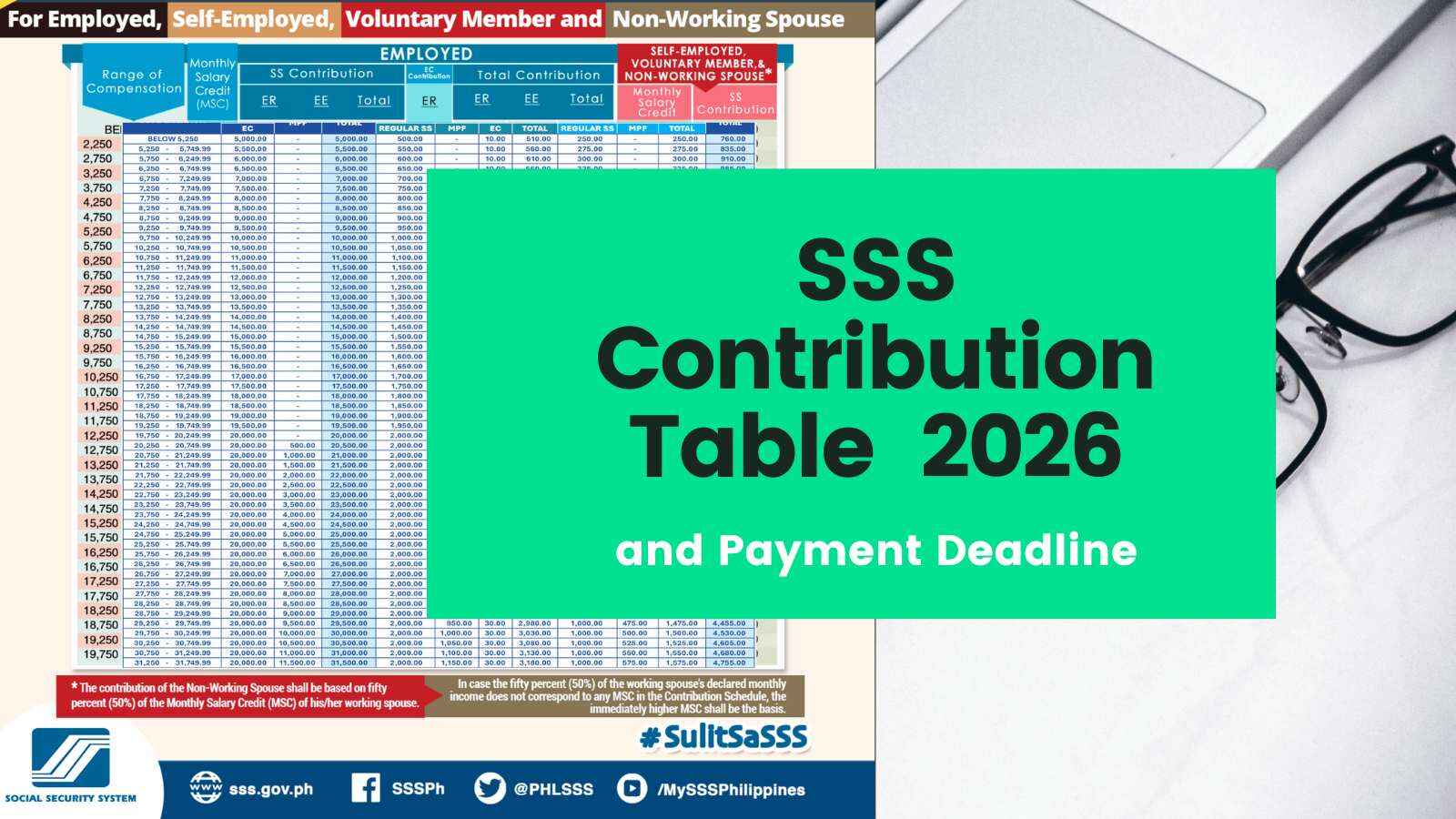

The Social Security System released the new SSS contribution brackets for 2026. Effective January 2026, SSS members must comply with the updated monthly contributions to maintain their active membership status.

Pursuant to the enactment of Republic Act No. 11199, which includes a provision that increases the contribution rate to 15%, the minimum Monthly Salary Credit (MSC) to P5,000, and the maximum MSC to P35,000, the new SSS Contribution Schedule of employers (ER), employees (EE), self-employed, voluntary members, kasambahay, and non-working spouse is issued and shall be effective for the applicable month starting January 2026. The minimum MSC for OFW is 8,000.

