A lot of our readers were asking which is better: lump sum investing or periodic investing. That is why we are sharing this topic here to discuss the comparison further about lump sum investing vs PCA method.

Two common investment strategies are Lump Sum investing and Peso Cost Averaging method. Let us first compare and talk about the two before we give the pros and cons, advantages and disadvantages of Lump Sum and Peso Averaging investing.

What is Lump Sum Investing and Peso Cost Averaging Investing?

- Lump Sum Investing – is putting all your funds at once. It is a one-time or single placement of investment. Gain/Loss is computed at present value of the units or shares at time of redemption of the amount.

- Peso Averaging Investing – is investing on regular intervals over a period of time. It is also called periodic investment plan wherein you invest your funds monthly or whenever you wish. Gain/Loss is computed at the average amount of the units or shares.

These two methods and strategies of investments can be applied in buying shares of stocks or stocks investments, investing in mutual funds, investing in UITFs (Unit Investment Trust Funds) and other funds.

If you are directly investing in stocks, ask your broker for any PCA plan. If you are investing in Mutual Funds, ask your Fund Manager for this product. If you are into UITF, ask your bank or Trust representative.

Who Usually Invest Lump Sum?

Lump Sum or single placement investment is usually applied by investors who are very much not afraid of risks or already aware enough of what might happen in spite of risks. They usually have big amount of money set aside sleeping in their vault already and are very much financially stable.

When we say financially stable, that means you have money or income coming regularly and that you have excess funds over basic expenses and necessities. You don’t have to wait for few months to save and buy a thing you fancy.

Who Usually Invest Peso Cost Averaging?

Investors apply Peso Cost Averaging method depending on the frequency they save or set aside money. They add funds to their investment whenever they wish or on regular intervals (example: every 10th, 15th, 25th and 30th of the month).

This method is usually chosen by investors who are scared of uncertainties knowing that the market would drop extremely any time so they don’t want to regret investing the wrong way. In short, it’s for conservative investors who believe that investing regularly will minimize losses and produce sure profit in the long run.

Whether the market is low or high, you will win and earn money in the process. They choose PCA because on average, they still have other ways to spend the money with.

Which Usually Gives More Profit between Lump Sum and Cost Averaging Method?

Time and money are the biggest factors in earning profit. Either Lump Sum or PCA can give you big money, it just depends on the amount you invest, the types of funds you joined and the time you plan to maintain the investment until you withdraw all of it.

To dig deeper, I put the data below for historical comparison of Lump Sum vs Peso Cost Averaging investment using one of the my favorite Equity Funds, BDO, as an illustration. This illustration below by the way, is based from real reports.

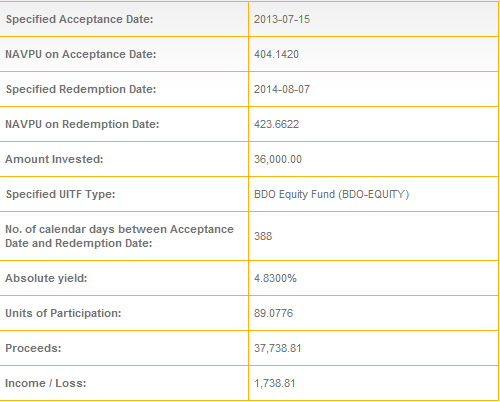

Lump Sum Investment Sample:

Assuming I invested 36,000 on July 2013 and redeem on August 7, 2014, I will get this gain:

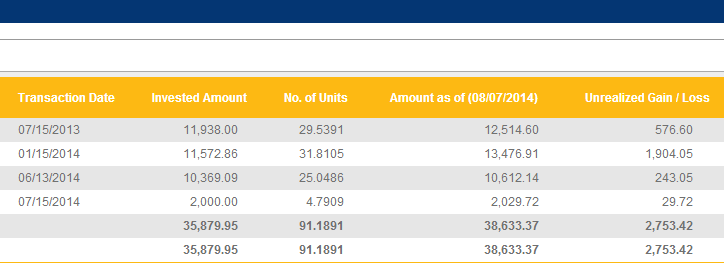

Peso Cost Averaging Investment Sample:

Assuming I opted for the EIP Plan using Averaging Method and chose 2,000 every 15th of the month and redeemed until I reached 36,000, this is what I got.