What is SSS Contribution Table?

SSS Contribution Table is the official contribution schedule issued by the Social Security System (SSS) in the Philippines to guide SSS members the specific amount of their monthly contributions according to their monthly salary credit or range of monthly compensation.

Advantages of the New SSS Contributions Schedule:

The new SSS contributions table and schedule also highlights the mandatory provident fund for members to implement to boost benefits and retirement pension of members. These are the benefits of the new 2026 rates.

- Covers a larger percentage of member’s monthly income

- Ensures larger benefits and pension savings in the future

- Employer’s share becomes 10% while employee’s share become 5%

- Contributions starting at MSC above P20,000 shall go to the Mandatory Provident Fund (MPF) program

We thought to share the latest SSS contributions schedule 2026 here. It will be very helpful if you print it out especially if you’re an employer so you can update your employees’ contributions earlier and not rush doing it at the exact time of your payment.

SSS also advise voluntary members, self-employed, household employers and kasambahays to know the update and check the new amounts from the table to avoid payment errors.

By the way, all members of SSS including employers are now required to have an SSS online account. Apparently, the Social Security System is aiming to make everything online now which is great I think. Eventually, we don’t need to go to the SSS to transact or inquire about our account.

There are features on the online account such as viewing premiums, static information, and employment history download and PRN forms that are now working.

If you want to view and check your SSS account online, we have the ultimate guide here:

The New SSS Contribution Table in 2026

This table is the summary of the new SSS monthly contributions brackets in 2026. It contains the complete membership categories for employed, self-employed, voluntary, OFW, and non-working spouse.