The result from the comparison above favors PCA over One-time investing. Of course, money and investments are too volatile and NAV changes every day. The truth is, either PCA or Lump Sum can win or out-perform each other. It just depends on these things: the market, the money you invested, the time you placed the investment and the time you redeem.

Lump Sum Investing versus Peso Cost Averaging Sum up:

One-time investment and Peso Cost Averaging method of investment both give money in the long run especially if your fund is participating with blue-chip companies or well-proven corporations.

Lump Sum or One-time investment could have extreme earning potential in spite of risks. PCA investment will help you minimize risk while maximizing your profits because in real life, it’s already a time-tested strategy.

The most important thing you have chosen is that you have invested anyway. It’s far better than never. Nobody knows how the market will be. Nobody could predict the value of shares or units otherwise, you will be an instant millionaire after reading this.

Ms Fehl,

Keep up the good work.

Thanks, Corazon 🙂 God bless!

Hi Fhel,

What is the difference of the EIP and PCA? if I invest for example 5k in COL, I can only use EIP or I can choose whether i will use PCA or SAM or will it only be EIP?

Thanks

Hi mam fehl , first metro save and learn Equity fund po ba is Pwd ako mag invest ng mutual fund.aggresive po ako at equity fund my choice pls .thnxs po

Open an account with First Metro Sec (their online stock trading platform) and you can invest in mutual fund

Pwed po ba ako mag-practice ng PCA pero annual ung interval? let’s say 100k annually for 15 years?

Yes

Hi mam good day po ask ko lng po First metro save and learn equity fund po ba is still consider the best mutual funds na pwd ako mag invest.thnxs a lot?

Hello Ms. Fehl,

Can you please suggest sites on Phil investing or business news? I go on Philnews.com and scour each newslink’s business sections and fav is BUworld Online. Can you direct me how to do private investing and peer-to-peer in the Phils? Please email. Thank you.

Ano po yung UITF just new here trying to learn gusto ko kasi mag engage sa stock market and reading your post already it really helps

Thanks

You can learn about UITF by visiting UITF Guides on our menu above. God bless!

miss Fehl now i have 100 k where i can best invest my money, and become 500 k after 5 years. thnx and God bless.

Hi Irene! You’ll have to do your own research on that. Invest in knowledge first. You may also follow Miss Fehl’s recommended stock picks and decide which one of them suits your 5-year plan. Have a nice day!

Hi, Irene. There is no sure way to make 100K into 500K after 5 years because nobody can predict the market. It will be much faster to do that in business venture than local investment

hi miss fehl, i have been following and reading your blog regarding investments for the past weeks. I just want to ask which one is better, UITF of BDO equity or direct investing thru COL, both using EIP. Thanks!

I like them both – having UITF and having stocks thru COL 🙂 Diversification always works

hi ms.fehl,

lucky and fortunate that i came across to this blog of yours..i’m planning to start investing..though i’m still learning and gaining knowledge to all the queries and information you had provided..u are a blessing indeed! big thanks!

My pleasure and thank you for visiting. 🙂

Question po about the Averaging method table above, 7/15/2013 11k ang invested amount, then 1/15/14 another 11k, bakit po separate ang units na napurchase, at bakit yung units worth lang ng current investment, di ba dapat 22k worth of units na ang mabibili and so on as you invest more? Thanks for clarification.

The UITF above used EIP where in every 2K you spend every month, you can buy some units and every 10K you reached, you will have a new COP. Since NAVPU is different everyday, the units allotted for your budget will also be different

Ms Fehl, your blog is very informative and helpful especially to us na newbie sa investing. God bless you!

PCA doesn’t always give the best return. If the market’s general trend is going up, you will be better off investing a lump sum amount. As the stock price increases, the same amount of money will buy less number of shares so you end up with fewer shares.

Referring to your post https://philpad.com/what-is-peso-cost-averaging-and-how-does-it-work/, if you invested P61,350 in January 2014 rather spreading it over the next 12 months, you will end up with about 1,534 shares (P61,350 divided by P40/share) instead of only 1,240 shares.

The problem is that nobody really knows if the market is going to go up or down in the next several months or years. PCA will be a more prudent approach to investing because it can help you avoid

investing a large sum at the wrong time (i.e. investing when the market is high and it goes down shortly after). And you won’t have to try to time the market. Besides, a vast majority of Filipinos can only afford PCA because they don’t really have a big amount of money to invest lump sum.