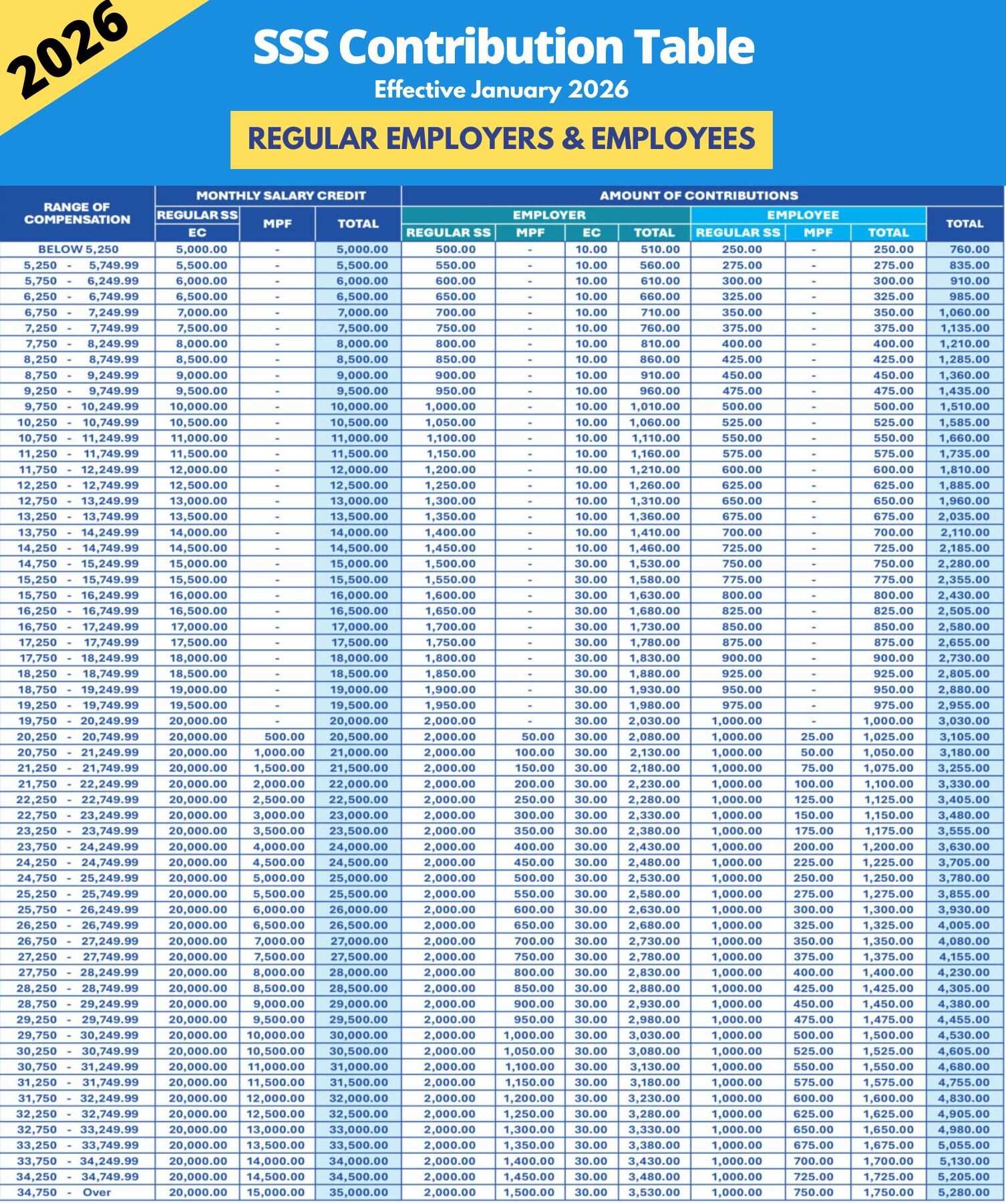

SSS Contribution Table for Employed Members and Employers in 2026

The SSS Table below will also guide business employers and employees about their latest salary brackets and SSS monthly contributions. The data also sort the employee and employer’s share from the total contribution. Additionally, the MPF (Mandatory Provident Fund) and EC amount are also listed from the table below.

Computation of Benefits:

- Contributions and benefits (retirement, permanent total/partial disability, death, maternity, sickness, unemployment, and funeral) under the Regular SS and EC Programs shall be computed based on the member’s MSC, which ranges from a minimum of PHP 5,000 up to the maximum PHP 20,000.

- Member’s contributions for MSC in excess of PHP 20,000 up to the maximum PHP 35,000 shall be for the MPF Program and credited to the member’s individual account. Benefits under this program (retirement, permanent total disability, and death) shall be the total accumulated account value consisting of total contributions plus net investment income.

SSS Contributions Table for Self-employed Members for 2026

If you are a self-employed professional or a freelancer, you may also follow the contributions below. Self-employed with 20,000 and over monthly salary credit now has mandatory provident fund to pay.

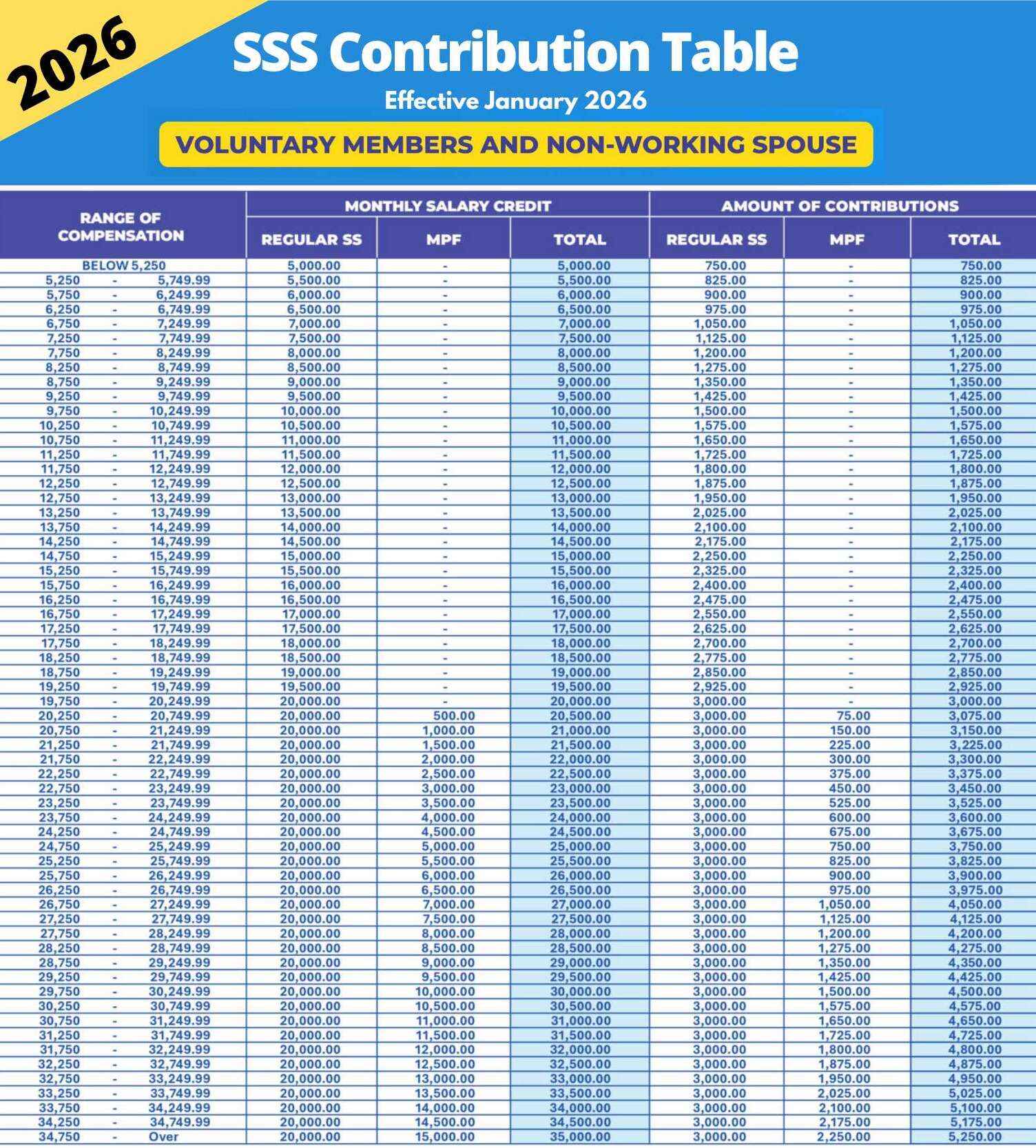

SSS Contributions Table for Voluntary Members and Non-working Spouse in 2026

If you are not an employee, you may switch into a voluntary member if you still want to resume your SSS membership. Likewise, if you are a non-working spouse and you want to retain your SSS active membership, you must follow the premiums below.

The minimum Monthly Salary Credit under the voluntary and non-working spouse member is now P5,000.

According to SSS, the contribution of the non-working spouse shall be based on 50% of the MSC (Monthly Salary Credit) of his/her working spouse.