Bottom line, whether it’s PCA or lump sum, keep your money invested and keep adding to it.

hi fehl

baguhan ako sa investment . what do you think is the best, philequity or bdo equity fund ?

Hi. Philequity is a mutual fund. BDO Equity Fund is a UITF. Both are good investments 🙂 Go to our post about Investing 100K in UITF vs MF vs VUL to compare the past earnings

Hi, Ms. Fehl! Thank you so much for writing this blog on investment. You are such a blessing! 🙂

I’m 24 years old and getting married in 3 years. I want to invest my hundred grand and make maximum profit. I read your article on “100,000 in a Mutual Fund vs UITF vs VUL Earnings” (so helpful!) and decided to invest on PhilEquity Fund. However, I have read here that SecBank’s UITF is doing good and I have savings there.

Question is: Should I pull out my time-deposit from MetroBank and go for PhilEquity or transfer my savings in SecBank to its UITF? Which has higher ROI in 3 years? Lump sum or PCA? Sorry, I have so many questions; I just want to make sure of my future. 🙂 Thanks again and God bless you!

Thank you 🙂 They are both Equity Funds and they are both very risky. If your term is 3 years or so, that would suit your plan. If you ask, I’d prefer Philequity than SECB’s UITF. BTW, the market is on a downtrend these days so it’s a good time to open investment while prices are down as well

Hi Ms. Fehl! NAVPUs of BDO are at an all-time low. Can I take advantage of it since I have a long-term invesment goal?

Yes 🙂

Hi Fehl,

I’ve been following your posts since the day I started investing. I have a question though. Is it ok if I start in stocks with 5k as a start and will fund 2k every month? I have three investment wheels na din kase (SunLife MF, BDO UITF, PruLife VUL). Just want to know if it’s advisable for me to do so. Thanks!

Yes, you can use that budget of 5K every month buying stocks like URC, JFC, BDO etc. You can check our Dailypik.com for more stock updates and suggestions

Hi Ms Fehl thank you so much for all your tips on how to invest in stocks, As i noticed last week till now, the Psei is going down, I would like to ask if today is the right time to buy Uitf or wait till june ? I bought sunlife growth plus last april 28 during high price, ty

If you are “investing” buying more shares when the market is down is a good opportunity

Hi ms fehl,

Im planning to open mutual fund @ philequity.i have 30k.im confuse if ila-lumpsum or cpa ko b cia?what is best lump sump 30k then add 4k monthly. OR CPA of 5k monthly(wait for 6mos) then add 4k monthly?

Thankee

It depends upon your preference. If stocks are cheap, I suggest you invest all 30K then add funds monthly continuously and maintain it in 3 years or so

Hi Ms. Fehl, I’m planning to open a UITF in BDO, may EIP sila for Balanced Fund and Equity Fund, tanong ko lang po.. Nag iisip pa ako kung anu po sa dalawa…. Ang question ko po, Sa ngaun kasi hndi pko mkakapag commit ng certain amount to invest monthly until the time magkaron na po ulet ako source of income, gusto ko lang po ilagay na sa UITF ang money na naipon ko.. Pwede ko ba ipa EIP ang UITF ko from lump sum investment?

Pasensya na po sa tanong ko, newbie lang din po ako, gusto ko lang po magka heads up before ako pumunta sa bank.

THank you very much Ms. Fehl.

Hi. Yes, but you need to close your regular UITF and redeem the funds if you want to place them on EIP. Be sure if you open EIP, you have enough funds monthly. It is a PLAN, so you must follow the plan you have set in your EIP

Hi Ms. Fehl I’ve been reading your blog this past few days and I open a UITF in bdo, I’m just wondering if in case, emergency happen and I need to withdraw the fund, pwede ba cyang ma withdraw anytime without hassle?

Yes, you can redeem all your funds if you want them na, it’s easy and without hassle

Hi Ms. Fehl,

I’m so thankful that i found your blog it’s very helpful to me as I am new into stocks. I wanted to apply the PCA investment method, should I advice my Broker to put my stocks into that method or it applies automatically if you hold your stocks for a couple of months? Thanks and God bless

Hi. If you use online broker like COL Financial, you can set up schedule under EIP (Easy Investment Program) which will let you automatically buy stocks following your set schedules. EIP has automatic and manual approach so it’s flexible. 🙂 God bless!

Hi ms.Fehl, your site is very helpful to us ofw, my question is mas makaka-save kami if lum-sum/ one time rather than PCA, so we will not send money monthly because of money remitting charges,, what do you think?

Second question, tumataas na ang mga stocks share TODAY, do you think too late na to START for investing in stock market whether in lum sum or in PCA method? thanks for info..GOD Bless

Hi. It depends on factors like how much you invested and the price at the start and redemption. Regular investment other than lump sum though can generate more if you never stop and you continue adding investments.

Actually, stocks today are on a rebound (tumaas ulit), mas mababa ang prices yesterday and last Monday. Stocks are very unpredictable so it’s always better you invest now than not at all. What matter is you invest on bluechip companies.

Hi ms. Fehl. Gud to know that there’s a person like you na never nagsawang magreply sa mga tanong sa mga bagohan like me dto. ur a God’s instrument. Hope you will never stop giving us tips and information on these matter. It really inspires me. Tanong ko lng if advisable ba na maginvest sa Equity fund on both banks like sa security bank at pnb ng sabay? Thank you in advance and God bless. 🙂

Hi Leigh. Thank you for the kind words here. Opening different investments is always better than opening only 1. 🙂 You can open on SECB and PNB ng sabay and you can monitor which is doing better between the 2. Cheers!

My tanong lng ko ms. Fehl..kung mag invest ako ng lumpsum halibawa hundred thousand s balance fund and the following months i apply ko ung PCA..ano masasabi s ganitong strategy?newbie lang kc ako s ganitong investment kaya ung mga suggestions and tips n maari mong maishare ay malaki ang maitutulong

That’s great coz you will add up funds to your investments making more room for profit. The more you invest, the better. The longer you invest, the better as well.

Hi ms.fehl!salamat s very informative blog mo..nakakalibang din basahin ung mga tanong n wala mong sawang cnasagot.. ang dami kong napupulot n tips

My pleasure. I hope you guys share your views too coz I’ll be happy to learn tips as well 🙂

Hi..ask po ng advise kung dpat bang iwithdraw ang savings ko sa bpi at ilipat sa bpi short term fund nila?? 3months na ang 10,000 ko sa STF pero 50 lng ang gain nya..

Hi, if you want higher gains, opt for risky funds like Balanced Funds and Equity Funds

Hello there! 🙂

I was randomly invited by a friend to invest in a mutual fund through Prulife UK.

I’ve been in the zone of finding the right company to invest with, my question simply is … why would a person invite me to invest in Prulike UK when he does not work with the same company, like What’s in it for him?

I am 25 years old and earning more than my age, i’d love to invest whilst im still single and to start this year right. I hope you could suggest which best company I should go to.

Thanks in advance and Happy New year! 😀

Hi 🙂 Maybe they’re concern about you and they want to suggest bout how you can earn more and they have great experience with Pru Life UK. Anything is possible. 🙂 Maybe they just want to really help. Pru Life UK is one the Top 4 insurance and investment companies here. I’d recommend it too 🙂

The ones I suggest are the best here: For Mutual Fund – Philequity, Sun Life, Philam Asset Management Inc.. For UITF – BDO, PNB, Security Bank. For insurance w/ investmet – Sun Life, Philam, Pru Life UK

Hi Miss FehL,

I’m really glad that I found your blog… nag try po ako ng risk profiling sa ibat ibang company then iba iba din ang result, i alos read the BPI ALMF mutual fund, ok ba un what do you suggest then (sa BPI risk profile ko is moderate aggressive ako)?? I believe na versatile naman kasi ako if medium to long term plan ko of course mf then gusto ko din aralin about stocks.. Seaman po kasi ako.. thanks..

Hi Mervin. ALFM Funds are great as well. BPI has very good fund managers. If you’re moderate aggressive, Balanced Funds suit you. The last decision still lies on you though. Stocks are very rewarding too. I enjoy investing stocks. The secret is choose bluechip companies and have an effective strategy. I follow DailyPik.com stocks because they are very profitable

Hi maam fehl! pwde po ba pagsabayin PCA at buy & hold strategy?5k ung iinvest ko

monthly pra bumili ng stocks kng pwde pgsabayin un kailngn po dagdgan ung 5k na budget ko every month?