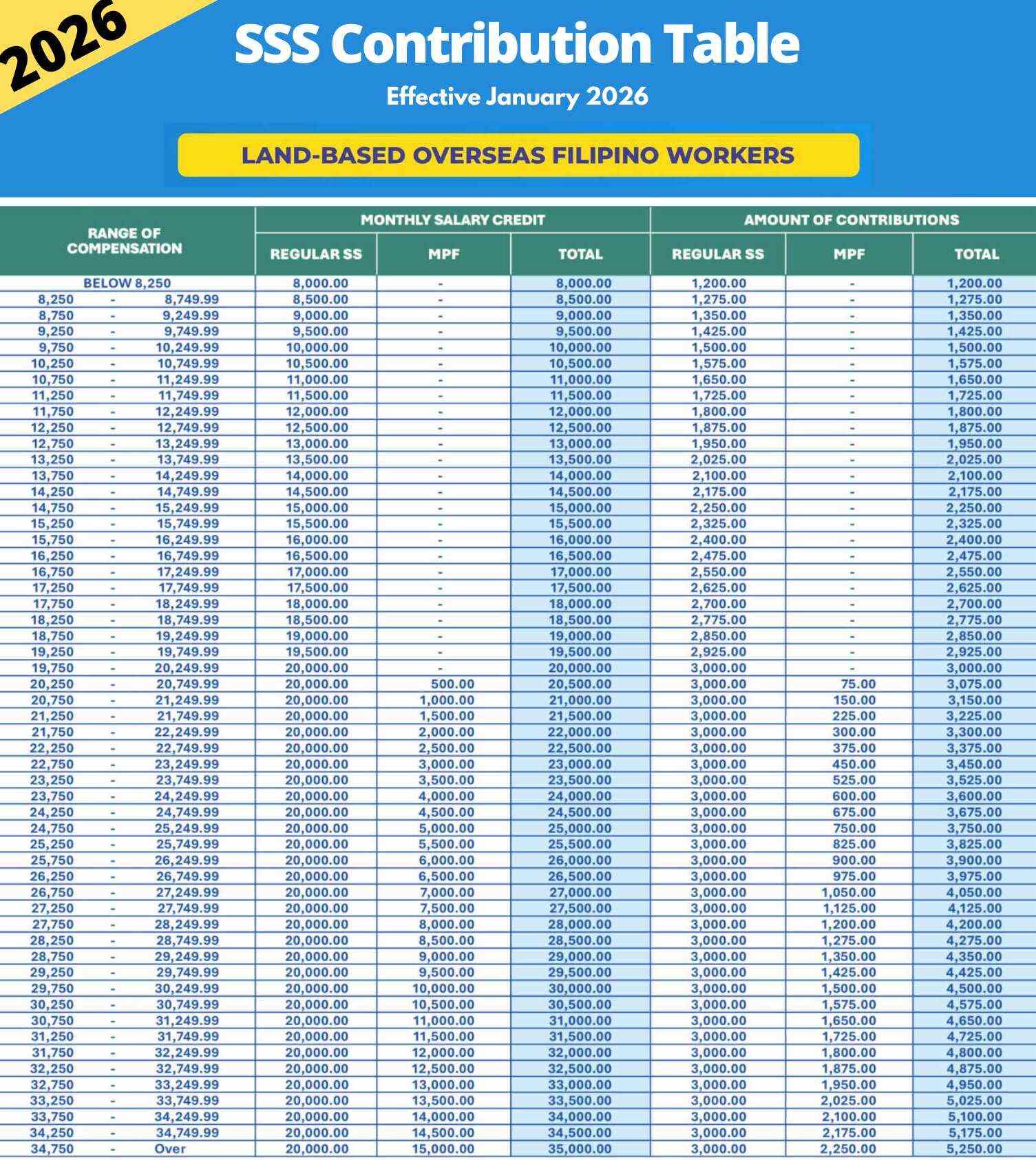

SSS Contributions Table for OFW in 2026

Land-based Overseas Filipino Workers who are members of SSS must pay their contributions following the amount below. The minimum Monthly Salary Credit for OFW member is P8,000.

Computation of benefits:

- Contributions and benefits (retirement, permanent total/partial disability, death, maternity, sickness, unemployment, and funeral) under the Regular SS and EC Programs shall be computed based on the member’s MSC, which ranges from a minimum of PHP 8,000 up to the maximum PHP 20,000.

- Member’s contributions for MSC in excess of PHP 20,000 up to the maximum PHP 35,000 shall be for the MPF Program and credited to the member’s individual account. Benefits under this program (retirement, permanent total disability, and death) shall be the total accumulated account value consisting of total contributions plus net investment income.