Thanks

Yes, you can also do that. I’m doing that as well

hi po maam fehl! cgoro meron na po ako broker pra mginvest sa stock at marami na rn ako nabasa na mga blog idea pgdating sa stock market..ano po ung ma irerecomend nyo na stock to buy na bluu chip kc PCA po ung method ko long term po ung goal ko at aggressive po ung risk appetite ko bale ung excess na 5k money ko lng po ung gagamitin ko pra mginvest monthly..meron po ba kayo ma irerecommend?pasensya na po medyo marami ako nsabi..maraming salamat po in advance..

god bless

Yes, we mentioned them in our “Best Stocks in the Philippines 2015” post

Thanks for posting Ms. Fhel. Dahil dito nagkaroon ako ng idea about investing…tanong ko lng po kung maganda din ba mag invest sa BPI? Myron din ba silang PCA method as you have mentioned in your post?

Thanks po uli and God Bless!

Yes, BPI mutual funds are very good too.

Hi po mam. Ask ko lang po kung may pera akong 100k gusto ko po i invest. San ko po pede i invest? Un long term at wala n po sana huhulugan monthly kasi po Sumasahod lang po ako ng minimun wages. At sakto lng n kinikita ko para sa pamilya ko..

Thankz po

It depends upon your risk appetite and your goal. How much risks you can take? If you’re conservative, open Money Market funds. If you’re aggressive, open Equity Funds.

*PNB enhanced phil index refereneced fund.. correction po..

Hi ms Fehl! Nag start na ko mag invest s PNB Phil index intermediate trust fund ngayong buwan.. ang pinili ko yung one time investment ndi AIP, 10k muna nilagay ko. Kung ggawin ko b yun monthly considered p din yun as PCA db?? Nkalink kc yun s savings q, ang gsto q pag may extra aqng illagay ska ln aq magiinvest. TIA!

yes you have the free will to place investments when you have available funds.

hello po miss fhel

thank you po sa blog nyo, last year po we open a dollar saving account for our new born daugther, now my wife and i are thinking to open uitf account for her,can you please give us advice what type of funds,becuase there’s so many type po pla, Godbless

Hi again James! Well it depends upon your goal and risk appetite. If you can take high risk, opt for Equity Funds. If you’re conservative, select Money Market Funds or Bond Funds. If you’re in between aggressive and conservative, select Balanced Funds. 🙂

Ask ko lng po dto po aq taiwan at gusto komgopen ng uitf ng bdo.possible po ba n makaopen ako tnx

BDO UITF opening currently requires personal appearance. YOu can try PNB instead, they have online UITF account opening

Hi Heidi,

Pde k mag open ng UITF sa BDO khit nsa ibang bansa ka. as long as meron ka debit account sa knila. hingi ka ng forms nila then submit it through email then ung original papadala mo thru snail mail. need nila mkuha ung original pra maprocess n nila and iccredit na lng nla un sa debit account mo monthly. I choose every 5th of the month. mganda ang EIP ng BDO very helpful sa mga employees or ofw na limited lng din nmn ang extra for investment. you can contact ms. Camille Idea. xa nag asikaso ng account ko. hope this will help you. thanks ms fehl again. god bless you more.

Not possible right now since BDO requires personal appearance if you are opening new accounts. If you want to open UITF online, you can but it’s with PNB. Check out this post: https://philpad.com/how-to-open-uitf-account-online-pnb/

Mam andito po pala yung sagot. Ano po maam masusugest niyo para sakin. Lump sum or yung monthly po? Parang gagawin ko nalang po is yung nabasa ko sa isang comment niyo po na savings account then doon nalang po nila kukunin yung monthly na 2k halimbawa. Sorry kulit ko. Hehe. Salamat very impormative po. Layo po kasi sa course na tinapos ko na tourism ee. 🙂

Yes, you can choose to invest monthly for now then add another investment soon once you have more funds available or once you have additional income (business income, higher salary etc.)

Hi fehl, tama ba pagkakabasa ko pwede nila kunin direct sa savings account yung iinvest mo monthly? ppaano kung guso mo may savings account ka at the same time iba yung account mo pag nag open ka sa kanila ng UITF.. anggulo..

Yes, ADA (Automatic Debit Arrangement) is the usual way. Savings account and UITF accounts are 2 different accounts. Iba naman talaga ang UITF mo sa savings account mo. I hope that is clear 🙂

Jdmr,

Tourism? You can invest in tourism-related stocks here and abroad 🙂

Seriously, you can start with monthly on how much extra cash you have. Better if you can try to buy when the stock you like is trading at lower prices.

Hello! I find your blog very informative and interesting. What would you recommend is the best alternative for me for investing my hard earned income, I am an OFW working in Saudi Arabia and I am planning to invest my money so it will grow overtime. I am planning to venture into stock investment as I believe this gives high returns … but I lack the practical know how of the trade.

Thanks and God bless.

If you want to invest into stocks but don’t have enough knowledge and time in trading all the time, I suggest you start with investing in Mutual Funds in Equity or in UITF Equity Funds because Equity Funds are also into stocks investment. In investing you must have the following before you invest:

knowledge – you should invest enough or basic knowledge first because the more you learn, the better

money – how much funds you want to invest

risk appetite – how much risk you can take? are you conservative or aggressive?

goal – you must have a target or goal. How long do you want to keep your investment: 3,5, 10 years or more?

You’ll have the first one (knowledge) by getting to know the kinds of investment you are interested in: stocks, mutual funds, uitf, etc. by reading about them in our website. Just browse and read anytime 🙂 Then you already have the rest

Mandy, it does give high returns but it can give you losses and lots of stress as well.

Continue reading here on Philpad and other websites available online — it is one of the best ways to learn. If you want to read about how certain Philippine stocks are doing, you can check our blog where local stocks are analyzed every week through the eyes of Technical Analysis, helping you to find good stocks to invest in, make timely investment decisions, and determine stocks that you might need to be careful with. In our blog, we help new investors and traders learn about market movements of local stocks and help manage your risk as well. Aside from helping new investors and traders, our second goal is donating to charities through our “subscription for a cause”. We hope to see you there!

Hi Ms. Fehl,

Thank you for this blog and all previous blogs you have written. Dhil dun nagstart nako mag invest sa BDO UITF. EIP of BDO is very helpful especially sa mga employee or ofw na katulad ko na average lng ang kinikita. I choose 5k monthly to invest in BDO UITF equity funds, hopefully mag succeed or mag gain xa in the long run. May question lng po ako ms Fehl, how can i track or monitor ang status ng ininvest ko sa BDO? because they say it na di na cla nagbibigay ng Master Number. is there any way pano makita ung status ng investment ko? by d way nagopen ako ng UITF or trust account habang nandito po sa ibang bansa. thank you.

Thank you for the kind words. I’m glad you are now investing. 🙂 Yes, you can monitor your BDO UITF performance online. Everything is discussed in this post I made: https://philpad.com/how-to-monitor-check-bdo-uitf-account-online-banking/

I’m a follower of your blog as well. I just shared one of your articles on FB about investing MF. And by reading all of your articles, madami na agad akong natutunan about investing. Thank God for you, Ms. Fehl. Please keep on posting more about investments.

Thank you very much Patrick! Yes, there are more posts to come. Subscribe here so you will not miss a thing 🙂

Wow, you’re a genius blogger ate Fehl. Thank you for the request po. Keep blogging, you have such a useful information here. Happy investing ate.

Thank you Mary Grace. Happy invetsing din sayo! 🙂

Hi Fehl,

Thanks to this blog, very informative and helpful sa mga me confusion and inquiry about investment.

My inquiry is, …nakapag-open na kc ko ng UITF sa bank, then nakalagay na minimum holding period is 30 days, ang tanong ko lang is….kailangan ba cya i-redeem after 30 days or di naman kailangan i-out, then me maximum holding period ba sa mga ganitong investment.

Thank you..

hi there! You can keep your funds as many months or years you want to keep them. I recommend that actually because it will grow over time. The minimum period is just the minimum time your investment need to be held. Example, if it’s 30 days, and you redeem your funds before 30 days, you will need to pay early redemption fees

Hi Fehl!

Thanks for this post (again). I started investing (UITF) last month, and doing CPA. My profile says that I am agressive but I am more comfortable with CPA. I don’t have that much gain (so far), considering that I just started investing only less than a month. But I am happy because I am starting to understand stock market.

I have visited other blogs, but yours is the only one I follow. This post is very timely for me because I really want to compare lumpsum vs CPA.

Thanks!!!

Hi HappyMom 🙂 Thank you for following my website and for reading regularly. Peso Cost Averaging is a time-tested method and proven effective. I’m happy for you enjoying your investments now and learning more about it. Not only you are gaining money, you are also gaining self-worth. Cheers!