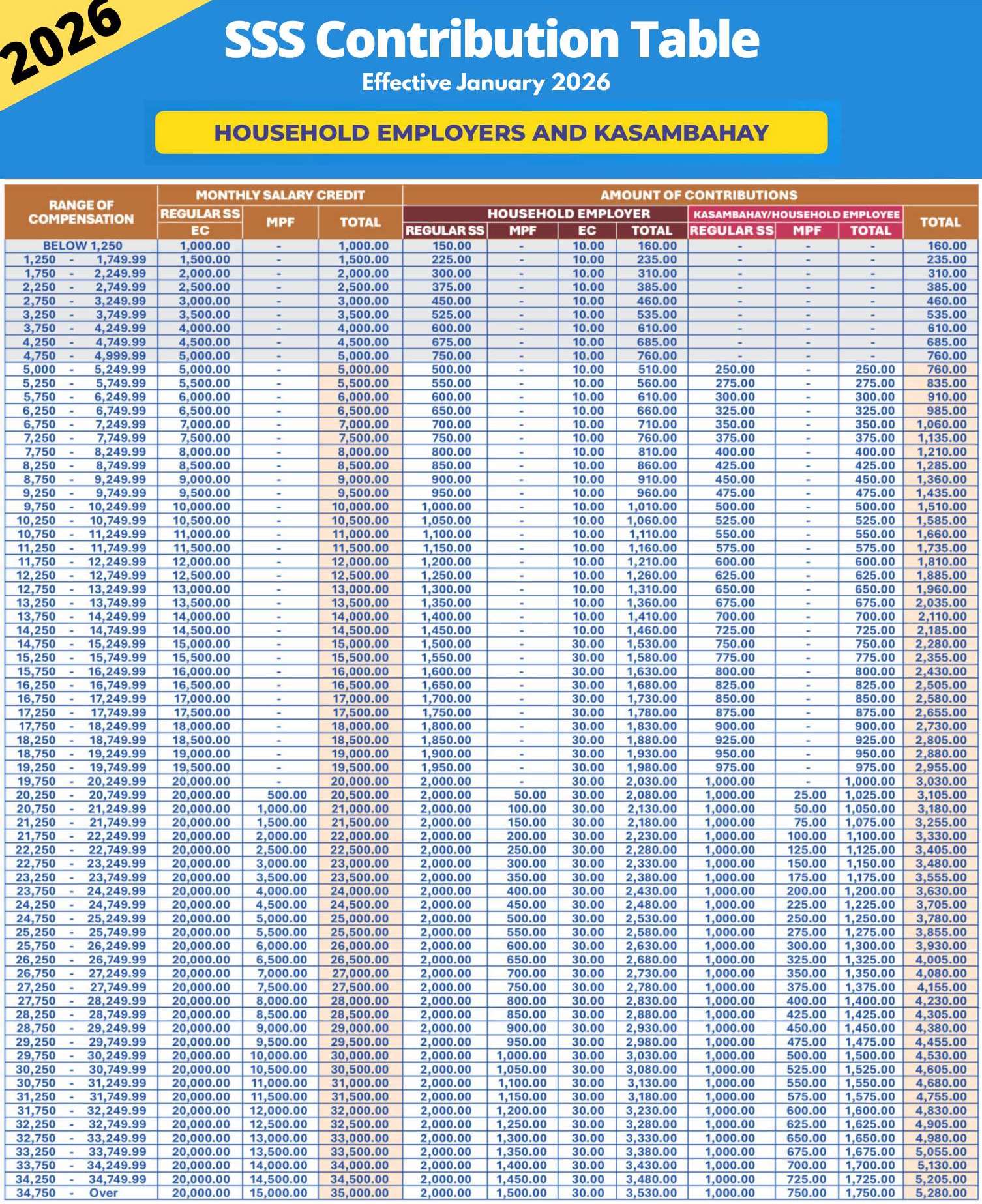

SSS Contributions Table for Household Employers and Kasambahay in 2026

Under Republic Act 10361 or the Domestic Workers Act or the Batas Kasambahay, the household employers pays the entire SSS contribution if the kasambahay earns less than P5,000 per month.

Computation of benefits:

- Contributions and benefits (retirement, permanent total/partial disability, death, maternity, sickness, unemployment, and funeral) under the Regular SS and EC Programs shall be computed based on the member’s MSC, which ranges from a minimum of PHP 1,000 up to the maximum PHP 20,000.

- Member’s contributions for MSC in excess of PHP 20,000 up to the maximum PHP 35,000 shall be for the MPF Program and credited to the member’s individual account. Benefits under this program (retirement, permanent total disability, and death) shall be the total accumulated account value consisting of total contributions plus net investment income.

SSS Contribution Table PDF Version

If you want to download the PDF version of SSS Contribution Schedule, you may download the photos of tables above and save them as PDF on your computer or device.

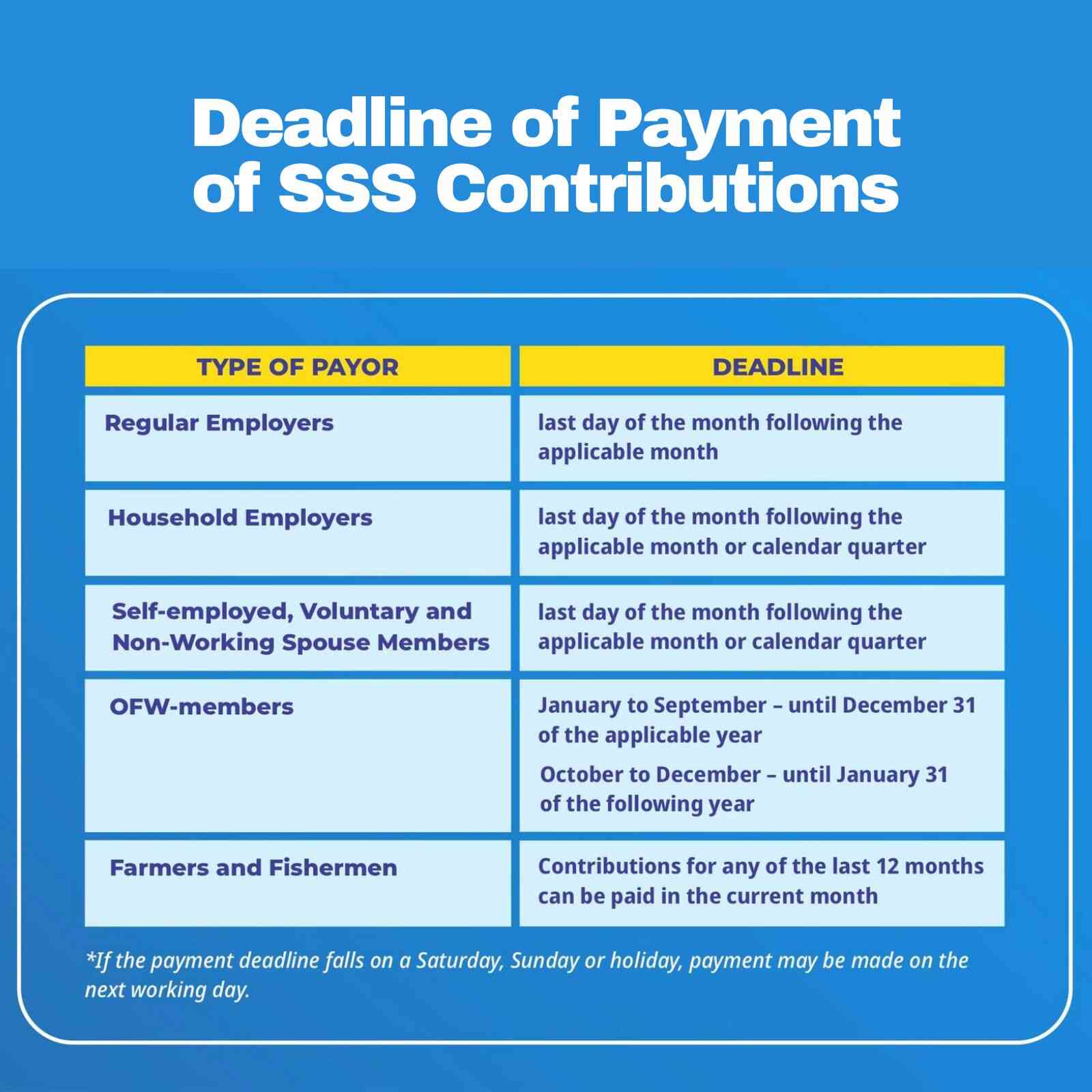

Updated Deadline for SSS Contribution Payment

The deadline for the payment of SSS contributions for regular employer is at last day of the month following the applicable month or period. The same is applied for household employers for the applicable month or quarter as the case may be. The following tables are the deadline schedule for voluntary members, self-employed individuals, OFW, non-working spouse, farmers and fishermen.

SSS FAQ:

How is SSS contribution calculated?

To compute SSS contribution for an employed person, just add Employer’s Share (ER) + Employee’s Share (EE) + MPF (if applicable). For example, if your monthly salary credit is 10,000, your employer will pay 1,010 (1,000 Regular SS + 10 EC) and you will pay 500. A total of 1,510 is your total monthly contribution.

How can I see my SSS contribution online?

- Log in to your MySSS account

- Select Inquiry from the menu

- Choose Member Info

- Select Actual Premiums

- Check your Monthly Premiums from Past to Present

How much is the SSS contribution per month?

If you are self-employed, freelancer or professional, and you are earning 30,000 per month, under the new SSS contribution table above, you will need to pay SSS contribution of 4,530 per month, that already includes your share of mandatory provident fund. SSS also allows quarterly payment for more convenience.

Can I increase my SSS contribution?

Yes, if your salary has increased, your employer can update your monthly salary credit. The same is true with your monthly contributions. They will follow your updated salary bracket from the updated SSS contribution schedule.

Related articles:

- Philhealth Contributions Table 2026

- Pag-ibig Contribution Table 2026

- New Income Tax Table Philippines 2026

- How to Pay SSS Contributions using PRN

- Complete List of SSS Benefits

Subscribe and receive the latest articles for FREE!